CRM Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438033 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CRM Software Market Size

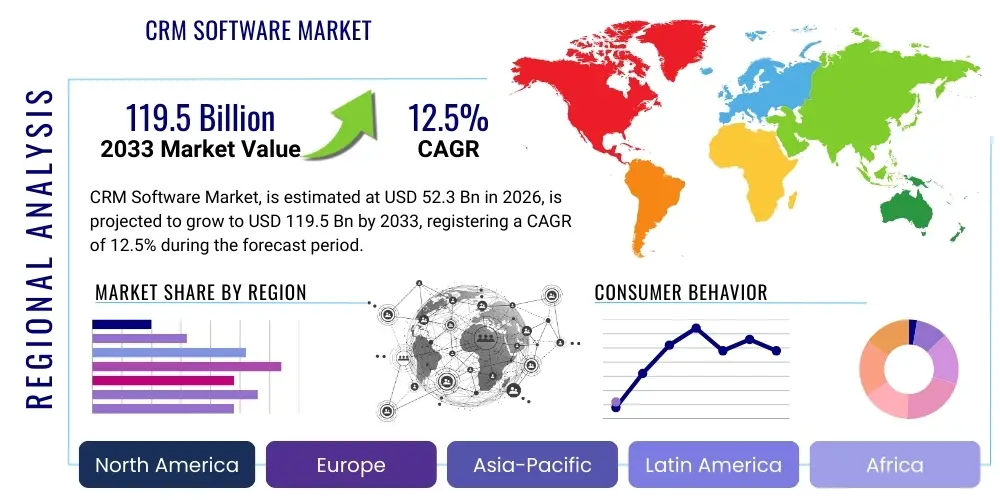

The CRM Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 52.3 Billion in 2026 and is projected to reach USD 119.5 Billion by the end of the forecast period in 2033.

CRM Software Market introduction

The Customer Relationship Management (CRM) Software Market encompasses solutions designed to manage and analyze customer interactions and data throughout the customer lifecycle, with the core objective of improving business relationships with customers, assisting in customer retention, and driving sales growth. These platforms integrate diverse functionalities such as sales force automation, marketing automation, and customer service management into a single, cohesive system. The fundamental shift towards customer-centric business models and the necessity for personalized customer experiences across multiple digital touchpoints are the primary structural components driving market demand. Modern CRM solutions are increasingly leveraging cloud infrastructure for scalability and accessibility, making them vital tools for organizations of all sizes, especially Small and Medium-sized Enterprises (SMEs) seeking rapid deployment and reduced capital expenditure.

Product descriptions within the CRM landscape range from operational CRM (focused on automating daily business processes) to analytical CRM (focused on data analysis for better decision-making) and collaborative CRM (focused on facilitating interaction across communication channels). Major applications include managing leads, tracking sales pipelines, streamlining marketing campaigns, and providing multi-channel customer support. The critical benefits delivered by these systems include enhanced organizational efficiency, improved customer satisfaction scores, increased revenue generation through better targeting, and superior data aggregation capabilities which inform strategic business development.

Key driving factors accelerating the market expansion include the widespread adoption of digital transformation initiatives across all industry verticals, the burgeoning demand for centralized customer data management platforms to ensure data integrity and compliance, and the critical need for businesses to optimize customer journey mapping in competitive environments. Furthermore, the integration of advanced technologies like Artificial Intelligence (AI) and Machine Learning (ML) within CRM platforms is creating more intelligent, predictive functionalities, fundamentally redefining how businesses interact with and anticipate customer needs. This technological evolution underscores the shift from purely transactional systems to highly sophisticated strategic intelligence tools.

CRM Software Market Executive Summary

The global CRM Software Market demonstrates robust growth, fundamentally underpinned by aggressive digital adoption across enterprise segments seeking operational efficiencies and deeper customer engagement. Current business trends highlight a decisive move towards specialized, vertical-specific CRM solutions, moving away from monolithic, one-size-fits-all platforms. The focus has sharpened on composable CRM architectures and highly integrable platforms that can seamlessly connect with existing enterprise software ecosystems (ERPs, data warehouses). Moreover, subscription-based pricing models (SaaS) continue to dominate, providing flexibility and enabling smaller businesses to access sophisticated tools previously exclusive to large corporations. Competitive dynamics show major players investing heavily in generative AI capabilities to automate conversational interactions and provide predictive sales insights, solidifying AI as the key differentiator in platform utility.

Regionally, North America maintains market dominance due to early adoption of advanced technologies, the presence of major CRM vendors, and a high concentration of sophisticated IT infrastructure. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid industrialization, increasing internet penetration, and significant government spending on digital transformation in emerging economies like India and China. Europe shows stable growth, driven primarily by stringent regulatory requirements, such as GDPR, which necessitate robust data management capabilities inherent in modern CRM systems, pushing businesses to upgrade legacy platforms.

Segment trends reveal that the Cloud Deployment model is the undisputed leader, favored for its agility and lower Total Cost of Ownership (TCO). In terms of functionality, the Marketing Automation and Sales Force Automation segments are experiencing particularly rapid growth as businesses prioritize efficient lead nurturing and streamlined sales processes. The Retail & E-commerce and BFSI (Banking, Financial Services, and Insurance) verticals remain the largest adopters, requiring complex relationship management tools to handle high volumes of transactions and personalized client interactions. The shift is generally towards integrated platforms that offer a unified view of the customer, blending sales, marketing, and service functions seamlessly.

AI Impact Analysis on CRM Software Market

Common user questions surrounding the integration of Artificial Intelligence (AI) into the CRM Software Market frequently center on practical implementation, Return on Investment (ROI), and ethical implications. Users are primarily concerned with how AI, specifically machine learning and natural language processing (NLP), can move beyond simple chatbots to offer truly predictive analytics—such as forecasting customer churn rates or identifying high-value sales opportunities that human agents might miss. Key thematic inquiries include the required skills gap for effective AI utilization, data privacy and security when feeding vast customer datasets into AI models, and the tangible reduction in operational costs promised by advanced automation tools. There is a high expectation that AI will deliver Hyper-Personalization at scale without compromising customer trust, leading to questions about the transparency of AI decision-making processes (explainable AI).

The impact of AI fundamentally reshapes the CRM paradigm by transitioning systems from reactive recording tools to proactive intelligence engines. AI algorithms now automate routine tasks like data entry and lead scoring, freeing up human agents to focus on complex, relationship-building activities. Generative AI is playing a growing role, enhancing content creation for marketing campaigns and summarizing voluminous customer service interactions to improve agent efficiency and response times. This convergence of analytical and generative capabilities is leading to the development of 'Intelligent CRM' platforms that provide context-aware recommendations for next best actions, thereby significantly boosting sales conversion rates and customer satisfaction.

Concerns, however, remain prevalent regarding the dependency on high-quality, vast amounts of training data and ensuring algorithmic bias does not negatively impact customer treatment or business strategy. Businesses are keen to understand the optimal balance between human oversight and automated decision-making. The consensus is that AI is not replacing CRM but augmenting it, making it more powerful and intuitive. The market is thus driven by vendors racing to embed proprietary, robust AI frameworks that address complex business logic while adhering to global data governance standards, ultimately positioning AI as the non-negotiable cornerstone of future CRM innovation.

- Automated Lead Scoring: AI algorithms analyze historical data to prioritize leads with the highest probability of conversion, improving sales efficiency.

- Predictive Analytics: Utilizing machine learning to forecast customer churn, predict purchasing behavior, and recommend optimal upselling/cross-selling strategies.

- Hyper-Personalization: Delivering highly customized communication and offers across all customer touchpoints in real-time.

- Intelligent Service Bots: Implementing advanced NLP-driven chatbots and virtual assistants for 24/7 customer support and automated query resolution.

- Operational Automation: Automating mundane tasks like data logging, report generation, and scheduling, reducing manual effort for sales teams.

- Sentiment Analysis: Analyzing textual and voice customer feedback to gauge satisfaction levels and identify potential service issues proactively.

- Explainable AI (XAI): Providing transparency into how AI models arrive at specific sales or service recommendations to build user trust.

- Generative AI for Content: Automatically drafting personalized email responses, summarizing customer conversation transcripts, and generating marketing copy.

DRO & Impact Forces Of CRM Software Market

The dynamics of the CRM Software Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively form the impact forces determining market trajectory. The principal drivers include the pervasive trend of digital transformation globally, which mandates efficient, scalable solutions for customer data management, coupled with the critical need for businesses to enhance customer retention and lifetime value in highly competitive digital ecosystems. Furthermore, the exponential growth of data generated from various digital channels (social media, IoT devices, mobile apps) necessitates sophisticated analytical CRM tools that can process and derive actionable insights from this massive data influx. This relentless pressure to deliver superior, individualized customer experiences is perhaps the single greatest driving force.

Conversely, significant restraints hinder uniform market acceleration. High implementation costs and the complexity associated with integrating new CRM systems with existing legacy IT infrastructure pose major barriers, particularly for mid-market and smaller enterprises with limited IT budgets. Data security concerns and compliance issues, especially concerning cross-border data transfer (e.g., GDPR, CCPA), also create regulatory hurdles and skepticism, demanding significant investment in data governance features. Additionally, the resistance to change within organizations, coupled with the steep learning curve required for end-users to fully leverage advanced CRM functionalities, often results in sub-optimal system utilization, dampening the expected ROI.

Opportunities in the market are abundant, primarily revolving around the expansion of industry-specific and niche CRM offerings tailored for sectors like healthcare (Patient Relationship Management) and governmental bodies. The advent of Composable CRM—where microservices and modular components allow businesses to tailor their systems precisely—presents a major avenue for customization and agility. Moreover, the surging demand for mobile CRM applications, enabling sales teams to access and update critical customer data on-the-go, along with the development of sophisticated predictive sales tools leveraging AI, promise substantial future revenue streams. The shift towards Experience-as-a-Service (XaaS) models emphasizes delivering consistent, positive outcomes, positioning the CRM platform as the central nervous system for customer experience management. The combined weight of these impact forces suggests sustained, though strategically challenging, growth.

Segmentation Analysis

The CRM Software Market is segmented based on deployment model, component type, application functionality, and industry vertical, reflecting the diverse needs of the global enterprise ecosystem. This layered segmentation is critical for vendors to tailor their product offerings and marketing strategies effectively. The analysis reveals that the choice of deployment model heavily influences the scale and speed of adoption, while application segmentation highlights the functional areas where businesses are prioritizing automation and investment. Industry verticals demonstrate varying levels of maturity and specific regulatory requirements that dictate the feature set demanded from CRM providers, leading to a proliferation of specialized solutions.

The dominance of the cloud segment underscores the broader IT trend towards operational flexibility and scalability, minimizing the burden of infrastructure management for end-users. Within applications, the holistic view provided by integrated suites covering sales, marketing, and service is gaining traction, although point solutions still thrive in niche markets requiring deep specialization. Understanding these segments is paramount for accurate market forecasting and strategic planning, as distinct purchasing patterns and growth rates characterize each segment. The ongoing evolution of customer data platforms (CDP) further influences segmentation, blurring the lines between pure CRM, marketing automation, and advanced data analytics tools.

- By Component: Software, Services (Consulting, Implementation, Training & Support)

- By Deployment Model: Cloud (SaaS), On-premise

- By Application: Sales Force Automation (SFA), Marketing Automation, Customer Service & Support, Others (e.g., E-commerce CRM, Social CRM)

- By Organization Size: Large Enterprises, Small and Medium-sized Enterprises (SMEs)

- By Industry Vertical: Banking, Financial Services, and Insurance (BFSI), Retail & E-commerce, IT & Telecom, Healthcare, Manufacturing, Government & Public Sector, Others (e.g., Media & Entertainment, Education)

Value Chain Analysis For CRM Software Market

The CRM Software market's value chain is characterized by distinct stages involving upstream component providers, core software developers, integration specialists, and downstream distribution channels leading to the end-users. Upstream activities involve technology infrastructure providers, including cloud service giants (AWS, Azure, Google Cloud) that supply the foundational computing and storage resources essential for SaaS CRM operations, along with providers of specialized embedded technologies such as AI/ML frameworks and robust database management systems. The quality and reliability of this foundational technology directly influence the performance and scalability of the final CRM product, making strong partnerships with these providers crucial for core vendors.

Midstream, the core CRM software developers focus on product development, continuous feature updates, and maintaining highly secure platforms. This stage involves significant investment in R&D to ensure the integration of emerging technologies like Generative AI and IoT compatibility. Downstream activities involve distribution and implementation. Distribution often occurs directly (via vendor websites and direct sales forces) for large enterprises and indirectly through a robust network of Value-Added Resellers (VARs), system integrators, and independent software vendors (ISVs) who tailor and embed the CRM software into specific industry contexts. These partners are vital for reaching regional markets and providing localized support, enhancing the overall utility of the solution.

The services component—consulting, implementation, and training—represents a significant portion of the value chain's total revenue, often surpassing the initial software license fees. Direct distribution ensures greater control over customer relationships and subscription management, while indirect channels provide wider market reach and specialized expertise required for complex system integration, particularly in hybrid or multi-cloud environments. Effective value chain management, therefore, necessitates optimizing relationships with both infrastructure providers and a diverse set of channel partners to ensure high customer lifetime value and rapid market penetration across varied geographical and industry segments.

CRM Software Market Potential Customers

Potential customers for CRM software span the entire spectrum of global organizations that interact with clients, vendors, or citizens, ranging from small local businesses to multinational conglomerates and public sector entities. The foundational requirement driving CRM adoption is the need for improved organizational efficiency in managing relationships and data—meaning any entity focused on revenue generation, service delivery, or complex stakeholder coordination is a prime candidate. Large enterprises, especially those in high-transaction volume sectors like BFSI and Telecommunications, are major consumers, demanding comprehensive, integrated suites capable of handling millions of customer interactions and ensuring regulatory compliance across multiple jurisdictions.

Small and Medium-sized Enterprises (SMEs) constitute a rapidly growing segment of potential customers, driven by the affordability and accessibility of subscription-based cloud CRM (SaaS). These businesses prioritize solutions that are easy to deploy, require minimal specialized IT staff, and offer focused capabilities, such as streamlined sales pipeline tracking or basic marketing campaign management. The appeal lies in gaining enterprise-level efficiency tools without the associated high upfront capital expenditure. Industry-specific requirements also define distinct customer profiles; for instance, healthcare providers are adopting CRM for patient relationship management, while governmental bodies use it for citizen service delivery and managing public sector interactions efficiently.

Beyond traditional commercial sectors, potential buyers include non-profit organizations, educational institutions, and associations seeking to manage donor relationships, alumni networks, and member engagement effectively. The commonality across all these end-users is the strategic objective of leveraging customer data to drive better decisions, foster loyalty, and achieve scalable growth. The market increasingly caters to highly discerning buyers who seek systems that are not just repositories of data, but intelligent platforms providing predictive and prescriptive insights derived from their specific operational data, making composability and AI integration key buying criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 52.3 Billion |

| Market Forecast in 2033 | USD 119.5 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Salesforce, Microsoft, SAP, Oracle, Adobe, HubSpot, Zoho Corporation, SugarCRM, Freshworks, PegaSystems, Zendesk, Infor, Creatio, Appian, ServiceNow, Pegasystems, Insightly, Maximizer, Copper CRM, Keap (Infusionsoft) |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CRM Software Market Key Technology Landscape

The CRM Software market's technological landscape is rapidly evolving, driven by the need for smarter, faster, and more integrated customer management systems. The predominant shift involves the deep integration of Artificial Intelligence and Machine Learning (AI/ML) across all CRM functions, moving beyond simple automation to predictive and prescriptive capabilities. This includes AI-driven sales forecasting, personalized marketing content generation, and intelligent routing of customer service queries. Another crucial technological development is the shift towards microservices-based, or Composable CRM architecture. This architectural approach allows businesses to select and assemble best-of-breed modules from various vendors, enhancing flexibility and ensuring that the CRM system can be precisely tailored to complex, evolving business processes without being locked into a monolithic vendor suite.

Furthermore, the increased reliance on Customer Data Platforms (CDPs) represents a fundamental technological pivot. While traditionally distinct, CDPs are increasingly converging with core CRM functionalities to provide a truly unified, real-time customer profile by ingesting and standardizing data from disparate sources. This unified view is essential for executing hyper-personalized campaigns and ensuring data accuracy across all channels. Additionally, mobile CRM technology is maturing, moving past basic data access to incorporate features like geolocation-based services, offline data synchronization, and mobile-optimized workflow automation, catering specifically to the needs of field sales and service personnel.

Blockchain technology, though still nascent in its CRM application, presents potential for enhanced data security, immutable audit trails for customer interactions, and improved transparency in complex supply chain or loyalty programs. Cloud infrastructure remains the technological backbone, with vendors increasingly leveraging multi-cloud strategies to offer resilience and comply with regional data residency requirements. The overall technological direction emphasizes seamless integration, sophisticated data analysis, and user experience enhancements via intuitive interfaces and advanced low-code/no-code platforms for internal customization, reducing dependence on specialized developers.

Regional Highlights

Regional dynamics significantly influence the CRM Software Market landscape, reflecting varied economic maturity levels, digital adoption rates, and regulatory environments. North America holds the largest market share, characterized by a highly mature IT infrastructure, the presence of global CRM headquarters (e.g., Salesforce, Microsoft), and substantial investment in cutting-edge technologies like AI and predictive analytics. High concentration of technologically advanced enterprises and a strong emphasis on maximizing Customer Lifetime Value (CLV) drive persistent market saturation and innovation in this region.

Europe represents the second-largest market, exhibiting stable growth influenced heavily by stringent data protection laws, notably the General Data Protection Regulation (GDPR). This regulatory environment necessitates CRM solutions with advanced data governance, consent management features, and robust security protocols. Western European nations, particularly the UK, Germany, and France, are key consumers, driving demand for specialized operational and analytical CRM platforms, with increasing cloud adoption offsetting legacy on-premise setups.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is fueled by massive digital transformation efforts in large economies like China, India, and Japan, coupled with the burgeoning SME sector seeking affordable SaaS solutions to scale operations. Increased internet penetration, rapid urbanization, and a growing middle class generating vast amounts of consumer data are accelerating the adoption of cloud-based, mobile-friendly CRM systems across diverse sectors including BFSI and Retail. Meanwhile, Latin America (LATAM) and the Middle East and Africa (MEA) are emerging markets. Growth in these regions is primarily driven by expanding telecommunications and oil & gas sectors in MEA and infrastructural improvements in LATAM, although challenges related to political instability and fragmented IT ecosystems persist.

- North America: Market leader; driven by high technological maturity, presence of key vendors, and massive R&D spending on AI integration. Focus on enterprise-level, comprehensive SaaS solutions.

- Europe: Second largest market; growth dictated by regulatory compliance (GDPR) and demand for robust data security features. Strong shift towards integrated, personalized customer journeys.

- Asia Pacific (APAC): Fastest-growing region; fueled by massive digital transformation in emerging economies, high mobile usage, and rapid SME cloud adoption.

- Latin America (LATAM): Emerging market; increasing demand in BFSI and retail sectors, focused on affordable, localized cloud CRM implementations.

- Middle East and Africa (MEA): Growth centered in the Gulf Cooperation Council (GCC) countries due to government digitalization initiatives and expansion in telecom and financial services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CRM Software Market.- Salesforce

- Microsoft

- SAP

- Oracle

- Adobe

- HubSpot

- Zoho Corporation

- SugarCRM

- Freshworks

- PegaSystems

- Zendesk

- Infor

- Creatio

- Appian

- ServiceNow

- Pegasystems

- Insightly

- Maximizer

- Copper CRM

- Keap (Infusionsoft)

Frequently Asked Questions

Analyze common user questions about the CRM Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the CRM Software Market?

The CRM Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033, driven primarily by ongoing digital transformation and the rapid adoption of intelligent automation features like AI.

What is the most significant trend shaping the future of CRM technology?

The most significant trend is the integration of Artificial Intelligence (AI) and Machine Learning (ML), enabling predictive analytics, hyper-personalization, and automated customer interactions, leading to the development of 'Intelligent CRM' platforms.

Which deployment model dominates the CRM Software Market?

The Cloud (SaaS) deployment model significantly dominates the market, preferred by both large enterprises and SMEs for its operational flexibility, scalability, lower upfront costs, and faster implementation times compared to traditional on-premise solutions.

Which region is expected to demonstrate the fastest growth in CRM adoption?

The Asia Pacific (APAC) region is expected to demonstrate the fastest growth rate, fueled by aggressive digitalization initiatives, high internet and mobile penetration, and expanding market opportunities in emerging economies.

How is Composable CRM changing enterprise purchasing strategies?

Composable CRM, based on modular architecture, allows enterprises to select specific best-of-breed components and integrate them seamlessly. This approach mitigates vendor lock-in, enables precise customization, and enhances agility in adapting the CRM system to evolving business needs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Retail CRM Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Nonprofit CRM Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Operational CRM, Analytical CRM), By Application (NGO, NPO, Religious Organization, Community Organizations), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- CRM Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud-Based, On-Premise), By Application (SMEs, Large Enterprises), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Small Business CRM Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (On-Premises Deployment, Cloud-Based Deployment), By Application (Financial Services, Retail, Other), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

- Financial CRM Software Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Cloud-based, On-premises), By Application (Small and Medium Enterprises (SMEs), Large Enterprises), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager