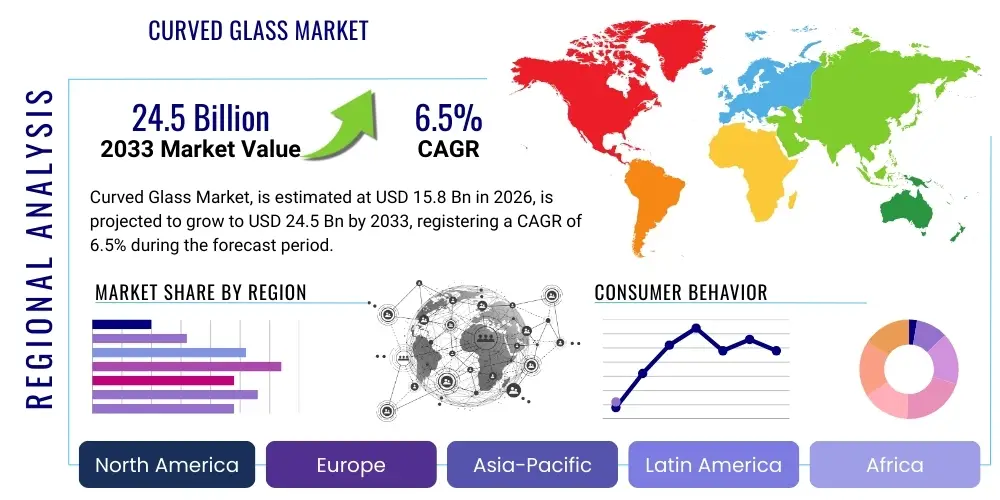

Curved Glass Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438856 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Curved Glass Market Size

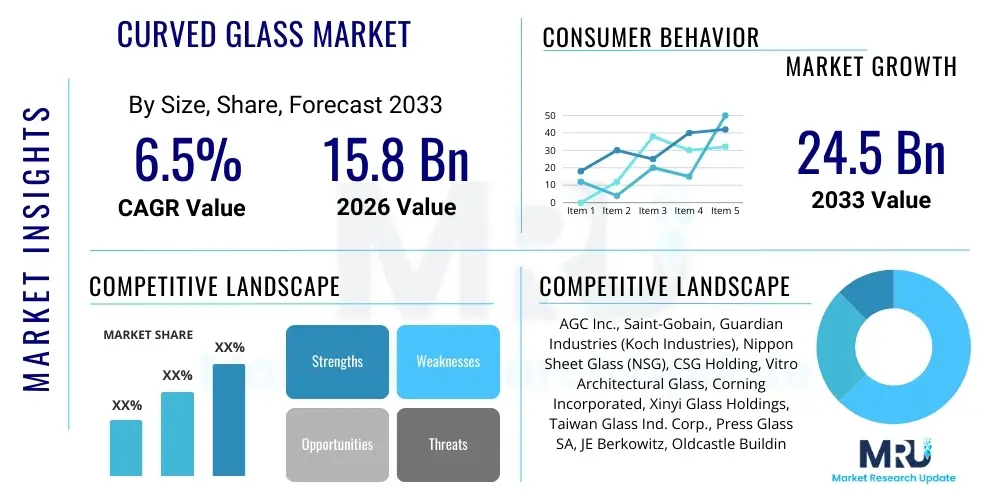

The Curved Glass Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 24.5 Billion by the end of the forecast period in 2033.

Curved Glass Market introduction

The Curved Glass Market encompasses the fabrication and utilization of glass sheets that have been heated, shaped, and cooled to achieve specific curvatures, offering aesthetic, structural, and aerodynamic advantages across multiple industries. This specialized product, known for its visual appeal and functional flexibility, is fundamentally changing architectural design and automotive engineering by enabling complex geometries that flat glass cannot achieve. Curved glass is produced through processes such as gravity bending or pressing, often requiring meticulous thermal management to maintain optical clarity and structural integrity. Key applications span across residential and commercial building façades, interior partitions, shower enclosures, automotive windshields and sunroofs, and sophisticated display cases for consumer electronics.

A primary benefit of curved glass lies in its enhanced structural resistance to wind load and thermal stress, especially when processed as laminated or tempered units. Architecturally, it provides panoramic views, reduces glare through optimized geometry, and enhances building energy efficiency by allowing for double-skin facades with aerodynamic properties. The market expansion is significantly driven by the booming construction sector globally, particularly the demand for contemporary, high-end building designs that utilize sweeping glass features to maximize natural light and visual connection to the surroundings. Furthermore, the automotive industry's continuous evolution towards sleeker designs and larger cabin surfaces, including expansive glass roofs and complex side windows, fuels the demand for high-quality, precision-curved glass components.

The convergence of sustainable building practices and advanced glass processing technologies acts as a crucial propellant for market growth. Manufacturers are continuously investing in technology such as precision CNC bending and advanced coating techniques to improve the thermal performance and safety features of curved glass products. The product range is highly diverse, including annealed, tempered, laminated, and insulated curved units, catering to strict regulatory standards for safety and performance in various end-use segments. As consumer preferences shift toward bespoke architectural elements and technologically advanced vehicle designs, the curved glass market is poised for robust expansion, reflecting its indispensable role in modern design aesthetics and functional performance.

Curved Glass Market Executive Summary

The Curved Glass Market exhibits strong momentum, driven primarily by favorable macroeconomic trends in infrastructure development and technological innovation in the automotive and construction sectors. Current business trends indicate a significant shift towards customization, where architects and automotive designers increasingly require unique, large-format curved glass solutions that necessitate advanced manufacturing capabilities like sophisticated numerical control (NC) bending furnaces. This has led to greater capital investment in automated production lines, enhancing precision and throughput while reducing waste. The competitive landscape is characterized by integration across the value chain, with leading players focusing on expanding their processing capabilities from raw glass sourcing to complex installation support, positioning themselves as full-service solution providers rather than just material suppliers. Sustainability mandates are also impacting business operations, pushing companies toward developing lighter, higher-performance curved glass with low-emissivity (Low-E) coatings.

Regionally, the Asia Pacific (APAC) stands out as the dominant growth engine, fueled by rapid urbanization, massive infrastructure projects in countries like China and India, and the explosive growth of domestic automotive production. North America and Europe, while mature markets, demonstrate high demand for high-value applications, particularly smart curved glass integrated with electrochromic or photovoltaic technologies for premium architectural and high-end automotive applications. Regional trends also reflect varying regulatory environments, with Europe having strict energy efficiency standards that favor insulated and coated curved glass units, while North America’s demand is often driven by aesthetic considerations and storm resistance requirements.

Segmentation trends highlight the dominance of the construction segment, particularly commercial and high-rise residential buildings, where curved façades are defining modern cityscapes. However, the fastest growth is anticipated in the automotive segment, propelled by electric vehicle (EV) manufacturing. EVs often feature panoramic curved sunroofs and larger, more ergonomically curved displays, integrating glass technology deeply into vehicle functionality and safety systems. By product type, laminated curved glass is gaining traction due to increased safety regulations and its superior acoustic dampening properties, making it essential for both premium cars and noise-sensitive building environments.

AI Impact Analysis on Curved Glass Market

User queries regarding the impact of Artificial Intelligence (AI) on the Curved Glass Market primarily revolve around operational efficiency, quality control, and predictive maintenance within complex bending and tempering processes. Common questions explore how AI algorithms can optimize furnace temperatures and bending pressure to minimize defects (such as optical distortion or breakage), especially for highly customized, large-format pieces. Users are keenly interested in understanding if AI can streamline supply chain logistics for custom glass orders and if machine learning can predict shifts in raw material costs, thereby optimizing procurement strategies. The key theme is the expectation that AI will transition the manufacturing process from relying heavily on operator expertise and trial-and-error to a data-driven, highly repeatable, and energy-efficient system, crucial for handling the tight tolerances demanded by modern architecture and automotive sectors.

- AI-driven optimization of thermal bending cycles, reducing energy consumption and minimizing stress points.

- Predictive quality control systems utilizing computer vision to detect subtle optical distortions or imperfections in real-time during processing.

- Enhanced production scheduling and supply chain logistics management based on predictive demand modeling.

- Machine learning algorithms applied to sensor data for predictive maintenance of bending furnaces and tempering lines, reducing unplanned downtime.

- Automated design validation tools ensuring complex curvatures meet structural integrity and safety standards before physical prototyping.

DRO & Impact Forces Of Curved Glass Market

The Curved Glass Market is shaped by a confluence of driving factors, restrictive barriers, and substantial growth opportunities, all governed by powerful impact forces. Key drivers include the global surge in high-end construction activities, particularly modern architectural designs favoring aesthetic curved features, and the relentless innovation within the automotive sector, focusing on larger, curved glass surfaces for enhanced driver experience and vehicle aerodynamics. Restraints primarily involve the high capital expenditure required for specialized bending and tempering equipment, leading to limited capacity among smaller players. Additionally, the complexity and associated defect rates during the fabrication of unique, large-scale, deep-curved glass pose significant manufacturing challenges, often resulting in higher production costs and longer lead times compared to standard flat glass.

Opportunities in the market are significant, revolving heavily around the integration of smart technologies. The development of curved smart glass, which can dynamically adjust opacity or incorporate embedded electronics, presents substantial growth avenues in both luxury architecture and future vehicle cockpits. Furthermore, addressing the demand for ultra-thin, lightweight curved glass for advanced consumer electronics displays (e.g., smart watches and flexible phones) offers specialized, high-margin opportunities. The principal impact forces acting on this market are regulatory pressure concerning energy efficiency and safety standards (e.g., impact resistance requirements), which continually compel manufacturers to innovate material composition and processing techniques to produce high-performance, multilayered curved glass products.

The market dynamics are highly sensitive to global economic indicators, particularly interest rate fluctuations and housing market stability, which directly affect construction project pipelines. Technological impact forces, specifically advancements in precision robotics and automated handling systems, are lowering the manufacturing barriers and enabling mass production of previously customized pieces. This interplay between high demand from aesthetic-driven industries and technological improvements that address operational complexities defines the overall trajectory and competitive intensity within the global curved glass landscape, pushing the industry toward greater specialization and efficiency.

Segmentation Analysis

The Curved Glass Market is meticulously segmented based on product type, processing technology, application, and end-user, providing a granular view of specific industry demands and growth pockets. The segmentation highlights the diverse functional requirements across major consumer and industrial applications, ranging from high-security laminated units to aesthetically driven architectural structures. Understanding these distinct segments is crucial for strategic market positioning, allowing companies to tailor their manufacturing investments and material offerings, such as focusing on heat-strengthened glass for structural applications or chemically tempered glass for consumer electronics.

- By Product Type:

- Tempered Curved Glass

- Laminated Curved Glass

- Insulated Curved Glass Units (IGUs)

- Heat-Strengthened Curved Glass

- By Technology:

- Gravity Bending (Slumping)

- Press Bending (Molding)

- Continuous Bending

- Chemical Tempering

- By Application:

- Automotive (Windshields, Sunroofs, Side/Rear Windows)

- Architectural (Façades, Skylights, Canopies, Interior Partitions)

- Consumer Electronics (Display Screens, Device Covers)

- Showcases and Refrigeration

- Others (Furniture, Solar Panels)

- By End-User:

- Residential Construction

- Commercial Construction

- Automotive OEMs

- Electronics Manufacturers

- Industrial & Retail

Value Chain Analysis For Curved Glass Market

The value chain for the Curved Glass Market begins with the upstream segment, which involves the sourcing and preparation of high-quality raw materials, primarily silica sand, soda ash, and limestone, essential for producing flat float glass. This upstream segment is dominated by large-scale float glass manufacturers who supply the base material. The subsequent critical stage involves the midstream processing, where specialized glass processors transform flat glass into curved units using complex thermal processes like gravity bending or press bending, followed by tempering or lamination for safety and structural enhancement. This processing stage adds the highest value and requires significant technological expertise and capital investment, serving as the primary competitive differentiator in the market.

The distribution channel facilitates the movement of finished curved glass products to end-users. Direct channels are predominantly used for large, custom architectural projects or established relationships with Automotive OEMs, where direct consultation and installation oversight are necessary due to the complexity of the product. Indirect distribution involves working through specialized distributors, fabricators, and glass installation contractors, particularly for standardized or smaller volume orders, such as retail showcases or standardized shower enclosures. These distribution partners provide logistical support and often perform the final installation, requiring specialized handling expertise due to the delicate nature and unique shapes of the curved units.

The downstream analysis focuses on the final application and installation. Automotive OEMs utilize curved glass in assembly lines, integrating it into the vehicle body, while the construction sector relies on specialized glazing contractors to install large, structural façade elements. The growing demand for highly customized, large-format curved glass has strengthened the negotiating power of downstream consumers, particularly major architectural firms and global automotive manufacturers, who demand stringent quality, precise dimensions, and integrated smart features. Effective coordination between the midstream processors and downstream installers is crucial to minimize breakage and ensure the successful deployment of these sophisticated building materials.

Curved Glass Market Potential Customers

The primary consumers of curved glass are concentrated within two major sectors: high-end construction and the global automotive industry. Within construction, potential customers include large commercial real estate developers specializing in office towers, luxury hotels, and airport terminals, all of which prioritize distinctive, contemporary designs incorporating large, sweeping glass façades for aesthetic impact and natural lighting maximization. Architectural firms and specialized facade engineering consultants act as influential buyers, specifying the type, thickness, and performance characteristics (e.g., solar control, low-e coatings) of the curved glass units required for complex projects.

The automotive industry represents a high-volume, high-precision customer base, encompassing global Original Equipment Manufacturers (OEMs) of passenger vehicles, commercial trucks, and buses. OEMs procure complex curved glass for applications such as panoramic sunroofs, curved laminated windshields (offering optimal visibility and enhanced safety), and increasingly, internal curved display screens and digital cockpit surfaces. The burgeoning Electric Vehicle (EV) market is a rapidly expanding customer segment, as EVs often utilize expansive glass roofs and aerodynamic designs that necessitate precision-curved glass components, focusing on lightweight and acoustic performance.

Beyond these two major sectors, significant potential customer bases include specialized manufacturers in the retail and display industry, requiring curved glass for refrigeration units, museum showcases, and high-end retail display cases where optical clarity and security are paramount. Additionally, manufacturers of premium consumer electronics seek suppliers capable of providing chemically tempered, thin, and highly precise curved glass for wearable devices, smartphones, and augmented reality glasses, marking a high-growth, technology-intensive customer segment that demands extreme manufacturing accuracy.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 24.5 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AGC Inc., Saint-Gobain, Guardian Industries (Koch Industries), Nippon Sheet Glass (NSG), CSG Holding, Vitro Architectural Glass, Corning Incorporated, Xinyi Glass Holdings, Taiwan Glass Ind. Corp., Press Glass SA, JE Berkowitz, Oldcastle BuildingEnvelope, Bendheim, Cristacurva, SCHOTT AG, Trulite Glass & Aluminum Solutions, China Southern Glass, Fuyao Glass Industry Group, Central Glass Co., Ltd., Sisecam Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Curved Glass Market Key Technology Landscape

The technological landscape of the Curved Glass Market is defined by the evolution of precision bending techniques aimed at achieving complex geometric shapes without compromising the optical quality or structural integrity of the material. Traditional gravity bending (slumping) remains the foundational technology, involving heating float glass sheets on molds until they soften and conform to the desired curve. However, for high-volume, precision-demanding applications, especially in the automotive sector, advanced press bending technology is crucial. Press bending utilizes a male and female mold combination to mechanically form the glass while it is in a softened state, offering superior repeatability and dimensional accuracy, which is essential for perfect integration into vehicle frames or complex facade systems.

A significant technological advancement involves the integration of sophisticated computer numerical control (CNC) systems into bending furnaces. These systems precisely manage heating profiles, pressure application, and cooling rates, allowing manufacturers to handle deep curves, tight radii, and asymmetrical shapes with minimal thermal distortion. Furthermore, continuous bending lines are being adopted for high-throughput production of standardized curved components, enhancing efficiency and reducing per-unit costs. These technological improvements are vital as modern architectural and automotive designs push the boundaries of what glass structures can achieve.

Beyond forming, the landscape is heavily influenced by post-bending processes. Lamination technology is critical, involving bonding two or more layers of curved glass with an interlayer (typically PVB or SentryGlas) to enhance safety, sound attenuation, and security. Furthermore, advanced coating technologies, such as vacuum sputtering for Low-E and solar control coatings, are now adapted to the curved surface geometry, ensuring that the finished product meets rigorous energy performance standards. For consumer electronics, chemical tempering—a process that exchanges ions on the glass surface to increase surface compression—is essential for creating thin, durable, and highly precise curved covers for displays, showcasing the diverse technological requirements based on the end-use application.

Regional Highlights

Regional dynamics heavily influence the demand and supply structures of the Curved Glass Market, driven by differential construction activity, regulatory frameworks, and automotive production volumes across the globe. Each region presents unique growth opportunities and technical requirements.

- Asia Pacific (APAC): Dominates the market share due to unprecedented growth in infrastructure and construction across emerging economies like China, India, and Southeast Asian nations. Rapid urbanization and the massive scale of residential and commercial development projects, coupled with significant domestic automotive manufacturing expansion, make APAC the largest and fastest-growing region.

- North America: Characterized by high demand for premium, customized curved glass solutions in both high-rise commercial architecture and specialized residential markets. The region leads in the adoption of curved smart glass and technologically advanced, energy-efficient Insulated Glass Units (IGUs), driven by robust building codes and consumer preference for luxury features.

- Europe: Exhibits steady growth, heavily influenced by stringent energy efficiency directives (e.g., European Green Deal) which mandate high thermal performance. Demand is concentrated on high-quality, complex curved facades for historical restoration and innovative contemporary designs, alongside strong uptake in the premium vehicle manufacturing sector.

- Latin America (LATAM): Market expansion is moderate but accelerating, primarily driven by investments in major commercial hubs and increasing foreign direct investment in manufacturing. Brazil and Mexico are key contributors, focusing on both architectural projects and local automotive assembly.

- Middle East and Africa (MEA): Shows high potential, particularly in the Gulf Cooperation Council (GCC) countries, where monumental architectural projects and luxury developments require vast quantities of specialized, often custom-engineered, curved and solar-control glass to address extreme climatic conditions and aesthetic ambitions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Curved Glass Market.- AGC Inc.

- Saint-Gobain

- Guardian Industries (Koch Industries)

- Nippon Sheet Glass (NSG)

- CSG Holding

- Vitro Architectural Glass

- Corning Incorporated

- Xinyi Glass Holdings

- Taiwan Glass Ind. Corp.

- Press Glass SA

- JE Berkowitz

- Oldcastle BuildingEnvelope

- Bendheim

- Cristacurva

- SCHOTT AG

- Trulite Glass & Aluminum Solutions

- China Southern Glass

- Fuyao Glass Industry Group

- Central Glass Co., Ltd.

- Sisecam Group

Frequently Asked Questions

Analyze common user questions about the Curved Glass market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary manufacturing techniques used to produce curved glass?

The primary techniques are gravity bending (slumping), where heat and gravity form the glass over a mold, and press bending, which uses mechanical molds for higher precision and volume. Chemical tempering is also used for producing thin, highly durable curved glass for electronic displays.

How does curved glass contribute to the energy efficiency of modern buildings?

Curved glass, particularly when processed into Insulated Glass Units (IGUs) with Low-E coatings, improves thermal performance by minimizing heat transfer. Furthermore, its aerodynamic shape can optimize airflow around buildings, contributing to enhanced HVAC efficiency and reduced energy loads.

What role does laminated curved glass play in safety and security applications?

Laminated curved glass involves bonding multiple layers of glass with a durable interlayer (like PVB or SGP). This enhances safety by preventing the glass from shattering into sharp pieces upon impact and significantly improves security and sound dampening qualities in automotive and architectural uses.

Which industry segment is expected to show the highest growth rate for curved glass adoption?

The Automotive segment is projected to show the highest growth rate, driven by the shift towards Electric Vehicles (EVs) which demand large panoramic curved sunroofs, complex aerodynamic windshields, and integrated curved interior displays for advanced cockpit designs.

What are the main challenges associated with fabricating large-format, deep-curved glass?

Key challenges include maintaining precise dimensional tolerances across large surfaces, preventing optical distortions (known as 'roller wave' or 'pitting') during the thermal process, and managing the high risk of breakage or stress concentration during handling and subsequent tempering.

How are advancements in robotics affecting the curved glass manufacturing process?

Robotics and automation are crucial for minimizing defects and improving efficiency. They are utilized for precise handling of hot, fragile glass during transfer between furnaces and cooling stages, ensuring consistent positioning on molds, and aiding in complex cutting and edging processes after bending.

What is the significance of the Asia Pacific region in the global Curved Glass Market?

APAC holds the largest market share due to rapid urbanization, immense investment in new commercial and public infrastructure (e.g., airports, convention centers), and the massive production scale of both domestic and international automotive manufacturers operating within countries like China and India.

Can curved glass be used for structural applications, such as supporting loads in buildings?

Yes, curved glass can be used for structural applications, especially when heat-strengthened or fully tempered and laminated. These units, often designed as structural glass fins or large self-supporting canopies, require precise engineering to manage deflection and meet strict load-bearing safety codes.

What is the difference between tempered and heat-strengthened curved glass?

Both are thermally treated, but tempered glass is heated to a higher temperature and cooled rapidly, resulting in high surface compression (four to five times stronger than standard glass) and fragmenting into small, blunt pieces upon breakage. Heat-strengthened glass is cooled slower, resulting in lower compression, making it twice as strong as standard glass, and producing larger, safer fragments upon failure.

How do smart glass technologies integrate with curved glass products?

Smart glass technologies, such as electrochromic or liquid crystal technologies, involve applying specialized layers or films that can dynamically change the glass's opacity or tint electronically. When applied to curved substrates, this creates high-value products like switchable privacy partitions or dynamically dimming automotive sunroofs, enhancing user control and thermal comfort.

What are the major raw materials required for manufacturing high-quality curved glass?

The foundational raw material is high-quality float glass (derived from silica sand, soda ash, and lime). For specialized applications, interlayers (like PVB, EVA, or SGP) are required for lamination, alongside specialized coatings (metals and oxides) for solar control and Low-E performance.

How does the demand for luxury architecture impact the Curved Glass Market?

Luxury architecture, characterized by unique, bespoke designs, drives demand for complex, large-format, custom-radius curved glass. This segment commands premium pricing and necessitates specialized, high-investment manufacturing capabilities, fueling technological advancement in precision forming.

What factors restrain the wider adoption of curved glass compared to flat glass?

The key restraints include significantly higher manufacturing costs due to specialized equipment and increased energy consumption; longer production lead times for custom molds; and greater logistical difficulty and higher risk of breakage during transportation and installation due to the unique shape.

Which technology is preferred for producing curved glass components for wearable electronics?

Chemical tempering is the preferred technology for wearable electronics, as it allows for the creation of ultra-thin, lightweight, and highly durable curved cover glass with exceptional scratch resistance, meeting the stringent aesthetic and functional requirements of consumer devices.

In the value chain, which segment adds the most significant value to the final curved glass product?

The midstream processing segment, which includes the thermal bending, tempering, and lamination processes, adds the most significant value. This stage requires the highest technological expertise, specialized machinery, and is where the flat base material is transformed into a high-performance, complex geometrical product.

How is the Curved Glass Market addressing sustainability and environmental concerns?

The market is addressing sustainability by developing lighter glass compositions to reduce transportation emissions, increasing the use of recyclable materials, and focusing on high-performance coated curved IGUs that significantly reduce a building's energy consumption by minimizing heating and cooling loads.

What are the key differences in demand for curved glass between residential and commercial construction?

Commercial construction demands large, structural, often custom-radius, high-performance laminated and insulated curved glass for façades and atriums. Residential construction primarily requires smaller, aesthetic curved glass for interior features, shower enclosures, and specific architectural windows.

How does AI contribute to minimizing waste in the curved glass manufacturing process?

AI minimizes waste by optimizing furnace parameters in real-time. Machine learning models analyze sensor data (temperature, pressure) to predict and prevent thermal inconsistencies that lead to optical defects, cracking, or dimensional non-compliance, thereby maximizing yield rates, especially for costly custom pieces.

What are the primary applications of curved glass in the automotive interior?

In the automotive interior, curved glass is increasingly used for advanced digital cockpit displays, integrated infotainment screens, and potentially for lightweight, curved interior partitions, contributing to sleek design aesthetics and enhanced driver ergonomics.

Why is high optical quality especially important for curved windshields in the automotive sector?

High optical quality is critical for safety, as distortions in curved windshields can lead to visual fatigue, parallax errors, or inaccurate perception of depth and distance, particularly when integrated with heads-up display (HUD) technology, demanding extremely tight tolerances for forming.

What is the projected impact of autonomous vehicles on the demand for curved glass?

Autonomous vehicles are expected to increase demand for expansive, highly functional curved glass surfaces, including smart windows capable of dynamic tinting, and larger interior glass displays that serve as interactive surfaces for passengers, prioritizing passenger comfort over traditional driver needs.

Which regulatory standards most influence the technical specifications of curved glass products?

Key regulatory standards include those governing safety (e.g., ANSI Z97.1, EN 12150 for tempering and impact resistance) and energy performance (e.g., U-factor, SHGC standards set by organizations like the NFRC and European Union directives), which dictate material thickness, coatings, and lamination requirements.

How does the choice of interlayer material affect the performance of laminated curved glass?

The interlayer material (PVB, EVA, or SGP) dictates performance characteristics. SGP (SentryGlas Plus) provides superior structural strength and stiffness, allowing laminated curved glass to be used in high-load bearing applications, while PVB is generally used for standard safety and sound attenuation.

What are the growth prospects for curved glass in the renewable energy sector?

Curved glass has growing prospects in the renewable energy sector, particularly in concentrated solar power (CSP) parabolic trough mirrors and specialized photovoltaic panels, where curvature is utilized to optimize light collection efficiency and enhance module resilience against environmental stress.

How do manufacturers ensure the consistent thickness and precise geometry of deep-curved glass?

Consistency is ensured through highly controlled thermal cycles, precise CNC-machined molds, and vacuum systems during the bending process to ensure the glass adheres perfectly to the mold shape. Laser scanning and non-contact measurement systems are used post-process for quality verification and geometric conformity.

What competitive strategies are major players employing in the Curved Glass Market?

Major players are focusing on vertical integration, acquiring specialized processors or expanding in-house bending capabilities. They are also investing heavily in R&D for smart glass integration, developing proprietary high-strength formulations, and expanding their geographical footprint, particularly in high-growth APAC markets.

How has the rise of prefabricated construction influenced the demand for curved glass?

The rise of prefabricated and modular construction necessitates pre-engineered curved glass units with extremely high dimensional accuracy, as these units must fit perfectly into factory-built facade elements, driving demand towards press bending technology over less precise gravity bending methods.

What are the risks associated with transporting large, specialized curved glass units?

Transportation risks are high due to the glass's vulnerability to torsional stress and external impact. Manufacturers mitigate this using custom-designed, geometrically precise packaging crates, specialized handling equipment, and ensuring controlled environments during transit to prevent flexing or vibrations.

Explain the concept of 'optical distortion' in curved glass and how it is minimized.

Optical distortion refers to non-uniformities that warp light passing through the curved surface, often caused by uneven heating or contact with rollers during tempering. It is minimized by using advanced non-contact heating methods (like air flotation furnaces) and highly precise, automated temperature mapping systems.

What is the expected long-term impact of digitalization (Industry 4.0) on the curved glass production line?

Industry 4.0 will lead to fully integrated, cyber-physical production lines where AI optimizes energy usage, predicts equipment failure, and manages the entire production flow from raw material input to finished product output, resulting in higher efficiency, customization flexibility, and reduced operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager