Crypto Art Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434110 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Crypto Art Market Size

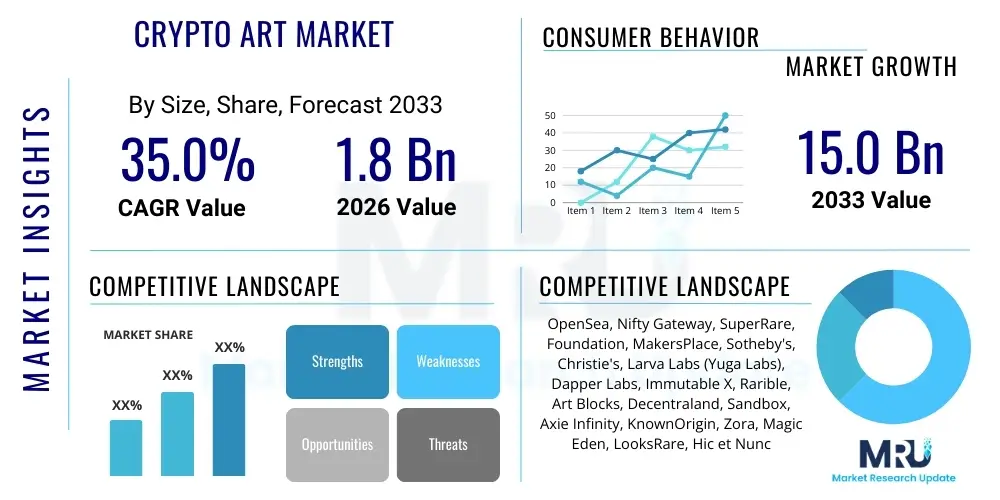

The Crypto Art Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 35.0% between 2026 and 2033. The market is estimated at USD 1.8 Billion in 2026 and is projected to reach USD 15.0 Billion by the end of the forecast period in 2033.

Crypto Art Market introduction

The Crypto Art Market, intrinsically linked to Non-Fungible Tokens (NFTs) and blockchain technology, represents a paradigm shift in how digital ownership, provenance, and authentication are managed for creative works. This nascent yet rapidly maturing market transcends traditional art boundaries by enabling verifiable scarcity and unique ownership of digital assets, ranging from static images and animations to interactive virtual environments and generative code. The core product description revolves around unique digital tokens stored on decentralized ledgers, most commonly the Ethereum blockchain, serving as certificates of authenticity and ownership for the associated artwork. This fundamental technological integration addresses long-standing issues of piracy and reproduction inherent in digital media, providing creators with new monetization streams and collectors with verifiable assets.

Major applications of crypto art span several high-growth digital domains, including high-end digital collectibles marketed through specialized platforms, integration within virtual reality (VR) and metaverse platforms where art can be displayed and interacted with, and utilization within blockchain-based gaming ecosystems as unique in-game assets. The primary benefit driving market expansion is the empowerment of artists, who now receive direct royalties on secondary sales via smart contracts, bypassing traditional gallery commissions and intermediaries. Furthermore, crypto art fosters a sense of community and direct interaction between artists and collectors, leveraging decentralized autonomous organizations (DAOs) and token-gated access to exclusive content and exhibitions, thereby enhancing cultural engagement and investment value.

Driving factors for the substantial market growth include the increasing adoption of cryptocurrencies globally, leading to a larger pool of potential crypto-native buyers with liquidity. Concurrently, high-profile sales at major auction houses, coupled with aggressive marketing by NFT marketplaces, have brought mainstream legitimacy and exposure to the asset class. Technological advancements, particularly the development of more efficient and less energy-intensive blockchain protocols (such as proof-of-stake systems), are reducing transaction costs and environmental concerns, making the creation and trading of crypto art more accessible and sustainable. The speculative investment appeal, combined with genuine artistic innovation, fuels the robust expansion projected through the forecast period.

Crypto Art Market Executive Summary

The Crypto Art Market is characterized by highly volatile yet consistently upward-trending business dynamics, primarily driven by rapid infrastructural improvements in underlying blockchain technology and aggressive platform specialization. Current business trends indicate a shift from generic NFT marketplaces toward curated, high-fidelity platforms focusing on specific art genres (e.g., generative art or PFP projects), optimizing user experience and fostering higher value transactions. Key business strategies involve securing strategic partnerships with established brands and traditional artists to bridge the gap between legacy creative industries and Web3, alongside continuous innovation in smart contract capabilities to enable sophisticated financial instruments built around digital art ownership, such as fractionalization and art-backed lending.

Regional trends demonstrate North America's dominance, fueled by early adoption, significant venture capital investment in NFT infrastructure, and a strong presence of influential tech and crypto entrepreneurs. The Asia Pacific (APAC) region is rapidly accelerating its market share, particularly driven by large-scale adoption in South Korea and Japan, focusing heavily on gaming and metaverse integration where digital art serves both aesthetic and functional purposes. Europe, especially Western Europe, shows strong growth led by institutional acceptance and the establishment of regulatory frameworks that seek to legitimize digital asset ownership. These regional dynamics highlight diverse cultural approaches to crypto art, from speculative investment in the US to utility-driven adoption in APAC, all contributing to global market robustness.

Segmentation trends reveal significant traction in the Generative Art segment, where code-based outputs offer uniqueness and mathematical scarcity, attracting both traditional art collectors and sophisticated crypto investors. The Ethereum blockchain continues to hold the largest market share due to its first-mover advantage and robust developer ecosystem, though competing chains like Solana and Tezos are gaining ground by offering lower transaction fees and faster processing times, appealing to mass-market and lower-entry-point creators. Furthermore, the application segment is increasingly weighted towards the Metaverse and Gaming sectors, as these platforms provide immediate utility and a display environment for digital assets, moving crypto art beyond static collection into immersive experiences and virtual economies.

AI Impact Analysis on Crypto Art Market

Common user questions regarding AI's impact on the Crypto Art Market center intensely on copyright, authenticity, and the very definition of 'artistic authorship.' Users frequently query how AI-generated art affects the value proposition of human-created NFTs, expressing concern over market saturation and the potential devaluation of traditional crypto art forms due to the ease and speed of AI output generation. Furthermore, there are significant technical inquiries about the legal standing of AI-generated content when minted as an NFT—specifically, who owns the intellectual property (the programmer, the user of the AI model, or the AI itself). Expectations are high for AI tools to become integrated creative collaborators, enhancing efficiency, while concerns persist about deepfakes and the misuse of AI to generate unauthorized derivatives, challenging the foundational principles of verifiable uniqueness that underpin the NFT ecosystem.

The integration of sophisticated generative models, such as latent diffusion models and Generative Adversarial Networks (GANs), directly challenges the provenance model of crypto art. While AI tools empower non-traditional artists to create high-quality, complex visual assets quickly, this democratization introduces a complexity regarding true scarcity. The key themes summarized from user inquiries revolve around the necessity for clear attribution standards, robust technical solutions for detecting AI-assisted versus purely human-driven art, and the potential for AI itself to drive new categories of crypto art, such as dynamic, continuously evolving NFTs that react to real-time data or user input. This blending of computation and creativity is seen both as the biggest threat to existing valuation models and the most promising avenue for innovation.

Ultimately, the consensus suggests that AI will not eliminate the crypto art market but will fundamentally transform it, demanding greater transparency about the creation process. Market players must adapt by focusing on 'curated AI art,' emphasizing the prompt engineering skills, model fine-tuning, and human conceptualization behind the AI output, rather than just the final image. This technological shift necessitates the rapid evolution of smart contracts to incorporate meta-data certifying the extent of AI involvement, thus maintaining collector trust and distinguishing conceptually profound works from mass-produced digital noise. The future market will likely segment further, distinguishing between human-led scarcity and algorithmic abundance, each valued differently by diverse collector profiles.

- AI enhances creation velocity, leading to market saturation concerns.

- It raises complex legal questions regarding intellectual property ownership of AI-generated NFTs.

- AI-driven tools facilitate new art forms, such as dynamic and perpetually evolving NFTs.

- Increased need for technical standards and metadata disclosure regarding AI involvement in creation.

- AI assists in personalization and customization of digital art within metaverse environments.

- It poses a risk of deepfake art and unauthorized derivatives challenging provenance verification.

- The technology drives the evolution of generative art, focusing value on prompt engineering and model selection.

DRO & Impact Forces Of Crypto Art Market

The dynamics of the Crypto Art Market are governed by a robust interplay of Drivers, Restraints, and Opportunities (DRO), collectively channeled through critical Impact Forces that dictate market volatility and long-term sustainability. Drivers predominantly center on the cultural shift toward digital native ownership, the proven ability of NFTs to provide verifiable provenance, and the substantial revenue potential (including royalties) for creators, fostering a highly innovative environment. Restraints involve significant regulatory uncertainties across major jurisdictions, persistent concerns over the environmental impact of certain blockchain protocols (though mitigated by proof-of-stake migration), and high barriers to entry for non-crypto native collectors due to complex wallet management and volatile gas fees. Opportunities lie in the massive untapped potential of institutional adoption, the proliferation of utility-focused NFTs integrated into gaming and decentralized finance (DeFi), and the expansion into less resource-intensive blockchain ecosystems.

The primary impact force shaping the market is Technological Advancement. Continuous upgrades to blockchain infrastructure (e.g., Layer 2 solutions, sidechains, and new L1 protocols) significantly reduce transaction costs and increase scalability, directly influencing the volume and accessibility of crypto art trading. A secondary but powerful impact force is Regulatory Scrutiny and Acceptance. Clear regulatory guidelines concerning digital asset classification, taxation, and intellectual property rights would dramatically reduce uncertainty, attracting institutional capital and stabilizing long-term investment. Conversely, overly restrictive legislation could halt growth in specific regions, making regulatory clarity a defining factor in market maturation. This force dictates the flow of large-scale investment and the willingness of traditional institutions like museums and established auction houses to fully commit to the sector.

The third major impact force is Market Sentiment and Speculation. Due to the relatively young nature of the asset class, the market remains highly susceptible to high-profile sales, celebrity endorsements, and macroeconomic conditions affecting global crypto asset valuations. While speculation fuels rapid price appreciation and draws media attention, it also introduces significant volatility, posing risks to long-term collector base development. Successfully mitigating these forces requires platforms to focus on utility, community building, and genuine artistic merit over speculative hype, transitioning the market from a purely financial instrument to a recognized cultural asset class. Balancing rapid technological scaling with the demands for environmental sustainability and regulatory compliance remains the central challenge and opportunity for the market's future trajectory.

Segmentation Analysis

The Crypto Art Market is highly segmented based on the fundamental characteristics of the digital assets themselves, the underlying technology used for minting and transfer, and the ultimate application or utility provided to the end-user. This segmentation allows market players to specialize and target specific collector demographics, whether they are high-net-worth investors seeking rare collectibles, gaming enthusiasts looking for functional in-game items, or pure art collectors focused on aesthetic and conceptual value. Understanding these distinctions is crucial for developing tailored marketing strategies and optimizing blockchain infrastructure efficiency based on volume, transaction speed, and security requirements pertinent to each segment.

Segmentation by Type details the artistic medium, ranging from highly technical generative code outputs to traditional digital paintings and immersive 3D creations, reflecting diverse creative processes and value propositions. Segmentation by Blockchain Network reflects the technological infrastructure choice, impacting transaction costs, security, and the size of the native collector base. Meanwhile, segmentation by Application highlights the increasing utilitarian role of crypto art, moving beyond simple collection into integration within complex, interactive virtual economies and social platforms, driving demand based on functional utility rather than solely artistic merit.

- By Type:

- Generative Art (Code-based output)

- Digital Painting and Illustration

- 3D Art and Sculptures

- Video and Animation (Looping and Single-Channel)

- Music and Audio NFTs

- By Blockchain Network:

- Ethereum (ETH)

- Solana (SOL)

- Tezos (XTZ)

- Flow (FLOW)

- Polygon (MATIC)

- By Application:

- Digital Collectibles (PFP Projects)

- Metaverse and Virtual Real Estate

- Gaming Assets (In-game utility)

- Curation and Exhibition

- Art-backed Decentralized Finance (DeFi)

Value Chain Analysis For Crypto Art Market

The value chain for the Crypto Art Market is distinctly decentralized and technologically intensive, fundamentally altering the traditional art market structure by minimizing the role of physical intermediaries. The upstream segment primarily involves the creation process, dominated by digital artists, software developers (for generative art algorithms), and blockchain protocol creators who maintain the underlying infrastructure. Key activities here include aesthetic creation, smart contract development, and token standardization (e.g., ERC-721 or ERC-1155). Efficiency in this segment is driven by accessible software tools and low-cost development environments, enabling a continuous supply of novel digital assets into the ecosystem.

The midstream operations are dominated by specialized NFT marketplaces (e.g., OpenSea, SuperRare) and auction houses (both crypto-native and traditional entrants like Christie's). These platforms act as key distribution channels, facilitating the minting, listing, and transaction verification processes. Distribution is almost entirely digital, operating primarily through direct and indirect channels. Direct distribution occurs when artists mint and sell directly through personal websites or contracts; however, the overwhelming majority utilize indirect distribution through major marketplaces that provide visibility, secure transaction environments, and royalty enforcement via smart contracts. These platforms monetize through transaction fees and listing fees, essentially acting as decentralized gallery infrastructure.

Downstream analysis focuses on the buyers—collectors, investors, institutions, and metaverse users. This segment is concerned with secure storage (digital wallets), display, and liquidity. Liquidity is provided not only by secondary market sales but also increasingly by DeFi protocols that allow for fractional ownership or collateralization of high-value crypto art. The value chain is characterized by rapid feedback loops between creators and collectors, bypassing lengthy institutional vetting processes. The successful optimization of this chain depends on reducing gas fees, enhancing cross-chain compatibility, and improving user experience to onboard new collectors, ensuring the seamless transfer of value from creation to realization and subsequent utilization.

Crypto Art Market Potential Customers

The Crypto Art Market attracts a diverse array of end-users and buyers, segmented broadly into investment-driven collectors and utility-driven consumers. The primary cohort of buyers includes high-net-worth individuals and crypto-native investors seeking portfolio diversification and exposure to high-growth, high-risk digital assets. These customers are motivated by the potential for exponential value appreciation, cultural significance, and the perceived status associated with owning blue-chip NFT projects or works by highly renowned digital artists. They require verifiable provenance, strong security measures for storage, and access to sophisticated secondary market liquidity mechanisms, often engaging in fractionalization and lending protocols to leverage their holdings.

A second significant customer base comprises digital art enthusiasts, traditional art collectors transitioning to the digital space, and museum curators. This group is driven primarily by aesthetic appeal, conceptual innovation, and the desire to support digital artists, viewing crypto art as a legitimate evolution of contemporary art practice. Their needs revolve around high-resolution display standards, strong metadata integrity, and platforms that provide contextual information about the artist and their creative process. They are less focused on immediate financial returns and more interested in the preservation, exhibition, and cultural significance of the asset, often requiring educational resources to navigate the Web3 landscape.

Finally, the largest emerging customer segment is the mass consumer base driven by utility, particularly within the gaming and metaverse ecosystems. These buyers are looking for functional assets—skins, avatars, virtual land, or access tokens—where the art serves a practical purpose within a digital environment. Their purchasing decisions are influenced by ease of transaction (low fees), high transaction speed, and seamless integration into their preferred virtual worlds. This segment demands high accessibility and interoperability across different platforms, suggesting a shift toward user-friendly, non-custodial wallets and Layer 2 solutions to facilitate high-volume, lower-value transactions, significantly expanding the overall buyer universe.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.8 Billion |

| Market Forecast in 2033 | USD 15.0 Billion |

| Growth Rate | 35.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | OpenSea, Nifty Gateway, SuperRare, Foundation, MakersPlace, Sotheby's, Christie's, Larva Labs (Yuga Labs), Dapper Labs, Immutable X, Rarible, Art Blocks, Decentraland, Sandbox, Axie Infinity, KnownOrigin, Zora, Magic Eden, LooksRare, Hic et Nunc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crypto Art Market Key Technology Landscape

The technological landscape underpinning the Crypto Art Market is defined by the decentralized infrastructure that ensures scarcity and verifiable ownership, primarily revolving around blockchain protocols and smart contract functionality. The foundational technology is the blockchain itself, with Ethereum currently dominating due to its robust ecosystem and the widespread adoption of the ERC-721 and ERC-1155 token standards, which define the non-fungibility of digital assets. However, the market is rapidly evolving towards multi-chain environments, utilizing scaling solutions like Layer 2 networks (e.g., Polygon, Arbitrum) and alternative high-speed, lower-fee Layer 1 protocols (e.g., Solana, Tezos) to enhance transaction speed and reduce the environmental footprint, addressing critical scalability restraints that have historically hampered mass adoption.

Smart contracts are the critical enabling technology, automating transactions, enforcing royalty payments on secondary sales, and allowing for complex ownership structures such as fractionalization (dividing ownership of a single NFT). The security and immutable nature of these contracts are paramount for maintaining collector trust. Furthermore, the reliance on secure, non-custodial digital wallets (like MetaMask and hardware wallets) is essential for asset storage, placing the onus of security directly on the user. Technological advancements are focused on improving wallet accessibility and integrating better security features, alongside developing decentralized identifiers (DIDs) to enhance user privacy and authentication within the digital art ecosystem.

A crucial secondary layer of technology involves decentralized storage solutions, such as the InterPlanetary File System (IPFS) and Arweave, which ensure that the actual digital artwork (the underlying media file) is stored in a decentralized and permanent manner, decoupled from the NFT token itself. This prevents 'rug pulls' where the artwork link might be broken or altered. The ongoing development of cross-chain bridges and interoperability standards is also vital, allowing crypto art minted on one blockchain to be seamlessly traded or utilized on others, significantly improving market liquidity and utility within disparate metaverse platforms and virtual economies, thus driving technological convergence across the Web3 stack.

Regional Highlights

Global demand for crypto art exhibits significant regional variation, driven by differences in regulatory environments, technological readiness, and cultural acceptance of digital assets as legitimate investment vehicles and cultural phenomena. North America, specifically the United States, stands as the indisputable market leader, characterized by the highest transaction volumes and the location of major NFT platforms and foundational infrastructure providers. The region benefits from a robust venture capital ecosystem aggressively funding Web3 projects, strong crypto liquidity, and a culture of speculative investment. Key drivers in North America include high-profile sales at renowned auction houses and the early adoption of collectible PFP (Profile Picture) projects, setting global trends and valuation benchmarks.

Europe demonstrates substantial growth, particularly in Western European nations like the UK, Germany, and France. European crypto art collectors often show a greater emphasis on conceptual and generative art, aligning with traditional artistic sensibilities. The region is moving towards clearer regulatory frameworks (such as MiCA in the EU), which, while potentially restrictive initially, promise to formalize the market and attract institutional players seeking secure operational environments. Europe is also a key hub for sustainable blockchain initiatives, driven by environmental consciousness, leading to increased adoption of proof-of-stake and carbon-neutral blockchain solutions for art minting.

Asia Pacific (APAC) represents the fastest-growing region, driven primarily by the massive scale of its gaming and digital consumption markets, notably in South Korea, Japan, and Southeast Asia. The focus in APAC is heavily skewed toward utility, utilizing NFTs for virtual land, in-game assets, and character authentication within thriving metaverse platforms. Governmental receptivity varies, but market adoption is aggressive, supported by strong mobile technology penetration and a high propensity for digital transactions. Latin America and the Middle East & Africa (MEA) are emerging regions, where crypto art serves as a hedge against fiat currency instability and provides artists with uncensored, global monetization opportunities, though market size remains comparatively smaller, focusing primarily on cultural preservation and decentralized identity projects.

- North America: Market dominance, high liquidity, strong venture funding, and key influencer hub.

- Europe: Focus on regulatory clarity, institutional engagement, and sustainable blockchain use.

- Asia Pacific (APAC): Rapid growth, driven by gaming, metaverse integration, and high digital adoption rates.

- Latin America (LATAM): Emerging market, utilizing crypto art for economic stability and artist empowerment.

- Middle East & Africa (MEA): Growing interest in digital identity and decentralized cultural preservation.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crypto Art Market.- OpenSea

- Nifty Gateway

- SuperRare

- Foundation

- MakersPlace

- Sotheby's

- Christie's

- Larva Labs (Yuga Labs)

- Dapper Labs

- Immutable X

- Rarible

- Art Blocks

- Decentraland

- Sandbox

- Axie Infinity

- KnownOrigin

- Zora

- Magic Eden

- LooksRare

- Hic et Nunc

Frequently Asked Questions

Analyze common user questions about the Crypto Art market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technology underlying Crypto Art?

The primary technology is Non-Fungible Tokens (NFTs) minted on decentralized ledgers, most commonly the Ethereum blockchain, which ensures unique ownership, verifiable provenance, and automated royalty enforcement via smart contracts.

How does AI impact the authenticity and valuation of digital art in the market?

AI introduces efficiency but raises authorship concerns; it necessitates new valuation models that prioritize the human curation, prompt engineering, and conceptual contribution behind the AI output, demanding metadata transparency on the extent of machine involvement.

Which blockchain network holds the largest share in the Crypto Art Market?

Ethereum (ETH) currently holds the largest market share due to its established infrastructure, robust developer community, and the widespread adoption of its ERC token standards, though scaling solutions and competing chains are gaining momentum.

What are the main drivers of market growth?

Key drivers include rising crypto adoption and liquidity, the cultural shift towards digital native ownership, the promise of royalties for creators, and increasing integration of utility-driven NFTs within gaming and metaverse platforms.

Are there significant environmental concerns associated with Crypto Art?

Historically, concerns existed due to the energy consumption of Proof-of-Work (PoW) blockchains; however, the ongoing transition of major protocols like Ethereum to the energy-efficient Proof-of-Stake (PoS) consensus mechanism significantly mitigates these environmental risks.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager