Cups and Lids Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431890 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Cups and Lids Packaging Market Size

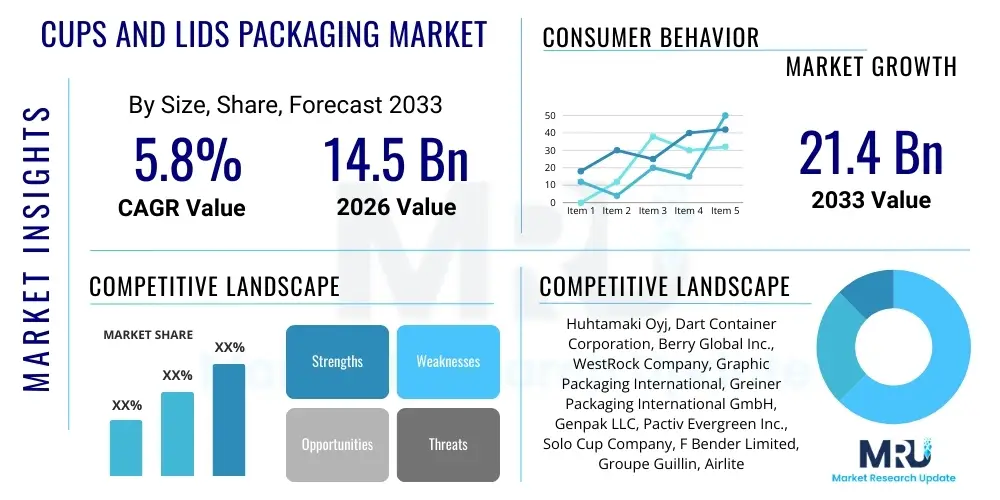

The Cups and Lids Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 14.5 Billion in 2026 and is projected to reach USD 21.4 Billion by the end of the forecast period in 2033.

Cups and Lids Packaging Market introduction

The Cups and Lids Packaging Market encompasses a diverse range of products essential for the food service, retail, and healthcare industries. These packaging solutions are designed primarily for portability, convenience, and preservation, catering to beverages, hot and cold foods, and various consumer goods. Key materials utilized include paper, plastics (such as PET, PP, and PS), and increasingly, sustainable and biodegradable alternatives like molded fiber and polylactic acid (PLA). The functionality of cups and lids is critical, requiring excellent thermal retention, leak prevention, and compatibility with automated filling and sealing machinery, driving continuous innovation in material science and design engineering.

Product descriptions within this market vary widely, ranging from single-use coffee cups and dome lids designed for immediate consumption to durable, reusable containers and specialized sealing films for ready-to-eat meals. Major applications span quick-service restaurants (QSRs), institutional catering, retail grocery, and beverage manufacturing. The foundational benefits derived from these packaging formats include enhanced hygiene, extended shelf life, optimized logistical handling, and crucial branding opportunities for manufacturers. Furthermore, the rise of e-commerce and food delivery services has amplified the demand for robust, tamper-evident, and aesthetically pleasing packaging that maintains product integrity during transit.

Driving factors for sustained market growth are multifaceted, anchored by global urbanization and the resultant increase in on-the-go consumption habits. The rising penetration of coffee culture, coupled with the expansion of international QSR chains in emerging economies, significantly boosts demand for specialized hot and cold beverage containers. Simultaneously, stringent regulatory shifts concerning single-use plastics compel manufacturers toward sustainable material adoption, particularly fiber-based cups and compostable lids, generating a dynamic landscape focused on circular economy principles and environmentally responsible packaging solutions.

Cups and Lids Packaging Market Executive Summary

The Cups and Lids Packaging Market is experiencing robust expansion driven by converging business trends, evolving consumer preferences, and proactive regional regulatory measures focused on sustainability. Key business trends include strategic mergers and acquisitions aimed at vertically integrating the supply chain, particularly raw material sourcing, and significant investments in high-speed, automated production lines to meet the surging demand from the food delivery sector. Companies are heavily focused on product differentiation through enhanced barrier properties, improved lid security features (e.g., sip-through lids, snap-on seals), and customizable printing techniques that facilitate advanced brand marketing and consumer engagement at the point of use, thereby consolidating market share among major players.

Regional trends reveal disparate growth trajectories influenced by disposable income levels and environmental legislation. The Asia Pacific (APAC) region is poised for the highest growth, fueled by rapid expansion in QSR networks, burgeoning middle-class populations, and the cultural shift towards packaged convenience foods, though challenges persist regarding waste management infrastructure. Conversely, North America and Europe are characterized by maturation and are intensely focused on the transition to non-plastic and recyclable materials, driven by EU Directives and state-level bans on specific plastic items. This shift is creating significant opportunities for innovation in barrier coatings for paper cups and bio-plastic formulations, leading to higher average selling prices (ASPs) for premium sustainable options.

Segment trends emphasize the dominance of paper-based materials, projected to capture a larger market share due to their superior recyclability and acceptance in the consumer packaged goods (CPG) chain. Within product type segmentation, hot drink cups remain central, but the fastest growth is anticipated in specialized cold beverage cups and matching lids, catering to the booming iced coffee and smoothie markets. Furthermore, the healthcare segment is showing consistent, albeit smaller, growth for sterile lidded containers used for pharmaceuticals and laboratory sampling. Overall, the market remains highly competitive, demanding operational efficiency and a commitment to sustainable sourcing to maintain long-term viability and address increasingly complex consumer and regulatory demands globally.

AI Impact Analysis on Cups and Lids Packaging Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning (ML) are reshaping traditional manufacturing processes, particularly concerning efficiency, material waste reduction, and quality control within the Cups and Lids Packaging sector. The primary concerns revolve around the cost-effectiveness of implementing advanced AI systems, the necessary data infrastructure, and how AI can aid in the complex task of sorting and recycling multi-material packaging components. Expectations center on AI's ability to optimize the entire lifecycle, from predictive maintenance minimizing downtime on high-speed thermoforming and molding machines to sophisticated demand forecasting that aligns production schedules precisely with volatile QSR and delivery platform orders. Furthermore, there is significant interest in using computer vision systems, powered by AI, to conduct real-time, high-precision defect detection on cups and lids during high-volume runs, significantly improving product consistency and reducing reliance on manual inspection, which is critical for food safety compliance.

- AI-driven predictive maintenance optimizes production schedules by anticipating equipment failures, maximizing uptime on high-speed cup forming and lid molding lines.

- Machine learning algorithms enhance demand forecasting accuracy, reducing inventory holding costs and minimizing overproduction, especially crucial for customized seasonal packaging.

- Computer vision systems leverage AI for ultra-fast, non-destructive quality inspection, identifying minute defects, material inconsistencies, and sealing errors on cups and lids in real-time.

- AI tools assist in complex material informatics, accelerating the development and formulation of new sustainable, high-barrier paper coatings and compostable bioplastics.

- Optimization of supply chain logistics using AI models improves route planning and warehouse management for sensitive packaging materials, reducing damage and transportation costs.

- AI applications are being explored in automated recycling facilities to improve the segregation and purity of recovered packaging materials, boosting the circularity of PP and PET cups.

- Generative AI tools are starting to assist packaging designers in rapidly creating and simulating novel cup shapes and lid geometries optimized for material efficiency and enhanced consumer functionality.

- Data analytics platforms utilizing AI process vast datasets from production floor sensors (Industry 4.0), providing actionable insights for process refinement and energy efficiency gains in molding operations.

DRO & Impact Forces Of Cups and Lids Packaging Market

The dynamics of the Cups and Lids Packaging Market are shaped by a powerful interplay of drivers (D), restraints (R), and opportunities (O), which collectively define the impact forces governing growth trajectories and competitive strategies. The primary driver is the accelerating consumer demand for convenience, fueled by the global shift towards prepared meals, on-the-go beverages, and the booming food delivery ecosystem, mandating the use of secure, durable, and temperature-retentive packaging. Opportunities arise prominently from technological breakthroughs in sustainable materials, specifically high-barrier paperboard, bio-degradable polymers (PLA, PHA), and the development of single-material packaging systems that simplify end-of-life recycling, allowing companies to meet evolving regulatory requirements and corporate sustainability targets. However, the market faces significant restraints, chiefly stemming from volatile raw material prices (pulp, resins), which compress profit margins, and the ongoing regulatory pressure globally to limit or ban certain plastic formats, requiring costly shifts in manufacturing infrastructure and material sourcing.

The impact forces driving change are predominantly environmental and regulatory. Government mandates, particularly in Europe and parts of North America, are actively phasing out expanded polystyrene (EPS) and conventional single-use plastics, creating an immediate, high-pressure market need for alternatives. This regulatory pressure acts as a powerful catalyst for innovation, forcing companies to invest in R&D for compostable and recyclable solutions, thus accelerating the market penetration of premium, sustainable offerings. Concurrently, increasing consumer awareness regarding plastic pollution exerts significant market pull towards eco-friendly brands, translating into a strong competitive advantage for early adopters of sustainable packaging practices. The force of competitive intensity remains high, characterized by continuous price pressure from major buyers (QSR chains) and ongoing efforts by leading packaging firms to secure supply agreements for sustainable inputs, leading to market consolidation and vertical integration strategies.

Furthermore, operational risks, particularly concerning supply chain resilience, constitute a critical impact force. The complexity of manufacturing specialized lids and cups requires sophisticated molding and printing technologies. Disruptions in the global supply of wood pulp or petrochemical feedstocks can rapidly halt production. To mitigate this, companies are exploring localized production strategies and diversifying material suppliers. The imperative to design packaging that is simultaneously functional (leak-proof, thermal performance) and compliant with evolving waste management infrastructures worldwide represents a critical challenge and opportunity. Ultimately, success is defined by the ability of manufacturers to navigate this intricate balance between cost efficiency, material innovation, and strict adherence to diverse global environmental standards, ensuring both product safety and environmental responsibility.

Segmentation Analysis

The Cups and Lids Packaging Market is comprehensively segmented based on material type, product form, application, and end-user industry, reflecting the diverse functional requirements across the value chain. The dominant materials include paper and paperboard, plastics (PET, PP, PS, PVC), and sustainable/compostable bioplastics. Paper remains vital for hot beverages due to its insulation properties, while plastics dominate cold beverages and general food containers due to cost-effectiveness and transparency. Analyzing segments by product form highlights the distinction between standard cups (single-wall, double-wall, ripple) and the diverse array of lids (flat, dome, sip-through, snap-on), which often require higher precision manufacturing. This detailed segmentation aids stakeholders in identifying high-growth niches, particularly in the premium, customized, and eco-friendly product categories, allowing for tailored strategic investments based on regional material preferences and regulatory mandates.

Application-based segmentation is crucial, distinguishing between food packaging (e.g., yogurt, soup, ice cream containers), beverage packaging (hot and cold), and specialized uses such as pharmaceuticals or laboratory supplies. The food and beverage segment constitutes the bulk of the market, exhibiting robust growth driven by meal kit services and quick-service chain expansions. The end-user analysis further refines this view, focusing on commercial entities like QSRs, coffee shops, hotels, institutional caterers, and retail outlets. The shift towards institutional use cases requiring high-volume, standardized packaging, versus consumer retail demanding bespoke, shelf-stable formats, dictates specific product development priorities. Furthermore, the segmentation by insulation type, focusing on single-use versus reusable products, is becoming increasingly relevant as regulatory pressures push consumers towards multi-use systems, influencing long-term market forecasts and material science research directions.

- By Material Type:

- Plastic (PET, PP, PS, PVC, Others)

- Paper & Paperboard

- Bioplastics (PLA, PHA)

- Molded Fiber/Pulp

- Aluminum

- By Product Form:

- Cups (Hot Beverages, Cold Beverages, Food Containers)

- Lids (Flat Lids, Dome Lids, Sip-Through Lids, Snap-On Lids, Custom Seals)

- By Application:

- Beverages (Carbonated Soft Drinks, Juices, Coffee/Tea, Water)

- Food Service (QSR, Catering, Institutional)

- Dairy & Frozen Products (Yogurt, Ice Cream)

- Consumer Goods & Retail

- Healthcare & Pharmaceuticals

- By End-Use Industry:

- Quick Service Restaurants (QSR)

- Hotels, Restaurants, Cafés (HORECA)

- Institutional (Hospitals, Schools)

- Supermarkets & Hypermarkets

- E-commerce and Food Delivery Platforms

Value Chain Analysis For Cups and Lids Packaging Market

The Value Chain for the Cups and Lids Packaging Market is complex, beginning with upstream raw material sourcing and culminating in final distribution to end-users. Upstream analysis involves key suppliers of foundational materials: forestry companies and pulp producers for paperboard, petrochemical firms providing resin pellets (PP, PET), and specialized biopolymer manufacturers. The quality and sustainability of these raw inputs directly influence the final product's cost and environmental footprint. Fluctuations in commodity prices and the transition from fossil fuel-derived plastics to renewable materials represent significant upstream risks and opportunities, respectively. Manufacturers must establish strong, often long-term, relationships with these suppliers to ensure material consistency and volume, especially when dealing with certified sustainable or food-grade materials that require specific compliance documentation.

The manufacturing process itself forms the core of the value chain, involving sophisticated technologies like injection molding (for lids), thermoforming (for plastic cups), and converting/printing (for paper cups). Direct and indirect distribution channels dictate how products reach the market. Direct distribution is common for large-volume customers like multinational QSR chains and beverage companies, where manufacturers negotiate customized supply contracts and potentially utilize captive or dedicated logistics networks. This allows for optimized inventory management and direct feedback loops on product performance. Indirect distribution involves leveraging third-party wholesalers, distributors, and specialized packaging brokers who aggregate products and serve smaller independent food service operators and general retail outlets, providing broad market access but potentially adding complexity and cost layers.

Downstream analysis focuses on the end-use applications and the ultimate disposal/recycling phase. Consumers and businesses demand high functional performance—leak protection, heat insulation, and aesthetic appeal. The increasing reliance on food delivery platforms means downstream demands now include tamper-evidence and specialized compartment designs. Crucially, the final step—waste management and recycling—is becoming an integral part of the value chain. As producers take on Extended Producer Responsibility (EPR), investment in downstream collection, sorting, and reprocessing infrastructure is mandatory. Collaboration with waste management entities and material recovery facilities (MRFs) is essential to close the loop, confirming the circular viability of the packaging sold, which in turn strengthens brand reputation and compliance with evolving global environmental mandates.

Cups and Lids Packaging Market Potential Customers

Potential customers and primary buyers of cups and lids packaging are highly diverse, spanning the entire food and beverage service ecosystem, institutional catering, and specialized industrial applications. The largest volume buyers are Quick Service Restaurant (QSR) chains and large multi-national coffee retailers, whose business models are inherently reliant on standardized, high-volume disposable (or sustainable alternative) packaging for their extensive global footprints. These customers prioritize cost-efficiency, consistent branding, and high functional performance, demanding custom sizes, complex barrier coatings for paper cups, and proprietary lid designs that ensure thermal retention and minimize spillage during transport, often leading to stringent supplier qualification processes and long-term supply agreements.

Another significant customer segment includes institutional caterers and large facility management groups serving hospitals, educational campuses, corporate cafeterias, and airlines. These buyers typically focus on bulk purchases, standardization for streamlined operations, and often require compliance with specific health and safety regulations, necessitating rigorous quality control for all packaging components. Additionally, the rapid growth of third-party food delivery platforms and meal kit services has created a unique class of potential customers who require specialized, robust, and often multi-compartment containers and secure lids designed explicitly to withstand the rigors of last-mile delivery while maintaining food temperature and presentation integrity upon arrival, driving demand for premium sealing technologies and sustainable materials.

Finally, packaging wholesalers, distributors, and large retail chains (supermarkets/hypermarkets) represent critical indirect customers. These entities serve as intermediaries, supplying independent cafes, small restaurants, and direct consumer retail shelves with generic or private-label packaging solutions. For distributors, product diversity, inventory availability, and reliable logistics are paramount. Specialized end-users, such as pharmaceutical companies and clinical laboratories, also form a smaller but high-value customer base, requiring sterile, often tamper-evident, lidded containers for controlled substances and sample collection, where compliance with FDA/EMA regulations and material purity are the absolute non-negotiable purchasing criteria.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 14.5 Billion |

| Market Forecast in 2033 | USD 21.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki Oyj, Dart Container Corporation, Berry Global Inc., WestRock Company, Graphic Packaging International, Greiner Packaging International GmbH, Genpak LLC, Pactiv Evergreen Inc., Solo Cup Company, F Bender Limited, Groupe Guillin, Airlite Plastics Co., Detpak (Paper Products Pty Ltd), Reynolds Consumer Products, Dixie Consumer Products LLC, BillerudKorsnäs AB, Novolex Holdings LLC, Sonoco Products Company, Georgia-Pacific LLC, International Paper. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cups and Lids Packaging Market Key Technology Landscape

The technological landscape of the Cups and Lids Packaging Market is rapidly evolving, driven primarily by the need for enhanced functionality, increased production efficiency, and material sustainability. A core area of technological focus is advanced paperboard coating. Traditional polyethylene (PE) linings, which hinder recycling, are increasingly being replaced by innovative, water-based, or dispersion coatings that provide necessary liquid and grease barriers while maintaining the paper cup’s recyclability in standard paper recycling streams. This transition requires significant investment in specialized coating and converting equipment capable of handling these newer, more sensitive barrier materials at high production speeds. Simultaneously, the manufacturing of lids utilizes highly advanced precision injection molding and thermoforming technologies, which must ensure exact dimensional accuracy and robust sealing capabilities to prevent leaks and spills, crucial for the integrity of food service operations.

Another pivotal technology involves the development and scaling of bio-plastic and compostable polymer processing. Manufacturers are investing in specialized extrusion and molding equipment optimized for materials like PLA (Polylactic Acid) and PHA (Polyhydroxyalkanoates), which have different thermal and processing characteristics compared to conventional plastics. The goal is to produce cups and lids that biodegrade or compost effectively in industrial facilities, addressing end-of-life concerns. Furthermore, the integration of Industry 4.0 principles, including sensor technology, IoT, and high-speed robotics, is transforming the factory floor. Automated handling systems and sophisticated quality control mechanisms, often utilizing AI-powered vision systems, ensure zero-defect packaging production, minimizing material waste and maximizing throughput efficiency across complex assembly lines where cups and lids must mate perfectly.

In terms of consumer interface, smart packaging technologies are beginning to emerge, though still niche. This includes the integration of QR codes or NFC tags printed directly onto cups and lids, facilitating consumer engagement, verifying product authenticity, and providing detailed recycling or composting instructions. Furthermore, research is ongoing into self-sealing and tamper-evident lid solutions that utilize specialized films and sealing mechanisms, vital for enhancing food safety and security within the booming food delivery sector. The confluence of material science innovation (barrier coatings), process engineering (high-speed molding), and digital manufacturing (AI and IoT) defines the competitive edge in this technologically sophisticated market, allowing companies to meet the contradictory demands for high performance and strict environmental compliance simultaneously.

Regional Highlights

- North America: The North American market is mature but highly dynamic, characterized by high consumer spending on convenience foods and beverages, driving consistent demand, particularly from major QSRs and coffee chains. The region is a leader in adopting specialized and customized packaging solutions, including double-wall insulated cups and high-security snap-on lids. However, this market is also at the forefront of the regulatory pushback against single-use plastics. States like California and New York have implemented bans or taxes on certain plastic items, compelling manufacturers to rapidly transition to certified compostable or highly recyclable paperboard products. Innovation is centered on sustainable fiber-based materials and the development of advanced recycling infrastructure to handle complex packaging formats. Significant investment is seen in domestic manufacturing capacity to secure supply chains and mitigate geopolitical risks. The strong presence of key market players dictates intense competition based on supply reliability and sustainability credentials.

- Europe: Europe is defined by some of the world's most stringent environmental policies, particularly the European Union’s Single-Use Plastic (SUP) Directive, which has dramatically restructured the cups and lids packaging landscape. This legislative framework mandates the reduction and eventual phase-out of many traditional plastic items, creating immense demand for certified bio-based, compostable, and recyclable alternatives. Consequently, the European market is a hotbed for material science innovation, focusing on developing high-barrier, PFAS-free paper coatings and optimizing polylactic acid (PLA) use. The market growth here is driven less by volume increase and more by value increase, as sustainable and compliant packaging solutions often command higher prices. Germany, the UK, and France are leading contributors, investing heavily in infrastructure for collection and mechanical recycling to meet ambitious circular economy targets.

- Asia Pacific (APAC): The APAC region is projected to exhibit the highest growth rate globally, propelled by rapid urbanization, significant expansion of the middle-class population, and the subsequent proliferation of global and regional QSR chains across countries like China, India, and Southeast Asia. The demand here is fundamentally driven by high consumption volume and cost-effectiveness. While sustainability regulations are emerging, particularly in developed Asian economies like Japan and South Korea, the sheer scale of the population and the expanding food service industry fuel massive demand for standard, high-volume disposable packaging. Opportunities are vast for companies capable of establishing localized, high-capacity production facilities. The shift towards sustainable packaging is slower than in the West, though growing, often starting in major metropolitan areas, presenting a phased transition opportunity for manufacturers offering a diverse portfolio of both conventional and eco-friendly options.

- Latin America (LATAM): The LATAM market growth is characterized by increasing foreign investment in QSR and fast-food franchises, coupled with rising disposable incomes in key economies such as Brazil and Mexico. Convenience remains a primary purchasing driver. The cups and lids market in this region faces challenges related to economic volatility and less developed municipal waste management systems compared to Europe or North America. Packaging solutions must be robust and often budget-conscious. While environmental consciousness is rising, compliance enforcement can be inconsistent. Manufacturers focus on providing cost-effective, basic functional packaging while gradually introducing sustainable alternatives in premium segments and major urban centers where consumer and governmental pressure for green packaging is more pronounced.

- Middle East and Africa (MEA): The MEA region presents a fragmented market landscape, with significant growth pockets concentrated in the Gulf Cooperation Council (GCC) nations due to high per capita income, extensive tourism, and robust HORECA sector development. Saudi Arabia and the UAE are major demand centers, often importing high-quality, specialized cups and lids to meet the standards of international hospitality chains. In contrast, growth in many African markets is driven by basic, high-volume needs. Regulatory shifts are localized; for instance, some GCC states are implementing selective plastic bans, pushing localized adoption of biodegradable or paper-based alternatives. Extreme climatic conditions necessitate packaging with superior thermal insulation and material durability, especially for cold beverages, influencing technological requirements in the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cups and Lids Packaging Market, showcasing their strategic positioning, product portfolios, recent developments, and focus on sustainable manufacturing practices.- Huhtamaki Oyj

- Dart Container Corporation

- Berry Global Inc.

- WestRock Company

- Graphic Packaging International

- Greiner Packaging International GmbH

- Genpak LLC

- Pactiv Evergreen Inc.

- Solo Cup Company (A subdivision of Dart Container)

- F Bender Limited

- Groupe Guillin

- Airlite Plastics Co.

- Detpak (Paper Products Pty Ltd)

- Reynolds Consumer Products

- Dixie Consumer Products LLC (A subdivision of Georgia-Pacific)

- BillerudKorsnäs AB

- Novolex Holdings LLC

- Sonoco Products Company

- Georgia-Pacific LLC

- International Paper

Frequently Asked Questions

Analyze common user questions about the Cups and Lids Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current shift in cups and lids packaging materials?

The primary driver is the stringent global regulatory push, notably the EU’s Single-Use Plastic Directive, coupled with escalating consumer demand for sustainability, forcing a rapid transition from conventional plastics to paperboard, bioplastics, and certified compostable alternatives.

How is the growth of food delivery services impacting the design requirements for packaging?

Food delivery growth mandates packaging with superior functional integrity, including robust sealing, excellent thermal retention to keep food hot or cold during transit, and enhanced tamper-evident features to assure food safety and product security for the consumer.

Which material segment holds the largest potential for market growth through 2033?

The Paper and Paperboard segment is projected to experience the fastest market value growth, driven by innovation in recyclable barrier coatings (PE-free) and increased acceptance as the preferred sustainable alternative for high-volume hot and cold beverage applications globally.

What role does automation and Industry 4.0 play in the manufacturing of cups and lids?

Automation, leveraging IoT and AI-driven systems, is critical for optimizing high-speed production lines, enabling predictive maintenance, reducing material waste, and ensuring precise quality control necessary for the exact dimensional mating of cups and lids.

Which geographical region offers the most significant volume growth opportunity for cups and lids packaging?

Asia Pacific (APAC), particularly emerging economies like China and India, offers the most substantial volume growth opportunity due to rapid urbanization, massive expansion of the QSR sector, and increasing disposable incomes driving on-the-go consumption habits.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager