Customer Care BPO Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438494 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Customer Care BPO Market Size

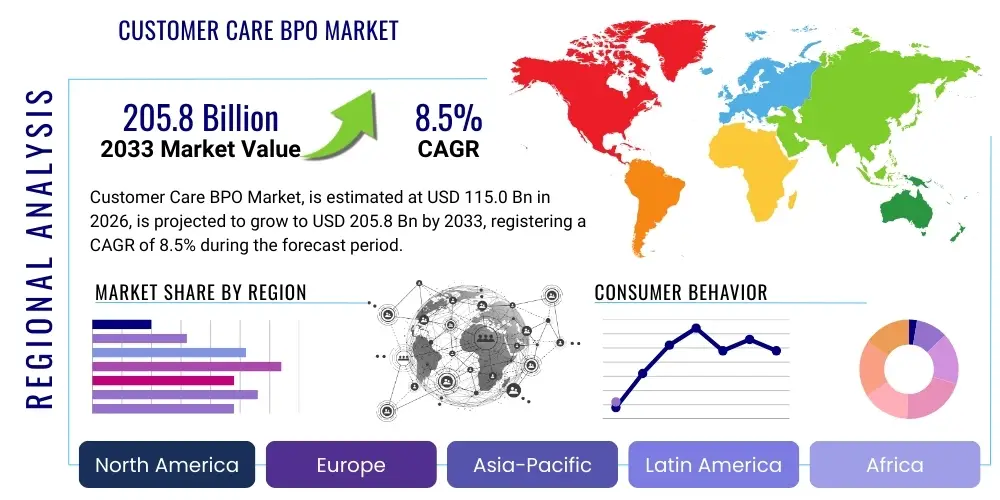

The Customer Care BPO Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 115.0 Billion in 2026 and is projected to reach USD 205.8 Billion by the end of the forecast period in 2033.

Customer Care BPO Market introduction

The Customer Care Business Process Outsourcing (BPO) Market encompasses the delegation of customer interaction services, including inbound and outbound calls, email support, chat services, and social media engagement, to third-party vendors. This practice allows organizations to enhance service quality, improve operational efficiencies, and manage fluctuating customer demand without substantial internal investment in infrastructure and staffing. The fundamental product description involves providing highly specialized, multi-channel customer relationship management (CRM) functions on behalf of clients, often leveraging advanced technology stacks.

Major applications of Customer Care BPO span nearly every industry vertical, including telecommunications, banking, financial services and insurance (BFSI), retail and e-commerce, healthcare, and technology. These services are crucial for processes such as technical support, warranty claims, billing inquiries, proactive retention campaigns, and comprehensive complaint resolution. The transition towards digital service models has elevated the importance of BPO providers who can effectively integrate digital touchpoints and ensure seamless customer journeys.

Key benefits driving the adoption of Customer Care BPO include significant cost reduction compared to in-house operations, access to specialized multilingual talent pools, enhanced scalability to handle peak loads, and improved compliance management. The primary driving factor currently dominating the market is the imperative for digital transformation, where enterprises seek BPO partners capable of deploying Artificial Intelligence (AI), Robotic Process Automation (RPA), and sophisticated analytics to deliver personalized and efficient customer experiences (CX) at scale.

Customer Care BPO Market Executive Summary

The Customer Care BPO market is experiencing robust expansion, fundamentally driven by pervasive digital transformation initiatives and the intensified global competition requiring superior customer experience delivery. Business trends indicate a marked shift from traditional voice-only services towards integrated omnichannel platforms, necessitating significant investment in cloud-based contact center solutions and advanced automation capabilities. Outsourcing providers are repositioning themselves as strategic CX partners rather than mere cost centers, focusing on value-added services such as predictive analytics, customer journey mapping, and complex interaction handling. Consolidation among leading vendors and strategic acquisitions of niche technology firms are common strategies employed to broaden technological scope and geographic reach.

Segment trends reveal that the demand for technical support and complex problem-solving remains extremely high, especially in high-tech and BFSI sectors, which require specialized domain expertise. Furthermore, non-voice channels, particularly social media management and dedicated self-service tools supported by human intervention, are exhibiting the fastest growth rates. Large enterprises continue to be the primary consumers of BPO services, although the mid-market segment is increasingly adopting managed services to gain competitive parity in CX. The adoption of Outcome-Based Pricing (OBP) models is gaining traction, aligning vendor remuneration directly with achieved business results, such as Net Promoter Score (NPS) improvement or reduction in customer churn.

Regionally, the Asia Pacific (APAC) continues to dominate the delivery side due to favorable cost structures and abundant skilled labor, particularly in countries like the Philippines and India. However, nearshore locations in Latin America (LATAM), such as Mexico and Colombia, are gaining prominence for serving the North American market, offering cultural affinity and closer time zones. North America and Europe remain the largest consuming regions, characterized by demand for highly sophisticated, compliant, and data-secure services, thereby pushing BPO providers to adhere strictly to regulations like GDPR and HIPAA. The market equilibrium is being defined by the interplay between cost optimization drivers and the necessity for technological superiority.

AI Impact Analysis on Customer Care BPO Market

Common user questions regarding the influence of Artificial Intelligence (AI) on the Customer Care BPO market primarily revolve around job displacement, the efficacy of AI in complex interaction handling, security implications, and the return on investment (ROI) of adopting AI tools. Users frequently inquire: “Will generative AI replace all human agents?”, “How do BPO providers manage data privacy when deploying large language models (LLMs)?”, and “What are the specific operational efficiency gains realized through AI-powered chatbots versus traditional IVR systems?” These inquiries highlight a critical tension: the expectation of dramatic cost savings and efficiency gains offered by AI, balanced against concerns about maintaining service quality, empathy, and security in customer interactions.

The analysis indicates that the integration of AI, encompassing virtual assistants, sophisticated chatbots, predictive analytics, and conversational intelligence, is not replacing the BPO function but profoundly augmenting it, leading to a synergistic "AI-Human Hybrid" model. AI handles routine, high-volume transactional queries (Level 1 support), freeing up human agents to focus on complex, emotionally sensitive, or sales-oriented interactions (Level 2/3 support). This stratification optimizes operational costs while significantly elevating the overall customer and agent experience. Providers are actively developing specialized AI platforms tailored for specific industry compliance requirements, directly addressing user concerns about data security and regulatory adherence in highly regulated sectors like BFSI and healthcare.

Furthermore, AI provides BPO providers with unprecedented insights into customer sentiment, journey bottlenecks, and agent performance. Tools utilizing natural language processing (NLP) analyze thousands of daily interactions to identify root causes of frustration and areas for service improvement, transforming raw interaction data into actionable business intelligence. This capability enables BPO firms to move beyond mere transaction processing towards offering proactive customer retention strategies and personalized engagement models. Consequently, the successful BPO firm of the future is defined by its ability to seamlessly integrate and manage a suite of cognitive technologies, using AI not just for automation but as a strategic differentiator for deep customer understanding.

- AI drives automation of transactional and repetitive queries, optimizing resource allocation for complex issues.

- Generative AI enhances agent productivity through real-time guidance, suggested responses, and sophisticated knowledge base retrieval.

- Predictive analytics powered by AI allows BPO providers to anticipate customer needs and proactively resolve potential issues (proactive customer care).

- AI systems are instrumental in quality assurance, automatically monitoring and scoring agent performance and ensuring compliance standards are met.

- Development of secure, industry-specific Large Language Models (LLMs) mitigates data privacy concerns and enhances domain-specific competence.

- The rise of the "Super Agent," an agent leveraging AI tools to handle complex, high-value interactions efficiently.

DRO & Impact Forces Of Customer Care BPO Market

The dynamics of the Customer Care BPO market are governed by a robust combination of compelling drivers, persistent restraints, and significant strategic opportunities, creating a complex impact force matrix. Key drivers, such as the global demand for superior and personalized customer experiences and the necessity for enterprises to maintain cost competitiveness, continually push organizations toward outsourcing strategic customer functions. Simultaneously, the accelerating pace of digital transformation necessitates specialized technological capabilities, which BPO providers are better equipped to deliver quickly and at scale than most in-house departments. These market forces converge to ensure consistent growth and technological advancement within the sector.

Despite strong drivers, the market faces significant restraints. Data security and privacy concerns, particularly in light of stringent global regulations like GDPR, CCPA, and evolving sector-specific compliance mandates, present a major hurdle. Organizations are hesitant to transfer sensitive customer data unless BPO partners demonstrate impeccable security protocols and robust governance frameworks. Furthermore, the inherent risk of quality degradation, cultural misalignment between the client and the provider, and potential public perception issues related to outsourcing represent ongoing management challenges. Maintaining the human touch and empathy in automated or geographically distant interactions requires continuous innovation and investment in agent training and morale.

Opportunities for expansion are predominantly centered around niche service offerings and geographical diversification. There is a burgeoning opportunity in offering specialized BPO services for emerging technologies, such as IoT device support, blockchain applications, and advanced telehealth systems, requiring highly trained, technically proficient agents. Geographically, expanding into untapped markets in Eastern Europe, Africa, and specific APAC countries offers access to new linguistic skills and cost-efficient delivery centers. Leveraging hyperscalers and cloud-based solutions to offer flexible, disaster-resilient contact center services globally represents a pivotal strategic avenue for competitive differentiation and long-term sustainable growth.

Segmentation Analysis

The Customer Care BPO market is systematically segmented across various dimensions including service type, technology deployed, application area, and enterprise size. This segmentation provides a granular view of specific market demands and growth pockets, enabling providers to tailor their offerings effectively. Historically, inbound services dominated the market, but the emphasis has significantly shifted towards integrated offerings that blend voice, non-voice, and advanced digital interaction management. The technological segmentation is increasingly defined by the adoption rate of sophisticated automation tools versus traditional labor-intensive processes, reflecting the market’s technological maturity curve.

- By Service Type:

- Inbound Customer Care (Technical Support, Product Information, Billing & Account Management)

- Outbound Customer Care (Telemarketing, Surveys, Collections)

- Digital Customer Care (Chat Support, Email Support, Social Media Management, Self-Service Integration)

- By Channel:

- Voice

- Non-Voice (Digital Channels)

- By End-Use Industry:

- BFSI (Banking, Financial Services, and Insurance)

- Telecommunications and IT

- Retail and E-commerce

- Healthcare and Pharmaceuticals

- Travel and Hospitality

- Government and Public Sector

- By Enterprise Size:

- Large Enterprises

- SMEs (Small and Medium-sized Enterprises)

- By Technology Deployment:

- Cloud-based

- On-premise

Value Chain Analysis For Customer Care BPO Market

The value chain for the Customer Care BPO market begins with upstream activities focused heavily on technological infrastructure procurement and human capital management. Upstream analysis involves establishing robust, cloud-enabled contact center infrastructure, securing resilient telecommunication links, and developing proprietary or third-party CRM and workforce management (WFM) software. Crucially, this stage includes rigorous talent acquisition, specialized training in client domain knowledge, and compliance certification, forming the foundation of service quality and differentiation. Strategic partnerships with technology vendors, particularly those specializing in AI/ML and automation, are integral to the upstream process, determining the provider's capability to deliver modern CX solutions.

The midstream segment comprises core service delivery—the actual execution of customer interactions across multiple channels (voice, chat, email, social). This phase involves managing agent schedules, ensuring service level agreements (SLAs) are met, deploying quality assurance (QA) protocols, and utilizing advanced analytics to generate operational insights. Efficiency in the midstream is enhanced by sophisticated routing systems and agent assist technologies. Successful BPO providers excel by maintaining high first call resolution (FCR) rates and improving customer satisfaction scores (CSAT), demonstrating superior operational governance and adaptability to volatile interaction volumes.

Downstream analysis focuses on the distribution channel and the relationship with the end-user clients. Direct distribution, involving BPO providers contracting directly with large enterprises, remains the primary channel, often through large, multi-year contracts managed by dedicated account teams. Indirect channels involve partnerships with consulting firms, system integrators, or technology resellers who bundle BPO services with broader IT transformation projects. Effective downstream strategy includes transparent reporting, continuous strategic business reviews (SBRs), and consultative selling aimed at expanding the scope of services based on demonstrated value, driving retention and maximizing client lifetime value.

Customer Care BPO Market Potential Customers

Potential customers for Customer Care BPO services are diverse, characterized by their high volume of customer interactions, complex service needs, and stringent regulatory environments. End-users span across all industry verticals, but the most significant buyers remain entities within the BFSI and Telecommunications sectors. These industries face intense competition, demanding 24/7 support, high transactional security, and compliance with complex regulatory frameworks, making outsourcing a necessary strategy to maintain service excellence without overextending internal resources. BFSI clients, for instance, seek expertise in handling sensitive transactions, fraud detection, and multi-jurisdictional compliance.

The Retail and E-commerce segment represents another massive cohort of potential customers, driven by the need for scalable support during peak sales seasons, managing logistics inquiries, and integrating post-purchase experience with digital marketing efforts. Given the shift towards omnichannel retail, these clients require BPO partners who can flawlessly manage interactions across marketplaces, social media, and dedicated mobile applications. Similarly, the Healthcare sector is rapidly expanding its adoption of BPO, seeking assistance with patient scheduling, insurance verification, billing processes, and technical support for burgeoning telehealth and remote monitoring devices, all while adhering strictly to privacy mandates like HIPAA.

Furthermore, technology companies, ranging from multinational software giants to rapidly scaling SaaS startups, are continuous consumers of technical support BPO. These organizations require highly technical expertise to resolve complex product issues, manage global user bases, and provide Level 3 technical assistance. Small and Medium-sized Enterprises (SMEs) are increasingly becoming potential buyers, particularly for outsourced digital care and foundational support, as they seek cost-effective ways to deliver professional customer service that rivals larger competitors, often leveraging cloud-based, subscription-model BPO solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.0 Billion |

| Market Forecast in 2033 | USD 205.8 Billion |

| Growth Rate | 8.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teleperformance SE, Concentrix Corporation, Sitel Group (Foundever), TTEC Holdings, Inc., Alorica Inc., Transcom, Genpact Ltd., HCL Technologies Limited, IBM Corporation, Infosys BPM, Wipro Limited, Conduent, Inc., Webhelp (part of Concentrix), Startek, Atento, VXI Global Solutions, Tech Mahindra, Sutherland Global Services, CSS Corp, Everise. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Customer Care BPO Market Key Technology Landscape

The technology landscape governing the Customer Care BPO market is rapidly evolving, driven by the necessity for enhanced operational efficiency and superior customer experience delivery. The most critical technology foundation remains the adoption of sophisticated Contact Center as a Service (CCaaS) platforms. These cloud-based solutions offer flexibility, scalability, and integration capabilities far exceeding traditional premise-based systems, facilitating seamless deployment of omnichannel strategies and ensuring business continuity across geographically disparate locations. CCaaS platforms are essential for consolidating customer interaction data across voice, chat, email, and social media into a unified agent interface, driving down average handling time (AHT) and improving first contact resolution (FCR).

Artificial Intelligence (AI) and Machine Learning (ML) constitute the major disruptive force within this landscape. Key applications include Intelligent Virtual Agents (IVAs) and sophisticated chatbots capable of handling up to 70% of routine customer inquiries autonomously. Beyond frontline automation, AI/ML models are integrated into back-office functions for predictive routing, forecasting peak demand, and analyzing customer sentiment in real-time. Robotic Process Automation (RPA) further streamlines the BPO operational environment by automating repetitive, rule-based back-end tasks, such as data entry, policy retrieval, and transaction processing, thereby improving accuracy and compliance while reducing human intervention in non-customer-facing processes.

Furthermore, advanced analytics and business intelligence tools are fundamental for strategic decision-making within the BPO ecosystem. These platforms utilize interaction metadata, speech analytics, and text analytics to uncover profound customer journey insights, identify training gaps for agents, and pinpoint root causes of service failures. Security technologies, including advanced encryption methods, secure cloud architecture, and specialized compliance monitoring software, are non-negotiable components, particularly for BPO providers serving regulated industries. The successful service providers are those that master the integration of these disparate technologies into a cohesive, secure, and future-proof digital ecosystem, ensuring high-fidelity data transfer and interaction management.

Regional Highlights

The regional distribution of the Customer Care BPO market exhibits distinct patterns concerning both demand and supply dynamics, influenced heavily by labor cost structures, digital penetration rates, and regulatory environments.

- North America: This region stands as the largest consumer market for sophisticated Customer Care BPO services. Demand is characterized by a high emphasis on digital transformation, outcome-based contracts, and advanced technology integration, particularly AI and GenAI applications. Enterprises here require BPO providers capable of managing complex technical support and financial transactions with stringent security protocols (SOC 2, HIPAA). Growth is fueled by the robust financial services, healthcare, and technology sectors seeking specialized, high-value support rather than just cost reduction.

- Europe: Europe is a mature market driven primarily by the need for multilingual support and strict adherence to data protection regulations, notably the General Data Protection Regulation (GDPR). The region demonstrates strong demand for both onshore (high complexity, high-touch services) and nearshore solutions (e.g., Eastern Europe, North Africa) to address linguistic diversity and time zone compatibility. Western European countries emphasize quality assurance, compliance, and leveraging BPO for brand reputation management.

- Asia Pacific (APAC): APAC is crucial both as a rapidly growing consumer market (driven by rising middle-class consumption in countries like China and India) and as the dominant global delivery hub (e.g., Philippines, India, Malaysia). The delivery side is motivated by low operational costs and a vast pool of highly educated, English-proficient, and increasingly multilingual workforce. The market dynamics here are shifting towards specialized digital care and technical back-office support, moving beyond traditional voice services.

- Latin America (LATAM): LATAM is experiencing significant growth as a preferred nearshore destination for the North American market, offering cultural proximity, Spanish and Portuguese language capabilities, and favorable time zones. Countries like Mexico, Colombia, and Brazil are strategically positioned to handle high-volume contact center operations, making the region highly competitive in the areas of bilingual technical support and financial services BPO.

- Middle East and Africa (MEA): This region is an emerging market, driven by accelerating telecommunication penetration and government initiatives focused on digital economy development. While service delivery is still nascent, MEA countries represent growing consumer demand, particularly in the telecommunications and public sector, seeking expertise in managing rapidly expanding customer bases and implementing foundational digital services.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Customer Care BPO Market.- Teleperformance SE

- Concentrix Corporation

- Sitel Group (Foundever)

- TTEC Holdings, Inc.

- Alorica Inc.

- Transcom

- Genpact Ltd.

- HCL Technologies Limited

- IBM Corporation

- Infosys BPM

- Wipro Limited

- Conduent, Inc.

- Webhelp (part of Concentrix)

- Startek

- Atento

- VXI Global Solutions

- Tech Mahindra

- Sutherland Global Services

- CSS Corp

- Everise

- Fusion CX

- Capita plc

- SYKES Enterprises, Incorporated (now part of Sitel Group)

- TaskUs

- Intelenet Global Services (now Teleperformance)

- Accenture PLC

- Cognizant Technology Solutions

- Majesco Limited

- Exela Technologies

- Pegasus Knowledge Solutions

Frequently Asked Questions

Analyze common user questions about the Customer Care BPO market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving growth in the Customer Care BPO market?

The primary driver is the accelerating imperative for enterprises to achieve true digital transformation and deliver seamless, integrated omnichannel customer experiences (CX) at a reduced operational cost, leveraging the advanced technological capabilities offered by BPO providers.

How is AI fundamentally changing the role of BPO human agents?

AI is shifting the role of human agents from handling transactional, routine queries to becoming "Super Agents" who manage complex, high-value, and emotionally sensitive interactions, supported by real-time data and guidance provided by AI tools like conversational intelligence and predictive analytics.

Which geographic region dominates the Customer Care BPO market in terms of service delivery?

The Asia Pacific (APAC) region, primarily driven by hubs in the Philippines and India, continues to dominate global service delivery due to significant labor cost advantages, large skilled workforces, and established BPO infrastructure, though Latin America is rapidly gaining ground as a nearshore alternative.

What are the greatest restraints impacting market expansion for BPO providers?

The most significant restraints include heightened concerns surrounding data security and privacy compliance, particularly in regulated sectors like BFSI and Healthcare, necessitating substantial investment in robust governance, cybersecurity, and adherence to global regulations such as GDPR and HIPAA.

What is the difference between voice and non-voice segmentation in BPO?

Voice segmentation includes traditional inbound and outbound telephone calls, while non-voice segmentation encompasses all digital and textual interactions, including email support, live chat, social media management, and the integration of automated self-service portals and sophisticated AI chatbots.

What technological investments are crucial for BPO market leaders?

Market leaders must prioritize investments in Contact Center as a Service (CCaaS) cloud platforms for scalability, advanced Artificial Intelligence (AI) for automation and analytics, Robotic Process Automation (RPA) for back-office efficiency, and proprietary tools for enhanced cybersecurity and compliance monitoring.

What are the typical end-user industries for complex technical support BPO?

Complex technical support BPO is predominantly utilized by the Telecommunications and IT sector, High-Tech manufacturing, and specialized sub-sectors within Healthcare (med-tech), where resolving intricate product issues and providing specialized Level 2 and Level 3 troubleshooting is critical for customer retention and product functionality.

How does nearshoring benefit North American companies using BPO?

Nearshoring, primarily utilizing locations in Latin America, benefits North American companies by offering agents with cultural affinity, reducing language barriers, and providing time zone alignment, resulting in higher quality real-time customer support and improved customer satisfaction scores compared to distant offshore locations.

What is an Outcome-Based Pricing (OBP) model in the BPO sector?

The Outcome-Based Pricing (OBP) model is a contractual arrangement where the BPO provider’s fee structure is partially or wholly tied to measurable business results and key performance indicators (KPIs) achieved for the client, such as improvements in Net Promoter Score (NPS), reduction in churn rate, or increased sales conversion, rather than simply basing pricing on hours worked or agents deployed.

Why is regulatory compliance a significant impact force in the European BPO market?

Regulatory compliance, particularly GDPR, is a major force in Europe because it dictates extremely strict rules regarding the handling, storage, and processing of personal customer data. BPO providers operating in or serving Europe must demonstrate certified adherence to these data protection standards, significantly influencing vendor selection and operational complexity.

How do BPO providers leverage analytics for strategic advantage?

BPO providers utilize speech, text, and descriptive analytics to transform raw interaction data into actionable strategic insights. This allows them to identify root causes of customer dissatisfaction, optimize internal processes, customize training programs for agents, and offer clients valuable business intelligence regarding product defects or market reception.

What defines the upstream segment of the Customer Care BPO value chain?

The upstream segment is defined by foundational activities, including securing technological infrastructure (CCaaS platforms), human capital management (recruitment, specialized domain training, and certification), and establishing strategic technology partnerships crucial for enabling advanced service delivery capabilities.

What is the significance of the shift from inbound to integrated digital care?

The shift signifies that customers demand flexibility across multiple channels. BPO providers must integrate voice, chat, social media, and self-service into a cohesive, non-disjointed customer journey, prioritizing seamless context transfer between channels to maintain high efficiency and customer satisfaction.

How is the SME segment contributing to BPO market growth?

SMEs are increasingly adopting BPO services, primarily through flexible, cloud-based subscription models, to gain access to professional, scalable customer service capabilities that would otherwise be too costly or complex to build in-house, enabling them to compete effectively on CX with larger enterprises.

What is a key difference between onshore and offshore BPO delivery models?

Onshore BPO involves operations within the client's home country, offering maximum cultural and linguistic alignment and often higher security assurance, typically handling complex or highly sensitive interactions. Offshore BPO, situated in distant locations like APAC, primarily targets significant cost reduction for high-volume, potentially less complex tasks.

How does the BPO market address the need for multilingual support?

The BPO market addresses multilingual demand by strategically placing delivery centers in geographic regions with specific language proficiencies (e.g., LATAM for Spanish/Portuguese, specific APAC countries for Mandarin/Japanese, and Eastern Europe for various continental languages), ensuring comprehensive global coverage for multinational clients.

What role does workforce management (WFM) technology play in BPO operations?

WFM technology is critical for optimizing BPO operations by accurately forecasting demand, scheduling the appropriate number of agents with required skills, and monitoring agent adherence and productivity in real-time, directly impacting service level attainment and overall cost efficiency.

Why is the healthcare sector rapidly increasing its use of Customer Care BPO?

The healthcare sector is increasing BPO adoption to manage the complexity of insurance and billing processes, handle patient scheduling, provide technical support for telehealth solutions, and ensure strict compliance with privacy regulations like HIPAA while focusing internal resources on core clinical activities.

How do BPO providers use predictive routing?

Predictive routing uses AI and historical data analysis to route customer interactions not just based on the next available agent, but to the agent predicted to be most effective at resolving that specific customer's query quickly, considering factors like sentiment, transaction history, and agent specialization, significantly improving FCR.

What is the expected long-term impact of Generative AI on the BPO market?

The long-term impact of Generative AI is expected to revolutionize knowledge management and agent training, allowing BPO providers to quickly generate detailed, context-aware responses and training materials. It will further automate highly complex, non-standard interactions, significantly expanding the scope of tasks that can be handled without human intervention, leading to higher efficiency and specialized service offerings.

Why are cloud-based solutions now preferred over on-premise contact centers?

Cloud-based solutions (CCaaS) are preferred due to their superior scalability, lower total cost of ownership (TCO), faster deployment times, inherent disaster recovery capabilities, and seamless integration with emerging technologies such as AI and advanced analytics, providing the flexibility needed to manage volatile global demand.

What is the significance of the financial services sector in BPO demand?

The financial services sector is significant because it requires highly secure, compliant, and complex transactional support, including fraud prevention, loan servicing, and portfolio management. They demand BPO partners with expertise in complex regulation (e.g., Basel III, AML) and robust data protection frameworks, making it a high-value segment.

How does quality assurance evolve with the integration of AI in BPO?

Quality assurance moves from manual monitoring of a small sample of interactions to automated, AI-driven analysis of 100% of interactions (speech and text). AI flags specific compliance risks, sentiment anomalies, and agent behavior patterns in real-time, providing more accurate, comprehensive, and objective quality scoring and feedback.

What are the key differentiators for top-tier BPO providers today?

Key differentiators include the ability to offer genuinely integrated omnichannel platforms, superior digital transformation consulting capabilities, certified data security and compliance across multiple jurisdictions, specialized vertical domain expertise, and the effective deployment and management of a proprietary or integrated suite of AI and automation tools.

Why is adherence to SLAs crucial in the BPO sector?

Adherence to Service Level Agreements (SLAs) is crucial because SLAs define the measurable standards of performance (e.g., FCR, AHT, CSAT) that the BPO provider guarantees to the client. Failure to meet these contractual obligations can lead to financial penalties, contract termination, and severe reputational damage, making SLA management central to operational success.

What are the implications of BPO vendor consolidation?

Vendor consolidation, characterized by large providers acquiring smaller, specialized firms, leads to increased market share concentration, broader geographical reach, and the rapid integration of specialized technologies (such as niche AI solutions), offering clients a single, comprehensive source for a wider range of global CX services.

How do Customer Care BPO providers support e-commerce peak seasons?

BPO providers utilize their vast global resources and scalable cloud infrastructure to rapidly onboard and train temporary agents, dynamically adjusting staffing levels to handle massive fluctuations in inquiry volume during peak e-commerce seasons (e.g., holidays, major sales events), ensuring continuous service quality and logistical support.

What role does agent training play in modern BPO strategy?

Agent training is central to modern BPO strategy, moving beyond basic communication skills to include specialized domain knowledge (e.g., financial products, complex software), empathy training for sensitive interactions, and rigorous instruction in utilizing complex AI-powered agent assistance tools, transforming agents into highly skilled brand representatives.

Define the downstream function within the Customer Care BPO value chain.

The downstream function focuses on client relationship management, service delivery monitoring, strategic business reviews, transparent performance reporting, and leveraging successful project execution to consultatively upsell or expand the scope of services, thus maximizing client lifetime value and contract renewal rates.

How is cybersecurity integrated into the BPO operational framework?

Cybersecurity is integrated through multiple layers, including secure CCaaS architecture, robust network perimeter defense, mandatory agent training on data handling protocols, adherence to PCI DSS (for payments), use of encryption for data in transit and at rest, and continuous vulnerability assessments to ensure the integrity of client and customer information.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager