Curtain Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434692 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Curtain Fabric Market Size

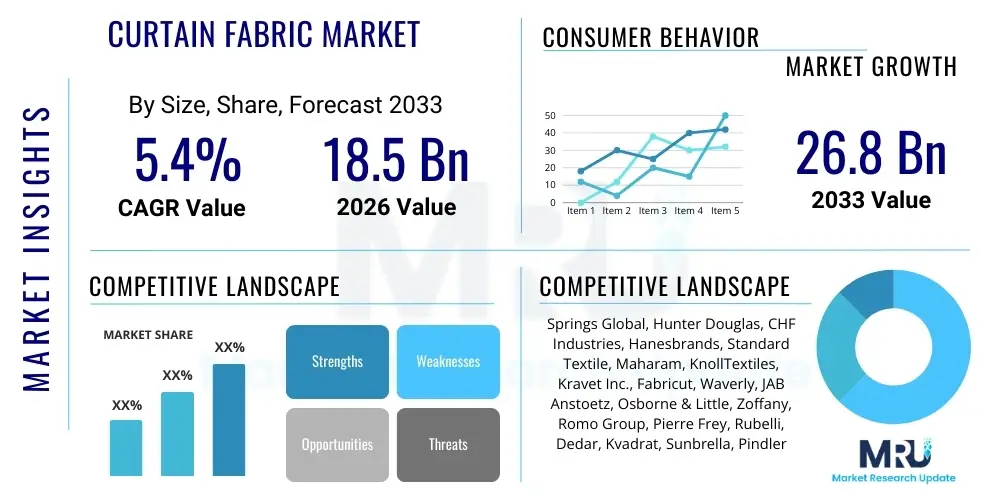

The Curtain Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 26.8 Billion by the end of the forecast period in 2033.

Curtain Fabric Market introduction

The Curtain Fabric Market encompasses the global trade and utilization of textiles specifically designed and manufactured for window treatments, including drapes, sheers, blinds, and valances. These fabrics serve the dual purpose of aesthetic enhancement and functional utility, providing light control, thermal insulation, and privacy across various settings. Key product characteristics driving demand include durability, texture, pattern variety, and specialized performance attributes such as flame resistance and UV protection. The functional versatility of these textiles allows them to be categorized broadly based on material composition (natural, synthetic, blended) and application (residential, commercial, hospitality).

Major applications of curtain fabrics span the residential sector, driven by increasing disposable incomes and a rising trend in home décor renovation, and the commercial sector, which includes offices, hospitals, and educational institutions requiring specific regulatory compliance concerning fire safety and hygiene. The hospitality industry, encompassing hotels and resorts, represents a significant segment due to the high turnover rate of interior designs and the constant need for premium, durable, and aesthetically appealing window dressings. The market’s growth is fundamentally linked to global construction activity, urbanization trends, and evolving consumer preferences toward customized and high-performance interior furnishings.

Driving factors for this market include the global expansion of the real estate sector, particularly in emerging economies, alongside technological advancements in textile manufacturing that facilitate the production of sustainable and intelligent fabrics. Furthermore, increased consumer awareness regarding energy efficiency fuels the demand for blackout and thermal-insulating fabrics. The benefits derived from quality curtain fabrics extend beyond mere decoration, contributing significantly to interior acoustic management, reduction in external noise pollution, and creation of comfortable, energy-efficient indoor environments, thus solidifying their essential role in modern architecture and interior design.

Curtain Fabric Market Executive Summary

The Curtain Fabric Market is characterized by robust business trends focusing on sustainability, technological integration, and customization. Manufacturers are increasingly adopting eco-friendly materials, such as organic cotton, recycled polyester, and biodegradable fibers, responding to heightened consumer demand for environmentally conscious products. Furthermore, the integration of smart textiles, offering features like automatic light adjustment or temperature responsiveness, represents a pivotal technological trend. Business models are shifting towards direct-to-consumer (D2C) and high-level customization platforms, allowing end-users and interior designers precise control over texture, color, and functional specifications, thereby optimizing supply chain efficiency and addressing niche market requirements.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, massive infrastructure projects, and a burgeoning middle class in countries like China and India, leading to substantial growth in residential and commercial construction. North America and Europe maintain stable positions, characterized by high demand for premium, performance-driven fabrics (e.g., sound absorption, thermal efficiency) and strict adherence to fire safety regulations. The Middle East and Africa (MEA) region shows significant potential, propelled by luxurious residential projects and continuous investment in the hospitality sector, demanding high-end, designer-grade fabrics often imported from European manufacturers.

Segment trends reveal that the synthetic segment, particularly polyester, continues to dominate in terms of volume due to its cost-effectiveness, durability, and versatility in achieving various textures and prints. However, the natural fiber segment (cotton, linen, silk) is experiencing accelerating growth in value, driven by premiumization and the demand for breathable, high-quality, and hypoallergenic materials in the luxury residential market. Within applications, the residential segment remains the largest consumer, while the hospitality sector demonstrates the fastest CAGR, driven by the cyclical nature of hotel refurbishments and the need for fabrics that meet both aesthetic rigor and stringent commercial specifications like heavy-duty wear and maintenance.

AI Impact Analysis on Curtain Fabric Market

User queries regarding AI’s impact on the Curtain Fabric Market primarily revolve around three central themes: optimization of manufacturing processes, personalization of consumer experiences, and supply chain resilience. Users are keen to understand how AI-driven analytics can streamline textile production, predict popular design trends with greater accuracy, and manage inventory to reduce waste and excess stock. Concerns often focus on the potential displacement of traditional design roles versus the opportunity for designers to use AI tools for rapid prototyping and generating novel patterns. Expectations are high concerning AI’s ability to facilitate hyper-personalization, allowing consumers to digitally visualize custom fabrics in their space and receive automated recommendations based on interior design style, lighting conditions, and regional climatic factors.

The utilization of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the design, production, and retail aspects of the curtain fabric industry. In manufacturing, AI optimizes machinery settings, monitors thread tension, and performs real-time quality control checks on weaving and printing lines, significantly reducing material defects and improving throughput efficiency. On the retail side, AI powers sophisticated recommendation engines and augmented reality (AR) visualization tools, enabling consumers to "try on" fabrics digitally before purchase, thus minimizing returns and enhancing customer satisfaction. Furthermore, predictive analytics driven by AI models are crucial for forecasting demand based on seasonal shifts, macroeconomic indicators, and social media trends, enabling manufacturers to align production capacities effectively and manage volatile raw material pricing.

AI's role in the supply chain is equally critical, enhancing logistical efficiency through optimized routing and warehousing management. By analyzing vast datasets related to material sourcing, shipping constraints, and customs regulations, AI minimizes delays and mitigates risks associated with global sourcing. In the creative design sphere, Generative AI models are being used to create intricate, unique textile patterns and color palettes that might take human designers significantly longer to develop. This accelerates product development cycles, keeping brands highly responsive to fast-changing fashion and interior trends, thereby marking a shift towards 'smart manufacturing' and 'algorithmic aesthetics' within the textile segment.

- AI-driven trend forecasting for pattern and color palette design.

- Machine learning optimization of textile weaving and dyeing processes, reducing waste.

- Enhanced quality control using computer vision for defect detection in finished fabric rolls.

- Augmented Reality (AR) tools, powered by AI, allowing virtual fabric draping visualization for end-users.

- Predictive supply chain analytics for optimal inventory management and raw material procurement.

- Chatbots and conversational AI improving customer support and answering technical fabric specifications.

- Personalized recommendations engines based on user behavior and design preferences (AEO-driven personalization).

DRO & Impact Forces Of Curtain Fabric Market

The Curtain Fabric Market is influenced by a complex interplay of Drivers, Restraints, and Opportunities, which collectively form the Impact Forces shaping its trajectory. Key drivers include the revitalization of the global construction industry, particularly residential housing, and a rising focus on interior aesthetics fueled by social media influence and lifestyle branding. The strong emphasis on energy efficiency worldwide significantly drives demand for specialized thermal and blackout fabrics, offering measurable energy savings. Opportunities lie primarily in the development of smart textiles integrating IoT functionalities and expanding into high-growth regional markets through localized production and distribution networks. Conversely, restraints encompass the volatility of raw material prices, particularly petroleum-based synthetics, and stringent environmental regulations concerning dyeing and finishing processes, which necessitate substantial capital investment in sustainable technologies. These forces dictate strategic direction and market resilience.

Drivers prominently feature the increasing disposable income in developing nations, translating directly into higher spending on home furnishings and interior décor upgrades. Furthermore, the rapid growth of the hospitality and healthcare sectors globally requires large volumes of durable, anti-microbial, and fire-resistant fabrics that meet stringent commercial standards. Technological innovation acts as a continuous driver, introducing new materials such as high-performance microfibers and sustainable alternatives derived from recycled ocean plastics, broadening the scope of product offerings and appealing to environmentally conscious consumer segments. The continuous pursuit of unique and exclusive interior designs by architects and interior designers also fuels the custom, high-end segment.

Restraints are often linked to macroeconomic instability and supply chain complexities. The curtain fabric industry, being heavily dependent on global trade, is vulnerable to geopolitical tensions and fluctuations in currency exchange rates, impacting profitability margins. Another significant hurdle is the challenge posed by counterfeit products and the unauthorized replication of specialized designs, which dilutes the market value for original manufacturers. Opportunities present themselves through the digital transformation of the sales process, including the proliferation of e-commerce platforms specific to textiles, and the untapped potential in the retrofitting market, where older commercial buildings are updated with modern, energy-efficient window treatments, creating a continuous demand stream beyond new construction.

Segmentation Analysis

The Curtain Fabric Market is comprehensively segmented based on material, application, function, and distribution channel, providing a granular view of market dynamics and consumer preferences. The segmentation by material is crucial, differentiating performance and cost structures, ranging from cost-effective synthetics like polyester to premium naturals like silk and linen. Application segmentation highlights the key consumer bases—residential, commercial, and hospitality—each requiring distinct fabric characteristics and bulk purchase volumes. Functional segmentation focuses on specialized attributes such as blackout capability, acoustic absorption, fire resistance, and thermal insulation, addressing specific end-user needs. Analyzing these segments is essential for manufacturers to tailor their production lines and marketing strategies to target high-potential niches effectively.

- By Material:

- Natural Fibers (Cotton, Silk, Linen, Wool)

- Synthetic Fibers (Polyester, Rayon, Nylon, Acrylic)

- Blended Fabrics (Poly-cotton, Linen-viscose blends)

- By Application:

- Residential

- Commercial (Offices, Retail Spaces)

- Hospitality (Hotels, Resorts)

- Healthcare and Institutional

- By Function:

- Blackout Fabrics

- Sheer/Semi-Sheer Fabrics

- Thermal Insulating Fabrics

- Acoustic Fabrics

- Fire Retardant Fabrics

- By Distribution Channel:

- Offline Retail (Specialty Stores, Department Stores)

- Online Retail (E-commerce Platforms, Brand Websites)

Value Chain Analysis For Curtain Fabric Market

The Value Chain for the Curtain Fabric Market begins with upstream activities involving raw material procurement, which includes sourcing natural fibers from agriculture and chemical precursors for synthetic fiber production. This stage is critical as it dictates the base cost and sustainability profile of the final product. Midstream activities encompass complex textile manufacturing processes such, as spinning, weaving, knitting, dyeing, printing, and specialized finishing treatments (e.g., anti-microbial, fire-retardant applications). Technological investment in efficient and sustainable dyeing processes is a major cost factor here. The integration of advanced machinery and precision engineering in this stage ensures quality and consistency required for commercial applications.

Downstream operations focus on the distribution and installation phases. Products move from manufacturers or converters to various distribution channels, including wholesalers, interior designers, retail chains, and e-commerce platforms. Direct channels involve manufacturers selling high-end or customized fabrics directly to large-scale commercial projects (hotels, major office fit-outs), offering greater control over pricing and client specifications. Indirect channels rely on a network of distributors and retailers, providing broader market access but potentially diluting brand control. The final stage involves fabrication (cutting, sewing, and assembly of curtains) and professional installation, which are essential value-added services often provided by specialized retailers or interior decorators, linking the finished textile product to the end consumer environment.

The effectiveness of the value chain is increasingly reliant on digital integration, optimizing material tracking and demand synchronization across all stages. Key players are strategically focusing on vertical integration—either backward integration into fiber sourcing or forward integration into direct retail—to capture higher margins and ensure quality consistency. Challenges include maintaining ethical sourcing standards upstream and managing the complexity of diverse regulatory requirements downstream across different international markets. Efficiency in the distribution channel, especially through specialized logistics for bulky textile rolls, directly impacts the final cost and availability of the product to both industrial buyers and individual consumers.

Curtain Fabric Market Potential Customers

Potential customers for curtain fabrics are highly diverse, spanning both B2B and B2C segments, reflecting the ubiquitous need for window treatments in constructed spaces. In the B2C segment, the primary end-users are homeowners and renters who purchase fabrics for aesthetic upgrades, privacy, or energy efficiency in residential settings. This segment is highly responsive to retail trends, seasonal fashion cycles, and DIY customization options. The B2B segment, however, represents the largest volume consumption and includes specialized buyers such as interior design firms, architecture practices, and commercial procurement departments responsible for large-scale projects like office towers, retail centers, and educational facilities.

A significant category of potential customers is the hospitality industry, comprising hotel chains, boutique resorts, and serviced apartment operators. These buyers demand fabrics that are aesthetically superior, highly durable (able to withstand frequent washing and heavy use), and compliant with strict fire safety codes (often NFPA 701 or similar international standards). Similarly, the healthcare sector—hospitals, clinics, and assisted living facilities—requires specialized functional fabrics that are anti-microbial, easy to clean, and hypoallergenic, focusing heavily on infection control and longevity rather than just design novelty. These institutional buyers prioritize performance metrics and long-term cost of ownership.

Furthermore, specialized fabric converters and professional curtain makers, who purchase materials in bulk rolls to create finished window treatments tailored to specific client dimensions and requirements, also form a critical customer base. These intermediate customers often require exclusive patterns, high minimum order quantities, and reliable supply chain logistics. Export and import traders, facilitating the movement of textiles between manufacturing hubs in Asia and consuming markets in North America and Europe, also serve as essential bulk buyers. Effective targeting requires understanding the specific quality demands, regulatory compliance needs, and procurement cycles inherent to each distinct end-user category.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 26.8 Billion |

| Growth Rate | 5.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Springs Global, Hunter Douglas, CHF Industries, Hanesbrands, Standard Textile, Maharam, KnollTextiles, Kravet Inc., Fabricut, Waverly, JAB Anstoetz, Osborne & Little, Zoffany, Romo Group, Pierre Frey, Rubelli, Dedar, Kvadrat, Sunbrella, Pindler |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Curtain Fabric Market Key Technology Landscape

The Curtain Fabric Market’s technological landscape is rapidly evolving, driven by the dual pressures of performance demand and sustainability mandates. Key manufacturing technologies center around advanced weaving and knitting techniques that allow for multi-layer fabrics capable of achieving specific functional attributes, such as high-level sound absorption or integrated thermal barriers, often without increasing the fabric weight excessively. Digital printing technology has revolutionized the market, enabling high-definition, complex pattern transfers directly onto various substrates with minimal water waste and rapid design turnaround times. This shift from traditional screen printing offers unparalleled customization capabilities, particularly beneficial for small-batch designer collections and personalized residential orders.

Further innovation is concentrated in the chemical finishing and coating sector. Technologies such as nanotechnology are being deployed to impart functional enhancements like superior stain resistance, UV protection, and permanent anti-microbial properties to fabrics, significantly extending their service life, especially in high-traffic commercial and healthcare environments. The development of environmentally friendly dyeing processes, moving away from heavy metal dyes and implementing closed-loop water systems, is also paramount, driven by increasingly strict global environmental standards. These green technologies are becoming major competitive differentiators, catering to sustainable building certifications and eco-conscious consumer demand globally.

The rise of smart textiles represents the market's frontier technology. Although still nascent, integrated conductive fibers and micro-sensors are being developed for applications in motorized curtains and smart homes. These fabrics can interact with building automation systems, adjusting opacity or opening/closing based on ambient light levels or temperature readings, thereby maximizing energy efficiency automatically. Furthermore, specialized manufacturing techniques for producing recycled and bio-based fibers (e.g., fibers made from bamboo, Tencel, or reclaimed plastics) are gaining traction, requiring advanced polymer processing and spinning equipment to maintain the tensile strength and aesthetic quality required for curtain applications, ensuring structural integrity alongside sustainable sourcing.

Regional Highlights

Regional dynamics are critical to understanding the global Curtain Fabric Market, with consumption patterns and growth rates varying significantly based on construction activity, economic development, and cultural preferences for interior design.

- Asia Pacific (APAC): The fastest-growing region, driven by massive urbanization, infrastructure development, and a booming residential sector in China, India, and Southeast Asian nations. APAC is both a major manufacturing hub (synthetic fibers) and a rapidly expanding consumer market, with demand shifting towards mid-to-high-end functional fabrics as disposable incomes rise. Government initiatives promoting affordable housing and green building standards further stimulate market growth, particularly for flame-retardant and thermal fabrics in commercial spaces.

- North America: A mature market characterized by high consumer spending and strong regulatory enforcement, especially regarding fire safety standards (e.g., California fire codes). Demand is concentrated in high-performance materials like acoustic fabrics and advanced thermal barriers, driven by energy efficiency mandates and premium residential construction. E-commerce penetration is extremely high, influencing shorter lead times and greater demand for customized solutions.

- Europe: Dominated by sophisticated design preferences and a strong focus on sustainability. European consumers and commercial buyers prioritize natural, organic, and recycled fibers. The market is highly segmented, with countries like Italy and Germany leading in high-quality, designer textiles, while Northern Europe shows strong demand for insulation properties due to colder climates. Strict EU regulations on chemical usage (REACH) influence manufacturing standards globally.

- Latin America (LATAM): Exhibits moderate growth potential, tied closely to economic stability and residential construction cycles in Brazil and Mexico. The market is often price-sensitive, leading to a reliance on cost-effective synthetic fibers, though the luxury segment in major urban centers is growing, favoring imported designer fabrics.

- Middle East and Africa (MEA): Growth is primarily fueled by extensive investment in the hospitality sector (hotels, resorts) and high-end residential projects, particularly in the UAE and Saudi Arabia. This region demands luxurious, heavy-weight fabrics (silks, velvets) and materials offering maximum UV protection and insulation against extreme heat. Specific regulatory compliance for public spaces is rigorously applied, promoting fire-retardant materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Curtain Fabric Market.- Springs Global

- Hunter Douglas

- CHF Industries

- Hanesbrands

- Standard Textile

- Maharam

- KnollTextiles

- Kravet Inc.

- Fabricut

- Waverly

- JAB Anstoetz

- Osborne & Little

- Zoffany

- Romo Group

- Pierre Frey

- Rubelli

- Dedar

- Kvadrat

- Sunbrella

- Pindler

Frequently Asked Questions

Analyze common user questions about the Curtain Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Curtain Fabric Market?

The Curtain Fabric Market is projected to grow at a steady Compound Annual Growth Rate (CAGR) of 5.4% during the forecast period spanning from 2026 to 2033, driven largely by increasing construction activities and technological integration of smart textiles.

Which fiber material segment dominates the global market?

The Synthetic Fibers segment, particularly polyester, dominates the market in terms of volume due to its excellent durability, low cost, resistance to fading, and high versatility in achieving various textures and prints required for both residential and commercial applications.

What is the primary driving factor for the demand for functional fabrics?

The primary driving factor is the global focus on energy efficiency and sustainable building practices. This increases demand for specialized functional fabrics such as thermal insulating and blackout curtains, which significantly reduce heat transfer and minimize the need for artificial cooling or heating.

How is AI influencing the customization of curtain fabrics?

AI influences customization through generative design models that create unique patterns and colors, and via Augmented Reality (AR) visualization tools, which allow consumers to digitally preview custom fabrics in their own spaces, streamlining the selection process and boosting personalized sales.

Which region offers the highest growth potential for the curtain fabric market?

The Asia Pacific (APAC) region offers the highest growth potential, fueled by robust urbanization, large-scale infrastructure projects, rapid expansion of the middle class, and high-volume residential and hospitality development across key economies like China and India.

Detailed Market Segment Analysis: Material Type Dynamics

The material composition of curtain fabrics is the foundational element defining product functionality, cost, and aesthetic appeal. The market is broadly categorized into Natural, Synthetic, and Blended fibers, each catering to distinct market segments and performance requirements. Natural fibers, encompassing cotton, linen, silk, and wool, are highly valued for their luxurious feel, breathability, and natural drape. While these fibers command a premium price and require specific care, the increasing consumer preference for sustainable, biodegradable, and hypoallergenic materials is fueling steady value growth in this segment, particularly within the high-end residential and luxury hospitality sectors. Brands often leverage the sustainable sourcing narrative to enhance market positioning for products made from organic cotton or ethically sourced linen, aligning with AEO trends focused on ecological responsibility.

Synthetic fibers, predominantly polyester, nylon, and acrylic, hold the largest market share by volume due to their superior performance-to-cost ratio. Polyester fabrics are highly favored for their exceptional resilience, resistance to shrinking and stretching, colorfastness, and low maintenance requirements, making them ideal for heavy-duty commercial applications and budget-conscious residential projects. Technological advancements in synthetic fiber manufacturing have improved their texture and hand-feel, often mimicking natural fibers while retaining enhanced durability and fire-retardant capabilities. The dominance of synthetics is underpinned by their essential role in producing specialized functional textiles, such as blackout materials and heavy-duty, cleanable fabrics for healthcare settings. Their manufacturing process, however, faces increasing scrutiny regarding petrochemical origins and waste management.

Blended fabrics, combining two or more fiber types (e.g., poly-cotton blends, linen-viscose mixes), represent a strategic segment designed to maximize performance while optimizing cost. These blends aim to harness the desirable qualities of natural fibers (texture, feel) and the functional benefits of synthetics (durability, wrinkle resistance). For instance, a cotton-polyester blend is often used to achieve the breathability of cotton with the easy-care properties of polyester, creating a versatile and moderately priced product suitable for mass-market consumption. Manufacturers utilize blending to precisely tune attributes such as thermal resistance, drape quality, and tensile strength, offering a customized solution that often bridges the gap between the premium natural segment and the volume synthetic segment, enabling greater product diversification and market reach across various pricing points.

- Natural Fibers: Preferred for luxury, sustainability, breathability, and aesthetic drape. High growth in the value segment.

- Synthetic Fibers: Dominant in volume, characterized by low cost, high durability, excellent colorfastness, and resistance to environmental factors. Essential for specialized functional textiles.

- Blended Fabrics: Offer optimized balance between cost and performance; leverage properties of both natural and synthetic inputs to meet mid-range market demand.

Detailed Market Segment Analysis: Application Type Dynamics

The application segmentation is crucial for understanding demand elasticity and regulatory requirements within the Curtain Fabric Market, classifying consumption into Residential, Commercial, and Hospitality sectors. The Residential segment accounts for the largest share of the market, driven by household consumption for decoration, privacy, and basic light control. Demand in this sector is highly sensitive to consumer trends, seasonal renovations, and disposable income levels. Consumers increasingly seek customized lengths, unique patterns, and easily installed products, often utilizing online channels and direct-to-consumer models for convenience and access to a wider variety of styles. The growth in smart home technology also drives demand for fabrics compatible with motorized curtain systems.

The Commercial sector, encompassing offices, retail spaces, educational institutions, and public buildings, requires fabrics that prioritize functionality, longevity, and adherence to public safety standards, especially fire retardancy. Commercial buyers focus on technical specifications like sound absorption (acoustic fabrics), light diffusion to reduce screen glare, and maintenance ease. Purchases in this segment are typically large-volume, project-based contracts, necessitating reliable supply chains and certified products. The ongoing trend of refurbishing older office spaces to meet modern environmental and ergonomic standards provides a continuous demand cycle for high-specification commercial fabrics that contribute to indoor air quality and worker comfort.

The Hospitality segment, including hotels, resorts, and cruise ships, is the fastest-growing application area due to frequent refurbishment cycles and a mandatory need for premium aesthetics combined with extreme durability. Hospitality fabrics must withstand rigorous commercial laundering and meet the highest global standards for flame resistance (e.g., IMO, NFPA). Furthermore, hotel owners prioritize acoustic performance and blackout capabilities to ensure guest comfort. Suppliers serving this sector often provide comprehensive bespoke services, from design consultation to certified installation, requiring fabrics that offer excellent thermal insulation for energy cost management and high aesthetic value to align with brand identity and luxury expectations. The demand here is highly concentrated among specialized textile contractors.

- Residential: Largest market share, driven by aesthetics, privacy needs, home renovations, and e-commerce growth; sensitive to interior design trends.

- Commercial: Focuses on durability, light management, and regulatory compliance (fire safety, acoustics); driven by new construction and corporate refurbishment cycles.

- Hospitality: Fastest-growing segment, demands high-end aesthetics combined with extreme durability, superior blackout features, and stringent fire safety certifications (NFPA, IMO).

Detailed Market Segment Analysis: Function Type Dynamics

Functional segmentation is a critical differentiator in the Curtain Fabric Market, reflecting the specialized needs of end-users beyond basic decoration. Blackout fabrics represent a significant and growing segment, designed to completely block exterior light. These fabrics are essential in bedrooms, home theaters, and hospitality settings (hotels) where maximizing sleep quality and minimizing light pollution are key objectives. Modern blackout fabrics achieve their high performance through multi-layered construction, often incorporating dense synthetic materials or specialized coatings, and increasingly focus on combining light control with thermal insulation capabilities to address energy conservation mandates effectively. The demand for these fabrics is globally consistent, particularly in urban environments and regions with high sun exposure.

Thermal Insulating Fabrics are designed to create a barrier against heat transfer, helping to keep interiors cooler in warm weather and warmer in cold weather, thereby reducing reliance on HVAC systems. This functional segment aligns perfectly with global sustainability goals and consumer concerns over escalating energy costs. These fabrics often utilize foam-backed designs or dense, tightly woven microfibers that minimize air flow and conduction. The market penetration of thermal fabrics is strongest in North America and Europe, where climate extremities and high energy prices make insulation a priority purchase driver. The technological challenge remains in maximizing thermal performance without compromising the fabric’s aesthetic drape and appearance.

Fire Retardant (FR) Fabrics constitute an indispensable segment, particularly within the Commercial, Healthcare, and Hospitality sectors where human safety and adherence to building codes are non-negotiable legal requirements. FR fabrics are treated with specialized chemicals or manufactured using inherently flame-resistant fibers (e.g., modacrylic, specialized polyesters). Demand for these certified textiles is project-driven and non-discretionary, directly linked to regulatory oversight. Acoustic Fabrics, designed to absorb sound waves and improve indoor sound quality, are also gaining traction, driven by the shift towards open-plan office designs and the construction of multi-family dwellings. These materials are crucial for noise mitigation and are increasingly specified by architects and interior designers aiming to meet demanding acoustic performance standards in modern construction.

- Blackout Fabrics: Essential for complete light control, crucial in residential bedrooms and the hotel industry, often featuring thermal insulation properties.

- Thermal Insulating Fabrics: High demand driven by energy efficiency and cost savings; specialized construction minimizes heat transfer and air leakage.

- Fire Retardant (FR) Fabrics: Mandatory requirement for commercial, public, and hospitality sectors, dictated by stringent local and international safety regulations (NFPA, IMO).

- Acoustic Fabrics: Growing niche market addressing noise reduction in open-plan offices and residential buildings, specified for improved sound quality and environment comfort.

Detailed Market Segment Analysis: Distribution Channel Dynamics

The Curtain Fabric Market’s distribution landscape is bifurcated into Offline Retail and Online Retail channels, each serving distinct consumer needs and logistical requirements. Offline retail, comprising specialty textile stores, interior design showrooms, department stores, and large format home improvement centers, historically dominated the market. This channel remains crucial for customers who need to physically inspect the fabric’s texture, color, and weight before purchase, especially for large investment items or custom design projects. Specialty showrooms often provide value-added services such as professional consultation, measurement, and installation, which are essential for complex commercial or bespoke residential projects. Despite the rise of e-commerce, the offline channel maintains its strength in the premium and high-specification commercial segments due to the need for tactile confirmation and specialized fitting services.

Online retail, including e-commerce giants, brand-specific websites, and specialized textile marketplaces, has experienced exponential growth, particularly in the residential segment. The digital channel offers unparalleled convenience, competitive pricing, and a vast selection of patterns and materials that are geographically agnostic. The pandemic accelerated the adoption of online purchasing, forcing manufacturers to invest heavily in digital infrastructure, including high-resolution imagery, detailed technical specifications (AEO optimization), and AR visualization tools. While online sales are dominant for standard, ready-made curtains and basic fabrics, the challenge lies in translating the tactile experience of luxury fabrics through a screen. Therefore, many online providers offer swatch sampling services to bridge the gap between digital selection and physical quality confirmation.

The trend shows a strategic blending of these channels, often referred to as omnichannel distribution. Manufacturers are developing platforms that allow customers to research products online, order swatches for home inspection, and then finalize custom orders either through a dedicated online portal or via an affiliated local showroom or interior designer. For the B2B sector, online distribution takes the form of sophisticated, closed-access portals for bulk ordering, specification management, and real-time inventory tracking, ensuring efficiency in high-volume transactions for commercial fit-outs. Success in distribution increasingly relies on seamless integration, offering logistics optimized for both small residential shipments and large commercial fabric rolls, thereby maximizing reach and customer retention across all market segments.

- Offline Retail: Crucial for tactile evaluation, professional consultation, and complex installations; dominates the high-end luxury and commercial project segments.

- Online Retail: Fastest-growing channel, offers convenience, wide selection, and competitive pricing; dominant for standard residential and ready-made products; relies heavily on high-quality digital content and AR tools.

- Omnichannel Strategy: Integration of online and offline experiences (e.g., online research, physical swatch ordering, professional offline installation) to maximize customer journey satisfaction and market penetration.

Market Competitive Landscape and Strategic Insights

The Curtain Fabric Market features a highly fragmented competitive landscape, characterized by a mix of large, multinational textile conglomerates specializing in commercial-grade performance fabrics and numerous small-to-medium-sized designer houses focused on high-end, bespoke residential materials. Key competitive factors include product innovation (especially in smart and sustainable fabrics), price competitiveness, supply chain efficiency, and brand reputation linked to quality and design exclusivity. Leading global players leverage their scale to achieve cost efficiencies in raw material procurement and advanced manufacturing techniques, allowing them to dominate volume segments and meet stringent international compliance standards required by the hospitality and healthcare sectors.

Strategic initiatives adopted by market participants predominantly revolve around sustainability and digitization. Many companies are investing significantly in R&D to launch product lines utilizing recycled materials or bio-based polymers, securing certifications (e.g., Global Organic Textile Standard - GOTS) to gain a competitive edge in environmentally conscious markets, particularly Europe. Furthermore, mergers and acquisitions remain a core strategy, allowing large players to absorb niche designer brands, thereby gaining access to exclusive pattern archives, specialized production capacity, and established distribution networks in luxury markets. This inorganic growth enables rapid portfolio diversification, mitigating risks associated with reliance on single material types or application segments.

In terms of AEO and GEO strategy, key players are optimizing their digital presence to capture search intent related to specific functional benefits (e.g., "best fire-retardant hospital curtains" or "acoustic curtain fabric suppliers"). Manufacturers increasingly utilize data analytics to track consumer preferences in real-time, allowing for highly responsive product development cycles and targeted marketing campaigns. The establishment of localized production or conversion facilities in high-growth regions like APAC is another vital strategy, reducing logistical costs, mitigating import duties, and providing faster fulfillment to large regional commercial projects. Ultimately, success hinges on balancing mass production efficiencies with the ability to offer highly customized, performance-driven solutions that adhere to global safety and sustainability benchmarks, ensuring long-term relevance and market resilience against volatile economic conditions.

- Competitive Landscape: Highly fragmented, mixture of large conglomerates (volume focus) and specialized designer houses (value focus).

- Strategic Focus: Significant investment in sustainable R&D (recycled, bio-based fibers) and digitization of the supply chain and sales process (AR visualization).

- M&A Activity: Used to gain access to designer archives, exclusive brands, and expand into premium segments and geographical markets quickly.

- Key Differentiators: Performance specifications (FR, acoustic, thermal), supply chain resilience, and price point in high-volume segments.

Emerging Trends and Future Outlook

The Curtain Fabric Market is poised for transformative growth driven by several emerging trends centered around smart textiles and hyper-personalization. The integration of technology is moving beyond simple motorized systems to incorporating fabric-level sensors and conductivity. Future curtain fabrics may include integrated features that monitor indoor air quality, adjust transparency based on solar heat gain in real-time, or even integrate flexible lighting elements (OLEDs) for atmospheric control, positioning the product as a proactive component of the smart building envelope rather than a static décor item. This shift necessitates collaboration between textile manufacturers and technology providers, creating new market entry barriers and opportunities.

The relentless pursuit of hyper-personalization, enabled by advancements in digital textile printing (DTG) and AI design tools, means that the concept of mass-market patterns will diminish, particularly in the residential and boutique hospitality segments. Consumers and designers will expect the ability to specify every detail—from fiber density to bespoke color matches and unique scale prints—with short lead times. This trend favors manufacturers with agile, on-demand production capabilities that minimize inventory risk and cater directly to niche aesthetic demands, accelerating the move away from traditional bulk production models towards customized, data-driven manufacturing workflows. Such flexibility enhances market responsiveness and allows for greater design fluidity.

Looking ahead, sustainability will transition from a niche differentiator to a foundational requirement. The industry will face increasing pressure to adopt circular economy principles, requiring comprehensive solutions for textile waste management, recycling old curtains back into new fibers, and further reducing water and chemical usage in finishing processes. Companies successfully implementing closed-loop manufacturing systems and transparent supply chains will gain substantial long-term competitive advantage, especially as regulatory bodies worldwide introduce stricter environmental mandates. The future outlook is characterized by a technologically sophisticated, highly customized, and environmentally responsible textile landscape, where functional performance is seamlessly integrated with aesthetic design. This focus on verifiable sustainability metrics and technological functionality will be the main determinant of market leadership in the post-2030 era.

- Smart Textiles: Integration of conductive fibers, sensors, and micro-electronics for real-time light and temperature adjustment, enhancing functionality within IoT ecosystems.

- Hyper-Personalization: Demand for bespoke patterns, colors, and textures facilitated by advanced digital printing and AI design software, shifting production towards on-demand models.

- Circular Economy: Mandatory focus on closed-loop systems, high-efficiency recycling of old fabrics, and reduction of manufacturing waste to meet sustainability goals and regulations.

- Digital Supply Chain: Utilization of blockchain and advanced ERP systems to ensure transparency in sourcing and improve efficiency in logistics across global value chains.

The market for curtain fabric is expected to maintain its current trajectory, continually adapting to the macroeconomic indicators of global construction and the microeconomic demands of interior design trends. The convergence of high-performance technical textiles with sustainable material sourcing will unlock new avenues for market expansion, ensuring that curtain fabrics remain an integral and evolving element of both architecture and interior décor worldwide.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager