Crossover Tires Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432871 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Crossover Tires Market Size

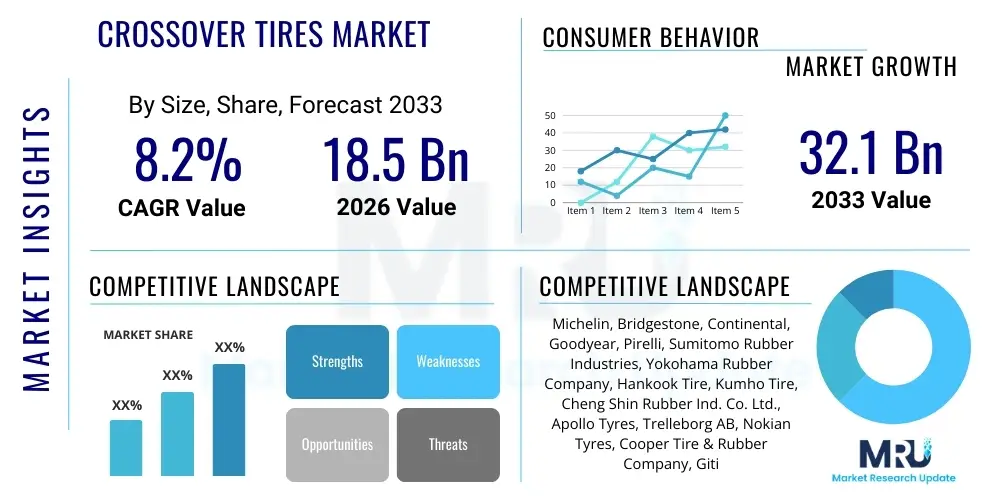

The Crossover Tires Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.2% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 32.1 Billion by the end of the forecast period in 2033.

Crossover Tires Market introduction

The Crossover Tires Market encompasses a specialized range of automotive rubber products designed specifically to meet the unique performance demands of Crossover Utility Vehicles (CUVs) and Sport Utility Vehicles (SUVs). These vehicles, blending passenger car comfort with truck-like utility, require tires that offer superior handling, stability, and load-bearing capabilities across varied road conditions, ranging from paved city streets to light off-road terrain. The inherent market dynamism is directly proportional to the sustained global preference shift towards CUVs, which are now outselling traditional sedans and hatchbacks in major automotive markets across North America, Europe, and Asia Pacific. These tires are engineered to deliver a crucial balance between ride comfort, fuel efficiency—a growing priority due to stringent emission regulations—and exceptional traction, particularly in all-season variants that dominate the segment.

Crossover tires are characterized by robust construction, often incorporating reinforced sidewalls and advanced rubber compounds that resist premature wear while managing higher vehicle weights and dynamic loads associated with utility driving. A primary driver for the expansion of this market is the continual technological innovation aimed at optimizing tire performance metrics such as rolling resistance, wet grip, and noise reduction, aligning with consumer expectations for a premium driving experience. Major applications of these tires span across compact CUVs, mid-size luxury crossovers, and larger SUVs, serving both original equipment manufacturers (OEMs) during vehicle assembly and the robust aftermarket segment catering to replacement cycles.

The benefits derived from high-quality crossover tires include enhanced vehicle safety due to reliable braking distances, improved driving stability necessary for higher-center-of-gravity vehicles, and superior longevity compared to standard passenger car tires. Driving factors propelling market growth include rapid urbanization necessitating versatile vehicles capable of navigating diverse infrastructure, the accelerating integration of electric vehicle (EV) technology—which requires specialized tires to manage instant torque and battery weight—and increasing average vehicle miles traveled globally. Furthermore, the push for sustainable manufacturing processes and the development of bio-based materials are positioning the market for long-term, ecologically conscious expansion.

Crossover Tires Market Executive Summary

The Crossover Tires Market is experiencing transformative growth, underpinned by fundamental shifts in consumer automotive preference and concurrent technological advances. Business trends indicate a fierce competition among Tier 1 manufacturers, who are heavily investing in specialized segments, particularly tires optimized for Electric Vehicles (EVs). These EV-specific tires address challenges like higher mass, rapid wear due to immediate torque delivery, and the critical need for ultra-low rolling resistance to maximize battery range. The aftermarket segment remains highly profitable, driven by mandatory replacement cycles and consumer willingness to upgrade to premium, high-performance, or all-weather options, thus sustaining elevated average selling prices (ASPs).

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by burgeoning automotive production in China and India, coupled with rising disposable incomes that promote the purchase of CUVs and SUVs. North America maintains its dominance in terms of value, driven by strong consumer demand for large, premium crossovers and favorable vehicle replacement rates. European markets, characterized by stringent environmental regulations and a preference for performance and fuel efficiency, are driving innovation in sustainable material usage and noise reduction technologies, creating a segmented demand for specialized, high-specification products.

Segmentation trends highlight the robust expansion of the All-Season tire segment due to versatility, though All-Terrain (A/T) tires are gaining traction in markets with rugged infrastructure. The OEM segment is dominated by long-term contracts based on performance and cost effectiveness, while the aftermarket sees intense brand loyalty and proliferation of private label brands. Furthermore, the incorporation of "smart tire" technologies—including embedded sensors for real-time monitoring of pressure, temperature, and wear—is increasingly becoming a key differentiation factor, moving the market toward digitally integrated products that enhance both safety and maintenance predictability for the end-user.

AI Impact Analysis on Crossover Tires Market

Common user questions regarding AI's influence in the Crossover Tires Market predominantly center on how Artificial Intelligence can enhance tire longevity, optimize vehicle performance, and contribute to manufacturing sustainability. Users frequently inquire about the reliability of AI-driven predictive maintenance systems, the use of machine learning in developing new chemical compounds, and the potential for AI to personalize tire recommendations based on specific driving behaviors and geographical conditions. Based on this analysis, the key themes summarize that AI is expected to revolutionize the entire tire lifecycle, from accelerating R&D cycles and streamlining complex manufacturing processes to delivering value directly to the consumer through highly accurate performance monitoring and timely, tailored service notifications.

The application of AI in the manufacturing sector specifically addresses quality control issues and throughput optimization. AI algorithms are deployed to analyze massive datasets collected during the curing and molding stages, identifying microscopic flaws and inconsistencies far more accurately and rapidly than human inspectors, thereby reducing scrap rates and ensuring superior product reliability. This data-driven approach also enables proactive calibration of machinery, minimizing downtime and energy waste, which significantly improves the overall efficiency and cost structure of high-volume tire production facilities, contributing directly to better supply chain robustness for crossover tires.

In the realm of product development, generative AI and machine learning models are transforming material science, allowing manufacturers to simulate millions of compound variations and tread patterns under diverse virtual driving conditions. This drastic reduction in physical prototyping time allows companies to swiftly introduce tires specifically engineered for emerging vehicle types, such as heavy-duty electric crossovers, which require novel materials to handle increased weight and torque characteristics. Furthermore, AI-powered predictive analytics integrated into smart tires offers end-users precise data on optimal inflation pressure and remaining tread life, dramatically enhancing safety and maximizing the return on investment for high-value crossover vehicles.

- AI-driven Predictive Maintenance: Utilizing sensor data to forecast tire failure, optimize replacement schedules, and prevent blowouts, enhancing safety for CUV drivers.

- Generative Design Optimization: Employing machine learning to design complex tread patterns and internal structures for enhanced grip, noise reduction, and reduced rolling resistance.

- Enhanced Manufacturing Quality Control: AI vision systems detecting micro-defects during production, leading to higher product consistency and lower warranty claims.

- Supply Chain and Inventory Management: Predictive algorithms optimizing raw material sourcing and distribution logistics based on real-time market demand for specific crossover tire types.

- Personalized Tire Recommendations: Using driver behavior data (speed, cornering force, terrain) processed by AI to recommend the most suitable tire compound and model for longevity and performance.

DRO & Impact Forces Of Crossover Tires Market

The Crossover Tires Market's trajectory is primarily shaped by a confluence of strong drivers (D), persistent restraints (R), emerging opportunities (O), and pervasive impact forces (IF). The primary driver remains the pervasive global shift in consumer preference toward CUVs and SUVs, which consistently leads to high volume sales in both emerging and established economies. Restraints include the highly volatile nature of raw material prices, particularly natural rubber and petrochemical-derived synthetic elastomers, which directly impact manufacturing costs and necessitate complex hedging strategies. Opportunities are profoundly linked to the rapid electrification of the automotive industry, demanding new generations of low-rolling-resistance tires specifically designed to manage the unique performance requirements of electric crossovers, alongside the push for sustainable and bio-based tire materials. Impact forces involve stringent regulatory mandates related to fuel efficiency (labeling requirements) and environmental compliance, pushing manufacturers to continuously innovate compound chemistry and construction techniques.

Further elaborating on the driving factors, the necessity for replacement tires, coupled with the mandatory rotation cycles of large CUV fleets operated by rental agencies and corporate entities, ensures a steady, inelastic demand stream. Moreover, consumers increasingly prioritize safety and performance features, leading to greater uptake of premium-priced performance crossover tires (e.g., Ultra High Performance All-Season), thereby boosting overall market value. However, the market faces significant restraint from the intense R&D investment required to meet the conflicting requirements of enhanced durability, reduced weight, and improved wet braking performance simultaneously. This high barrier to entry limits the ability of smaller players to compete effectively in the premium segment, leading to market consolidation among global giants.

Critical opportunities lie in leveraging digital transformation through the integration of RFID tags and intelligent sensors into tire architecture, enabling vehicle-to-infrastructure (V2I) communication and advanced driver assistance systems (ADAS) functionality, which rely on precise tire data. The impact forces are multifaceted; economic instability in major markets can temporarily suppress discretionary vehicle purchasing, impacting OEM demand, while escalating global trade tensions necessitate localized manufacturing strategies. Ultimately, the market is structurally sound, benefiting from the non-discretionary nature of tire replacement, but its profitability remains highly sensitive to commodity market fluctuations and the pace of regulatory adoption concerning safety and environmental standards.

Segmentation Analysis

The Crossover Tires Market is comprehensively segmented based on various criteria, including product type, vehicle application, distribution channel, and construction type, each revealing distinct growth patterns and competitive dynamics. Analyzing these segments is crucial for understanding regional market priorities and investment avenues. The product type segmentation distinguishes between All-Season, All-Terrain, Winter, and Performance tires, reflecting diverse geographical needs and consumer driving habits. Vehicle applications classify the market into tires for Compact CUVs, Mid-Size CUVs, and Luxury/Full-Size SUVs, where pricing and technology sophistication scale with vehicle size. The segmentation provides a clear framework for tire manufacturers to tailor their product offerings and marketing strategies to specific end-user requirements, maximizing market penetration across varied automotive categories and consumer demographic profiles.

The All-Season segment historically dominates the market share due to its versatility and suitability for moderate climates, acting as the industry volume leader. However, the All-Terrain segment is witnessing accelerated growth, particularly in regions characterized by rugged topography or a strong outdoor recreational culture, such as North America and parts of Australia, driven by the increasing popularity of off-road styled crossovers. In terms of distribution, the market is fundamentally divided between the Original Equipment Manufacturer (OEM) segment, characterized by high volume and thin margins, and the Aftermarket segment, which offers higher margins and faster adoption rates for new technologies and premium branded products. The complexity in material composition required for modern crossover tires, particularly those targeting zero-emission vehicles, necessitates continuous refinement of these segmentation strategies.

Furthermore, segmentation by construction type—specifically radial versus bias tires (with radial dominating)—highlights the technological preference in this market segment, emphasizing stability and durability at highway speeds. The Luxury/Full-Size SUV segment is a vital revenue generator, requiring tires with advanced noise reduction features, high speed ratings, and superior comfort characteristics, thus driving innovation in acoustic dampening materials and specialized polymer compounds. Consequently, successful market players must maintain a finely granular view of these segments, understanding that the requirements for a compact EV crossover tire are fundamentally different from those of a large gasoline-powered SUV, requiring distinct R&D pipelines and supply chain configurations.

- By Product Type:

- All-Season Crossover Tires

- All-Terrain Crossover Tires (A/T)

- Performance Crossover Tires (UHP)

- Winter/Snow Crossover Tires

- By Vehicle Type:

- Compact CUVs

- Mid-Size CUVs

- Luxury and Full-Size SUVs

- By Distribution Channel:

- Original Equipment Manufacturer (OEM)

- Aftermarket (Replacement)

- By Rim Size:

- Below 18 Inches

- 18 to 21 Inches

- Above 21 Inches

Value Chain Analysis For Crossover Tires Market

The value chain for the Crossover Tires Market is extensive and complex, beginning with the upstream sourcing of crucial raw materials, progressing through highly capital-intensive manufacturing processes, and concluding with a multi-layered distribution and retail network reaching the end consumer. Upstream analysis highlights the critical importance of secure and sustainable sourcing of raw materials, primarily natural rubber, synthetic rubber (like SBR and PBR), carbon black, steel cord, and various petrochemical derivatives used as reinforcing fillers and oils. Volatility in the commodity markets for these materials, coupled with environmental concerns associated with rubber cultivation and processing, necessitates strong long-term procurement contracts and vertical integration or strategic partnerships to ensure stability and cost control for major tire manufacturers.

The midstream phase involves manufacturing and R&D, which represent the highest value-addition points, driven by advanced mixing, compounding, and curing technologies. Significant capital expenditure is required for highly automated factories that can produce tires meeting stringent quality and performance standards, particularly those required for premium and EV crossover segments. Manufacturing efficiency and precision are paramount, as the integrity of the tire tread, sidewall, and internal structure directly correlates to vehicle safety and warranty performance. Downstream activities focus heavily on distribution channels, including direct sales to OEMs, which require precise delivery schedules and inventory management, and the robust aftermarket, which relies on expansive wholesaler, independent dealer, and large-scale retail chains for effective market penetration.

Distribution is bifurcated into direct sales (primarily to OEM assembly lines) and indirect sales (through authorized distributors, franchise outlets, and increasingly, e-commerce platforms for the replacement market). The indirect channel benefits from localized inventory and fitting services, which are critical components of the consumer experience. Direct interaction with the end-user provides valuable feedback regarding wear characteristics and performance, influencing subsequent R&D cycles. Effective management of this value chain, focusing on minimizing manufacturing costs while maximizing material sustainability and logistical efficiency, is essential for maintaining competitive advantage and navigating the complex landscape of global regulatory compliance and consumer expectations for high-performance crossover tires.

Crossover Tires Market Potential Customers

Potential customers for the Crossover Tires Market are broadly categorized into Original Equipment Manufacturers (OEMs), Fleet Operators, and Individual Vehicle Owners, each possessing distinct procurement criteria and volume requirements. OEMs constitute a high-volume, cost-sensitive segment, demanding tires customized precisely to the performance specifications of newly launched crossover models. These major automotive producers (such as Ford, Toyota, BMW, and Tesla) enter into multi-year contracts, prioritizing consistent quality, supply chain reliability, and the manufacturer’s capability to integrate cutting-edge technologies like sensors and low-rolling resistance compounds that contribute to the vehicle's overall fuel economy and range ratings. Securing OEM contracts is crucial not only for sales volume but also for brand visibility, which strongly influences aftermarket purchasing decisions.

Fleet operators, including ride-sharing services, corporate fleets, and rental companies, represent a rapidly growing customer base where the key procurement metric is Total Cost of Ownership (TCO). These buyers prioritize tire durability, longevity (mileage warranty), and high retreadability potential to minimize operational downtime and replacement expenditure. Their demand is generally consistent and focuses on dependable, robust, all-season tires that can withstand high utilization rates across varied driving conditions. The shift towards large electric crossover fleets necessitates specific high-load index tires for these customers, driving specialized product development aimed at minimizing replacement frequency.

Individual vehicle owners constitute the largest segment of the high-margin aftermarket, driven by the natural wear-and-tear replacement cycle. These end-users are segmented further by their purchasing motivations: some prioritize cost-effectiveness (seeking mid-range tires), others prioritize high-performance and brand reputation (seeking premium tires), and a growing segment prioritizes environmental factors (seeking eco-friendly or sustainable tires). The purchasing journey for individual customers is heavily influenced by digital content, professional recommendations from tire service centers, and marketing campaigns focusing on safety, warranty coverage, and the suitability of the tire for their specific crossover model and regional weather conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 32.1 Billion |

| Growth Rate | 8.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Michelin, Bridgestone, Continental, Goodyear, Pirelli, Sumitomo Rubber Industries, Yokohama Rubber Company, Hankook Tire, Kumho Tire, Cheng Shin Rubber Ind. Co. Ltd., Apollo Tyres, Trelleborg AB, Nokian Tyres, Cooper Tire & Rubber Company, Giti Tire, MRF Tyres, Toyo Tire Corporation, Sailun Group, Nexen Tire, Maxxis International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crossover Tires Market Key Technology Landscape

The Crossover Tires Market is undergoing a rapid technological evolution, primarily focused on enhancing performance parameters, optimizing energy efficiency, and improving durability to meet the demands of modern CUVs and, crucially, Electric Vehicles (EVs). A core area of advancement involves sophisticated compound chemistry, where manufacturers are utilizing advanced silica and specialized functionalized polymers to reduce rolling resistance significantly without compromising wet traction or tread wear life. This focus is particularly critical for EV crossovers, where every incremental improvement in rolling efficiency directly translates to extended battery range, thus addressing a major concern for EV adoption. New compounding techniques also include the integration of sustainable or bio-based materials, such as specific resins derived from non-petroleum sources, aligning with global green manufacturing mandates and appealing to environmentally conscious consumers.

Structural engineering innovations represent another key technological pillar. Modern crossover tires frequently employ advanced reinforcement plies and optimized carcass designs to manage the higher load indexes and increased dynamic stresses associated with heavier vehicles, especially large CUVs equipped with substantial battery packs. This includes the development of self-sealing and run-flat technologies tailored for crossovers, providing enhanced safety and convenience by allowing the vehicle to operate temporarily after a puncture, reducing reliance on spare tires and freeing up vehicle space. Furthermore, acoustic technology is a major differentiator in the luxury crossover segment; manufacturers are integrating sound-absorbing foam layers or specialized interior patterns within the tire structure to significantly minimize cavity resonance and road noise transmitted to the cabin, thereby enhancing ride comfort.

Perhaps the most transformative technological shift is the widespread adoption of smart tire technology. This involves embedding sophisticated sensors (Tire Pressure Monitoring System – TPMS combined with additional sensors) directly into the tire liner or sidewall. These intelligent systems are capable of measuring not only pressure and temperature but also real-time tread wear depth, load capacity, and subtle road surface conditions. This data is transmitted wirelessly to the vehicle’s central computer and driver interface, enabling proactive maintenance alerts, optimizing vehicle handling control systems (like stability control and traction control), and facilitating highly accurate predictive maintenance models that enhance fleet efficiency and overall driver safety. This integration positions the tire as a critical sensor within the vehicle ecosystem, essential for future autonomous driving systems.

Regional Highlights

- North America (NA): This region holds a dominant market share in terms of value, primarily driven by the consistently high sales volume of large, high-margin CUVs and SUVs. The market is characterized by strong consumer demand for All-Season and Performance crossover tires (UHP CUV tires), reflecting diverse climate zones and a culture of high-speed highway travel. The aftermarket is highly mature, with consumers frequently opting for premium international brands. Furthermore, the rapid adoption of electric crossovers, supported by governmental incentives, is accelerating demand for highly durable, low-rolling-resistance EV-specific tires.

- Europe: The European Crossover Tires Market is defined by stringent environmental regulations, including mandatory tire labeling requirements emphasizing wet grip, external rolling noise, and fuel efficiency. Consumers in countries such like Germany and the Scandinavian regions exhibit high demand for specialized Winter Crossover Tires. The strong presence of luxury automotive manufacturers drives premiumization, with a focus on advanced acoustic technologies and sustainable manufacturing practices, making it a key hub for R&D innovation in tire materials.

- Asia Pacific (APAC): APAC is the fastest-growing market globally, driven by escalating vehicle ownership in populous countries such as China and India, coupled with rising middle-class disposable incomes leading to significant CUV adoption. The market here is highly competitive, seeing robust growth in both the OEM segment (due to substantial domestic automotive production) and the replacement market. Infrastructure development and varying regional road conditions drive demand for durable, robust tires, often focusing on longevity and cost-effectiveness in the volume segments.

- Latin America (LATAM): Growth is steady in this region, influenced by economic stability and improving road infrastructure. The market prioritizes durability and resilience due to sometimes challenging road conditions, favoring high-mileage all-terrain crossover tires. Pricing sensitivity remains a significant factor, leading to a strong presence of both global manufacturers and regional competitors offering cost-effective solutions.

- Middle East and Africa (MEA): This region exhibits demand concentration in high-temperature performance tires and durable A/T tires, necessary for the desert climates and less developed road networks in many areas. Geopolitical stability and investment in infrastructure development directly correlate with the growth rate of the crossover vehicle segment, particularly in Gulf Cooperation Council (GCC) countries where luxury SUVs and CUVs are highly popular.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crossover Tires Market.- Michelin Group

- Bridgestone Corporation

- Continental AG

- Goodyear Tire & Rubber Company

- Pirelli & C. S.p.A.

- Sumitomo Rubber Industries, Ltd.

- Yokohama Rubber Company, Ltd.

- Hankook Tire Co., Ltd.

- Kumho Tire Co., Inc.

- Cheng Shin Rubber Ind. Co. Ltd. (Maxxis)

- Apollo Tyres Ltd.

- Trelleborg AB

- Nokian Tyres plc

- Cooper Tire & Rubber Company (a subsidiary of Goodyear)

- Giti Tire Pte Ltd.

- MRF Tyres Limited

- Toyo Tire Corporation

- Sailun Group Co., Ltd.

- Nexen Tire Corporation

- Zhongce Rubber Group Co., Ltd. (ZC Rubber)

Frequently Asked Questions

Analyze common user questions about the Crossover Tires market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Crossover Tires and traditional Passenger Tires?

Crossover tires are specifically engineered with higher load indexes, more robust sidewalls, and optimized tread patterns to handle the greater mass, higher center of gravity, and dynamic stresses of CUVs and SUVs. They prioritize stability, durability, and all-weather performance over the sheer lightweight efficiency typically sought in standard passenger car tires.

How is the growth of Electric Vehicles (EVs) impacting the demand for Crossover Tires?

The rise of EV crossovers is creating a substantial demand for specialized tires that address unique EV characteristics, including handling instantaneous torque, managing increased battery weight, and providing ultra-low rolling resistance to maximize driving range. This segment drives innovation in material science and tire construction.

Which geographical region dominates the Crossover Tires Market in terms of revenue?

North America currently dominates the Crossover Tires Market in terms of revenue value, owing to the long-standing consumer preference for large, high-specification SUVs and CUVs, resulting in high average selling prices (ASPs) for replacement and OEM tires in this region.

What are 'Smart Tires' and how do they benefit Crossover Vehicle owners?

Smart tires are equipped with integrated sensors that monitor critical parameters like pressure, temperature, and wear in real-time. For crossover owners, this provides enhanced safety, optimized fuel efficiency, extended tire life through predictive maintenance alerts, and seamless integration with advanced vehicle control systems.

What technological advancements are crucial for improving the sustainability of Crossover Tires?

Crucial technological advancements for sustainability include utilizing bio-based and recycled materials in compounds, employing advanced manufacturing processes to reduce energy consumption, and developing highly durable tires that offer extended lifespan, thereby reducing the frequency of tire replacement and waste generation.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager