Crocodile Leather Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432671 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Crocodile Leather Market Size

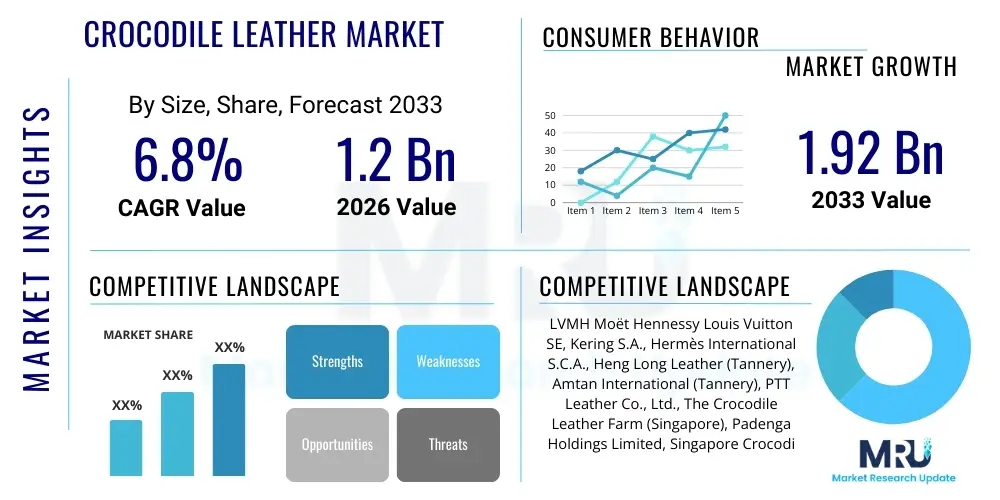

The Crocodile Leather Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.92 Billion by the end of the forecast period in 2033.

Crocodile Leather Market introduction

The Crocodile Leather Market constitutes a niche yet highly valuable segment within the global luxury goods industry, characterized by the use of skin derived primarily from controlled farming of crocodilian species such as the saltwater crocodile (Crocodylus porosus), the Siamese crocodile (Crocodylus siamensis), and the Nile crocodile (Crocodylus niloticus). This material is prized globally for its aesthetic uniqueness, durability, and symbolic association with status and exclusivity, making it a critical component in high-end fashion accessories, particularly bespoke handbags, luxury footwear, and premium watch straps. The entire supply chain operates under strict international regulations enforced by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES), which mandates traceability, ethical sourcing, and sustainable farming practices to ensure the conservation status of the species is maintained.

The product description centers on highly specialized tanning and finishing processes that transform raw hides into supple, durable, and visually appealing leather, often categorized by finishes such as glazed, matte, or nubuck. Major applications are overwhelmingly concentrated in the prestige sector, where leading luxury conglomerates drive demand for limited-edition and core collection items. The inherent benefits of crocodile leather, aside from its perceived luxury, include its exceptional strength and unique scale patterns, which ensure that no two finished products are exactly alike, appealing directly to the discerning tastes of High-Net-Worth Individuals (HNWIs) and collectors seeking differentiated products. This intrinsic rarity and superior quality justify the premium pricing structure that characterizes this market segment.

Driving factors underpinning the market's stability and moderate growth include the rapid expansion of the affluent consumer base in the Asia Pacific region, particularly China and Southeast Asia, coupled with sustained high demand in established luxury markets like Europe and North America. Furthermore, fashion cycles continually reinforce the material's status as an ultimate luxury staple, encouraging brands to invest heavily in vertically integrated supply chains or secure long-term contracts with certified farms and tanneries. However, the market’s trajectory is heavily moderated by ongoing ethical consumption debates and the complexity of adhering to stringent CITES compliance requirements, which necessitate sophisticated documentation and reporting systems across all trade activities.

Crocodile Leather Market Executive Summary

The Crocodile Leather Market is experiencing structural shifts driven by increasing scrutiny regarding ethical sourcing and environmental sustainability, yet underpinned by robust and inelastic demand from the ultra-luxury consumer segment. Business trends indicate a strong move towards vertical integration among major luxury houses, seeking direct control over farming and tanning operations to ensure complete traceability from farm to finished product. This integration strategy mitigates risks associated with supply chain transparency and strengthens brand narratives around responsibility. Regionally, the European Union remains the primary hub for high-end manufacturing, design, and consumption, while the Asia Pacific region, particularly Greater China, is the fastest-growing consumption market, fueled by rising disposable incomes and the cultural significance placed on status symbols. North America maintains a mature and stable demand profile, focusing heavily on boutique and custom-made accessories.

Segment trends highlight the dominance of the handbags and accessories segment due to high average selling prices and volume consistency compared to footwear or small leather goods. Within product types, the matte finish continues to gain favor over the traditional glazed finish, reflecting a contemporary shift in luxury aesthetics toward understated elegance. The market is highly consolidated at the tanning stage, where a few specialized tanneries, often linked to or owned by major conglomerates, process the vast majority of high-quality hides, creating significant barriers to entry for smaller players. Moreover, the segmentation based on distribution channels shows a marginal but steady shift toward direct-to-consumer (DTC) boutique models and controlled e-commerce platforms, designed to safeguard brand exclusivity and manage price integrity globally.

Overall, the market remains resilient against economic downturns affecting lower-tier luxury, but it faces persistent challenges related to consumer perception management and the threat of substitution from high-quality, scientifically advanced synthetic materials that promise zero animal involvement. Successful market participants are those who demonstrate exemplary CITES compliance, invest in advanced traceability technologies like blockchain, and effectively communicate their commitment to animal welfare standards and habitat preservation. The future growth hinges less on volume increase and more on optimizing yield, efficiency, and maintaining the premium positioning through verifiable ethical practices, thereby commanding the necessary price points to sustain high-cost regulatory compliance.

AI Impact Analysis on Crocodile Leather Market

User queries regarding AI's influence in the crocodile leather sector predominantly revolve around three critical areas: enhanced traceability and anti-counterfeiting measures, optimization of high-cost farming operations, and predictive modeling for luxury demand fluctuations. Users are deeply concerned about ensuring the authenticity of extremely expensive products and verifying ethical sourcing claims, pushing brands to adopt verifiable, tamper-proof systems. They frequently ask how AI can validate CITES permits automatically or distinguish genuine high-grade leather from sophisticated replicas. Furthermore, there is significant interest in how machine learning can improve the sustainability and economic efficiency of crocodile farming, specifically through advanced monitoring of animal health, feed conversion ratios, and maximizing hide quality yield by minimizing defects, which directly impacts the profitability of the highly regulated and costly ranching phase. The synthesis of these concerns indicates that the market expects AI to transition the industry from reactive compliance to proactive, data-driven ethical management and superior quality assurance.

The direct impact of Artificial Intelligence is manifesting primarily across supply chain management and quality control protocols. AI-powered image recognition and computer vision systems are being deployed at the tanning stage to automatically grade hides based on criteria such as scale pattern uniformity, defect density, and overall surface integrity, ensuring only the highest quality skins proceed to manufacturing, thereby reducing waste and optimizing material allocation for specific products. In logistics, AI algorithms process complex CITES documentation and cross-reference permits against shipment tracking data, significantly streamlining international customs processes and reducing the bureaucratic bottlenecks inherent in cross-border trade of controlled wildlife products. This automation minimizes human error and substantially reinforces the integrity of the chain of custody, a vital requirement for maintaining regulatory confidence.

Beyond logistics and grading, AI offers transformative potential in captive breeding and farming environments. Machine learning models can analyze vast amounts of data—including climate conditions, genetics, feeding schedules, and individual animal behavior captured by IoT sensors—to predict growth rates and optimize farming protocols for superior hide yield. This data-centric approach ensures animals are raised under optimal conditions, leading to higher quality skins with fewer blemishes, ultimately justifying the substantial investment required for ethical, controlled farming. Moreover, in the retail sphere, predictive analytics utilize AI to forecast demand for specific leather finishes, colors, and product types based on global luxury spending indices, seasonal trends, and geopolitical stability, allowing manufacturers to fine-tune production schedules and minimize inventory risk for these high-value, slow-moving assets.

- AI-driven computer vision enhances automated hide grading and defect detection, increasing yield and quality consistency.

- Machine learning algorithms optimize farm management, predicting health issues, improving feed conversion ratios, and maximizing skin quality.

- AI systems automate CITES compliance validation, streamlining international trade documentation and reducing customs delays.

- Predictive analytics forecast global luxury consumer demand, allowing for optimized production planning for specific leather finishes and products.

- Integration of AI with blockchain technology provides robust, immutable traceability and anti-counterfeiting solutions for high-value items.

- Natural Language Processing (NLP) aids in monitoring global consumer sentiment regarding ethical sourcing and sustainability debates, allowing brands to tailor their communication strategies.

DRO & Impact Forces Of Crocodile Leather Market

The Crocodile Leather Market is governed by a precarious balance of inherent luxury appeal and stringent environmental constraints, summarized by its DRO (Drivers, Restraints, Opportunities) framework. The primary driver remains the unwavering global appetite for exclusive, high-status luxury goods, particularly among burgeoning affluent classes in emerging economies, coupled with the established tradition of luxury procurement in Western markets. Opportunities are strongly linked to technological innovation, specifically in developing verifiable traceability systems (like blockchain) that can assuage consumer concerns over ethics and legality. Conversely, the market faces intense restraints, chief among them being the strict regulatory oversight by CITES, which complicates international commerce, and the growing social pressure and consumer activism against the use of exotic skins, posing a constant reputational risk. These forces dictate that profitability must be achieved through premium pricing supported by ethical transparency, rather than through volume expansion.

Key drivers include the limited supply inherent to regulated species farming, which maintains exclusivity and price stability, and the high-margin potential for finished products, incentivizing luxury houses to secure premium raw material sources. Furthermore, the material's unique tactile and visual properties resist easy substitution by mass-produced alternatives, solidifying its place in the top echelon of materials. Restraints are manifold; they include the extremely long and capital-intensive nature of crocodile farming (up to four years required for hides of optimal size), the high variable costs associated with specialized tanning processes, and the logistical nightmare of obtaining and maintaining valid CITES permits for every cross-border movement of hides or finished goods. Moreover, the periodic listing changes of certain crocodile species under CITES Appendix I or II can introduce significant volatility and uncertainty into future supply planning.

Impact forces currently shaping the market are dominated by socio-political shifts toward sustainability and animal welfare. The impact of high-profile luxury brand pledges to cease or limit the use of exotic skins, although currently confined to a minority of players, exerts pressure on the entire ecosystem to elevate standards. The impact of regulatory forces is profound, with CITES compliance acting as a non-negotiable gateway to market access; failure to comply results in trade sanctions and severe damage to brand integrity. Economically, the market is influenced by the concentration of wealth—where growth among HNWIs directly correlates with demand—and technological forces, where innovations in sustainable traceability are essential for mitigating ethical risks and ensuring long-term viability. The interaction of these forces compels participants to adopt best-in-class ethical practices to maintain market acceptance and premium pricing.

Segmentation Analysis

The Crocodile Leather Market is analyzed across critical dimensions including product type, application, and distribution channel, reflecting the highly specialized nature of the luxury value chain. Segmentation by product type primarily relates to the finishing process applied to the raw hide, which dramatically affects the material’s final appearance, feel, and suitability for specific products. The dominance of specific finishes often reflects current luxury trends, with matte and glazed competing for market share based on regional consumer preferences. Segmentation by application is crucial, as the economic value is concentrated overwhelmingly in specific high-ticket luxury items that utilize large, flawless sections of the skin, driving material specifications and pricing structures. The high average transaction value necessitates controlled distribution through exclusive channels.

Analyzing the market through product type reveals that matte finishes, characterized by a soft, sophisticated look, are highly sought after, particularly in the European and North American luxury markets, and are increasingly used for structured handbags. Glazed finishes, offering a high-shine, classic aesthetic, maintain strong popularity in traditional luxury strongholds and parts of Asia, often associated with timeless evening wear accessories. Segmentation by application clearly defines the market's focus, with "Handbags and Luggage" generating the highest revenue share due to the prestige and pricing commanded by these items. Smaller applications like watch straps and wallets provide ancillary revenue but are highly sensitive to small defects in the leather, requiring premium segments of the hide.

The distribution channel segmentation underscores the market's luxury positioning, with specialized brand boutiques and high-end department stores (Offline Retail) accounting for the vast majority of sales, allowing brands to control the customer experience, environment, and pricing narrative. While e-commerce (Online Retail) growth is evident, particularly for accessories and smaller goods, the high-touch, consultative sales process required for core crocodile leather products ensures the physical retail presence remains paramount. This restricted distribution model is vital for maintaining brand exclusivity and verifying the authenticity of high-value purchases, acting as a crucial element of the overall anti-counterfeiting strategy.

- By Product Type:

- Glazed Finish

- Matte Finish

- Nubuck/Suede Finish

- Others (e.g., Metallic, Patent)

- By Application:

- Handbags and Luggage

- Footwear (Boots, Dress Shoes)

- Small Leather Goods (Wallets, Card Holders)

- Watch Straps and Belts

- Apparel and Jackets

- By Source:

- Farmed Crocodile Species (Crocodylus porosus, Crocodylus niloticus)

- Wild-Harvested (Highly restricted and niche)

- By Distribution Channel:

- Offline Retail (Brand Boutiques, Department Stores)

- Online Retail (Brand E-commerce, Authorized Luxury Platforms)

Value Chain Analysis For Crocodile Leather Market

The value chain for crocodile leather is unusually complex and tightly regulated, beginning with the upstream analysis involving specialized ranching or farming operations. The upstream segment is critical because the quality of the raw hide, which accounts for a substantial percentage of the final product cost, is determined here through meticulous care, feeding, and ethical welfare practices that must comply with national and international standards. Raw hides are then processed through highly specialized and often proprietary tanning facilities. Tanning is the pivotal value-adding step, transforming the raw material into durable leather; this process requires immense technical expertise, significant capital investment, and strict adherence to environmental regulations concerning chemical usage and wastewater management. Only a select number of globally certified tanneries possess the capability to handle exotic skins to the standards required by top luxury brands.

The midstream phase transitions from tanning to the manufacturing of finished goods. This involves skilled artisan labor for cutting, stitching, and assembling the final products—handbags, shoes, or accessories. Due to the high value and irregular nature of the skin, cutting requires extremely precise planning to maximize yield and ensure symmetrical scaling on the final product. This stage is dominated by European luxury manufacturers who possess the institutional knowledge and craftsmanship required. The downstream analysis focuses on distribution and retail. The primary distribution channel is direct, via exclusive brand-owned boutiques (Direct), which allows for maximized profit margins and complete control over branding, pricing, and consumer interaction. Indirect channels, such as authorized high-end department stores, are used selectively to broaden geographical reach but are managed under stringent partnership agreements that protect the brand's luxury positioning.

The distribution complexity is magnified by the requirement for CITES re-export permits at almost every stage of international movement—from the farm country to the tanning country, from the tanning country to the manufacturing country, and finally to the retail market. This bureaucratic necessity ensures accountability but adds significant time and cost to the supply chain. The efficiency of the entire chain hinges on seamless documentation transfer and verification. The high level of vertical integration observed in the market, where luxury conglomerates own or have exclusive contracts with farming and tanning entities, demonstrates the industry’s realization that control over every link is necessary not just for quality, but critically, for verifiable ethical and legal compliance, which is now the defining competitive factor in this market segment.

Crocodile Leather Market Potential Customers

The primary customer base for the Crocodile Leather Market consists overwhelmingly of High-Net-Worth Individuals (HNWIs) and Ultra High-Net-Worth Individuals (UHNWIs) globally, who perceive these products not merely as accessories but as tangible symbols of wealth, enduring investment pieces, and collectible items. This demographic is characterized by inelastic demand; price fluctuations rarely impact their purchasing decisions. These consumers seek exclusivity, proven provenance, and impeccable craftsmanship, making transparency and traceability a significant, non-financial value proposition. They are typically discerning buyers who possess deep brand loyalty to established luxury houses recognized for their history and quality assurance, often purchasing through bespoke or personalized services offered within exclusive boutiques.

Beyond the final consumer, the market's potential customers include the institutional buyers: Tier 1 Global Luxury Fashion Conglomerates (e.g., LVMH, Kering, Hermès). These entities are the largest purchasers of high-grade raw crocodile hides and finished leather from specialized farms and tanneries. Their demand is driven by seasonal collection requirements, brand positioning, and commitments to maintain a portfolio of exotic skin offerings. These corporate buyers demand rigorous adherence to CITES documentation, specific quality grading (such as belly skin size and flawless finish), and increasingly, audited environmental and animal welfare practices from their upstream suppliers. Their strategic long-term procurement contracts stabilize the market and drive standards.

A secondary, yet important, customer segment includes Independent Bespoke Accessory Makers and High-End Watch Manufacturers. These smaller entities source finished leather for specialized, custom-order products like tailored watch straps or limited-edition briefcases. They prioritize specialized cuts, unique colors, and smaller quantities of exceptionally flawless leather. These customers often require detailed technical specifications and rely heavily on specialized leather distributors or agents who can guarantee material origin and compliance. Their purchasing behavior is less about volume and more about securing rare, perfect material for one-off artisanal projects that command the highest possible margins at the retail level.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.92 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | LVMH Moët Hennessy Louis Vuitton SE, Kering S.A., Hermès International S.C.A., Heng Long Leather (Tannery), Amtan International (Tannery), PTT Leather Co., Ltd., The Crocodile Leather Farm (Singapore), Padenga Holdings Limited, Singapore Crocodile Leather, Zegna Group, Tanneries Haas, ISA TanTec, JBS Couros, Alligator Leather Co., Crocodylus International, R.M. Williams, Fendi (part of LVMH), Prada S.p.A., John Lobb (Hermès subsidiary), Gucci (part of Kering). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crocodile Leather Market Key Technology Landscape

The technology landscape in the Crocodile Leather Market is primarily driven by the imperative for enhanced traceability, quality assurance, and sustainable process optimization, moving away from traditional, manual systems. Key technology adoption focuses on digital documentation and tracking systems to manage CITES compliance seamlessly. Blockchain technology is emerging as a foundational tool, offering immutable, distributed ledgers that record every transfer of ownership and regulatory approval (from hatching to tanning to finished product). This system drastically reduces the potential for fraud and guarantees the provenance of the expensive raw material, addressing a core concern of both consumers and regulatory bodies. The integration of RFID (Radio-Frequency Identification) tags directly into the hides during the early stages of processing complements blockchain, providing physical proof linked to the digital record, ensuring that every genuine product can be verified instantly.

Furthermore, technology plays a vital role in optimizing the primary value-add process: tanning. Traditional tanning processes are chemical-intensive and environmentally impactful. Consequently, specialized tanneries are investing heavily in advanced, sustainable chemical technologies, including chrome-free and heavy-metal-free tanning agents (often referred to as 'wet-white' processes). These innovations reduce the environmental footprint associated with processing, allowing luxury brands to align their manufacturing practices with broader corporate sustainability goals. Simultaneously, sophisticated water treatment and recycling technologies are being deployed in tannery operations to manage and minimize wastewater discharge, which is a significant regulatory and environmental pain point in leather production.

In the ranching segment, the adoption of IoT (Internet of Things) devices and advanced monitoring systems is transforming animal husbandry. Sensors are used to monitor water quality, temperature, and individual animal activity within enclosures, allowing for real-time adjustments to optimize the environment for optimal growth and health. Coupled with this, specialized computer vision systems, often leveraging AI, are being developed to non-invasively monitor skin quality and identify potential defects early, allowing farmers to intervene and maximize the yield of flawless, premium-grade hides. These technological integrations are not merely about efficiency; they are fundamentally about risk mitigation and building consumer trust through verifiable, high-standard ethical farming practices, crucial for sustaining the luxury narrative.

Regional Highlights

The global crocodile leather market exhibits distinct regional dynamics, driven by varying consumption patterns, manufacturing concentration, and regulatory frameworks. Europe, particularly Italy and France, stands as the indisputable center for high-end manufacturing, design, and consumption. Major luxury conglomerates, headquartered here, control the global flow of raw materials, tanning operations, and final product distribution. The region's consumers display mature, stable demand and prioritize craftsmanship, brand heritage, and provable ethical sourcing. European regulations, often exceeding CITES requirements in their strictness regarding animal welfare and chemical usage (e.g., REACH), heavily influence global supply chain standards, compelling non-European suppliers to comply with stringent criteria to access this critical market.

The Asia Pacific (APAC) region represents the primary engine for future consumption growth. Fueled by exponential increases in the HNW population in countries like China, Singapore, and Hong Kong, demand for ultra-luxury goods, including crocodile leather accessories, is robust. In this region, crocodile leather often holds significant cultural resonance as a symbol of prosperity and status. While consumption is high, APAC is also a major source of raw hides, particularly Southeast Asia (Thailand, Vietnam, Singapore, and Australia), where significant farming and preliminary processing infrastructure is established. The complexity here lies in managing the local supply chain infrastructure to meet the rigorous compliance demands of Western luxury brands.

North America maintains a stable and high-value consumer market, characterized by strong demand for both classic and bespoke items. The U.S. consumer base is highly receptive to transparent sourcing narratives, and while manufacturing is limited, the consumption of finished European luxury goods is substantial. The trade within North America, particularly involving the processing of alligators (related species), operates under its own highly regulated framework (US Fish and Wildlife Service), contributing a specialized, albeit distinct, segment to the broader exotic skin market. The Middle East and Africa (MEA) represent a growing, affluent consumer base, particularly in the Gulf Cooperation Council (GCC) states, where luxury expenditure is among the highest globally, ensuring continued niche demand for ultra-exclusive leather goods.

- Europe: Dominant manufacturing hub (France, Italy); center of luxury design; high consumer demand focused on craftsmanship and verified ethical sourcing; strict regulatory adherence (CITES and local environmental laws).

- Asia Pacific (APAC): Fastest-growing consumption market (China, Southeast Asia); major raw material sourcing region (Thailand, Australia); demand driven by rising HNW population and status symbolism.

- North America: Stable, high-value consumer market; strong demand for bespoke and luxury items; high emphasis on brand traceability and transparency; specialized market for American alligator leather.

- Latin America: Important source market for certain crocodilian species; challenges in achieving the scale and standardization required by global luxury tanneries; opportunities for sustainable farming development.

- Middle East & Africa (MEA): High-spending, emerging consumer market (GCC countries); consumption focused on ultra-luxury and exclusive retail experiences.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crocodile Leather Market.- LVMH Moët Hennessy Louis Vuitton SE

- Kering S.A.

- Hermès International S.C.A.

- Heng Long Leather (Tannery)

- Amtan International (Tannery)

- PTT Leather Co., Ltd.

- Padenga Holdings Limited

- Singapore Crocodile Leather

- Crocodile International Group

- Zegna Group

- Tanneries Haas

- ISA TanTec

- JBS Couros

- Alligator Leather Co.

- Crocodylus International

- R.M. Williams

- Fendi (part of LVMH)

- Prada S.p.A.

- Gucci (part of Kering)

- Polo Ralph Lauren

Frequently Asked Questions

Analyze common user questions about the Crocodile Leather market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulations governing the international trade of crocodile leather?

The trade is strictly regulated by the Convention on International Trade in Endangered Species of Wild Fauna and Flora (CITES). All international transactions require specific permits certifying that the skin was legally and sustainably sourced, usually from CITES-approved captive breeding farms, ensuring the conservation status of wild populations.

How is the authenticity and ethical sourcing of crocodile leather verified in the modern market?

Authenticity is increasingly verified using advanced technologies such as blockchain and integrated RFID tags. These systems provide immutable, transparent records detailing the provenance of the skin, including farm origin, CITES permit numbers, and processing history, assuring consumers of ethical and legal sourcing.

Which geographical region holds the largest share in the consumption of crocodile leather luxury goods?

Europe, driven by major luxury houses and high consumer spending in France and Italy, currently holds the largest share in the manufacturing and consumption value. However, the Asia Pacific region, particularly China, is the fastest-growing market segment for consumption due to rising affluent populations.

What is the key difference between the glazed finish and the matte finish in crocodile leather?

The key difference is the surface appearance achieved during the final finishing process. Glazed leather is buffed with felt wheels to achieve a high-gloss, reflective shine, traditionally favored for classic luxury. Matte leather utilizes a specialized oil application to achieve a soft, non-reflective, sophisticated finish favored in contemporary luxury aesthetics.

Are there viable substitutes or alternatives impacting the crocodile leather market?

While the market remains niche and resistant to true substitution, highly advanced synthetic and bio-engineered leathers are emerging as competitors, particularly those marketed under strong sustainability narratives. However, for the ultra-luxury segment, the natural texture and inherent rarity of genuine crocodile skin remain superior and difficult to replicate fully.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager