Cryogenic Storage Dewars Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433549 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Cryogenic Storage Dewars Market Size

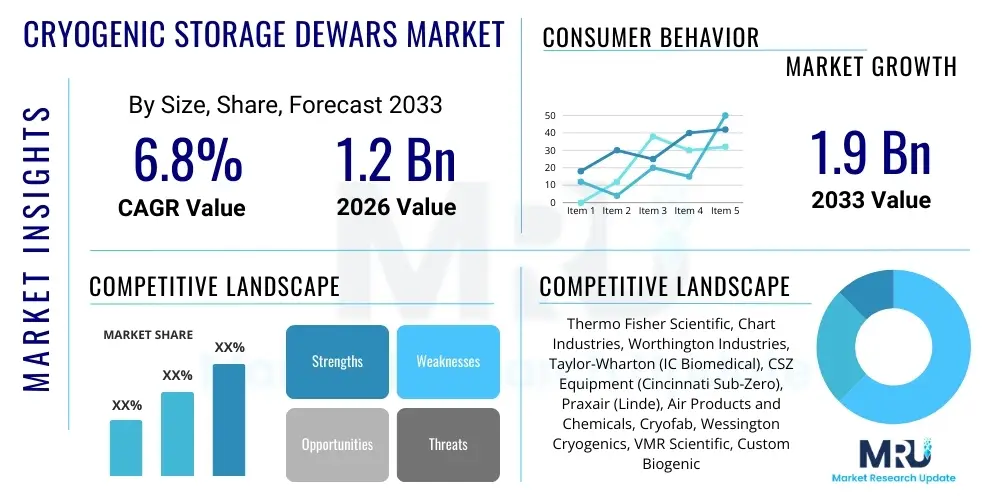

The Cryogenic Storage Dewars Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.9 Billion by the end of the forecast period in 2033.

Cryogenic Storage Dewars Market introduction

Cryogenic storage dewars represent highly specialized vacuum-insulated vessels engineered for the static storage, temporary holding, and secure transportation of substances requiring ultra-low temperatures, typically below the boiling point of nitrogen (-196°C or 77K). These sophisticated containers, pivotal to modern scientific and industrial operations, function by minimizing all three modes of heat transfer—conduction, convection, and radiation—through the implementation of a high-performance vacuum annulus between inner and outer shells. The inner vessel holds the cryogenic fluid or stored samples, while the outer jacket provides structural integrity and environmental protection. Critical design factors include the material selection (often high-grade stainless steel or corrosion-resistant aluminum), the efficacy of the vacuum, and the presence of advanced thermal shielding materials, such as Multi-Layer Insulation (MLI), which significantly mitigate radiant heat influx, ensuring minimal cryogenic fluid loss, known as boil-off.

The operational necessity of these dewars spans diverse high-stakes sectors. In biological sciences, they are the backbone of biobanking and clinical storage, preserving invaluable cell lines, human tissues, blood components, viral vectors for gene therapy, and reproductive samples (IVF materials). The demand here is driven by the unprecedented expansion of personalized medicine and the long-term preservation requirements mandated by clinical research protocols. Industrially, cryogenic dewars are indispensable for managing bulk volumes of liquefied industrial gases such as liquid oxygen, argon, and particularly liquid helium, which is essential for cooling superconducting magnets utilized in Magnetic Resonance Imaging (MRI) and Nuclear Magnetic Resonance (NMR) spectroscopy, as well as in advanced physics research and semiconductor fabrication processes.

Market expansion is fundamentally propelled by technological refinements that improve thermal efficiency and enhance safety and monitoring capabilities. The increasing adoption of ‘smart dewars’ integrated with IoT monitoring systems allows for real-time tracking of liquid levels and thermal performance, which is a key benefit in regulatory environments where meticulous record-keeping is non-negotiable. Furthermore, the global push towards sustainable energy, particularly the development of the Liquefied Natural Gas (LNG) supply chain, contributes significantly to the industrial application segment, necessitating durable and reliable transport dewars. The continuous evolution of these containers—moving towards lighter, more robust composites and sophisticated vacuum technology—secures their crucial role as enablers of cutting-edge scientific and industrial progress worldwide.

Cryogenic Storage Dewars Market Executive Summary

The Cryogenic Storage Dewars Market is experiencing dynamic growth catalyzed by synchronized advancements in biotechnology and supportive digital technologies. Current business trends indicate a critical focus on product differentiation through automation and data integration. Leading manufacturers are investing heavily in developing fully automated inventory systems that reside within the dewar itself, seamlessly linking sample location and storage conditions to centralized Laboratory Information Management Systems (LIMS). This integration not only minimizes retrieval time and thermal shock risk but also satisfies rigorous global clinical standards (e.g., cGMP requirements). Competitive strategy is increasingly centered on offering comprehensive service contracts that include liquid nitrogen replenishment management and predictive maintenance powered by cloud-based analytics, transforming the product sale into a long-term service relationship.

Geographically, market expansion is unbalanced but strategically focused. North America and Western Europe, characterized by mature, high-value biotechnology ecosystems, dominate in terms of installed base value and early adoption of high-tech, automated units. However, the future locus of growth is undeniably shifting towards the Asia Pacific (APAC) region. APAC’s rapid modernization of healthcare infrastructure, coupled with government policies supporting indigenous biotech sectors (particularly in China and India), creates substantial new demand, often initially favoring cost-effective, high-volume stainless steel dewars for bulk industrial and emerging clinical applications. The regional demand profiles dictate whether manufacturers prioritize complex, highly monitored storage solutions (West) or durable, high-capacity industrial transport solutions (East).

Analysis of market segmentation reveals the biological storage segment is the definitive growth engine, driven by the commercial viability of gene and cell therapies which require indefinite cryopreservation of living materials. This high-growth area demands specialized vapor-phase storage dewars to prevent cross-contamination risks inherent in traditional liquid immersion systems. Concurrently, the capacity segmentation shows polarization; robust demand exists for both portable, small-volume benchtop units for daily laboratory use and large-scale (over 500L) static storage tanks required for national-level biobanks and pharmaceutical manufacturing warehouses. Material trends show aluminum maintaining market share in portable applications due to weight benefits, while specialized composite materials are emerging as a niche solution for ultra-light transport needs, challenging the traditional dominance of high-grade stainless steel in fixed installations.

AI Impact Analysis on Cryogenic Storage Dewars Market

User engagement concerning AI's role in cryogenic storage overwhelmingly highlights the desire for enhanced reliability and reduced operational expenditure through intelligent management. Common questions focus on AI's ability to transition from passive monitoring (simply recording temperature) to active, prescriptive control (suggesting adjustments or predicting failures). Users are particularly keen on leveraging machine learning (ML) to analyze complex variables such as micro-pressure fluctuations, external ambient temperature changes, and historical usage patterns to construct a highly accurate predictive model for liquid nitrogen consumption and equipment health. The consensus is that AI offers the potential to standardize operational protocols across geographically dispersed facilities, ensuring consistent, high-quality cold chain integrity essential for multi-site clinical trials and global pharmaceutical distribution networks.

The implementation of AI algorithms, fed by continuous data streams from IoT-enabled dewars, enables advanced thermal anomaly detection. By establishing sophisticated baseline models for normal boil-off rates specific to each dewar model and environment, AI can identify even subtle deviations indicative of potential vacuum degradation or insulation failure far earlier than traditional limit-checking systems. This capability shifts maintenance from reactive or time-based schedules to condition-based monitoring, optimizing resource allocation and preventing the gradual degradation of sample viability. For large biobanks containing millions of high-value samples, the marginal reduction in failure risk provided by AI represents enormous value protection and operational efficiency gains, justifying the significant investment in intelligent monitoring hardware and software platforms.

Beyond hardware monitoring, AI is transforming inventory management within large cryogenic storage freezers. Machine learning models analyze sample withdrawal and deposit requests, optimizing the three-dimensional placement of samples within racks and canes to minimize the total duration the dewar is exposed to ambient air during access (known as lid open time). Furthermore, AI can forecast the need for specific sample retrieval based on impending clinical trial phases or research requirements, proactively suggesting grouping or reorganization to consolidate high-priority samples into easily accessible locations. This optimization directly reduces thermal stress on stored materials and enhances the efficiency of laboratory workflows, providing a substantial competitive advantage to service providers and pharmaceutical companies utilizing these advanced, intelligent storage architectures.

- AI enhances predictive maintenance by analyzing thermal data patterns, forecasting vacuum degradation, and scheduling proactive repairs based on condition rather than fixed schedules.

- Machine learning optimizes cryogenic fluid replenishment cycles by accurately predicting boil-off rates based on environmental factors and usage history, minimizing waste and operational costs (OpEx).

- Intelligent inventory management systems improve sample traceability, retrieval efficiency, and minimize exposure time during access by optimizing 3D sample placement within the dewar (AEO focus on minimizing thermal shock).

- AI facilitates automated regulatory compliance and auditing by providing seamless, tamper-proof logs of storage conditions and access events, meeting GxP and ISO requirements (GEO benefit).

- Robotics guided by AI automate high-throughput sample storage and retrieval in centralized cryo-warehouses, ensuring optimal cold chain integrity and minimizing human error and variability.

DRO & Impact Forces Of Cryogenic Storage Dewars Market

The market is predominantly driven by the escalating success and commercialization of advanced biotherapies, including CAR T-cell therapies and personalized cancer vaccines, all of which mandate stable, long-term cryopreservation infrastructure. This biological imperative is strongly supported by global regulatory trends, particularly the increasing enforcement of cGMP (Current Good Manufacturing Practice) and GxP standards across the cold chain, compelling end-users to upgrade to verifiable, monitored dewar systems. Concurrently, the industrial segment benefits from global infrastructure projects, notably the expansion of global LNG terminals and distribution networks, requiring specialized, robust bulk storage and transfer equipment. The combined force of biological R&D acceleration and mandatory regulatory compliance creates a sustained demand floor for high-quality, high-reliability cryogenic dewars.

Restraints primarily revolve around financial and safety hurdles. The sophisticated engineering required for highly efficient, vacuum-jacketed dewars, coupled with integrated monitoring electronics, results in significant initial capital expenditure, which can be a barrier to entry for smaller research institutions or emerging economies. Operationally, the cost and logistics associated with reliable, frequent resupply of cryogenic fluids (especially liquid helium, which faces supply chain volatility) contribute to high ongoing operational expenditure. Crucially, the mandatory safety protocols—dealing with extreme temperatures, potential asphyxiation hazards, and high internal pressures—necessitate specialized facility design, rigorous staff training, and continuous monitoring, adding layers of complexity and cost to the adoption process, thereby potentially slowing market penetration in less industrialized regions.

Opportunities for market growth are vast and largely tied to technological leapfrogging and geopolitical shifts. The accelerating transition to dry storage techniques, often employing highly efficient mechanical cryocoolers alongside the vacuum jacket, offers the promise of "zero boil-off" storage, drastically reducing the OpEx associated with cryogen replenishment. Furthermore, the global need for preparedness against future pandemics highlights the critical role of standardized, globally distributable cryogenic infrastructure for vaccine storage. The expansion of niche applications, such as advanced quantum computing and superconducting technologies which utilize liquid helium, also presents high-value opportunities for manufacturers specializing in ultra-low temperature, highly technical dewar solutions, ensuring the market's long-term technical vitality and financial resilience against temporary cyclical downturns in traditional industrial gas markets.

- Drivers:

- Rapid expansion of the biotechnology and pharmaceutical industries, particularly in cell, gene, and regenerative therapies requiring secure, indefinite cryopreservation.

- Increasing global demand for industrial specialty gases (e.g., high-purity argon, helium) crucial for advanced electronics and aerospace manufacturing.

- Implementation of rigorous regulatory standards (GxP, ISO) requiring verifiable, uninterrupted cold chain integrity and automated data logging for clinical samples.

- Technological performance improvements in vacuum insulation and materials leading to superior thermal efficiency (reduced boil-off).

- Restraints:

- High initial capital investment required for procurement of high-capacity and automated cryogenic storage systems, limiting adoption in resource-constrained markets.

- Inherent safety risks and operational complexities associated with handling ultra-low temperature liquids, requiring extensive specialized training and infrastructure.

- Volatility and high cost associated with the supply and logistics of specialized cryogens like liquid helium.

- Need for continuous, specialized maintenance and high operational costs related to liquid cryogen replenishment and vacuum integrity verification.

- Opportunities:

- Growing adoption of Liquefied Natural Gas (LNG) as a cleaner energy source, necessitating enhanced, robust infrastructure for transport and storage.

- Development of "zero boil-off" technologies incorporating mechanical cryocoolers (cryofree systems) for reduced operational reliance on consumable fluids.

- Expansion of centralized national biobanking and public health preparedness initiatives requiring high-volume, secure, and standardized storage facilities.

- Niche applications in advanced computing (quantum technology) and superconducting research requiring specialized, ultra-low temperature containment.

- Impact Forces:

- The dual market reliance (Medical/Biotech and Industrial Gas) provides resilience against sector-specific slowdowns.

- Regulatory pressure enforces continuous upgrading cycles to modern, monitored equipment, favoring technologically advanced suppliers.

Segmentation Analysis

The segmentation of the Cryogenic Storage Dewars Market provides a granular view of demand profiles, emphasizing the interplay between product engineering and end-user needs. By material, the dominance of stainless steel (for fixed infrastructure and industrial transport due to its durability, structural stability, and pressure rating) contrasts with the lightweight, portability advantages of aluminum, favored in small-to-medium volume laboratory settings where frequent movement is required. Newer composite materials are increasingly being utilized, particularly in non-load-bearing components or high-performance transport applications, to minimize thermal conductivity and further reduce overall weight, targeting specialized logistics providers.

Capacity segmentation is critical, ranging from benchtop dewars (under 10 liters, optimized for single-day use or small sample processing) up to massive bulk storage and transport vessels exceeding 500 liters, tailored for gas production facilities or centralized biobanks. The most dynamic growth area within capacity lies in the 50-200 liter transport segment, driven by the global movement of clinical trial materials, cell therapies, and personalized medicine components. These transport vessels require specialized design elements to withstand vibration, maintain thermal stability during long transit times, and often include integrated GPS and temperature logging capabilities to satisfy chain-of-custody requirements, demanding a higher price point per unit capacity.

Segmentation by application confirms the bifurcation of the market: the biological storage segment requires specialized thermal mapping, advanced inventory systems, and rigorous regulatory features, making it high-value per unit. The industrial gas segment, conversely, demands high-volume durability, pressure safety certification (e.g., DOT/ADR standards), and robust engineering for continuous heavy use in environments like welding, chemical processing, and aerospace. The growth of specialized cryogenic fluids, such as LNG, introduces new material requirements (e.g., tolerance to higher pressures and specialized internal coatings) within the industrial application sphere, pushing manufacturers to continuously adapt material specifications and safety features to meet diverse regulatory and operational standards across different geographical jurisdictions.

- By Material: Stainless Steel (Dominant in industrial and bulk storage), Aluminum (Preferred for portability and laboratory use), Composites/Other Alloys (Niche, used for lightweight transport and specialized components).

- By Capacity: <10 Liters (Benchtop/Lab Use), 10–50 Liters (Small/Medium Lab/Transport), 50–200 Liters (High-Value Transport/Mid-sized Storage), >200 Liters (Bulk Static/Industrial Storage).

- By Cryogenic Fluid: Liquid Nitrogen (LN2 – Most common, used extensively in biological preservation), Liquid Helium (LHe – High-value, used for MRI/NMR and superconducting research), Liquid Oxygen (LOX – Industrial and medical applications), Liquid Argon (LAr – Industrial and welding processes), Others (e.g., LNG).

- By Application: Biological Storage (Biobanking, IVF, Cell/Gene Therapy, Vaccine Storage), Industrial Gas Storage and Transport (Welding, Metallurgy), Research & Development (Academic, Physics, Material Science), Healthcare/Medical Imaging (MRI cooling), Electronics/Semiconductor Manufacturing (Purity gas delivery).

- By End-User: Hospitals and Clinics (Focus on small-to-medium LN2 units), Biobanks (Focus on high-capacity, automated storage), Pharmaceutical and Biotechnology Companies (Focus on transport and research units), Academic and Research Institutions (Diverse range, including LHe dewars), Industrial Gas Producers and Distributors (Focus on high-pressure, bulk transport vessels), Chemical/Petrochemical Industries (LNG and industrial gas storage).

Value Chain Analysis For Cryogenic Storage Dewars Market

The upstream segment of the value chain is characterized by the procurement of highly specific, quality-assured materials. This includes certified pressure vessel grade stainless steel (304 or 316L) and aerospace-grade aluminum alloys, which must meet stringent mechanical and thermal tolerance specifications. Suppliers of specialized insulation materials, such as vacuum pump components, MLI reflective sheets, and low-thermal-conductivity composite materials for neck tubes, are critical. Manufacturer relationships with these upstream suppliers are highly strategic, as material quality directly dictates the thermal efficiency, longevity, and safety certifications of the final dewar product. Reliability in the vacuum sealing process, demanding high-precision welding and meticulous quality control checks, represents a significant cost and technical barrier at this stage.

The core manufacturing and assembly process involves sophisticated engineering expertise, particularly in the creation and maintenance of the ultra-high vacuum necessary for maximum insulation effectiveness. This stage also includes the integration of electronic components for smart dewars (sensors, data loggers, telematics). Distribution channels are highly nuanced: large industrial gas suppliers often act as distributors for high-capacity dewars, bundling them with ongoing gas supply contracts, thereby stabilizing demand. Conversely, biological and medical units are typically sold directly or through specialized lab equipment resellers who provide detailed technical installation, validation, and calibration services mandated by regulatory bodies like the FDA. The choice of channel depends heavily on the dewar’s capacity and the complexity of the required after-sales support.

Downstream activities are dominated by specialized service and maintenance. Given that cryogenic dewars are high-capital, long-life assets, the provision of reliable cryogen refill services, vacuum pump maintenance, periodic pressure vessel re-certification (mandated by transport regulations), and calibration of monitoring systems constitutes a significant portion of the total market value. End-users, especially hospitals and pharmaceutical firms, depend heavily on these recurring services to ensure continuous operational integrity and compliance. The logistics involved in transporting temperature-sensitive biological samples, often requiring specialized courier services utilizing high-performance transport dewars, connects the manufacturing process directly to specialized cold chain logistics providers, emphasizing the interconnectedness of product quality and service reliability across the entire value chain.

Cryogenic Storage Dewars Market Potential Customers

The primary potential customers for cryogenic storage dewars are highly regulated institutions and industries requiring ultra-stable, long-term storage of temperature-sensitive materials or cryogenic gases. In the healthcare sector, this includes major academic hospitals, private fertility clinics (IVF), and dedicated biobanking facilities that manage vast repositories of irreplaceable human samples, genetic material, and biological reagents. These buyers prioritize safety, inventory traceability (often requiring LIMS integration), and proven thermal performance over decades, typically opting for high-capacity, automated stainless steel dewars that adhere to stringent GxP standards for long-term clinical storage.

The second major cohort comprises pharmaceutical and biotechnology companies heavily engaged in R&D for novel therapies, particularly those involving cell culture, viral vectors, and advanced therapeutics. These customers demand portable, reliable dewars for logistics between research centers and manufacturing sites, alongside high-efficiency lab units for daily experimental work. They are increasingly interested in smart dewars equipped with IoT connectivity to ensure continuous monitoring during clinical trials. Furthermore, national and governmental public health organizations represent significant bulk buyers, especially in preparation for infectious disease outbreaks, where rapid and secure vaccine component storage is paramount.

The third substantial segment includes industrial gas producers and high-technology manufacturing firms, particularly those in semiconductor, aerospace, and metallurgy. These customers utilize large-volume, high-pressure dewars for bulk storage and transport of industrial gases (LOX, LAr, Helium) used in fabrication processes or rocketry. Their purchasing decisions are driven by volume capacity, operational durability, regulatory compliance for pressure vessels, and economic factors related to reducing boil-off losses. Research universities and government laboratories conducting foundational physics, material science, and superconducting research also form a consistent demand base for highly specialized, often custom-engineered, liquid helium dewars.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.9 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Chart Industries, Worthington Industries, Taylor-Wharton (IC Biomedical), CSZ Equipment (Cincinnati Sub-Zero), Praxair (Linde), Air Products and Chemicals, Cryofab, Wessington Cryogenics, VMR Scientific, Custom Biogenic Systems, Statebourne Cryogenics, Cryogenic & Vacuum Solutions (CVS), FIOCET, Meilv, Brooks Automation, Herose GmbH, Technifab, Inc., Cryo Diffusion, IC Bio Medical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cryogenic Storage Dewars Market Key Technology Landscape

The core technology underpinning cryogenic storage dewars is the ultra-high vacuum insulation system, which requires specialized manufacturing processes to achieve vacuum levels below 10-5 torr. Current innovation focuses on two main areas: optimizing the structural components to minimize thermal conduction and enhancing the radiative barriers. For conduction reduction, manufacturers utilize specialized neck tubes constructed from materials like Glass Reinforced Plastic (GRP) or advanced stainless steel alloys with extremely thin wall sections, reducing the path for heat ingress through the structure while maintaining mechanical stability. The use of specialized powder insulation (perlite) or sophisticated Multi-Layer Insulation (MLI) wraps around the inner vessel further tackles radiative heat transfer, where high-reflectivity layers drastically decrease the heat load, resulting in extended holding times and lower operational costs. Continuous monitoring of vacuum integrity via specialized pressure sensors is also a key technological feature to ensure the long-term viability of the insulation.

A significant technological advancement gaining traction is the transition toward hybrid systems incorporating mechanical refrigeration, often referred to as Cryocooler technology (e.g., Pulse Tube or Stirling cycle coolers). These systems are designed to intercept heat before it reaches the cryogenic fluid, or, in 'zero boil-off' systems, they actively re-liquefy any gas that boils off. While these systems increase the initial capital investment and introduce mechanical complexity, they drastically reduce or eliminate the need for manual fluid replenishment, offering substantial long-term savings and enhanced reliability, particularly for high-value cryogens like liquid helium, which are expensive and prone to supply instability. This mechanical integration marks a shift from purely passive storage to actively managed, near-permanent cold chain solutions, critical for large, fixed installations like MRI magnets and centralized biobanks.

Furthermore, the digital integration of monitoring and control systems—the 'smart dewar' evolution—is rapidly becoming standard. These systems utilize advanced sensors (capacitive, differential pressure, or ultrasonic) for accurate liquid level measurement and incorporate microprocessors for data logging and telecommunications (4G/5G or WiFi). The ability to provide continuous, auditable, and traceable data on storage conditions satisfies the increasingly complex regulatory requirements (e.g., ISO 9001, GxP). Advanced manufacturing techniques, such as orbital welding and robotic assembly, are also being employed to ensure highly consistent and defect-free vacuum jacket seals, maximizing the longevity and reliability of the final product, which is particularly vital for transport vessels subjected to mechanical stress and vibration during global logistics operations.

Regional Highlights

The regional market for Cryogenic Storage Dewars reflects global scientific and industrial activity levels. North America’s leading position is sustained not only by the sheer volume of its pharmaceutical and biotech output but also by the region's early and aggressive adoption of cutting-edge cryogenic technologies, including automated robotic storage systems and sophisticated vapor-phase dewars. The robust intellectual property framework and abundant venture capital funding continue to drive specialized R&D within this region, fostering a premium market environment where end-users prioritize technology integration and quality assurance over low initial cost. The concentration of leading market players and specialized service providers further solidifies North America’s dominance in high-end, complex cryogenic solutions.

Europe’s market is characterized by maturity, stringent quality standards, and centralized institutional purchasing power. Demand is consistently high across the continent, driven by strong academic research in countries like the UK, Germany, and Switzerland, alongside established industrial gas markets. European regulations, particularly those concerning transport of dangerous goods (ADR/RID) and medical device certification (MDR), enforce continuous technical innovation focused on safety and verifiable performance. The European market sees steady demand for medium-to-large capacity dewars used in regional logistics and the maintenance of large-scale biobanks funded by national health services, prioritizing long operational lifetimes and excellent energy efficiency to meet sustainability mandates.

The APAC region is the primary engine for future volumetric growth, propelled by the rapid establishment of pharmaceutical production capacity and substantial government initiatives supporting domestic scientific endeavors. Countries like China are making massive infrastructure investments, leading to a surge in demand for bulk industrial gas storage dewars necessary for rapidly expanding manufacturing sectors (e.g., solar, semiconductor). While initial adoption often focuses on cost-effective stainless steel units, the increasing sophistication of healthcare systems is rapidly driving demand for advanced biological storage systems to support a growing patient base and clinical trial activity. The region’s growing importance is leading to localized manufacturing and supply chain optimization, ultimately influencing global pricing and competition dynamics within the dewar market.

- North America (Dominant and Innovative): Largest market share, driven by cutting-edge biotech R&D, personalized medicine initiatives, high investment in automated storage, and strict regulatory enforcement requiring monitored, traceable dewar systems. High emphasis on service contracts and software integration.

- Asia Pacific (Fastest Growth Driver): Massive infrastructural development in healthcare and manufacturing, high demand for industrial gas dewars (LOX, LAr) in semiconductor and heavy industry, and increasing establishment of centralized biobanks in China, India, and Japan. High competition based on volume and localized production.

- Europe (Mature and Quality-Focused): Stable demand supported by strong academic research funding, established industrial gas distribution, and rigorous EU regulatory compliance (MDR/ADR). Focus on long-life, efficient systems and support for pan-European biobanking networks.

- Latin America (Developing Market): Growth tied to emerging energy projects (LNG infrastructure) and modernization of medical facilities, but constrained by capital intensity and dependence on imported specialized equipment.

- Middle East and Africa (MEA - Niche Growth): Demand primarily linked to oil/gas (LNG) projects and specialized medical centers (e.g., regional IVF clinics), characterized by high-cost imports and specialized logistics requirements.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cryogenic Storage Dewars Market.- Chart Industries

- Worthington Industries

- Thermo Fisher Scientific

- Taylor-Wharton (IC Biomedical)

- Linde plc (incorporating Praxair)

- Air Products and Chemicals, Inc.

- Wessington Cryogenics

- Custom Biogenic Systems

- MVE Biological Solutions (Part of Chart Industries)

- Cryofab, Inc.

- Statebourne Cryogenics

- CSZ Equipment (Cincinnati Sub-Zero)

- GWS Gases

- FIOCET

- Croyotemp Cryogenic Systems

- Cryogenic & Vacuum Solutions (CVS)

- Jenetsis Health

- VMR Scientific

- Meilv Cryogenic Equipment

- Cryotherm GmbH

- Brooks Automation (A major player in automated cryogenic storage)

- High Pressure Equipment Company

- Stirling Cryogenics

Frequently Asked Questions

Analyze common user questions about the Cryogenic Storage Dewars market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between aluminum and stainless steel cryogenic storage dewars?

Aluminum dewars are utilized primarily for their lightweight properties, making them ideal for portable, small-to-medium capacity applications like field collection or benchtop use, often optimized for low-pressure liquid nitrogen storage. Stainless steel dewars provide superior mechanical strength, corrosion resistance, and are mandatory for high-capacity, high-pressure industrial gas transport and fixed bulk storage facilities, ensuring structural integrity and longevity under rigorous industrial conditions.

How does Multi-Layer Insulation (MLI) enhance the performance of modern dewars?

MLI significantly enhances thermal performance by utilizing multiple, alternating layers of thin, highly reflective foil and low-conductivity spacers positioned within the vacuum annulus. This structure drastically reduces radiant heat transfer, which is the major source of heat leak in high-vacuum vessels. By minimizing heat ingress, MLI lowers the cryogenic fluid boil-off rate, thereby extending the dewar's holding time and reducing operational costs related to fluid replenishment.

What role do smart dewars and IoT play in maintaining regulatory compliance in biobanking?

Smart dewars integrate IoT sensors for continuous, real-time monitoring of critical parameters like temperature and liquid level. These systems automatically log data and provide secure, traceable, and auditable records of storage conditions, which is essential for adhering to strict regulatory requirements such as FDA GxP and ISO standards. This automated data collection minimizes human error and provides verifiable evidence of continuous cold chain integrity, crucial for clinical and pharmaceutical applications.

What is the impact of zero boil-off technology on cryogenic storage market economics?

Zero boil-off (ZBO) technology integrates mechanical cryocoolers to actively capture and re-liquefy any gaseous cryogen that attempts to escape. While requiring higher initial capital investment, ZBO drastically reduces or eliminates the need for expensive and continuous liquid cryogen replenishment, particularly for high-value fluids like liquid helium. This leads to substantial long-term reduction in operational expenditure (OpEx) and greater storage reliability, making it attractive for critical, long-duration installations.

Which capacity segment is experiencing the most dynamic growth, and why?

The 50–200 liter transport capacity segment is experiencing dynamic growth, primarily driven by the global logistics requirements of the pharmaceutical and biotechnology industries. This segment is essential for the secure, verifiable transportation of high-value clinical trial materials, cell therapies, and biopharmaceuticals between manufacturing sites and clinical locations, necessitating lightweight, highly efficient dewars certified for international shipping standards and often equipped with telemetry for real-time tracking.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager