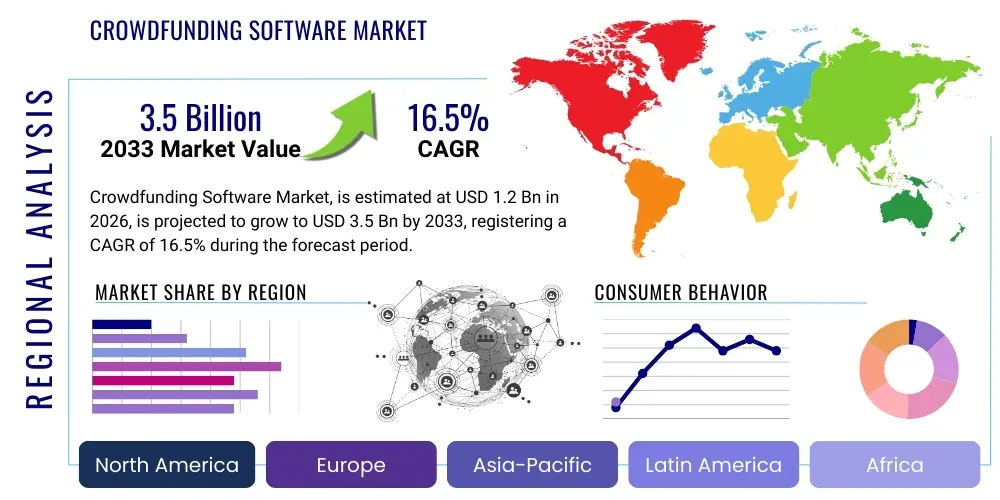

Crowdfunding Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437510 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Crowdfunding Software Market Size

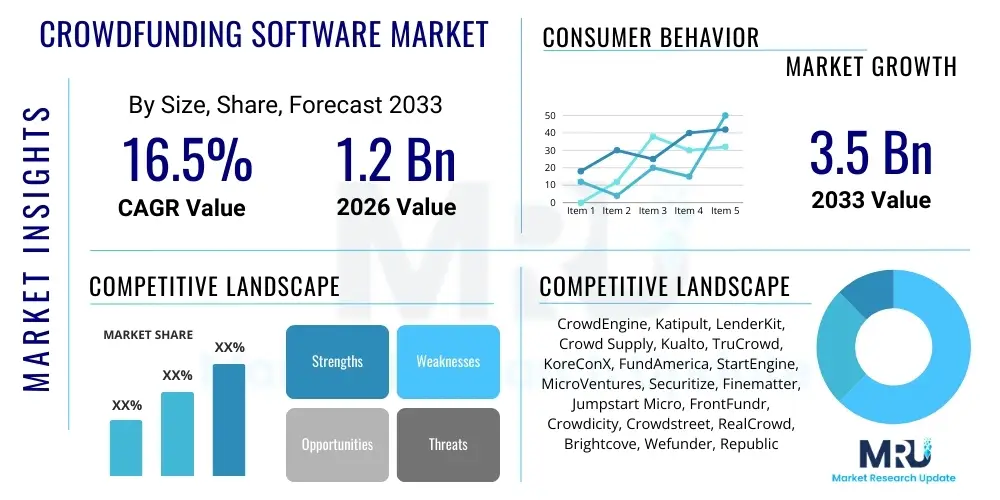

The Crowdfunding Software Market is experiencing robust expansion driven by the increasing democratization of finance and the global surge in startup ecosystems. This specialized sector, which includes platform-as-a-service (PaaS) and software-as-a-service (SaaS) solutions designed to facilitate online fundraising campaigns, is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The underlying momentum stems from technological advancements, particularly in areas like blockchain and artificial intelligence, which enhance security, transparency, and investor matching efficiency, thereby bolstering market confidence.

The market is estimated at $1.2 Billion in 2026, a valuation reflecting the baseline adoption across major crowdfunding models including equity, debt, rewards, and donation-based platforms. This initial valuation is supported by established real estate crowdfunding platforms and the growing popularity of white-label solutions among financial institutions and venture capital firms looking to launch their own branded fundraising portals, which allows them to bypass lengthy and expensive in-house development cycles.

The market is projected to reach $3.5 Billion by the end of the forecast period in 2033. This substantial growth is primarily attributed to favorable regulatory environments in key jurisdictions (such as the US, UK, and EU) that have introduced specific rules (e.g., Regulation CF, European Crowdfunding Service Provider Regulation) enabling smaller businesses and individuals to raise capital publicly with reduced compliance burdens. Furthermore, the persistent need for alternative financing options, especially for SMEs and creative projects often overlooked by traditional banking systems, solidifies the sustained demand for sophisticated crowdfunding software solutions that can handle complex transactional and regulatory requirements on a global scale.

Crowdfunding Software Market introduction

The Crowdfunding Software Market encompasses specialized digital platforms and tools designed to connect project creators or businesses seeking capital with a diverse pool of potential investors or backers. These platforms serve as intermediaries, managing campaign creation, payment processing, communication, and compliance requirements, facilitating transactions across various models: equity-based (investors receive shares), debt-based (investors receive interest repayments), rewards-based (backers receive a product or service), and donation-based (funds are given without expectation of return). The proliferation of these solutions is intrinsically linked to the global FinTech movement, democratizing access to capital by significantly lowering the entry barrier for both fundraising entities and participants.

Major applications for crowdfunding software span a wide economic spectrum, extending from innovative technology startups and small to medium-sized enterprises (SMEs) to large-scale real estate development projects and non-profit charitable causes. The inherent benefits provided by these platforms include accelerated funding timelines, broad geographic reach to an international investor base, validation through market interest, and enhanced brand awareness built during the campaign process. Crucially, the software provides the necessary compliance infrastructure, handling Know Your Customer (KYC), Anti-Money Laundering (AML) checks, and complex securities registration processes, ensuring adherence to often stringent national and international financial regulations.

Key driving factors fueling the market's expansion include the escalating global digitalization, which makes online transaction processing and due diligence commonplace; the increasing comfort level among retail investors with digital asset ownership and fractional investment opportunities; and the persistent efficiency gap in traditional venture capital and angel investing processes. Moreover, the demand for white-label crowdfunding solutions is rising sharply among established financial institutions that seek to diversify their product offerings without extensive infrastructure investment, opting instead for configurable, robust software to manage their own private or public fundraising ecosystems efficiently. Regulatory clarity and harmonization across major economic blocks further solidify the foundation for sustained growth in this software sector.

Crowdfunding Software Market Executive Summary

The Crowdfunding Software Market is positioned for aggressive growth, driven by key business trends emphasizing regulatory technology (RegTech) integration and the expansion of the equity and debt crowdfunding segments, which offer higher transaction values compared to traditional rewards-based models. Business adoption favors comprehensive, modular software suites that can seamlessly integrate with existing enterprise resource planning (ERP) and customer relationship management (CRM) systems, providing end-to-end management from initial campaign structuring to ongoing investor relations and dividend distribution. A dominant trend involves the shift towards highly customizable white-label solutions, allowing institutional players, including broker-dealers and specialized real estate funds, to launch bespoke portals quickly while ensuring complete regulatory adherence specific to their operational region and asset class.

Regionally, North America maintains market dominance due to early adoption, a highly developed venture capital culture, and supportive regulatory frameworks like Regulation Crowdfunding (Reg CF) and Regulation A+ in the United States, which have significantly opened pathways for online securities offerings. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by massive internet penetration, a rapidly expanding middle class eager for investment opportunities, and governmental initiatives in countries like India and China promoting FinTech innovation and alternative financing for SMEs. Europe demonstrates steady growth, consolidated by the unified regulatory environment established by the European Crowdfunding Service Provider Regulation (ECSPR), fostering cross-border crowdfunding activities and reducing fragmentation.

Segment trends highlight the critical role of deployment type, where Cloud-based (SaaS) models are overwhelmingly preferred over on-premise solutions due to lower initial costs, scalability, and simplified maintenance, aligning perfectly with the dynamic nature of startup financing. Furthermore, the market is segmenting sharply by end-user application, with Real Estate Crowdfunding Software witnessing particularly high demand, necessitating robust platforms capable of handling complex fractional ownership structures, sophisticated due diligence processes, and automated distribution schedules. Technology integration, particularly blockchain for immutable record-keeping and AI for enhanced investor verification and fraud detection, is no longer a differentiator but a necessary competitive baseline for advanced market offerings.

AI Impact Analysis on Crowdfunding Software Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Crowdfunding Software Market frequently center around how AI can mitigate inherent risks, such as project failure and fraud, and how it can personalize the user experience for both creators and investors. Key concerns often revolve around the algorithmic bias in project selection and the accuracy of AI-driven risk assessments, while expectations focus on dramatically enhanced operational efficiencies, particularly in due diligence and compliance automation. Users are highly interested in AI’s capability to predict campaign success rates based on historical data and to accurately match niche investors with specific project verticals, moving beyond rudimentary keyword matching to true behavioral and thematic alignment. The general consensus among users is that AI will transform crowdfunding from a volume-based transaction model into a highly targeted and risk-managed investment ecosystem, provided transparency and explainability of the algorithms are maintained to build user trust.

AI’s influence is rapidly permeating the core functions of crowdfunding software platforms, primarily enhancing security protocols and optimizing investment flows. Machine learning algorithms are crucial for real-time fraud detection by analyzing behavioral patterns during the campaign submission and funding phases, identifying anomalous activities indicative of fabricated projects or money laundering attempts with far greater speed and accuracy than manual methods. Furthermore, Natural Language Processing (NLP) capabilities are being deployed to scrutinize project business plans, financial projections, and pitch decks, automatically scoring them for clarity, coherence, and potential red flags by cross-referencing industry benchmarks and historical failure indicators, thereby significantly reducing the initial due diligence workload for platform administrators.

Beyond risk mitigation, AI plays a pivotal role in optimizing market operations and maximizing platform engagement. Predictive analytics models are used to forecast the likelihood of a campaign hitting its funding goal, allowing platforms to intervene with targeted marketing or strategic advice early in the lifecycle. Crucially, AI-driven recommendation engines personalize the platform experience for investors by analyzing their portfolio history, risk tolerance, and declared investment interests, presenting them with highly relevant opportunities, which increases conversion rates and investor retention. This personalization moves crowdfunding towards a precision matching system, enhancing liquidity and efficiency across niche markets, thereby making the overall platform more valuable to both capital seekers and capital providers.

- AI enhances risk scoring and due diligence automation for project evaluation.

- Machine Learning algorithms provide superior real-time fraud detection and anomaly analysis (KYC/AML).

- Predictive analytics forecasts campaign success rates and optimal funding targets.

- Personalized recommendation engines match investors to projects based on behavioral data and risk profiles.

- NLP assists in automated analysis of complex legal and financial documentation for compliance checks.

- AI-powered chatbots improve customer service and instant investor query resolution.

- Algorithmic assessment of market demand helps optimize platform fee structures and campaign timing.

DRO & Impact Forces Of Crowdfunding Software Market

The Crowdfunding Software Market is shaped by powerful internal and external forces driving expansion, countered by significant regulatory and technological hurdles. Key drivers include the global push for financial inclusion, accelerated adoption of FinTech solutions across emerging economies, and sustained regulatory support, which validates crowdfunding as a legitimate asset class. Opportunities are abundant, specifically in integrating blockchain technology to enhance transactional transparency and attract institutional capital, along with expanding specialized software offerings tailored for niche vertical markets such as cultural heritage preservation or green energy projects. These forces collectively create a highly dynamic environment where rapid innovation is mandatory for sustained competitive advantage.

However, the market faces significant restraints that necessitate sophisticated software development. The foremost restraint is the complexity and fragmentation of global regulatory landscapes; platforms operating internationally must constantly update their software to comply with varied securities laws, tax regulations, and AML requirements across different jurisdictions, demanding robust, modular RegTech components. Data security and the risk of cyberattacks targeting sensitive investor information and financial transactions also represent a persistent barrier, requiring platforms to invest heavily in advanced encryption, multi-factor authentication, and continuous vulnerability management. Another challenge is building investor trust in early-stage projects, which often requires comprehensive due diligence tools and transparent reporting mechanisms embedded within the software.

The impact forces influencing market direction are primarily the increasing integration of proprietary technology stacks and the rising expectation of institutional-grade security and liquidity. The shift from simple transaction platforms to full-service financial ecosystem management tools necessitates complex software capable of handling secondary market trading functionality and automated regulatory filing. The impact of blockchain, moving from being a futuristic concept to a practical application for tokenizing assets (Security Token Offerings or STOs), compels software vendors to adapt their core infrastructure. Success in this environment depends heavily on software vendors’ ability to rapidly deploy scalable, legally compliant, and highly secure cloud-based solutions that streamline the entire investment lifecycle, from project pitch to eventual investor exit strategy.

Segmentation Analysis

The Crowdfunding Software Market is broadly segmented based on the funding model supported, deployment methodology, end-user type, and the geographical region of operation, providing a detailed view of where growth capital and technological investment are concentrated. The differentiation between software built for equity crowdfunding versus rewards/donation models is critical, as the former requires highly complex compliance features (e.g., investor accreditation verification) that are not necessary for the latter. The market analysis reveals a significant preference shift towards cloud-based platforms due to their inherent scalability and lower total cost of ownership, making sophisticated software accessible even to nascent platform operators.

- By Crowdfunding Model:

- Equity Crowdfunding

- Debt Crowdfunding (P2P Lending)

- Rewards-based Crowdfunding

- Donation-based Crowdfunding

- Hybrid Models

- By Deployment Type:

- Cloud-based (SaaS)

- On-premise

- By End-User:

- Startups and SMEs

- Real Estate Developers

- Financial Institutions (Banks, VCs)

- Non-profit Organizations

- Individual Creators and Artists

- By Component:

- Platform Software/Core Engine

- Add-on Modules (Compliance, CRM, Secondary Trading)

- Professional Services (Implementation, Consultation, Support)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Value Chain Analysis For Crowdfunding Software Market

The value chain for the Crowdfunding Software Market begins with the Upstream activities, focused heavily on core platform development, intellectual property creation, and API design. This stage involves deep research into financial regulations, security best practices, and user experience design to build a scalable and robust proprietary codebase. Key upstream providers include specialized software development firms, cybersecurity experts, and legal compliance consultants who define the platform’s foundational architecture. A critical element at this stage is the integration of third-party financial tools for payment gateways (e.g., Stripe, PayPal integration), digital identity verification services (KYC/AML providers), and automated escrow management systems, ensuring seamless and secure financial flow management before the platform reaches the end user.

The Midstream phase focuses on the platform’s operational delivery and management, primarily executed through Software-as-a-Service (SaaS) delivery models. This stage involves maintaining the hosting infrastructure, managing data storage, performing continuous software updates, and providing technical support to platform administrators and end-users. Distribution channels are predominantly Direct, where software vendors market and license their white-label solutions directly to enterprise clients (such as banks or large real estate firms) seeking to launch their own branded portals. Indirect channels, while less common, involve strategic partnerships with FinTech consultancies or system integrators who implement and customize the crowdfunding software within a client's broader financial technology stack, offering a comprehensive implementation package.

Downstream activities concentrate on maximizing the platform's utility for the ultimate consumers: the project creators and investors. This involves platform marketing, user acquisition strategies, and the integration of advanced tools for investor relationship management (IRM), automated reporting, and secondary market liquidity features. Effective downstream support includes training the platform administrator on optimizing campaign performance using built-in analytics and ensuring creators have tools for compliance reporting post-funding. The overall value chain demonstrates a strong vertical integration approach, where the core software provider aims to capture value by offering an all-encompassing suite, minimizing the need for clients to source fragmented services from multiple external vendors, thus maintaining high service quality and regulatory consistency across all transactional layers.

Crowdfunding Software Market Potential Customers

The potential customers for sophisticated Crowdfunding Software are diverse, ranging from small, agile startups seeking Seed or Series A funding to large, highly regulated financial institutions aiming to digitize their capital raising processes. The core buyer persona is typically a business or entity requiring a formalized, legally compliant, and scalable platform to manage multiple fundraising campaigns simultaneously, demanding high-level security and integrated RegTech features. Primary target customers include Financial Technology (FinTech) startups intending to establish themselves as a public crowdfunding portal, specialized Private Equity (PE) firms moving towards fractional digital ownership of assets, and traditional Venture Capital (VC) firms looking to launch parallel funds accessible to retail investors under specific regulatory exemptions.

A rapidly expanding segment of buyers consists of Real Estate Developers and Investment Trusts (REITs) who utilize sector-specific crowdfunding software to pool capital for specific property acquisitions or development projects. These customers require platforms engineered to handle complex property documentation, manage escrow accounts for large sums, and automate dividend or rental income distribution based on fractional ownership stakes. Non-profit Organizations and Charitable Foundations also represent a significant customer base for donation-based crowdfunding software, requiring tools optimized for donor management, automated tax receipt generation, and compelling storytelling features to maximize community engagement and fundraising reach, often preferring white-label solutions that fully integrate into their existing donor management ecosystem.

Furthermore, established financial services firms, including regional banks and broker-dealers, are increasingly becoming crucial potential customers. They are leveraging crowdfunding software, often through private, customizable deployment, to launch controlled funding programs for their existing client base, positioning the platform as a value-added service. This institutional adoption emphasizes demand for software features such as robust API connectivity for seamless integration with legacy banking systems, superior audit trails, and strict adherence to institutional-level data governance policies. The ability of the software vendor to provide comprehensive regulatory updates and legal compliance support across multiple international jurisdictions is a non-negotiable requirement for securing large-scale institutional contracts.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $3.5 Billion |

| Growth Rate | 16.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CrowdEngine, Katipult, LenderKit, Crowd Supply, Kualto, TruCrowd, KoreConX, FundAmerica, StartEngine, MicroVentures, Securitize, Finematter, Jumpstart Micro, FrontFundr, Crowdicity, Crowdstreet, RealCrowd, Brightcove, Wefunder, Republic |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crowdfunding Software Market Key Technology Landscape

The core technology landscape of the Crowdfunding Software Market is centered around developing scalable, secure, and compliant Platform-as-a-Service (PaaS) infrastructure, with cloud computing being the foundational layer for nearly all modern solutions. Robust backend frameworks, often leveraging highly performant languages and databases (like Python/Django, Node.js, and PostgreSQL), are essential for handling high volumes of simultaneous transactions, managing vast databases of investor identities, and ensuring low-latency interactions. Critical technological features include advanced Application Programming Interface (API) management capabilities, allowing platforms to seamlessly integrate with mandatory third-party services such as credit bureaus, tax reporting software, and secure payment processing gateways, thereby minimizing manual data entry and reducing operational friction for both creators and investors.

A significant technological innovation driving the market is the integration of Distributed Ledger Technology (DLT), specifically Blockchain. This technology is increasingly being adopted for tokenizing equity and debt assets, allowing for immutable ownership records, instantaneous transfer of fractional shares, and automated dividend distribution via smart contracts. This shift, often termed Security Token Offerings (STOs), demands specialized software modules capable of issuing, managing, and governing digital securities in compliance with national regulations, offering unprecedented transparency and potential liquidity through secondary market trading functionalities built directly into the platform architecture. Furthermore, the reliance on advanced security infrastructure, including ISO 27001 compliance, penetration testing, and geographically redundant data centers, is standard practice to safeguard sensitive financial data and maintain user trust.

In addition to foundational and disruptive technologies, the landscape is heavily influenced by the adoption of sophisticated data analytics and Customer Relationship Management (CRM) tools customized for the investment domain. Platforms leverage deep learning models to analyze investor behavior, track campaign performance metrics in real-time, and generate complex regulatory reports automatically. The integration of proprietary CRM functions is vital for managing ongoing investor relations, ensuring timely delivery of updates, and handling subscription management, moving the software beyond a mere fundraising portal into a continuous investor engagement ecosystem. The emphasis on mobile-first design and responsive interfaces using modern front-end frameworks (like React or Angular) is also paramount, reflecting the reality that a large percentage of investor activity and due diligence is now conducted via mobile devices, requiring flawless user experience across all digital touchpoints.

Regional Highlights

- North America (NA): Dominates the global market share, largely attributed to highly established FinTech ecosystems in the United States and Canada, robust regulatory frameworks (e.g., Reg CF, Reg A+ allowing mass market participation), and high levels of retail investor engagement. The region shows strong demand for white-label equity crowdfunding platforms, especially in the real estate and technology sectors, focusing heavily on advanced compliance and secondary market solutions.

- Europe: Exhibits steady and harmonized growth following the implementation of the European Crowdfunding Service Provider Regulation (ECSPR), which facilitates cross-border operations within the EU. Key markets like the UK, Germany, and France prioritize debt and P2P lending software, with an increasing trend towards green and sustainable finance platforms requiring specialized impact reporting modules.

- Asia Pacific (APAC): Projected as the fastest-growing region due to explosive digital transformation, rapid urbanization, and government support for SME financing in economies like India, Southeast Asia, and Australia. The market is highly diverse, spanning both large-scale rewards crowdfunding (driven by high consumer density) and emerging sophisticated equity platforms catering to the burgeoning tech startup scene.

- Latin America (LATAM): Showing accelerated adoption, particularly in Mexico, Brazil, and Chile, driven by financial inclusion initiatives and a gap in traditional banking services for entrepreneurs. Demand focuses on mobile-optimized platforms and local currency integration, with growing regulatory efforts to formalize crowdfunding mechanisms and enhance consumer protection.

- Middle East and Africa (MEA): Emerging market where adoption is concentrated in the UAE and Saudi Arabia, heavily influenced by government initiatives promoting digital finance and diversification away from oil economies. The region sees specialized demand for Sharia-compliant debt and equity platforms, requiring unique software architecture to adhere to Islamic finance principles and regulatory restrictions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crowdfunding Software Market.- CrowdEngine

- Katipult

- LenderKit

- Crowd Supply

- Kualto

- TruCrowd

- KoreConX

- FundAmerica

- StartEngine

- MicroVentures

- Securitize

- Finematter

- Jumpstart Micro

- FrontFundr

- Crowdicity

- Crowdstreet

- RealCrowd

- Brightcove

- Wefunder

- Republic

Frequently Asked Questions

Analyze common user questions about the Crowdfunding Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of white-label crowdfunding solutions?

The primary factor driving the adoption of white-label solutions is the need for speed, cost-efficiency, and regulatory compliance. Established financial institutions and large real estate firms prefer these ready-made software platforms to quickly launch their own regulated fundraising portals without incurring the massive development costs, time, and specialized expertise required for building a compliant platform from scratch.

How does blockchain technology specifically enhance the security of equity crowdfunding software?

Blockchain enhances security by providing an immutable, transparent ledger for recording tokenized securities and managing ownership stakes (Security Token Offerings or STOs). This DLT prevents unauthorized alterations of ownership records, automates compliance functions via smart contracts, and significantly simplifies secondary market trading processes, thereby drastically reducing the risk of fraud and increasing investor confidence in the integrity of the investment records.

Which crowdfunding model requires the most complex regulatory compliance features in the software?

Equity crowdfunding and debt crowdfunding (P2P lending) require the most complex regulatory compliance features. These models involve the offering of securities or loans, necessitating rigorous software functions for investor accreditation verification (KYC/AML), detailed transaction reporting to financial authorities, and managing jurisdictional limits on investment amounts, unlike simpler rewards or donation models.

What role does AI play in optimizing due diligence for projects hosted on crowdfunding platforms?

AI plays a critical role in optimizing due diligence by leveraging machine learning and NLP to analyze vast datasets, including project business plans, financial models, and team backgrounds. AI algorithms can rapidly score projects based on predictive risk factors, identify potential inconsistencies or fraud markers in documentation, and cross-reference regulatory filing requirements, thereby automating initial vetting and allowing human analysts to focus on high-risk cases.

Why is the Asia Pacific region expected to exhibit the fastest growth in the Crowdfunding Software Market?

The Asia Pacific region's projected high growth rate is driven by exceptional internet and mobile penetration, a burgeoning middle class seeking new investment avenues, and proactive government policies across nations like India and parts of Southeast Asia that are aggressively promoting digital financing for SMEs. This confluence of technological readiness and favorable regulatory momentum creates fertile ground for rapid deployment and adoption of new crowdfunding platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager