Crystalline Fructose Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436360 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Crystalline Fructose Market Size

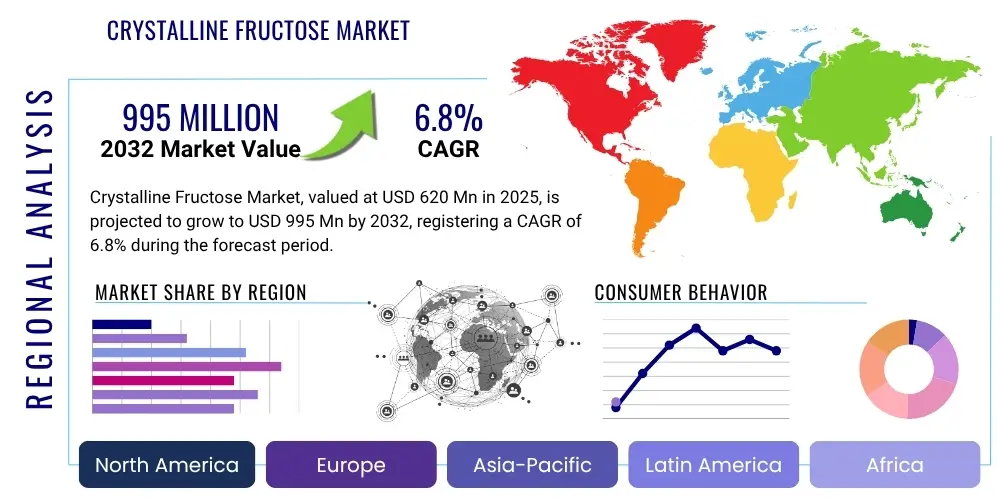

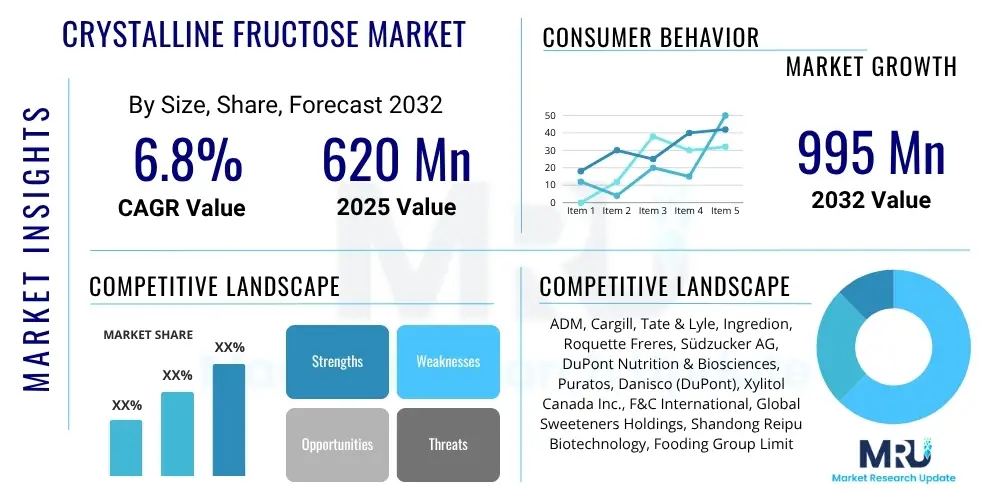

The Crystalline Fructose Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,175 Million by the end of the forecast period in 2033.

Crystalline Fructose Market introduction

The Crystalline Fructose Market encompasses the global trade and utilization of highly purified fructose, a simple monosaccharide derived primarily from corn starch or sugar cane. Unlike high-fructose corn syrup (HFCS), crystalline fructose is processed into a pure, granulated powder (typically 98-100% fructose purity), offering a sweeter profile than sucrose (table sugar) and exhibiting unique functional properties such as enhanced flavor masking, humectancy, and low glycemic index relative to glucose. This product is critical in formulations seeking improved texture, extended shelf life, and perceived health benefits related to blood sugar management, although its caloric value remains comparable to other sugars.

Major applications of crystalline fructose span across the food and beverage industry, pharmaceutical sector, and dietary supplement manufacturing. In beverages, it is prized for enhancing fruit flavors and providing stable sweetness, particularly in sports drinks and flavored waters where high solubility is necessary. In baked goods and confectionary, its humectant property aids in moisture retention, preventing staling and improving mouthfeel. Furthermore, its lower glycemic response compared to sucrose has positioned it as a preferred sweetener in "better-for-you" products targeting health-conscious consumers and diabetic populations, driving consistent demand.

The primary driving factors propelling market expansion include the increasing consumer preference for natural sweeteners over artificial alternatives, coupled with rising awareness regarding the benefits of low glycemic index ingredients. Urbanization and changing dietary habits, particularly the higher consumption of processed and convenient foods and beverages, further solidify the demand base. Regulatory shifts in various regions encouraging the reduction of overall caloric intake, without compromising taste, also favor the adoption of crystalline fructose due to its high sweetness intensity, which allows formulators to use less material to achieve the desired effect. The versatility and technical superiority of crystalline fructose in specific applications ensure its sustained growth trajectory.

- Product Description: Highly purified monosaccharide sweetener, typically 98-100% fructose, available in crystalline or powder form.

- Major Applications: Soft drinks, sports beverages, baked goods, dairy products, nutritional supplements, and pharmaceuticals.

- Key Benefits: Higher relative sweetness (1.2–1.8 times sweeter than sucrose), lower glycemic index, enhanced flavor profile, superior humectancy, and high solubility.

- Driving Factors: Growing demand for natural sweeteners, functional benefits in food formulation, focus on low glycemic index diets, and increasing application in specialized nutritional products.

Crystalline Fructose Market Executive Summary

The global Crystalline Fructose Market is demonstrating robust growth, primarily fueled by the sustained pivot in consumer preferences towards natural, plant-derived sweetening agents and the imperative for functional ingredients in the food processing industry. Business trends indicate a heightened focus on optimizing supply chain efficiency, particularly securing stable, cost-effective sources of corn or cassava feedstock. Key players are investing heavily in advanced crystallization technologies to ensure high purity standards and competitive pricing, vital differentiators in a price-sensitive commodity market. Furthermore, strategic collaborations between crystalline fructose producers and large-scale beverage manufacturers are becoming common, securing long-term supply contracts and influencing new product development based on specific formulation needs.

Regionally, the market exhibits divergent maturity levels. North America remains a significant consumer, driven by established demand in the specialized sports nutrition and beverage sectors, although it faces competitive pressure from alternative non-caloric sweeteners. Asia Pacific (APAC) is projected to be the fastest-growing region, spurred by rapid economic development, increasing disposable incomes, and the Westernization of diets, leading to explosive growth in processed food consumption. European market growth is steady, underpinned by stringent quality regulations and a strong consumer focus on label transparency and natural ingredient sourcing. Market leaders are consequently prioritizing expansion in high-growth APAC economies, establishing localized production and distribution networks to mitigate logistics costs and address regional taste preferences.

Segmentation analysis reveals that the food and beverage application segment holds the dominant market share, particularly due to high volume usage in soft drinks and energy bars. However, the pharmaceutical and nutraceutical segment is exhibiting the highest projected CAGR, driven by the ingredient's utility as an excipient, tablet binder, and palatable sweetening agent in medicinal formulations and dietary supplements. Form segment analysis suggests that the pure powder form dominates, but liquid concentrates are gaining traction in industrial applications where ease of blending and handling are prioritized. These segmentation trends necessitate diversified product offerings tailored to specific industry requirements, moving beyond simple bulk commodity sales toward value-added solutions for specialized market niches.

AI Impact Analysis on Crystalline Fructose Market

User queries regarding AI's influence on the Crystalline Fructose Market commonly revolve around improving feedstock management, optimizing complex crystallization processes, predicting commodity price volatility, and enhancing supply chain resilience. Key concerns include how AI can ensure sustainable sourcing of corn derivatives amid climate change pressures, whether machine learning can accelerate new product formulation (e.g., blend optimization with other sweeteners), and how predictive analytics might affect pricing strategies for bulk industrial sales. Users are particularly interested in the application of AI in quality control systems, ensuring the ultra-high purity required for crystalline fructose, minimizing waste during manufacturing, and streamlining energy-intensive drying operations.

The consensus expectation is that AI will not fundamentally alter the chemical structure or consumer end-use of crystalline fructose, but rather revolutionize the efficiency and profitability of its production and distribution. Advanced algorithms are expected to provide real-time optimization of fermentation and separation stages, reducing operational costs significantly. Furthermore, AI-driven demand forecasting, integrating complex variables like climate patterns, agricultural yields, and consumer sentiment data, will allow manufacturers to manage inventory levels more effectively, reducing spoilage and preventing stock-outs, thereby enhancing overall market responsiveness and competitiveness across the sweetener supply chain.

- Supply Chain Optimization: AI-driven logistics planning minimizing transportation costs and improving cold chain integrity where applicable.

- Production Efficiency: Machine learning models optimizing crystallization temperature and pressure parameters, maximizing yield and purity while reducing energy consumption.

- Demand Forecasting: Predictive analytics integrating market sentiment, historical consumption, and seasonal patterns to minimize inventory risk.

- Quality Control: AI-powered image analysis and sensor data processing for real-time detection of impurities, ensuring compliance with strict food and pharmaceutical grade standards.

- Pricing Strategy: Algorithmic pricing tools analyzing competitor data and raw material volatility to set dynamic, optimal market prices.

DRO & Impact Forces Of Crystalline Fructose Market

The Crystalline Fructose Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant Impact Forces. A primary driver is the accelerating consumer shift towards natural ingredients and the functional benefits crystalline fructose offers, specifically its perceived advantage in glycemic control compared to standard table sugar, catering to the growing global diabetic and pre-diabetic population. This demand is further supported by the superior functionality of fructose in enhancing flavor profiles, especially for fruit-based products, which is a technical requirement for many modern beverage formulations. These internal factors create a persistent, upward pressure on market volume.

Conversely, significant restraints hinder optimal market growth. The most prominent restraint is the enduring negative public perception surrounding high sugar intake, often fueled by generalized health warnings that fail to distinguish between crystalline fructose and high-fructose corn syrups (HFCS), leading to regulatory scrutiny and consumer confusion. Additionally, fierce competition from established high-intensity artificial sweeteners (like sucralose and aspartame) and emerging natural high-intensity sweeteners (like stevia and monk fruit) poses a substantial threat, as these alternatives offer zero calories, appealing strongly to weight-conscious segments. Furthermore, the reliance on corn feedstock exposes the market to volatility in agricultural commodity prices and geopolitical disruptions affecting global trade.

Opportunities for expansion lie in penetrating emerging applications, particularly in the sports nutrition and clinical dietary segments where its slow energy release properties are highly valued. Developing advanced co-crystallization techniques to create specialized blends with reduced total sugar content but maintained sweetness intensity presents a compelling opportunity for market leaders. The increasing focus on clean label ingredients in developing regions, especially in Asia and Latin America, provides untapped geographical potential. The convergence of these forces dictates that market players must prioritize technological differentiation, robust feedstock management, and effective consumer education to navigate the regulatory and competitive landscape successfully.

Segmentation Analysis

The Crystalline Fructose Market is extensively segmented based on application, form, source, and regional geography, allowing for precise market targeting and strategic resource allocation. The segmentation by application clearly differentiates demand dynamics, with the Food & Beverage industry being the dominant volume driver, particularly the non-alcoholic beverage and processed food sub-segments. Segmentation by form—powder versus liquid—highlights the varying needs of industrial users, where the pure powder form is essential for baked goods and dry mixes, while liquid fructose is often preferred in large-scale beverage compounding due to ease of handling and solubility. Analyzing these segments is critical for understanding current consumption patterns and predicting future growth hotspots, specifically the accelerated growth expected in the nutraceutical sector.

Source segmentation, primarily distinguishing between corn-derived and sugar cane/beet-derived fructose, is vital for managing supply chain logistics and adhering to regional labeling requirements, such as those related to genetically modified organisms (GMOs). While corn remains the primary source globally due to cost efficiencies, the demand for non-GMO and organic crystalline fructose, often derived from alternative sources like cassava or specific non-GMO corn varieties, is steadily increasing, commanding a price premium. Understanding these segment complexities ensures that manufacturers can align their production capabilities with evolving consumer demands for transparency and purity, particularly in highly regulated markets such as the European Union and specific states within North America.

- By Application: Food & Beverages, Pharmaceuticals, Nutraceuticals, Personal Care, Others.

- By Form: Powder, Liquid (Solutions and Syrups).

- By Source: Corn, Sugar Beet, Others (e.g., Cassava, Fruits).

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa.

Value Chain Analysis For Crystalline Fructose Market

The value chain for the Crystalline Fructose Market begins with the upstream processes involving the cultivation, harvesting, and initial processing of raw starch sources, predominantly corn kernels, but also sugar cane or cassava depending on regional feedstock availability. Upstream analysis focuses on managing the agricultural supply chain, including securing favorable commodity prices, ensuring crop quality, and addressing sustainability issues related to water usage and land management. The immediate subsequent stage involves wet milling, where the starch is separated and converted into glucose, and then isomerized to produce high-fructose syrups (HFCS). Efficiency at this initial conversion stage directly impacts the ultimate cost structure of the crystalline product.

The core manufacturing process, the midstream segment, involves the sophisticated purification and crystallization of the high-fructose syrup into the final crystalline form, requiring advanced separation technologies, chromatography, and energy-intensive drying processes. Quality control at this stage is paramount, as purity levels must meet stringent food and sometimes pharmaceutical-grade specifications (typically >98% fructose). The distribution channel, bridging the midstream and downstream segments, relies on specialized logistics, primarily bulk shipping in large sacks or containers for powder, and tanker trucks for specialized liquid formats, demanding strict control over moisture and temperature to prevent caking or degradation.

Downstream analysis centers on the utilization of crystalline fructose by end-user industries, including large food and beverage manufacturers, pharmaceutical companies, and nutraceutical formulators. Direct distribution often targets major institutional buyers and global corporations through established, long-term supply agreements, ensuring volume stability. Indirect distribution involves working with regional distributors and ingredient brokers who cater to smaller manufacturers and specialty markets. The relationship between the producer and the downstream formulator is often consultative, focusing on developing custom sweetener blends or optimizing dosages for specific product attributes, solidifying the importance of technical service within the downstream component of the value chain.

Crystalline Fructose Market Potential Customers

The primary end-users and potential customers of crystalline fructose span a broad spectrum of industries requiring functional, high-purity sweetening agents. The largest buyer base resides within the non-alcoholic beverage sector, particularly producers of premium soft drinks, energy drinks, and enhanced water formulations that leverage fructose’s ability to accentuate fruit flavors and provide stable sweetness. These large beverage corporations prioritize suppliers who can guarantee high volume, consistent quality, and compliance with international food safety standards (e.g., ISO, HACCP). The demand here is driven by seasonal fluctuations and marketing campaigns that necessitate agile supply chain responses.

Another significant customer segment is the bakery and confectionary industry. Bakers utilize crystalline fructose for its superior humectancy—the ability to retain moisture—which significantly extends the shelf life of goods like cakes, cookies, and packaged pastries while improving texture and softness. Customers in this sector are highly focused on cost-in-use and technical assistance related to formulation stability and crystalline structure interaction with other dry ingredients. The dairy industry, including manufacturers of yogurts and ice creams, represents a steady customer base, using fructose for its clean taste profile and ability to depress the freezing point in frozen desserts.

The fastest-growing potential customer segment encompasses nutraceutical and pharmaceutical companies. In pharmaceuticals, fructose serves as a highly soluble, non-reactive excipient, tablet binder, and flavoring agent to mask the bitterness of active ingredients in pediatric medicines and oral suspensions. Nutraceutical manufacturers use crystalline fructose in protein powders, meal replacement shakes, and health bars, valuing its specific metabolic pathway and lower glycemic index for products marketed toward fitness enthusiasts and consumers managing glucose levels. These buyers demand the highest purity grades and detailed certification documentation, making quality assurance a key purchasing criterion.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,175 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tate & Lyle PLC, ADM, Cargill Incorporated, Ingredion Incorporated, Roquette Frères, COFCO Biochemical (Anhui) Co., Ltd., Global Sweeteners Holdings Limited, Mitsubishi Shoji Foodtech Co., Ltd., Kerry Group plc, Südzucker AG, Xylitol China, Incorporated, Fazer Group, P&H Milling Group, Hangzhou Sanba Chemical Co., Ltd., PureCircle Ltd., Shandong Tianli Pharmaceutical Co., Ltd., Galam Group, Samyang Genex. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Crystalline Fructose Market Key Technology Landscape

The Crystalline Fructose market relies heavily on advanced biochemical processing and separation technologies to achieve the required high purity level. The core technological process is the isomerization of glucose to fructose using immobilized enzyme systems (typically glucose isomerase). This is followed by critical separation stages, primarily involving Simulated Moving Bed (SMB) chromatography, which is essential for efficiently separating fructose from remaining glucose and other residual components in the high-fructose syrup. SMB technology allows for continuous, high-throughput separation with minimal solvent usage, making it the standard for industrial-scale, high-purity crystalline fructose production. Innovations in enzyme technology, aiming for higher isomerization conversion rates at lower temperatures, are continually sought to reduce energy consumption and operational costs.

Further technological advancements are concentrated in the crystallization and drying phases. Achieving a stable, non-caking crystalline product requires precise control over supersaturation levels and crystal growth kinetics. Modern facilities utilize continuous vacuum crystallizers and fluid bed dryers, coupled with sophisticated process analytical technology (PAT) to monitor moisture content and particle size distribution in real time. Optimizing these processes is critical because inconsistent crystal size or excess moisture content significantly reduces shelf stability and handling ease for downstream users. Research efforts are also focused on developing sustainable, solvent-free crystallization methods and improving overall yield efficiency from the input syrup.

The emerging technological landscape includes exploration into non-corn feedstock processing, utilizing starch sources like potato or tapioca (cassava) to cater to the growing demand for non-GMO certified products and to mitigate risks associated with reliance solely on corn. Additionally, there is increasing integration of digitalization and Industrial Internet of Things (IIoT) sensors across the manufacturing chain. This technological adoption facilitates predictive maintenance, improves system uptime, and enables tighter process control, ensuring compliance with strict pharmaceutical and food safety regulations. These technological innovations collectively define the competitive edge in the highly mechanized production environment of crystalline fructose.

Regional Highlights

The global Crystalline Fructose Market exhibits substantial regional variation in terms of consumption patterns, regulatory environments, and feedstock availability. North America, particularly the United States, represents a mature but substantial market, characterized by high adoption rates in the sports and functional beverage sectors. The region benefits from robust infrastructure and a reliable supply chain derived from corn wet milling operations. However, growth is tempered by intensive marketing efforts for zero-calorie sweeteners and persistent public scrutiny regarding caloric intake. Regulatory guidance from agencies like the FDA significantly influences product labeling and marketing claims, necessitating careful adherence by market players. The market dynamics here are defined by innovation in specialized diet foods and sustained demand from established industrial users.

Asia Pacific (APAC) is positioned as the primary growth engine for the crystalline fructose market over the forecast period. Countries such as China, India, and Southeast Asian nations are experiencing rapid urbanization, leading to an expansion of the middle class and increased consumption of packaged foods, confectioneries, and Western-style beverages. This region’s high growth is also driven by improving awareness regarding dietary management and increasing instances of lifestyle diseases, boosting demand for low glycemic index ingredients in dietetic products. Local manufacturers are rapidly scaling up production capacity, often leveraging domestic starch sources like rice and cassava, although investment in advanced separation technology remains a crucial requirement for competing with global purity standards.

Europe maintains a stable market share, underpinned by stringent quality standards and a strong emphasis on natural and clean label ingredients. European consumers demonstrate a higher preference for transparent sourcing and non-GMO certification, often driving manufacturers to utilize non-corn sources or certified non-GMO corn derivatives. Demand is concentrated in the functional food and pharmaceutical segments. Meanwhile, Latin America (LATAM) and the Middle East & Africa (MEA) are emerging markets showing promising growth. LATAM’s growth is spurred by expanding food processing industries in Brazil and Mexico, while MEA's expansion is tied to population growth and increasing affluence, though both regions face challenges related to supply chain complexity and logistical costs for imported ingredients.

- North America: Mature market, high adoption in sports and functional beverages, driven by corn-based supply.

- Asia Pacific (APAC): Fastest growing region, fueled by urbanization, rising disposable income, and expanding processed food consumption in China and India.

- Europe: Stable growth, emphasis on non-GMO and clean label ingredients, strong demand from pharmaceutical and high-end nutraceuticals.

- Latin America (LATAM): Emerging market, growth driven by expanding domestic food and beverage production, reliance on imports or local sugarcane derivatives.

- Middle East & Africa (MEA): Growth potential linked to demographic shifts and increased investment in local food manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Crystalline Fructose Market.- Tate & Lyle PLC

- Archer Daniels Midland Company (ADM)

- Cargill Incorporated

- Ingredion Incorporated

- Roquette Frères

- COFCO Biochemical (Anhui) Co., Ltd.

- Global Sweeteners Holdings Limited

- Mitsubishi Shoji Foodtech Co., Ltd.

- Kerry Group plc

- Südzucker AG

- Xylitol China, Incorporated

- Fazer Group

- P&H Milling Group

- Hangzhou Sanba Chemical Co., Ltd.

- Shandong Tianli Pharmaceutical Co., Ltd.

- Galam Group

- Samyang Genex

- Quantum Hi-Tech Biological Co., Ltd.

- Shandong Futeng Biotechnology Co., Ltd.

- Jining Henglian Food Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Crystalline Fructose market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between crystalline fructose and High Fructose Corn Syrup (HFCS)?

Crystalline fructose is a highly purified, granulated form of fructose (typically 98%+ purity), whereas HFCS is a liquid blend of fructose, glucose, and water (commonly 42% or 55% fructose content). Crystalline fructose offers superior purity, stability, and higher relative sweetness, making it suitable for specialized applications like dry mixes and pharmaceutical formulations where HFCS cannot be used.

What are the main applications driving demand in the Crystalline Fructose Market?

The principal applications driving market demand are the food and beverage sectors, particularly in non-alcoholic drinks, functional foods, and sports nutrition products. Its utility in baking as a humectant to preserve moisture, coupled with growing usage in the nutraceutical industry for low glycemic index formulations, further cements its market relevance.

How does the lower glycemic index of crystalline fructose benefit end-users?

Crystalline fructose has a lower glycemic index (GI) compared to sucrose or glucose, meaning it causes a slower and less dramatic spike in blood sugar levels. This characteristic is highly valued in the creation of dietetic, diabetic-friendly, and health-focused products, allowing manufacturers to cater to consumers seeking better blood glucose management and sustained energy release.

Which geographical region is expected to exhibit the highest growth rate for crystalline fructose?

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR). This acceleration is attributed to rapidly growing populations, increasing disposable incomes, and the corresponding shift toward Westernized dietary habits involving higher consumption of packaged and processed food and beverage products.

What are the key technological challenges in the production of crystalline fructose?

Key technological challenges include optimizing the energy-intensive purification and crystallization stages, particularly achieving consistent ultra-high purity (>98%) efficiently. Manufacturers constantly focus on improving Simulated Moving Bed (SMB) chromatography separation efficacy and reducing energy consumption in the drying phase to maintain cost competitiveness and product quality stability.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager