Crossflow Membrane Wine Filtration Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433308 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Crossflow Membrane Wine Filtration Market Size

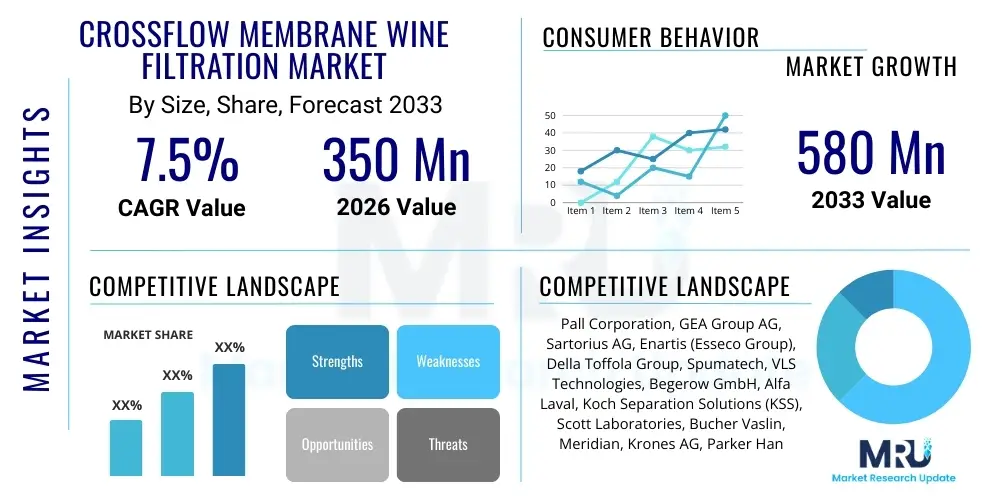

The Crossflow Membrane Wine Filtration Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 580 Million by the end of the forecast period in 2033.

Crossflow Membrane Wine Filtration Market introduction

The Crossflow Membrane Wine Filtration Market encompasses specialized tangential flow separation technology utilized for clarifying, stabilizing, and preparing wine for bottling. This technology operates by flowing the wine parallel to the membrane surface, allowing permeate (filtered liquid) to pass through while concentrating retained solids (lees, yeast, bacteria) along the surface, thereby minimizing membrane fouling and maximizing operational uptime. Unlike traditional methods like diatomaceous earth filtration or plate-and-frame systems, crossflow filtration offers superior quality control, eliminates the need for filter aids, and significantly reduces wine loss, making it a critical process optimization tool for modern wineries striving for consistency and efficiency in large-scale production environments.

The core product within this market includes filtration units equipped with various membrane types, primarily polymeric (such as Polyvinylidene Fluoride (PVDF) and Polyethersulfone (PES)) or ceramic materials. These membranes are classified by pore size, ranging from microfiltration (MF) used for yeast and bacterial stabilization, to ultrafiltration (UF) used for colloid and protein removal, though MF dominates the wine application sector. Major applications span the treatment of red, white, and sparkling wines, serving to remove haze-causing particles, microbial contaminants, and undesirable solid residues prior to final packaging, which ensures both visual clarity and microbiological stability, crucial factors for product shelf life and consumer appeal.

Key driving factors accelerating the adoption of crossflow filtration include increasingly stringent global quality regulations regarding microbiological stability and turbidity standards, particularly in export markets. Furthermore, the strong emphasis on sustainable winemaking practices favors crossflow systems due to their reduced environmental footprint compared to traditional methods. Crossflow eliminates waste streams associated with filter media disposal and minimizes water usage during cleaning, offering substantial operational and environmental benefits that are highly valued by commercial wineries seeking to optimize their cellar processes and reduce overall operating expenses associated with clarification and sterilization phases.

Crossflow Membrane Wine Filtration Market Executive Summary

The global Crossflow Membrane Wine Filtration Market is characterized by a strong shift toward automation and integrated system solutions, driven by the necessity for high-throughput processing in major wine-producing regions such as Europe and North America. Business trends indicate increasing consolidation among equipment providers who are focusing on offering full-suite filtration solutions, often incorporating advanced diagnostic and cleaning-in-place (CIP) functionalities. Wineries are prioritizing investments in systems that offer operational longevity and versatility to handle diverse wine styles, leading to higher demand for robust ceramic membranes and advanced polymeric modules designed for minimal shear stress and optimized energy consumption during the complex filtration processes.

Regionally, Europe, particularly countries like Italy, France, and Spain, maintains market dominance due to its high volume of wine production and early adoption of advanced cellar technologies to meet stringent EU quality standards. The Asia Pacific region, led by emerging markets such as China and Australia, is showing the fastest growth rate, propelled by modernization initiatives in local wineries and increasing investment in export-grade production capabilities. Regional trends highlight that while North America focuses heavily on integrating smart monitoring systems and data analytics into filtration processes, APAC regions are primarily driven by initial infrastructure investment and scaling up production capacity efficiently, leading to high demand for medium-to-large capacity skid-mounted systems.

Segment trends underscore the continued dominance of the Microfiltration segment based on membrane pore size, as microbial stabilization remains the primary application goal before bottling across all wine types. In terms of membrane material, polymeric membranes, favored for their cost-effectiveness and adaptability, currently hold the largest market share. However, ceramic membranes are rapidly gaining traction, particularly among large-scale producers, due to their superior chemical resistance, thermal stability, and prolonged operational lifespan, which justify the higher initial capital expenditure through lower lifetime operating costs and reduced frequency of module replacement. The market also exhibits a growing preference for skid-mounted, fully automated systems over manually controlled units, reflecting the industry's commitment to optimizing labor use and ensuring process repeatability.

AI Impact Analysis on Crossflow Membrane Wine Filtration Market

User inquiries regarding AI's influence in the Crossflow Membrane Wine Filtration Market center on several key themes: how AI can optimize flux rates and minimize fouling; the potential for predictive maintenance of costly membrane modules; and the integration of machine learning algorithms to correlate filtration parameters with final wine quality attributes. Users are keenly interested in whether AI can automatically adjust process variables (pressure, flow rate, temperature) in real-time based on the wine matrix (e.g., viscosity, solids content, sugar level) to achieve maximum throughput without compromising flavor integrity. Concerns often revolve around the initial investment required for sensor integration and data infrastructure, and the complexity of training models for diverse wine types and vintage variability inherent in winemaking.

The core promise of AI in this sector lies in optimizing the filtration cycle through predictive modeling. AI systems can analyze historical operational data, including fouling patterns, cleaning cycles, and membrane lifespan, coupled with real-time sensor inputs, to predict when fouling is likely to occur and proactively trigger optimized backflushing or chemical cleaning cycles. This shift from reactive or time-based cleaning protocols to condition-based maintenance drastically improves membrane efficiency, prolongs the life of expensive hardware, and ensures consistent quality output. Furthermore, AI facilitates better inventory management of consumables and optimizes energy consumption by fine-tuning pump speeds and pressure differentials throughout the filtration run.

Beyond process efficiency, AI is beginning to impact quality assurance. Machine learning models are being developed to analyze spectroscopic or compositional data of the wine pre- and post-filtration, helping winemakers understand the subtle qualitative impact of different filtration protocols on color, tannin structure, and aromatic compounds. While full automation of flavor profile adjustments based solely on AI remains aspirational, these tools provide crucial decision support, enabling winemakers to select the least intrusive filtration parameters necessary to meet microbiological stability requirements, ensuring that the finished product maintains its desired sensory characteristics, thereby increasing the value proposition of integrated filtration systems.

- Real-time optimization of transmembrane pressure and flux rates based on wine composition analysis.

- Predictive maintenance schedules for membrane modules, reducing unexpected downtime and replacement costs.

- Automated diagnosis of fouling mechanisms and fine-tuning of Cleaning-in-Place (CIP) protocols.

- Integration with winery Enterprise Resource Planning (ERP) systems for seamless inventory and quality tracking.

- Data-driven correlation between filtration parameters and final wine sensory attributes for enhanced quality control.

DRO & Impact Forces Of Crossflow Membrane Wine Filtration Market

The market dynamics of Crossflow Membrane Wine Filtration are significantly shaped by a confluence of accelerating drivers and persistent restraining factors, alongside compelling opportunities for growth, all interacting as critical impact forces. The primary driver is the pervasive industry shift towards achieving higher standards of microbiological stability and clarity without compromising the wine's sensory profile. Modern consumers and regulatory bodies demand impeccably clear and stable products, pushing winemakers away from less precise methods toward highly controllable, verifiable crossflow technology. This driver is amplified by the cost-efficiency realized through reduced wine loss and the elimination of expensive filter aids inherent in crossflow systems, offering a tangible return on investment for high-volume producers.

Key restraints tempering market expansion include the substantial initial capital investment required for high-capacity crossflow units, particularly those featuring durable ceramic membranes, which can be prohibitive for small and medium-sized wineries (SMWs). Furthermore, the operational complexity and the need for specialized technical expertise for maintenance and troubleshooting of highly automated membrane systems pose barriers in regions where skilled labor is scarce. Another restraint involves the potential for irreversible fouling by complex wine colloids if the system is not meticulously managed or if the wine matrix is highly challenging, leading to high maintenance costs and shorter membrane lifespan than advertised, generating hesitation among potential first-time adopters.

Opportunities for growth are largely centered around technological innovation and geographic expansion. The development of next-generation membranes with improved anti-fouling surfaces and higher resistance to cleaning chemicals, alongside enhanced automation features compatible with Industry 4.0 principles, provides avenues for market penetration. Geographically, significant opportunities exist in developing wine regions in Eastern Europe, South America, and parts of Asia, where winemakers are rapidly upgrading legacy equipment to compete in global export markets. The overall impact force matrix favors continued growth, as the superior quality control and sustainability benefits derived from crossflow filtration fundamentally align with long-term industry objectives, gradually overcoming the initial capital cost barrier through proven operational savings and premium product differentiation.

Segmentation Analysis

The Crossflow Membrane Wine Filtration Market is meticulously segmented based on key criteria including the material used in the filtration modules, the operational scale of the equipment, the intended pore size for separation, and the specific application (type of wine processed). This segmentation provides a granular view of market demand, highlighting how specific technological configurations cater to diverse operational needs ranging from small-batch artisanal wineries to multi-million-liter industrial facilities. Understanding these segments is crucial for manufacturers to tailor their product offerings and for winemakers to select the most economically viable and technically appropriate filtration solution for their specific cellar requirements and wine styles, such as delicate white wines or high-tannin red wines.

The segmentation by membrane material, dividing the market into polymeric and ceramic types, is perhaps the most significant in terms of performance and cost differentiation. Polymeric membranes (such as PVDF and PES) are characterized by lower initial cost and good flexibility, dominating the smaller-to-medium scale operations. Conversely, ceramic membranes, while demanding higher upfront investment, offer unparalleled durability, resistance to aggressive cleaning chemicals, and extremely long operational lifecycles, making them the preferred choice for large-scale, high-throughput commercial wineries prioritizing robustness and minimum system downtime. The performance trade-offs between these two material classes drive considerable investment decisions across the industry value chain.

Further segmentation by application—red, white, or sparkling wine filtration—reveals distinct processing needs. White wines typically require aggressive filtration for clarity and protein stability, often involving finer pore sizes or specific pre-treatment regimes. Red wines, particularly high-end vintages, require stabilization processes that minimize the stripping of valuable phenolics and color compounds, demanding gentle filtration parameters and specialized low-shear modules. Sparkling wine filtration, focused heavily on microbial stability before secondary fermentation or bottling, also requires dedicated robust systems. These application-specific requirements necessitate different flow dynamics and maintenance protocols, creating specialized sub-markets within the broader crossflow sector.

- By Membrane Material

- Polymeric Membranes (PVDF, PES, others)

- Ceramic Membranes (Alumina, Zirconia)

- By Technique/Pore Size

- Microfiltration (MF)

- Ultrafiltration (UF)

- Nanofiltration (NF) (Limited application in wine)

- By Application

- Red Wine Filtration

- White Wine Filtration

- Sparkling Wine/Fizzy Wine Filtration

- By Scale/Capacity

- Small Wineries (Below 50,000 Gallons/Year)

- Medium Wineries (50,000 to 500,000 Gallons/Year)

- Large Wineries (Above 500,000 Gallons/Year)

Value Chain Analysis For Crossflow Membrane Wine Filtration Market

The value chain for the Crossflow Membrane Wine Filtration Market begins with upstream suppliers, primarily focusing on the provision of raw materials crucial for membrane construction, including specialized polymers (e.g., PVDF, PES powders) and ceramic precursors (e.g., high-purity alumina or zirconia). This upstream segment is highly specialized and often dominated by large chemical and material science companies, whose innovation in material properties directly influences the performance and durability of the final membrane modules, such as resistance to ethanol and caustic cleaning agents. Quality control at this stage is paramount, as inconsistencies in raw materials can lead to premature membrane failure and high replacement costs downstream.

The mid-stream segment involves the core activities of equipment manufacturing and system integration. This is where specialized filtration technology companies design, manufacture, and assemble the crossflow filtration skid units, incorporating membranes (purchased or manufactured in-house), pumps, valves, instrumentation, and control systems (PLCs/SCADA). These manufacturers differentiate themselves through modular design, automation capabilities, efficiency (flux rate vs. energy consumption), and user interface complexity. System integrators often customize standard skids to meet specific winery flow rates and space constraints, ensuring seamless integration into existing cellar infrastructure, thereby adding significant value to the final product offering.

The downstream segment focuses on distribution, installation, and after-sales support, connecting the equipment manufacturer to the end-user (wineries). Distribution channels are typically a mix of direct sales teams for large, complex installations and a network of specialized regional distributors or agents who possess deep knowledge of local winemaking practices and regulations. After-sales service, including routine maintenance, membrane cleaning consultation, replacement module supply, and technical support, constitutes a crucial aspect of value delivery, especially given the technical nature and high cost of the filtration units. Direct relationships between manufacturers and large commercial wineries are common for strategic sales, while smaller producers often rely on indirect distribution channels offering tailored financing and localized support services.

Crossflow Membrane Wine Filtration Market Potential Customers

The primary potential customers and end-users of Crossflow Membrane Wine Filtration technology are wineries ranging from boutique operations focused on premium, small-batch production to multinational conglomerates running high-volume, continuous production facilities. Large commercial wineries represent the most significant segment due to their acute need for high throughput, consistent product quality, and maximizing operational efficiency, making the high capital cost of crossflow systems readily justifiable through realized savings in labor, filter aids, and reduced wine loss. These buyers prioritize systems that offer full automation, remote monitoring capabilities, and robust ceramic modules capable of running 24/7 during peak harvest periods.

Mid-sized regional wineries constitute another major customer base, driven by the desire to improve quality control and transition away from traditional, labor-intensive filtration methods that utilize disposable filter media. For this segment, the investment decision is often focused on finding the optimal balance between cost-effectiveness and performance, leading to a high demand for high-quality polymeric membrane systems that provide necessary clarity and stability with manageable operational expenses. These customers often seek modular systems that can be easily scaled up as their production volumes increase, requiring flexible financing and robust local technical support from distributors.

Emerging potential customers include specialized beverage producers that utilize wine or wine bases, such as ready-to-drink (RTD) cocktail manufacturers or producers of non-alcoholic wine alternatives. While not traditional wineries, their reliance on achieving microbiological stability and specific clarity standards necessitates high-efficiency filtration solutions. Furthermore, third-party bottling and mobile filtration service providers represent a rapidly growing customer segment. These service providers purchase and maintain high-capacity crossflow units that they lease or operate on-site for multiple smaller wineries, effectively democratizing access to this advanced technology for producers who cannot afford the full capital investment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 580 Million |

| Growth Rate | CAGR 7.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Pall Corporation, GEA Group AG, Sartorius AG, Enartis (Esseco Group), Della Toffola Group, Spumatech, VLS Technologies, Begerow GmbH, Alfa Laval, Koch Separation Solutions (KSS), Scott Laboratories, Bucher Vaslin, Meridian, Krones AG, Parker Hannifin Corporation, Donaldson Company, Inc., Viniquip, Microfilt Italia Srl, Pera, Juice Tech |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crossflow Membrane Wine Filtration Market Key Technology Landscape

The technology landscape in crossflow membrane wine filtration is evolving rapidly, driven primarily by the need for enhanced efficiency, reduced energy consumption, and superior quality preservation. A major technological focus involves the continuous refinement of membrane materials and module geometry. For polymeric systems, manufacturers are developing hollow fiber and spiral wound modules with higher packing density and specialized surface coatings aimed at minimizing irreversible protein or polysaccharide fouling, which is a major operational headache for winemakers. These advancements seek to increase the average time between intensive chemical cleanings, thereby reducing both chemical usage and downtime, improving the sustainability profile of the equipment.

Ceramic membranes represent a significant leap in filtration technology, utilizing materials like alumina or zirconia to create extremely robust, temperature-resistant, and chemically stable membranes. While they are more expensive upfront, ceramic systems boast flow paths designed to enhance turbulence and shear rates, which naturally mitigate the build-up of the polarization layer, leading to sustained high flux rates. Recent innovations include multi-channel monolithic ceramic elements that maximize filtration surface area within a compact footprint, allowing large wineries to handle significantly increased volumes without expanding the physical size of their processing cellars. The durability of ceramic membranes also permits more aggressive cleaning protocols, ensuring optimal performance recovery even after heavy processing seasons.

Beyond the physical membranes, the technological landscape is defined by the integration of advanced process control and automation systems. Modern crossflow units are increasingly equipped with Supervisory Control and Data Acquisition (SCADA) systems and sophisticated Programmable Logic Controllers (PLCs) that allow for fully automated operation, cleaning, and sanitization cycles. These systems feature precise sensing mechanisms that monitor transmembrane pressure (TMP), flow rates, and turbidity in real time, enabling automatic adjustments to prevent damaging pressure spikes and excessive fouling. This shift towards smart filtration systems facilitates remote monitoring and diagnostic capabilities, optimizing labor requirements and ensuring consistent, verifiable filtration quality compliant with global bottling standards.

Regional Highlights

- Europe: Europe remains the undisputed leader in the Crossflow Membrane Wine Filtration Market, driven by its massive wine production volumes (France, Italy, Spain, Germany) and highly mature regulatory environment that mandates rigorous quality and stability controls. The region is characterized by high adoption rates of both polymeric and advanced ceramic systems, especially among large cooperatives and premium producers seeking long-term operational excellence and minimal sensory impact on high-value wines. Germany and Italy are focal points for manufacturing innovation and the deployment of fully automated, energy-efficient filtration skids.

- North America: North America, particularly the United States (California) and Canada, represents a highly technologically advanced market segment. Adoption is strong, driven by large-scale, export-focused wineries and a willingness to invest heavily in smart, integrated cellar technology. The regional focus is heavily skewed towards optimizing labor efficiency and utilizing data analytics for process improvement, leading to high demand for systems compatible with existing digital winery infrastructure and featuring remote diagnostic capabilities.

- Asia Pacific (APAC): APAC is projected to exhibit the highest CAGR during the forecast period. This rapid growth is fueled by expanding domestic wine consumption in countries like China and Australia, coupled with significant investment in modernizing winemaking facilities to meet international export quality standards. Australia and New Zealand are early adopters of crossflow technology, primarily prioritizing efficiency and minimizing wine loss, while emerging markets like China represent substantial future demand for new, medium-to-large capacity installations.

- Latin America: Led by Chile and Argentina, Latin America is a significant market for crossflow technology, primarily due to large-scale, cost-competitive wine production aimed at the global market. The market drivers here center on efficiency, robustness, and the ability to handle high volumes of challenging matrices. While cost remains a factor, the long-term benefits of reduced labor and filter aid costs are compelling, driving steady adoption, particularly of reliable polymeric membrane systems.

- Middle East and Africa (MEA): This region represents a smaller but growing market, mainly confined to South Africa, which has a well-established and technologically progressive wine industry. South African producers are increasingly integrating crossflow systems to enhance export quality and sustainability compliance. Adoption rates in the MEA region are slower but highly concentrated among major commercial producers focused on accessing European and North American markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crossflow Membrane Wine Filtration Market.- Pall Corporation (A Danaher Company)

- GEA Group AG

- Sartorius AG

- Enartis (Esseco Group)

- Della Toffola Group

- Spumatech

- VLS Technologies

- Begerow GmbH

- Alfa Laval

- Koch Separation Solutions (KSS)

- Scott Laboratories

- Bucher Vaslin

- Meridian

- Krones AG

- Parker Hannifin Corporation

- Donaldson Company, Inc.

- Viniquip

- Microfilt Italia Srl

- Pera

- Juice Tech

- Membrapore GmbH

- Meissner Filtration Products

- Pentair plc

- Eaton Corporation

- Taminco

Frequently Asked Questions

Analyze common user questions about the Crossflow Membrane Wine Filtration market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of crossflow filtration over traditional sheet or plate filtration methods for wine?

The primary advantage is the elimination of filter aids and the substantial reduction of wine loss, maximizing yield. Crossflow filtration is a continuous, automated process that maintains microbiological stability and consistent clarity without frequent media replacement, leading to lower operating costs and a superior environmental profile compared to diatomaceous earth systems.

Are ceramic membranes cost-effective despite their high initial purchase price?

Yes, for large commercial operations, ceramic membranes are highly cost-effective in the long term. Their superior durability, resistance to aggressive chemical cleaning, and exceptional lifespan (often exceeding 10 years) drastically reduce module replacement frequency and minimize operational downtime, offsetting the higher initial capital expenditure through lower total cost of ownership.

How does crossflow filtration impact the sensory characteristics and quality of wine, particularly delicate varietals?

Modern crossflow systems are designed with low-shear pumps and optimized flow dynamics to minimize the negative impact on wine quality. When operated correctly, they effectively remove microbial contaminants and particulates while minimizing the stripping of volatile aromatic compounds, ensuring the retention of the desired color and flavor profile, which is critical for premium wines.

What are the typical maintenance requirements and how often do membranes need replacement?

Maintenance primarily involves routine automated Cleaning-in-Place (CIP) cycles using caustic and acidic solutions, and regular integrity testing. Replacement frequency is highly variable; polymeric membranes typically last 3-5 years under normal operation, while robust ceramic membranes can last 10 years or more, provided optimal cleaning protocols are strictly adhered to.

Which type of wine filtration, microfiltration or ultrafiltration, is most commonly used in commercial wineries?

Microfiltration (MF) is the most commonly used technique in commercial wineries. MF is highly effective for pre-bottling sterilization, successfully removing yeast and bacteria to ensure microbiological stability. Ultrafiltration (UF) has more niche applications, generally reserved for specific tasks like removing certain colloidal haze or specific proteins.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager