Cube Ice Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435258 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Cube Ice Market Size

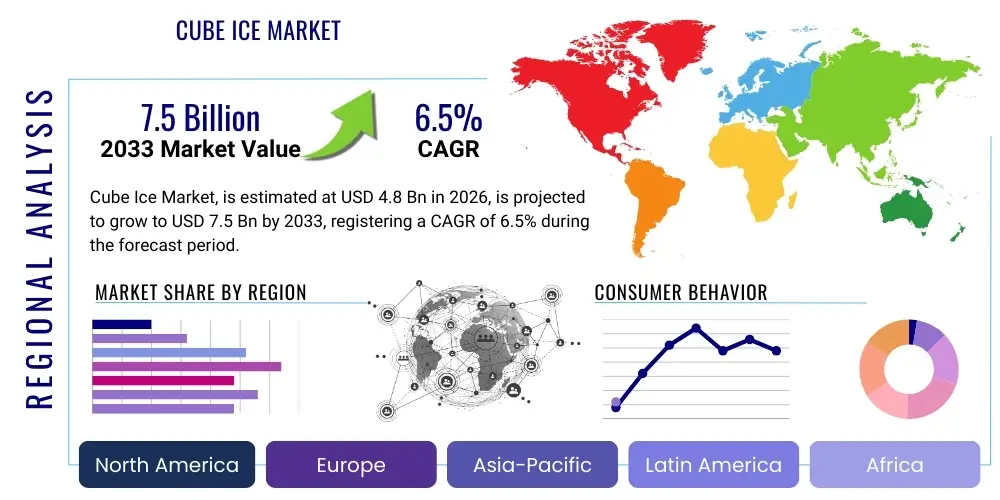

The Cube Ice Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 7.5 Billion by the end of the forecast period in 2033.

Cube Ice Market introduction

The Cube Ice Market encompasses the manufacturing, distribution, and sale of standardized, commercially produced ice cubes, primarily utilized for cooling beverages and preserving foodstuffs. This segment includes both packaged ice sold in retail channels and ice generated on-premise using commercial ice machines. Cube ice, characterized by its uniform shape and high density, is preferred across various sectors, including food service, hospitality, retail grocery, and commercial catering. The product is fundamentally defined by its ability to rapidly chill liquids while maintaining a slow melting rate, ensuring quality consumption experience, making it a critical component of the cold chain infrastructure globally.

Major applications of cube ice span from consumer use in homes and recreational activities to high-volume commercial needs such as cocktail preparation, soda fountain dispensing, and bulk cooling processes in perishable goods transport. The foundational benefits of using commercially produced cube ice include convenience, sanitation, and standardization. Modern production techniques utilize advanced filtration systems, ensuring that packaged ice adheres to stringent food safety and water quality standards, addressing key consumer concerns related to hygiene and purity compared to self-made ice. This reliability is a major driver, particularly in regulatory-heavy regions and high-end hospitality venues where brand reputation is paramount.

Driving factors propelling the market expansion include the increasing urbanization and the resulting demand for ready-to-consume food and beverages, especially in emerging economies. Furthermore, the robust growth in the global tourism and hospitality industry, particularly the proliferation of quick-service restaurants (QSRs), cafes, and bars, significantly escalates the need for large, consistent supplies of ice. Climate change and persistently warmer weather patterns in many regions also contribute to elevated seasonal demand for cooling agents. Technological advancements in energy-efficient ice manufacturing and improved packaging solutions that extend shelf life are further solidifying the market's growth trajectory, shifting reliance away from traditional, less sanitary methods.

Cube Ice Market Executive Summary

The Cube Ice Market is currently characterized by significant fragmentation in terms of regional supply chains, contrasted with consolidation among global players in the packaged ice segment. A key business trend involves sustainability mandates, where manufacturers are increasingly investing in ice machines that minimize water consumption and utilize refrigerants with low Global Warming Potential (GWP). Pricing strategies are heavily influenced by fluctuating utility costs, particularly electricity and water, alongside intense local competition, necessitating operational efficiencies. The adoption of subscription and delivery models, leveraging e-commerce platforms and specialized logistics for cold chain management, represents a notable shift in how ice reaches both commercial and residential end-users, enhancing convenience and reducing storage burden for retailers.

Regionally, North America and Europe maintain dominance, driven by high consumer spending on food service and well-established cold chain logistics. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth, propelled by rapid infrastructure development, rising disposable incomes, and the massive expansion of the HoReCa (Hotels, Restaurants, and Cafes) sector, particularly in countries like China and India. The seasonal variability in demand is acutely felt across all regions, demanding robust inventory management systems. Furthermore, regulatory environments concerning food safety and water quality significantly impact regional market dynamics; for instance, stricter sanitation controls in developed markets drive demand for premium, certified packaged ice products.

Regarding segmentation, the Food Service segment holds the largest market share due to the inherently high volume requirements of bars, restaurants, and institutional catering. Within the production type segmentation, packaged ice is seeing increased retail penetration due to consumer preferences for hygienic, readily available cooling solutions, often surpassing the growth rate of on-premise ice generation in certain residential and small commercial contexts. Furthermore, advancements in specialized ice cube shapes and sizes, catering to niche beverage applications (e.g., craft cocktails requiring specific clarity and melting characteristics), are creating premium sub-segments and driving marginal revenue growth for specialized suppliers. The shift towards automated distribution mechanisms, reducing human handling, is a consistent trend across all segments, addressing operational hygiene concerns.

AI Impact Analysis on Cube Ice Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cube Ice Market primarily center around operational optimization, predictive maintenance, and supply chain efficiency. Key themes include how AI can forecast highly variable demand patterns, which are subject to weather extremes and localized events, and whether intelligent systems can improve the energy efficiency of ice production plants. Users are concerned about the cost implications of implementing AI-driven automation in traditional manufacturing settings and how these technologies could enhance sanitation monitoring and quality control, thereby reducing regulatory risks. Expectations involve AI transforming the logistics of ice distribution, especially in urban environments where delivery timing is critical for maintaining product integrity and minimizing melting losses.

- AI-powered demand forecasting utilizes meteorological data, event schedules, and historical sales trends to predict highly variable seasonal and localized ice requirements, optimizing production schedules and reducing energy waste from unnecessary operation.

- Predictive maintenance systems employ machine learning algorithms to analyze sensor data from industrial ice machines, identifying potential component failures (e.g., compressors, water pumps) before they occur, thus minimizing costly downtime and ensuring continuous supply during peak demand.

- Optimized cold chain logistics using AI routing algorithms improve delivery efficiency, reducing fuel consumption and minimizing melting losses during transit, which is critical for maintaining profitability in the packaged ice sector.

- Enhanced quality control systems leverage computer vision and sensor technology to automatically monitor water filtration processes and ice crystal structure, ensuring consistent product quality and adherence to strict hygiene standards without extensive manual inspection.

- AI integration in energy management systems monitors and adjusts production cycles based on real-time electricity prices and grid load, allowing manufacturers to run high-energy processes during off-peak hours, substantially reducing operational utility costs.

DRO & Impact Forces Of Cube Ice Market

The Cube Ice Market dynamics are shaped by a complex interplay of demand-side growth factors and operational constraints. Key drivers include the massive expansion of the global food service and hospitality industries, particularly the proliferation of bars, QSRs, and catering services that rely on high-volume, standardized ice supply. Moreover, rising global temperatures due to climate change consistently boost consumer and commercial demand for cooling agents, especially during extended summer seasons. Convenience and hygiene factors associated with packaged ice are also significant drivers, shifting consumer preferences away from self-production towards certified, commercially sterile products, particularly in regions with concerns over municipal water quality.

Restraints primarily revolve around the high operational costs associated with maintaining the cold chain. Energy consumption for industrial freezing processes and the logistics of refrigerated transport constitute a major hurdle, directly impacting profitability margins, especially for smaller market participants. Furthermore, the highly seasonal nature of demand creates challenges in capacity utilization; plants often run at maximum capacity for a few months and significantly reduced capacity otherwise, leading to inefficient resource allocation over the year. Competition from inexpensive, on-premise ice machines, particularly in large commercial establishments that can justify the capital expenditure, also acts as a restraint on the packaged ice segment.

Opportunities in the market center on technological innovation, specifically the development and adoption of high-efficiency ice machines that minimize water usage and energy draw, aligning with corporate sustainability goals. The penetration of cube ice in emerging markets, characterized by rapid urbanization and increasing cold beverage consumption, presents substantial untapped potential. Furthermore, product diversification into specialty ice forms (e.g., gourmet, clear ice for premium beverages) allows manufacturers to command higher price points and cater to the growing craft beverage movement. The increasing focus on food safety regulations globally provides an opportunity for certified packaged ice providers to differentiate themselves based on verifiable purity standards and quality assurance protocols, solidifying market trust and consumer loyalty.

The impact forces are substantial, driven predominantly by technological advancements in freezing technology and geopolitical stability affecting energy prices. The continuous pressure to reduce the environmental footprint necessitates investment in sustainable refrigerants (e.g., natural refrigerants like R717) and highly efficient heat exchangers, compelling market players to modernize infrastructure or face obsolescence. Consumer behavior, increasingly focused on health and environmental stewardship, indirectly pressures suppliers to ensure both the purity of the product and the sustainable sourcing of water. Lastly, regulatory shifts in food handling and sanitation standards globally act as a major external force, dictating the minimum quality baseline required to operate successfully in the commercial ice sector.

Segmentation Analysis

The Cube Ice Market segmentation provides a granular view of demand distribution and consumption patterns across different user profiles and production methodologies. The market is fundamentally segmented by End-Use, which delineates where the final product is consumed; by Production Type, separating commercially prepared packaged ice from ice generated in-house; and by Distribution Channel, which examines the primary routes to market. Analyzing these segments is crucial for identifying high-growth pockets, tailoring product offerings (e.g., varying purity levels or bag sizes), and optimizing distribution strategies to maximize logistical efficiency, particularly in highly competitive urban and seasonal markets.

The segmentation highlights the duality of the market, which serves both industrial B2B clients (Food Service, Commercial) requiring bulk supply and B2C clients (Retail, Residential) demanding convenience and smaller volumes. The rapid expansion of the food delivery ecosystem and the rise of convenience stores have blurred some traditional boundaries, necessitating agile supply chain solutions capable of handling both high-volume deliveries to restaurants and frequent, smaller replenishment orders to retail outlets. Understanding the nuances within each segment, such as the specific quality requirements for premium bars versus mass-market QSRs, allows companies to effectively position their brands and manage pricing elasticity within these diverse consumer groups, ultimately driving overall market performance and stability against external economic shocks.

- By End-Use:

- Food Service (Restaurants, Cafes, Bars, Catering)

- Retail (Grocery Stores, Convenience Stores, Gas Stations)

- Residential (Household Consumption, Events)

- Commercial & Institutional (Hospitals, Hotels, Corporate Offices, Construction Sites)

- By Production Type:

- Packaged Ice (Bagged, Branded Retail Ice)

- On-Premise Ice Generation (Commercial Ice Machines used in HoReCa)

- By Distribution Channel:

- Supermarkets and Hypermarkets

- Convenience Stores and Small Retailers

- Online Retail and Direct-to-Consumer Delivery

- Direct Sales to Commercial Users

Value Chain Analysis For Cube Ice Market

The Cube Ice Market value chain commences with the upstream acquisition and purification of water, which is the primary raw material. Upstream processes involve sourcing high-quality water, mandatory multiple-stage filtration, and sterilization techniques (including reverse osmosis and UV treatment) to meet potable water standards, significantly increasing the cost and complexity compared to standard municipal water usage. Key upstream suppliers include specialized filtration equipment manufacturers and suppliers of industrial refrigerants and compressors, whose technological advancements directly influence the energy efficiency and purity achievable in the production phase. Manufacturing involves highly automated industrial freezers and packaging machinery, where efficiency and sanitation protocols are the central focus of operational excellence.

The downstream segment encompasses distribution and final consumption. Distribution is arguably the most critical and expensive component of the value chain, heavily reliant on maintaining the cold chain integrity through refrigerated storage facilities and specialized transport vehicles. The distribution channel is bifurcated into direct sales, typically utilized for high-volume commercial clients (e.g., major hotel chains or institutional food service providers), and indirect sales through retail networks. Indirect channels rely on third-party logistics (3PLs) or integrated distributor networks that manage last-mile delivery to grocery stores, convenience stores, and specialized ice vending locations, where inventory turnover must be rapid to minimize melt loss.

Both direct and indirect channels demand rigorous inventory management and logistical scheduling, particularly during peak seasons. Direct distribution offers manufacturers greater control over branding and pricing but requires significant capital investment in fleet management. Indirect channels, while outsourcing the logistical complexity, introduce margin pressure from retailers and distributors. A notable trend is the increased use of technology, such as real-time tracking and temperature monitoring systems, across both distribution models to ensure product safety and quality assurance. The efficiency of the downstream segment directly influences the final price and accessibility of cube ice to the end-user, making logistical optimization a primary competitive differentiator in mature markets.

Cube Ice Market Potential Customers

Potential customers for the Cube Ice Market are highly diverse, spanning both the business-to-business (B2B) and business-to-consumer (B2C) domains, characterized by a fundamental need for reliable and sanitary cooling agents. The most significant end-user segment is the Food Service industry, encompassing all establishments that prepare and serve beverages and chilled food, including global QSR chains, fine-dining restaurants, local bars, and large-scale institutional caterers. These customers require consistent, high-volume supplies, often demanding customized sizes or shapes of ice for aesthetic or functional purposes (e.g., maximizing displacement in drinks).

Another major buyer category is the Retail sector, comprising supermarkets, hypermarkets, convenience stores, and specialized ice vending machine operators. These customers purchase packaged ice for resale to the general public for use in homes, parties, camping, and other recreational activities. The demand here is highly driven by seasonality, temperature spikes, and proximity to densely populated residential areas. These retailers prioritize ease of handling, attractive packaging, and guaranteed shelf stability, relying on manufacturers for reliable just-in-time delivery to avoid stockouts during critical demand periods.

Furthermore, the Commercial and Institutional sectors represent steady, often year-round, consumption patterns. This includes hospitals and healthcare facilities that use ice for medical and therapeutic purposes, large corporate offices that operate cafeterias, construction sites requiring hydration solutions, and the extensive network of hotels and resorts globally. For these institutional buyers, the critical factors are certified purity (especially in healthcare), reliability of supply, and competitive bulk pricing through contractual agreements, often favoring large manufacturers capable of meeting specific quality compliance and volume commitments across multiple locations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 7.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | The Arctic Glacier Company, Reddy Ice, US Ice Corp., Emergency Ice Inc., Ice District, Hoshizaki Corporation, Manitowoc Ice, Scotsman Ice Systems, Kold-Draft, Follett LLC, North Star Ice Equipment, Koller, Focusun, Ice Express, Icemasters, Custom Ice Inc., Crystal Ice Company, G&S Quality Ice, Polar Ice, Rutter's |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cube Ice Market Key Technology Landscape

The technological landscape of the Cube Ice Market is centered on enhancing energy efficiency, improving water purification standards, and increasing automation in production and packaging. Modern industrial ice machines primarily rely on advanced vapor compression refrigeration cycles, utilizing increasingly environmentally friendly refrigerants, moving away from high GWP HFCs towards natural alternatives like R290 (Propane) and R744 (CO2), which comply with tightening global environmental mandates. Significant advancements have been made in thermal efficiency, utilizing optimized heat exchangers and sophisticated microprocessors for cycle control, leading to substantial reductions in kilowatt-hour consumption per ton of ice produced, directly addressing the market's primary operational restraint: high electricity costs.

Furthermore, water purification technology is paramount, driven by consumer expectations and regulatory mandates for purity. Key technologies include multi-stage filtration systems incorporating sediment filters, activated carbon filtration to remove tastes and odors, and advanced sterilization techniques such as Reverse Osmosis (RO) and UltraViolet (UV) light treatment. These technologies ensure that the final product, particularly packaged ice, is free from contaminants and micro-organisms, thereby positioning certified packaged ice as a superior, hygienic alternative to tap water or less regulated homemade ice. The use of sophisticated monitoring sensors integrated into these systems ensures continuous compliance and real-time quality assurance throughout the production cycle.

Automation and packaging technologies also represent a crucial element of the landscape. High-speed, automated packaging lines minimize human contact, enhancing sanitation and increasing throughput. This includes robotic arm utilization for bag handling, precise weight measurement systems, and improved bag sealing materials that maintain the integrity of the ice during distribution and storage, minimizing contamination and maximizing melt resistance. For the on-premise segment, self-cleaning and modular ice machine designs are key technological selling points, simplifying maintenance, reducing labor requirements, and improving the operational lifecycle of the equipment for commercial users in the hospitality and food service industries.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for cube ice, driven by high consumer spending on food service, extensive outdoor recreational activities, and a deeply entrenched culture of cold beverage consumption. The region is characterized by highly sophisticated cold chain logistics and the dominance of large, consolidated packaged ice manufacturers who heavily invest in branding and retail distribution networks. Demand is intense and highly seasonal, with significant market activity concentrated in the Southern and Western states. Stringent food safety regulations compel high investment in certified purification and packaging technologies.

- Europe: The European market shows steady growth, driven by the strong tourism industry and increasing adoption of QSR and convenience food formats, particularly in Southern and Western Europe. Market dynamics are slightly fragmented due to varying national regulations concerning water quality and product labeling. The focus in Europe is increasingly on sustainability, promoting the adoption of energy-efficient ice machines and the use of natural refrigerants, driven by stringent EU environmental directives. Demand for specialty, clear ice for the craft cocktail scene is a notable growth niche in major metropolitan areas.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by rapid urbanization, expanding middle-class populations, and significant infrastructure investment in the hospitality and food service sectors across countries like China, India, and Southeast Asia. The rise in disposable income correlates directly with increased consumption of Westernized cold beverages and packaged convenience foods. Challenges include developing robust, reliable cold chain infrastructure, especially in rural areas, but the sheer scale of population and consumption potential offers unparalleled growth opportunities for packaged ice suppliers.

- Latin America (LATAM): The LATAM market is characterized by high, year-round ambient temperatures in many countries, sustaining consistent demand for ice. Growth is spurred by improved economic stability and the expansion of international hotel chains and restaurant franchises. Market penetration of packaged ice is increasing, driven by hygiene concerns regarding local water supplies in some areas, positioning commercially sterilized ice as a premium health necessity. However, volatile economic conditions and logistical challenges present operational hurdles.

- Middle East and Africa (MEA): Demand in the MEA region is strongly sustained by extremely high temperatures, particularly in the Gulf Cooperation Council (GCC) countries, and substantial tourism inflows. The Middle Eastern segment demands premium quality, often imported, packaged ice due to high per capita income and stringent quality expectations within the luxury hospitality sector. Africa presents a nascent but high-potential market, where investment in reliable power supply and cold chain logistics is essential for expanding the commercial ice market beyond major metropolitan centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cube Ice Market.- The Arctic Glacier Company

- Reddy Ice

- US Ice Corp.

- Emergency Ice Inc.

- Ice District

- Hoshizaki Corporation

- Manitowoc Ice

- Scotsman Ice Systems

- Kold-Draft

- Follett LLC

- North Star Ice Equipment

- Koller

- Focusun

- Ice Express

- Icemasters

- Custom Ice Inc.

- Crystal Ice Company

- G&S Quality Ice

- Polar Ice

- Rutter's

Frequently Asked Questions

What is the primary factor driving the demand for packaged cube ice over on-premise ice?

The primary factor driving the demand for packaged cube ice is guaranteed hygiene and certification standards. Packaged ice undergoes rigorous filtration, reverse osmosis, and UV sterilization processes, ensuring purity and minimizing health risks associated with variable municipal water quality or poorly maintained commercial ice machines, making it the preferred choice for consumer retail and sensitive commercial applications.

How do fluctuating energy costs impact the profitability of the Cube Ice Market?

Fluctuating energy costs significantly impact profitability because the production and maintenance of the cold chain (freezing, storage, and refrigerated transport) are highly energy-intensive processes. Manufacturers must absorb or pass on these increases, leading to price volatility. This dynamic drives continuous investment in energy-efficient production technologies, such as advanced heat recovery systems and solar power integration, to mitigate operational expenditure risks.

Which geographical region exhibits the highest growth potential for the Cube Ice Market between 2026 and 2033?

The Asia Pacific (APAC) region is projected to exhibit the highest growth potential. This rapid expansion is attributed to fast-paced urbanization, the substantial growth of the middle class, and explosive development within the food service and hospitality industries, necessitating reliable, commercially produced ice supplies across densely populated and increasingly affluent urban centers.

What role does Artificial Intelligence play in optimizing cube ice production and distribution?

AI plays a critical role in optimization through precise demand forecasting, integrating real-time weather data and event schedules to align production cycles, thereby minimizing unnecessary energy consumption and reducing waste. Furthermore, AI-driven routing optimizes refrigerated logistics, ensuring faster delivery, reduced fuel costs, and minimized melt loss across the complex cold chain network.

What are the key technological trends influencing the design of modern industrial cube ice machines?

Key technological trends focus on sustainability and efficiency, including the integration of low Global Warming Potential (GWP) natural refrigerants (like CO2 or Propane), advanced self-cleaning mechanisms to ensure sanitation, and modular designs that allow for easy maintenance and scaling. Continuous improvement in water purification systems, utilizing multi-stage RO and UV treatment, remains standard for product quality assurance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager