Cresylic Acid Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435131 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cresylic Acid Market Size

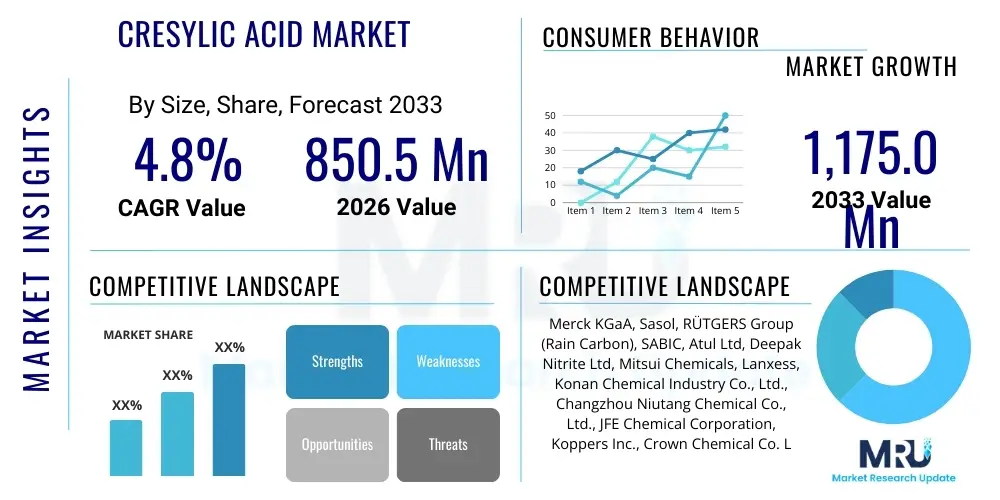

The Cresylic Acid Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850.5 Million in 2026 and is projected to reach USD 1,175.0 Million by the end of the forecast period in 2033.

Cresylic Acid Market introduction

Cresylic acid, often referred to as cresol, is a mixture of ortho, meta, and para isomers of methylphenol. These aromatic organic compounds are derived primarily from coal tar distillation or through the synthesis of toluene. The unique chemical structure of cresylic acid, offering excellent solvency and disinfectant properties, establishes it as a foundational intermediate chemical utilized across numerous heavy industries globally. Its distinct chemical reactivity allows it to serve as a crucial precursor in the manufacture of complex chemical derivatives, which are essential for high-performance applications demanding specific functional attributes, such as enhanced flame retardancy, superior lubrication characteristics, and robust antimicrobial efficacy. The market dynamics are intrinsically linked to the industrial output and regulatory landscape of key consuming sectors, particularly construction, automotive manufacturing, and healthcare, driving a stable yet consistently growing demand trajectory for this versatile chemical intermediate.

The product portfolio derived from cresylic acid is remarkably diverse, spanning high-value applications such as phosphate esters, specialized resins, and potent disinfectants. Phosphate esters, synthesized using cresylic acid, are highly sought after in the automotive and aerospace industries for their excellent fire resistance and use as functional fluids, hydraulic lubricants, and critical components in advanced wire enamel formulations used for insulating electric motors and coils. Furthermore, the inherent biocidal properties of cresylic acid make it an invaluable ingredient in formulating powerful industrial and institutional disinfectants, particularly relevant in current global health environments emphasizing stringent hygiene protocols. This dual functionality—serving as a chemical building block and a direct functional agent—insulates the market from volatility inherent in relying on a single end-use sector, providing a broad base for sustained market expansion and investment.

Key driving factors supporting the steady expansion of the Cresylic Acid Market include the escalating global demand for high-performance lubricants and hydraulic fluids that are non-flammable or exhibit superior thermal stability in extreme operating conditions. Simultaneously, the rapid growth in industrialization and urbanization across emerging economies, especially in the Asia Pacific region, fuels the construction and infrastructure sectors, which, in turn, increases the need for cresylic acid-based specialty resins and protective coatings. Regulatory shifts emphasizing fire safety standards in construction materials and electronics further boost the adoption of cresylic acid-derived flame retardants. However, the market must navigate challenges related to the cyclical nature of its primary raw material sources (coal tar and petroleum) and the ongoing necessity for environmentally sound disposal and handling processes, given the toxicity profile of the material.

Cresylic Acid Market Executive Summary

The Cresylic Acid Market is experiencing moderate growth driven fundamentally by robust demand from the phosphate esters segment, which critically supports the expansion of the high-performance lubricants and functional fluids market. Current business trends indicate a pronounced shift towards synthetic cresylic acid production to mitigate supply chain instability associated with coal tar sourcing, which is subject to fluctuating coke production rates. Furthermore, manufacturers are focusing intensely on developing higher purity grades of cresylic acid to meet the exacting specifications required by advanced applications, such as specialized aviation hydraulic fluids and high-voltage electrical insulation coatings. Strategic mergers, acquisitions, and joint ventures aimed at securing captive raw material supplies and expanding geographical manufacturing footprints are defining the competitive landscape, pushing established players to innovate process efficiencies and enhance product customization capabilities to maintain market share and address niche market demands effectively.

Regionally, the Asia Pacific (APAC) market continues to dominate both in terms of consumption and production capacity, primarily due to accelerated industrial growth, massive infrastructure investments, and the presence of numerous manufacturing hubs for consumer electronics and automotive components in countries like China and India. Europe and North America represent mature markets characterized by stringent environmental regulations and a focus on advanced technology applications, driving the demand for specialty, high-value cresylic acid derivatives, particularly in the aviation and medical disinfectant sectors. The Middle East and Africa (MEA) region is emerging as a potential growth area, spurred by investments in oil and gas infrastructure and the resultant increase in demand for industrial cleaning agents and corrosion inhibitors. These regional variations necessitate tailored marketing and distribution strategies, emphasizing compliance with local chemical registration and safety standards, particularly concerning handling and disposal.

In terms of segmentation trends, the application segment of phosphate esters is expected to register the fastest growth rate, fueled by the essential requirement for flame-retardant additives in plastics, coatings, and specialized lubricants globally. The disinfectant segment, while mature, has witnessed renewed interest and demand surges, especially following heightened global health awareness, leading to increased adoption of powerful, hospital-grade cleaning agents that utilize cresylic acid compounds. Segmentation based on purity indicates a premiumization trend, where high-purity cresylic acid grades (essential for polymerization reactions and high-spec resins) command higher price points and experience steadier demand growth compared to lower-purity grades primarily used in bulk industrial applications like flotation reagents. This segment diversity ensures resilience against downturns in specific end-use markets, supporting the overall market's steady financial outlook throughout the forecast period.

AI Impact Analysis on Cresylic Acid Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cresylic Acid Market frequently revolve around two main themes: optimization of complex chemical synthesis processes and enhanced raw material sourcing prediction, particularly concerning coal tar and petroleum byproduct availability. Users are keen to understand how machine learning models can be deployed to predict price volatility of raw materials, thereby optimizing procurement strategies and reducing overall operational costs for synthetic cresylic acid production. Furthermore, there is significant interest in using AI-driven computational chemistry to accelerate the discovery and formulation of novel cresylic acid derivatives with improved environmental profiles or enhanced performance characteristics, potentially identifying greener, more sustainable synthesis routes that minimize toxic byproduct formation, addressing longstanding regulatory concerns in the industry.

The integration of AI and machine learning is poised to revolutionize the manufacturing efficiency within the cresylic acid production lifecycle. Predictive maintenance algorithms, powered by deep learning on sensor data, can forecast equipment failures in distillation columns and reactors, dramatically reducing unplanned downtime and improving overall plant capacity utilization. AI is also critical in optimizing the complex separation processes required to isolate specific cresol isomers, ensuring higher purity yields and reducing energy consumption associated with refining. This technological adoption translates directly into reduced production costs and increased consistency of the final product quality, making manufacturers more competitive in the global market, particularly those focused on high-specification, isomer-specific products required by specialty chemical consumers.

Beyond production, AI applications extend into market intelligence and supply chain resilience. Natural Language Processing (NLP) tools can analyze vast amounts of global trade data, regulatory changes, and industrial output forecasts (e.g., coke production rates) to provide accurate, real-time demand and supply forecasts for cresylic acid. This proactive approach allows producers to adjust inventory levels and production schedules dynamically, minimizing risks associated with demand fluctuations and geopolitical supply shocks. The ability of AI to model complex chemical interactions also opens up avenues for better hazard assessment and safer handling protocols, contributing to regulatory compliance and bolstering the industry's commitment to worker and environmental safety management.

- AI-driven optimization of distillation parameters to increase isomer purity yield and reduce energy consumption.

- Machine learning models for predictive maintenance, minimizing downtime in large-scale production facilities.

- Advanced supply chain analytics utilizing AI to forecast raw material (coal tar) availability and price volatility.

- Computational chemistry tools accelerating the development of novel cresylic acid derivatives with improved flame retardancy.

- Use of AI for quality control and contamination detection in high-purity cresylic acid batches.

- Automated analysis of global regulatory documents to ensure proactive compliance with environmental standards.

DRO & Impact Forces Of Cresylic Acid Market

The Cresylic Acid Market is influenced by a dynamic interplay of Drivers (D), Restraints (R), and Opportunities (O) that collectively determine its growth trajectory and competitive intensity. A primary driver is the accelerating requirement for specialized functional fluids, particularly non-flammable hydraulic fluids and advanced engine lubricants, which rely heavily on cresylic acid-derived phosphate esters, especially in critical sectors like aviation, mining, and heavy machinery manufacturing. Alongside this, the global push for enhanced hygiene standards and ongoing infrastructure development, particularly in Asia, acts as a fundamental growth catalyst, ensuring a steady stream of demand for disinfectants and specialized resins used in protective coatings. However, these drivers are counterbalanced by significant restraints, primarily the extreme price volatility and finite nature of coal tar and petroleum fractions, which constitute the primary raw material base, leading to unpredictable operational costs for synthetic and natural producers alike.

Restraints are further exacerbated by increasingly stringent environmental regulations, particularly concerning volatile organic compounds (VOCs) and the toxicity profile of cresol isomers, demanding continuous investment in safer manufacturing processes and environmentally benign product formulations. This regulatory pressure often results in high compliance costs and acts as a significant barrier to entry for smaller manufacturers. Opportunities, nevertheless, abound in the development of bio-based cresylic acid alternatives or the utilization of non-conventional feedstocks, addressing both sustainability concerns and raw material price dependency. Furthermore, the rising demand for high-performance resins in niche markets, such as wind energy turbine blades and specialized composite materials, offers avenues for premium product differentiation and technological advancement within the market structure.

Impact forces stemming from this DRO analysis include the intense competition among key producers who are focused on vertical integration—securing access to crude coal tar supply chains—to mitigate raw material risks. The substitution threat remains moderate, as alternative chemical precursors offer comparable performance but often at a higher cost or with different processing requirements; however, continuous R&D in alternative solvents and flame retardants poses a persistent long-term threat. Bargaining power of buyers, predominantly large chemical manufacturers and formulators, is moderately high due to the standardized nature of some lower-purity grades, necessitating that suppliers focus on differentiation through high purity, specialized isomeric content, and superior technical support to maintain margin strength.

Segmentation Analysis

The Cresylic Acid Market segmentation provides a granular view of consumption patterns, allowing stakeholders to identify high-growth sub-markets and tailor product offerings accordingly. The market is primarily segmented based on product type (differentiating between various isomeric mixtures and purity levels), application (the final end-use sector), and end-use industry. This structure is essential because the performance requirements and pricing structures vary drastically; for instance, the demand for meta-cresol or para-cresol in specialized electronic resins is entirely different from the demand for technical-grade cresol mixtures used in flotation reagents for mineral processing. Understanding these nuances helps manufacturers allocate resources effectively, focusing R&D on segments where high-purity and advanced functionality are rewarded with premium pricing and robust demand growth.

The product type segmentation is critical as it highlights the inherent difference between synthetic production, which yields highly controlled, often single-isomer streams, and natural production (coal tar derived), which typically yields mixed cresol streams. Synthetic cresylic acid is increasingly favored in highly sensitive applications like pharmaceuticals and specific polymers where trace contaminants cannot be tolerated, reflecting a premium segment with sustained growth. Conversely, segmentation by application reveals the market's dependence on the phosphate esters category, which dictates the overall volume growth, while the resins and specialty chemicals segments drive value growth due to their high barrier to entry and specialized formulation needs. Geographical segmentation remains paramount, with APAC maintaining its leadership due to extensive industrial output, necessitating focused investment in regional manufacturing and distribution logistics.

The detailed segmentation structure facilitates comprehensive strategic planning, enabling companies to target specific vertical markets. For example, focusing on the wire enamel segment requires adherence to stringent electrical insulation standards, while targeting the disinfectant market requires registration and compliance with health and safety regulations, such as those governed by the EPA or equivalent international bodies. This diversity in regulatory environments across segments underscores the need for localized market strategies. Furthermore, the continuous emergence of new applications, such as in high-temperature polymers and next-generation composite materials, suggests that the 'Others' application segment will remain a dynamic area for future market innovation and specialized product introduction.

- By Product Type:

- Natural (Coal Tar Derived)

- Synthetic (Toluene Derived)

- By Grade/Isomer:

- O-Cresol

- M-Cresol

- P-Cresol

- Cresylic Acid Mixture (Meta/Para Ratio)

- By Application:

- Phosphate Esters (Flame Retardants, Plasticizers, Hydraulic Fluids)

- Disinfectants and Biocides

- Resins (Phenolic Resins, Epoxy Resins)

- Wire Enamel Coatings

- Flotation Reagents

- Specialty Solvents and Intermediates

- Others (Dye Intermediates, Antioxidants)

- By End-Use Industry:

- Automotive and Transportation

- Aerospace

- Chemical and Petrochemical

- Construction and Infrastructure

- Healthcare and Institutional Cleaning

- Mining and Metallurgy

- Electronics and Electrical

Value Chain Analysis For Cresylic Acid Market

The value chain for the Cresylic Acid Market initiates with the upstream supply of fundamental raw materials, predominantly crude coal tar (a byproduct of coke oven operations in the steel industry) and petroleum fractions (toluene derivatives for synthetic routes). The upstream segment is characterized by high capital intensity and reliance on the cyclical performance of the steel and petrochemical industries, which directly influences the volume and pricing stability of cresol precursors. Manufacturers in this initial stage often require specialized infrastructure for handling, extraction, and initial purification processes. Integrated producers who control the raw material source (e.g., steel companies with coke oven batteries) possess a significant competitive advantage by ensuring continuity of supply and minimizing price exposure compared to those reliant solely on open market procurement, thereby strengthening their position in the highly competitive market.

The core manufacturing and processing stage involves complex separation technologies, such as fractional distillation and solvent extraction, to isolate cresylic acid from crude mixtures and further purify it into specific isomers (o-, m-, p-cresol) required by various downstream applications. This stage adds significant value through chemical expertise, process efficiency, and quality control, ensuring the product meets rigorous purity standards. Following manufacturing, the distribution channel plays a vital role. Due to the hazardous nature of cresylic acid, distribution channels, which include both direct sales to large end-users and indirect sales through specialized chemical distributors and agents, must adhere to strict safety, handling, and logistics regulations, often involving specialized tank containers and certified handlers, adding complexity and cost to the supply chain management process.

The downstream segment encompasses the conversion of cresylic acid into final products, such as phosphate esters, thermosetting resins, and disinfectants, which are then sold to various end-use industries like automotive, construction, and healthcare. The profitability in the downstream stage is driven by innovation and specialization; for instance, a company formulating a high-performance, low-toxicity hydraulic fluid derivative commands higher margins than a bulk supplier of industrial disinfectant concentrates. Direct distribution is favored for large-volume, sophisticated customers (e.g., aerospace fluid manufacturers), allowing for tailored technical support, while indirect channels serve smaller volume users and regional markets effectively, leveraging the distributor's local warehousing capabilities and established customer networks for broad market reach.

Cresylic Acid Market Potential Customers

The primary potential customers and buyers of cresylic acid are large-scale chemical formulators and industrial manufacturers across several key vertical markets demanding high-performance chemical intermediates and functional fluids. Companies specializing in the production of phosphate esters, such as lubricant and plasticizer manufacturers, constitute a major customer base due to the indispensable role of cresylic acid in creating fire-resistant and high-stability functional fluids utilized in aircraft hydraulics, industrial machinery, and engine lubrication systems. These customers require high-volume, consistent supply of specific cresol isomers, often meta-cresol, and prioritize quality certifications and long-term supply agreements to ensure the integrity of their final product formulations, making reliability a critical factor in supplier selection.

Another significant customer segment includes manufacturers of specialized resins, particularly those creating phenolic resins and epoxy curing agents used in protective coatings, adhesives, and composites for the construction and electronics industries. For instance, manufacturers of wire enamel coatings for electrical motors and transformers rely on cresylic acid to achieve superior thermal and electrical insulation properties, requiring suppliers to meet stringent purity and performance specifications. The healthcare and institutional cleaning sector represents a robust, though cyclical, customer base, purchasing cresylic acid for its powerful biocidal properties, utilizing it in the production of concentrated disinfectants and antiseptics aimed at maintaining stringent public health standards in hospitals, schools, and commercial facilities worldwide.

Furthermore, the mining and metallurgy industries are important consumers, particularly utilizing lower-purity grades of cresylic acid as a flotation reagent in the selective separation of minerals from ore. This segment demands cost-effective, high-volume supply. Potential buyers also include specialty chemical synthesis companies that use cresylic acid as a precursor for producing dyes, antioxidants, and pharmaceutical intermediates. The diversity of these end-users underscores the necessity for suppliers to maintain a versatile product portfolio, catering from bulk industrial needs to highly specialized, low-volume requirements demanding exceptional purity and bespoke technical support, thus optimizing customer retention and market penetration across multiple industrial fronts simultaneously.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850.5 Million |

| Market Forecast in 2033 | USD 1,175.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, Sasol, RÜTGERS Group (Rain Carbon), SABIC, Atul Ltd, Deepak Nitrite Ltd, Mitsui Chemicals, Lanxess, Konan Chemical Industry Co., Ltd., Changzhou Niutang Chemical Co., Ltd., JFE Chemical Corporation, Koppers Inc., Crown Chemical Co. Ltd., Nanjing Datang Chemical Co., Ltd., SI Group, Votteler Lacktechnik GmbH, P.C. Products Company, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cresylic Acid Market Key Technology Landscape

The technological landscape of the Cresylic Acid Market is characterized by continuous refinement in separation and synthesis methodologies aimed at improving yield, reducing energy consumption, and achieving superior isomeric purity. Key technologies include advanced fractional distillation and solvent extraction techniques, specifically tailored to separate the closely boiling isomers (o-, m-, and p-cresol) efficiently. Modern processing facilities are increasingly adopting highly efficient column designs and sophisticated process control systems, leveraging digital twin technology and real-time analytics to precisely manage temperature and pressure gradients. This technological focus is driven by the necessity of meeting the exacting quality requirements of high-end applications, such as the production of specialty resins for electronics, where even minor impurities can compromise performance and lead to product failure, thus demanding significant capital investment in purification technology.

In the synthetic production segment, catalytic processes starting from toluene are continually being optimized. The latest technological advancements focus on developing highly selective catalysts that minimize byproduct formation and maximize the yield of specific cresol isomers, particularly meta-cresol, which is often in higher demand for flame retardant synthesis. Furthermore, membrane separation technology is being explored as an alternative or complement to traditional distillation methods. While still nascent in large-scale cresol production, membrane processes offer the potential for lower energy consumption and finer control over isomer separation, presenting a significant long-term disruptive technological pathway for the industry, especially as environmental standards tighten and energy costs escalate, making process efficiency a paramount concern for manufacturers globally.

Beyond core manufacturing, emerging technologies related to sustainable chemistry are gaining prominence. Research efforts are focused on utilizing renewable feedstocks or waste streams (e.g., lignin pyrolysis products) as potential sustainable sources for cresylic acid, mitigating the reliance on fossil fuels. Furthermore, innovative waste treatment technologies are crucial, given the inherent toxicity of cresols. Advanced oxidation processes and biological treatment systems are being deployed to effectively neutralize process effluent before discharge, ensuring adherence to stringent global environmental protection agency mandates. These technological investments are not just regulatory requirements but are increasingly viewed as strategic differentiators in a market sensitive to environmental, social, and governance (ESG) performance metrics, positioning firms with superior technological capabilities as preferred partners.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and supply equilibrium of the Cresylic Acid Market, reflecting varying levels of industrialization, regulatory pressures, and consumer demands across major economic zones. The Asia Pacific (APAC) region stands as the undisputed market leader, driven by large-scale production capacities in chemical synthesis, rapid expansion of the automotive and construction sectors, and the massive consumption of cresylic acid in countries like China, India, and South Korea. These nations serve as global manufacturing hubs for electronics and polymers, necessitating substantial volumes of cresol derivatives for wire enamels, resins, and phosphate esters. Furthermore, the burgeoning demand for sophisticated industrial and consumer disinfectants in response to population growth and health awareness solidifies APAC's dominant market position.

North America and Europe represent mature markets characterized by sophisticated regulatory frameworks and a strong focus on high-value, specialized applications. Demand here is less volume-driven and more quality-centric, focusing primarily on high-purity synthetic cresylic acid for aerospace-grade hydraulic fluids, pharmaceutical intermediates, and advanced composite materials. Strict REACH regulations in Europe and similar environmental mandates in North America compel manufacturers to invest heavily in sustainable production practices and low-toxicity product formulations, leading to market growth concentrated in premium, specialized grades where price sensitivity is lower, and performance requirements are exceptionally high, driving innovation in chemical process engineering.

Latin America and the Middle East & Africa (MEA) are emerging regions exhibiting considerable growth potential. Latin America, particularly Brazil and Mexico, demonstrates increasing demand tied to infrastructure projects and mining activities, where cresylic acid is utilized in both protective coatings and flotation reagents. The MEA region's growth is largely supported by expansion in the petrochemical and oil and gas sectors, leading to higher consumption of industrial cleaners, specialty solvents, and corrosion inhibitors derived from cresol. However, these regions often face challenges related to logistics infrastructure and political instability, which can temporarily impede market expansion, requiring international suppliers to navigate complex local market entry strategies and supply chain resilience measures.

- Asia Pacific (APAC): Dominates the market due to robust manufacturing of automotive components, electronics, and construction materials. China and India are the largest consumers, driving demand for both synthetic and natural cresylic acid in flame retardants and resins. The region hosts the highest number of new capacity additions.

- North America: Focuses on high-purity, specialized applications, particularly in the aerospace and healthcare sectors. Growth is steady, driven by strict fire safety standards necessitating advanced phosphate ester fluids and continued demand for institutional disinfectants. Emphasis on sustainable sourcing and compliance.

- Europe: Characterized by stringent chemical regulations (REACH). Demand is focused on specialized, low-volume, high-value applications, including advanced wire enamels and pharmaceutical precursors. Germany and France are key consumers, prioritizing technological innovation and environmentally friendly products.

- Latin America (LATAM): Growth is primarily linked to infrastructure development and the revitalization of the mining sector, increasing the use of cresylic acid as a flotation reagent and in industrial protective coatings. Market size is smaller but exhibits high growth potential.

- Middle East and Africa (MEA): Emerging market driven by investments in the oil, gas, and petrochemical sectors. Demand is strong for industrial cleaning agents, specialized solvents, and construction chemicals. Market penetration is often challenging due to logistical complexities and regulatory fragmentation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cresylic Acid Market.- Merck KGaA

- Sasol

- RÜTGERS Group (Rain Carbon)

- SABIC

- Atul Ltd

- Deepak Nitrite Ltd

- Mitsui Chemicals

- Lanxess

- Konan Chemical Industry Co., Ltd.

- Changzhou Niutang Chemical Co., Ltd.

- JFE Chemical Corporation

- Koppers Inc.

- Crown Chemical Co. Ltd.

- Nanjing Datang Chemical Co., Ltd.

- SI Group

- Votteler Lacktechnik GmbH

- P.C. Products Company, Inc.

- Covestro AG

- Huntsman Corporation

Frequently Asked Questions

Analyze common user questions about the Cresylic Acid market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is cresylic acid primarily used for in the industrial sector?

Cresylic acid is primarily used as a critical chemical intermediate in the production of high-performance phosphate esters, which serve as non-flammable hydraulic fluids, specialty plasticizers, and flame retardants for the automotive, aerospace, and construction industries. Additionally, it is essential for manufacturing potent disinfectants and specialized phenolic resins used in protective coatings and wire enamels, due to its excellent solvent and antiseptic properties.

How do synthetic and natural cresylic acid sources differ in market application?

Synthetic cresylic acid, derived from toluene, offers higher purity and consistency in isomeric composition (e.g., pure m-cresol or p-cresol) and is therefore preferred for sensitive applications like pharmaceuticals, specific electronic resins, and high-specification specialty chemicals. Natural cresylic acid, sourced from coal tar, is typically a mixture of isomers and is generally utilized in bulk industrial applications such as flotation reagents, general-purpose solvents, and large-volume disinfectant formulations where precise isomer control is less critical and cost efficiency is paramount.

What are the main factors restraining the growth of the Cresylic Acid Market?

The primary restraints include the significant volatility in the cost and supply of raw materials, specifically crude coal tar and certain petroleum fractions, which creates pricing instability for manufacturers. Furthermore, increasingly strict global environmental regulations regarding the handling, emission, and toxicity profile of cresol isomers necessitate substantial capital investment in compliance and waste management, acting as a financial burden and limiting market expansion in highly regulated economies.

Which geographical region holds the largest market share for cresylic acid and why?

The Asia Pacific (APAC) region currently holds the largest market share due to its massive industrial base and rapid urbanization. Countries like China and India are major consumers and producers, driven by explosive growth in manufacturing sectors, including automotive production, electronics, and construction, which demand large volumes of cresylic acid-based resins, wire enamels, and functional fluids to support their rapidly expanding infrastructure and industrial output capacities.

What role do phosphate esters play in the overall demand for cresylic acid?

Phosphate esters represent the most significant application segment, crucially determining overall market volume demand. Cresylic acid is vital for synthesizing these esters, which are indispensable as flame-retardant additives in plastics, protective coatings, and as base stocks for high-performance hydraulic fluids and specialized lubricants requiring exceptional thermal stability and fire resistance, especially in high-risk industrial environments such as aerospace and heavy manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager