CPVC Pipe & Fittings Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438063 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

CPVC Pipe & Fittings Market Size

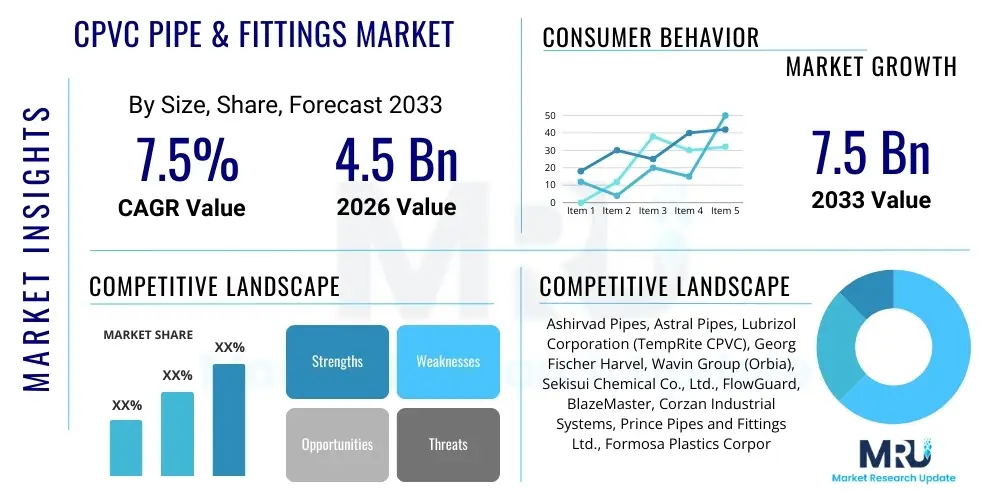

The CPVC Pipe & Fittings Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

CPVC Pipe & Fittings Market introduction

The Chlorinated Polyvinyl Chloride (CPVC) Pipe and Fittings Market encompasses the manufacturing, distribution, and utilization of thermoplastic piping systems specifically engineered for applications requiring high heat resistance and superior chemical inertness compared to standard PVC. CPVC is derived from PVC resin through a chlorination reaction, which significantly enhances its heat deflection temperature and mechanical strength, making it ideal for transporting hot and cold pressurized liquids. This robust material is highly valued across diverse sectors, including residential plumbing, commercial building services, and heavy industrial fluid handling, offering reliability and a long service life, often exceeding 50 years under standard operating conditions. The inherent resistance of CPVC to corrosion, scaling, and microbial growth positions it as a preferred alternative to traditional metallic piping, which faces challenges related to maintenance and premature failure in corrosive environments. The operational safety and cost-effectiveness of installation, typically achieved through solvent cement joining, further solidify its market position.

The principal applications driving the demand for CPVC pipe and fittings involve domestic and commercial potable water distribution systems, fire sprinkler systems, and complex industrial processes requiring the movement of acidic or alkaline media. In residential construction, CPVC is increasingly specified due to its proven track record in maintaining water purity, satisfying stringent health and safety standards, and reducing installation complexity compared to copper or galvanized steel. Furthermore, the material exhibits low thermal conductivity, which translates into reduced heat loss in hot water lines and limits condensation on cold water lines, enhancing overall system energy efficiency. The aesthetic uniformity and availability of extensive fittings—including elbows, tees, couplings, and adapters—allow for seamless integration into existing infrastructure and complex design layouts. Its lightweight nature also drastically reduces logistical costs and labor intensity during construction phases.

Major market driving factors include the rapid pace of urbanization, particularly in developing economies, which necessitates extensive investment in water supply infrastructure and robust sewage systems. Regulatory support favoring non-metallic piping for improved public health and the replacement of aging infrastructure prone to leaks and contamination also propel market expansion. Benefits associated with CPVC include exceptional fire resistance—it possesses a high limiting oxygen index (LOI)—and dimensional stability under thermal stress, minimizing the risk of catastrophic system failure. The shift from traditional materials is further accelerated by the volatility in metal prices and the comparatively stable cost structure of polymer resins. However, sustained innovation in manufacturing processes aimed at improving impact strength and reducing raw material waste continues to be a key element of competitive differentiation among market participants.

CPVC Pipe & Fittings Market Executive Summary

The CPVC Pipe & Fittings Market is defined by robust growth, primarily stemming from global infrastructure development and stringent regulatory mandates concerning water quality and safety. Business trends indicate a strong focus on backward integration among major manufacturers to secure stable raw material supply (PVC resin and chlorination inputs) and optimize production costs. There is an increasing emphasis on developing specialized CPVC compounds that offer enhanced pressure ratings and UV resistance for specific outdoor applications, catering directly to the industrial sector, particularly chemical processing and wastewater treatment facilities. Strategic collaborations and mergers and acquisitions are commonplace, allowing established players to expand their geographical footprint, especially into high-growth regions like Southeast Asia and Latin America, and to acquire advanced solvent cement technologies crucial for leak-proof installations. The shift toward sustainable manufacturing practices, including energy-efficient extrusion processes and recyclable product formulations, is becoming a central competitive advantage, appealing to environmentally conscious construction firms and utility companies.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, fueled by massive government spending on housing projects, the burgeoning sanitation sector, and widespread adoption of modern plumbing practices replacing older metallic systems. North America and Europe, while mature, exhibit steady growth driven by the continuous renovation and replacement of aging water distribution networks and increased uptake in non-residential sectors, such as hotels, hospitals, and high-rise commercial complexes, where fire safety and long-term durability are paramount concerns. Regional market fragmentation in CPVC pipe specifications, notably regarding Schedule 40 versus Schedule 80 classifications, dictates local manufacturing strategies. For instance, regions with strict building codes requiring high-pressure resistance generally prefer Schedule 80 products, driving differential demand across continents. Furthermore, climatic variations influence demand; regions experiencing extreme temperatures require materials, like CPVC, that maintain structural integrity under thermal cycling.

Segment trends highlight the dominance of the hot and cold-water distribution application segment, which accounts for the largest market share due to universal residential and commercial plumbing needs. However, the industrial fluid handling segment is projected to exhibit the highest Compound Annual Growth Rate (CAGR) owing to rapid industrialization and the critical requirement for corrosion-resistant piping in chemical and pharmaceutical manufacturing. By product type, the pipe segment commands the majority of the market value, but the fittings segment, encompassing complex connectors and specialty adaptors, registers higher profitability margins due to the intricacy of manufacturing and the necessity for precise dimensional tolerance. Future growth trajectory is intrinsically linked to macro-economic stability and continued global investment in urban infrastructure resilience, ensuring that CPVC remains a vital component in modernizing global utility services.

AI Impact Analysis on CPVC Pipe & Fittings Market

User queries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the CPVC pipe and fittings industry frequently center on efficiency gains, predictive quality control, and optimized supply chain logistics. Common themes include how AI can enhance the extrusion process to reduce material waste, predict equipment failures in complex molding machinery, and optimize the formulation of CPVC compounds for specific performance requirements (e.g., higher stress crack resistance or increased pressure rating). Users are highly interested in the integration of ML algorithms for analyzing large datasets generated during manufacturing, focusing on minimizing defects such as wall thickness variations or dimensional non-conformities that are critical for fittings performance. Expectations revolve around AI's capacity to move CPVC manufacturing toward a 'smart factory' model, ensuring energy efficiency and reducing the overall carbon footprint of production. Furthermore, there is significant curiosity about using AI-powered demand forecasting to manage the complex inventory of thousands of different pipe sizes and fitting configurations necessary for a global supply chain.

- AI-driven optimization of polymer compounding recipes, leading to materials with enhanced thermal stability and improved long-term hydraulic performance.

- Predictive maintenance analytics applied to extrusion and injection molding equipment, minimizing unplanned downtime and extending the lifespan of critical machinery components.

- Machine Learning algorithms deployed for real-time quality control using sensor data, immediately identifying and rejecting pipes or fittings with micro-defects or dimensional variance.

- Optimized supply chain and logistics management through AI-powered demand forecasting, reducing inventory holding costs and improving fulfillment rates across diverse geographical markets.

- Autonomous robotic systems guided by computer vision for complex assembly, sorting, and packaging of fittings, enhancing throughput and labor safety in manufacturing plants.

- Simulation models utilizing AI to predict the long-term structural integrity and stress points of CPVC piping systems under varying operational temperatures and pressures, aiding product development.

- Energy consumption optimization in high-temperature chlorination processes and extrusion cooling cycles via AI control systems, leading to substantial operational cost reductions and sustainability improvements.

- Automated market trend analysis using natural language processing (NLP) to gauge customer preferences and regulatory changes, enabling rapid product adaptation and strategic market positioning.

DRO & Impact Forces Of CPVC Pipe & Fittings Market

The dynamics of the CPVC Pipe & Fittings Market are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), significantly shaped by powerful external and internal impact forces, primarily urbanization rates and material substitution threats. The primary driver is the accelerating global need for superior water management and sanitation infrastructure, particularly the replacement of corroded metal pipes with non-reactive, long-lasting CPVC systems that uphold stringent public health standards. This demand is amplified by the material's recognized benefits, including resistance to high temperatures, superior fire rating (high LOI), and inherent corrosion resistance, positioning it ideally for aggressive chemical transport in industrial settings. However, the market faces significant restraints, notably the reliance on stable crude oil and natural gas prices, as they form the foundational inputs for PVC resin production, leading to susceptibility to price volatility. Furthermore, the inherent susceptibility of all polymer materials to UV degradation necessitates specialized formulations for exterior applications, slightly limiting universal applicability. The competitive threat from advanced materials like PEX (Cross-linked Polyethylene) and PPR (Polypropylene Random Copolymer), particularly in the residential sector, demands continuous innovation to maintain CPVC’s market share.

Opportunities for market expansion are substantial, particularly in developing nations where infrastructure gaps are significant, and in the burgeoning sector of fire protection systems globally, where CPVC is increasingly mandated due to its excellent hydraulic properties and compliance with fire codes. The ongoing trend of "green building" initiatives presents a strong growth vector, as CPVC's efficiency in hot water systems and its long life span contribute positively to overall building sustainability ratings. Manufacturers are leveraging technological advancements to develop CPVC systems with enhanced impact strength and easier, faster joining methods to reduce installation costs and complexity further. The impact forces acting on the market are profound; regulatory forces, particularly those governing potable water safety (e.g., NSF 61 certification), directly influence material adoption, favoring CPVC over materials that may leach harmful substances. Economic growth cycles correlate closely with construction activity, making the market sensitive to interest rate hikes and housing market fluctuations. Competition from alternative materials forces continuous process efficiency improvements and cost optimization.

The inherent durability of CPVC, coupled with its resistance to dezincification and galvanic corrosion common in metallic systems, secures its place in critical applications. However, the market must navigate the challenge of specialized training required for solvent cement joining techniques to ensure installation quality, as improper welding can lead to premature failure. Strategic focus remains on capitalizing on opportunities within industrial process piping, especially where high temperatures and aggressive chemicals necessitate a material superior to standard PVC. Successful market penetration hinges on demonstrating the total cost of ownership (TCO) benefits of CPVC, which often outweigh the higher initial material costs compared to some conventional plastics, through decades of maintenance-free operation and energy savings. Overall, while geopolitical risks affecting raw material procurement pose structural restraints, the fundamental societal need for resilient and safe water infrastructure ensures a positive long-term growth trajectory for CPVC pipe and fittings.

Segmentation Analysis

The CPVC Pipe & Fittings Market is comprehensively segmented based on its application, product type, and the dimensional characteristics required for specific use cases, reflecting the specialized demands of the construction and industrial sectors. This segmentation allows manufacturers to tailor production and marketing efforts effectively. The primary dimensions for market analysis include the specific application area, such as residential plumbing versus chemical processing, which dictates performance specifications like pressure rating and chemical resistance. Furthermore, the market is differentiated by product configuration, classifying sales into pipes, which represent the bulk material volume, and fittings, which are essential for system assembly and connection points. Understanding these segments is crucial for strategic planning, enabling companies to focus R&D on high-growth segments like large-diameter industrial pipes or intricate, high-pressure fittings required for sophisticated manifold systems.

Segmentation by product type typically distinguishes between the straight pipe material and the wide array of connectivity components, including couplers, elbows, tees, valves, and specialized transition fittings used to interface CPVC with metallic or other plastic systems. Fittings often incorporate complex geometry achieved through advanced injection molding techniques and require stricter dimensional tolerances, making them a higher value-added component of the overall system. Application-based segmentation provides the clearest view of demand drivers, where residential building and refurbishment account for the largest, most stable demand volume, primarily utilizing thinner Schedule 40 products. Conversely, the industrial sector, characterized by highly demanding operational parameters, drives the demand for thicker, higher-pressure-rated Schedule 80 and Schedule 120 pipes, often requiring enhanced chemical resistance properties tailored to specific media being transported.

Geographic segmentation is also highly relevant, as regional construction norms and temperature extremes influence the required thickness and certification standards. For instance, cold climate regions may require materials with better low-temperature impact resistance, while tropical regions demand superior UV stabilization. The cumulative effect of these granular segmentations ensures that market participants can accurately size opportunities, mitigate risks associated with material standardization, and achieve optimal pricing strategies based on the complexity and performance requirements of the final CPVC installation. The continuous innovation in fitting design, particularly in solvent cement alternatives and quick-connect systems, further refines the segmentation landscape, targeting efficiency improvements for installers.

- By Application:

- Hot and Cold Water Distribution (Residential, Commercial, Institutional)

- Industrial Fluid Handling (Chemical Processing, Pharmaceutical, Food & Beverage)

- Fire Sprinkler Systems (Commercial and High-Rise Residential)

- Waste and Vent Systems

- By Product Type:

- Pipes (Schedule 40, Schedule 80, SDR classifications)

- Fittings (Couplings, Elbows, Tees, Adapters, Flanges, Valves)

- By End-User:

- Residential Construction

- Commercial & Institutional Construction

- Industrial (Manufacturing, Power Generation, Chemical)

- Utilities (Water Treatment Plants)

- By Dimension/Standard:

- Metric

- Imperial (ASTM, NEMA)

Value Chain Analysis For CPVC Pipe & Fittings Market

The CPVC Pipe & Fittings value chain is a complex, multi-stage process starting from petrochemical derivatives and concluding with installed piping systems, characterized by significant specialized processing and distribution networks. Upstream analysis begins with the procurement of essential raw materials: ethylene, chlorine, and natural gas or crude oil derivatives. Ethylene and chlorine are crucial for manufacturing Vinyl Chloride Monomer (VCM), which is then polymerized to produce PVC resin. The subsequent, high-tech chlorination process of the PVC resin, often performed using specialized reactors and proprietary chemical formulations, is the critical value-adding step that transforms standard PVC into high-performance CPVC, significantly influencing the final material properties, such as chlorine content and heat resistance. Key suppliers in this segment include major petrochemical corporations and specialized polymer producers, where negotiating stable, long-term supply contracts is paramount to manage raw material price volatility.

Midstream activities involve the primary manufacturing processes: extrusion for pipes and injection molding for fittings. These processes require substantial capital investment in highly specialized, precision machinery capable of handling the high melt viscosity and processing temperatures characteristic of CPVC compounds. Manufacturers focus on maximizing throughput while maintaining strict dimensional tolerances, particularly for fittings, where precise geometry is essential for reliable solvent welding and leak-proof performance under pressure. Quality assurance at this stage is intensive, involving ultrasonic testing and hydrostatic pressure testing to ensure products meet international standards (e.g., ASTM, NSF). Efficiency in manufacturing, driven by lean production techniques and energy optimization, is a major determinant of profitability. Furthermore, the formulation and production of high-quality solvent cements—a critical component for installation—are often integrated into the CPVC manufacturer's operations or sourced from highly specialized chemical partners, representing another crucial link in the value chain.

Downstream distribution channels are diverse, structured to serve the fragmented construction and industrial markets efficiently. The distribution architecture typically utilizes a mix of direct sales to large industrial clients and infrastructure projects, and indirect channels relying heavily on wholesale distributors, plumbing supply houses, and retail hardware chains to reach small to medium-sized contractors and residential installers. Direct channels allow for greater control over pricing and technical support, which is vital for complex industrial applications requiring customized solutions. Indirect channels, however, provide the necessary geographical reach and inventory capacity to service the high-volume, quick-turnaround demands of the residential and commercial building sectors. Effective logistics, including warehousing and transportation, are crucial due to the bulkiness of pipes, requiring optimized routing to minimize freight costs. The final stage involves professional contractors and certified plumbers who install the systems, where training and product education provided by the manufacturer significantly impact installation quality and long-term system performance, ultimately closing the value loop.

CPVC Pipe & Fittings Market Potential Customers

The CPVC Pipe & Fittings Market serves a highly diverse clientele, primarily concentrated within the construction, institutional, and heavy industrial sectors, all seeking reliable, corrosion-resistant fluid transport solutions. The largest segment of potential customers comprises residential and commercial building developers and contractors. These buyers prioritize systems that offer ease of installation, compliance with potable water safety standards (e.g., NSF/ANSI 61), and cost-effectiveness over the system's life cycle. For residential projects, CPVC is the preferred choice for internal plumbing due to its non-toxicity and proven reliability in hot water applications. Commercial structures, such as hotels, offices, and high-rise apartments, are major consumers, particularly where safety regulations necessitate materials with excellent fire resistance properties, driving demand for specialized CPVC fire sprinkler systems.

The institutional sector represents another significant customer base, encompassing hospitals, schools, universities, and governmental facilities. These end-users demand piping systems that minimize maintenance disruption, offer long-term chemical stability for specialized laboratory or medical gas applications, and adhere to strict sanitation protocols. Hospitals, in particular, rely on CPVC for ensuring water quality and reducing the risk of waterborne pathogens like Legionella, as CPVC surfaces do not promote biofilm growth as readily as some metallic materials. Furthermore, the low noise transmission characteristics of CPVC systems are highly valued in environments requiring quiet operation, such as academic libraries and patient rooms. Procurement decisions in this segment are often driven by stringent lifecycle cost analysis, favoring CPVC's low maintenance needs over decades of service.

Finally, the industrial sector constitutes the most technically demanding set of potential customers, spanning chemical processing, power generation, mining, and food and beverage manufacturing. These buyers require CPVC piping capable of safely handling corrosive industrial chemicals, highly pressurized water, and slurry transport at elevated temperatures. Specific applications include electroplating lines, chlorine treatment systems, and acidic wastewater disposal lines, where metallic pipes would rapidly fail. Procurement in this segment relies heavily on material performance data, chemical compatibility charts, and the availability of large-diameter, high-schedule (e.g., Schedule 80) components. These industrial clients often engage directly with manufacturers for highly customized, engineered piping solutions, requiring extensive technical support and specialized installation training to ensure system integrity in harsh operational environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ashirvad Pipes, Astral Pipes, Lubrizol Corporation (TempRite CPVC), Georg Fischer Harvel, Wavin Group (Orbia), Sekisui Chemical Co., Ltd., FlowGuard, BlazeMaster, Corzan Industrial Systems, Prince Pipes and Fittings Ltd., Formosa Plastics Corporation, Finolex Industries Ltd., Supreme Industries Ltd., NIBCO Inc., Viking Group Inc., Charter Plastics Inc., Genuit Group plc, KWH Pipe Ltd., Rehau AG + Co, PolyOne Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CPVC Pipe & Fittings Market Key Technology Landscape

The technological landscape of the CPVC Pipe & Fittings Market is continuously evolving, focusing heavily on compounding science, advanced manufacturing precision, and improved joining methods to enhance product performance and installation efficiency. The foundational technology remains the chlorination process of PVC, but manufacturers are increasingly leveraging proprietary polymer compounding techniques to tailor CPVC resin for specific needs, such as developing materials with higher chlorine content for superior high-temperature performance or incorporating specialized stabilizers to enhance UV resistance for outdoor applications. Advanced compounding involves precise blending of CPVC resin with various additives—impact modifiers, processing aids, heat stabilizers, and pigments—using high-shear mixers to ensure homogeneous dispersion. This granular control over the material composition is critical for optimizing characteristics like stress crack resistance, crucial in pressurized systems, and minimizing potential leachables to comply with increasingly strict potable water certifications globally. The ability to customize these material characteristics provides a significant competitive edge in securing high-specification industrial contracts.

In the manufacturing domain, the focus is on maximizing the efficiency and precision of extrusion and injection molding. Modern extrusion lines incorporate sophisticated feedback control systems, often utilizing non-contact sensors (e.g., ultrasonic gauges) to monitor wall thickness and diameter in real time, ensuring strict adherence to dimensional standards and minimizing scrap rates. For fittings, high-precision, multi-cavity injection molds are employed, coupled with automated robotics for rapid part extraction and quality checking, addressing the demand for high volumes of intricate components with tight tolerances essential for proper solvent welding. Furthermore, the development of specialized extrusion dies and screw designs specifically optimized for CPVC’s high melt viscosity helps achieve smoother internal surfaces, reducing flow restriction and pressure drops in installed systems. Continuous improvement in cooling technologies within the manufacturing line also contributes to dimensional stability and reduces internal stresses in the finished product, enhancing long-term durability.

A critical area of technological innovation involves installation methods and accessory materials, specifically solvent cements. Manufacturers are developing low-VOC (Volatile Organic Compound) solvent cements to address environmental and worker safety concerns, improving adhesion strength, and accelerating cure times to reduce project timelines, particularly in large commercial builds. Additionally, there is burgeoning research into alternative, quick-connect mechanical joint technologies for CPVC, offering potential alternatives to traditional solvent welding in specialized, constrained installation environments, although solvent welding remains the dominant and most cost-effective method. Digitalization is also impacting the landscape, with manufacturers offering Building Information Modeling (BIM) ready content for their products, allowing engineers and architects to seamlessly integrate CPVC systems into complex digital design models, optimizing material usage and collision avoidance before construction begins. These cumulative technological advances ensure that CPVC systems remain competitive against next-generation materials and align with modern construction productivity demands.

Regional Highlights

The global CPVC Pipe & Fittings Market exhibits distinct consumption patterns and growth drivers across major geographical regions, influenced heavily by regional infrastructure development stages, regulatory environments, and prevailing construction material traditions. The Asia Pacific (APAC) region is the powerhouse of the market, driven by unprecedented rates of urbanization and massive governmental investments in public utilities, water supply, and residential housing, especially in countries like India and China. The sheer volume of new construction projects, coupled with the critical necessity to upgrade outdated, often leaky or corrosive metal piping systems, provides a perpetually robust demand base for CPVC, valued for its cost-efficiency and superior corrosion resistance.

North America (NA), while mature, maintains a substantial market share driven primarily by replacement and renovation activities, particularly in the US and Canada. Stringent building codes, especially those governing fire safety and potable water quality (NSF certification), favor the adoption of CPVC in commercial and institutional settings, including the specialized use of CPVC for non-metallic fire sprinkler systems. Demand is steady, supported by consistent investment in commercial real estate and the continuous need to replace older, failure-prone galvanized steel and copper plumbing systems. Technological adoption is high, with a strong focus on high-quality, high-pressure Schedule 80 pipes used extensively in industrial and high-rise applications.

Europe’s CPVC market experiences moderate, stable growth, heavily influenced by EU regulations on construction product standards and environmental performance. Western Europe focuses on high-quality, certified products, often prioritizing sustainability and low-VOC installation methods. Eastern Europe, benefitting from EU structural funds, presents higher growth potential as countries modernize their infrastructure and adopt non-metallic piping for efficiency gains. Latin America and the Middle East & Africa (MEA) are emerging markets, characterized by sporadic but accelerating infrastructure spending. MEA sees CPVC adoption driven by harsh operating environments—high temperatures and water scarcity issues—making durable, low-maintenance materials highly attractive, particularly in sectors like hospitality and rapid housing development.

- Asia Pacific (APAC): Dominant market share and fastest growth trajectory. Driven by rapid urbanization, extensive residential and commercial infrastructure construction, and governmental initiatives focused on improving sanitation and water accessibility, notably in India and Southeast Asian nations. High adoption in multi-story residential plumbing and industrial chemical handling due to competitive pricing and durability.

- North America (NA): Steady market growth primarily driven by infrastructure replacement, adherence to strict building codes (e.g., NFPA standards for fire systems), and the necessity for certified potable water systems. Strong presence in institutional (hospitals, schools) and commercial markets utilizing high-pressure Schedule 80 specifications.

- Europe: Growth influenced by replacement cycles and compliance with European Union construction directives emphasizing safety, energy efficiency, and material sustainability. Focused growth in specialized applications like fire suppression and industrial processing across Central and Eastern European economies undergoing modernization.

- Latin America (LATAM): Emerging market characterized by volatile yet strong potential, linked to economic stability and investment in residential construction and public infrastructure. CPVC is increasingly replacing traditional, corrosion-prone materials, offering long-term cost benefits.

- Middle East & Africa (MEA): Growth spurred by significant capital projects in the oil and gas sector (industrial applications) and rapid expansion of residential and hospitality sectors. CPVC's ability to withstand high ambient temperatures and aggressive water conditions (high mineral content) provides a distinct material advantage over alternatives.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CPVC Pipe & Fittings Market.- Lubrizol Corporation (TempRite CPVC, FlowGuard, BlazeMaster, Corzan Industrial Systems)

- Astral Limited

- Ashirvad Pipes Pvt. Ltd. (A member of the Aliaxis Group)

- Wavin Group (Orbia)

- Georg Fischer Harvel LLC

- Sekisui Chemical Co., Ltd.

- Prince Pipes and Fittings Ltd.

- Formosa Plastics Corporation

- Finolex Industries Ltd.

- Supreme Industries Ltd.

- NIBCO Inc.

- Viking Group Inc.

- Charter Plastics Inc.

- Genuit Group plc

- KWH Pipe Ltd.

- Rehau AG + Co

- PolyOne Corporation (Avient Corporation)

- China Lesso Group Holdings Ltd.

- Reliance Industries Limited

- Tirupati Plastomatics Pvt. Ltd.

Frequently Asked Questions

Analyze common user questions about the CPVC Pipe & Fittings market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of CPVC piping over traditional metallic and other plastic materials?

CPVC offers superior resistance to corrosion, scaling, and chemical attack, ensuring long-term system integrity and water purity, which is particularly vital for potable water systems. Unlike metallic piping (copper or galvanized steel), CPVC does not suffer from dezincification or galvanic corrosion. Compared to standard PVC, CPVC has a significantly higher heat deflection temperature, allowing it to safely handle hot water up to approximately 200°F (93°C), making it suitable for both hot and cold-water distribution and specialized industrial processes.

Which key factors are driving the growth of the CPVC Pipe & Fittings market globally?

The primary drivers are rapid global urbanization and increasing infrastructural expenditure, particularly in emerging economies requiring modern water and sanitation solutions. Regulatory mandates promoting safe potable water systems and fire safety codes that favor non-metallic, fire-resistant piping also substantially boost demand. Additionally, the comparative ease and speed of CPVC installation, combined with its long maintenance-free service life, make it an economically compelling alternative to traditional plumbing materials.

How do CPVC Schedule 40 and Schedule 80 pipes differ in application?

The distinction lies primarily in wall thickness and pressure rating. Schedule 40 CPVC pipes have thinner walls and are commonly used in residential and light commercial plumbing applications where standard pressure and flow rates are required. Schedule 80 CPVC pipes have significantly thicker walls, providing higher pressure resistance and greater physical durability, making them the standard choice for heavy industrial applications, chemical processing, and critical high-pressure commercial installations where system failure must be absolutely avoided.

What is the technological significance of solvent cement in CPVC systems and how is it evolving?

Solvent cement is technologically critical because it creates a molecular fusion bond between the CPVC pipe and fitting, effectively making the joint the strongest part of the system and ensuring a leak-proof connection crucial for pressurized systems. Technological evolution is focused on developing low-VOC (Volatile Organic Compound) formulations to improve worker safety and environmental compliance, while also enhancing cure times and joint strength consistency across varying ambient temperatures encountered during installation projects.

What are the main regional consumption trends for CPVC pipe and fittings?

Asia Pacific is characterized by high-volume demand driven by new residential and commercial construction in rapidly expanding urban centers. North America and Europe primarily focus on renovation, replacement of aging infrastructure, and specialized high-specification segments like fire protection and chemical industrial piping, adhering to stringent regional certifications. Emerging markets in Latin America and MEA are seeing growth due to large-scale infrastructure projects requiring highly durable, heat-resistant materials capable of performing reliably in challenging environmental conditions, ensuring diverse demand profiles globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager