CRO in Clinical Trials Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434683 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

CRO in Clinical Trials Market Size

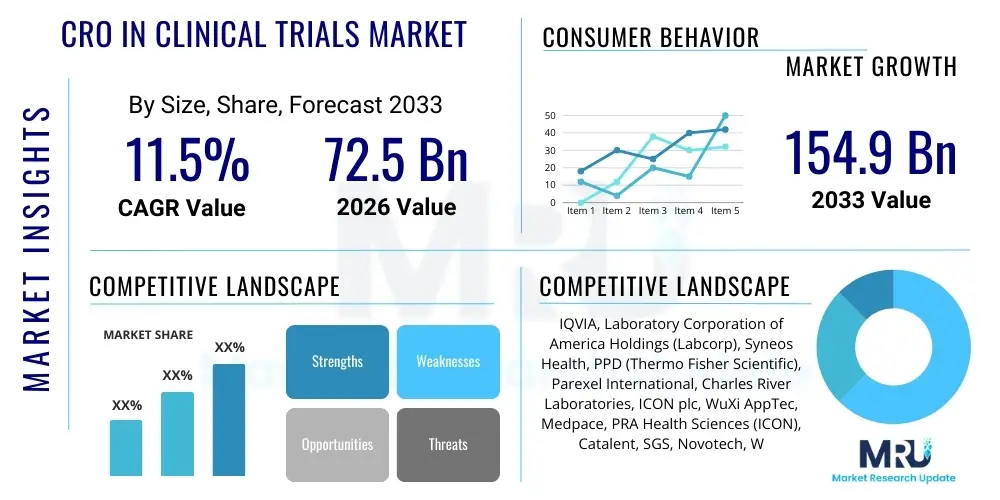

The CRO in Clinical Trials Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $72.5 Billion in 2026 and is projected to reach $154.9 Billion by the end of the forecast period in 2033.

CRO in Clinical Trials Market introduction

The Contract Research Organization (CRO) in Clinical Trials Market encompasses specialized services outsourced by pharmaceutical, biotechnology, and medical device companies to manage research and development processes, particularly focusing on the execution, monitoring, and analysis of clinical trials. This outsourcing model allows sponsors to mitigate risks, reduce operational costs, and accelerate time-to-market for novel therapeutics. The core function of CROs involves providing expertise across various trial phases, including protocol design, patient recruitment, site management, data collection and analysis, regulatory submission, and post-marketing surveillance. The increasing complexity of regulatory frameworks globally, coupled with the need for specialized therapeutic expertise, has firmly established CROs as indispensable partners in the drug development pipeline.

The major applications of CRO services span across various stages of drug development, from preclinical studies to late-phase trials (Phase I-IV). Key services include clinical data management (CDM), biostatistics, regulatory affairs, clinical monitoring, and specialized laboratory services. The shift towards personalized medicine, complex biologics, and cell and gene therapies necessitates CROs capable of handling intricate trial designs, often involving global, multi-center studies. Furthermore, the push for decentralized clinical trials (DCTs), accelerated by technological advancements and recent global health challenges, is reshaping the service landscape, requiring CROs to integrate digital tools and remote monitoring capabilities.

The primary driving factors propelling the growth of this market include the escalating cost and complexity associated with internal drug discovery and development, high failure rates in late-stage trials, and the intense competitive pressure on pharmaceutical companies to launch innovative products rapidly. Benefits realized through CRO engagement include access to global patient populations, specialized therapeutic knowledge, scalable operational resources, and enhanced compliance with international regulatory standards like ICH-GCP. These advantages collectively position CROs not just as service providers, but as strategic partners critical for maintaining a competitive edge in the highly regulated life sciences industry, ensuring sustained market expansion throughout the forecast period.

CRO in Clinical Trials Market Executive Summary

The CRO in Clinical Trials Market is characterized by robust growth, driven primarily by the escalating demand for outsourced expertise in managing complex clinical protocols, particularly within high-growth therapeutic areas such as oncology and rare diseases. Business trends highlight significant merger and acquisition (M&A) activities as large CROs consolidate services, enhancing their global footprint and specialized offerings. Furthermore, the industry is undergoing a digital transformation, with rapid adoption of technology platforms supporting decentralized clinical trials (DCTs), optimizing patient recruitment, and streamlining data management processes. Key stakeholders are prioritizing strategic partnerships over transactional relationships to ensure long-term stability and access to cutting-edge capabilities, reflecting a shift towards integrated end-to-end solutions rather than standalone services.

Regional trends indicate North America maintaining its dominance due to a strong presence of pharmaceutical giants, substantial R&D investments, and advanced regulatory environments, although the Asia Pacific (APAC) region is emerging as the fastest-growing market. This accelerated growth in APAC is fueled by lower operational costs, vast untapped patient pools, increasing government support for clinical research, and the establishment of local regulatory harmonization efforts. European markets continue to be critical hubs, leveraging strong academic research centers and established pharmaceutical infrastructure, while emerging markets in Latin America and MEA are increasingly being utilized for site diversity and global trial expansion, contributing significantly to market volume.

Segment trends demonstrate the significant growth of full-service CROs offering comprehensive solutions across all trial phases, favored by smaller biotech firms lacking internal infrastructure. Within service types, Clinical Data Management and Biostatistics segments are experiencing rapid growth, driven by the sheer volume and complexity of data generated by modern trials, demanding sophisticated analytical tools and robust data governance frameworks. Therapeutic area segmentation continues to be dominated by Oncology, reflecting the high incidence and large R&D spend in cancer treatment research. The increasing complexity of trials in areas like cell and gene therapy is also creating demand for highly specialized CRO units, commanding premium pricing and driving value-based segmentation.

AI Impact Analysis on CRO in Clinical Trials Market

User queries regarding the impact of Artificial Intelligence (AI) on the CRO market frequently revolve around themes such as the automation of routine tasks, improvements in patient recruitment efficiency, acceleration of data analysis timelines, and the regulatory acceptance of AI-derived insights. Key concerns often focus on data privacy, the potential displacement of human roles, and the initial investment required for sophisticated AI infrastructure. Users widely anticipate that AI will fundamentally transform clinical trial design, moving from reactive monitoring to predictive modeling, thereby minimizing protocol amendments and reducing overall trial duration and cost. The consensus expectation is that CROs successfully integrating AI will gain a significant competitive advantage by offering faster, more efficient, and de-risked services to their clients.

AI's primary role within the CRO framework is to enhance efficiency and precision across the clinical trial lifecycle. In the early stages, AI algorithms are being used for predictive modeling to identify optimal patient cohorts and high-performing investigative sites, drastically cutting down the time spent on recruitment, which is often the most significant bottleneck in trial timelines. During execution, machine learning (ML) models automate the review of vast datasets, identifying anomalies, ensuring data quality, and performing real-time risk-based monitoring, allowing human monitors to focus exclusively on critical issues that require in-person resolution. This digital oversight ensures higher compliance standards and optimizes resource allocation.

Furthermore, AI significantly accelerates the transition from raw data to actionable insights, a core function of CROs. Natural Language Processing (NLP) processes unstructured data from electronic health records (EHRs) and literature reviews, augmenting trial design and providing crucial evidence for regulatory submissions. The integration of AI tools, particularly in pharmacovigilance for adverse event reporting and signal detection, is streamlining post-market activities, making the entire R&D pipeline more responsive and adaptive. CROs are increasingly rebranding themselves as technology-enabled service providers, investing heavily in proprietary AI platforms to maintain relevance and meet the growing demand for intelligent, predictive clinical research services.

- Automated patient identification and matching for improved recruitment rates.

- Enhanced risk-based monitoring through predictive analytics to identify site issues proactively.

- Accelerated data processing and cleaning using Machine Learning (ML) algorithms.

- Optimization of clinical trial protocol design and simulation, leading to fewer amendments.

- Streamlined pharmacovigilance and safety reporting through NLP processing of adverse event narratives.

- Creation of synthetic control arms, reducing the need for extensive placebo groups.

- Improved quality assurance and regulatory compliance checks through automated documentation review.

DRO & Impact Forces Of CRO in Clinical Trials Market

The CRO in Clinical Trials Market is simultaneously propelled by substantial drivers and constrained by structural challenges, while numerous opportunities allow for strategic expansion, all interacting under significant impact forces. The primary drivers include the soaring global R&D expenditure by pharmaceutical companies, the increasing complexity of clinical protocols requiring specialized expertise (especially for complex biologics and niche therapies), and the continuous pressure from sponsors to reduce time-to-market. These factors create an ongoing demand for outsourced solutions. Restraints largely center on stringent and heterogeneous regulatory requirements across different geographies, challenges in standardized data handling and integration across disparate systems, and the persistent difficulty in global patient recruitment and retention, particularly in Phase III trials. Opportunities lie in the adoption of decentralized clinical trial (DCT) models, the specialization in high-growth areas like gene therapy and personalized medicine, and the integration of advanced technologies like AI/ML and digital platforms for enhanced operational efficiency.

Impact forces dictate the direction and speed of market evolution. Regulatory impact forces, driven by agencies like the FDA and EMA, mandate continuous investment in compliance and quality systems, favoring large, established CROs with global regulatory experience. Economic forces, characterized by fluctuating healthcare budgets and pharmaceutical pricing pressures, compel sponsors to seek cost-efficient outsourcing options, driving demand for services in lower-cost regions like APAC. Competitive impact forces are high, leading to intense rivalry among the top-tier CROs, resulting in strategic M&A activities aimed at expanding service portfolios and geographical reach. Technological impact forces, particularly the rapid advancement in data science and digital health tools, necessitate continuous innovation and adaptation among CROs to remain competitive and offer state-of-the-art services.

The balance between these forces determines market dynamics. The overwhelming financial and logistical drivers associated with clinical development ensure continued outsourcing, sustaining high growth. However, the operational challenges related to data security and interoperability act as a crucial check on unchecked expansion, demanding robust technological governance. Opportunities in digitalization and specialization offer clear pathways for new revenue streams and differentiation, particularly for mid-sized CROs focusing on niche expertise. The market's resilience is built upon the foundational need for specialized expertise to navigate the complex scientific and regulatory landscape of modern drug development.

Segmentation Analysis

The CRO in Clinical Trials market is meticulously segmented based on the type of service offered, the specific phase of the clinical trial, the therapeutic area under investigation, and the ultimate end-user requiring these specialized services. This comprehensive segmentation allows stakeholders to analyze market penetration, identify high-growth niches, and tailor strategies to meet specific sponsor requirements. The segmentation highlights the shift from generalized outsourcing towards highly specialized, integrated service packages, particularly driven by the complexity of Phase III trials and the high demand for advanced data management capabilities.

- By Service Type:

- Clinical Data Management Services

- Monitoring Services

- Regulatory Affairs

- Medical Writing

- Clinical Trial Management

- Biostatistics

- Site Management and Patient Recruitment

- Others (e.g., Central Laboratory Services, Pharmacovigilance)

- By Phase:

- Phase I

- Phase II

- Phase III

- Phase IV (Post-marketing Surveillance)

- By Therapeutic Area:

- Oncology

- Cardiology

- Infectious Diseases

- Neurology

- Gastroenterology

- Endocrinology

- Immunology

- Others (e.g., Rare Diseases, Ophthalmology)

- By End-User:

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Companies

- Academic and Government Institutes

Value Chain Analysis For CRO in Clinical Trials Market

The value chain for the CRO in Clinical Trials Market is highly integrated, starting with upstream activities related to technology infrastructure and specialized human capital, extending through core clinical execution, and culminating in downstream services centered around data delivery and regulatory submission. Upstream analysis focuses on the sourcing of critical resources, including highly skilled biostatisticians, clinical research associates (CRAs), and medical writers, alongside the development or licensing of proprietary clinical trial management systems (CTMS), Electronic Data Capture (EDC) systems, and AI/ML platforms crucial for efficient trial execution. The strength of the upstream depends heavily on maintaining a global network of qualified professionals and investing continuously in compliant digital infrastructure, which acts as the foundation for high-quality service delivery.

The core execution phase involves the critical processes managed by the CRO, including protocol design, site selection, patient recruitment, clinical monitoring (both remote and on-site), and raw data collection. Distribution channels in this market are primarily direct, involving long-term, strategic contracts established directly between the CRO and the sponsor (pharmaceutical, biotech, or device company). Indirect influence can be seen through partnerships with technology vendors, central labs, or third-party patient recruitment firms that augment the CRO's core capabilities. This phase adds maximum value by translating research protocols into compliant, actionable trials and efficiently collecting robust clinical data.

Downstream analysis centers on post-trial activities, where the CRO prepares the final deliverables essential for the sponsor's objectives. This includes extensive data analysis, statistical reporting, medical writing of the Clinical Study Report (CSR), and submission of documentation to regulatory bodies (such as FDA or EMA). The ultimate potential customer, the end-user, consumes this finalized, validated data package to support marketing applications. The effectiveness of the downstream process, particularly the speed and accuracy of regulatory filing support, determines the overall success and value delivered by the CRO, ensuring that the entire value chain is focused on accelerating safe product approval.

CRO in Clinical Trials Market Potential Customers

The primary customers for CRO services are organizations heavily invested in research and development activities for human health products. These include global pharmaceutical corporations, innovative small and mid-sized biopharmaceutical firms, and manufacturers of advanced medical devices. Pharmaceutical and biopharmaceutical companies represent the largest segment, driven by the need to manage extensive drug pipelines, navigate complex global regulatory landscapes, and gain access to specialized scientific expertise that may not be available internally. The inherent risks and high costs associated with bringing a new drug to market compel these entities to leverage the efficiency and cost-savings offered by external partners.

Small and emerging biotech companies, characterized by limited infrastructure, personnel, and funding compared to multinational pharmaceutical giants, are increasingly reliant on full-service CROs. For these entities, outsourcing is not merely an option but a necessity to manage Phase I and Phase II trials effectively while maintaining focus on core R&D activities. CROs provide them with immediate access to a global operational footprint, regulatory intelligence, and scalable resources, enabling them to compete effectively in the innovative drug space. This segment is characterized by rapid decision-making and a strong preference for integrated, end-to-end solutions.

Furthermore, academic institutions and government research organizations also constitute a growing base of potential customers, particularly those involved in large-scale public health studies or investigator-initiated trials that require professional project management, data handling, and regulatory compliance support typically provided by CROs. Medical device companies, especially those developing high-risk or novel Class III devices, require specialized CRO expertise to manage clinical investigations that adhere to stringent ISO and regulatory standards, completing the core customer landscape for the CRO in Clinical Trials Market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $72.5 Billion |

| Market Forecast in 2033 | $154.9 Billion |

| Growth Rate | CAGR 11.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | IQVIA, Laboratory Corporation of America Holdings (Labcorp), Syneos Health, PPD (Thermo Fisher Scientific), Parexel International, Charles River Laboratories, ICON plc, WuXi AppTec, Medpace, PRA Health Sciences (ICON), Catalent, SGS, Novotech, Worldwide Clinical Trials, Fortrea, TFS HealthScience, CTI Clinical Trial and Consulting Services, PSI CRO, Everest Clinical Research, PHOENIX Clinical Research |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CRO in Clinical Trials Market Key Technology Landscape

The technological landscape driving the CRO market is rapidly evolving, moving away from paper-based systems to fully integrated digital platforms that emphasize real-time data flow and security. Electronic Data Capture (EDC) systems, Clinical Trial Management Systems (CTMS), and Electronic Health Records (EHR) integration capabilities form the foundational technological infrastructure. The current focus, however, is on leveraging advanced data science tools, primarily Artificial Intelligence (AI) and Machine Learning (ML), to enhance predictive capabilities in areas such as patient selection, risk-based monitoring, and data quality checks. These technologies are crucial for managing the exponential growth in data volume and complexity generated by modern clinical trials, ensuring data integrity and expediting the transition from clinical execution to regulatory submission.

A significant technological shift involves the rise of technologies supporting Decentralized Clinical Trials (DCTs). These tools include telemedicine platforms, wearable sensors, remote monitoring devices, and specialized eConsent solutions. DCT technologies allow trials to be conducted with fewer on-site visits, improving patient centricity, broadening geographical reach for recruitment, and ultimately reducing the burden on both participants and site staff. CROs are investing heavily in establishing proprietary or partnered platforms that can seamlessly integrate data from these disparate digital sources while maintaining rigorous compliance with global data privacy regulations like GDPR and HIPAA.

Furthermore, specialized technologies supporting complex therapeutic areas, such as advanced bioinformatics tools for genomic and proteomic data analysis required in oncology and rare disease trials, are becoming essential differentiators. Technologies like Natural Language Processing (NLP) are also increasingly used to extract meaningful insights from unstructured text data in medical reports and literature, supplementing structured clinical trial data. The strategic integration of these diverse technologies enables CROs to offer highly specialized, data-driven services that optimize trial efficiency, minimize costs, and significantly accelerate the delivery of safe and effective medical treatments.

Regional Highlights

The global CRO in Clinical Trials market exhibits distinct regional dynamics, influenced by R&D spending, regulatory maturity, patient pool size, and operational cost structures. North America, particularly the United States, holds the dominant market share due to the highest concentration of leading pharmaceutical and biotechnology companies, substantial private and public funding for clinical research, and an early adoption rate of advanced clinical technologies such as AI and DCT platforms. The region benefits from a well-established regulatory pathway (FDA) and robust infrastructure, though the high operational costs continue to drive sponsors to seek alternative sites for specific trial phases.

Europe is the second-largest market, characterized by strong academic research institutions and a supportive environment for investigator-initiated trials. Countries such as Germany, the UK, and France are major hubs, contributing significantly to Phase I and II research. The regulatory environment, governed by the European Medicines Agency (EMA), is highly harmonized but also stringent regarding data privacy (GDPR), pushing CROs in this region to maintain exceptionally high standards in data management and security, fostering expertise in complex, multi-country submissions.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This rapid expansion is attributable to lower clinical trial execution costs compared to Western nations, the availability of large, diverse, and treatment-naïve patient populations, and increasing R&D investments by both local and multinational pharmaceutical companies establishing regional subsidiaries. Key countries driving this growth include China, Japan, South Korea, and India, which are actively working to streamline their regulatory processes and harmonize standards, making APAC an increasingly vital location for large-scale Phase III trials and post-marketing studies.

- North America (Dominant Market): Characterized by high R&D spending, strong regulatory compliance infrastructure (FDA), and leadership in adopting advanced technologies (AI, DCTs). Key focus on complex biologics and niche therapies.

- Europe (Major Contributor): Known for established academic centers, robust regulatory standards (EMA/GDPR), and strong presence in early-phase development and complex, multi-country clinical operations.

- Asia Pacific (Fastest Growth): Driven by low operational costs, large patient pools, and supportive government initiatives promoting clinical research, making it critical for Phase III global expansion and market access.

- Latin America & MEA (Emerging Markets): Important for enhancing patient diversity and accelerating recruitment timelines, offering competitive operational costs, though still facing challenges related to infrastructure maturity and regulatory consistency.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CRO in Clinical Trials Market.- IQVIA

- Laboratory Corporation of America Holdings (Labcorp)

- Syneos Health

- PPD (Thermo Fisher Scientific)

- Parexel International

- Charles River Laboratories

- ICON plc

- WuXi AppTec

- Medpace

- PRA Health Sciences (ICON)

- Catalent

- SGS

- Novotech

- Worldwide Clinical Trials

- Fortrea

- TFS HealthScience

- CTI Clinical Trial and Consulting Services

- PSI CRO

- Everest Clinical Research

- PHOENIX Clinical Research

Frequently Asked Questions

Analyze common user questions about the CRO in Clinical Trials market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected Compound Annual Growth Rate (CAGR) for the CRO in Clinical Trials Market?

The CRO in Clinical Trials Market is projected to exhibit a substantial Compound Annual Growth Rate (CAGR) of 11.5% from 2026 to 2033, driven by increasing outsourcing needs from pharmaceutical and biotech companies and technological advancements.

How is Artificial Intelligence (AI) transforming clinical trial management by CROs?

AI is transforming the sector by optimizing patient recruitment through predictive analytics, enabling efficient risk-based monitoring, accelerating data processing and analysis timelines, and improving overall trial design efficiency, leading to significant cost and time reductions.

Which therapeutic area contributes the most to the CRO in Clinical Trials Market revenue?

Oncology (cancer research) consistently represents the largest segment of the CRO market by therapeutic area, primarily due to the high global disease burden, extensive research investments, and the complexity of conducting oncology clinical trials requiring specialized expertise.

What are the key drivers fueling the growth of the global CRO market?

Key drivers include the soaring R&D expenditure by life sciences companies, the inherent complexity and globalization of modern clinical trials, the need for specialized therapeutic and regulatory expertise, and the continuous pressure to achieve faster time-to-market for novel drugs.

Why is the Asia Pacific (APAC) region experiencing the fastest growth rate in the CRO market?

APAC’s rapid growth is primarily attributed to its lower operational costs, the availability of large and diverse patient populations, government efforts to streamline regulatory processes, and increased investments in regional clinical research infrastructure by multinational firms seeking global trial expansion.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager