Custom Video Wall Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436640 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Custom Video Wall Market Size

The Custom Video Wall Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033. This robust expansion is primarily fueled by the accelerating digital transformation initiatives across corporate, retail, and public sectors, demanding large-scale, high-resolution display solutions tailored to specific architectural and functional requirements. The shift from standardized display solutions to fully integrated, bespoke visual platforms necessitates specialized design, integration, and content management, thereby bolstering the value proposition of custom video walls.

Custom Video Wall Market introduction

The Custom Video Wall Market encompasses the design, installation, and integration of non-standardized display systems composed of multiple interlinked screens that form a single, cohesive visual canvas. These systems are distinctly characterized by their modularity, high pixel density, advanced processing capabilities, and the need for site-specific engineering to ensure seamless visual performance across bezel lines or LED gaps. Unlike off-the-shelf displays, custom video walls require sophisticated content management systems (CMS) and complex video processors to manage heterogeneous inputs and maintain synchronization, making the integration process highly specialized and value-added.

Key product types within this market include fine-pitch LED video walls, ultra-narrow bezel LCD walls, and rear-projection DLP cubes, often deployed in mission-critical environments or high-impact public spaces. Major applications span Command and Control Centers (C2), where flawless real-time data visualization is paramount; architectural display features in corporate headquarters designed for brand messaging and immersive experiences; and large-scale digital out-of-home (DOOH) advertising requiring dynamic content delivery. The primary benefit derived from custom solutions is the ability to achieve precise scaling, irregular shapes, and unique resolutions that perfectly match the spatial constraints and viewing distances of the installation environment, ensuring maximum visual impact and functional utility.

The driving factors behind market expansion are multifaceted, including the decreasing cost of high-resolution display modules, particularly fine-pitch LED technology which offers superior brightness and near-zero bezel configurations. Furthermore, the pervasive trend toward digitalization across retail, transportation, and hospitality sectors is pushing demand for dynamic visual communication tools that can engage audiences effectively. The increasing sophistication of content, demanding 4K and 8K processing capabilities, necessitates powerful video wall controllers capable of handling massive bandwidth and multiple simultaneous sources, driving the need for custom hardware and software integration solutions.

Custom Video Wall Market Executive Summary

The Custom Video Wall Market is experiencing dynamic growth driven by the convergence of technological advancements, particularly in LED display manufacturing, and evolving end-user requirements for immersive and functional visualization tools. Business trends indicate a pronounced shift toward microLED and Chip-on-Board (COB) technologies, which significantly improve durability, visual uniformity, and pixel pitch reduction, making these technologies viable for even smaller, tighter spaces previously dominated by LCD. Furthermore, the market structure is becoming increasingly complex, with specialized integrators playing a crucial role in providing bespoke software calibration and maintenance services, moving beyond mere hardware installation to offering complete managed display solutions.

Segment trends reveal that the LED display segment is dominating market revenue due to its superior brightness, scalability, and ability to create truly seamless visual canvases, displacing traditional LCD and DLP solutions in large-format, high-visibility applications. Geographically, Asia Pacific (APAC) maintains its position as the fastest-growing region, propelled by massive infrastructure projects, smart city initiatives, and high investment in corporate and retail modernization, especially in China, South Korea, and Japan. North America and Europe, while mature, demonstrate stable demand fueled by continuous upgrades of existing control room infrastructure and high adoption rates in experiential marketing and broadcast environments.

The core strategic challenge for market participants revolves around maintaining technological superiority amidst rapid innovation while managing complex global supply chains, especially those reliant on specific semiconductor components and display drivers. Successful market penetration strategies increasingly focus on vertical specialization, where vendors develop deep expertise in specific application areas, such as designing video walls optimized for critical infrastructure monitoring (utilities, transportation) or delivering high-fidelity visual displays for luxury retail environments. The integration of advanced content management systems capable of real-time data visualization and AI-driven content scheduling is now a prerequisite for competitiveness in this high-value market segment.

AI Impact Analysis on Custom Video Wall Market

Users frequently ask how Artificial Intelligence (AI) will automate content creation for complex, custom aspect ratios, whether AI can optimize the operational uptime of mission-critical video walls, and if deep learning models can enhance real-time data interpretation displayed on these large canvases. Analysis reveals that the key themes center on efficiency, predictive reliability, and intelligent visualization. Concerns revolve around ensuring data security when using cloud-based AI processing for content delivery and integrating disparate legacy systems with new, AI-enabled control platforms. Users expect AI to move beyond simple automation to provide proactive system diagnostics and contextual content relevant to the moment-to-moment operational requirements of a control room or public display.

AI is fundamentally transforming the custom video wall ecosystem by enhancing control, optimization, and content relevance. In control room environments, AI algorithms are utilized for intelligent visualization, prioritizing and highlighting critical data feeds based on pre-defined operational thresholds or learned threat patterns, reducing cognitive load on operators viewing hundreds of simultaneous inputs. This shift ensures the video wall functions not just as a passive display, but as an active, intelligent decision-support tool. Furthermore, AI enables automated calibration and self-correction mechanisms, ensuring color uniformity and brightness consistency across the entire wall assembly over its lifespan, minimizing manual maintenance interruptions and maximizing uptime, which is crucial for 24/7 operations.

For digital signage and architectural displays, Generative AI (GenAI) is beginning to play a vital role in dynamic content generation, automatically adapting content layouts, resolution, and aesthetic elements to fit unusual custom display shapes and real-time audience metrics captured by sensors. AI-powered CMS platforms can predict optimal scheduling times and content sequencing based on foot traffic patterns and demographic analysis, maximizing the advertising or communication return on investment. This intelligent optimization of content delivery, combined with predictive maintenance alerts generated by analyzing display component telemetry data, solidifies AI's role as a core innovation driver in the custom video wall market.

- AI-Driven Predictive Maintenance: Utilizes sensor data to anticipate display component failure (e.g., power supplies, LED modules) and schedule proactive repairs, ensuring near 100% operational uptime.

- Intelligent Content Scaling and Adaptation: AI algorithms automatically reformat and optimize visual content for non-standard resolutions and asymmetric video wall layouts.

- Real-Time Data Prioritization: AI integrated into control room video processors highlights critical incoming data feeds or anomalies, facilitating rapid situational awareness and decision-making.

- Automated Calibration and Uniformity Correction: Machine learning models continuously analyze and adjust color and brightness parameters across multiple display units to maintain visual seamlessness.

- Audience Analytics and Content Optimization: AI analyzes viewer behavior (via sensors/cameras) to dynamically alter content display frequency and messaging effectiveness, particularly in retail and DOOH environments.

DRO & Impact Forces Of Custom Video Wall Market

The Custom Video Wall Market is significantly influenced by a powerful combination of drivers, restraints, and opportunities that shape investment decisions and technological roadmaps. Key drivers include the overwhelming need for high-impact visual communication in corporate branding and the increasing deployment of centralized monitoring systems (CCTV, SCADA, BMS) that necessitate large, unified display surfaces for comprehensive oversight. Restraints primarily center on the substantial capital expenditure required for high-end custom installations, particularly those utilizing fine-pitch LED technology, coupled with the inherent technical complexity involved in integrating these systems with legacy IT and AV infrastructure. Opportunities lie in the rapidly developing MicroLED technology, offering unprecedented display quality and robustness, and the expansion of the rental and staging segment, which leverages custom video walls for temporary, high-profile events, offering a lower barrier to entry for users. These forces collectively dictate the market dynamics, favoring solution providers capable of delivering highly specialized integration and long-term support services.

Drivers: The accelerating adoption of digital signage across vertical industries, particularly retail and hospitality, compels businesses to invest in unique, custom display formats to differentiate themselves and capture consumer attention in highly competitive markets. Simultaneously, global spending on critical infrastructure upgrades, including traffic management centers, utility control rooms, and cybersecurity operations centers, mandates reliable, high-resolution custom video walls for continuous operational monitoring. Furthermore, advancements in 4K and 8K video processing capabilities have made multi-input, high-density visualization practically achievable and affordable, eliminating previous technical barriers to adoption.

Restraints: Despite declining hardware costs, the total cost of ownership (TCO) remains high due to the specialized nature of installation, commissioning, and required high-level technical support, often necessitating highly skilled labor. Another significant restraint is the technical challenge of managing complex video wall content across diverse operating platforms and inputs, often requiring proprietary controllers and complex software licenses. Additionally, power consumption and thermal management requirements for large-scale LED walls can present significant logistical and operational constraints for installations in existing commercial buildings not originally designed for such high-density display infrastructure.

Opportunities: The advent of modular MicroLED technology presents a substantial long-term growth opportunity, promising superior contrast ratios, greater energy efficiency, and extended lifespan compared to traditional LED or LCD. The emerging demand for customized virtual production sets (VPC) in the film and broadcast industry, utilizing high-resolution LED walls as dynamic backdrops, represents a niche but highly profitable market segment for specialized integrators. Moreover, the integration of cloud-based Content Management Systems (CMS) offers opportunities for recurring revenue streams and simplifies the management of geographically dispersed custom video wall networks, enhancing scalability and reducing local infrastructure requirements.

Segmentation Analysis

The Custom Video Wall Market is segmented based on Display Type, Application, and End-Use Industry, reflecting the varied technological requirements and functional demands across different sectors. This segmentation highlights the market's dependency on display technology, where Fine-Pitch LED solutions are increasingly dominating due to their seamless performance and superior optical characteristics, especially in installations requiring close viewing distances. The application segmentation differentiates between mission-critical uses, such as control rooms demanding extreme reliability and low latency, and aesthetic uses, such as digital signage focused on high visual impact and flexible content delivery. Understanding these segments is crucial for manufacturers and integrators to tailor their offerings, whether focusing on high-robustness hardware for public infrastructure or high-fidelity visual fidelity for corporate and entertainment clients.

Segmentation by Display Type remains critical, defining the visual quality and physical structure of the wall. LED solutions, subdivided into Chip-on-Board (COB) and Surface-Mounted Device (SMD), are preferred for large, seamless configurations, while LCD walls, despite their narrow bezels, still serve cost-sensitive applications where extreme resolution is not the primary requirement. Application segmentation reveals the highest growth in the retail and advertising sectors driven by the need for captivating brand engagement, while the control room segment maintains steady, albeit slower, growth driven by necessary replacement cycles and infrastructure modernization mandates. End-Use Industry segmentation highlights robust spending by the Government, Defense, and Utilities sectors, prioritizing functionality, redundancy, and long-term support contracts over initial capital costs.

- By Display Type:

- LED (Fine-Pitch, Standard Pitch, MicroLED)

- LCD (Ultra-Narrow Bezel)

- DLP (Rear-Projection Cubes)

- By Application:

- Command and Control Centers (C2)

- Digital Signage and Advertising (DOOH)

- Corporate and Lobby Displays

- Broadcast and Entertainment (Virtual Production)

- Security and Surveillance

- By End-Use Industry:

- Government and Defense

- Transportation and Logistics

- Utilities and Energy

- Corporate and Enterprise

- Retail and Hospitality

- Media and Entertainment

Value Chain Analysis For Custom Video Wall Market

The value chain for the Custom Video Wall Market is complex and involves multiple highly specialized stages, beginning with upstream sourcing of specialized components and culminating in bespoke system integration and long-term support. The upstream analysis focuses on raw material and component suppliers, including manufacturers of high-performance LED chips (e.g., specific binning for color uniformity), display driver integrated circuits (ICs), and high-bandwidth video processing chipsets (e.g., FPGA and specialized GPUs). Sourcing is highly centralized, often reliant on a few key Asian semiconductor and panel manufacturers. Quality control and supply chain stability are paramount at this stage, as minor variations in component quality can drastically affect the visual performance of the assembled wall, particularly concerning color consistency and brightness across modules.

Midstream activities involve the fabrication and assembly of the modular display units and the manufacturing of proprietary video wall controllers and content management platforms. This stage includes complex engineering and testing to ensure seamless physical alignment and electronic synchronization between numerous panels. Downstream activities are dominated by specialized System Integrators (SIs) and AV consultants, who provide the critical value-add services: site assessment, structural engineering, custom display configuration (including non-standard aspect ratios), software integration with client systems, and final on-site calibration. Unlike standard IT hardware, custom video walls require meticulous installation and highly specialized post-sale calibration to mask bezels or gaps and ensure optimal viewing fidelity.

Distribution channels for custom video walls are predominantly direct or through highly trained indirect channel partners, primarily specialized AV distributors and integrators rather than broad-line distributors. Direct sales are common for large government or mission-critical projects where the manufacturer needs to retain tight control over the entire process, from design to service level agreements (SLAs). Indirect channels leverage the integrator network's geographical reach and local technical expertise, offering services like structural modification and ongoing maintenance contracts. Given the customization required, the consultative sales approach is standard, emphasizing deep technical knowledge and solution design rather than simple product sales, making the relationship with certified integrators the most crucial link in the downstream value chain.

Custom Video Wall Market Potential Customers

The primary consumers and end-users of custom video wall solutions are organizations requiring high-impact visual communication or mission-critical real-time data visualization across large-scale display surfaces. This customer base includes diverse sectors, ranging from municipal and national security entities to global corporate giants and high-end consumer-facing businesses. Potential buyers value reliability, visual fidelity, and the ability to handle heterogeneous data sources simultaneously. For instance, command and control centers (e.g., military operations, emergency services) are cornerstone buyers, prioritizing zero downtime, exceptional processing capacity, and ergonomic display configurations tailored for 24/7 operator use, often driving demand for robust DLP cubes or high-redundancy fine-pitch LED solutions.

Another significant customer segment is the corporate and enterprise sector, particularly those involved in global finance, telecommunications, and high-tech manufacturing. These entities utilize custom video walls in executive briefing centers, corporate lobbies, and Network Operations Centers (NOCs) to project brand image, disseminate real-time KPIs, and facilitate collaborative data review. These customers often seek aesthetically pleasing, high-resolution LED walls that blend seamlessly with modern architectural design. The buying decision in this segment is influenced not only by performance but also by design flexibility, minimal maintenance requirements, and overall visual impact, making the total immersive experience a key purchasing criterion.

Furthermore, the retail and hospitality industries represent a rapidly expanding customer base seeking experiential marketing tools. Luxury retail brands use custom, often curved or irregularly shaped, video walls to create immersive shopping environments, while large hotel chains utilize them in convention centers and public spaces for dynamic event scheduling and high-impact advertising. For these buyers, content flexibility, ease of remote management, and high visibility under various lighting conditions are crucial. These customers often partner with specialized integrators capable of managing both the complex hardware installation and the sophisticated, dynamic content delivery platforms necessary to maximize audience engagement.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Samsung Electronics, LG Display, Planar Systems (Leyard), Christie Digital Systems, Barco N.V., NEC Display Solutions, Daktronics, Absen, Sony Corporation, Delta Electronics, Mitsubishi Electric, Sharp Corporation, SiliconCore, Panasonic Corporation, DynaScan Technology, Userful Corporation, Matrox, Extron Electronics, VuWall, DataPath. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Custom Video Wall Market Key Technology Landscape

The technological landscape of the Custom Video Wall Market is rapidly evolving, primarily centered around achieving higher pixel density, greater energy efficiency, and modular flexibility. Fine-Pitch LED technology remains the current standard, enabling seamless visual canvases with pixel pitches below 2.5mm, which allows for close viewing distances without noticeable pixelation. However, the market is quickly transitioning toward next-generation solutions like Chip-on-Board (COB) and MicroLED technologies. COB packaging improves LED robustness and thermal dissipation while allowing for even finer pitches (sub-1mm). MicroLED represents the pinnacle of current display innovation, offering superior brightness, contrast ratios (true black), and significantly lower power consumption compared to traditional LEDs, though its high manufacturing cost currently limits mass adoption to ultra-premium custom installations and virtual production environments.

Beyond the display hardware itself, advancements in video processing and content management are crucial differentiators. Modern custom video walls require sophisticated controllers capable of handling vast amounts of data simultaneously, often requiring 4K or 8K input/output processing with extremely low latency, especially in mission-critical applications. Manufacturers are integrating powerful Field-Programmable Gate Arrays (FPGAs) and specialized GPU clusters within controllers to manage windowing, scaling, and synchronization across hundreds of millions of pixels. The trend is moving toward decentralized processing, where intelligence is distributed across the wall modules, simplifying wiring and reducing reliance on a single central point of failure, thereby increasing system redundancy and reliability.

Furthermore, cloud-based content management systems (CMS) are becoming integral, facilitating remote monitoring, content distribution, and diagnostic checks across geographically dispersed custom video wall networks. These platforms often incorporate APIs for seamless integration with corporate databases, real-time analytics dashboards, and building management systems (BMS). The focus is on offering comprehensive software stacks that simplify the complexity of managing heterogeneous content streams and provide predictive maintenance alerts. Virtual Reality (VR) and Augmented Reality (AR) tools are also beginning to be employed in the design phase, allowing system integrators and clients to visualize the custom wall configuration in the actual environment before physical installation, streamlining the consultation and design process significantly.

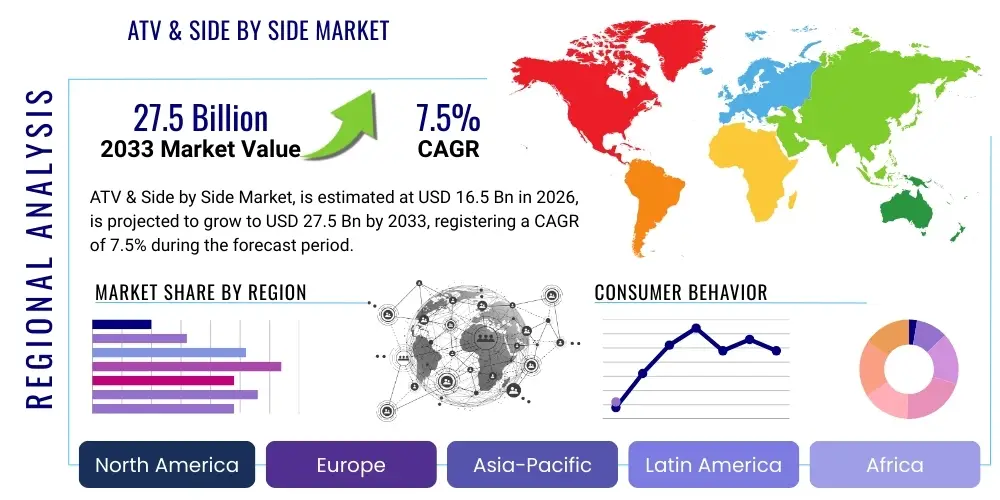

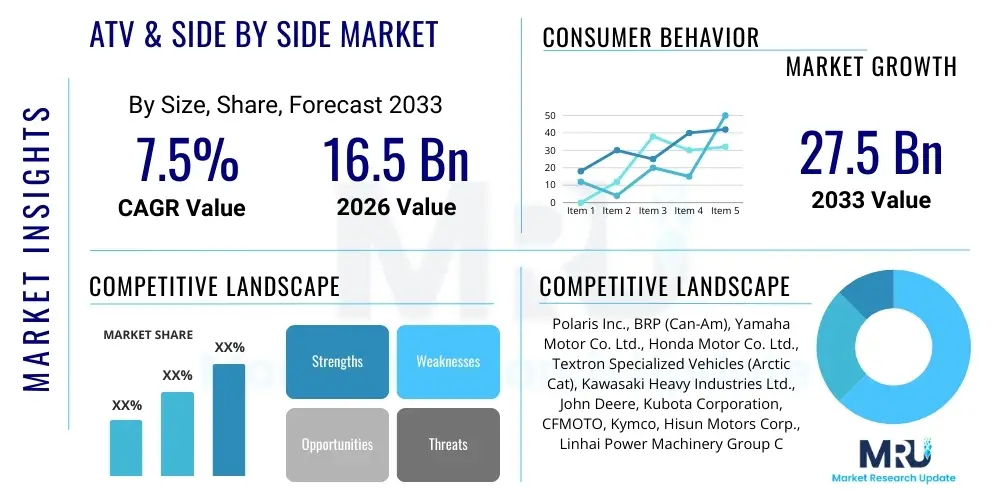

Regional Highlights

Geographically, the Custom Video Wall Market exhibits distinct growth patterns and drivers across major regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East & Africa (MEA). North America, particularly the United States, represents a highly mature market characterized by early adoption of new display technologies and high expenditure on corporate infrastructure upgrades. The dominance of large technology companies, financial institutions, and sophisticated broadcast studios drives substantial demand for premium, highly customized LED video walls for executive briefing centers, command centers, and virtual reality production stages. Market growth here is stable, characterized by replacement cycles and the strong influence of specialized system integrators who command high margins due to the complexity of installations and the required high level of after-sales service and support.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by rapid urbanization, massive government investment in smart city projects, and infrastructural modernization across countries like China, India, South Korea, and Southeast Asia. The retail and transportation sectors in APAC are aggressively adopting large-scale, custom digital signage solutions for dynamic advertising and passenger information systems. This region benefits from having major manufacturing hubs for LED components, resulting in competitive pricing and quicker adoption of fine-pitch technology. However, the market is highly fragmented, requiring vendors to navigate diverse regulatory environments and cultural preferences regarding display aesthetics and content.

Europe holds a strong position, driven by regulatory compliance standards that necessitate sophisticated monitoring solutions, particularly in the utility, energy, and government sectors. Western European countries exhibit a strong demand for high-end, energy-efficient custom video walls for broadcast, museums, and experiential marketing. The European market places a strong emphasis on sustainability and product lifespan, leading to a preference for high-quality, long-lasting LED and LCD solutions with robust maintenance contracts. The implementation of EU directives regarding data privacy and infrastructure security further mandates the use of cutting-edge video wall technology in centralized security and control centers across major capital cities. Eastern Europe, while smaller, is demonstrating increased momentum in corporate and retail modernization projects.

Latin America and the Middle East & Africa (MEA) present emerging market opportunities. In the MEA region, substantial investment in large-scale architectural projects, such as those related to global events and tourism expansion (e.g., UAE, Saudi Arabia), drives significant demand for unique, large-format custom video wall installations in public spaces, mega-malls, and luxury hotels. The focus here is often on creating spectacular visual displays that enhance the visitor experience and architectural prestige. Latin America’s growth is concentrated in key economies like Brazil and Mexico, driven primarily by government expenditure on security and transportation infrastructure, coupled with growing adoption in the corporate presentation and finance sectors, although economic volatility sometimes necessitates a preference for more cost-effective LCD solutions over premium LED.

- North America: Focus on corporate campus modernization, high penetration in broadcast/film production (virtual sets), and continuous upgrades of defense and governmental control rooms.

- Asia Pacific (APAC): Highest growth region driven by smart city initiatives, infrastructure development, and major manufacturing presence (China, South Korea).

- Europe: Strong demand in the utility, energy, and broadcast sectors; high emphasis on sustainability and long-term reliability in procurement decisions.

- Middle East & Africa (MEA): Significant investment in monumental architectural displays, luxury retail, and large-scale tourism infrastructure projects.

- Latin America: Growing adoption in public security and transportation management centers; sensitivity to capital expenditure driving interest in mid-range solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Custom Video Wall Market.- Samsung Electronics

- LG Display

- Planar Systems (Leyard)

- Christie Digital Systems

- Barco N.V.

- NEC Display Solutions

- Daktronics

- Absen

- Sony Corporation

- Delta Electronics

- Mitsubishi Electric

- Sharp Corporation

- SiliconCore

- Panasonic Corporation

- DynaScan Technology

- Userful Corporation

- Matrox

- Extron Electronics

- VuWall

- DataPath

Frequently Asked Questions

Analyze common user questions about the Custom Video Wall market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a custom video wall and a standard commercial display network?

A custom video wall is a fully integrated system engineered specifically for the site's unique architectural constraints and functional requirements, utilizing advanced controllers to create a single, seamless, high-resolution canvas often involving non-standard dimensions or curves. Standard commercial displays are standalone units with limited coordination capabilities.

Which display technology is currently dominating the custom video wall market?

Fine-pitch LED technology is currently dominating the custom video wall market due to its superior brightness, infinite scalability, and ability to achieve near-zero bezels, offering a truly seamless visual experience critical for both mission-critical control rooms and high-impact digital signage.

How does AI improve the functionality and operational uptime of video walls?

AI enhances functionality through intelligent content visualization and data prioritization, particularly in control rooms, and improves uptime through predictive maintenance analytics that detect component degradation before failure occurs, ensuring continuous 24/7 operation.

What are the key cost components contributing to the high total cost of ownership (TCO) for a custom video wall?

The TCO includes not only the high initial hardware cost (especially for MicroLED and fine-pitch LED) but also significant expenditures on specialized structural installation, complex video processing controllers, custom software licensing, and long-term maintenance and calibration contracts requiring highly specialized technicians.

In which end-use sector is the demand for custom video walls growing fastest globally?

The Retail and Hospitality sectors are exhibiting the fastest growth in demand for custom video walls, driven by the intense need for experiential marketing and immersive visual branding designed to capture consumer attention and enhance in-store or hotel guest experiences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager