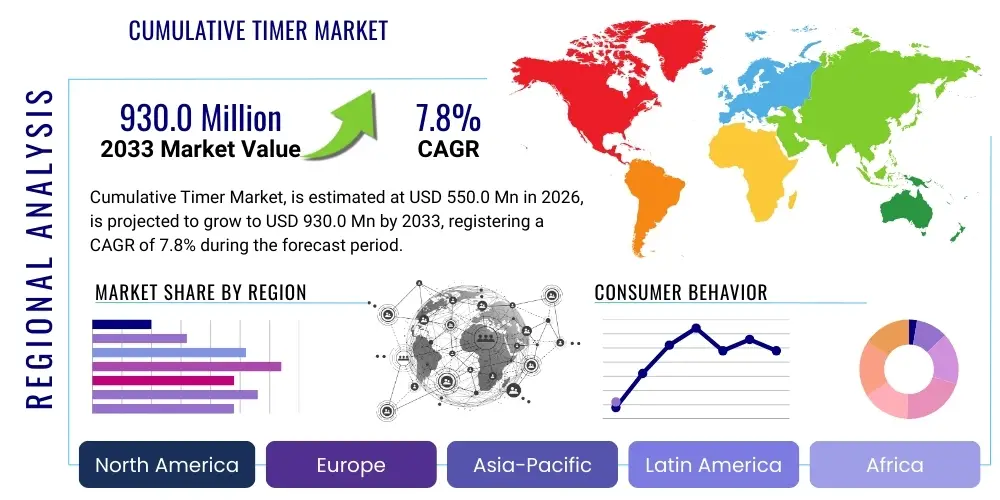

Cumulative Timer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438561 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cumulative Timer Market Size

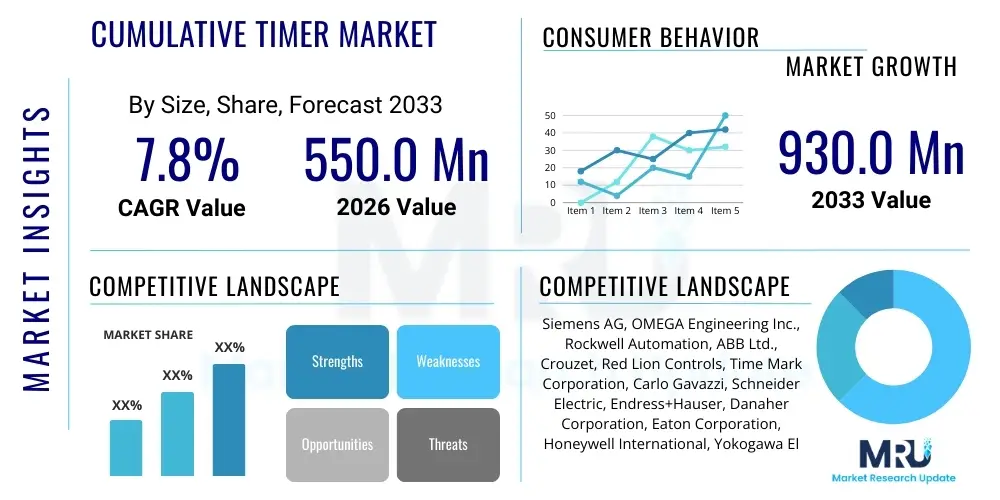

The Cumulative Timer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $550.0 Million USD in 2026 and is projected to reach $930.0 Million USD by the end of the forecast period in 2033.

Cumulative Timer Market introduction

The Cumulative Timer Market encompasses devices designed to measure and totalize time over successive, non-continuous intervals, providing a critical metric for operational efficiency, equipment maintenance scheduling, and resource allocation. These sophisticated timing instruments, ranging from simple electromechanical counters to advanced digital programmable modules, are essential for monitoring machine run-time, batch processing duration, and overall operational lifespan in complex industrial environments. They offer high precision and reliability, differentiating them from standard timers by focusing on accumulated usage rather than elapsed time from a single starting point, making them indispensable in applications where tracking total operational hours is vital for preventative maintenance cycles and warranty validation.

Major applications of cumulative timers span across various sectors, including industrial automation (tracking pump or motor run-time), aerospace and defense (monitoring component operational history), and medical devices (ensuring calibrated usage limits). The primary benefits derived from the deployment of these timers include enhanced asset management, reduced downtime through timely maintenance interventions, and improved regulatory compliance, particularly in high-precision manufacturing and healthcare sectors. The demand for these devices is intrinsically linked to the global trend toward Industry 4.0, which mandates granular data collection on machine performance and utilization rates.

The market is primarily driven by the increasing complexity of industrial machinery and the resultant need for highly accurate time-based tracking mechanisms. Furthermore, stringent safety regulations requiring documented operational history for critical equipment, coupled with the rapid adoption of predictive maintenance strategies, significantly contribute to market expansion. The continuous integration of digital and network capabilities into cumulative timers, enabling remote monitoring and data logging, is cementing their role as foundational components within modern operational technology (OT) infrastructure, further fueling market growth.

Cumulative Timer Market Executive Summary

The Cumulative Timer Market exhibits robust growth, underpinned by accelerating global industrial automation and a sustained focus on operational efficiency across manufacturing and utility sectors. Key business trends indicate a strong shift towards advanced digital and programmable cumulative timers that offer connectivity features (IoT/IIoT compatibility), replacing older, less flexible analog models. Vendors are increasingly concentrating on developing integrated solutions that link timing data directly into enterprise resource planning (ERP) and computer maintenance management systems (CMMS), facilitating predictive maintenance and optimizing spare parts inventory. This integration capability is proving to be a major competitive differentiator, encouraging rapid technological upgrades among industrial users.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructure investment, rapid expansion of the electronics manufacturing base, and government initiatives promoting smart factory implementation in countries like China, India, and South Korea. North America and Europe, while representing mature markets, maintain high revenue shares due to the early adoption of high-specification, specialized timers for critical applications in aerospace, defense, and pharmaceutical manufacturing. These regions are characterized by demand for high-reliability, certified timers, driving value-based market competition rather than volume.

Segmentation trends highlight the dominance of programmable cumulative timers, particularly those offering multi-functionality and complex logic integration capabilities suitable for advanced process control. The end-user segment is increasingly led by the manufacturing sector, which uses these devices extensively for asset utilization tracking and warranty management. Furthermore, the specialized application of cumulative timers in renewable energy generation, specifically for tracking component life in solar inverters and wind turbine gearboxes, presents a lucrative emerging segment expected to experience above-average growth throughout the forecast period.

AI Impact Analysis on Cumulative Timer Market

User queries regarding the impact of Artificial Intelligence on the Cumulative Timer Market primarily revolve around how AI can enhance the predictive capabilities derived from accumulated operational data and whether smart systems will render discrete timers obsolete. Common themes include the integration potential of AI algorithms for anomaly detection based on cumulative runtime thresholds, the shift from traditional fixed maintenance schedules to dynamically adjusted schedules derived from AI-driven usage patterns, and the cybersecurity implications of connecting these critical timing devices to broader AI-managed industrial networks. Users are deeply interested in the transition from simple data logging to intelligent data interpretation facilitated by machine learning, seeking reassurance that their investments in advanced digital timers will future-proof their operations.

AI is transforming the function of cumulative timers from mere data collectors into critical data nodes within a larger predictive maintenance ecosystem. By feeding high-fidelity, real-time cumulative usage data into machine learning models, enterprises can move far beyond simple threshold alarms. AI algorithms analyze historical runtime profiles, environmental factors, and cumulative load statistics to accurately predict potential equipment failure, thereby optimizing resource scheduling and extending equipment lifespan more precisely than traditional rule-based CMMS systems. This evolution significantly increases the value proposition of modern, connected cumulative timers.

Furthermore, AI facilitates Generative Engine Optimization (GEO) in the deployment and configuration of complex timing solutions. AI tools can analyze operational requirements and automatically suggest the optimal type and placement of cumulative timers necessary for comprehensive asset coverage, minimizing setup time and maximizing data integrity. While AI systems might eventually integrate timing functions into supervisory control layers, the need for physical, tamper-proof, dedicated cumulative timers remains paramount for regulatory compliance and fundamental process validation, ensuring the core market for specialized hardware remains strong but highly sophisticated.

- AI enables dynamic threshold adjustment for maintenance based on cumulative usage profiles, optimizing asset performance.

- Machine Learning algorithms utilize cumulative timer data for advanced predictive failure modeling and anomaly detection.

- AI integration drives the demand for high-connectivity (IoT-enabled) cumulative timers capable of transmitting large datasets efficiently.

- Generative AI tools assist in optimizing timer placement and configuration within complex industrial control systems (ICS).

- AI enhances data security protocols surrounding networked timers, addressing user concerns about potential vulnerabilities in OT infrastructure.

DRO & Impact Forces Of Cumulative Timer Market

The Cumulative Timer Market is shaped by a critical balance of stimulating drivers, constraining factors, and promising opportunities, all subjected to potent impact forces that dictate market trajectory and adoption rates. The primary driving force is the global imperative for enhanced industrial efficiency and precision tracking, particularly within sectors adopting Industry 4.0 principles, where every minute of operational time must be accurately recorded and analyzed. Conversely, market expansion is restrained by the inherent complexity and high cost associated with migrating from legacy analog systems to sophisticated, networked digital cumulative timers, creating adoption barriers for small and medium-sized enterprises (SMEs) that lack the necessary capital or technical expertise for integration.

Significant opportunities arise from the rapid expansion of specialized industries, such as renewable energy generation and advanced medical device manufacturing, both of which require highly reliable, certified timing solutions for regulatory compliance and operational safety. The development of compact, ruggedized, and wirelessly connected cumulative timers that can withstand harsh environments and transmit data remotely is opening up new market avenues in remote monitoring applications and utilities infrastructure. The interplay between these factors determines the overall impact forces, which currently lean towards expansion dueenced technological advancements and sustained industrial digitization efforts worldwide.

The dominant impact forces influencing the market include the accelerating pace of technological obsolescence, where analog timers are quickly being phased out, and the growing regulatory pressure requiring auditable operational records for machine usage. These forces compel industries to invest in modern cumulative timers, despite the initial investment hurdles. Furthermore, the rising global cost of raw materials and electronic components exerts upward pressure on manufacturing costs, requiring vendors to focus on value-added features like enhanced connectivity and extended warranty periods to justify premium pricing.

Segmentation Analysis

The Cumulative Timer Market is systematically segmented primarily based on the type of technology employed, the specific applications served, and the broad end-user industries utilizing the devices. Analyzing these segments provides a clear view of market dynamics, revealing where innovation is concentrated and which sectors are driving volume versus value growth. Technological segmentation (Digital vs. Analog) illustrates the market's transition towards high-precision, network-enabled solutions, while application segmentation highlights the increasing dependency on these timers in critical, regulated environments such as medical and aerospace sectors where failure is not an option. End-user segmentation confirms the dominant role of the manufacturing sector, though growth is diversifying rapidly into new areas like utilities and R&D.

Digital Cumulative Timers currently hold the largest market share and are projected to exhibit the highest CAGR due to their superior accuracy, integration capabilities (e.g., Modbus, Ethernet/IP), and ease of programming. These devices allow for remote data logging and diagnostics, essential features for modern smart factories. Although Analog and Electromechanical Cumulative Timers still find use in legacy systems and basic, non-critical applications due to their simplicity and low cost, their market relevance is diminishing rapidly in favor of more versatile programmable digital alternatives that offer enhanced functionality such as multiple timing ranges and secure data storage.

In terms of application, Industrial Automation accounts for the bulk of timer deployments, driven by the need to track operational hours of motors, conveyors, and pumps for preventative maintenance scheduling (PMS). However, the Automotive Testing and Aerospace & Defense segments command higher average selling prices (ASPs) due to rigorous qualification requirements, demand for extended durability, and the need for certified, tamper-proof operational records. The continued technological convergence across these segments mandates that manufacturers offer highly customizable and robust products to meet diverse and stringent operational requirements.

- By Type:

- Digital Cumulative Timers

- Analog Cumulative Timers

- Programmable Cumulative Timers

- By Application:

- Industrial Automation

- Aerospace & Defense

- Medical Devices

- Laboratory Research

- Automotive Testing

- Consumer Electronics Manufacturing

- By End-User:

- Manufacturing Sector

- R&D Institutions

- Healthcare Providers

- Utilities Sector

- Automotive Industry

Value Chain Analysis For Cumulative Timer Market

The Value Chain for the Cumulative Timer Market begins with upstream activities dominated by component manufacturing, primarily involving specialized sensor fabrication, microcontroller production (for digital timers), and precision mechanical parts (for analog timers). Key upstream suppliers include producers of application-specific integrated circuits (ASICs), display interfaces, and high-reliability power management modules. The quality and availability of these core electronic components directly influence the final product's performance, reliability, and cost. Effective supply chain management in the upstream segment is crucial, particularly in navigating geopolitical risks associated with semiconductor sourcing and ensuring compliance with Restriction of Hazardous Substances (RoHS) directives.

Midstream activities involve the core manufacturing, assembly, software development (for programmable timers), rigorous testing, and quality assurance processes carried out by Original Equipment Manufacturers (OEMs) like Siemens, Rockwell, and Crouzet. OEMs focus on optimizing the integration of software and hardware to achieve superior accuracy and networking capabilities. Distribution is handled through a hybrid model: direct sales channels cater to large industrial clients and specialized military/aerospace contracts requiring bespoke solutions, while indirect channels—comprising regional industrial distributors, electronics parts wholesalers, and system integrators—handle the high volume, standardized product sales to smaller enterprises and general automation installers.

Downstream activities focus on installation, calibration, post-sales technical support, and eventual maintenance and replacement cycles. System integrators play a vital role downstream by incorporating cumulative timers into larger Supervisory Control and Data Acquisition (SCADA) systems and Industrial Control Systems (ICS). The final end-users depend heavily on robust documentation and readily available calibration services to maintain accuracy and ensure regulatory compliance, particularly in highly regulated fields like pharmaceuticals and nuclear power generation. The efficiency of the distribution channel, particularly the expertise of indirect partners in providing technical consultation, significantly impacts customer satisfaction and market penetration.

Cumulative Timer Market Potential Customers

The potential customer base for the Cumulative Timer Market is highly diversified, spanning nearly every sector that relies on machinery, processed workflows, or certified operational history. The primary purchasers, or end-users, are large-scale industrial manufacturing enterprises, especially those involved in continuous processing like chemicals, oil and gas, and automotive assembly, where tracking machine usage is non-negotiable for predictive maintenance and optimization. These buyers seek durable, high-specification digital timers with advanced connectivity features to integrate with their existing Industrial Internet of Things (IIoT) infrastructure, prioritizing reliability and network security.

A secondary, high-value customer segment includes R&D institutions and specialized healthcare providers. R&D labs require extremely accurate cumulative timers for long-duration testing and experimentation, often demanding bespoke, ultra-precise models. Healthcare providers, particularly those managing expensive diagnostic imaging equipment (like MRI or CT scanners), are critical buyers, as cumulative timer data is often mandated for compliance, warranty enforcement, and certifying the safety limits of specialized medical devices. These buyers prioritize certification (e.g., ISO, FDA standards) and tamper-proof design to ensure data integrity.

Emerging potential customers are concentrated in the rapidly expanding utilities and sustainable energy sectors. Utility companies use cumulative timers to monitor the operational life of crucial infrastructure components in power grids and water treatment facilities, ensuring optimal replacement cycles. Renewable energy providers utilize these timers to track the runtime of critical components within wind turbines and solar power conditioning units, maximizing energy generation uptime. These customers are driven by cost efficiency and the need for timers capable of remote operation and enduring harsh environmental conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $550.0 Million USD |

| Market Forecast in 2033 | $930.0 Million USD |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Siemens AG, OMEGA Engineering Inc., Rockwell Automation, ABB Ltd., Crouzet, Red Lion Controls, Time Mark Corporation, Carlo Gavazzi, Schneider Electric, Endress+Hauser, Danaher Corporation, Eaton Corporation, Honeywell International, Yokogawa Electric, Panasonic Corporation, IDEMIA, Autonics Corporation, Trumeter, Major Tech, Hohner Automation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cumulative Timer Market Key Technology Landscape

The technological landscape of the Cumulative Timer Market is rapidly evolving, driven primarily by the transition from purely electromechanical mechanisms to sophisticated micro-controller based digital systems that leverage connectivity. Core technologies currently dominating the market include precise quartz crystal oscillators and highly accurate internal clocks necessary for maintaining timing integrity, particularly in environments subject to vibration or extreme temperature fluctuations. The integration of solid-state components has enhanced the durability and lifespan of modern cumulative timers, reducing the reliance on moving mechanical parts and consequently lowering maintenance requirements. Furthermore, enhanced display technologies, such as high-contrast OLED and LCD screens, improve readability and user interface functionality, facilitating easier on-site configuration and data verification.

A major technological trend is the pervasive incorporation of Industrial Internet of Things (IIoT) capabilities. Advanced cumulative timers are now equipped with standard industrial communication protocols such as Ethernet/IP, PROFINET, and Modbus TCP/IP, allowing for seamless integration into supervisory control systems and cloud-based data analytics platforms. This connectivity is crucial for enabling remote monitoring, centralized data aggregation across multiple assets, and the implementation of sophisticated predictive maintenance algorithms powered by AI. Edge computing technologies are also emerging, allowing certain cumulative timers to process usage data locally before transmission, reducing network latency and improving real-time decision-making capabilities regarding asset usage.

Further technological differentiation occurs through the development of specialized features like non-volatile memory and tamper-proof casings. Non-volatile memory ensures that accumulated time data remains secure and accessible even during power outages, critical for regulatory compliance in sensitive applications. The demand for safety-certified cumulative timers (SIL-rated or equivalent) is also growing in high-risk industrial environments, requiring manufacturers to implement redundant timing circuits and self-diagnostic functionalities. The future landscape suggests continued miniaturization, leveraging System-on-Chip (SoC) architectures to embed cumulative timing functionality directly into primary control units, optimizing space and reducing complexity in densely packed industrial cabinets.

Regional Highlights

-

Asia Pacific (APAC): Dominance and Rapid Growth

The APAC region currently represents the largest and fastest-growing segment in the Cumulative Timer Market, driven primarily by extensive manufacturing base expansion, particularly in high-volume electronics, textiles, and automotive industries across China, India, Japan, and South Korea. Government initiatives, such as China’s "Made in China 2025" and similar digital manufacturing policies across Southeast Asia, necessitate massive investments in factory automation, directly fueling the demand for digital and programmable cumulative timers used for asset tracking and quality control. The high rate of new factory construction and infrastructure development in this region ensures sustained, high-volume demand.

The market environment is characterized by intense price competition, encouraging local manufacturers to produce cost-effective, yet functional, digital timers. However, specialized, high-precision timers required by the sophisticated semiconductor manufacturing sector in Taiwan and South Korea attract premium pricing, maintaining a healthy value proposition for global vendors. Furthermore, the burgeoning renewable energy sector in Australia and India requires robust cumulative timers for monitoring remote installations, presenting a significant opportunity for vendors specializing in ruggedized, IIoT-enabled solutions.

-

North America: Technological Leadership and High Value

North America holds a substantial market share, defined by its mature industrial base, early adoption of advanced technologies, and a concentration of highly regulated industries such as aerospace, defense, and pharmaceuticals. The region is a primary consumer of high-specification, certified cumulative timers, where compliance and data integrity are prioritized over unit cost. Demand here is less about expanding factory volume and more about upgrading existing operational technology (OT) infrastructure with smart, network-ready timers that integrate smoothly with advanced predictive maintenance software.

Key drivers include stringent regulatory requirements imposed by organizations like the FDA and FAA, which mandate precise, auditable records of equipment usage for safety and calibration purposes. This focus on regulatory compliance ensures a continuous replacement cycle for specialized equipment. Moreover, significant research and development expenditure, particularly in technology and biotech hubs, sustains high demand for ultra-precise cumulative timers used in laboratory and testing environments, ensuring North America remains a crucial market for technological innovation and high-margin product sales.

-

Europe: Focus on Sustainability and Integration

The European market is robust and stable, characterized by a strong emphasis on industrial efficiency, sustainability, and adherence to strict EU directives, including directives related to energy consumption and equipment lifespan. Countries such as Germany, the UK, and France are leaders in industrial automation, driving consistent demand for programmable cumulative timers capable of detailed energy monitoring and process optimization. European manufacturers often require timers that comply with specific regional standards (e.g., ATEX certification for hazardous environments).

The region’s strong commitment to the transition to renewable energy generation (wind and solar farms) is a critical growth segment. Cumulative timers are essential for maintenance tracking and performance validation in these facilities. Additionally, the mature automotive manufacturing sector demands high-reliability timers for quality assurance in complex assembly lines and testing facilities. The focus on integration is high, with users seeking timers that communicate seamlessly using regional industrial standards, supporting the region’s established lead in developing sophisticated industrial control systems.

-

Latin America (LATAM) and Middle East & Africa (MEA): Infrastructure-Driven Demand

LATAM and MEA are emerging markets characterized by significant investments in infrastructure, oil and gas, and mining sectors. In the Middle East, substantial investment in large-scale utilities projects, desalination plants, and refining operations drives the need for ruggedized cumulative timers capable of operating reliably in harsh climate conditions. Demand is project-based, linked closely to large-scale government and private sector capital expenditure in critical national infrastructure.

In LATAM, particularly in Brazil and Mexico, the expansion of the manufacturing base and resource extraction activities fuels the market. While price sensitivity is generally higher in these regions compared to North America and Europe, the need for efficiency and preventative maintenance in crucial resource extraction machinery (e.g., mining equipment) ensures a steady demand for durable digital timers. The growth potential lies in the continued industrialization and the eventual integration of IIoT standards, which will push demand from basic analog units toward connected digital solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cumulative Timer Market.- Siemens AG

- OMEGA Engineering Inc.

- Rockwell Automation

- ABB Ltd.

- Crouzet

- Red Lion Controls

- Time Mark Corporation

- Carlo Gavazzi

- Schneider Electric

- Endress+Hauser

- Danaher Corporation

- Eaton Corporation

- Honeywell International

- Yokogawa Electric

- Panasonic Corporation

- IDEMIA

- Autonics Corporation

- Trumeter

- Major Tech

- Hohner Automation

Frequently Asked Questions

Analyze common user questions about the Cumulative Timer market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a cumulative timer and a standard elapsed time counter?

A cumulative timer specifically measures and aggregates non-continuous periods of operation (run-time totalization), whereas a standard elapsed time counter measures a single, continuous time interval from start to stop. Cumulative timers are crucial for tracking total machine usage for preventative maintenance.

How is Industry 4.0 influencing the adoption of cumulative timers?

Industry 4.0 mandates the use of connected, smart devices. This drives demand for digital cumulative timers with IIoT capabilities (e.g., Ethernet connectivity) to feed precise operational usage data directly into centralized predictive maintenance and enterprise resource planning systems.

Which end-user segment demonstrates the highest growth potential for cumulative timers?

The Utilities Sector and the Renewable Energy segment show significant growth potential, driven by the need to monitor remote equipment lifespan (e.g., wind turbines, smart grid components) and comply with stringent operational safety and efficiency regulations.

Are analog cumulative timers still relevant in the modern industrial landscape?

Analog timers maintain relevance in basic, low-cost applications or as replacements in existing legacy infrastructure due to their simplicity and reliability. However, the market is rapidly shifting toward digital, programmable models offering superior accuracy and data integration necessary for advanced automation.

What key factors determine the cost and reliability of a cumulative timer?

Cost and reliability are determined by the internal timing mechanism (quartz vs. standard crystal), the complexity of programming capabilities, the level of connectivity (IIoT features), required certifications (e.g., SIL rating), and the durability of the housing against environmental stressors like vibration and moisture.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager