Custom Paper Cup Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433645 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Custom Paper Cup Service Market Size

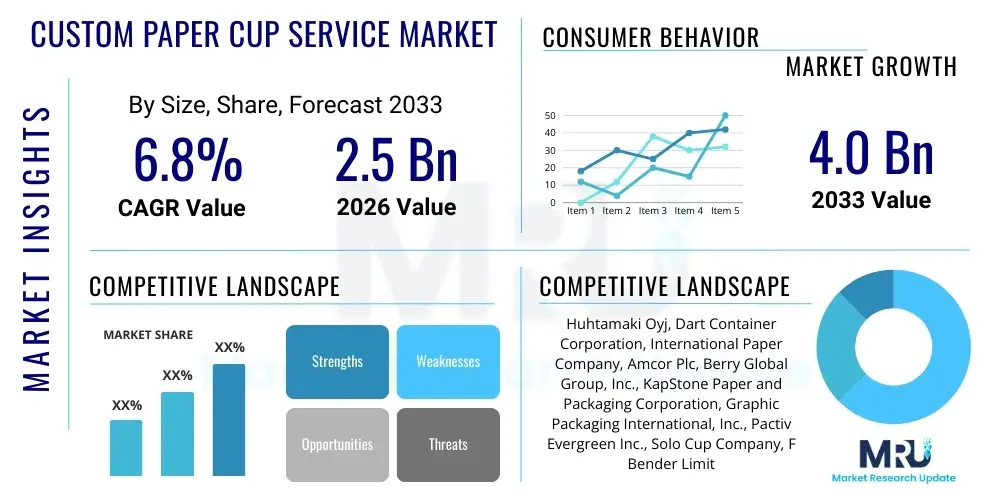

The Custom Paper Cup Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $2.5 Billion in 2026 and is projected to reach $4.0 Billion by the end of the forecast period in 2033.

Custom Paper Cup Service Market introduction

The Custom Paper Cup Service Market involves the specialized provision of disposable paper cups featuring custom branding, unique designs, and tailored sizes for businesses, events, and institutional use. This service extends beyond simple manufacturing to include design consultation, high-quality printing (such as offset or flexographic), sustainable material options (e.g., PLA-lined or compostable papers), and streamlined logistics for delivery. The core value proposition lies in enabling businesses, particularly in the food and beverage sector, to leverage their packaging as a dynamic marketing tool, enhancing brand visibility and consumer engagement in a highly competitive retail environment. As regulations increasingly restrict plastic use, paper cups, particularly those customizable for specific branding needs, are becoming the preferred sustainable alternative, driving significant market momentum.

Major applications for custom paper cups span a wide range of industries, including coffee shops, fast-food restaurants, corporate offices, large-scale event management, and healthcare facilities. These cups are primarily used for hot beverages (coffee, tea, hot chocolate), cold beverages (soda, water, milkshakes), and sometimes for serving small food portions or samples. The benefits derived from utilizing custom paper cup services are manifold: they offer robust brand differentiation, ensure compliance with environmental regulations regarding single-use plastics, provide sanitary and disposable packaging solutions, and allow businesses to run time-sensitive promotional campaigns directly on their serving ware. The ability to customize small batch orders further opens the market to small and medium-sized enterprises (SMEs) that require flexibility.

Key driving factors propelling the market growth include the global surge in out-of-home consumption of beverages, particularly specialized coffees; stringent governmental regulations favoring biodegradable and sustainable packaging materials; and the increasing recognition among Quick Service Restaurants (QSRs) and cafes that packaging is a critical element of the overall consumer experience and brand image. Furthermore, advancements in printing technology have made custom designs more affordable and accessible, reducing the minimum order quantities and enabling high-fidelity graphic reproduction, which directly fuels demand for sophisticated custom paper cup services tailored to precise brand specifications.

Custom Paper Cup Service Market Executive Summary

The Custom Paper Cup Service Market is poised for robust expansion, driven by shifting consumer preferences toward convenience and sustainability, coupled with aggressive brand marketing strategies utilizing disposable packaging. Business trends indicate a strong move towards environmentally friendly materials, with compostable and recyclable paper cups capturing significant investment and innovation. Key players are focusing on vertical integration, enhancing their design capabilities, and optimizing supply chains to manage fluctuating raw material costs (pulp) and maintain competitive pricing. The growth trajectory is also heavily influenced by the proliferation of specialized coffee culture globally, which necessitates premium, customized serving vessels that reflect high-end branding and quality.

Regional trends show Asia Pacific (APAC) emerging as the fastest-growing market, primarily due to rapid urbanization, increasing disposable income, and the expansion of international and domestic coffee chains, particularly in China and India. North America and Europe, while mature, remain dominant in terms of market value, led by strict sustainability mandates (like the EU's Single-Use Plastic Directive) which necessitate immediate transitions from plastic to custom paper alternatives. Latin America and the Middle East and Africa (MEA) are also exhibiting accelerated adoption, spurred by large-scale commercial development and burgeoning tourism, driving demand for custom branded services in hospitality and food service sectors.

Segmentation trends highlight the dominance of the hot beverage cup segment due to the pervasive global coffee market, though the cold beverage segment is catching up rapidly, driven by customized cups for smoothies and craft sodas. In terms of technology, flexographic printing dominates due to cost-efficiency for large volumes, but digital printing is gaining traction for short runs and highly personalized, variable-data custom orders. The material segment shows a clear pivot towards Poly Lactic Acid (PLA) lined paper and fully compostable paper stocks, as end-users actively seek suppliers who can demonstrate genuine circular economy credentials and environmental responsibility in their service offerings.

AI Impact Analysis on Custom Paper Cup Service Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Custom Paper Cup Service Market frequently revolve around topics such as optimizing the supply chain, enhancing personalized design capabilities, and predicting consumer demand for specific cup features (like size or material). Users are keen to understand how AI can streamline the complex customization workflow, from initial design approval and mock-up generation to ensuring color accuracy across mass production runs. Key concerns often focus on the capital investment required for AI implementation in traditional printing facilities and how small-to-mid-sized service providers can leverage low-cost AI tools for inventory management and waste reduction. Expectations center on AI driving significant efficiency gains, improving forecasting accuracy to reduce overstocking of raw materials, and potentially enabling hyper-customization at scale for individual retail locations or promotional events, thus lowering the effective cost of specialized custom services.

- AI-powered Demand Forecasting: Optimizes inventory of raw materials (paperboard, coatings) and finished goods by accurately predicting seasonal and promotional peaks, minimizing waste and storage costs.

- Automated Design Generation: Uses generative AI models to create initial design concepts and mock-ups based on client brand guidelines, accelerating the pre-press process and reducing design iteration time.

- Predictive Maintenance: AI algorithms monitor printing and forming machinery for anomalies, forecasting equipment failures before they occur, maximizing uptime and service delivery reliability.

- Quality Control (QC) Automation: Computer vision systems driven by AI rapidly inspect printed cups for defects (color inconsistencies, misregistration), ensuring strict adherence to custom quality specifications during high-speed production.

- Optimized Logistics and Fulfillment: AI routes orders and manages delivery schedules, particularly for fragmented, just-in-time custom orders required by multiple independent coffee shops, ensuring prompt service.

- Personalized Marketing Insights: Analyzes consumer purchase data to recommend optimal cup size, material choices, and design themes tailored to specific geographic or demographic market segments.

DRO & Impact Forces Of Custom Paper Cup Service Market

The dynamics of the Custom Paper Cup Service Market are heavily influenced by a confluence of accelerating drivers (D), persistent restraints (R), and expansive opportunities (O), collectively forming the impact forces shaping its trajectory. The primary driver is the global regulatory push towards sustainability, mandating the phase-out of plastic disposable items, thereby creating a captive demand pool for high-quality paper alternatives, especially customized ones that can maintain brand identity. Alongside this, the flourishing global coffee and beverage shop culture requires aesthetic and branded packaging, further solidifying custom paper cups as a non-negotiable marketing tool. However, the market faces significant restraints, chiefly concerning the volatility and rising cost of virgin wood pulp and recycled fiber, coupled with infrastructure gaps in effectively recycling or composting existing paper cup waste, which casts doubt on their ultimate environmental footprint. The logistical complexity of managing highly variable custom orders also poses a scaling challenge for smaller providers.

A major opportunity exists in the development and large-scale deployment of next-generation barrier coatings, such as mineral-based or water-dispersible coatings, which negate the need for difficult-to-recycle polyethylene (PE) linings, thus solving the core environmental challenge associated with traditional paper cups and opening new sustainable premium market segments. Furthermore, the expansion of custom service offerings beyond just printing—including customized lids, sleeves, and specialized vending machine integration—offers pathways for service providers to increase their value capture. The market's impact forces are therefore pushing suppliers to invest aggressively in material science R&D and supply chain optimization to mitigate cost risks while capitalizing on the massive shift away from conventional plastics and toward comprehensive, branded, and verifiable sustainable packaging solutions.

These forces dictate competitive strategies, forcing companies to differentiate not only on price and design quality but increasingly on verifiable sustainability metrics. The collective impact is a market characterized by high innovation intensity in materials and printing technology, and intense pressure on profit margins due to raw material costs. Only those service providers who can offer end-to-end, certified sustainable custom solutions combined with efficient digital order management will secure long-term market leadership and effectively navigate the complex regulatory and environmental scrutiny facing the disposable packaging industry today.

Segmentation Analysis

The Custom Paper Cup Service Market is comprehensively segmented based on material, printing technology, cup size, and end-use application, providing a granular view of demand patterns and competitive landscapes. Analyzing these segments is critical for service providers to tailor their offerings, optimize production efficiency, and penetrate niche markets effectively. The material segmentation underscores the industry's shift towards sustainable alternatives, differentiating between PE-lined, PLA-lined, and fully compostable cups. End-use segmentation clearly illustrates the high volume demand originating from QSRs and coffee chains versus the specialized, smaller volume requirements of corporate offices or institutional buyers, each demanding distinct service level agreements regarding design flexibility and order frequency.

The market volume is heavily skewed towards standardized cup sizes (8 oz, 12 oz, 16 oz) optimized for high-throughput beverage services, although customized, larger sizes for specialty beverages or food items are growing rapidly. Furthermore, the distinction between printing technologies—Flexographic versus Digital—is crucial as it determines the economic viability of order size; Flexo remains the benchmark for large, repetitive custom runs, while Digital Printing is the enabler for personalized marketing campaigns and low Minimum Order Quantity (MOQ) services demanded by small businesses and event organizers. This complex interplay between size, material, and technology defines the strategic operational focus for leading custom cup providers globally.

- By Material Type:

- PE (Polyethylene) Lined Paper Cups

- PLA (Polylactic Acid) Lined Paper Cups (Compostable)

- Water-based Dispersion Coated Cups

- Recycled Paperboard Cups

- By Printing Technology:

- Flexographic Printing

- Offset Printing

- Digital Printing

- Gravure Printing

- By Cup Size:

- Small (Below 8 oz)

- Medium (8 oz to 16 oz)

- Large (Above 16 oz)

- By End-Use Application:

- Quick Service Restaurants (QSRs) and Fast Food Chains

- Cafés and Coffee Shops (Independent and Chains)

- Institutional & Corporate Offices

- Event Management and Catering Services

- Healthcare Facilities

- Vending Machines

Value Chain Analysis For Custom Paper Cup Service Market

The value chain for the Custom Paper Cup Service Market begins with upstream activities focused on raw material sourcing, predominantly centered around wood pulp harvesting and processing into high-quality paperboard suitable for food contact. Key upstream considerations include ensuring the sustainable sourcing of certified pulp (FSC or PEFC) and procuring specialized barrier coatings (PE, PLA, or mineral-based). The efficiency and cost-effectiveness of this upstream segment are highly sensitive to global commodity prices and regulatory standards concerning forest management and chemical additives. Manufacturers invest heavily in machinery (printing presses, die-cutting, and cup forming equipment) to convert these raw materials into blanks and then into final cup structures, focusing on minimal material wastage and high-speed conversion, which is crucial for profitability in this volume-driven sector.

Midstream activities involve the specialized process of customization, including graphic design, pre-press proofing, and the actual printing of custom brand logos and artwork. This phase demands technical expertise in color matching (critical for brand consistency) and handling various printing techniques (Flexo for large orders, Digital for small runs). The customization service providers often act as consultants, guiding clients on material suitability and sustainable options. Downstream activities encompass warehousing, inventory management of finished custom goods, and final distribution. Due to the high volume and relatively low value per unit, optimized logistics and localized fulfillment centers are vital to minimizing shipping costs and meeting tight delivery schedules, especially for QSRs operating under just-in-time inventory models.

Distribution channels are bifurcated into direct and indirect routes. Direct distribution involves large custom cup manufacturers supplying directly to major national and international QSR chains or corporate clients through long-term contracts. This channel offers better control over quality and pricing. Indirect channels involve utilizing specialized packaging distributors, brokers, and e-commerce platforms that aggregate demand from small to medium-sized independent coffee shops and event organizers. The rise of digital printing services has significantly boosted the indirect channel, allowing smaller entities to offer custom services online with lower MOQs. Maintaining stringent hygiene and food safety standards throughout all stages of distribution is a non-negotiable element, enforced through rigorous quality checks and certification processes across the entire value chain.

Custom Paper Cup Service Market Potential Customers

The potential customer base for custom paper cup services is exceptionally broad, spanning any commercial or institutional entity that serves beverages for immediate consumption and seeks to leverage packaging for branding purposes. The largest volume consumers remain the Quick Service Restaurant (QSR) sector, including global burger chains and dedicated breakfast/snack operations, requiring massive quantities of consistently branded cups for both hot and cold drinks. Similarly, major international and regional coffee chain operators represent a premium segment, demanding high-fidelity printing, specialized sustainable materials, and varying cup sizes to support complex menus and loyalty programs. These large chains are typically long-term contract buyers, valuing supply chain reliability and material innovation.

Beyond the major chains, the fastest-growing segment of potential customers includes independent cafes, specialty coffee roasters, and local food trucks. These SMEs utilize custom cups to differentiate themselves in saturated urban markets, often preferring digital printing services that allow for low Minimum Order Quantities (MOQs) and quick turnaround for seasonal or promotional campaigns. Furthermore, institutional buyers such as large corporate campuses, universities, hospitals, and entertainment venues (stadiums, theaters) represent stable demand for custom-branded cups used internally for staff, visitors, and events, emphasizing compliance with facility sustainability goals and brand visibility within their premises.

Event management companies and catering services form another significant customer cohort, requiring flexible, short-term, and often elaborate custom designs tailored specifically for single events, product launches, or large-scale festivals. Finally, the emergence of customized cup programs for vending machine operators and subscription box services demonstrates new avenues for market penetration. In essence, any business prioritizing disposable convenience, seeking to reduce their environmental impact (by replacing plastic), and viewing its packaging as a core marketing touchpoint constitutes a high-potential customer for tailored custom paper cup services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.5 Billion |

| Market Forecast in 2033 | $4.0 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Huhtamaki Oyj, Dart Container Corporation, International Paper Company, Amcor Plc, Berry Global Group, Inc., KapStone Paper and Packaging Corporation, Graphic Packaging International, Inc., Pactiv Evergreen Inc., Solo Cup Company, F Bender Limited, Groupe Nors, Benders Paper Cups, Genpak LLC, Dixie Consumer Products LLC, Detpak, ConverPack, Inc., Duni Group, Go-Pak UK Ltd, Seda International Packaging Group, New WinCup Holdings, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Custom Paper Cup Service Market Key Technology Landscape

The technological landscape of the Custom Paper Cup Service Market is primarily defined by advancements in three critical areas: printing methods, paperboard materials, and barrier coatings. Flexographic printing remains the foundational technology for high-volume, low-complexity custom orders, offering high speed and cost efficiency. However, the rapidly growing demand for highly personalized and smaller batch orders is driving the adoption of high-speed Digital Inkjet Printing technology. Digital printing allows for variable data printing, meaning every cup in a run can feature a unique design element or code, opening up sophisticated promotional and anti-counterfeiting applications. Manufacturers are continuously investing in digital presses that can handle the thick paperboard required for cups while maintaining high resolution and color accuracy consistent with major brand guidelines.

Material science is arguably the most dynamic technological field, revolving around the search for a perfect, food-safe, high-barrier coating that is easily recyclable or compostable without expensive processing. Traditional polyethylene (PE) linings are being phased out in favor of polylactic acid (PLA), a bioplastic derived from renewable resources like corn starch, suitable for composting facilities. More recently, water-based dispersion coatings are gaining prominence. These coatings create a barrier without a separate plastic layer, allowing the resulting cup to be pulped and recycled alongside standard paperboard, addressing the critical end-of-life challenge associated with previous designs. The technological competitiveness of service providers is increasingly tied to their ability to deploy these advanced, verifiable sustainable materials at scale without compromising the cup's structural integrity or barrier properties.

Furthermore, technology enabling efficient workflow management, including advanced Computer-Aided Design (CAD) for rapid prototyping and cloud-based Enterprise Resource Planning (ERP) systems, is crucial for custom service operations. These systems integrate customer order intake, design approval, inventory tracking, and machine scheduling, ensuring minimal lead times for custom orders. Automation in the cup-forming process, utilizing advanced robotics and sensor technology, minimizes human error and ensures consistency in cup dimension and sealing integrity. The integration of QR codes and Near Field Communication (NFC) chips into the custom print design also represents a growing trend, transforming the disposable cup into a connected digital marketing touchpoint, directly linking the physical product to digital customer engagement strategies.

Regional Highlights

Regional dynamics play a significant role in shaping the Custom Paper Cup Service Market, reflecting varied regulatory environments, economic development levels, and established coffee cultures. North America (U.S. and Canada) holds a mature and high-value share, characterized by high consumer awareness regarding brand packaging and a demanding QSR sector that constantly seeks innovative and custom-branded solutions. The market here is driven by large-scale consumption of both hot and cold beverages, sophisticated digital printing demand for regional campaigns, and increasing pressure from state and municipal legislation requiring verifiable compostable or recyclable cup options.

Europe represents a highly fragmented yet rapidly evolving market, dominated by the European Union's ambitious sustainability directives, particularly the Single-Use Plastic Directive, which accelerates the transition from plastic to custom paper alternatives across all member states. This region is a hotbed for material innovation, with a strong focus on water-based dispersion coatings and certified compostable materials. Countries like Germany, the UK, and France show significant demand, balanced by complex national recycling infrastructures that custom cup service providers must navigate by offering country-specific solutions.

Asia Pacific (APAC) is projected to experience the highest growth rate during the forecast period. This acceleration is attributed to massive urbanization, the rapid expansion of international and domestic coffee and bubble tea chains (especially in China, India, and Southeast Asia), and rising middle-class disposable incomes driving out-of-home consumption. While cost competitiveness remains key, the adoption of customized, premium paper cup services is growing fastest among younger, urban consumers who associate quality packaging with brand value. Regulatory landscapes are diverse, with some countries mirroring Western sustainability pushes, while others prioritize cost and volume.

Latin America and the Middle East and Africa (MEA) are emerging markets, driven by infrastructural development, growing tourism, and increased foreign investment in food service. Demand for custom paper cups in MEA is particularly strong in hospitality sectors (hotels, resorts) and corporate catering, where maintaining a high-end brand image is paramount. In Latin America, the market growth is supported by large population centers and the increasing penetration of global QSR brands requiring localized custom branding solutions. These regions often look for robust, cost-effective custom services that can withstand varied climatic conditions.

- North America (U.S., Canada): Focus on high-end customization, strong regulatory pressure for sustainability, high adoption of digital printing for targeted marketing.

- Europe (Germany, UK, France): Mandate-driven transition to PLA/water-based coatings, complex recycling logistics, focus on certified sustainable sourcing.

- Asia Pacific (China, India, Japan): Highest growth potential, driven by QSR and coffee chain expansion, high volume demand, and increasing consumer willingness to pay for premium, branded packaging.

- Latin America: Growing middle-class consumption, localization of branding strategies, significant potential for market penetration in urban centers.

- Middle East and Africa (MEA): Demand centered in the hospitality and corporate sectors, emphasis on premium branding and high-quality graphics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Custom Paper Cup Service Market.- Huhtamaki Oyj

- Dart Container Corporation

- International Paper Company

- Amcor Plc

- Berry Global Group, Inc.

- KapStone Paper and Packaging Corporation

- Graphic Packaging International, Inc.

- Pactiv Evergreen Inc.

- Solo Cup Company

- F Bender Limited

- Groupe Nors

- Benders Paper Cups

- Genpak LLC

- Dixie Consumer Products LLC

- Detpak

- ConverPack, Inc.

- Duni Group

- Go-Pak UK Ltd

- Seda International Packaging Group

- New WinCup Holdings, Inc.

- Tork Group (Essity AB)

- Greiner Packaging International

- Walki Group

Frequently Asked Questions

Analyze common user questions about the Custom Paper Cup Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What materials are considered sustainable alternatives in custom paper cup services?

The primary sustainable alternatives replacing traditional polyethylene (PE) liners are Polylactic Acid (PLA) linings, which are derived from renewable resources and are industrially compostable, and water-based dispersion coatings. Water-based coatings allow the paper cup to be recycled in standard paper waste streams, making them highly desirable for companies seeking circular economy credentials.

How does digital printing impact the cost and accessibility of custom paper cups?

Digital printing significantly lowers the minimum order quantity (MOQ) barrier, making custom paper cups accessible to small businesses and reducing initial capital outlay. While the unit cost may be slightly higher than flexographic printing for large volumes, digital technology allows for faster turnaround times and superior flexibility for unique designs and personalized marketing campaigns.

What is the typical lead time for a custom paper cup order, and how is it optimized?

Standard lead times for custom paper cup orders typically range from 4 to 8 weeks, depending on the complexity of the design, required volume, and printing technology used (digital is faster than flexo). Optimization is achieved through automated pre-press proofing, streamlined logistics software, and utilizing domestic manufacturing facilities to reduce overseas shipping times.

Which end-use segment drives the highest demand volume in the Custom Paper Cup Service Market?

The Quick Service Restaurant (QSR) and global coffee chain segment drives the highest demand volume. These enterprises require continuous, massive supplies of consistently branded cups for both hot and cold beverages, making them the cornerstone of market consumption and often demanding the most complex, long-term supply chain solutions.

What are the primary regulations affecting the Custom Paper Cup Service Market globally?

The market is primarily affected by the European Union’s Single-Use Plastic Directive (SUPD), which mandates reduced reliance on conventional plastics, and various municipal bans in North America and Asia on expanded polystyrene (EPS) and non-recyclable single-use items. Food contact safety certifications (like FDA or EU regulations) are also non-negotiable requirements for all custom cup materials.

What is the difference between compostable and recyclable custom paper cups?

Compostable cups (typically PLA-lined) require specific industrial composting facilities to break down effectively, which are not universally available. Recyclable cups (often water-based coated) can theoretically be processed alongside general paper waste in standard recycling facilities, although success depends heavily on local infrastructure and collection methods.

How significant is the cost volatility of raw materials (pulp) on the service pricing?

Cost volatility of wood pulp and paperboard is a major restraint. Since raw materials constitute a large portion of the overall cost, significant fluctuations necessitate frequent price adjustments or hedging strategies by custom cup service providers, directly impacting the final contract pricing offered to end-users like QSR chains.

Why is brand consistency crucial in the custom paper cup market?

Brand consistency is paramount because the cup serves as a tangible, temporary billboard for the brand in the consumer's hand. Any deviation in color (e.g., matching a logo's Pantone code), print quality, or material feel can negatively affect consumer perception of the brand's quality and professionalism, making color management a core service requirement.

What role does automation play in manufacturing custom paper cups?

Automation, including high-speed forming machines and robotic handling systems, is essential for maintaining high throughput and minimizing labor costs in this volume-driven industry. It also ensures precise dimensional accuracy and secure sealing, which is vital for preventing leaks and maintaining beverage temperature.

Are smaller custom cup service providers gaining market share?

Yes, smaller providers are gaining traction, particularly those specializing in digital printing and offering low MOQ services, allowing them to cater effectively to the growing independent coffee shop and specialized event market segments that larger, volume-focused manufacturers traditionally overlook.

How are advancements in barrier coatings affecting the service market?

Advancements, particularly in water-based coatings, are providing manufacturers with compelling sustainable selling points. These coatings offer a viable path for true paper recyclability, serving as a competitive differentiator and driving new contracts with large corporations committed to verifiable environmental goals.

What are the challenges associated with implementing AI in the custom paper cup supply chain?

Key challenges include the high initial investment in software and sensors, the need to integrate disparate legacy manufacturing systems, and ensuring the quality and volume of data input are sufficient for effective AI-powered demand forecasting and quality control training models.

How does regional climate affect the demand for specific cup features?

Regions with warmer climates (e.g., Southeast Asia, Middle East) exhibit higher demand for custom cold cups and specialized insulation to manage condensation and maintain drink temperature. Conversely, colder regions prioritize thermal insulation features for hot beverage cups.

What is the expected lifespan of PE-lined paper cups in the market?

While PE-lined cups still dominate in terms of volume due to cost-effectiveness, their market share is expected to decline significantly over the forecast period (2026-2033) as environmental regulations and corporate sustainability targets increasingly mandate the shift toward readily compostable or recyclable alternatives.

What factors determine the choice between Flexographic and Digital printing for a client?

The choice hinges primarily on volume and design complexity. Flexographic is preferred for high-volume orders (millions of units) with standard, repetitive designs due to its low running cost. Digital printing is chosen for low-volume, short-run campaigns or designs requiring variable data, personalization, or extremely quick delivery.

Do customers prioritize cost or sustainability when selecting custom cup services?

For large QSR chains, sustainability is increasingly becoming a core compliance factor, but cost efficiency remains vital. For smaller, brand-focused businesses, sustainability is a strong marketing asset, leading to a balance where they seek cost-effective sustainable options like PLA-lined cups where infrastructure permits.

How does the custom paper cup market address issues of plastic lid waste?

The market is increasingly addressing lid waste by offering customized fiber lids (pulp-based, compostable alternatives) as part of the overall service package, or by designing cup rims that accommodate specialized, recyclable plastic lids where fiber alternatives are not yet suitable for high-heat applications.

What is 'up-stream analysis' in the context of the custom cup value chain?

Upstream analysis focuses on the sourcing and processing of core raw materials, specifically securing certified wood pulp (FSC/PEFC) and the initial manufacture of paperboard blanks, assessing factors like sustainable forestry practices and global commodity pricing impacting material availability.

Is customization service viable for cups used in high-volume vending machines?

Yes, customization is viable. Vending machine operators utilize custom cups to enhance the perceived value and quality of the dispensed beverage. Due to the standardized nature of vending cups, manufacturers can run large custom batches efficiently using flexographic printing technology.

How do currency fluctuations affect the international custom cup trade?

Currency fluctuations significantly impact the cost of imported raw materials (pulp) and the competitiveness of exports. Manufacturers often use complex financial hedging strategies to stabilize pricing, but sustained volatility can lead to contract repricing, particularly in regions dependent on international sourcing like parts of Europe and MEA.

What safety standards must custom paper cups comply with?

All custom paper cups must comply with stringent food safety standards, including FDA regulations in the US and the Framework Regulation (EC) No 1935/2004 in the EU, ensuring that inks, adhesives, and barrier coatings do not leach harmful substances into the beverage.

How important is brand authentication on custom cups?

Brand authentication is becoming increasingly important, especially in high-volume markets, to combat counterfeiting. Custom cup services integrate hidden watermarks, unique serial codes, or specialized inks as part of the design, ensuring product legitimacy and protecting brand integrity.

What is driving the demand for custom cups in the institutional segment?

Demand in the institutional segment (universities, hospitals, large corporations) is driven by the need to maintain consistent organizational branding across all internal catering services and the institutional commitment to replace reusable plastics with sanitary, single-use, often compostable, custom options.

How are custom cup manufacturers addressing deforestation concerns?

Manufacturers are addressing deforestation by prioritizing paperboard suppliers that hold certifications from organizations like the Forest Stewardship Council (FSC) or the Programme for the Endorsement of Forest Certification (PEFC), ensuring the material is sourced from sustainably managed forests.

What are the current trends in graphic design for custom paper cups?

Current design trends favor minimalist aesthetics, high-impact colors, and the use of the cup surface for storytelling about the brand's sustainable journey or local sourcing. Furthermore, textural elements achieved through specialized printing techniques are gaining popularity to enhance the premium feel.

How does the market differentiate between hot beverage and cold beverage custom cups?

Hot beverage cups require thicker paperboard and double-wall construction or sleeves for insulation and consumer safety against heat. Cold beverage cups require robust condensation resistance and typically use a moisture-resistant barrier coating suitable for chilled liquids, often utilizing clear, high-quality printing for visual appeal.

What impact does the 'war on straws' have on custom cup design?

The global reduction in plastic straw use has led to innovations in custom cup lids, focusing on 'sippy' or dome lids that eliminate the need for a separate straw. This redesign often requires corresponding modifications to the cup rim dimensions, affecting the overall custom service specification.

How is the packaging industry tackling the issue of cup collection and recycling infrastructure?

Industry initiatives involve collaborative efforts (e.g., the Paper Cup Recycling and Recovery Group) to fund and establish dedicated infrastructure for collecting and processing cups, particularly those with complex linings. Simultaneously, innovation in material science is focused on creating cups that fit into existing, generalized recycling infrastructure.

What is the primary advantage of Offset Printing in custom cup manufacturing?

Offset printing is primarily used for its ability to reproduce high-quality, continuous-tone images with superior color accuracy, especially on pre-cut paperboard blanks before the cup forming process. It is often employed for highly detailed, branded images that require excellent resolution and fidelity.

How do service providers manage small batch custom orders economically?

Small batch orders are managed economically primarily through the use of high-speed digital printing technology, which minimizes setup time and material waste associated with traditional plate-based printing. Consolidating orders from multiple small clients into continuous runs also improves efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager