Custom Software Development Services Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432222 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Custom Software Development Services Market Size

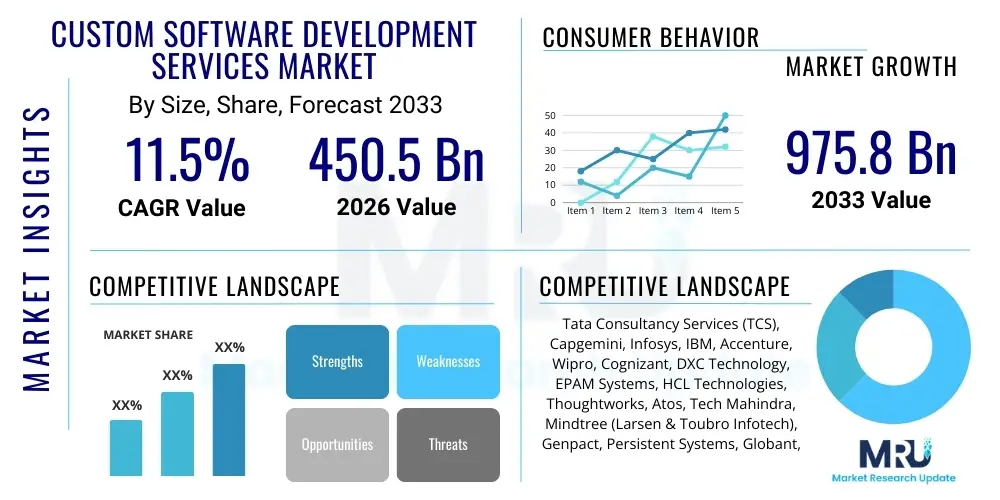

The Custom Software Development Services Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% between 2026 and 2033. The market is estimated at $450.5 Billion USD in 2026 and is projected to reach $975.8 Billion USD by the end of the forecast period in 2033.

Custom Software Development Services Market introduction

The Custom Software Development Services market fundamentally addresses the creation and deployment of highly specialized digital solutions crafted precisely to meet the unique operational and strategic requirements of individual enterprises, fundamentally diverging from the mass-market applicability of commercial off-the-shelf (COTS) software. This bespoke approach ensures maximum alignment between the software architecture and the client’s core business processes, regulatory compliance necessities, and specific competitive landscape challenges. The service scope encompasses the entire software development lifecycle, extending from initial ideation and detailed requirements engineering through iterative design, robust programming, rigorous quality assurance, secure deployment, and long-term application maintenance and feature enhancement. The inherent value proposition of custom development lies in providing superior performance, optimized integration capabilities with legacy or proprietary systems, and the crucial benefit of intellectual property ownership, which fortifies the client's market differentiation and secures long-term competitive superiority.

Key service offerings within this dynamic market spectrum are broad and complex, including, but not limited to, the modernization of mission-critical legacy enterprise systems, the development of sophisticated, secure mobile and web applications designed for large-scale customer engagement, and the engineering of tailored Enterprise Resource Planning (ERP) or Customer Relationship Management (CRM) solutions optimized for sector-specific workflows. Major applications often revolve around enabling core business functions such as supply chain management optimization, advanced data analytics platform construction, and the development of internal tools that automate complex, repetitive processes. The derived benefits are manifold: clients gain a distinct competitive edge by implementing unique features unavailable in standard software; they achieve significantly higher operational efficiency due to precise workflow mapping; and they secure long-term cost savings by avoiding perpetual vendor licensing fees associated with generic platforms. These services are typically contracted under flexible engagement models—such as dedicated teams or project-based fixed scope agreements—allowing clients to manage financial risks and staffing volatility effectively, ensuring project deliverables meet strict time-to-market and budget constraints.

Market growth is being propelled significantly by the unrelenting global imperative for comprehensive digital transformation across all economic sectors. Organizations recognize that achieving superior customer experience and streamlined backend operations requires software that is perfectly integrated and infinitely scalable, attributes often lacking in standardized packages. Crucial driving factors include the rapid technological shifts necessitating seamless integration with new paradigms like the Internet of Things (IoT), sophisticated Artificial Intelligence (AI) models, and decentralized applications powered by Blockchain technology. Furthermore, the increasing complexity of cross-border data privacy regulations, such as GDPR and CCPA, compels enterprises in sensitive sectors like finance and healthcare to invest heavily in custom-built compliance mechanisms embedded directly into their applications. This necessity for architectural agility, technological specificity, and unwavering regulatory adherence cements custom software development as a critical strategic expenditure rather than a mere IT cost, guaranteeing sustained market expansion and robust demand throughout the forecast period and beyond, irrespective of minor economic fluctuations.

Custom Software Development Services Market Executive Summary

The Custom Software Development Services market is experiencing an unprecedented surge in demand, underscored by major business trends emphasizing agility, cloud adoption, and specialization in emerging technologies. Enterprises are increasingly shifting IT budgets towards OpEx-friendly, consumption-based cloud services, which translates directly into higher demand for custom cloud-native development, application re-platforming, and specialized migration services. A dominant trend involves the strategic decoupling of rigid monolithic architectures into flexible, independently deployable microservices, necessitating specialized expertise in containerization technologies like Kubernetes and serverless functions. The competitive landscape is characterized by intense fragmentation, where globally dominant system integrators compete fiercely with highly specialized boutique firms and geographically optimized nearshore providers, focusing on acquiring niche technical certifications and expanding global delivery capabilities to manage complex, multinational projects effectively. Key strategic activities include accelerated investment in talent acquisition across AI and cybersecurity domains, and continuous optimization of remote delivery models to leverage global talent pools efficiently while maintaining stringent project velocity and security integrity standards.

Regional dynamics exhibit significant divergence in maturity and growth rates. North America maintains its position as the undisputed epicenter of innovation and market size, benefiting from pioneering adoption of cutting-edge technologies, particularly in FinTech, biotech, and high-tech manufacturing, supported by massive venture capital inflows into digitally transformative projects. The North American market is typically focused on high-value, complexity-driven contracts. Conversely, the Asia Pacific (APAC) region is demonstrating the most explosive Compound Annual Growth Rate (CAGR). This acceleration is driven by widespread digital penetration in populous markets, robust government backing for smart infrastructure development, and the maturation of key outsourcing hubs in India, Vietnam, and the Philippines, which offer scalable, high-quality development resources at highly competitive cost structures. Europe maintains steady, resilient growth, primarily concentrated around mandatory regulatory compliance projects, critical data platform modernization, and highly localized language requirements crucial for banking, public sector, and automotive applications across its diverse national jurisdictions, requiring a nuanced understanding of local legal frameworks.

Analysis of market segmentation highlights a profound strategic move toward Application Modernization as the leading and most critical service type, necessitated by the obsolescence of decades-old legacy systems that hinder current digital transformation efforts and pose significant security risks. From an end-user perspective, the Banking, Financial Services, and Insurance (BFSI) sector continues its role as the dominant consumer, driven by continuous demands for ultra-low latency trading systems, complex integrated risk management platforms, and robust consumer authentication mechanisms compliant with international standards. Furthermore, the deployment segment underscores the clear industry preference for Cloud-Based (SaaS and PaaS) custom solutions over traditional on-premise deployments. This preference is strongly driven by the intrinsic benefits of cloud architecture—enhanced fault tolerance, global accessibility, and the ability to scale computational resources instantaneously—which are non-negotiable requirements for modern, data-intensive custom applications built for high availability and global market reach. The transition also minimizes client dependency on maintaining substantial in-house hardware infrastructure.

AI Impact Analysis on Custom Software Development Services Market

User inquiries concerning the influence of Artificial Intelligence (AI) predominantly center on understanding the future role of the human developer in an environment increasingly populated by Generative AI (GenAI) code assistants and automated testing frameworks. Primary themes include deep anxieties regarding whether GenAI tools can handle the non-standardized complexity inherent in highly customized enterprise logic, particularly concerning navigating complex regulatory environments and achieving flawless integration with unique, often poorly documented, legacy systems. Users frequently ask about the strategic skills necessary for developers to transition from traditional manual coding to effective prompt engineering, specialized model tuning, and sophisticated AI model governance, demanding clarity on the required future competencies. Key expectations include drastically reduced time spent on boilerplate coding tasks, higher intrinsic software quality outputs due to automated error detection, and the emergence of new, lucrative service lines focused explicitly on customizing and integrating proprietary AI models for achieving competitive advantage, fundamentally reshaping the cost structure and expertise requirements of development firms globally.

The strategic deployment of AI tools necessitates a complete re-evaluation of current security, compliance, and intellectual property methodologies. As code components are increasingly generated or augmented by Large Language Models (LLMs), development firms must establish robust validation checkpoints to ensure that no proprietary client data is inadvertently used to train public models, and critically, that the generated code adheres strictly to established corporate security standards and underlying open-source licensing requirements, mitigating legal risks. The most sophisticated service providers are strategically leveraging AI not just for internal efficiency gains, but as a core, value-added component of the resulting custom application, designing solutions that feature advanced predictive analytics, natural language interfaces optimized for specific domain knowledge, and dynamic, self-optimizing data structures—services that command premium pricing and require an elevated level of technical consulting expertise beyond conventional software engineering skill sets, shifting the value focus to complex systems orchestration.

- Accelerated development cycles through AI-assisted code generation and intelligent auto-completion tools, leading to significant productivity gains, particularly for routine and repetitive mid-level coding tasks.

- Enhanced quality assurance and testing accuracy via AI-powered defect prediction, automated test case generation, and continuous predictive maintenance analysis of deployed complex codebases.

- Fundamental shift in developer roles toward high-level solution architecture design, effective prompt engineering for GenAI, and sophisticated data governance related to managing and securing AI model inputs and resulting outputs.

- Improved project management efficiency through AI-driven resource allocation optimization, real-time risk prediction, dynamic scheduling adjustments, and automated generation of technical and client-facing documentation tailored precisely to project specifications.

- Increased demand for specialized custom AI model integration services, embedding proprietary machine learning capabilities directly into client-specific business applications like personalized recommendation engines, advanced forecasting tools, or highly specialized security monitoring systems.

- Lowering technical barriers to entry for rapid prototyping and Minimum Viable Product (MVP) creation, enabling faster validation of new product concepts and allowing non-technical stakeholders to influence early-stage digital product definition.

- Significant challenges in defining and protecting intellectual property rights, ensuring clear code traceability, and maintaining ethical governance over source code components partially or wholly generated by large language models (LLMs) with uncertain training data origins.

- Mandate for new security protocols, rigorous DevSecOps integration, and comprehensive auditing frameworks to protect sensitive AI training data and ensure the long-term security, compliance, and functional integrity of embedded AI components within mission-critical custom applications.

DRO & Impact Forces Of Custom Software Development Services Market

The trajectory of the Custom Software Development Services market is primarily driven by the accelerating demand for digital differentiation, fueled by the intrinsic limitations of standardized COTS platforms which frequently lack the necessary flexibility, scalability, or integration depth required for highly complex enterprise operations. A primary driver is the widespread necessity for comprehensive application modernization, as organizations globally recognize that their decades-old legacy systems are becoming severe liabilities, incurring prohibitive maintenance costs, creating insurmountable security vulnerabilities, and hindering competitive agility. The exponential increase in organizational data volumes and the subsequent need for specialized, highly performant data processing platforms also acts as a powerful catalyst, compelling significant investment in custom-built analytics and big data infrastructure optimized for unique data sources and highly complex processing logic, ensuring market relevance and operational superiority in data-intensive sectors such as finance and telecoms.

Conversely, significant structural restraints currently impede market velocity and growth potential, most notably the persistent and globally worsening deficit of highly specialized technical talent, particularly in niche, high-demand areas such as advanced quantum computing algorithms, robust cloud-native cybersecurity engineering, and high-performance, real-time cloud architecture design. This acute skills gap drives up premium labor costs, creates salary inflation, and extends project timelines for the most complex, mission-critical projects, thereby restricting the potential delivery capacity of specialized service providers. Additionally, the initial capital outlay required for bespoke software development is substantially higher than acquiring off-the-shelf licenses, creating a significant barrier to entry for smaller enterprises or those with conservative, risk-averse technology budgets, often necessitating rigorous, multi-faceted justification of the strategic long-term return on investment (ROI) derived from custom IP ownership.

Opportunities for strategic expansion are substantially positioned around several emerging technology frontiers. The exponential growth of the Industrial Internet of Things (IIoT) across manufacturing and logistics demands specialized software for managing, processing, and analyzing vast streams of edge data, creating massive demand for custom IoT platform development tailored specifically to industry-specific requirements, such such as smart factory automation, predictive maintenance scheduling, and real-time asset tracking. Furthermore, the evolving regulatory landscape, particularly intensifying global data governance and privacy mandates, presents a continuous, lucrative opportunity for highly specialized firms offering custom compliance software, automated auditability frameworks, and data localization solutions. The overarching impact forces include the disruptive technological leap driven by Generative AI, which simultaneously threatens manual development roles while creating new high-value opportunities in AI customization consulting, and continuous geopolitical instability, which necessitates increased focus on localized data centers and resilient, geographically distributed development and service delivery models to mitigate operational risks and ensure business continuity across multinational client operations.

Segmentation Analysis

The granular analysis of the Custom Software Development Services market segmentation is critical for understanding specific market drivers, identifying high-growth niches, and enabling effective competitive differentiation among service providers. Segmentation is highly multifaceted, covering technical stacks, functional application areas, preferred deployment strategy, and the size and sector of the client base. The segmentation by Service Type precisely reflects the diverse technological requirements of clients, ranging from fundamental Mobile Application Development, which caters to increasing customer mobility and seamless digital interaction, to complex System Integration and Consulting, focusing on achieving flawless interoperability between highly disparate enterprise systems. Technology segmentation highlights the prevailing market shift towards advanced methodologies such as Cloud-Native Development, emphasizing proficiency in serverless architecture and sophisticated container orchestration, and specialized domains like Blockchain Development, which addresses unique requirements for transparency and immutable security in complex logistics and financial ledger processes. Understanding these detailed segments allows providers to optimize their service portfolios, strategically allocate capital investments, and tailor their workforce skills effectively for future market demands.

Segmentation by Deployment Model reveals a definitive industry-wide transition away from traditional On-Premise installations, which are resource-intensive and lack modern agility, toward highly flexible Cloud-Based and sophisticated Hybrid models. The Cloud-Based segment, encompassing bespoke SaaS and PaaS offerings built on platforms like AWS, Azure, and Google Cloud, dominates growth projections, providing clients with superior elasticity, continuous, automatic updates, and global accessibility which are essential for modern distributed operations. The end-user industry segmentation is paramount, demonstrating that sectors with high data sensitivity, complex legacy infrastructure, and stringent regulatory demands—specifically BFSI, Healthcare, and Government—are the predominant drivers of high-value, complex custom projects, demanding specialized vertical knowledge from their service providers to ensure robust security architecture, industry-specific compliance, and superior domain expertise in system design.

Finally, segmentation by Organization Size—Small and Medium Enterprises (SMEs) versus Large Enterprises—demonstrates radically differing needs in terms of project scale, required technical depth, and preferred financial pricing structures. Large Enterprises typically require massive scale application modernization projects, complex systems integration across diverse global operations, and often engage in multi-year strategic contracts involving significant teams. Conversely, SMEs, while significantly more budget-conscious, are rapidly adopting custom solutions to gain critical operational efficiencies and competitive differentiation, often utilizing faster, Low-Code enabled deployment methods or leveraging nearshore providers for critical cost optimization. Recognizing these distinct client profiles and tailoring engagement models accordingly is absolutely essential for effective market positioning and scalable solution delivery across the entire economic spectrum of customers.

- By Service Type:

- Web Application Development, including complex portal solutions, e-commerce platform customization, and high-traffic customer interaction portals.

- Mobile Application Development (iOS, Android, Cross-Platform), focusing on user experience optimization, enterprise mobility solutions, and secure data handling on mobile devices.

- Legacy System Modernization and Re-platforming, converting outdated, high-risk architectures to modern, scalable cloud environments with minimal downtime.

- Custom ERP/CRM Development, tailored specifically to specialized industry workflows, unique business processes, and specific regulatory compliance needs.

- System Integration and API Development, ensuring seamless, real-time data flow and interoperability between internal, external, and cloud-based enterprise applications.

- Data Warehousing, Business Intelligence, and Advanced Analytics Platform Development optimized for proprietary data ingestion and complex report generation.

- By Technology:

- Cloud-Native Development (AWS, Azure, Google Cloud, and sophisticated multi-cloud strategies using Kubernetes and serverless functions).

- Low-Code/No-Code Platform Customization and Integration (e.g., extensions and integration with leading platforms like Salesforce and ServiceNow).

- Artificial Intelligence/Machine Learning (AI/ML) Integration, covering predictive modeling, cognitive services, and deep learning solutions specialized for business intelligence.

- Blockchain and Distributed Ledger Technology (DLT) Development for supply chain traceability, secure financial settlements, and verifiable digital identity applications.

- Internet of Things (IoT) Software Development, encompassing device management, data ingestion pipelines, and specialized Edge Computing solutions.

- By Deployment Model:

- On-Premise (decreasing market share, generally reserved for specific high-security mandates or defense applications).

- Cloud-Based (SaaS, PaaS, IaaS) including public, highly secured private, and specialized government cloud deployments.

- Hybrid Cloud and Multi-Cloud Environments requiring complex integration and workload management across different platforms.

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI), demanding ultra-high security, low-latency trading systems, and rigorous compliance platforms.

- Healthcare and Life Sciences, focused on HIPAA compliance, Electronic Health Records (EHR) systems customization, and complex clinical trial management software.

- Telecommunications and IT, requiring complex network management, custom billing systems, and operational support systems (OSS/BSS) development.

- Retail and E-commerce, emphasizing personalized customer experience platforms, robust inventory management, and omnichannel integration.

- Government and Public Sector, needing secure citizen service portals, large-scale data management solutions, and proprietary defense software.

- Manufacturing and Automotive, focusing on Industrial IoT (IIoT) platforms, supply chain transparency, and automated factory management software optimized for efficiency.

- By Organization Size:

- Small and Medium Enterprises (SMEs), prioritizing cost-effective agility, rapid time-to-market, and modular scaling capabilities.

- Large Enterprises, focused on strategic, long-term application transformation, massive scale integration, and achieving global deployment uniformity and standardization.

Value Chain Analysis For Custom Software Development Services Market

The Custom Software Development Services value chain initiates with critical upstream activities centered on rigorous resource mobilization and the strategic accumulation of technical assets, which are foundational determinants of project success, service quality, and competitive differentiation. Upstream elements include the rigorous acquisition, specialized training, and continuous development of human capital—highly skilled software architects, senior cybersecurity professionals, and highly certified cloud engineers—who possess the niche expertise demanded by modern enterprise projects. Establishing strategic vendor relationships with major cloud providers (AWS, Microsoft Azure, Google Cloud) and specialized technology platform vendors (e.g., Salesforce, SAP) are also crucial upstream components, ensuring privileged access to cutting-edge tools, early beta programs, and advanced integration libraries. Furthermore, significant investment in scalable internal infrastructure, including secure, standardized DevOps toolchains and proprietary, AI-enhanced project management methodologies, establishes the robust operational capability required for high-velocity global delivery across distributed teams.

The core midstream segment involves the meticulous execution of the development lifecycle, where the highest value-creation activities such as detailed solution design, sophisticated code engineering, and continuous integration and continuous deployment (CI/CD) pipelines occur. This phase is characterized by intense, transparent collaboration, predominantly driven by Agile principles and significantly enhanced by automated tools for code quality scanning, performance monitoring, and compliance checking (DevSecOps). The transformation process here converts client requirements, technical specifications, and accumulated intellectual expertise into functional, rigorously tested, and secure custom software. High efficiency and integrity in the midstream process are paramount, minimizing technical debt accumulation and ensuring that all deliverables align precisely with stringent client expectations regarding functionality, performance metrics, user experience, and seamless integration with existing business intelligence and data warehousing systems.

Downstream activities focus strategically on maximizing the lifetime value and ongoing utility of the custom software solution through sustained client engagement, which is crucial for maximizing long-term profitability and ensuring high client retention rates. This includes comprehensive post-deployment services such as proactive maintenance, immediate 24/7 technical support, continuous security patching against zero-day threats, and strategic application modernization roadmap consulting aimed at extending the software's lifespan and feature set. Distribution channels are overwhelmingly direct, relying on dedicated, highly knowledgeable account management teams and transparent client communication mechanisms to foster deep trust and ensure ongoing project success and evolution. While the service delivery is intrinsically direct, indirect influence occurs through partnerships with venture capitalists recommending specialized development partners to their portfolio companies, or collaborations with large strategic consulting firms that require niche programming expertise to fulfill broad, complex digital transformation contracts, thereby extending the specialized provider's market reach into vast enterprise projects. Effective downstream management transforms a one-time project into a durable, strategic partnership and a reliable source of recurring, high-margin maintenance revenue.

Custom Software Development Services Market Potential Customers

The spectrum of potential customers for Custom Software Development Services is exceptionally broad, but demand concentration is highest among large organizations navigating highly complex operational environments, requiring proprietary technological advantages for competitive gain, or mandated by intense regulatory scrutiny. Large Enterprises in the Banking, Financial Services, and Insurance (BFSI) sector are consistently the primary buyers, needing highly specialized, ultra-low latency, and fault-tolerant software for high-frequency trading, complex actuarial modeling, real-time risk assessment, and secure customer data handling (KYC/AML compliance) that generic platforms simply cannot provide. Similarly, the Healthcare and Life Sciences vertical requires bespoke software for specialized clinical data management, seamless electronic health record (EHR) integration across multiple providers, and sophisticated research platforms that comply strictly with global privacy standards like HIPAA and GDPR, making standardized solutions impractical for their core, sensitive data management needs.

Beyond these highly regulated sectors, the Manufacturing and Automotive industries represent a burgeoning and critically important customer base, specifically seeking custom software for complex Industrial IoT (IIoT) applications, extensive factory floor automation systems, advanced predictive maintenance platforms, and end-to-end supply chain visibility and optimization tools. These custom solutions enable manufacturers to effectively leverage vast amounts of sensor and operational data to significantly increase throughput efficiency, minimize machine downtime, and optimize inventory levels, creating a clear, measurable operational advantage over competitors using older systems. Furthermore, technology companies themselves often engage custom development firms to strategically accelerate product launches, fill specific capability gaps, or acquire niche expertise they lack internally, especially in specialized areas like embedded systems development or advanced cryptography engineering, viewing external service providers as crucial, strategic capability extenders.

Small and Medium Enterprises (SMEs) are increasingly entering the custom software market, driven by the democratization of technology through cloud platforms and the increasing affordability of specialized development services, particularly from cost-effective nearshore and offshore providers. SMEs typically seek bespoke custom solutions for critical business process automation (e.g., tailored e-commerce platforms, field service management systems, personalized customer portals) that grant them operational agility traditionally reserved for larger, resource-rich competitors. While their individual project budgets are generally smaller, their aggregate demand volume is significant and rapidly growing, often fulfilled through rapid deployment strategies utilizing modular architecture, reusable components, or customized Low-Code platforms, demonstrating the market's adaptability to varying budgetary and scaling requirements across organizational sizes and strategic priorities.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450.5 Billion USD |

| Market Forecast in 2033 | $975.8 Billion USD |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tata Consultancy Services (TCS), Capgemini, Infosys, IBM, Accenture, Wipro, Cognizant, DXC Technology, EPAM Systems, HCL Technologies, Thoughtworks, Atos, Tech Mahindra, Mindtree (Larsen & Toubro Infotech), Genpact, Persistent Systems, Globant, iTechArt Group, ScienceSoft, Mphasis. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Custom Software Development Services Market Key Technology Landscape

The contemporary technological environment defining the Custom Software Development Services market is dominated by an architectural focus on maximum resilience, infinite scalability, and integrated security, driven overwhelmingly by the principles of cloud-native development. This mandates the widespread adoption of microservices architecture, strategically replacing monolithic systems, which necessitates deep expertise in containerization technologies such as Docker and high-performance orchestration tools like Kubernetes, often managed via hyperscalers (AWS EKS, Azure AKS, Google GKE). The underlying infrastructure increasingly relies on serverless computing paradigms (e.g., AWS Lambda, Azure Functions) to minimize operational overhead, abstract away infrastructure management, and maximize cost efficiency by dynamically provisioning resources only when execution is strictly required. Furthermore, the commitment to Continuous Integration/Continuous Delivery (CI/CD) pipelines, underpinned by robust automated testing and infrastructure-as-code (IaC) tools (Terraform, Ansible), is now standard practice, guaranteeing faster, more reliable, and auditable deployment cycles with minimal human error during high-frequency releases.

In addition to these foundational architectural shifts, the seamless integration of advanced computational capabilities—particularly Artificial Intelligence, Machine Learning, and specialized Big Data technologies—is rapidly becoming a standard expectation for all high-value custom solutions. Developers are now routinely incorporating proprietary AI models for specialized tasks such as advanced behavioral analysis, hyper-accurate predictive maintenance scheduling in industrial settings, and sophisticated, real-time fraud detection in financial applications. This requires proficiency not just in general programming but also in specialized data science frameworks like TensorFlow, PyTorch, and the construction of scalable MLOps pipelines that effectively manage the entire lifecycle of the data models deployed within the custom application, from training to inference. Furthermore, the massive proliferation of data generation at the network edge is driving significant demand for custom Edge Computing solutions, optimized for low-latency processing, local decision-making, and secure aggregation in distributed IoT environments before crucial data is transmitted to the central cloud infrastructure.

Integrated security and rigorous data governance technologies also form a critical and non-negotiable part of the modern technology landscape. The mandated implementation of DevSecOps—integrating security practices directly and continuously into every stage of the development pipeline—is now non-negotiable, employing sophisticated tools for automated static and dynamic application security testing (SAST/DAST) and comprehensive vulnerability scanning throughout the code lifecycle. There is a growing, strategic emphasis on Zero Trust Architecture (ZTA) principles, rigorously ensuring that no user, application, or system, inside or outside the network perimeter, is inherently trusted without continuous verification. Finally, the strategic use of Low-Code/No-Code (LCNC) platforms is expanding, though primarily confined to accelerating front-end development, automating non-core internal workflows, or creating rapid prototypes, thereby effectively freeing up specialized senior developers to focus exclusively on highly complex, proprietary backend logic, critical systems integration, and advanced algorithm development, reinforcing the paramount value of specialized custom coding expertise in the most complex aspects of digital solution creation.

Regional Highlights

- North America: The uncontested leader in terms of market value, technological adoption, and expenditure on advanced services, driving global trends in AI integration, Cloud-Native development, and high-stakes cybersecurity engineering. The United States accounts for the majority of regional spending, fueled by aggressive digitalization across the technology, defense, and capital markets sectors. Projects here command premium pricing due to the high demand for specialized, niche expertise, complex regulatory compliance with stringent state and federal standards, and the necessity for building robust, scalable infrastructure for global deployments.

- Europe: A large and mature market segment characterized by regional fragmentation and an intense focus on data sovereignty, data localization, and strict adherence to privacy regulations. Western Europe, particularly the DACH region (Germany, Austria, Switzerland) and the UK, invests heavily in complex manufacturing automation, automotive electronics, and financial services modernization, requiring custom solutions that adhere strictly to pan-European regulations such as GDPR and PSD2. Nearshore development models leveraging talent from Central and Eastern European nations are highly favored for cost optimization, talent quality, and geographical proximity/cultural alignment.

- Asia Pacific (APAC): Positioned as the fastest-growing market globally, propelled by rapidly increasing internet penetration, massive government investment in scalable digital public infrastructure (e.g., India's digital stack), and rapid industrial automation in high-growth economies like China, South Korea, and Southeast Asia. APAC is dual-faceted: it is crucial both as a rapidly growing consumer market demanding mobile-first, highly scalable custom applications and as the world's leading offshore development hub, offering highly scalable, professional, and cost-competitive service delivery capabilities across multiple convenient time zones for global clients.

- Latin America (LATAM): Showing accelerated growth, driven by multinational companies standardizing operations and local businesses aggressively seeking digital competitiveness across sectors like banking and retail. Brazil, Mexico, and Chile are leading the adoption curve, with strong regional demand for custom solutions in banking modernization, complex e-commerce optimization, and leveraging the region’s growing fintech ecosystem. LATAM is strategically emerging as a critical nearshore alternative for North American enterprises due to favorable time-zone overlap, cultural affinity, and rising technical expertise.

- Middle East and Africa (MEA): Growth is highly concentrated and driven by substantial investment in the wealthy Gulf Cooperation Council (GCC) nations (UAE, Saudi Arabia, Qatar), supported by massive, state-sponsored vision projects aimed at economic diversification (e.g., NEOM, Saudi Vision 2030). These ambitious, large-scale projects require substantial investment in custom smart city platforms, integrated digital public services, and massive-scale infrastructure management software, necessitating highly complex, bespoke systems integration capabilities and specialized security protocols from global service providers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Custom Software Development Services Market.- Tata Consultancy Services (TCS)

- Capgemini

- Infosys

- IBM

- Accenture

- Wipro

- Cognizant

- DXC Technology

- EPAM Systems

- HCL Technologies

- Thoughtworks

- Atos

- Tech Mahindra

- Mindtree (Larsen & Toubro Infotech)

- Genpact

- Persistent Systems

- Globant

- iTechArt Group

- ScienceSoft

- Mphasis

Frequently Asked Questions

Analyze common user questions about the Custom Software Development Services market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between custom software and COTS solutions?

Custom software is built specifically to address unique operational requirements, offering full ownership of intellectual property and superior integration with existing proprietary systems, whereas COTS (Commercial Off-The-Shelf) software is generic, designed for mass markets, and typically involves ongoing licensing costs without IP ownership.

How is the adoption of Cloud-Native development affecting the market?

Cloud-Native development is a major market driver, shifting custom projects toward flexible microservices, containers (Kubernetes), and serverless architectures. This approach ensures maximum scalability, faster deployment cycles via CI/CD, and improved cost efficiency by optimizing resource consumption on public cloud platforms.

Which industry vertical is the largest consumer of Custom Software Development Services globally?

The Banking, Financial Services, and Insurance (BFSI) sector remains the largest consumer, driven by continuous demands for ultra-low latency trading platforms, complex real-time risk management systems, strict regulatory compliance (KYC/AML), and advanced cybersecurity protocols for protecting massive volumes of sensitive financial data.

What role does Artificial Intelligence (AI) play in custom development today?

AI plays a critical dual role: internally, it accelerates the development process through generative code assistants and automated testing frameworks; externally, it drives demand for specialized services focused on integrating and tuning custom machine learning models into proprietary business applications to achieve predictive intelligence and automation.

What are the typical project engagement models used by custom development firms?

The prevalent models are Fixed Price (ideal for projects with clear, unchanging scopes), Time and Material (suited for evolving, research-heavy projects requiring flexibility), and the Dedicated Team model (providing the client with a specialized, external workforce unit managed under long-term strategic contracts).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager