Cupolas Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438027 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Cupolas Market Size

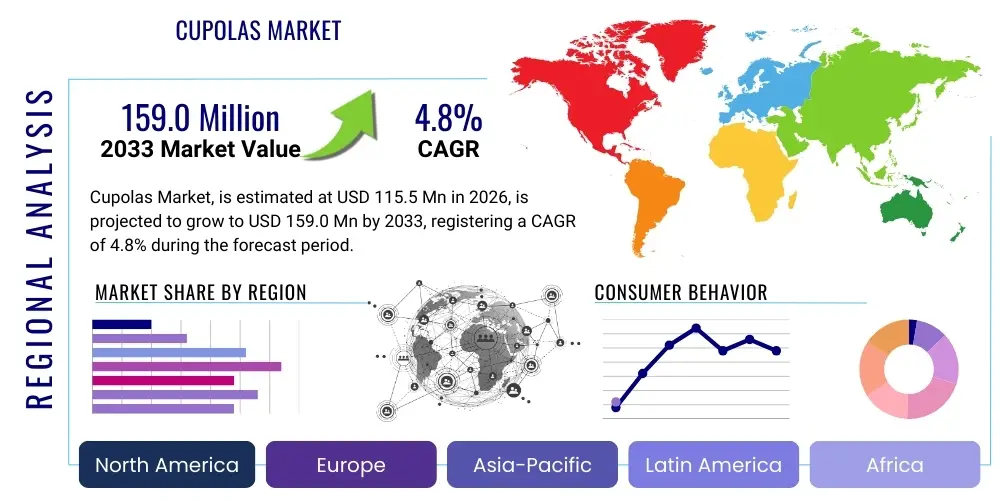

The Cupolas Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 115.5 Million in 2026 and is projected to reach USD 159.0 Million by the end of the forecast period in 2033.

Cupolas Market introduction

The Cupolas Market encompasses the manufacturing, distribution, and installation of decorative and functional rooftop structures primarily utilized to enhance the aesthetic value and, historically, provide ventilation for residential, commercial, and agricultural buildings. Originally serving as vital components for airflow and light introduction in large structures, modern cupolas are predominantly regarded as premium architectural accents, reflecting classical, Victorian, or contemporary design elements. The evolution of the product has shifted emphasis from pure functionality—now often replaced by modern HVAC systems—to customized ornamentation, driving demand in high-end remodeling and new luxury construction projects globally. The structural integrity and longevity of these components are paramount, leading to advancements in material science incorporating high-durability vinyl, maintenance-free composites, and corrosion-resistant metals like copper and aluminum.

The major applications for cupolas span a diverse range of building types, including stately homes, agricultural barns, commercial retail outlets, institutional buildings such as schools and churches, and historic preservation sites. Product description involves defining the key components: the base (which integrates with the roofline), the mid-section (housing louvers or windows), and the cap (often topped with a weathervane or finial). Benefits derived from cupola installation include significantly increased curb appeal, enhanced property valuation, and adherence to specific regional architectural traditions. Customization is a central offering, allowing architects and homeowners to match cupola specifications—such as size, pitch, color, and trim work—precisely to the underlying structure, ensuring architectural harmony and distinctiveness.

Driving factors propelling the Cupolas Market growth include robust activity in the residential renovation sector, where homeowners are investing heavily in exterior enhancements to maximize property distinctiveness and perceived value. Furthermore, a resurgence in demand for traditional and classic architectural styles, particularly in North America and parts of Europe, fuels the need for authentic and high-quality roofline structures. The development of low-maintenance and highly durable materials, such as engineered vinyl and cellular PVC, addresses historical concerns related to wood rot and decay, significantly lowering the long-term cost of ownership and thus broadening market acceptance among discerning buyers who prioritize longevity and minimal upkeep.

Cupolas Market Executive Summary

The Cupolas Market is characterized by steady, moderate growth, primarily driven by niche demand within the luxury residential and historic restoration segments. Current business trends indicate a strong move towards customization and material innovation, with cellular PVC and advanced composites increasingly favored over traditional wood due to superior weather resistance and reduced maintenance requirements. Manufacturers are focusing on streamlining production processes using CNC technology to efficiently meet bespoke design requirements, moving away from standardized, off-the-shelf models for high-value contracts. This focus on premium, custom-engineered products ensures higher average selling prices (ASPs) and maintains profitability despite the specialized nature of the demand base. Furthermore, strategic alliances between cupola manufacturers and specialized roofing contractors are crucial for market penetration and reliable installation services, mitigating risks associated with improper fitting and structural failure.

Regionally, North America maintains market dominance, specifically the Eastern and Midwestern United States, due to deeply rooted architectural traditions that favor roofline embellishments, coupled with significant expenditure in the high-end custom home building sector. European markets show stable demand, heavily influenced by strict conservation laws governing historical buildings, necessitating expert craftsmanship for replication and replacement projects. Asia Pacific (APAC) represents an emerging opportunity, driven by increasing urbanization and the adoption of Western-style luxury architecture in rapidly developing economies, particularly within private residential communities and exclusive resort complexes. Manufacturers are adapting distribution strategies, including increased use of e-commerce platforms, to efficiently serve geographically dispersed custom builders and end-users.

Segment trends highlight the dominance of the residential application segment, though the fastest growth rate is projected within the agricultural segment, particularly for large, specialized barns and outbuildings requiring both aesthetic appeal and enhanced ventilation features. In terms of design, the louvered cupola remains the standard functional choice, but the windowed design is gaining traction in luxury residential applications where the internal light well effect is desired. The vinyl/PVC material segment is expected to capture an increasing market share due to its low maintenance profile and versatility in design replication. Overall, the market remains moderately fragmented, emphasizing quality, craftsmanship, and material excellence as key differentiators for sustained competitive advantage.

AI Impact Analysis on Cupolas Market

User inquiries regarding AI's influence in the Cupolas Market often center on whether AI can replace traditional craftsmanship, how it might personalize the design process, and its role in supply chain efficiency for custom orders. Key concerns revolve around the integration of AI-powered visualization tools for complex architectural integration and the potential for generative design algorithms to produce optimized, yet architecturally compliant, cupola structures. The analysis reveals that AI is not viewed as a replacement for skilled labor but rather as an enhancement tool. Specifically, AI-driven software facilitates real-time 3D configuration and visualization, allowing customers to digitally place and adjust cupolas on their actual building renderings, minimizing ordering errors and significantly speeding up the design approval process. Furthermore, AI algorithms can optimize material cutting layouts in CNC manufacturing to reduce waste (critical for expensive materials like copper or high-grade lumber) and improve production throughput for highly customized, low-volume orders, thereby optimizing operational expenditure and enhancing overall market responsiveness.

- AI-powered Generative Design: Utilized to create structurally optimized and aesthetically balanced cupola designs based on inputs like roof pitch, building size, and regional architectural style, minimizing manual design iteration time.

- Predictive Manufacturing Scheduling: AI algorithms analyze incoming custom orders and existing capacity to forecast production bottlenecks, optimizing resource allocation, and ensuring timely delivery of specialized components.

- Augmented Reality (AR) Configuration Tools: AI underpins AR applications that allow clients to visualize custom cupolas in real-time, overlaid on their property via smart devices, significantly improving the purchasing decision process and reducing returns due to sizing or style mismatches.

- Automated Quality Control (AQC): Vision systems integrated with AI monitor CNC machining and assembly processes, ensuring dimensional accuracy and surface finish quality against highly precise custom specifications.

- Supply Chain Optimization: AI analyzes historical material lead times and regional demand patterns to optimize inventory levels for specialty components (e.g., custom flashing, weathervanes, specific wood species), ensuring the efficient fulfillment of unique orders.

DRO & Impact Forces Of Cupolas Market

The market dynamics of cupolas are shaped by a complex interplay of architectural trends, material innovation, and macroeconomic factors impacting construction and renovation expenditure. Drivers include the robust luxury housing market worldwide, where cupolas serve as a clear symbol of architectural refinement and historical appreciation, appealing to consumers seeking to differentiate their properties. Additionally, the growing popularity of specialized outbuildings, such as professional-grade barns, horse stables, and pool houses, which often incorporate cupolas for ventilation and aesthetic coherence, contributes substantially to demand volume. The successful market penetration of low-maintenance materials like vinyl and composites has significantly mitigated consumer hesitation associated with upkeep, providing a durable and cost-effective alternative to traditional wood while maintaining traditional aesthetics.

Restraints impeding aggressive market expansion largely revolve around installation complexity and inherent cost considerations. Installing a cupola requires specialized roofing skills to ensure proper flashing and weatherproofing, adding significantly to the final project expense; a shortage of specialized contractors in certain regions can further constrain growth. Furthermore, modern architectural trends, particularly in urban and commercial developments, often favor minimalist, flat roofing designs or highly angular structures that preclude the inclusion of traditional cupola styles, thereby limiting the market's total addressable volume. Regulatory barriers related to building codes, particularly in areas prone to high winds or seismic activity, can impose stringent structural requirements that necessitate custom engineering, increasing both complexity and price.

Opportunities for future growth are significant, centering on product diversification and technological integration. The development of 'smart cupolas,' which incorporate integrated features such as solar-powered lighting, automated ventilation sensors, or discreet 5G antenna housing, offers a pathway to increase the product's functional utility beyond purely aesthetic ornamentation. Furthermore, expanding the application scope into modular and prefabricated housing markets by offering standardized, easy-to-install units presents a viable strategy for volume growth. The primary impact forces influencing this market are consumer disposable income levels (which directly affect luxury construction spending) and the cost volatility of key raw materials, particularly copper and specialized lumber, which can compress manufacturer profit margins if not managed effectively through forward procurement contracts and sophisticated pricing strategies.

Segmentation Analysis

The Cupolas Market is comprehensively segmented based on the type of material used in construction, the specific design aesthetics, and the nature of the application environment. Segmentation is crucial for manufacturers to target specific demographic and architectural niches, allowing for specialized product development, from high-end copper cladding tailored for historic restoration to mass-produced, weather-resistant vinyl units for standard residential construction. The analysis of these segments reveals shifts in consumer preference driven by durability requirements, budgetary constraints, and regional architectural conformity standards, providing a detailed map of the market's evolving landscape and future growth pockets. The customization trend means that hybrid products—combining a vinyl base for maintenance ease with a copper roof for aesthetic appeal—are becoming increasingly common, blurring traditional material lines.

- By Material:

- Wood (Cedar, Pine, Redwood)

- Vinyl/PVC (Cellular PVC, Engineered Composites)

- Copper

- Fiberglass

- Aluminum and Other Metals

- By Application:

- Residential (Custom Homes, Remodeling)

- Commercial (Retail, Hospitality)

- Agricultural (Barns, Stables, Outbuildings)

- Institutional (Churches, Government, Universities)

- By Design:

- Louvered Cupolas (Primary function: ventilation)

- Windowed Cupolas (Primary function: light and aesthetics)

- Custom/Hybrid Designs

- By Distribution Channel:

- Online Retail and E-commerce Platforms

- Specialty Building Supply Stores and Distributors

- Direct Sales to Contractors and Builders

Value Chain Analysis For Cupolas Market

The value chain for the Cupolas Market begins with the highly specialized procurement of raw materials. Upstream analysis highlights the importance of sourcing high-quality, knot-free lumber (such as Western Red Cedar for premium wood cupolas) or specialized resin compounds for cellular PVC products. Material suppliers must adhere to strict quality controls regarding dimensional stability and weather resistance. For metal cupolas, securing competitively priced and certified copper or aluminum sheets is essential, often involving hedging against commodity price volatility. Manufacturing involves a combination of high-precision automated processes (CNC routing for base and mid-sections) and traditional, skilled craftsmanship, particularly for complex detailing, copper working, and the fitting of weathervanes or finials. Quality control is rigorous due to the high visibility of the final product and the critical requirement for structural integrity against high wind loads.

The downstream component of the value chain focuses heavily on efficient distribution and professional installation. Distribution channels are bifurcated into direct and indirect methods. Direct sales typically involve large custom orders sold straight to high-end builders, architects, or institutions, offering high margins and complete control over the installation process. Indirect distribution relies heavily on regional specialty building suppliers, lumber yards, and increasingly, large e-commerce platforms specializing in exterior home improvement products. E-commerce platforms address the needs of smaller contractors and DIY homeowners, requiring robust logistics for handling large, sometimes fragile components, and accurate visualization tools to ensure the right size is ordered. Efficient installation, often carried out by specialized roofing subcontractors, is the final critical step, ensuring the cupola is structurally sound, properly sealed, and aesthetically integrated into the roofline.

The complexity of the product means that the distribution channel often includes a consultative phase. Distributors must possess deep product knowledge to advise on material suitability based on local climate, appropriate sizing relative to the building, and adherence to specific aesthetic requirements. For custom designs, the manufacturer often works directly with the architect throughout the design and specification phase, bypassing standard retail distribution. This complex, high-touch distribution model emphasizes expertise and service delivery over sheer volume, positioning specialized manufacturers and niche distributors as central players in maintaining the product's premium market position. The strong correlation between flawless installation and end-user satisfaction underscores the importance of a vetted network of professional installers within the overall service offering.

Cupolas Market Potential Customers

The end-user base for cupolas is highly segmented, primarily comprising entities and individuals involved in new construction, large-scale remodeling, or architectural preservation efforts who seek distinctive, high-quality exterior elements. The largest consumer segment remains the high-net-worth individual (HNWI) homeowner engaged in custom residential construction or substantial home renovation projects. These buyers prioritize aesthetic excellence, material longevity (such as copper or cellular PVC), and personalized design options that elevate their property's curb appeal and market value. They are typically served through architectural firms and custom builders who source cupolas based on stringent design specifications and quality certifications. This segment demands bespoke solutions that conform to specific architectural periods or personal style preferences.

Another significant customer segment includes commercial property developers, particularly those focusing on retail centers, boutique hotels, or planned community clubhouses designed to evoke traditional or classical architecture. For commercial applications, cupolas are often used as visual anchors or distinguishing features to enhance brand image and property memorability. These buyers prioritize durability, low maintenance, and cost-effectiveness, favoring materials like fiberglass or engineered vinyl that offer large-scale uniformity and simplified installation. The institutional sector, encompassing historical churches, university buildings, and public libraries, constitutes a niche yet valuable customer base, especially in restoration markets where authenticity and compliance with historical material specifications are mandatory, often requiring highly specialized, handcrafted wood or metal cupolas.

The agricultural sector forms a growing and critical segment, consisting of farm owners, large equestrian facility operators, and specialized barn builders. In this application, the cupola often reverts to its original functional purpose: providing essential, passive ventilation for large enclosed spaces like stables and storage barns to manage temperature and humidity. While aesthetic appeal is still important, structural robustness and effective ventilation design (louvered systems) are paramount. Customers in this category often seek durable, weather-resistant materials like vinyl or treated lumber that can withstand harsh environmental conditions and animal wear. Manufacturers targeting this segment must emphasize utility and longevity alongside simplified, modular installation processes suitable for large, often remote, construction sites.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Million |

| Market Forecast in 2033 | USD 159.0 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Good Directions, Dalton Pavilions, Cedarwood Products, Vixen Hill, Newmont Cupolas, Builders Edge, Walpole Outdoors, EZ Vent Cupola, Mid-America Siding Components, Pinnacle Architectural Products, T.H. Enterprise, Creative Homeowner, Mitten Inc., Fypon, Alcoa Building Products, Classic Cupolas, Architectural Products by Outwater, Cupola Depot |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cupolas Market Key Technology Landscape

The technological landscape of the Cupolas Market is primarily defined by advancements in precision manufacturing and material science, crucial for enhancing product durability, structural accuracy, and customization capability. Central to modern cupola production is the widespread adoption of Computer Numerical Control (CNC) machining. CNC routers and cutters allow manufacturers to achieve extremely tight tolerances, essential for ensuring that the cupola base integrates seamlessly with diverse and complex roof pitches without structural compromise. This technology enables rapid prototyping and efficient small-batch production for custom orders, drastically reducing the time and cost historically associated with traditional, labor-intensive woodworking or metal fabrication. Furthermore, CNC technology supports the precise routing of complex decorative details into materials like cellular PVC, mimicking the intricacy of fine carpentry while leveraging the durability of synthetic materials.

Material technology represents another core area of innovation. The development and refinement of high-density cellular PVC (polyvinyl chloride) and specialized fiberglass composites have revolutionized the low-maintenance segment. These materials are engineered to resist UV degradation, moisture ingress, insect damage, and thermal warping, issues endemic to traditional wood products. Advanced polymer formulations now enable manufacturers to produce cupolas that possess the weight, texture, and paintability of high-grade lumber, but with significantly enhanced longevity and minimal maintenance requirements, appealing directly to the modern consumer who seeks long-term value. Furthermore, specialized coating technologies, including powder coating for metal components and advanced weather-resistant primers for vinyl, ensure colorfastness and protection against severe environmental exposure, extending the product's aesthetic life cycle.

Finally, the integration of 3D modeling and specialized architectural software forms the backbone of the custom design process. Building Information Modeling (BIM) tools allow architects and manufacturers to collaboratively design cupolas that are perfectly scaled and structurally assessed within the context of the entire building model, identifying potential conflicts or structural weak points before manufacturing begins. This digital precision minimizes costly on-site modifications and ensures compliance with load-bearing and wind resistance standards. Emerging technologies, such as advanced sensor integration for ‘smart’ functions (e.g., automated attic fan activation based on temperature or humidity), demonstrate the beginning of a shift toward blending traditional architectural elements with modern, subtle technological utility, providing new avenues for premium product development and market differentiation within the high-end sector.

Regional Highlights

Regional dynamics significantly influence the Cupolas Market, reflecting variations in architectural heritage, climate, construction spending, and regulatory environments. North America, particularly the United States, stands as the dominant market share holder. Demand here is characterized by a strong appreciation for historical American architectural styles (like Colonial, Federal, and Victorian), which mandates the inclusion of exterior architectural accents such as cupolas. High levels of disposable income channeled into custom home building and extensive residential renovations across the Northeast and Mid-Atlantic states fuel steady demand for high-quality, often custom, vinyl, and cedar cupolas. Furthermore, the large agricultural infrastructure, requiring functional ventilation for extensive barns and facilities, contributes significantly to the demand for larger, utility-focused louvered designs, solidifying the region's market leadership through both luxury and functional applications.

Europe represents a mature and highly segmented market, largely driven by restoration and conservation mandates. Strict planning regulations and building codes across countries like the UK, France, and Germany often necessitate the use of traditional materials, particularly hand-crafted wood and genuine copper, for cupolas situated on or near historic sites. The emphasis here is on craftsmanship and adherence to period-specific designs, leading to higher price points and specialized manufacturing processes. While the volume of new construction requiring cupolas is lower than in North America, the preservation market guarantees a consistent, albeit specialized, demand for premium products and expert installation services. Southern European countries, influenced by Mediterranean styles, show a generally lower affinity for traditional cupola architecture, concentrating demand predominantly in historical city centers.

The Asia Pacific (APAC) region is projected to exhibit one of the fastest growth rates, albeit starting from a smaller base. This growth is linked directly to rapid luxury property development, urbanization, and the increasing influence of Western architectural designs in high-end residential and resort projects across major economies like China, India, and Australia. Consumers in this region often prefer the status and perceived quality associated with features like cupolas, driving demand for visually striking, modern interpretations often constructed from weather-resistant materials like fiberglass and aluminum to withstand high humidity and monsoon climates. Conversely, the Middle East and Africa (MEA) market remains relatively niche, centered on luxury residential compounds, high-end hospitality projects, and specialized governmental or institutional buildings, where cupolas are imported as exclusive architectural elements to confer prestige and architectural distinctiveness.

- North America: Dominant market, driven by historic architectural tradition, high custom residential construction spend, and substantial agricultural application needs (barn ventilation). Key materials include vinyl/PVC and cedar.

- Europe: Mature market focused on historic preservation and restoration; regulated by strict building codes emphasizing authentic materials (wood, copper) and meticulous craftsmanship, leading to high-value transactions.

- Asia Pacific (APAC): Fastest growing region, fueled by urbanization, luxury real estate development, and the adoption of high-status Western architectural elements in countries such as China and Australia, favoring durable, weather-resistant composites.

- Latin America (LATAM): Emerging demand concentrated in upscale resort and private residential markets, focusing on aesthetic enhancement rather than functional necessity.

- Middle East and Africa (MEA): Niche market confined largely to high-end commercial and institutional projects, valued for aesthetic prestige and imported quality.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cupolas Market.- Good Directions

- Dalton Pavilions

- Cedarwood Products

- Vixen Hill

- Newmont Cupolas

- Builders Edge

- Walpole Outdoors

- EZ Vent Cupola

- Mid-America Siding Components

- Pinnacle Architectural Products

- T.H. Enterprise

- Creative Homeowner

- Mitten Inc.

- Fypon

- Alcoa Building Products

- Classic Cupolas

- Architectural Products by Outwater

- Cupola Depot

Frequently Asked Questions

Analyze common user questions about the Cupolas market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most durable material for a cupola, minimizing long-term maintenance?

Cellular PVC (polyvinyl chloride) is widely considered the most durable and low-maintenance material for modern cupolas. It resists moisture, insect damage, rot, and weathering, often requiring only occasional cleaning rather than painting or repair, unlike traditional wood or certain metals.

How much does a custom cupola installation cost, and what factors influence the final price?

The cost varies significantly, ranging from USD 500 for a small, standard vinyl unit to over USD 10,000 for large, custom copper designs. Factors influencing price include material (copper is highest), size, complexity of design, specialized features (e.g., lighting, sensors), and the cost of professional roof installation and flashing.

Are cupolas primarily decorative, or do they still serve a functional ventilation purpose?

While modern cupolas are often installed purely for aesthetics and curb appeal, louvered designs maintain a vital functional role, particularly in agricultural settings (barns and stables) and large attic spaces, by facilitating passive ventilation to reduce heat and moisture buildup inside the structure.

What key structural considerations must be addressed when installing a cupola on a residential roof?

Key structural considerations involve determining the appropriate size relative to the roofline (typically 1 inch of cupola base per foot of roof length), ensuring the cupola is adequately secured to the roof rafters to withstand high wind loads, and meticulously installing proper flashing to guarantee a watertight seal against the elements.

How is the size of a cupola determined to ensure it is proportionate to the building?

Proportion is determined by architectural guidelines, with a standard rule suggesting the cupola base width should be approximately 1/10th to 1/12th the length of the roof section it sits upon. For complex structures, professional design consultation using 3D modeling ensures visual balance and harmonious integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager