Cultivator Finisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435422 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Cultivator Finisher Market Size

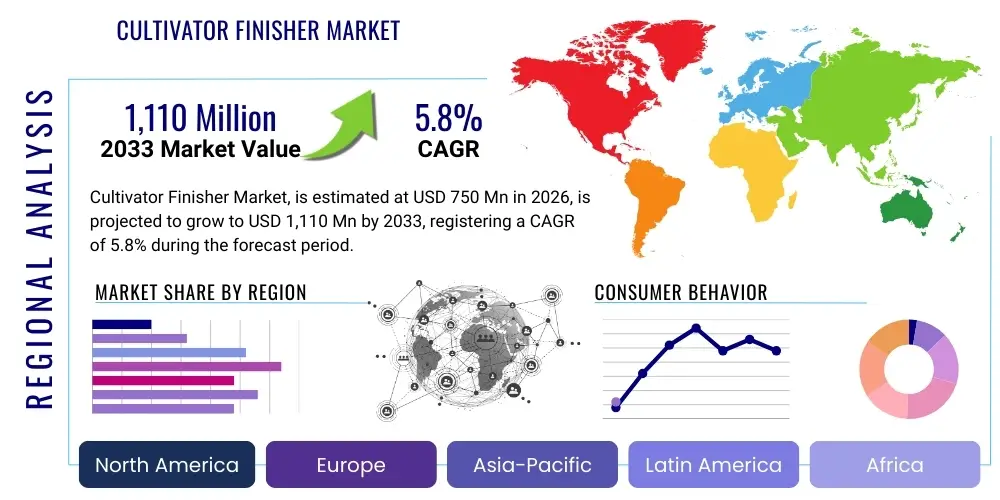

The Cultivator Finisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $750 Million in 2026 and is projected to reach $1,110 Million by the end of the forecast period in 2033.

Cultivator Finisher Market introduction

The Cultivator Finisher Market encompasses specialized agricultural machinery designed for secondary tillage operations, combining multiple soil preparation functions—such as cultivating, leveling, and seedbed firming—into a single pass. This integration significantly improves field efficiency, reduces fuel consumption, and optimizes soil structure immediately prior to planting. These implements are critical components in modern high-efficiency farming systems, playing a vital role in creating an optimal environment for seed germination and early plant development, thereby directly impacting overall crop yield and quality. The design innovations often focus on incorporating variable rate technology and enhanced residue management capabilities to suit diverse soil types and farming practices globally.

Major applications of cultivator finishers span across large-scale row crop farming, particularly for crops like corn, soybeans, wheat, and cotton, and broadacre operations where uniform seedbed preparation is paramount. The primary benefit derived from utilizing these machines is the maximization of operational throughput, allowing farmers to capitalize on narrow planting windows. Furthermore, the modern finisher's ability to minimize soil disturbance compared to traditional intensive tillage methods aligns strongly with the rising global emphasis on sustainable agriculture and soil health preservation. The dual action of incorporating crop residue while providing a smooth, consolidated seedbed makes them indispensable for maximizing the effectiveness of expensive, high-throughput planting equipment.

Driving factors for the market include the persistent global demand for increased agricultural productivity, necessitating the adoption of high-performance implements capable of handling vast acreage efficiently. The proliferation of precision agriculture techniques, which require finely tuned, uniform seedbeds for optimal sensor-guided planting, further accelerates demand. Additionally, government subsidies and incentive programs promoting farm mechanization and sustainable farming practices in emerging economies are instrumental in expanding the market's reach. The continuous innovation in materials science leading to lighter yet more durable implements also enhances the appeal and lifespan of cultivator finishers.

Cultivator Finisher Market Executive Summary

The Cultivator Finisher Market is undergoing robust expansion, characterized by a significant shift towards smart, interconnected machinery that integrates seamlessly with broader farm management systems. Business trends indicate a focus on modular designs, allowing farmers to customize their implements based on specific field conditions and tillage goals, moving away from rigid, single-purpose machinery. The market structure is moderately fragmented, with large multinational original equipment manufacturers (OEMs) dominating through expansive distribution networks and technological superiority, while specialized regional players focus on niche segments such as reduced tillage or organic farming applications. Supply chain resilience, particularly concerning steel and hydraulic components, remains a critical factor influencing production timelines and final equipment pricing in the current macroeconomic environment.

Regional trends highlight North America and Europe as mature markets driven by replacement cycles, high technology adoption rates, and stringent environmental regulations favoring minimal disturbance equipment. Conversely, the Asia Pacific (APAC) region, particularly India and China, represents the fastest-growing segment, propelled by increasing farm mechanization rates, favorable government policies promoting agricultural modernization, and the increasing consolidation of small land holdings into larger, commercially viable operations. Latin America is also showing accelerated growth, fueled by the expansion of soybean and corn production requiring efficient secondary tillage solutions. Investment in service infrastructure and localized component sourcing are crucial strategies for market penetration in these high-growth geographies.

Segmentation trends show a clear preference for towed cultivator finishers due to their versatility and compatibility with a wide range of tractor horsepower, making them the leading segment by market share. However, the self-propelled segment is witnessing accelerated technological integration, particularly in the realm of autonomy and high-precision mapping capabilities. Technology segmentation indicates a growing dominance of reduced tillage and conservation tillage finishers, reflecting the global imperative to mitigate soil erosion, sequester carbon, and improve water retention capabilities. The application segment remains concentrated in broadacre farming, where the efficiency gains of single-pass finishing operations yield the highest return on investment.

AI Impact Analysis on Cultivator Finisher Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cultivator Finisher Market primarily revolve around operational autonomy, predictive maintenance, and real-time field optimization. Key themes center on whether AI can enable implements to dynamically adjust tillage depth and aggressiveness based on integrated soil data (e.g., moisture, compaction variability) detected instantaneously during operation, thereby achieving hyper-localized, precision seedbed preparation. Concerns often focus on the complexity and cost associated with integrating sophisticated AI algorithms into robust mechanical equipment, as well as the need for standardized data protocols to ensure interoperability between the finisher, the tractor, and farm management software. Expectations are high regarding the potential for AI-driven systems to minimize human error, reduce fuel waste through optimized pulling resistance, and significantly extend the service life of wear components by predicting failure points.

- AI facilitates autonomous operation of finisher implements, removing the need for constant manual supervision and increasing operational safety.

- Predictive maintenance algorithms analyze sensor data (vibration, temperature, load) to forecast component failure, drastically reducing unplanned downtime.

- Real-time soil mapping and adjustment systems use AI to dynamically alter shank depth and angle based on instantaneous ground conditions, maximizing seedbed uniformity.

- Optimization of implement logistics and path planning via AI minimizes overlap and reduces fuel consumption across large fields.

- Enhanced residue management through AI vision systems ensures optimal incorporation rates based on predefined agronomic targets.

DRO & Impact Forces Of Cultivator Finisher Market

The Cultivator Finisher Market is shaped by significant impact forces stemming from economic viability, environmental mandates, and technological advancements. Drivers predominantly include the critical necessity for operational efficiency gains in agriculture to meet escalating global food demand, coupled with increasing farm labor costs which necessitate investment in automated and high-throughput machinery. The rising adoption of precision agriculture methodologies, which demand pristine and uniform seedbeds for optimal planting accuracy, serves as a fundamental driver. Furthermore, government policies across key agricultural regions promoting soil health and reduced environmental impact favor the adoption of modern finishers capable of reduced or conservation tillage.

Restraints impeding market growth primarily revolve around the substantial initial capital investment required for purchasing high-specification cultivator finishers, particularly for small and medium-sized farming operations in developing economies. The lack of standardized infrastructure, including limited connectivity and technical expertise required to operate and maintain sophisticated, sensor-laden equipment in rural areas, presents a significant barrier. Additionally, volatility in raw material costs, particularly steel and specialized alloys, frequently leads to unpredictable pricing and affects the profitability margins for OEMs, which is eventually passed onto the end-user.

Opportunities for expansion are centered on the rapid development and commercialization of fully autonomous cultivator finishers, which offer unparalleled operational flexibility and labor savings. The expanding application scope in emerging markets through tailored, lower-cost models designed for specific regional crops and soil types represents a substantial growth avenue. Moreover, the increasing integration of Internet of Things (IoT) capabilities for real-time diagnostics and optimization, along with aftermarket service modernization focused on data-driven predictive maintenance contracts, opens new revenue streams for manufacturers and dealers. The collective influence of these forces suggests a strong long-term positive trajectory, driven heavily by technological integration aimed at sustainable intensification.

Segmentation Analysis

The Cultivator Finisher Market segmentation provides a granular view of market dynamics based on implement type, technology utilized, and specific agricultural application. The analysis reveals distinct preferences among different farming scales and geographical regions, influenced by localized soil conditions, crop rotation practices, and available capital expenditure budgets. The market is primarily divided into towed and self-propelled types, where towed implements dominate in volume due to their cost-effectiveness and broad compatibility, while self-propelled units are emerging as the choice for highly automated, large-scale farming demanding superior precision and integrated systems control. Technology segmentation highlights the trend toward reduced tillage solutions, signaling a shift in global agronomic philosophy towards conservation practices, which directly impacts equipment design requirements.

- By Type

- Towed Cultivator Finishers

- Self-Propelled Cultivator Finishers

- By Technology

- Standard Tillage Finishers

- Reduced Tillage Finishers

- Conservation Tillage Finishers

- By Application

- Row Crop Farming (Corn, Soybeans, Cotton)

- Broadacre Farming (Wheat, Barley, Canola)

- Specialty Crop Applications

- By Region

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Cultivator Finisher Market

The value chain for the Cultivator Finisher Market initiates with complex upstream activities involving the sourcing and processing of core raw materials, predominantly high-tensile steel, specialized wear-resistant alloys for shanks and sweeps, and sophisticated hydraulic and electronic components (e.g., GPS sensors, control units). Raw material procurement and component manufacturing, particularly hydraulics and precision engineering parts, often dictate the lead times and quality standards of the final product. Strategic relationships with reliable, quality-certified suppliers are paramount in managing cost fluctuations and ensuring the durability required for rugged agricultural use. This stage is capital-intensive and subject to global commodity price volatility.

The middle segment of the value chain involves design, manufacturing, and assembly, where major OEMs leverage advanced production techniques such as robotic welding and high-precision machining. Differentiation at this stage relies heavily on intellectual property related to soil engagement tool design, residue flow management, and system integration (connecting the finisher to the tractor’s electronic backbone). Downstream activities focus on effective distribution channels, which are predominantly dominated by robust networks of authorized independent dealerships. These dealers provide not only sales but also critical pre-sale consultation, post-sale maintenance, and crucial spare parts supply, especially for high-wear items.

Distribution channels for cultivator finishers are bifurcated into direct sales through proprietary dealership networks and indirect sales via large agricultural equipment distributors. For major global players, the dealership model (direct channel) ensures brand control, specialized service delivery, and consistent customer engagement. Indirect channels are often utilized in fragmented or emerging markets where localized distribution expertise is required. Aftermarket service, including the sale of replacement blades, shanks, and hydraulic parts, constitutes a significant and high-margin component of the downstream value chain, vital for maintaining equipment longevity and customer satisfaction over the typical operational lifespan of the finisher.

Cultivator Finisher Market Potential Customers

The primary customer base for cultivator finishers consists of commercial farming enterprises operating large tracts of arable land, where the economic benefits of increased efficiency and reduced pass counts are most pronounced. These operations prioritize minimizing input costs (fuel, labor) and maximizing planting windows, making high-speed, integrated finishing implements essential. Large corporate farms and institutional agricultural investors, often employing professional farm managers, represent key decision-makers focused on total cost of ownership (TCO) and advanced technological integration, including telemetry and GPS guidance capabilities.

Another significant customer segment includes agricultural cooperatives and large farm machinery rental companies. Cooperatives purchase machinery in bulk to service their member farms, emphasizing versatility and robust construction to handle various users and soil types. Rental companies require equipment known for its reliability and ease of maintenance, capable of enduring intense seasonal use across diverse client operations. These customers often look for standardized models that are compatible across different tractor brands and horsepower ranges, driving demand for flexible, universally compatible towed units.

Emerging customers include custom farm service providers (contract farmers) who specialize in offering tillage and planting services to smaller, neighboring farms that cannot justify the high capital expense of owning specialized equipment. These contractors require maximum machine uptime and efficiency, driving demand for premium, technologically advanced finishers with integrated diagnostics and proven durability. Furthermore, government agricultural research stations and large educational farms purchase modern finishers for demonstrating best practices in sustainable soil management and conducting yield trials.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750 Million |

| Market Forecast in 2033 | $1,110 Million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | John Deere, AGCO Corporation, CNH Industrial, Kubota Corporation, CLAAS Group, Väderstad, Pöttinger Landtechnik, Horsch Maschinen GmbH, Kverneland Group, Great Plains Manufacturing, SALFORD Group, Degelman Industries, Schulte Industries, Versatile, Morris Industries, Summers Manufacturing, Unverferth Manufacturing, Rite Way Manufacturing, McFarlane Manufacturing, Wil-Rich |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cultivator Finisher Market Key Technology Landscape

The technology landscape in the Cultivator Finisher Market is rapidly evolving, driven primarily by the need for enhanced precision and operational data collection. The fundamental technological shift involves integrating advanced sensing capabilities directly into the implement structure. This includes the widespread use of Internet of Things (IoT) sensors, accelerometers, and load cells positioned on shanks and hydraulic cylinders. These systems provide real-time feedback on soil resistance, vibration, and depth, allowing the operator or automated systems to make immediate micro-adjustments to maintain consistent working depth and minimize fuel wastage resulting from excessive pull. Data collected from these integrated sensors is then transmitted wirelessly to the tractor terminal and, subsequently, to cloud-based Farm Management Systems (FMS) for comprehensive agronomic reporting and future optimization.

Precision guidance technologies constitute another critical element, with high-accuracy GPS (Global Positioning System) and GNSS (Global Navigation Satellite System) playing a crucial role. These systems ensure accurate pass-to-pass guidance, virtually eliminating overlap in fieldwork, which saves time and input costs. Furthermore, variable rate technology (VRT) is being incorporated, enabling the finisher to dynamically adjust its configuration—such as changing the angle of harrows or the pressure on rolling baskets—based on pre-loaded prescription maps detailing soil variability or residue density across the field. This capability moves the finisher from a static preparation tool to an adaptive, intelligent implement essential for prescription farming.

The newest technological frontier involves the development of autonomous capabilities. While fully autonomous tractors are still gaining regulatory clearance, cultivator finishers are being designed with interfaces ready for future autonomy. This includes independent power packs and sophisticated on-board diagnostics capable of operating and self-correcting without constant human input. The focus is also heavily placed on material science, utilizing ceramic coatings and specialized carbide inserts on wear parts to dramatically increase their lifespan, reducing the frequency of costly maintenance interventions and further improving machine uptime during critical planting seasons.

Regional Highlights

Geographical market dynamics are highly reflective of farm size, government policies, and the maturity of precision agriculture adoption across continents.

- North America (United States and Canada): This region dominates the market value due to large farm sizes, high labor costs, and rapid adoption of high-horsepower, wide-span implements. The focus here is on efficiency, speed, and integrating finishers into sophisticated digital farming ecosystems. Demand is high for reduced tillage and autonomous-ready equipment.

- Europe (Germany, France, UK): Characterized by stringent environmental regulations and a strong focus on sustainability and soil health (e.g., carbon sequestration goals). The European market shows strong growth in conservation tillage finishers and advanced, precision-controlled implements from regional specialists like Väderstad and Pöttinger.

- Asia Pacific (APAC - China, India, Australia): Represents the fastest-growing market by volume, driven by aggressive agricultural modernization programs, increasing farm consolidation, and state subsidies promoting mechanized farming. While the adoption rate of basic finishers is high, the market is quickly moving towards sophisticated models, particularly in Australia’s broadacre regions.

- Latin America (Brazil, Argentina): Significant growth is anticipated due to the vast expansion of commodity crop production (soybeans, corn). The region is characterized by high demand for robust, high-durability finishers capable of handling challenging tropical and subtropical soil conditions and residue management associated with no-till farming systems.

- Middle East and Africa (MEA): Growth is driven primarily by government investment in large-scale commercial farming projects aimed at enhancing food security. The focus is often on implements suited for arid or semi-arid conditions that prioritize moisture retention and deep soil penetration capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cultivator Finisher Market.- John Deere

- AGCO Corporation

- CNH Industrial

- Kubota Corporation

- CLAAS Group

- Väderstad

- Pöttinger Landtechnik

- Horsch Maschinen GmbH

- Kverneland Group

- Great Plains Manufacturing

- SALFORD Group

- Degelman Industries

- Schulte Industries

- Versatile

- Morris Industries

- Summers Manufacturing

- Unverferth Manufacturing

- Rite Way Manufacturing

- McFarlane Manufacturing

- Wil-Rich

Frequently Asked Questions

Analyze common user questions about the Cultivator Finisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a cultivator finisher in modern agriculture?

The primary function of a cultivator finisher is to perform secondary tillage in a single pass, combining operations such as cultivating, leveling, and seedbed firming. This action creates an optimal, uniform seedbed structure necessary for precision planting and efficient crop germination, significantly improving overall field operational efficiency.

How does the adoption of reduced tillage technology affect cultivator finisher market demand?

The global shift toward reduced tillage and conservation farming practices significantly drives demand for specialized cultivator finishers designed to handle high residue levels while minimizing soil disturbance. These finishers must maintain precise depth control and residue flow capabilities, differentiating them from traditional intensive tillage equipment.

Which geographical region exhibits the highest growth potential for cultivator finishers?

The Asia Pacific (APAC) region, driven by countries like China and India, presents the highest growth potential. This growth is fueled by increasing farm mechanization rates, government subsidies supporting agricultural infrastructure, and the need for modern equipment to enhance yields on consolidating farmland.

What are the main technological innovations impacting the market?

Key technological innovations include the integration of IoT sensors for real-time soil data collection, GPS/GNSS for precision pass mapping and guidance, and AI-driven systems enabling dynamic, variable rate adjustment of implement depth and components to optimize seedbed preparation based on localized field conditions.

What is the estimated Compound Annual Growth Rate (CAGR) for the Cultivator Finisher Market?

The Cultivator Finisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% over the forecast period spanning from 2026 to 2033, driven by farm efficiency demands and continuous advancements in precision agriculture technology.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager