Crypto Derivative Trading Platforms Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432463 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Crypto Derivative Trading Platforms Market Size

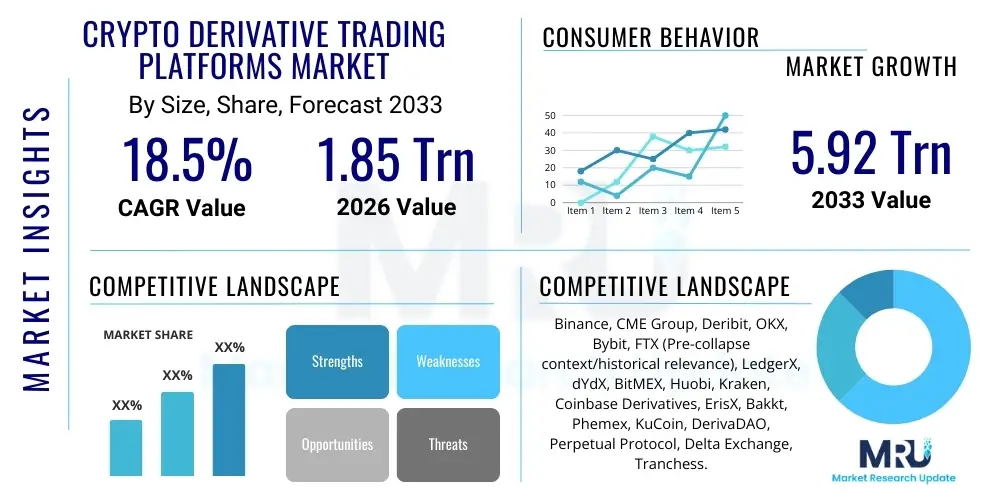

The Crypto Derivative Trading Platforms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 18.5% between 2026 and 2033. The market is estimated at USD 1.85 Trillion in 2026 and is projected to reach USD 5.92 Trillion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the increased institutional interest in digital assets, coupled with the volatility inherent in the cryptocurrency markets, which necessitates sophisticated risk management tools. Furthermore, the global accessibility of these platforms and the development of high-liquidity derivative products, such as perpetual swaps, are key accelerators for market valuation growth.

The market size estimation reflects the total notional value traded on centralized and decentralized derivative exchanges globally. While spot trading sets the baseline, the leverage offered by derivatives amplifies trading volume significantly. Regulatory clarity, or lack thereof, in major financial hubs profoundly influences the operational scope and trustworthiness of trading platforms, directly affecting market size expansion and institutional adoption rates. As regulatory frameworks mature, particularly concerning consumer protection and market manipulation, the influx of larger capital bases is expected, cementing the projected high growth trajectory.

Crypto Derivative Trading Platforms Market introduction

The Crypto Derivative Trading Platforms Market encompasses digital exchanges and technological infrastructures facilitating the trading of financial instruments whose value is derived from an underlying cryptocurrency asset, such as Bitcoin or Ethereum. These platforms offer crucial tools like futures, options, perpetual swaps, and interest rate swaps, enabling traders to speculate on price movements, hedge existing spot positions, and manage risk exposure without owning the underlying asset directly. The primary applications include speculative trading by retail and institutional investors, arbitrage across spot and derivative markets, and sophisticated portfolio management within the volatile digital asset ecosystem.

The core benefits provided by these platforms revolve around capital efficiency, enhanced liquidity, and flexibility in investment strategies. By allowing leveraged trading, derivative platforms enable participants to control larger positions with smaller capital outlay. Driving factors for market growth include the increasing sophistication of financial instruments tailored for digital assets, the maturation of institutional infrastructure, and the global trend toward decentralized finance (DeFi) derivatives. Moreover, high volatility in crypto markets inherently boosts the demand for derivatives as risk management and profit generation tools, attracting a diverse range of market participants globally.

Crypto Derivative Trading Platforms Market Executive Summary

The global Crypto Derivative Trading Platforms Market is experiencing a rapid structural transformation, marked by a decisive shift toward increased regulatory compliance among major centralized exchanges (CEXs) and explosive innovation within the Decentralized Finance (DeFi) derivatives sector. Business trends indicate aggressive competition focused on offering high-performance matching engines, deep liquidity pools, and novel derivative products, such as structured products based on crypto indices. A major overarching trend is the blending of traditional financial market structures with blockchain technology, leading to platforms that cater specifically to institutional mandates regarding security, auditability, and segregated accounts, thus driving professionalization across the entire ecosystem.

Regionally, Asia Pacific (APAC) continues to dominate trading volumes, largely driven by high retail participation and the concentration of major platform operators in jurisdictions like Singapore and Hong Kong, which are progressively establishing clearer digital asset regulatory guidelines. North America and Europe, while lagging slightly in volume dominance due to stricter regulatory oversight, are key centers for institutional adoption, focusing on regulated derivatives and compliance-centric custody solutions. Segment trends show perpetual swaps maintaining their position as the most traded product type due to their simplicity and high leverage, while options trading is seeing accelerated growth as institutional investors seek non-linear risk exposure management tools.

AI Impact Analysis on Crypto Derivative Trading Platforms Market

User queries regarding the impact of Artificial Intelligence (AI) on crypto derivative platforms frequently focus on four core themes: enhanced algorithmic trading capabilities, improved risk management frameworks, the potential for AI-driven market manipulation, and the role of AI in improving platform security and compliance. Users are keenly interested in how machine learning models can optimize complex derivative pricing, execute high-frequency trading strategies with minimal latency, and predict extreme volatility events. Concerns are often raised regarding the "black box" nature of proprietary AI algorithms, which could potentially lead to systemic risks or unfair market advantages, alongside the ethical implications of autonomous trading systems.

AI's primary transformative role is in optimizing operational efficiency and strategic execution. Machine learning algorithms are instrumental in developing sophisticated trading bots that leverage vast datasets—including order book depth, social sentiment, and macro market factors—to generate alpha, particularly in arbitrage and high-frequency trading of complex derivatives. Furthermore, AI significantly enhances platform integrity by utilizing natural language processing (NLP) for real-time monitoring of regulatory changes and applying behavioral analytics to detect and prevent spoofing, wash trading, and other forms of market abuse, thus raising the standards for market fairness and reducing operational risk exposure.

- AI-Powered Algorithmic Trading: Implementation of deep reinforcement learning models for optimal trade execution and derivative pricing strategies.

- Enhanced Risk Modeling: Using machine learning to forecast extreme market events (Black Swan scenarios) and dynamically adjust margin requirements in volatile derivative contracts.

- Market Surveillance and Compliance: Deployment of AI systems for real-time detection of illicit activities, ensuring adherence to KYC/AML and market integrity standards.

- Customer Service Automation: Utilizing chatbots and AI assistants to provide instantaneous support for complex derivative product queries and trade troubleshooting.

- Personalized Trading Insights: AI-driven analysis of user trading history to offer customized risk exposure limits and optimized product recommendations.

DRO & Impact Forces Of Crypto Derivative Trading Platforms Market

The market is defined by strong Drivers rooted in high cryptocurrency volatility and increasing institutional demand for hedging mechanisms. Restraints often center around ambiguous and fragmented global regulatory landscapes, particularly concerning investor protection and the legal status of specific derivative products. Opportunities are emerging through the expansion of decentralized platforms (DEXs) and the introduction of novel, compliant derivative instruments that appeal to traditional financial players. These factors collectively exert significant Impact Forces on market structure, primarily through shifting liquidity dynamics, influencing platform innovation velocity, and driving the imperative for robust security protocols to mitigate counterparty risk.

Key drivers include the rapid proliferation of high-volume perpetual swaps, which offer continuous access to leveraged exposure, and the inherent 24/7 nature of crypto trading, necessitating always-on derivative platforms. Regulatory uncertainty, however, acts as a critical restraint; jurisdictions that impose outright bans or severe limitations on leveraged trading significantly inhibit market potential and push trading activity onto less regulated, offshore platforms. The major opportunity lies in integrating institutional-grade infrastructure, such as prime brokerage services and regulated custody solutions, which will unlock significant capital currently hesitant to enter the volatile crypto derivatives space due to infrastructural limitations.

Segmentation Analysis

The Crypto Derivative Trading Platforms Market is meticulously segmented based on product type, the underlying asset, and the primary end-user base, reflecting the diverse applications and risk profiles within the ecosystem. This segmentation is crucial for understanding liquidity concentration and targeted platform development. Product differentiation, particularly between centralized and decentralized perpetual contracts, dictates which type of platform dominates specific user demographics, while the choice of underlying asset (e.g., major cryptocurrencies versus altcoins) determines the depth and stability of the order book. Furthermore, distinguishing between institutional and retail end-users helps platforms tailor their compliance frameworks, user interfaces, and risk management offerings to meet specific capital requirements and regulatory expectations.

The rapid evolution of the market mandates frequent reassessment of segmentation dynamics. For instance, the growing maturity of DeFi derivative platforms has created a distinct segment that challenges the long-standing dominance of centralized exchanges (CEXs). These decentralized offerings cater to users prioritizing anonymity and smart contract automation, contrasting sharply with CEXs, which prioritize speed, fiat gateways, and regulatory adherence. Analyzing these segment nuances provides granular insight into where innovation and regulatory scrutiny are most focused, guiding platform operators in optimizing their geographical and technological deployment strategies.

- By Product Type: Futures, Options, Perpetual Swaps, Interest Rate Swaps, Structured Products.

- By Underlying Asset: Bitcoin (BTC), Ethereum (ETH), Altcoins/Cross-Assets, Indices.

- By Platform Model: Centralized Exchange (CEX), Decentralized Exchange (DEX).

- By End-User: Retail Traders, Institutional Investors (Hedge Funds, Asset Managers), Financial Intermediaries.

Value Chain Analysis For Crypto Derivative Trading Platforms Market

The value chain for crypto derivative trading platforms begins with upstream analysis, primarily encompassing data providers, oracle services, and technological infrastructure vendors specializing in low-latency matching engines and secure cryptographic solutions. Data providers are foundational, supplying real-time pricing feeds and market depth data essential for accurate derivative pricing and risk calculations. Oracle services are critically important, especially for decentralized platforms, ensuring reliable and tamper-proof off-chain data is brought on-chain to trigger smart contracts and settle positions without centralized intervention, thereby forming the backbone of trustless derivative execution.

Moving through the value chain, the core platform acts as the central processor, managing order execution, margin management, and regulatory compliance (for CEXs). Downstream analysis focuses on the distribution channels and end-user interaction points. Direct channels include proprietary web and mobile applications, offering highly customized trading interfaces and direct access to liquidity. Indirect channels involve integration with third-party trading software, specialized APIs for institutional connectivity, and connectivity with prime brokerages or custodians, allowing sophisticated clients to manage their derivative exposure through familiar tools. The increasing importance of indirect institutional channels highlights the market’s pivot towards professionalization and integration with the traditional finance ecosystem.

Crypto Derivative Trading Platforms Market Potential Customers

The primary potential customers and buyers in the Crypto Derivative Trading Platforms Market span a spectrum from high-volume, risk-tolerant retail day traders to highly regulated, capital-intensive institutional entities. Retail traders represent the largest volume of platform users, driven by the desire for leveraged speculation and the low barrier to entry offered by many global exchanges. This segment values user-friendly interfaces, deep liquidity in major perpetual swap pairs, and competitive trading fees. Platforms must continuously innovate their mobile offerings and educational content to capture and retain this vast customer base, which drives significant transaction volume and platform fees.

Conversely, the institutional segment, including hedge funds, proprietary trading firms, and traditional asset managers, represents the highest potential for AUM and sophisticated product usage, such as bespoke options and complex structured products. These institutional buyers prioritize regulatory assurances, robust counterparty risk management, and the availability of segregated custodial services. Their decision-making heavily favors platforms that demonstrate high standards of security, possess clear licensing in reputable jurisdictions, and offer specialized API connectivity and prime brokerage services to handle large block trades and advanced hedging strategies efficiently. The future growth of the market is largely predicated on the successful conversion of this institutional segment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Trillion |

| Market Forecast in 2033 | USD 5.92 Trillion |

| Growth Rate | 18.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Binance, CME Group, Deribit, OKX, Bybit, FTX (Pre-collapse context/historical relevance), LedgerX, dYdX, BitMEX, Huobi, Kraken, Coinbase Derivatives, ErisX, Bakkt, Phemex, KuCoin, DerivaDAO, Perpetual Protocol, Delta Exchange, Tranchess. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crypto Derivative Trading Platforms Market Key Technology Landscape

The technological backbone of the Crypto Derivative Trading Platforms Market is defined by the imperative for speed, security, and scalability. Core technologies include proprietary, high-performance matching engines capable of processing millions of orders per second with microsecond latency, crucial for maintaining competitiveness in high-frequency trading environments. These systems are often developed in specialized languages like C++ to ensure deterministic execution and minimize slippage. Furthermore, robust security frameworks, incorporating multi-signature cold storage wallets, advanced encryption protocols, and mandatory two-factor authentication, are essential to protect the significant capital held by these platforms, mitigating the ever-present threat of external and internal cyberattacks.

The market increasingly relies on advanced distributed ledger technology (DLT), particularly for decentralized exchanges (DEXs). Smart contracts, often deployed on high-throughput layer 1 or layer 2 solutions (like Arbitrum or Optimism), automate the entire lifecycle of derivative contracts, from margin posting to settlement, eliminating the need for trusted intermediaries and significantly reducing counterparty risk. This smart contract automation is supported by decentralized oracle networks, which reliably feed external price data to the blockchain, ensuring that contract execution is based on accurate, real-time market conditions, a technological dependency that has become critical for ensuring the fairness and reliability of DeFi derivative platforms.

Regional Highlights

Regional dynamics heavily influence the operational landscape and regulatory certainty for crypto derivative trading platforms, leading to varying market maturity and trading volumes globally. Asia Pacific (APAC) currently holds the dominant position in terms of retail trading volume and platform presence, particularly due to the prevalence of perpetual swaps trading facilitated by exchanges domiciled in business-friendly jurisdictions. The culture of high-frequency and speculative trading across countries like South Korea, Japan, and Southeast Asia drives significant liquidity. However, this region is also characterized by regulatory fragmentation, with certain countries imposing stringent restrictions while others foster innovation through regulatory sandboxes and clear licensing regimes.

North America (NA), spearheaded by the United States, represents the focal point for regulated institutional adoption. Although retail leveraged trading faces significant restrictions in the US, the highly regulated derivatives market (managed by entities like CME Group and Bakkt) caters specifically to institutional investors demanding exchange-traded, cash-settled crypto futures and options. This focus on compliance and oversight attracts large traditional financial institutions, positioning North America as the critical region for integrating crypto derivatives into mainstream financial infrastructure, prioritizing security and clear legal frameworks over maximum leverage offerings.

Europe stands as a region balancing regulatory prudence with innovation. While the implementation of the Markets in Crypto-Assets (MiCA) regulation aims to harmonize crypto asset rules across the European Union, creating a clearer operational environment, platforms operating here often must navigate complex cross-border licensing requirements. The region is seeing strong growth in structured derivative products and is a key hub for DeFi innovation, particularly in jurisdictions like Switzerland. The Middle East and Africa (MEA) and Latin America (LATAM) are emerging rapidly, driven by high inflation rates and currency volatility, pushing local investors toward crypto derivatives as both hedging tools and alternative investment vehicles, despite localized regulatory hurdles.

- Asia Pacific (APAC): Dominant trading volume, led by retail participation and perpetual swap liquidity; key regulatory hubs include Singapore and Hong Kong.

- North America (NA): Focus on institutional, regulated futures and options markets; driven by CME Group and increasing regulatory clarity for institutional products.

- Europe: Maturing regulatory environment driven by MiCA; strong growth in structured products and a significant hub for decentralized finance (DeFi) derivatives.

- Latin America (LATAM): High adoption rates fueled by macroeconomic instability, increasing the demand for crypto derivatives as hedging instruments.

- Middle East and Africa (MEA): Emerging growth markets characterized by increasing regulatory frameworks (e.g., UAE, Bahrain) aimed at attracting global crypto exchanges and financial technology centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crypto Derivative Trading Platforms Market.- Binance

- CME Group

- Deribit

- OKX

- Bybit

- LedgerX (Now part of FTX Derivatives)

- dYdX

- BitMEX

- Huobi

- Kraken

- Coinbase Derivatives

- ErisX (Now part of Cboe Digital)

- Bakkt

- Phemex

- KuCoin

- DerivaDAO

- Perpetual Protocol

- Delta Exchange

- Tranchess

- Synthetix

Frequently Asked Questions

Analyze common user questions about the Crypto Derivative Trading Platforms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between centralized (CEX) and decentralized (DEX) crypto derivative platforms?

CEX derivative platforms facilitate trading through an intermediary, offering fiat access, speed, and regulatory compliance (KYC), but involve counterparty risk. DEX platforms use smart contracts for automated, permissionless trading, eliminating counterparty risk via non-custodial wallets and offering higher transparency, though often at the cost of execution speed.

Which derivative product drives the most volume in the current crypto market?

Perpetual swaps (or perpetual futures) consistently drive the highest trading volume in the crypto derivatives market. These instruments behave like traditional futures but lack an expiration date, allowing traders to hold leveraged positions indefinitely, which is highly popular among both retail and algorithmic traders.

How is AI improving risk management on crypto derivative platforms?

AI utilizes machine learning to analyze massive volumes of market data and user behavior in real time, enabling platforms to dynamically adjust margin calls, predict potential liquidity crises, and detect subtle patterns of market manipulation, significantly enhancing overall platform security and stability during periods of extreme volatility.

What are the main regulatory challenges facing the global crypto derivatives market?

The primary challenges include fragmented global regulations, determining the legal classification of various crypto derivative products (security vs. commodity), and ensuring robust consumer protection against high leverage, leading to jurisdictional arbitrage where platforms move operations to less restrictive countries.

Is institutional adoption growing in the crypto derivative space?

Yes, institutional adoption is growing significantly, driven primarily by the availability of regulated, cash-settled Bitcoin and Ethereum futures and options offered by traditional financial exchanges (like CME Group). Institutions use these products for portfolio hedging, efficient price discovery, and systematic risk management.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager