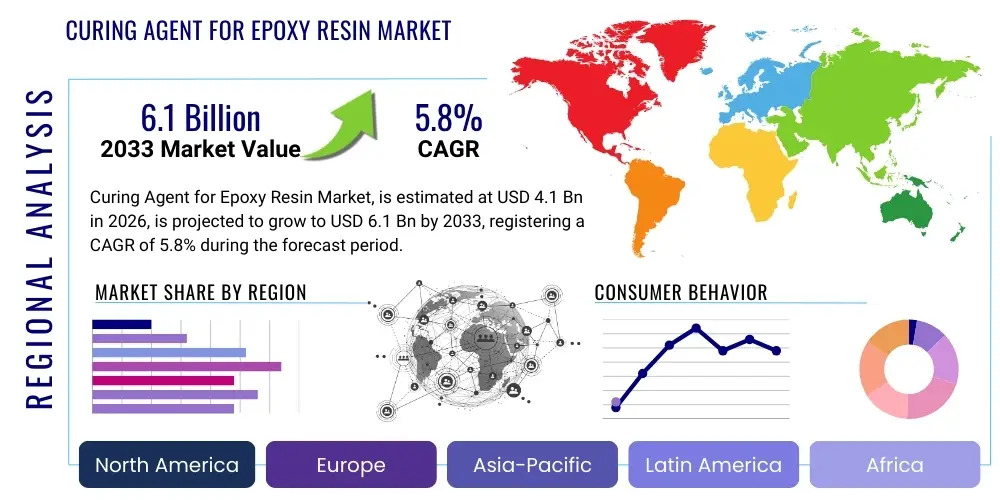

Curing Agent for Epoxy Resin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434973 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Curing Agent for Epoxy Resin Market Size

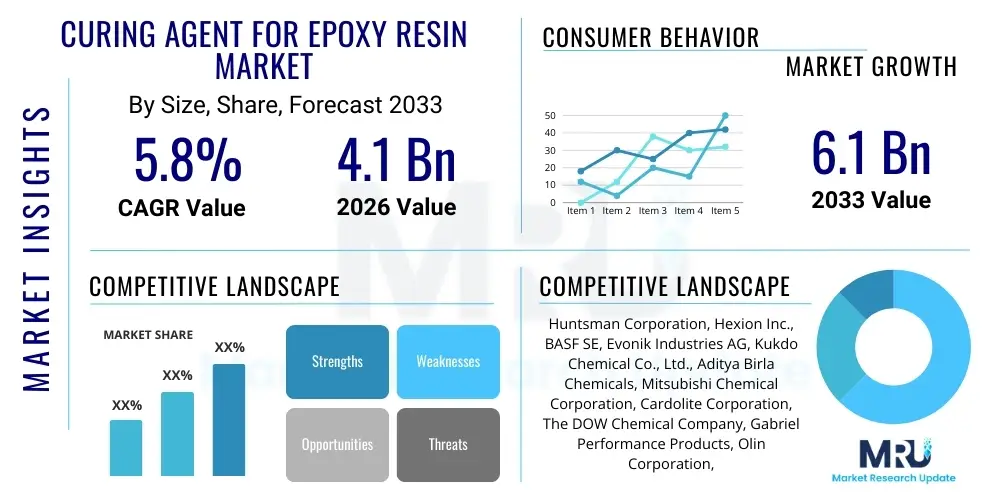

The Curing Agent for Epoxy Resin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033.

Curing Agent for Epoxy Resin Market introduction

The Curing Agent for Epoxy Resin Market encompasses specialty chemicals essential for the polymerization and cross-linking of epoxy resins, transforming liquid resin into a rigid, thermoset material. Curing agents, also known as hardeners, dictate the final properties of the epoxy system, including its chemical resistance, thermal stability, mechanical strength, and cure speed. Key product categories include amines (aliphatic, cycloaliphatic, aromatic), anhydrides, polyamides, and polyols, each suited for specific application requirements ranging from high-performance aerospace composites to durable protective coatings in industrial environments. The fundamental necessity of these agents stems from the inherent need for epoxy systems to achieve their final high-performance characteristics, making them indispensable components in modern materials science.

Major applications driving market demand include industrial coatings, which require superior corrosion resistance, high-strength adhesives used extensively in automotive and aerospace manufacturing for lightweighting initiatives, and composite materials crucial for wind energy and infrastructure projects. The versatility of epoxy resins, coupled with the ability to tailor final properties via the selection of a specific curing agent, provides manufacturers with a crucial tool for innovation. For instance, fast-curing agents enable quicker assembly processes in electronics and automotive sectors, while latent curing agents are preferred for prepreg materials used in high-end composites requiring long shelf life and precise processing temperatures. This wide spectrum of uses solidifies the market's robust growth trajectory, intrinsically linked to global industrial output.

The primary benefits derived from incorporating these specialized hardeners include enhanced physical properties such as elevated glass transition temperatures (Tg), superior adhesion to diverse substrates, and unmatched chemical and moisture resistance. Driving factors are multifaceted, centered around increasing infrastructure spending globally, rapid expansion in the wind energy sector requiring advanced composites, and stringent regulatory demands necessitating low-VOC and bio-based curing solutions. Furthermore, the rising adoption of epoxy systems over traditional materials, due to their performance benefits, particularly in demanding environments like marine and oil and gas, continues to propel market expansion across all major regions.

- Product Description: Specialty chemicals (hardeners) that initiate polymerization and cross-linking in epoxy resins to form rigid thermoset polymers.

- Major Applications: Protective and marine coatings, high-performance adhesives, electronic encapsulation, and composite materials (wind blades, aerospace structures).

- Key Benefits: Improved mechanical strength, thermal stability, chemical resistance, customized cure profiles, and enhanced adhesion.

- Driving Factors: Growth in construction and infrastructure, expansion of the wind energy sector, and demand for lightweight automotive materials.

Curing Agent for Epoxy Resin Market Executive Summary

The global Curing Agent for Epoxy Resin Market demonstrates resilient growth, underpinned by significant technological advancements focusing on sustainability and high-performance requirements. Business trends indicate a strong shift toward waterborne and solvent-free epoxy systems, necessitating the development of corresponding low-viscosity, high-efficiency curing agents. Mergers and acquisitions remain a consistent strategy among leading players seeking to consolidate technological expertise, secure specialized raw material supply chains, and expand regional manufacturing footprints, particularly in fast-growing Asian economies. Innovation is heavily concentrated in developing bio-based amines and imidazole derivatives that offer comparable performance to traditional petrochemical-based agents while addressing mounting environmental concerns regarding volatile organic compounds (VOCs) and hazardous air pollutants (HAPs). Furthermore, the industrial sector’s increasing need for faster processing times is pushing the adoption of novel accelerators and fast-curing anhydride systems for large-scale manufacturing operations.

Regional trends highlight the Asia Pacific (APAC) as the dominant and fastest-growing region, driven primarily by monumental investments in infrastructure development, burgeoning manufacturing bases in China and India, and the massive deployment of renewable energy projects, particularly wind farms. North America and Europe maintain significant market shares, characterized by high demand for specialized, high-cost curing agents catering to the stringent performance standards of the aerospace, electronics, and automotive industries. These developed markets are also the primary drivers of R&D efforts in sustainable chemistry, fostering regulatory frameworks that favor green hardeners, which is subsequently influencing product development across the global market. Furthermore, Latin America and the Middle East & Africa (MEA) are emerging as high-potential markets, fueled by urbanization projects, petrochemical expansions, and increasing demand for protective coatings in harsh climates.

Segmentation trends reveal that amine-based curing agents, particularly cycloaliphatic and polyether amines, retain the largest market share due to their versatility and applicability across coatings and adhesives. However, anhydride curing agents are experiencing accelerated growth, driven by their superior thermal and electrical properties, making them indispensable in the electronics encapsulation and electrical insulation sectors. From an end-use perspective, the coatings segment accounts for the largest volume due to the vast application scope in industrial protective coatings, flooring, and decorative paints. Conversely, the composites segment, driven by aerospace and wind energy applications, is exhibiting the highest CAGR, demanding highly specialized, often latent, curing agents that facilitate complex manufacturing processes like resin transfer molding (RTM) and prepreg fabrication. This segment growth is critical for achieving net-zero goals globally, positioning curing agents as enablers of sustainable infrastructure.

AI Impact Analysis on Curing Agent for Epoxy Resin Market

User inquiries regarding AI's role in the Curing Agent for Epoxy Resin Market frequently center on three main themes: optimization of synthesis processes, prediction of final epoxy system performance, and acceleration of R&D cycles for novel, sustainable hardeners. Users are keen to understand how AI and machine learning (ML) algorithms can reduce the vast experimental space typically required to find the optimal hardener-to-resin ratio and curing conditions, which currently relies heavily on empirical trial-and-error. Key concerns revolve around the integration cost of AI systems into existing chemical manufacturing infrastructure and the reliability of AI models in predicting complex, multi-variable reactions, especially when dealing with new bio-based feedstocks. Expectations are high that AI will lead to the rapid commercialization of low-VOC, high-performance curing agents by accurately modeling structure-property relationships, thereby lowering material costs and minimizing waste associated with failed experiments in synthesis and formulation.

- AI Impact on Curing Agent Production: Process optimization through predictive maintenance and energy consumption modeling in production facilities.

- AI Impact on R&D: Machine learning models accelerate the design of novel curing agent chemistries (e.g., bio-based amines) by predicting reactivity and performance parameters (Tg, viscosity) before laboratory synthesis.

- AI Impact on Formulation: Algorithms optimize the blending ratio of curing agents and accelerators to match specific end-user performance requirements and cure profiles, minimizing empirical testing.

- AI Impact on Quality Control: Automated data analysis and computer vision systems enhance batch consistency and purity analysis of synthesized hardeners.

- AI Impact on Supply Chain: Predictive analytics improve raw material procurement and inventory management for specialized precursors needed for high-purity curing agents.

DRO & Impact Forces Of Curing Agent for Epoxy Resin Market

The Curing Agent for Epoxy Resin Market is highly susceptible to macro-economic forces and technical innovation, characterized by a complex interplay of Drivers, Restraints, and Opportunities (DRO). The primary impact forces currently reshaping the market are the accelerating global transition to sustainable materials and the relentless demand for higher performance specifications in niche applications like aerospace and semiconductor manufacturing. Market growth is fundamentally driven by robust construction and infrastructure expansion in emerging economies, coupled with significant mandates for lightweighting in the transportation sector, compelling the use of epoxy composites cured with advanced hardeners. However, the market faces inherent challenges, notably the volatility and increasing cost of key petrochemical raw materials such as phenol and ethylene derivatives, which are essential precursors for many traditional curing agents. This cost pressure, combined with increasingly stringent environmental regulations concerning VOC emissions, forces manufacturers to invest heavily in reformulation, thereby posing a short-term financial restraint.

The core drivers are the exponential growth in global wind energy installations, where epoxy resins and their specialized hardeners are critical for producing massive, durable rotor blades, and the escalating use of industrial protective coatings for asset integrity management across oil & gas, marine, and power generation sectors. These applications demand exceptional chemical resistance and long-term durability achievable only through expertly formulated curing systems. Opportunities are centered on the rapid commercialization of novel bio-based and waterborne curing agents. These green chemistries not only offer compliance with future environmental standards but also provide performance differentiation, allowing companies to capture premium segments, particularly in Europe and North America where sustainability mandates are strongest. Furthermore, developing advanced latent curing agents (e.g., dicyandiamide derivatives and accelerators) suitable for high-speed automated manufacturing processes presents a crucial opportunity for market penetration in mass-produced items like electronics components.

The overarching impact forces are technological substitution risk—where alternative adhesive and coating systems (e.g., polyurethanes, silicones) might gain ground if epoxy system costs rise too sharply—and regulatory shifts that can overnight ban or restrict the use of certain amine or anhydride hardeners deemed hazardous. Supply chain resiliency is also a critical force, especially following recent global logistical disruptions, emphasizing the need for regionalized production and diversified sourcing of precursors. Successful market players are those that can effectively navigate these forces by balancing cost control (restraint mitigation) with continuous, rapid innovation in green chemistry (opportunity capture), ensuring their curing agents meet the evolving requirements for high-performance, low-environmental impact applications.

- Drivers:

- Surging demand from high-growth end-use sectors (wind energy, electric vehicles, industrial coatings).

- Increasing need for high-strength, lightweight materials in aerospace and automotive applications.

- Rapid infrastructure development and urbanization, particularly in Asia Pacific.

- Restraints:

- Volatile prices and supply chain dependence on petrochemical raw materials.

- Strict environmental regulations pertaining to VOC emissions and hazardous chemicals (REACH, TSCA).

- High capital expenditure required for developing and scaling up bio-based or waterborne formulations.

- Opportunities:

- Development and commercialization of bio-based, sustainable, and low-viscosity curing agents.

- Expansion into specialty electronics, encapsulation, and semiconductor packaging applications requiring ultra-high purity hardeners.

- Focus on latency-controlled and accelerated curing systems for advanced manufacturing processes.

- Impact Forces:

- Technological innovation driving shift towards non-amine chemistries.

- Regulatory pressure shaping product composition and market entry barriers.

- Fluctuations in global crude oil prices affecting raw material costs.

Segmentation Analysis

The Curing Agent for Epoxy Resin Market is segmented primarily based on the type of curing agent chemistry, the application sector, and the physical form of the hardener. Understanding these segments is crucial as the choice of curing agent fundamentally dictates the thermal, electrical, and mechanical properties of the final cured epoxy product. Amine-based agents, including aliphatic, cycloaliphatic, and aromatic amines, dominate the market due to their excellent versatility, low temperature cure capabilities, and applicability in both coatings and adhesives. However, specialized agents like anhydrides and catalytic hardeners are increasingly gaining prominence in niche, high-value sectors such as electronics and electrical insulation, where superior thermal stability and electrical performance are paramount. The market structure reflects a trend toward highly customized formulations rather than general-purpose agents, necessitating close collaboration between chemical manufacturers and specific end-users like automotive OEMs or wind turbine manufacturers.

- By Type:

- Amines (Aliphatic, Cycloaliphatic, Aromatic, Polyetheramines)

- Anhydrides

- Polyamides

- Isocyanates

- Mercaptans

- Catalytic Curing Agents (Imidazoles, BF3 complexes)

- By Application:

- Coatings (Industrial, Protective, Marine, Automotive)

- Adhesives (Structural, Automotive, General Purpose)

- Composites (Aerospace, Wind Energy, Automotive, Construction)

- Encapsulation and Potting (Electronics, Electrical Insulation)

- Flooring and Paving

- By Form:

- Liquid

- Solid (Powders, Flakes)

Value Chain Analysis For Curing Agent for Epoxy Resin Market

The value chain for Curing Agent for Epoxy Resin spans from the sourcing of basic petrochemical raw materials to the final utilization by specialized end-users. The upstream segment is characterized by reliance on large petrochemical complexes that supply key precursors such as ethylene, propylene, and benzene derivatives, which are critical for synthesizing amines, anhydrides, and polyamides. Price volatility in these upstream commodities directly impacts the profitability and production cost of the specialized hardeners. Chemical manufacturers then engage in complex synthesis and purification steps, where technological expertise and intellectual property related to specific curing profiles (e.g., latency, cure speed) create significant competitive advantage. Maintaining high purity is essential, particularly for agents destined for sensitive electronics and aerospace applications.

The distribution channel is multifaceted, relying heavily on specialized chemical distributors who provide technical support, localized inventory management, and smaller batch sizes to diverse regional customers. Direct sales, however, are prevalent for large-volume customers, particularly major coatings formulators and Tier 1 composite manufacturers, where customized formulation support is a prerequisite. Indirect channels, through regional distribution networks, are essential for penetrating smaller industrial markets and specialized repair sectors. The high technical complexity of selecting and applying curing agents means that technical services and application engineering support provided by both manufacturers and distributors form a critical, value-added component of the midstream and downstream segments.

The downstream analysis focuses on the end-use sectors, including coatings formulators, adhesive manufacturers, and composite fabricators. These entities select curing agents based on the final performance criteria required by their clients (e.g., resistance to harsh chemicals in marine environments, specific dielectric properties in electronics). The feedback loop from these end-users back to the chemical producers is vital for continuous product refinement and the development of next-generation, application-specific hardeners. Key trends in the downstream segment include the increasing demand for pre-weighed or pre-mixed systems to minimize application errors and enhance safety at the customer level, further solidifying the importance of sophisticated logistics and packaging throughout the value chain.

Curing Agent for Epoxy Resin Market Potential Customers

The primary customers for curing agents are industrial manufacturers and formulators that utilize epoxy resins to produce durable, high-performance materials and components. The largest cohort of buyers are coatings manufacturers who integrate these hardeners into protective coatings for infrastructure, industrial machinery, and marine vessels, prioritizing agents that offer robust corrosion resistance and rapid curing times suitable for large-scale industrial application. Another significant customer group comprises structural adhesive producers serving the automotive industry, particularly those involved in bonding dissimilar materials for electric vehicle battery packs and lightweight body structures, requiring agents with high toughness and peel strength.

In the specialty segment, aerospace and wind energy composite manufacturers represent high-value customers. These buyers demand highly specialized, often solid or semi-solid, latent curing agents like Dicyandiamide (DICY) and its derivatives, which allow for controlled processing (prepregs) and high-temperature curing to achieve maximum mechanical and thermal performance. The electronics industry, utilizing epoxy systems for encapsulation, potting, and semiconductor packaging, seeks ultra-high purity anhydrides and imidazoles to ensure excellent dielectric properties and minimal ionic contamination, essential for reliable electronic components.

Furthermore, construction companies and flooring specialists purchase significant volumes of curing agents for seamless industrial flooring, high-traffic pedestrian areas, and concrete repair applications. For these end-users, factors like fast return-to-service time, UV stability, and ease of application are critical purchasing criteria, driving demand for fast-set polyamines and cycloaliphatic amine systems. Essentially, any sector requiring materials with superior bonding strength, durability under harsh conditions, and specific electrical or thermal resistance constitutes a high-potential customer base.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huntsman Corporation, Hexion Inc., BASF SE, Evonik Industries AG, Kukdo Chemical Co., Ltd., Aditya Birla Chemicals, Mitsubishi Chemical Corporation, Cardolite Corporation, The DOW Chemical Company, Gabriel Performance Products, Olin Corporation, Royce International, Atul Ltd., Air Products and Chemicals, Inc., Polynt-Reichhold Group, Wanhua Chemical Group, Lonza Group, Epikote (Hexion), DIC Corporation, Nippon Shokubai. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Curing Agent for Epoxy Resin Market Key Technology Landscape

The technological landscape for curing agents is rapidly evolving, driven primarily by the need for enhanced sustainability, compliance with VOC reduction mandates, and the quest for superior performance in extreme environments. A major shift involves the development of bio-based curing agents derived from renewable resources, such as cardanol (cashew nutshell liquid) derivatives, which yield specialized phenalkamines. These bio-based agents not only offer a lower carbon footprint but also provide excellent moisture resistance, rapid cure at low temperatures, and superior adhesion, making them highly attractive for marine and heavy-duty industrial coatings. Furthermore, advancements in waterborne curing technology are critical, allowing epoxy systems to eliminate hazardous solvents while maintaining high cross-link density and film integrity, necessary for indoor protective applications.

Another crucial technological frontier involves latency and accelerating technologies. For the composites and prepreg sector, highly efficient latent curing agents, which remain inert until exposed to a specific temperature or light source, are vital for extended shelf life and precise control during automated manufacturing processes like Resin Transfer Molding (RTM) and filament winding. Research is focused on developing microencapsulation techniques for hardeners to achieve ultra-long latency and uniform dispersion within the epoxy matrix. Simultaneously, there is intensive development of accelerators (e.g., tertiary amines and imidazoles) that can significantly reduce curing time without compromising the final material properties, crucial for high-throughput processes like assembly line bonding in the automotive industry.

Finally, the focus on developing high-performance, ultra-pure hardeners for the electronics and semiconductor sectors remains paramount. This involves rigorous purification techniques for anhydrides and specialized amine derivatives to achieve extremely low levels of ionic impurities, which can compromise the dielectric function of electronic components. The integration of nanotechnology is also emerging, where modified curing agents incorporating nanoparticles (like graphene or carbon nanotubes) can enhance thermal conductivity, mechanical toughness, and electrical properties simultaneously. This continuous technological refinement ensures that curing agents remain the pivotal element for achieving tailored, high-specification performance in advanced material applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market in terms of both consumption volume and growth rate, primarily due to unprecedented infrastructure spending in China, India, and Southeast Asian nations. The region’s burgeoning automotive and electronics manufacturing sectors, coupled with large-scale wind energy projects, create immense demand for both standard and high-performance amine and anhydride curing systems. Local governments are increasingly implementing stricter environmental controls, leading to a rise in demand for imported or locally manufactured low-VOC, waterborne hardeners, driving technological transfer to regional players. China, as the world's largest chemical producer and consumer, dictates much of the supply chain dynamics for basic raw materials used in hardener synthesis.

The Asia Pacific region’s growth trajectory is strongly tied to its status as the global manufacturing hub. Countries like South Korea, Japan, and Taiwan are leaders in the electronics and semiconductor packaging sectors, driving the need for ultra-high purity anhydride and imidazole curing agents that offer exceptional thermal resistance and low ionic content. Furthermore, the aggressive expansion of urbanization projects requires vast quantities of durable epoxy flooring and protective coatings, which utilize high volumes of cycloaliphatic amines for UV resistance and quick return-to-service. This sustained investment across multiple heavy and advanced industries ensures that APAC will maintain its pole position throughout the forecast period, necessitating increased localized production capacity by major global chemical suppliers.

Regulatory shifts in key APAC nations, particularly concerning worker safety and environmental discharge, are subtly reshaping the product mix, favoring encapsulated and lower toxicity formulations. The competitive landscape in APAC is characterized by a mix of large multinational corporations and robust domestic chemical giants, leading to intense price competition in commodity segments, while specialty segments maintain high margins based on technological differentiation. The rapid scaling of the automotive industry, specifically the manufacturing of electric vehicles (EVs) and battery packs requiring structural adhesives cured with polyetheramines, is set to be a significant volume driver.

- North America: North America is a mature but high-value market, characterized by stringent performance requirements in aerospace, military, and energy (oil & gas and wind). The market exhibits strong demand for high-specification, low-latency curing agents for advanced composite manufacturing, particularly in the fabrication of large wind turbine blades and aircraft structural components. The region is a pioneer in the adoption of sustainable chemistries, driving market acceptance of bio-based phenalkamines and novel waterborne amine adducts to comply with federal and state-level VOC emission standards.

The U.S. remains the central hub for R&D and specialized manufacturing, concentrating on high-purity chemicals required for electronics encapsulation and advanced structural adhesives. Infrastructure modernization and maintenance, particularly concerning pipelines, bridges, and power generation facilities, fuel continuous demand for durable industrial protective coatings, where amine hardeners offer essential corrosion and chemical resistance. Furthermore, the push towards reshoring manufacturing and bolstering domestic supply chains is expected to increase consumption of domestically produced hardeners in the automotive and construction sectors.

- Europe: Europe is characterized by strict environmental legislation (e.g., REACH regulations) that heavily influences the chemical profile of curing agents used. This regulatory environment has fostered rapid innovation in solvent-free and waterborne systems, making Europe a leader in the development and adoption of high-solids, low-toxicity epoxy curing systems. Key industries driving demand include the automotive sector, focusing on lightweighting and safety through structural bonding, and the wind energy sector, which is heavily concentrated in the North Sea region and requires specific high-performance amine hardeners for rotor blade production.

The European market values sustainability and product transparency highly, leading to premium pricing for certified bio-based and low-irritant hardeners. Germany, France, and Italy are key manufacturing bases, utilizing curing agents extensively in high-quality industrial flooring, protective coatings, and specialized electronics assembly. Market growth in Europe is steady and driven more by technological upgrade cycles and regulatory compliance than by sheer volume expansion, focusing on specialty, high-margin products.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging opportunities. LATAM is primarily driven by large construction and infrastructure projects, particularly in Brazil and Mexico, leading to demand for standard protective coatings and construction adhesives. MEA, particularly the GCC nations, is a massive consumer of high-performance curing agents due to the substantial scale of the oil & gas industry, which requires exceptional anti-corrosion and temperature-resistant coatings (polyamides and anhydrides) for pipelines and processing plants operating in harsh desert and marine environments.

The market development in MEA is highly concentrated on industrial protective applications. As these regions continue to diversify their economies away from fossil fuels, investments in renewable energy and general manufacturing will increase, broadening the application base for specialty curing agents over the forecast period. However, these markets rely heavily on imports, making them susceptible to global supply chain fluctuations and currency exchange rates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Curing Agent for Epoxy Resin Market.- Huntsman Corporation

- Hexion Inc.

- BASF SE

- Evonik Industries AG

- Kukdo Chemical Co., Ltd.

- Aditya Birla Chemicals

- Mitsubishi Chemical Corporation

- Cardolite Corporation

- The DOW Chemical Company

- Gabriel Performance Products

- Olin Corporation

- Royce International

- Atul Ltd.

- Air Products and Chemicals, Inc.

- Polynt-Reichhold Group

- Wanhua Chemical Group

- Lonza Group

- Epikote (Hexion)

- DIC Corporation

- Nippon Shokubai

Frequently Asked Questions

Analyze common user questions about the Curing Agent for Epoxy Resin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary chemical types of curing agents driving market growth?

The market is primarily driven by amine-based curing agents (aliphatic, cycloaliphatic, and aromatic amines) due to their versatility in coatings and adhesives. However, anhydrides are experiencing strong growth in high-performance niche applications like electronics encapsulation due to their superior thermal and electrical insulating properties.

How does sustainability and regulatory compliance impact the curing agent market?

Sustainability mandates, especially strict VOC regulations (like those in North America and Europe), are significantly impacting the market by compelling manufacturers to prioritize R&D into bio-based curing agents, such as phenalkamines derived from cardanol, and low-viscosity, waterborne amine adducts to replace solvent-based systems.

Which application segment holds the largest market share for epoxy curing agents?

The coatings segment, which includes industrial protective coatings, marine coatings, and flooring applications, holds the largest volume share. This segment requires high volumes of hardeners to achieve corrosion resistance and durability in vast infrastructure and industrial settings globally.

What role does the Asia Pacific region play in the global market dynamics?

Asia Pacific (APAC) is the largest and fastest-growing market globally, driven by massive investments in construction, infrastructure, automotive manufacturing, and the wind energy sector. APAC's high consumption and production capacity dictate global pricing and supply trends, focusing on both commodity and specialized hardeners.

What are the major technological trends in curing agent formulation?

Key technological trends include the development of highly efficient latent curing agents for composite prepregs, the creation of ultra-pure hardeners for sensitive electronics, and the commercialization of bio-based agents that offer rapid cure at low temperatures alongside enhanced moisture resistance, facilitating green chemistry compliance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager