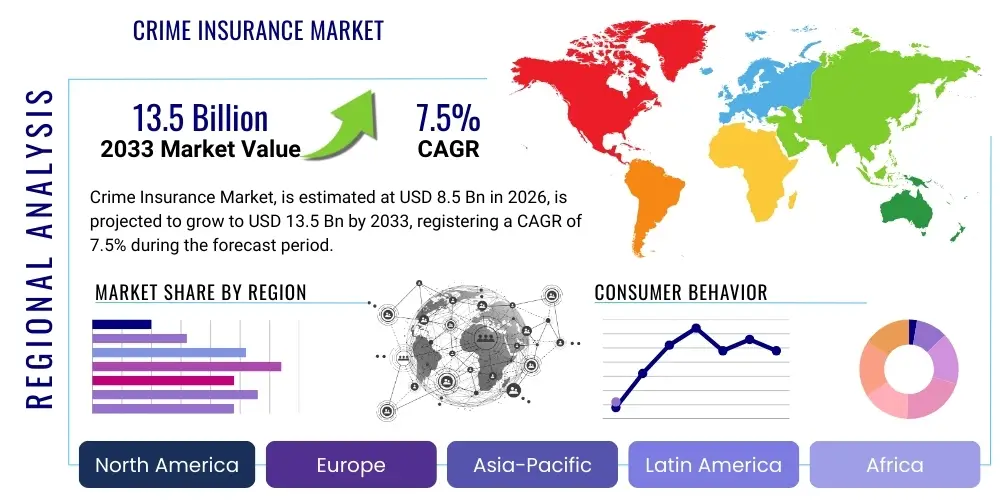

Crime Insurance Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436157 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Crime Insurance Market Size

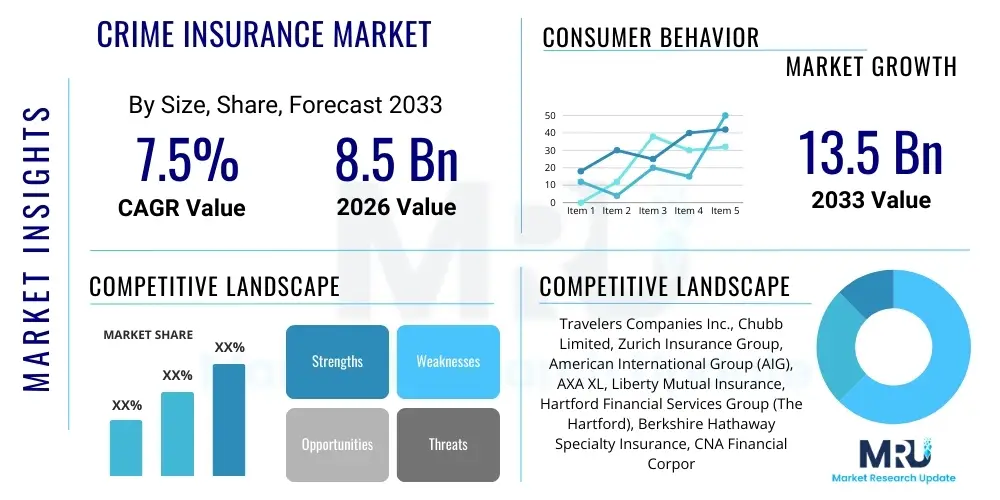

The Crime Insurance Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at $8.5 Billion in 2026 and is projected to reach $13.5 Billion by the end of the forecast period in 2033.

Crime Insurance Market introduction

The Crime Insurance Market encompasses specialized insurance products designed to protect commercial entities, financial institutions, and non-profit organizations against financial losses resulting from fraudulent activities, theft, and other criminal acts, both internal (employee dishonesty) and external (third-party fraud, forgery, cybercrime). Unlike general commercial property insurance, crime policies focus specifically on loss of money, securities, and other property due to criminal acts. The necessity for these policies has rapidly accelerated due to the increasing sophistication of corporate fraud schemes and the growing reliance on digital financial transactions, which introduces new vectors for computer fraud and funds transfer fraud. Historically, this market evolved from basic fidelity bonds—which only covered internal employee theft—to comprehensive crime policies that address a broad spectrum of risks, making it an essential component of modern corporate risk management portfolios across all major industry verticals globally.

The primary product offerings within this market are segmented based on the type of covered loss, including coverage for employee dishonesty, forgery or alteration, theft of money and securities, computer fraud, and kidnapping/ransom payments. Major applications span across highly regulated and cash-intensive sectors such as banking and finance, healthcare, retail, and manufacturing, where the exposure to both opportunistic and organized crime is substantial. The benefits derived from crime insurance are manifold; it ensures financial stability following a significant criminal loss event, facilitates business continuity by covering investigation and mitigation costs, and often satisfies regulatory or contractual requirements mandated by lenders or partners. The shift towards globalized supply chains and digitized operations has inherently increased exposure, thereby driving the sustained demand for robust and adaptable crime insurance solutions capable of addressing evolving threat landscapes.

Driving factors propelling the Crime Insurance Market include the exponential rise in cybercrime and associated social engineering attacks (e.g., Business Email Compromise - BEC), coupled with stringent regulatory mandates requiring businesses to secure assets and report financial crimes promptly. Furthermore, the economic volatility often contributes to an increase in white-collar crime and employee theft, prompting organizations to seek higher limits and broader coverage. Insurers are continuously innovating by integrating forensic investigation services and risk mitigation consulting into their crime policies, transitioning the offering from a reactive loss recovery tool to a proactive risk management partnership. This enhanced value proposition, combined with the increasing financial impact of organized crime syndicates targeting corporate assets, solidifies crime insurance as a critical defense layer in the modern commercial landscape.

Crime Insurance Market Executive Summary

The Crime Insurance Market is experiencing robust growth driven by converging trends in digitalization, elevated geopolitical risks, and heightened awareness regarding employee dishonesty and external fraud complexity. Business trends indicate a significant pivot among carriers towards developing specialized endorsements to address digital risks, particularly related to cryptocurrency theft and funds held in escrow accounts, which fall outside traditional policy definitions. Small and Medium Enterprises (SMEs) are increasingly becoming primary targets due to often weaker internal controls, leading to high growth rates in the SME segment. Moreover, the market is characterized by a flight to quality, where large corporations seek comprehensive policies offering global coverage and high limits, demanding sophisticated underwriting models that can quantify non-physical loss exposure precisely. Insurers leveraging advanced analytics and AI for fraud modeling are gaining a competitive edge by offering more accurately priced and tailored risk solutions, moving away from standardized blanket policies.

Regional trends highlight North America as the dominant market, primarily due to a mature regulatory environment, high frequency of sophisticated cyber-enabled fraud (like BEC), and a robust culture of litigation and financial disclosure, necessitating strong crime coverage limits. Europe follows, demonstrating accelerated growth fueled by regulatory compliance needs (especially GDPR indirectly affecting data-related financial fraud) and consolidation in the financial services sector, requiring standardized multinational crime policies. The Asia Pacific (APAC) region is projected to register the highest growth CAGR, driven by rapid urbanization, increasing foreign direct investment, and a burgeoning digital payment ecosystem that simultaneously introduces significant vulnerability to electronic funds transfer fraud. Emerging markets within APAC and Latin America are showing a foundational shift from self-retention of crime losses to procuring formal insurance, catalyzed by increased international business trade requirements and a stricter enforcement of anti-corruption and anti-fraud laws.

Segment trends underscore the criticality of the Financial Institutions segment, which remains the largest consumer of crime insurance due to their immense fiduciary responsibilities and exposure to large-scale, systemic fraud. However, the fastest-growing segment is expected to be in Professional Services and Technology, Media, and Telecommunications (TMT), sectors highly susceptible to computer fraud and proprietary data theft leading to financial loss. Furthermore, the segmentation by coverage type shows a pronounced demand shift from basic fidelity coverage towards comprehensive policies encompassing computer crime, social engineering fraud, and specialized expense coverage (e.g., investigative costs, legal defense), signaling that clients prioritize adaptability against novel threats over traditional theft protection. This trend necessitates that insurers continuously update policy language to avoid coverage gaps arising from rapid technological and criminal evolution.

AI Impact Analysis on Crime Insurance Market

User queries regarding the impact of Artificial Intelligence (AI) on the Crime Insurance Market frequently revolve around two main themes: its application in proactive risk mitigation and its effect on underwriting profitability and efficiency. Common user questions include: How can AI differentiate between accidental error and deliberate employee fraud? Will AI-driven predictive modeling reduce overall crime claims, consequently lowering premiums? And, conversely, how will AI-driven criminal enterprises challenge existing policy structures? Users seek reassurance that AI tools provide a measurable improvement in loss prevention and accurate claims assessment, specifically wanting to know if AI can detect sophisticated, non-obvious social engineering schemes that human underwriters might miss. The central expectation is that AI will transform crime insurance from a retrospective compensation model into a real-time risk prevention system, although concerns remain about data privacy, algorithmic bias, and the potential for AI tools themselves to be compromised or misused by internal bad actors.

The application of AI and Machine Learning (ML) is fundamentally altering the risk profile and operational efficiency within the crime insurance sector. Insurers are integrating AI algorithms into core processes to analyze massive datasets, including transaction histories, network activity logs, and behavioral patterns of employees, to identify anomalies indicative of potential fraud or criminal intent. For underwriting, AI models allow for highly granular risk segmentation, moving beyond industry averages to assess the specific organizational controls, IT security posture, and internal audit mechanisms of the insured entity. This precision enables more accurate premium pricing, reducing adverse selection and improving portfolio profitability. Moreover, AI aids in scenario modeling, predicting potential loss exposure from emerging fraud types, such as deepfake attacks used for identity spoofing in funds transfer authorizations.

On the claims front, AI significantly accelerates the detection of fraudulent claims and automates preliminary assessment of legitimate claims, substantially reducing the ‘cycle time’ from incident report to payout. Behavioral biometrics and advanced statistical modeling, powered by AI, are used to reconstruct the sequence of events leading to a loss, providing forensic certainty necessary for subrogation and policy enforcement. However, the adoption requires substantial investment in clean, high-quality training data, as flawed data can lead to biased risk assessments or misidentification of legitimate activity as fraud. The long-term impact is anticipated to create highly customized crime insurance products, dynamically priced based on the ongoing effectiveness of the insured's deployed defensive technologies, creating a truly data-driven approach to insuring criminal risk.

- AI enhances real-time fraud detection by analyzing transaction metadata and user behavior patterns.

- Machine Learning (ML) models improve underwriting accuracy by predicting the likelihood of employee dishonesty and external fraud based on organizational risk factors.

- Automation of routine claims processing using Natural Language Processing (NLP) speeds up the claim lifecycle and reduces operational costs.

- Predictive analytics enables insurers to identify and alert clients to emerging social engineering attack vectors (e.g., sophisticated BEC schemes).

- AI assists in forensic investigation by rapidly correlating evidence across disparate digital systems following a reported crime loss.

- Development of personalized, dynamic premium pricing based on the continuous monitoring of the insured's internal control strength.

DRO & Impact Forces Of Crime Insurance Market

The Crime Insurance Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that determine its trajectory and profitability. The primary drivers include the escalating global incidence of sophisticated financial crimes, particularly those leveraging digital platforms such as computer hacking and social engineering, which pose multi-million dollar losses for corporations. Concurrent with rising crime rates, regulatory shifts, such as stricter anti-money laundering (AML) and anti-fraud legislation globally, mandate greater financial accountability and robust loss mitigation strategies, pushing companies to secure adequate crime coverage. Furthermore, increased corporate governance scrutiny following high-profile internal fraud cases acts as a significant catalyst, prompting boards of directors to mandate comprehensive crime policies as a key fiduciary duty. These drivers collectively amplify the perceived value of crime insurance as an essential defense against unforeseen catastrophic financial loss.

Restraints impeding faster market expansion include the persistent challenge of 'silent cyber risk,' where traditional crime policies might unintentionally overlap with or exclude cyber-related losses, leading to coverage disputes and client uncertainty, particularly concerning ransomware payments disguised as funds transfer fraud. Another major restraint is the difficulty in accurately quantifying future crime loss exposure, especially for novel fraud types, making standardized underwriting challenging and potentially leading to high volatility in loss ratios for specific segments. For smaller businesses, the high cost of comprehensive policies, coupled with a lack of awareness regarding the nuances of modern crime risks compared to traditional physical theft, often acts as a deterrent to purchase or maintain sufficient coverage limits. The market also suffers from inconsistent international legal interpretations regarding policy triggers (e.g., what constitutes 'manifest intent' for employee dishonesty).

Opportunities for growth are predominantly found in the technological integration and product innovation space. The transition towards offering integrated security and insurance solutions—where risk advisory services, penetration testing, and forensic investigation services are bundled with the policy—represents a major value-add opportunity. Significant potential exists in expanding coverage tailored for the rapidly evolving cryptocurrency ecosystem, addressing risks like wallet theft and exchange failure. Additionally, penetrating underinsured sectors, such as high-growth technology startups, non-profit organizations, and public entities, represents a substantial opportunity for future premium growth. The ongoing shift from physical to purely electronic theft necessitates continuous policy wording modernization, providing a competitive advantage for carriers that can adapt quickly and clearly define coverage for digitally enabled crimes.

Segmentation Analysis

The Crime Insurance Market is strategically segmented across several dimensions to cater to the diverse needs of businesses facing varied criminal exposures. Key segmentation variables include the type of coverage required, the size of the enterprise (SME vs. large corporation), the industry vertical (end-user), and the channel through which the policy is distributed. Understanding these segments is crucial for insurers to develop targeted products and optimize their underwriting portfolios. For instance, financial institutions require specialized coverage focusing heavily on funds transfer fraud and armored car risk, whereas retail entities prioritize protection against internal employee theft and money/securities losses at their premises. The increasing differentiation in segment-specific risk profiles drives the need for highly modular and customizable insurance products, moving away from monolithic, one-size-fits-all policies.

Segmentation by Enterprise Size reveals fundamental differences in purchasing behavior and risk characteristics. Large enterprises generally demand high-limit, comprehensive policies with global jurisdiction and often leverage captive insurance structures or complex excess layers due to their large exposure and sophisticated risk management teams. Conversely, SMEs typically seek simplified, easily accessible policies, often purchased through package policies (like Business Owners Policies – BOPs), where the emphasis is on affordability and covering basic, yet devastating, losses such as simple employee theft and forgery. The highest growth rate is anticipated in the SME segment globally, driven by increased awareness and the fact that they represent the 'low-hanging fruit' for organized external criminals due to resource limitations in internal controls.

Further analysis of segmentation by Industry Vertical shows the highest concentration in Financial Services and Banking, followed by Commercial and Industrial sectors. The Financial Institutions Bond (FI Bond) remains the bedrock of crime coverage for banks, although modern commercial entities increasingly rely on comprehensive commercial crime policies. The future expansion of the market will largely depend on successfully addressing emerging vertical-specific risks, such as supply chain fraud in manufacturing, patient data theft leading to financial loss in healthcare, and sophisticated inventory manipulation in the retail sector. Effective segmentation allows insurers to align pricing more closely with the underlying frequency and severity of loss inherent to each business environment.

- Coverage Type:

- Employee Dishonesty/Fidelity Coverage

- Forgery or Alteration

- Theft, Disappearance, and Destruction (On-Premises/In Transit)

- Computer Fraud

- Funds Transfer Fraud/Social Engineering Fraud (BEC)

- Money Orders and Counterfeit Currency

- Enterprise Size:

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- End-User Vertical:

- Financial Institutions (Banks, Credit Unions, Brokerage Firms)

- Retail and Consumer Goods

- Manufacturing and Industrial

- Healthcare and Pharmaceutical

- Technology, Media, and Telecommunications (TMT)

- Government and Non-Profit Organizations

Value Chain Analysis For Crime Insurance Market

The value chain for the Crime Insurance Market begins with the Upstream Analysis, which is dominated by sophisticated data providers, actuarial modeling firms, and reinsurance capital providers. Reinsurers play a vital role by absorbing the high-severity, low-frequency risks associated with catastrophic crime losses, allowing primary carriers to underwrite larger limits and diversify their exposure geographically. Data providers supply critical proprietary and external data sets necessary for predictive underwriting, including historical loss data, macroeconomic indicators, and detailed profiles of specific criminal trends and cyber threat intelligence. The quality and accessibility of these upstream inputs directly influence the primary carriers' ability to accurately price risk, develop innovative products, and maintain solvency, especially against rapidly evolving criminal methodologies like complex phishing campaigns and digital impersonation fraud.

The midstream of the value chain is comprised of primary insurers, underwriters, and third-party administrators (TPAs) responsible for policy design, marketing, distribution, and claims management. Underwriters must possess highly specialized knowledge of forensic accounting, IT security frameworks, and evolving legal standards related to fraud liability. Distribution channels are multifaceted, utilizing both Direct and Indirect methods. Direct channels involve large corporations dealing directly with carriers or through captive brokers, seeking highly customized, manuscripted policies. Indirect channels, which dominate the SME segment, rely heavily on independent agents, regional brokers, and managing general agents (MGAs) who package and sell standardized policies. The efficiency of claims handling, particularly the integration of forensic investigators and legal counsel, is a critical value-added component in the midstream, significantly impacting customer retention and brand reputation.

Downstream analysis focuses on the final interaction with the policyholders—the customers—and the associated post-loss services. Key downstream elements include risk management consultation, fraud prevention training, and post-incident response services (e.g., legal counsel, PR management, system remediation). For the customer, the ultimate value is realized through swift and equitable claims settlement that minimizes business interruption and financial stress. The effectiveness of the distribution channel in educating the customer about complex policy exclusions (like the definitions of ‘computer system’ or ‘authorized transfer’ in fraud claims) is crucial for ensuring customer satisfaction. The trend is moving towards enhanced collaboration between insurers and specialized security vendors to provide integrated pre-loss services, solidifying the insurer's position beyond mere compensation provider to an active risk mitigation partner.

Crime Insurance Market Potential Customers

The potential customer base for Crime Insurance is expansive, encompassing any entity that handles substantial sums of money, securities, or valuable physical and digital assets, and whose operations rely on electronic transactions. The primary End-Users/Buyers of this product are highly capitalized organizations across multiple regulated industries. Financial institutions, including commercial banks, investment firms, and trust companies, remain the largest and most critical segment due to their immense fiduciary responsibilities and exposure to large-scale, systemic financial crime, ranging from employee manipulation of accounts to sophisticated wire transfer fraud orchestrated externally. These organizations often require mandatory crime coverage limits stipulated by regulatory bodies or internal compliance mandates, making them indispensable customers for high-limit policies.

Beyond the financial sector, a significant and rapidly growing customer segment includes large multinational corporations in the Manufacturing, Retail, and Technology sectors. Manufacturers face risks such as supply chain fraud, theft of proprietary designs, and inventory manipulation. Retailers are highly exposed to employee theft, cash handling fraud, and point-of-sale system compromise. Technology firms, despite often having robust IT security, are primary targets for computer fraud and social engineering attacks that seek to divert massive R&D funds or customer payments. These industries are realizing that general liability and property policies are inadequate for covering the purely financial and intangible losses characteristic of modern crime, thus driving demand for specific computer fraud and funds transfer coverage.

Furthermore, smaller organizations (SMEs) and non-traditional entities such as non-profit organizations, educational institutions, and municipalities represent substantial potential for market penetration. While their individual exposure may be smaller, their lack of robust internal controls makes them vulnerable, and a single, large crime loss can be catastrophic to their operational continuity. Non-profits, often perceived as ‘soft targets,’ face increasing risk from internal misappropriation of funds and external donor-targeted phishing schemes. Expanding the market requires educating these potential customers about the affordability and necessity of coverage tailored to common small-business exposures, often bundled within packaged commercial policies to simplify the buying process and ensure baseline protection against prevalent criminal risks.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $8.5 Billion |

| Market Forecast in 2033 | $13.5 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Travelers Companies Inc., Chubb Limited, Zurich Insurance Group, American International Group (AIG), AXA XL, Liberty Mutual Insurance, Hartford Financial Services Group (The Hartford), Berkshire Hathaway Specialty Insurance, CNA Financial Corporation, Starr Companies, QBE Insurance Group, Allianz SE, FM Global, Sompo Holdings, Tokio Marine Holdings. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crime Insurance Market Key Technology Landscape

The technological landscape supporting the Crime Insurance Market is rapidly evolving, moving beyond traditional statistical modeling to embrace advanced data science and cybersecurity integration. Key technologies center on enhancing fraud detection, improving underwriting precision, and streamlining claims adjudication. Central to this transformation is the use of big data analytics platforms capable of ingesting and correlating vast amounts of transactional, behavioral, and geopolitical data. These platforms utilize advanced statistical methods to identify outlier events and patterns associated with internal or external criminal activity, providing critical intelligence that informs both pre-loss risk advisory services and post-loss forensic investigations. Furthermore, blockchain technology is being explored, particularly in reinsurance and specialized crime policy claims, to ensure immutable records of transactions and policy contracts, thereby reducing disputes related to claim validity and payment trail integrity.

Artificial Intelligence (AI) and Machine Learning (ML) constitute the most impactful technology category. ML algorithms are deployed to create predictive models that assess the vulnerability of a client’s internal controls to specific types of fraud, such as impersonation or collusion. This technological capability allows underwriters to move away from questionnaire-based risk assessment towards evidence-based risk quantification. For instance, AI can analyze communication metadata (e.g., email volume, unusual access times) to flag suspicious employee behavior indicative of potential dishonesty before a major loss occurs. The integration of robust Application Programming Interfaces (APIs) facilitates seamless data exchange between the insurer’s systems and the insured's enterprise resource planning (ERP) or cybersecurity platforms, enabling continuous risk monitoring and dynamic policy adjustment, a major differentiator in competitive offerings.

Cybersecurity tools are intrinsically linked to the crime insurance product, especially regarding computer fraud and funds transfer risk. Insurers are increasingly mandating the use of multi-factor authentication (MFA), robust identity and access management (IAM) systems, and specialized email filtering technology as prerequisites for coverage or as a means of reducing premiums. The technological focus is shifting toward forensic investigation tools that can rapidly recover and analyze digital evidence following a breach or fraud event. These tools are essential for proving the policy trigger condition (i.e., that the loss was directly caused by a criminal act as defined in the policy). The continued development of sophisticated, secure cloud-based systems is also enabling carriers to handle sensitive claim data securely while offering global accessibility for multi-jurisdictional claims management teams.

Regional Highlights

- North America (United States, Canada, Mexico): North America dominates the global Crime Insurance Market due to the high frequency and severity of sophisticated, technology-enabled financial crimes, particularly Business Email Compromise (BEC) and computer fraud targeting corporate treasury departments. The U.S. market is highly mature, characterized by substantial market penetration, sophisticated policy wordings (including specialized social engineering endorsements), and high regulatory compliance standards (e.g., SOX requirements driving demand for internal control protection). Large corporations typically purchase multi-layered programs involving substantial excess limits, often purchased from global carriers. Canada mirrors many U.S. trends but shows increasing sensitivity to cross-border funds transfer risks due to close economic integration.

- Europe (Germany, UK, France, Italy, Spain, Rest of Europe): Europe is a highly fragmented market driven significantly by regulatory requirements (such as the need to protect corporate assets under various European directives) and increasing intra-European commerce. The UK remains a central hub due to its strong financial services sector, driving demand for specialist Financial Institution Bond coverage and comprehensive commercial crime policies. Continental Europe is rapidly professionalizing its approach to corporate fraud, moving away from self-insurance towards robust third-party policies. Growth is catalyzed by the need for compliant pan-European programs that address varied local legal interpretations of fraud and fidelity loss.

- Asia Pacific (APAC) (China, Japan, India, South Korea, Southeast Asia): APAC is projected to be the fastest-growing region, fueled by massive digital transformation, rapid growth of e-commerce, and increasing foreign investment, which brings sophisticated criminal targeting. Countries like China and India are seeing significant expansion in SME crime coverage adoption, moving beyond basic property protection. The challenges include inconsistent regulatory landscapes and varying levels of internal corporate governance maturity. Opportunities are immense, particularly in offering tailored coverage for supply chain fraud and electronic payment system risks prevalent in highly mobile, digital economies.

- Latin America (Brazil, Argentina, Colombia, Rest of Latin America): The market here is characterized by high levels of cash transactions and geopolitical instability, leading to significant risks of internal theft, forgery, and physical security risks (e.g., armed robbery, kidnapping and ransom). While penetration is lower than in North America, demand is growing rapidly among multinational companies operating in the region and local financial institutions seeking international standards of protection. The focus remains heavily on employee dishonesty and traditional fidelity exposures, though computer fraud is an accelerating risk.

- Middle East and Africa (MEA): MEA presents a diverse market. The Gulf Cooperation Council (GCC) countries, with their strong banking and sovereign wealth funds, are major buyers of high-limit crime insurance, prioritizing protection against wire transfer fraud and fidelity risk. In contrast, Africa faces challenges related to political instability and developing legal frameworks, though there is emerging demand from multinational corporations and large local enterprises seeking to secure assets against both external and internal criminal threats, particularly in the energy and mining sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crime Insurance Market.- Travelers Companies Inc.

- Chubb Limited

- Zurich Insurance Group

- American International Group (AIG)

- AXA XL

- Liberty Mutual Insurance

- Hartford Financial Services Group (The Hartford)

- Berkshire Hathaway Specialty Insurance

- CNA Financial Corporation

- Starr Companies

- QBE Insurance Group

- Allianz SE

- FM Global

- Sompo Holdings

- Tokio Marine Holdings

- Beazley Group

- Aon plc (Broker/Consultant Influence)

- Marsh & McLennan Companies (Broker/Consultant Influence)

Frequently Asked Questions

Analyze common user questions about the Crime Insurance market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between Fidelity Insurance and Crime Insurance?

Fidelity insurance, or a fidelity bond, primarily covers losses resulting from internal employee dishonesty or theft (first-party loss). Crime insurance is broader, encompassing fidelity coverage but also extending protection against various external threats, such as forgery, computer fraud, funds transfer fraud, and third-party criminal acts against the company.

Does a standard Commercial General Liability (CGL) policy cover losses due to computer fraud?

No. Standard CGL policies typically cover bodily injury and property damage, excluding purely financial losses resulting from computer crime or fraudulent transfers. Specific Computer Fraud and Funds Transfer Fraud coverage must be added as an endorsement or purchased through a standalone Crime Insurance policy.

Is Social Engineering Fraud covered under traditional Crime Insurance policies?

Historically, Social Engineering Fraud (like BEC scams) was often excluded because the initial transfer was authorized by an employee. Modern, comprehensive crime policies require specific endorsements or specialized modules to cover losses resulting from voluntarily parting with funds based on fraudulent instructions, reflecting the major shift in criminal methodology.

Which industry vertical is the largest consumer of Crime Insurance products globally?

The Financial Institutions (FI) vertical, including banks, credit unions, and investment houses, represents the largest consumer segment. This is due to regulatory mandates, the high volume of liquid assets handled, and the immense exposure to both internal fidelity risk and external, systemic financial fraud.

How is Artificial Intelligence (AI) influencing Crime Insurance premiums?

AI is positively influencing premiums by enabling granular risk assessment. Insurers use AI to analyze a client’s internal control effectiveness and predictive fraud metrics, allowing for more precise underwriting, which often translates to accurately priced, and potentially lower, premiums for organizations demonstrating superior risk mitigation capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager