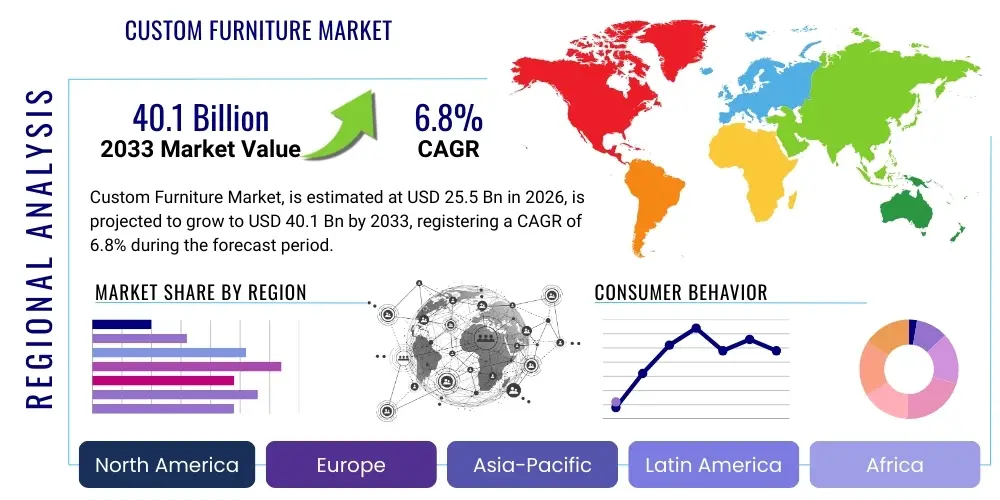

Custom Furniture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437455 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Custom Furniture Market Size

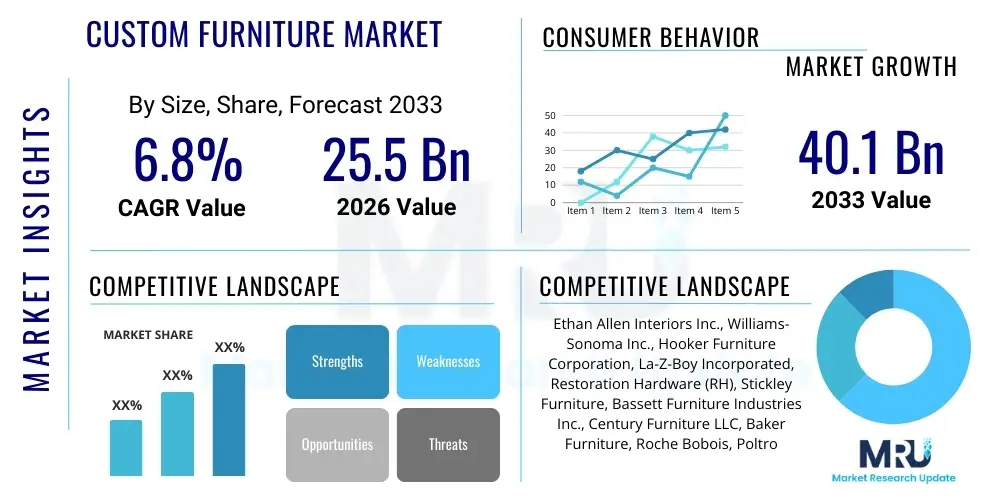

The Custom Furniture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 25.5 Billion in 2026 and is projected to reach USD 40.1 Billion by the end of the forecast period in 2033.

Custom Furniture Market introduction

The Custom Furniture Market encompasses the design, manufacturing, and distribution of bespoke furnishings tailored to specific client needs, aesthetic preferences, spatial requirements, and functional specifications. Unlike mass-produced items, custom furniture is characterized by its uniqueness, high quality, and often utilizes premium materials and specialized craftsmanship. This personalization extends across residential, commercial, and hospitality sectors, catering to consumers seeking exclusive designs that perfectly integrate into their environments. The product scope is vast, including specialized cabinetry, built-in storage solutions, upholstered seating, dining sets, and unique bedroom configurations, often incorporating advanced material combinations and smart technology integration.

Major applications of custom furniture span luxury residential developments, high-end commercial offices, boutique hotels, and institutional settings such as libraries and universities, where standard sizing and design templates are inadequate. The primary benefits driving adoption include superior utilization of irregular spaces, alignment with specific architectural styles, increased durability due to high-quality construction, and the ability to express individual or corporate brand identity through design. Furthermore, custom pieces often represent a long-term investment, maintaining value better than standardized alternatives, attracting consumers focused on sustainability and lasting quality.

Driving factors propelling market expansion include rising disposable incomes globally, particularly among affluent populations who prioritize unique home aesthetics and personalized luxury items. A growing trend in urbanization, leading to smaller, uniquely shaped living spaces, increases the demand for space-saving, tailor-made solutions like modular storage and built-in units. Moreover, the robust expansion of the interior design and architecture industries, coupled with technological advancements such as 3D rendering and augmented reality (AR) tools that simplify the customization process, significantly boosts consumer confidence and market accessibility. The increasing focus on ergonomic designs in both home and office environments also mandates custom solutions to meet specific user health and comfort requirements.

Custom Furniture Market Executive Summary

The Custom Furniture Market is experiencing robust growth driven by the convergence of affluent consumer demand for personalized luxury and technological advancements facilitating design precision and efficient production. Business trends indicate a strong shift towards direct-to-consumer (D2C) models, leveraging online visualization tools and shorter supply chains to reduce lead times and improve customer engagement. Key manufacturers are increasingly adopting sustainable sourcing practices and offering eco-friendly materials, responding to heightened consumer environmental awareness, which has become a crucial competitive differentiator. Strategic collaborations between furniture makers, interior designers, and architects are common, ensuring seamless integration of custom pieces into large-scale residential and commercial projects, thereby securing recurring high-value contracts and stabilizing revenue streams.

Regionally, the market dynamics are highly concentrated in developed economies, with North America and Europe maintaining dominant market shares due to high spending power and an established culture of interior design specialization. However, the Asia Pacific (APAC) region is projected to register the fastest growth rate, fueled by rapid urbanization, substantial growth in the luxury real estate sector, and the emergence of a large, aspirational middle class in countries like China and India seeking Western-style, high-quality furnishings. Demand in the Middle East and Africa (MEA) is predominantly driven by large infrastructure and hospitality projects requiring unique, high-specification fittings.

Segment trends reveal that the residential application segment remains the largest revenue contributor, spurred by homeowners undertaking extensive remodeling and seeking bespoke permanent installations. Material-wise, high-quality wood, including reclaimed and exotic variants, continues to dominate due to its aesthetic appeal and durability, although the metal and glass segments are rapidly expanding, especially for modern, minimalist designs. The increasing sophistication of digital customization platforms is boosting the online distribution channel, making the bespoke process more accessible and transparent, significantly impacting traditional showroom-centric business models.

AI Impact Analysis on Custom Furniture Market

Common user questions regarding AI's impact on the Custom Furniture Market predominantly revolve around automation in design, personalization scale, and optimizing the complex manufacturing supply chain. Users frequently ask if AI will replace human designers, how AI can visualize complex custom options accurately before production, and whether it can reduce the high costs and long wait times associated with bespoke pieces. The key themes emerging are the expectation that AI will democratize customization by offering sophisticated, yet simple, digital interfaces, allowing non-design professionals to create highly technical specifications. Concerns often center on maintaining the integrity of human craftsmanship and ensuring that AI algorithms can truly capture nuanced aesthetic intent. The prevailing user expectation is that AI will function as a powerful co-pilot, enhancing precision, accelerating prototyping, minimizing material waste, and streamlining the customer experience from initial consultation to final installation.

- AI-Powered Parametric Design: Automation of complex geometric adjustments based on user-defined constraints (e.g., room dimensions, desired functionality), accelerating the initial design phase significantly.

- Enhanced Customer Visualization: Utilization of machine learning for generating highly realistic 3D renderings and AR experiences, allowing clients to virtually place and manipulate custom pieces in their space with high fidelity, reducing decision risk.

- Predictive Material Optimization: AI algorithms analyze design specifications and available inventory to suggest optimal material cuts, minimizing waste and improving sustainability metrics in production.

- Supply Chain and Production Scheduling: Use of AI to optimize CNC machine schedules, manage complex logistics for unique components, and provide accurate, real-time lead time estimates to customers.

- Personalized Recommendation Engines: AI analyzes client browsing history, past purchases, and design inspiration images to suggest specific material combinations, finishes, and design elements tailored to individual style profiles.

- Quality Control and Defect Detection: Deployment of computer vision systems during manufacturing to instantaneously detect subtle defects or deviations from custom specifications, ensuring superior product quality before assembly.

DRO & Impact Forces Of Custom Furniture Market

The market dynamics are defined by powerful driving forces centered on increasing consumer personalization demands and technological integration, moderated by significant restraints related to cost and logistical complexity. Opportunities arise primarily from adopting advanced manufacturing technologies and expanding into high-growth regional markets. Impact forces ensure the market remains competitive and focused on efficiency and unique value proposition. The fundamental drivers include the global rise in high-net-worth individuals, who possess the capital and desire for unique, statement pieces, alongside the necessity for optimized space utilization in compact urban dwellings, particularly in multi-family housing projects.

Restraints largely concern the inherent complexity and time investment required for custom production. High initial consultation fees, lengthy production lead times (often 8 to 16 weeks), and significant costs associated with specialized craftsmanship and premium materials deter price-sensitive consumers. Furthermore, market fragmentation poses a challenge; the industry is composed of numerous small, highly specialized workshops alongside larger firms, making standardization of quality and pricing difficult, creating confusion for potential buyers. Another key restraint is the logistical complexity of delivering and installing unique, often oversized pieces in challenging urban environments, requiring specialized handling and coordination.

Opportunities are ample, specifically in the development of modular and semi-custom offerings that blend mass production efficiency with personalized aesthetics, bridging the gap between bespoke luxury and affordability. The integration of Industry 4.0 technologies—specifically robotic assembly, advanced CAD/CAM software, and 3D printing of non-structural components—presents a major opportunity to drastically cut production time and enhance design precision. Expanding digital footprint through immersive online design tools (AR/VR) and fostering stronger relationships with the burgeoning architecture and interior design community represent significant avenues for sustained revenue growth. Furthermore, sustainable and ethically sourced materials are emerging as crucial market differentiators, offering growth potential for companies prioritizing transparency and environmental responsibility throughout their supply chain.

Segmentation Analysis

The Custom Furniture Market is meticulously segmented across key parameters including material type, application area, distribution channel, and product category, reflecting the diverse needs and purchasing behaviors of end-users. The structure of segmentation highlights the dominance of premium materials and the critical role played by the residential sector. Analyzing these segments provides strategic insights into investment priorities, target marketing strategies, and operational focus areas for market participants. The application segment, particularly residential, dictates the volume and style preferences, while the material segment impacts cost structure and final product aesthetic. Distribution channels, increasingly moving towards online platforms, determine market accessibility and consumer engagement models.

- By Material:

- Wood (Hardwood, Engineered Wood, Reclaimed Wood)

- Metal (Steel, Aluminum, Brass)

- Glass and Stone (Marble, Quartz, Granite)

- Leather and Fabric (Upholstery)

- Plastic and Composites

- By Application:

- Residential (Apartments, Villas, Custom Homes)

- Commercial (Office Spaces, Retail Outlets, Corporate Lobbies)

- Hospitality (Hotels, Resorts, Restaurants)

- Institutional (Schools, Hospitals, Government Buildings)

- By Product:

- Cabinetry and Storage (Built-ins, Wardrobes, Modular Kitchens)

- Seating (Sofas, Chairs, Benches)

- Tables (Dining Tables, Coffee Tables, Desks)

- Beds and Headboards

- Other Custom Fixtures

- By Distribution Channel:

- Offline (Showrooms, Specialty Stores, Interior Designers)

- Online (E-commerce Platforms, Company Websites with Configurators)

Value Chain Analysis For Custom Furniture Market

The value chain for custom furniture is complex and highly integrated, beginning with upstream material sourcing and culminating in meticulous final installation. Upstream analysis focuses heavily on the procurement of high-grade, often specialized or exotic, raw materials such as sustainable hardwoods, unique metal alloys, and bespoke fabrics. Quality control and ethical sourcing at this stage are paramount, as the integrity of the custom piece depends entirely on the base material. Key activities include precision logging, material grading, and initial processing. The customization process introduces variability; unlike standard manufacturing, each production run is unique, demanding highly flexible and technically skilled fabrication workshops capable of adapting to individual CAD files and complex joint configurations. This phase often involves close interaction with specialized artisans for finishing and detailing.

Downstream activities center on distribution, sales, and post-sale services. The sales channel is bifurcated: direct sales, often managed through exclusive brand showrooms or specialized design studios, provide the high-touch, consultative service necessary for customization; and indirect sales, involving collaboration with third-party interior design firms, architecture studios, and high-end general contractors who act as intermediaries, specifying and procuring custom pieces for their projects. The distribution channel must manage unique logistical challenges, including bespoke packaging, specialized transportation to prevent damage to singular items, and highly professional installation services, often requiring specialized crew members trained in precision fitting and assembly within the client’s designated space. The reliance on indirect channels through design professionals represents a significant portion of high-value transactions, making professional relationships critical.

The final stage involves comprehensive customer support, including warranty services and maintenance advice tailored to the unique construction and materials of the custom piece. Direct interaction through company-owned design centers allows for immediate feedback loops, enabling manufacturers to refine their offerings and maintain high client satisfaction. For instance, manufacturers utilizing the direct channel often incorporate digital configurators and VR modeling to streamline the design-to-order process, enhancing transparency and reducing design approval cycles. The efficiency and reliability of the installation phase are often the final determinants of perceived value and significantly influence client advocacy and repeat business, highlighting the importance of specialized downstream partners capable of executing complex fitting requirements flawlessly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 25.5 Billion |

| Market Forecast in 2033 | USD 40.1 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ethan Allen Interiors Inc., Williams-Sonoma Inc., Hooker Furniture Corporation, La-Z-Boy Incorporated, Restoration Hardware (RH), Stickley Furniture, Bassett Furniture Industries Inc., Century Furniture LLC, Baker Furniture, Roche Bobois, Poltrona Frau Group, Kettal, Vitra International AG, Flexform S.p.A., Haworth Inc., HNI Corporation, Steelcase Inc., Herman Miller Inc., CustomMade Inc., and specialized local artisanal workshops. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Custom Furniture Market Potential Customers

The primary customers for custom furniture are high-net-worth individuals (HNWIs) and ultra-high-net-worth individuals (UHNWIs) undertaking large-scale luxury residential projects, where personalized design and exclusivity are paramount. These buyers typically seek unique solutions that reflect their sophisticated taste, are willing to pay a premium for certified quality materials, and require furniture to meet precise architectural and ergonomic specifications. Additionally, a growing segment of the affluent middle class, particularly millennials and Generation X homeowners, are increasingly investing in semi-custom or highly personalized modular units (such as kitchen cabinetry and built-in wardrobes) as part of major home renovations, emphasizing longevity and functional efficiency over disposable, low-cost options. This group often utilizes online configurators to manage costs while retaining a degree of personalization.

On the commercial side, the hospitality sector constitutes a significant customer base, encompassing luxury hotels, bespoke resorts, and high-end restaurant chains that require custom seating, reception desks, and specialty casegoods designed to reinforce their brand identity and withstand high traffic volumes. These commercial buyers prioritize durability, fire safety standards, and consistency across multiple units, often procuring large contracts directly from manufacturers. Similarly, corporate clients, particularly high-tech firms and professional service organizations, demand custom office solutions that enhance employee well-being and productivity, requiring bespoke ergonomic desks, specialized acoustic paneling, and unique collaborative furniture tailored to modern workspace layouts. Architects, interior designers, and professional property developers serve as crucial influencers and procurers for both residential and commercial projects, often dictating material selection and manufacturer choice.

Institutional customers, including universities, museums, and high-end healthcare facilities, also represent critical buyers, particularly for items that require stringent technical specifications, security features, or specialized historical reproduction. For instance, museum display cases or university library shelving often requires custom dimensions, specific load-bearing capacities, and non-standard finishes that standard suppliers cannot provide. These institutional customers tend to purchase based on long-term value, strict compliance with local building codes, and demonstrable commitment to high-quality craftsmanship. The purchasing decision for this segment is typically driven by project tenders and relies heavily on a manufacturer's proven track record of meeting complex, large-scale, and highly technical custom requirements within non-negotiable timelines.

Custom Furniture Market Key Technology Landscape

The Custom Furniture Market is rapidly integrating advanced technologies to address the dual challenges of manufacturing complexity and consumer demand for seamless digital experiences. Key technologies revolve around computer-aided design (CAD) and computer-aided manufacturing (CAM) systems, which are foundational, allowing designers to translate unique client concepts into precise, production-ready specifications. The integration of 3D modeling and rendering software, often paired with virtual reality (VR) and augmented reality (AR) visualization tools, is transforming the pre-sales process. AR technology enables customers to accurately visualize custom furniture pieces overlaid onto their actual living space, significantly improving decision-making confidence and reducing the need for physical samples. This technological shift optimizes the consultative sales cycle and minimizes costly design revisions after production has commenced.

On the manufacturing floor, the adoption of Industry 4.0 principles, including high-precision multi-axis CNC (Computer Numerical Control) machining, robotic sanding, and automated finishing systems, is enhancing efficiency and consistency in bespoke production. These machines can execute complex, one-off cuts with millimeter precision, drastically reducing labor time and material waste typically associated with traditional manual craftsmanship. Furthermore, the use of advanced Material Requirements Planning (MRP) and Enterprise Resource Planning (ERP) systems is critical for managing the non-standardized supply chain inherent in custom production, ensuring that unique components—ranging from specialty hardware to specific wood veneers—are ordered and delivered precisely when needed for assembly, minimizing operational bottlenecks and improving adherence to promised lead times for complex, personalized orders.

A crucial technological trend involves the increasing sophistication of online configurators and design platforms. These tools utilize parametric design methodologies, allowing customers or designers to easily modify dimensions, materials, finishes, and hardware choices in real-time. This front-end digitalization not only streamlines the ordering process but also automatically generates the necessary production files (CAD/CAM data) and pricing, directly connecting the consumer’s selection with the factory floor. The continuous improvement of these generative design platforms, often powered by AI to ensure aesthetic and structural integrity while maximizing material yield, is a central focus for market leaders seeking to scale the personalized customer experience while maintaining manufacturing cost-effectiveness and operational agility across a diverse, customized product portfolio.

Regional Highlights

- North America (USA, Canada, Mexico): North America, particularly the United States, represents a mature and dominant market segment driven by a high concentration of affluent consumers, strong housing market activity, and established luxury interior design culture. The demand here is characterized by high specifications for size, material quality (especially sustainable and reclaimed woods), and technological integration (e.g., custom cabinetry designed for smart home systems). The commercial sector, particularly corporate headquarters and luxury hospitality developments, drives substantial high-volume custom orders, emphasizing ergonomic and flexible workspace solutions. Technological adoption of online configurators and AR visualization is highest in this region, setting global benchmarks for digital customer interaction. Market growth is sustained by strong consumer confidence and a preference for domestically manufactured, high-quality bespoke furnishings over imported, standardized goods, often leveraging skilled local artisan networks.

- Europe (Germany, UK, France, Italy): Europe is recognized for its heritage in artisanal furniture craftsmanship, dominating the high-end luxury custom segment. Countries like Italy (Milan) and Germany maintain global leadership in design innovation and precision engineering. Demand in Europe is highly influenced by cultural appreciation for heritage, sustainable materials, and timeless design aesthetics. The market is moderately fragmented, featuring numerous small, highly specialized bespoke workshops alongside major international brands. Strict European Union environmental regulations drive innovation towards sustainable sourcing and low-VOC finishes in custom production. The UK market shows robust growth, fueled by high-value urban residential refurbishments, while German demand emphasizes functional, engineered custom solutions, particularly in kitchens and integrated storage systems that maximize spatial efficiency.

- Asia Pacific (APAC) (China, Japan, India, South Korea): APAC is the fastest-growing market, experiencing exponential demand growth due to rapid urbanization, increasing disposable income, and massive expansion of luxury residential and hospitality infrastructure, particularly in Tier 1 and Tier 2 cities in China and India. Consumers in this region are rapidly adopting customized solutions, moving away from traditional mass-produced items, seeking furniture that aligns with global design trends while respecting regional spatial constraints. Chinese consumers show high demand for fully integrated custom cabinetry and whole-house furnishing packages. While local competition is intense, there is a strong preference for recognized international brands that offer certified material quality and superior craftsmanship. Japan maintains a high-quality, niche market focusing on minimalist, space-efficient, and highly specialized custom solutions tailored to compact urban living.

- Latin America (Brazil, Argentina): The Latin American market exhibits growth potential, heavily influenced by regional economic conditions. Brazil, in particular, possesses a strong domestic furniture manufacturing base and a growing demand for custom pieces, particularly among the wealthy urban population. Market dynamics are centered around locally sourced materials and designs that reflect regional architectural styles. Challenges include volatile currency fluctuations and complex import/export regulations, often favoring local custom manufacturers who can minimize exposure to international logistical risks and costs. Adoption of advanced digital customization tools is still nascent but expanding as internet penetration increases and regional design firms seek efficiency.

- Middle East and Africa (MEA): Growth in the MEA market is largely project-driven, highly dependent on large-scale government investments in infrastructure, luxury hospitality (hotels, resorts), and high-end residential towers, notably in the UAE, Saudi Arabia, and Qatar. Demand is characterized by extremely high specifications, large-scale custom pieces (reflecting large living spaces), and a preference for exotic materials, elaborate detailing, and designs that project grandeur and luxury. Manufacturers catering to this region must demonstrate capacity for high-volume, quick turnaround on project-based custom orders and navigate complex logistics related to climate and installation requirements for premium, often heavy materials. The reliance on imported skilled labor and high-quality materials contributes to high average transaction values in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Custom Furniture Market.- Ethan Allen Interiors Inc.

- Williams-Sonoma Inc.

- Hooker Furniture Corporation

- La-Z-Boy Incorporated

- Restoration Hardware (RH)

- Stickley Furniture

- Bassett Furniture Industries Inc.

- Century Furniture LLC

- Baker Furniture

- Roche Bobois

- Poltrona Frau Group

- Kettal

- Vitra International AG

- Flexform S.p.A.

- Haworth Inc.

- HNI Corporation

- Steelcase Inc.

- Herman Miller Inc.

- CustomMade Inc.

- Arhaus, LLC

Frequently Asked Questions

Analyze common user questions about the Custom Furniture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the Custom Furniture Market?

The primary driver is the increasing demand for personalization and unique design aesthetics among affluent consumers, coupled with the necessity for optimized space utilization in compact urban housing. Technological advancements in 3D modeling and configuration tools also significantly ease the custom ordering process, enhancing market accessibility and driving adoption in both residential and commercial sectors seeking tailored solutions.

How does AI technology affect the production lead time for custom furniture?

AI technology significantly reduces production lead time by optimizing the design validation and manufacturing planning stages. AI-powered parametric design tools minimize human error in specifications, while AI-driven ERP systems optimize material procurement, CNC machining schedules, and logistics, leading to more efficient manufacturing workflows and faster delivery to the end customer.

Which application segment holds the largest share in the Custom Furniture Market?

The residential application segment currently holds the largest market share. This dominance is attributed to high consumer spending on luxury home renovations, the increasing trend of built-in storage solutions, and the high lifetime value of custom pieces for primary residences, including bespoke cabinetry, kitchens, and unique bedroom sets.

What are the main restraints hindering the Custom Furniture Market expansion?

Key restraints include the significantly higher cost compared to mass-produced furniture, the inherent long production lead times (often several months due to specialized labor and material sourcing), and the logistical complexity associated with delivering and installing one-of-a-kind, often oversized items. These factors deter price-sensitive consumers and those requiring rapid furnishing solutions.

Which region is expected to exhibit the fastest growth in custom furniture consumption?

The Asia Pacific (APAC) region, led by China and India, is projected to exhibit the fastest growth rate. This accelerated expansion is fueled by unprecedented growth in urbanization, the rise of a large, high-spending middle class, substantial investment in luxury real estate, and the rapid adoption of international design standards in commercial and hospitality projects.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager