Crane rail Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435144 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Crane rail Market Size

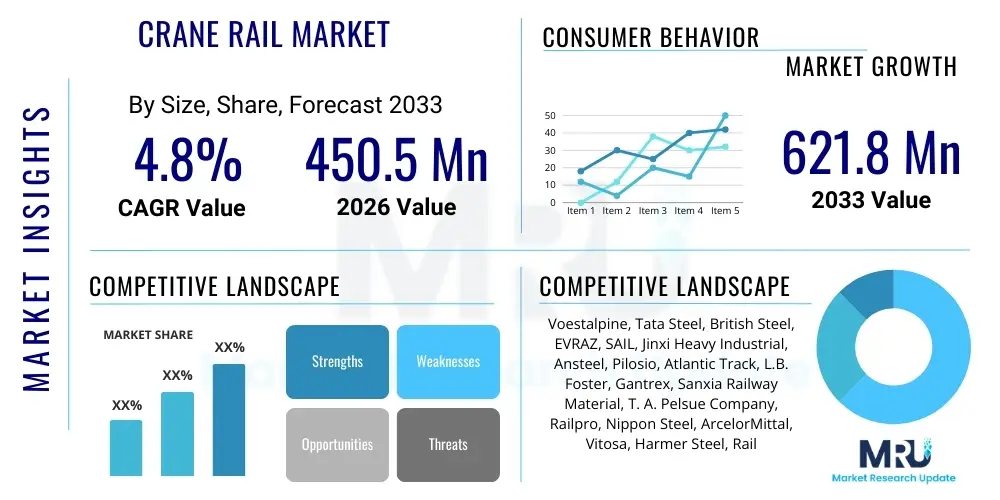

The Crane rail Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 450.5 Million in 2026 and is projected to reach USD 621.8 Million by the end of the forecast period in 2033.

Crane rail Market introduction

The Crane Rail Market encompasses the manufacturing, supply, and installation of specialized steel rails designed to support heavy dynamic loads, primarily used in industrial settings, ports, and material handling infrastructure. These rails provide a smooth, durable, and precise running surface for various types of cranes, including overhead bridge cranes, gantry cranes, stacker cranes, and specialized port handling equipment such as ship-to-shore (STS) cranes and rubber-tired gantry (RTG) cranes. The quality and structural integrity of crane rails are critical, as they directly impact the safety, efficiency, and operational lifespan of massive lifting machinery, particularly in sectors requiring continuous, high-intensity operations like steel production and container logistics. Their design necessitates high wear resistance, specific chemical compositions, and stringent dimensional tolerances to accommodate lateral and vertical forces.

Crane rails, often differentiated by size and chemical composition (e.g., DIN 536, MRS, CR series), serve as foundational components in global trade and manufacturing supply chains. Major applications span high-capacity ports handling millions of TEUs annually, expansive steel mills requiring continuous heavy slab transport, power generation facilities, and specialized warehousing or logistics centers. The core benefit derived from high-quality crane rails includes minimized friction, reduced maintenance requirements for both the rail and the crane bogies, and enhanced structural safety. They ensure the precise alignment and smooth operation of sophisticated lifting systems, preventing catastrophic failures and maximizing throughput in time-sensitive operations.

Market growth is predominantly driven by massive global investments in infrastructure development, particularly the expansion and modernization of seaports to accommodate ultra-large container vessels. Additionally, the rapid industrialization across Asia Pacific, leading to increased steel production capacity and the proliferation of large-scale manufacturing facilities, mandates the installation of new or replacement of existing heavy-duty crane systems. Furthermore, regulatory mandates concerning industrial safety and the push for automation in material handling processes are compelling end-users to adopt higher-grade, more resilient rail systems, thereby fueling sustained demand throughout the forecast period.

Crane rail Market Executive Summary

The global Crane Rail Market is poised for steady expansion, characterized by a fundamental shift toward high-performance, heat-treated rail profiles capable of withstanding extreme operational demands and extending service life. Business trends indicate strong consolidation among leading steel manufacturers, focusing on vertically integrated production to ensure quality control from raw material sourcing to final installation specifications. Market participants are increasingly emphasizing engineered solutions, offering welding techniques, clipping systems, and specialized pads alongside the rails to deliver complete, optimized track systems. The demand cycle remains closely tied to capital expenditure in the maritime and heavy industrial sectors, making the market susceptible to global trade fluctuations but structurally bolstered by essential maintenance and replacement requirements for aging infrastructure worldwide.

Regionally, Asia Pacific maintains its dominance, driven primarily by China and India, which are undertaking colossal infrastructure projects, including new deep-sea ports and massive integrated steel complexes. This region represents the epicenter of both demand and production capacity. Europe and North America, while exhibiting slower growth, focus heavily on modernization and replacement cycles, adopting specialized, premium-grade rails tailored for automated and high-speed handling equipment. Segment trends highlight that the Heavy Rail segment, particularly those designed for high axle loads and continuous duty cycles in ports and steel mills, is expected to maintain the highest revenue share and growth rate. This is largely attributable to the increasing size and capacity of container handling cranes and the continuous operation requirements inherent in major production environments.

In terms of technology, the market is witnessing growing adoption of sophisticated rail fastening and alignment monitoring systems, moving beyond simple mechanical clamps toward resilient pads and adjustable sole plates that minimize vibration and improve track geometry over time. Sustainability is emerging as a critical factor, with increasing scrutiny on the embodied carbon of steel products, prompting manufacturers to explore cleaner production methods. Overall, the market remains robust, underpinned by non-discretionary capital spending required to support global logistics and manufacturing throughput, defining a stable and essential component within the heavy infrastructure sector.

AI Impact Analysis on Crane rail Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Crane Rail Market primarily revolve around how automation and predictive maintenance, driven by AI, will affect rail lifespan, installation accuracy, and operational efficiency. Common user questions often focus on the synergy between automated crane systems and rail infrastructure stability, specifically: "How can AI-powered sensing detect rail wear before failure?" and "Will autonomous port operations necessitate entirely new rail specifications?" The core concern is centered on transitioning from reactive rail maintenance to predictive models that maximize uptime, alongside the integration of digital twins to simulate stress and fatigue. Users expect AI to optimize track geometry and maintenance schedules, thereby reducing unexpected downtime and maximizing the return on investment for high-cost rail infrastructure.

While AI does not directly alter the chemical composition or manufacturing process of the steel rail itself, its transformative impact lies in the operational domain and maintenance strategy. AI systems are increasingly being deployed in port logistics and heavy industry to analyze sensor data from crane wheels, bogies, and rail joints (often using LiDAR, vision systems, and acoustic monitoring). These systems process vast datasets related to load cycles, dynamic forces, temperature variations, and vibration patterns. By applying machine learning algorithms, deviations indicative of premature wear, track misalignment, or fatigue cracking can be identified far earlier than traditional visual inspection methods, fundamentally changing the lifecycle management of crane rails.

This AI-driven shift toward condition-based monitoring translates into optimized grinding and welding schedules, allowing rail replacement decisions to be made based on actual structural prognosis rather than fixed time intervals. Furthermore, in highly automated environments, such as fully automated container terminals, AI guides the precise movement of automated stacking cranes (ASCs) and rail-mounted gantry (RMG) cranes. Optimized movement paths and load distribution algorithms, informed by AI, minimize localized stress peaks on the rails, potentially increasing rail lifespan and reducing the overall Total Cost of Ownership (TCO) for end-users, thereby indirectly driving demand for rails compatible with high-precision monitoring systems.

- AI-enabled Predictive Maintenance: Utilizing sensor data to forecast rail wear and schedule maintenance, reducing unplanned outages by up to 30%.

- Optimized Load Distribution: AI algorithms controlling automated cranes minimize uneven force application, extending rail lifespan.

- Automated Inspection Systems: Integration of vision and acoustic AI for continuous monitoring of rail surface defects and joint integrity.

- Digital Twin Modeling: Creation of virtual models of rail infrastructure to simulate stress under various operational scenarios, guiding material selection.

- Increased Data Integration: Requirement for crane rail manufacturers to provide data points compatible with broader industrial IoT (IIoT) platforms used for AI analysis.

DRO & Impact Forces Of Crane rail Market

The Crane Rail Market is fundamentally shaped by a combination of robust growth drivers related to global economic activity and infrastructure development, counteracted by inherent industry restraints, alongside significant long-term technological opportunities. Key drivers include massive capital investments in maritime logistics infrastructure, necessitated by the need to handle mega container vessels, and the sustained expansion of heavy industries, particularly in Asia, which require continuous upgrades to their internal material handling systems. The requirement for improved safety standards globally also compels operators to replace older, lower-grade rails with modern, high-strength steel profiles, particularly those that are head-hardened or alloy-treated to resist greater abrasion and fatigue. These forces collectively maintain a baseline demand necessary for market stability.

However, the market faces several inherent restraints. Firstly, the high volatility and cyclical nature of steel pricing exert significant pressure on manufacturing costs, which can impact project timelines and overall profitability for rail producers. Secondly, the longevity of installed crane rails (often 15-25 years or more) means that replacement cycles are relatively slow, leading to sporadic and project-specific demand rather than continuous, high-volume orders. Furthermore, complex logistical requirements and high installation costs associated with heavy rails, requiring specialized welding and alignment expertise, often serve as financial barriers for smaller or less-developed infrastructure projects. Global economic downturns or prolonged trade disputes that suppress international shipping volumes can immediately decelerate investment decisions for new port construction or industrial expansion.

Opportunities primarily stem from technological advancements and regional infrastructure gaps. The development and commercialization of next-generation fastening systems, such as resilient pads and advanced welding techniques (e.g., flash-butt welding), offer improved performance and reduced long-term maintenance, creating opportunities for value-added products. Geographically, significant opportunities exist in developing regions (Africa and Southeast Asia) where industrialization is nascent, yet significant infrastructure development, particularly port capacity expansion, is planned. The shift towards fully automated crane systems also presents an opportunity for manufacturers capable of producing ultra-precision rail sections and offering integrated monitoring solutions, moving the industry toward a solutions-based service model rather than purely material sales.

These dynamic forces—structural demand from global trade and industrial production (Drivers), capital intensity and slow replacement cycles (Restraints), and the embrace of automation and material science advancements (Opportunities)—collectively determine the overall trajectory and profitability of the Crane Rail Market. The enduring impact force is the non-negotiable need for operational safety and reliability in heavy lifting, ensuring that demand for high-quality, certified rails remains constant despite economic headwinds. The balancing act lies between minimizing the high initial capital outlay and maximizing the operational lifespan and safety compliance of the rail system.

Segmentation Analysis

The Crane Rail Market segmentation provides a comprehensive view of the diverse product requirements and end-user demands across global industrial and logistical landscapes. The market is primarily categorized based on the Type of rail (which dictates strength and profile), and the Application (which defines the operational environment and load requirements). Analyzing these segments is crucial for manufacturers to align their production capabilities—ranging from standard rolled profiles to specialized, heat-treated sections—with the specific, stringent demands of sectors such as port logistics, where extreme dynamic loads are common, versus general industrial warehousing, where lighter duty cycles prevail. This structured differentiation helps identify key growth vectors and regional consumption patterns.

The segmentation by Type, including Light Rail, Heavy Rail, and Block Rail, is critical as it relates directly to the maximum axle load and operational environment. Heavy rails dominate the market value due to their necessity in high-throughput environments like container terminals and steel mills. Segmentation by Application highlights the varied demands, with Port Cranes representing the largest and most demanding segment, driven by continuous global container traffic growth. Industrial Cranes, serving vast manufacturing, mining, and energy sectors, form a stable secondary revenue stream. These segments are interconnected; the increasing capacity of cranes in ports directly dictates the required profile and quality of the heavy rails installed beneath them, leading to a constant cycle of upgrade and replacement in line with technological advancement in material handling machinery.

Furthermore, geographic segmentation is indispensable, reflecting disparities in infrastructure maturity and industrial activity. Asia Pacific leads in capacity expansion and new construction, demanding high volumes of rails across all types, while North America and Europe focus on premium, specialized rails for existing facility upgrades and automated systems. Strategic analysis of these segments enables market players to tailor marketing and distribution strategies, focusing premium, high-margin products like specialized fastening systems toward developed markets and bulk, high-volume rail delivery toward emerging economies undergoing rapid industrialization and port development.

- Type

- Light Rail (A45, A55, smaller industrial applications)

- Heavy Rail (A65, A75, A100, A120, A150, High-stress environments)

- Block Rail (Often used in specialized underground or compact installations)

- Others (Custom profiles, specialized alloys)

- Application

- Port Cranes (STS, RTG, RMG)

- Industrial Cranes (Steel Mills, Automotive Manufacturing, Heavy Machinery)

- Shipyards and Offshore Facilities

- Mining and Foundries

- Warehousing and Logistics Centers

- Grade/Treatment

- Standard Carbon Steel

- Head-Hardened Rail (Improved wear resistance)

- Alloy Steel Rail (Enhanced strength and toughness)

Value Chain Analysis For Crane rail Market

The value chain for the Crane Rail Market commences with the intensive upstream activity of raw material procurement, dominated by iron ore, coke, and scrap steel necessary for basic oxygen furnace (BOF) or electric arc furnace (EAF) steel production. This upstream phase is highly capital-intensive and concentrated among large, multinational steel manufacturers, determining the base cost and quality characteristics (such as carbon and manganese content) of the finished rail. Vertical integration is a common strategy among key market players, allowing them to control the metallurgical process, ensuring compliance with stringent international standards like DIN, ASTM, and specific regional requirements. The initial manufacturing involves complex rolling and heat treatment processes to create the specific rail profiles (e.g., A75, CR100) and achieve the necessary hardness, which is the crucial value-adding step in the production phase.

Midstream activities involve sophisticated processing and specialized services. This includes precision machining, end-milling, pre-curving, and crucially, specialized welding services (Thermit or flash-butt welding) necessary for joining segments into continuous, seamless tracks. Distribution channels are typically dual-layered: direct sales for large, customized infrastructure projects (like a major port expansion) handled by the rail manufacturer itself or through highly specialized industrial distributors and engineering firms. Indirect channels involve local stocking distributors who serve smaller industrial crane maintenance and replacement markets. Due to the weight, size, and critical nature of the product, logistics and inventory management are significant value chain components, demanding specialized heavy transport and storage facilities.

Downstream analysis focuses on installation and maintenance, which involves specialized civil engineering contractors and rail installation experts. The performance of the crane rail ultimately depends on the accuracy of the installation, alignment, and fastening systems. Post-installation, the value chain extends into the service domain, including rail grinding, non-destructive testing (NDT), and eventual rail replacement. End-users, such as major port operators (e.g., Hutchison Ports, DP World) and large industrial complexes (e.g., Tata Steel, ArcelorMittal), are highly sophisticated buyers, focused on Total Cost of Ownership (TCO) rather than just initial purchase price. The increasing reliance on engineered fastening systems and condition monitoring services is driving value further downstream into the specialized service and maintenance sector, providing opportunities for non-manufacturing entities in the supply chain.

Crane rail Market Potential Customers

The primary customers in the Crane Rail Market are large organizations operating heavy material handling equipment across critical global logistics and manufacturing infrastructure. The core buyer group is the Maritime Sector, encompassing major port authorities, terminal operators, and international shipping companies that invest heavily in infrastructure to accommodate mega-ships. These buyers require continuous, high-volume supplies of the heaviest rail profiles (e.g., A120, A150) for Ship-to-Shore (STS) cranes, Rail-Mounted Gantry (RMG) cranes, and stacking yard systems, prioritizing durability, high-yield strength, and minimal maintenance disruption to maintain round-the-clock throughput.

A second major customer segment is the Heavy Industry Sector. This includes global steel producers, large-scale automotive manufacturers, foundries, and mining operations. For instance, integrated steel mills utilize extensive networks of overhead cranes for transporting molten metal, slabs, and coils. These operations subject the rails to extreme temperatures, heavy impact, and abrasive environments, necessitating specialized alloy or heat-treated rails that offer superior wear resistance. Buyers in this segment often have highly technical procurement departments and require customized rail lengths and metallurgical reports to ensure product suitability for their specific high-stress indoor environments.

Finally, the Infrastructure and Construction segment, particularly related to shipbuilding and power generation (nuclear, conventional), represents another significant consumer base. Shipyards require durable rails for Goliath cranes used in assembling large vessel blocks. Power plants use specialized rails for handling turbines and heavy equipment during construction and maintenance. These buyers are often government or quasi-government entities and prioritize regulatory compliance, safety certifications, and long-term warranties. Procurement decisions across all segments are heavily influenced by consulting engineering firms and EPC (Engineering, Procurement, and Construction) contractors who specify the required rail systems during the project design phase.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450.5 Million |

| Market Forecast in 2033 | USD 621.8 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Voestalpine, Tata Steel, British Steel, EVRAZ, SAIL, Jinxi Heavy Industrial, Ansteel, Pilosio, Atlantic Track, L.B. Foster, Gantrex, Sanxia Railway Material, T. A. Pelsue Company, Railpro, Nippon Steel, ArcelorMittal, Vitosa, Harmer Steel, Rail One. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crane rail Market Key Technology Landscape

The technology landscape of the Crane Rail Market is characterized by continuous advancements in metallurgical science, precision manufacturing, and integrated track systems aimed at maximizing durability, reducing vibration, and simplifying installation. A primary technological focus is on enhancing rail hardness and resilience through sophisticated heat treatment processes, such as head hardening or full-body heat treatment. These techniques alter the microstructure of the steel, significantly increasing resistance to rolling contact fatigue and abrasive wear, crucial factors in high-duty cycle environments like container ports. Manufacturers utilize advanced rolling mills and controlled cooling processes to achieve specific hardness profiles (e.g., 300HB to 370HB) that extend the rail service life, thus offering superior performance over standard hot-rolled carbon steel rails.

Beyond the rail material itself, significant technological innovation centers on the peripheral track components and installation methods. Advanced fastening systems, particularly continuous elastic rail supports (e.g., specialized synthetic elastomer pads) combined with adjustable clip and sole plate assemblies, are replacing traditional, rigid mounting systems. These technologies are critical for damping dynamic forces, reducing noise, and providing precise vertical and lateral adjustability, which maintains optimal track geometry and minimizes localized stress points on the crane structure. Furthermore, specialized welding technologies, including automated flash-butt welding and specialized Thermit welding kits, ensure high-quality, seamless joints in the field, eliminating the maintenance issues associated with bolted joints.

The emerging technological front involves the integration of monitoring and surveying technologies. Laser scanning, drone-based aerial surveying, and high-precision inertial measurement units (IMUs) are used to map and assess rail track geometry with millimeter accuracy, feeding into predictive maintenance regimes. The adoption of smart rail systems, equipped with fiber optic sensors or acoustic emission sensors embedded near the track, represents the forefront of technology, allowing real-time monitoring of internal rail defects, joint movement, and wheel impact loads. This technological shift is moving the market toward a data-driven model, where the rail system is treated as an active, monitorable asset rather than a passive steel component.

Regional Highlights

Regional dynamics dictate the pace and nature of demand within the Crane Rail Market, reflecting varying levels of industrialization, infrastructure maturity, and regulatory frameworks. Asia Pacific (APAC) currently holds the dominant share and is forecasted to exhibit the highest growth rate. This exponential expansion is underpinned by China's continuous investment in vast industrial complexes and massive port capacity expansion projects, alongside significant infrastructure development initiatives in emerging economies like India, Vietnam, and Indonesia. APAC demand is characterized by high volume requirements for both new construction and comprehensive rail replacement in steel mills and rapidly expanding container terminals, focusing heavily on heavy-duty profiles (A75 and above) to support increasingly large-scale operations.

Europe and North America represent mature markets where growth is predominantly driven by modernization, maintenance, and the adoption of specialized, high-performance products. While new port construction is less frequent, existing facilities are continuously upgrading their rail systems to support higher automation, faster crane speeds, and stricter environmental and safety standards. European markets, in particular, favor advanced rail grades (e.g., heat-treated rails complying with DIN 536) and sophisticated fastening systems to mitigate noise and vibration in densely populated port areas. The focus here is on extending service life, reducing TCO, and maximizing operational efficiency through precision engineering and integration with autonomous material handling solutions.

The Middle East and Africa (MEA) and Latin America regions are emerging as key future growth areas, driven by strategic geopolitical infrastructure investments. MEA is heavily investing in new logistics hubs and trade corridors (e.g., Gulf Cooperation Council ports), leading to demand for high-capacity crane rail systems. Latin America's market growth is tied to commodity exports and associated port upgrades in Brazil, Mexico, and Chile. These regions typically lag slightly in adopting the highest level of automation but show high potential for large-scale greenfield projects, offering manufacturers substantial bulk sales opportunities for standard and medium-heavy rail profiles as they modernize their foundational infrastructure.

- Asia Pacific (APAC): Dominant market share and fastest growth; driven by infrastructural megaprojects in China, port expansion in India, and massive industrial production capacity requiring internal heavy lifting systems.

- Europe: Characterized by high demand for premium, specialized, and head-hardened rails for modernization projects; strong regulatory emphasis on safety and noise reduction in established industrial centers.

- North America: Stable market focused on replacement cycles and upgrades in intermodal terminals and industrial manufacturing; increasing adoption of advanced track monitoring and fastening technologies.

- Middle East & Africa (MEA): High potential due to significant government investment in maritime logistics hubs (e.g., UAE, Saudi Arabia) and nascent industrialization efforts.

- Latin America: Growth tied to port capacity improvements supporting agricultural and mining commodity exports; sensitivity to global commodity price fluctuations impacting infrastructure spending.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crane rail Market.- Voestalpine AG

- Tata Steel

- British Steel

- EVRAZ plc

- Steel Authority of India Limited (SAIL)

- Nippon Steel Corporation

- Ansteel Group Corporation

- Jingye Group (owner of British Steel assets)

- Jinxi Heavy Industrial Co., Ltd.

- Gantrex Group

- L.B. Foster Company

- Atlantic Track & Turnout Co.

- Pilosio S.p.A.

- Sanxia Railway Material Co., Ltd.

- Vossloh AG (Rail infrastructure systems provider)

- ArcelorMittal

- Railpro B.V.

- Vitosa Steel

- Harmer Steel Products Co.

- Rail One GmbH

Frequently Asked Questions

Analyze common user questions about the Crane rail market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Crane Rail Market?

The market growth is primarily fueled by extensive global investments in port modernization, necessary to handle ultra-large container vessels, and the sustained expansion of heavy industrial sectors, particularly in the Asia Pacific region, driving demand for heavy-duty material handling infrastructure.

How does head-hardened crane rail differ from standard carbon steel rail?

Head-hardened crane rail undergoes specialized heat treatment processes which significantly increase its hardness (often 300-370 HB) and resistance to abrasive wear and rolling contact fatigue, offering a substantially longer service life and higher load-bearing capacity compared to standard hot-rolled carbon steel rails.

Which application segment accounts for the largest market share for crane rails?

The Port Cranes segment, encompassing Ship-to-Shore (STS) and Rail-Mounted Gantry (RMG) cranes used in container terminals, accounts for the largest market share due to the immense size, continuous usage cycles, and stringent durability requirements of modern maritime logistics infrastructure.

What role do fastening systems play in the performance of crane rail tracks?

Advanced fastening systems (clips, pads, and sole plates) are crucial for maintaining optimal rail alignment, minimizing vibration, and effectively absorbing dynamic forces generated by moving cranes. They reduce stress on the crane structure and foundation, thus extending the overall lifespan of the entire rail system.

Which region is expected to lead the demand for new crane rail infrastructure?

Asia Pacific (APAC) is projected to lead the demand for new crane rail infrastructure, driven by rapid industrialization, massive investments in manufacturing expansion, and ongoing governmental strategies to increase port handling capacity across China, India, and Southeast Asian nations.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Crane Rail Market Size Report By Type (Below 70 Kg/m Rail, 70 to 90 Kg/m Rail, 90 to 120 Kg/m Rail, Above 120 Kg/m Rail), By Application (Industrial Sector, Marine Sector, Logistic Sector, Mining Sector, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Crane Rail Market Statistics 2025 Analysis By Application (Industrial, Marine, Logistic, Mining), By Type (Below 70 Kg/m Rail, 70 to 90 Kg/m Rail, 90 to 120 Kg/m Rail, Above 120 Kg/m Rail), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager