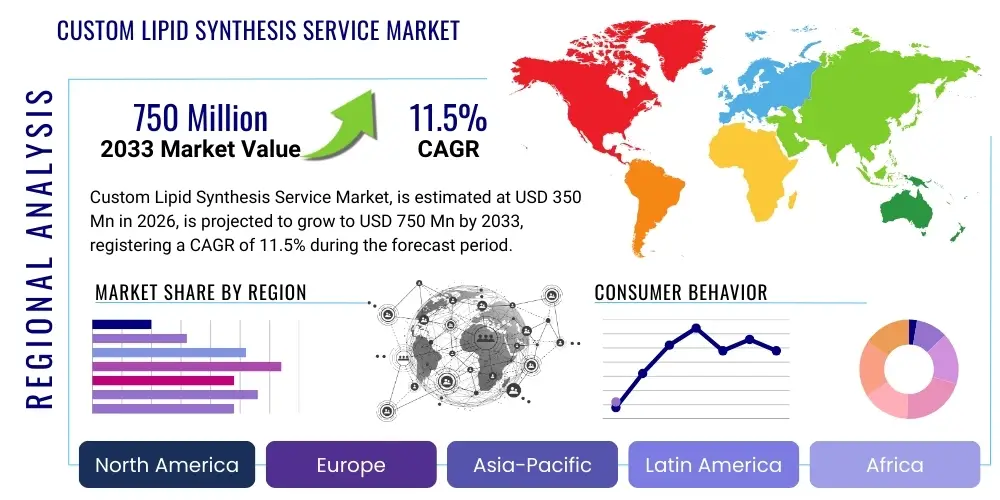

Custom Lipid Synthesis Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437969 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Custom Lipid Synthesis Service Market Size

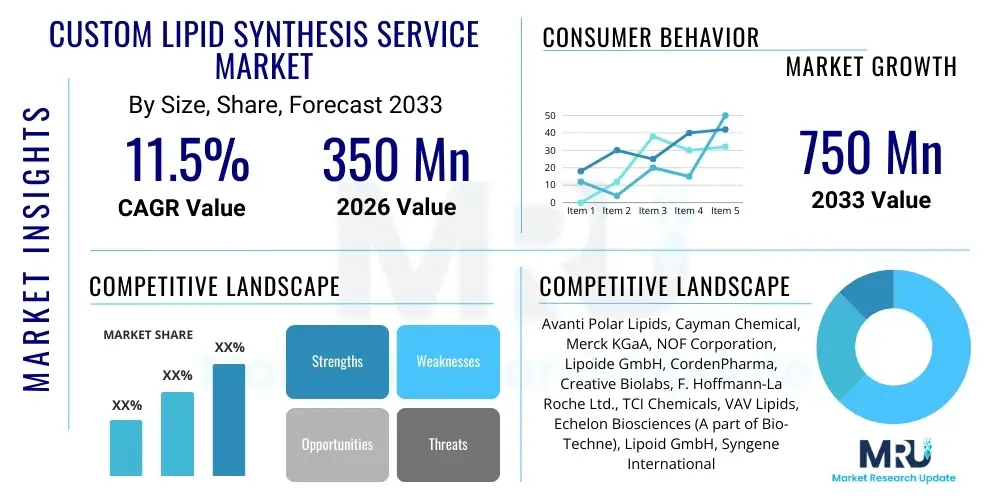

The Custom Lipid Synthesis Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at USD 350 Million in 2026 and is projected to reach USD 750 Million by the end of the forecast period in 2033.

Custom Lipid Synthesis Service Market introduction

The Custom Lipid Synthesis Service Market involves the tailored manufacturing of complex lipid molecules based on specific structural requirements for research, development, and therapeutic applications. Lipids are essential components in biological systems, and the ability to synthesize specific structural variants—such as novel phospholipids for enhanced liposomal stability or specialized glycolipids for targeting cancer cells—is critical for modern biotechnology and pharmaceutical advancements. The services provided span from milligram-scale research batches to large-scale cGMP manufacturing, ensuring high purity and quality standards for clinical applications.

Key applications driving this market include the burgeoning field of nucleic acid delivery, particularly the formulation of Lipid Nanoparticles (LNPs) crucial for mRNA vaccines and gene therapies. These custom lipids often incorporate proprietary head groups or unique fatty acid chains optimized for efficient encapsulation, cellular uptake, and endosomal escape. Furthermore, custom synthesis is vital for developing lipid standards for mass spectrometry and chromatography, crucial in metabolomics and diagnostics for accurate biomarker identification and quantification. The complexity and specificity required for these molecules necessitate highly specialized chemical expertise and advanced synthesis platforms, distinguishing custom services from bulk chemical production.

The primary benefits offered by custom lipid synthesis services include accelerated drug development timelines, access to structurally novel compounds unavailable commercially, and guaranteed lot-to-lot consistency crucial for clinical trials. Driving factors include the increasing prevalence of chronic diseases requiring targeted drug delivery, robust funding for biotechnology research, and the technological leaps in synthesis methodologies, including enzymatic and flow chemistry techniques, which allow for the generation of enantiomerically pure and highly complex lipid structures efficiently.

Custom Lipid Synthesis Service Market Executive Summary

The Custom Lipid Synthesis Service Market is experiencing significant acceleration, primarily fueled by the exponential growth in gene therapy and mRNA technology, where bespoke lipid components are mandatory for forming effective drug delivery vehicles like Lipid Nanoparticles (LNPs). Business trends indicate a strong move toward outsourcing specialized synthesis tasks to Contract Development and Manufacturing Organizations (CDMOs) and specialized synthesis firms that can provide cGMP-compliant production. Strategic collaborations between academic institutions developing novel lipid structures and synthesis service providers are becoming commonplace, focusing on intellectual property generation around next-generation delivery platforms. Furthermore, sustainability and green chemistry principles are increasingly influencing synthesis methodologies, prompting investments in environmentally friendly and efficient chemical processes.

Regionally, North America maintains market dominance due to its highly concentrated pharmaceutical and biotechnology sector, robust R&D spending, and stringent regulatory framework that necessitates high-quality, traceable synthetic inputs. Asia Pacific (APAC), however, is emerging as the fastest-growing region, driven by governmental support for biopharma manufacturing, lower operational costs, and the rapid expansion of research hubs in countries like China, India, and South Korea, which are increasingly investing in proprietary drug development pipelines utilizing custom components. European markets continue to demonstrate steady growth, bolstered by strong academic research in liposome technology and established biotech ecosystems, particularly in Germany, Switzerland, and the UK.

Segment trends reveal that the Phospholipids segment, specifically functionalized and PEGylated lipids critical for LNP formulation, holds the largest market share and is poised for the fastest expansion. The Drug Delivery Application segment dominates overall demand, reflecting the industry's pivot toward injectable, highly targeted therapeutic modalities. End-user analysis highlights Pharmaceutical & Biotechnology Companies as the most influential buyers, demanding large-scale, certified batches, while Contract Research Organizations (CROs) serve as crucial intermediaries, driving demand for diverse, smaller-scale libraries of novel lipid structures for preclinical testing and optimization studies.

AI Impact Analysis on Custom Lipid Synthesis Service Market

Common user questions regarding AI’s impact on custom lipid synthesis revolve around efficiency, novelty, and cost. Users frequently inquire: "How can AI reduce the time required to synthesize a novel lipid structure?" or "Can machine learning predict the stability and toxicity of uncharacterized synthetic lipids before laboratory testing?" and "Will AI lower the high cost associated with highly complex custom synthesis projects?" The overarching themes reflect expectations that AI and Machine Learning (ML) will serve as transformative tools, moving beyond simple automation to fundamentally altering the design and optimization phases. Users anticipate that AI-driven predictive modeling will minimize experimental failures, enhance purity yields, and accelerate the discovery of lipids possessing ideal physicochemical properties for specific applications, such as efficient LNP formulation with low immunogenicity.

The adoption of computational chemistry and AI platforms is expected to revolutionize the initial design phase of custom lipid synthesis. AI algorithms can rapidly sift through vast chemical databases and literature data to identify optimal starting materials, reaction conditions, and purification strategies for novel lipid targets, tasks that traditionally required extensive, time-consuming human expertise and iterative laboratory work. By simulating reaction kinetics and thermodynamics, AI helps synthetic chemists prioritize feasible and high-yielding synthesis pathways, significantly reducing resource consumption and maximizing the chances of achieving the desired high-purity product on the first attempt. This digital acceleration of the design-make-test cycle is crucial in highly competitive fields like novel drug delivery system development.

Furthermore, AI-powered quality control and analytical prediction are becoming integral to ensuring the consistency and compliance of custom synthetic lipids. Machine learning models, trained on spectral data (NMR, Mass Spectrometry) and chromatographic purity data, can instantaneously analyze synthesis outcomes, flag potential impurities, and even predict the long-term stability or degradation profiles of lipid products under various storage conditions. This capability directly supports cGMP requirements and strengthens the reliability of custom synthesis services, allowing providers to offer highly differentiated services based on guaranteed performance metrics derived from sophisticated data analytics rather than solely empirical observation.

- AI optimizes synthesis pathways, predicting high-yield reaction conditions for complex lipid structures.

- Machine learning accelerates the design phase, identifying novel lipid head groups and acyl chains with superior functional properties (e.g., LNP pKa).

- Predictive modeling minimizes empirical lab failures, reducing material costs and project timelines.

- AI enhances quality control by analyzing spectral data for rapid purity checks and impurity identification.

- Computational tools enable the prediction of lipid stability, toxicity, and cellular uptake efficiency prior to physical synthesis.

DRO & Impact Forces Of Custom Lipid Synthesis Service Market

The Custom Lipid Synthesis Service Market is shaped by a robust set of dynamic forces. The primary driving force is the relentless innovation in targeted drug delivery systems, particularly the commercial success and widespread adoption of mRNA technologies, which are entirely dependent on high-quality, custom-engineered lipids for formulation into stable Lipid Nanoparticles (LNPs). This demand is coupled with expanding academic and commercial interest in personalized medicine and metabolomics, requiring specialized lipid standards and probes. However, restraining factors include the extremely high cost and complexity associated with synthesizing chirally pure and large-scale cGMP-compliant complex lipids, requiring specialized facilities and highly skilled personnel, thereby limiting the number of capable service providers and potentially slowing down smaller biotech firms.

Opportunities in this market are vast, centered around exploiting emerging synthesis technologies, such as continuous flow chemistry, which promises enhanced purity, scalability, and safety compared to traditional batch processes. The rising demand for specialized, non-standard lipids for novel diagnostics, biosensors, and advanced materials also presents significant untapped potential. Furthermore, regulatory harmonization efforts across major markets could simplify the path for custom lipid manufacturers seeking global cGMP certification. The strategic impact of these forces suggests a market trajectory dominated by providers capable of investing heavily in automation, quality control infrastructure, and high-throughput screening technologies to meet both the volume and purity demands of the expanding biopharma pipeline.

The impact forces currently exerting the greatest influence include intensified industry focus on reducing immunogenicity and enhancing the efficacy of gene therapies, pressuring synthesis providers to deliver ultra-pure lipids with minimal batch variability. The substitution threat remains moderate; while bulk lipids are commoditized, custom, proprietary lipids are difficult to replace, ensuring service providers hold considerable niche value. Supplier power is high, particularly for specialty raw materials and highly sophisticated chromatographic purification columns necessary for ultra-high purity production. Overall, the market remains highly competitive yet offers substantial growth for firms that successfully navigate the demanding regulatory and technical complexity inherent in specialized chemical synthesis.

Segmentation Analysis

The Custom Lipid Synthesis Service Market is systematically segmented across various dimensions including the type of lipid synthesized, the application for which the lipid is used, and the primary end-user seeking the service. This segmentation is crucial for understanding specific demand pockets and technological needs within the diverse landscape of life sciences. The functional requirements imposed by drug delivery systems—specifically the need for ionizable and PEGylated lipids in LNPs—have fundamentally reshaped the landscape, making these subsegments the most valuable and fastest-growing areas. Analyzing these segments provides strategic clarity on where providers should focus R&D and manufacturing capacity to align with current and future biopharmaceutical trends.

Segmentation by Lipid Type reflects the chemical complexity and synthesis challenge; Phospholipids consistently hold the dominant share due to their role as fundamental structural components in liposomes and LNPs, while Sphingolipids are gaining traction due to their critical function in cellular signaling and neurodegenerative research. Segmentation by Application clearly shows the dominance of drug delivery, driven by the massive investment in prophylactic and therapeutic RNA-based products. Conversely, Diagnostics and Academic Research, while smaller in volume, drive the demand for highly novel and structurally complex small-batch lipids crucial for early-stage discovery and mechanistic studies.

The End-User segmentation distinguishes between large-scale cGMP demand from Pharmaceutical and Biotechnology Companies versus the varied, smaller-scale, non-cGMP needs of CROs and academic institutions. Pharmaceutical clients often require dedicated synthesis capacity and long-term supply agreements for commercialization, whereas CROs and academic groups look for flexibility, rapid turnaround, and expertise in synthesizing a broad range of unique or difficult-to-make compounds. The distinct requirements of each end-user group necessitate customized service models from synthesis providers, ranging from dedicated FTE models to project-based, fee-for-service arrangements.

- By Lipid Type:

- Phospholipids (e.g., PC, PE, PG, Cardiolipin)

- Sphingolipids (e.g., Ceramides, Sphingosines, Gangliosides)

- Glycerolipids (e.g., Mono-, Di-, Triglycerides)

- Fatty Acids and Derivatives (e.g., Conjugates, Stable Isotopes)

- Sterol Lipids (e.g., Cholesterol derivatives)

- Novel and Functionalized Lipids (e.g., Ionizable, PEGylated, Cationic)

- By Application:

- Drug Delivery Systems (Lipid Nanoparticles, Liposomes, Micelles)

- Research and Development (Mechanistic studies, Target Identification)

- Diagnostics and Imaging (Contrast agents, Lipid probes)

- Metabolomics and Lipidomics (Standards and Internal controls)

- Cosmetics and Personal Care

- By End-User:

- Pharmaceutical & Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic and Research Institutes

- Diagnostic Laboratories

- By Synthesis Scale:

- Research Scale (Milligram to Gram)

- Pilot Scale (Gram to Kilogram)

- Commercial Scale (Kilogram to Multi-Kilogram, cGMP)

Value Chain Analysis For Custom Lipid Synthesis Service Market

The value chain for custom lipid synthesis services is highly specialized and spans from the sourcing of rare chemical precursors to the final delivery of highly purified, cGMP-grade materials. The upstream segment involves securing specialized raw materials, such as high-purity fatty acids, glycerol backbones, and specialized hydrophilic head groups (like phosphocholine or polyethylene glycol derivatives). Reliability and quality control at this initial stage are critical, as the complexity of the final product dictates the need for meticulously pure starting materials. Key suppliers often include specialized chemical companies providing isotope-labeled compounds or niche fine chemicals. High dependence on specific, sometimes patented, precursors can give upstream suppliers significant bargaining power, influencing overall synthesis costs.

The core of the value chain is the synthesis and purification process. This stage involves complex, multi-step organic chemistry requiring specialized reactors, cryogenic capabilities, and, most importantly, advanced chromatographic purification technologies, such as High-Performance Liquid Chromatography (HPLC) and flash chromatography, to ensure the necessary purity levels (often >99%). Quality Assurance (QA) and Quality Control (QC) processes, including rigorous analytical testing (NMR, Mass Spec, elemental analysis), are integrated throughout. For pharmaceutical applications, this synthesis phase must adhere to strict cGMP (current Good Manufacturing Practices) regulations, which require extensive documentation and facility validation, adding significant complexity and cost, but also value.

The downstream component involves distribution channels and reaching the end-user. Direct channels are predominant, especially for custom, high-value contracts with major pharmaceutical and biotech firms, allowing for close technical collaboration and intellectual property protection. Indirect channels involve utilizing distributors or specialized CROs acting as intermediaries, particularly for standard research-grade lipids or smaller academic orders. The final step is application support, where synthesis providers often offer formulation and characterization services, assisting clients in transitioning the newly synthesized lipid into its final drug product, such as incorporating it into an LNP formulation, thereby completing the specialized service package and strengthening the provider-client relationship through enhanced technical integration.

Custom Lipid Synthesis Service Market Potential Customers

The primary customers in the Custom Lipid Synthesis Service Market are entities engaged in advanced biological and pharmaceutical R&D that require specialized lipid structures for functional purposes beyond those available commercially. These end-users typically include large multinational Pharmaceutical and Biotechnology Companies which drive demand for commercial-scale, cGMP-certified batches of lipids, particularly ionizable and helper lipids required for proprietary LNP formulations critical to their vaccine and gene therapy pipelines. These companies seek long-term supply security and stringent quality adherence, often negotiating dedicated capacity contracts to ensure timely and consistent supply for clinical trials and eventual market launch.

Another significant customer segment comprises Contract Research Organizations (CROs) and Contract Development and Manufacturing Organizations (CDMOs). CROs frequently outsource highly complex or specialized chemical synthesis tasks to focus on their core competencies like preclinical testing or clinical trial management. They act as intermediates, requiring diverse, small-to-mid-scale synthesis of novel lipid libraries to support their clients’ early-stage drug screening and formulation optimization efforts. The CDMOs, while often possessing some internal synthesis capabilities, may leverage external custom synthesis services for highly challenging molecules or during periods of peak demand, especially when requiring rapid access to niche synthesis expertise.

Finally, Academic and Governmental Research Institutes, alongside specialized Diagnostic and Lipidomics Laboratories, form the essential base of customers requiring ultra-high purity, small-scale custom lipids. These customers typically demand novel, stable-isotope labeled lipids, fluorescent probes, or structurally unique lipids for mechanistic research, biomarker identification, and establishing analytical standards. While their volume demand is low, their need for highly tailored and structurally unique compounds drives innovation and diversification within the service provider market. The specific requirements of these customers emphasize structural elucidation services and detailed analytical documentation over large-scale production capabilities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350 Million |

| Market Forecast in 2033 | USD 750 Million |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Avanti Polar Lipids, Cayman Chemical, Merck KGaA, NOF Corporation, Lipoide GmbH, CordenPharma, Creative Biolabs, F. Hoffmann-La Roche Ltd., TCI Chemicals, VAV Lipids, Echelon Biosciences (A part of Bio-Techne), Lipoid GmbH, Syngene International, Cerilliant (A part of Merck), Pfanstiehl, Precision NanoSystems, Genevant Sciences, Croda International Plc, Aeterna Zentaris Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Custom Lipid Synthesis Service Market Key Technology Landscape

The technological landscape of the Custom Lipid Synthesis Service Market is characterized by a push for enhanced efficiency, purity, and scalability to meet the demanding specifications of pharmaceutical applications. Traditional batch synthesis, while fundamental, is increasingly being supplemented or replaced by advanced methodologies. Flow chemistry, in particular, represents a significant technological advancement. This approach allows for reactions to be conducted in a continuous stream through narrow tubes or microreactors, offering superior control over reaction parameters, temperature, and mixing. The benefits include reduced byproduct formation, higher reaction yields, and inherently safer handling of hazardous intermediates, translating directly into higher purity and easier scalability for commercial cGMP manufacturing.

Furthermore, enzymatic synthesis is gaining prominence, particularly for producing enantiomerically pure and structurally complex lipids that are difficult or impossible to synthesize via conventional chemical routes. Enzymes offer high specificity, reducing the need for laborious purification steps and simplifying the creation of specific chiral centers crucial for the biological activity of many specialized lipids. The utilization of recombinant enzyme systems allows service providers to custom-tailor synthesis processes based on the desired lipid structure. This bio-catalytic approach is crucial for lipids used in nutraceuticals and certain pharmaceutical intermediates where stereochemical fidelity is paramount.

Advanced analytical and purification technologies form the backbone of service quality. Ultra-high performance liquid chromatography (UPLC) coupled with high-resolution mass spectrometry (HRMS) is mandatory for detailed structural characterization and quantification of trace impurities. Specifically for LNP components, dedicated purification protocols often involving tangential flow filtration (TFF) and specialized preparative chromatography are employed to ensure minimal residual solvents and heavy metals, meeting the strict guidelines set by regulatory bodies like the FDA and EMA. The strategic integration of these analytical platforms with automated synthesis modules is a core differentiator for leading custom synthesis providers, ensuring reproducibility and reducing time-to-market.

Regional Highlights

- North America: This region holds the largest market share, driven by its unparalleled concentration of leading pharmaceutical and biotechnology companies, particularly in the US (Boston/Cambridge, San Francisco Bay Area). The strong financial backing from venture capital and government grants for novel drug development, especially in oncology and gene therapy, sustains a high demand for cGMP-grade, custom-synthesized LNP components. The mature regulatory environment and established infrastructure for high-level chemical manufacturing further solidify its leadership position.

- Europe: Europe is a substantial and mature market, characterized by excellence in academic research (especially in liposome technology) and strong government funding through initiatives like Horizon Europe. Countries such as Germany, Switzerland, and the UK boast high-quality CDMOs and specialized synthesis houses. Demand is steady, focused on both complex research-grade lipids and mid-scale clinical supply, supported by rigorous regulatory standards that drive continuous investment in quality control and analytical services.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market due to escalating healthcare expenditure, expanding domestic pharmaceutical industries, and increasing outsourcing trends. Countries like China and India are rapidly establishing world-class research infrastructure and manufacturing bases, often offering cost advantages for large-scale production. Japan and South Korea, with strong biotechnology sectors, focus on high-end, proprietary lipid research for domestic innovation and export.

- Latin America (LATAM): The LATAM market remains nascent but is growing, primarily driven by increasing foreign investment in local drug manufacturing and clinical trials, particularly in Brazil and Mexico. Demand is mostly focused on specialized research-grade lipids and services supporting localized diagnostics development, relying heavily on imports or services outsourced from North American providers.

- Middle East and Africa (MEA): Growth in the MEA region is gradual, focused primarily on establishing local pharmaceutical production capacity in key economies like Saudi Arabia and UAE. The demand for custom lipid synthesis services is currently low volume and centered on academic and governmental research initiatives aimed at addressing specific regional health challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Custom Lipid Synthesis Service Market.- Avanti Polar Lipids

- Cayman Chemical

- Merck KGaA

- NOF Corporation

- Lipoide GmbH

- CordenPharma

- Creative Biolabs

- F. Hoffmann-La Roche Ltd.

- TCI Chemicals

- VAV Lipids

- Echelon Biosciences (A part of Bio-Techne)

- Lipoid GmbH

- Syngene International

- Cerilliant (A part of Merck)

- Pfanstiehl

- Precision NanoSystems

- Genevant Sciences

- Croda International Plc

- Aeterna Zentaris Inc.

- Sartorius AG (select services)

Frequently Asked Questions

Analyze common user questions about the Custom Lipid Synthesis Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for custom lipid synthesis services?

The central driver is the massive global investment and technological success of nucleic acid therapies, specifically mRNA vaccines and gene therapies, which critically depend on custom-engineered, ionizable lipids for stable and effective formulation into Lipid Nanoparticles (LNPs).

What are the typical purity requirements for custom lipids used in clinical applications?

For lipids designated for clinical trials or commercial drug products, cGMP standards require extremely high purity, often exceeding 99% purity for the target molecule, with stringent limits on residual solvents, heavy metals, and critical impurities, ensuring patient safety and efficacy.

How does the Custom Lipid Synthesis Market differentiate between research and commercial scale manufacturing?

Research scale involves small batches (milligrams to grams) of novel or complex structures, prioritizing structural novelty and rapid turnaround. Commercial scale demands large volumes (kilograms), absolute adherence to cGMP regulations, extensive analytical validation, and guaranteed batch-to-batch consistency for regulatory submission.

Which geographical region dominates the custom lipid synthesis service market?

North America currently holds the largest market share due to its established ecosystem of leading pharmaceutical and biotechnology companies, high R&D spending, and early adoption of advanced drug delivery technologies requiring specialized synthetic lipid inputs.

What role does flow chemistry play in modern custom lipid synthesis?

Flow chemistry enhances synthesis efficiency and purity by providing superior control over reaction conditions. This technology is vital for scaling up complex, multi-step reactions, improving safety, and ensuring the high reproducibility required for cGMP manufacturing of critical lipid intermediates.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager