Customer Support Software Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434274 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Customer Support Software Market Size

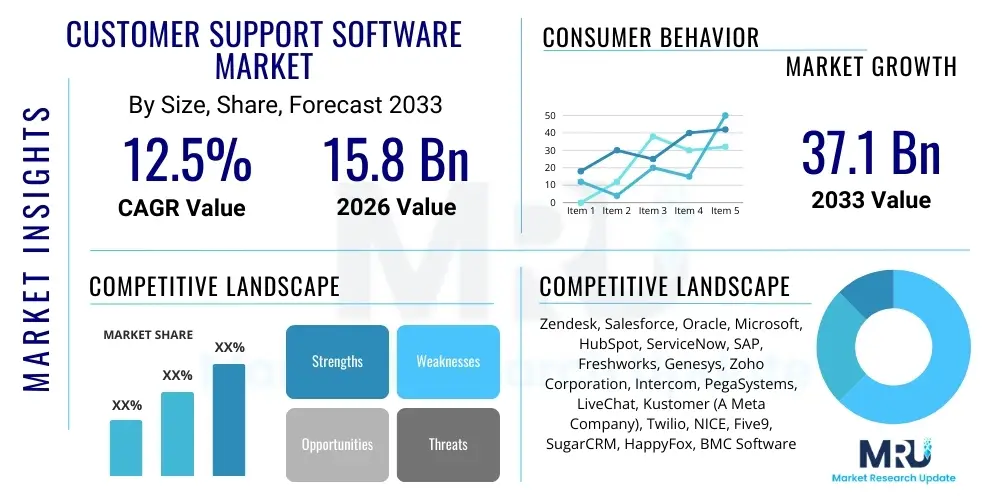

The Customer Support Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 15.8 Billion in 2026 and is projected to reach USD 37.1 Billion by the end of the forecast period in 2033.

Customer Support Software Market introduction

The Customer Support Software Market encompasses a wide range of sophisticated digital tools and platforms designed to facilitate interactions between businesses and their clients, ensuring efficient resolution of queries, proactive engagement, and overall enhanced customer satisfaction. These solutions typically include functionalities such as help desk management, ticketing systems, omnichannel communication integration (including email, chat, social media, and voice), self-service portals, and advanced knowledge management capabilities. The primary product description centers on delivering unified agent interfaces and comprehensive customer journey mapping tools, enabling businesses to provide seamless, consistent, and personalized support across all touchpoints. Major applications span across various industry verticals, including retail and e-commerce, banking, financial services, and insurance (BFSI), telecommunications, and healthcare, driven by the universal need to scale support operations while maintaining high quality.

The core benefits derived from implementing these solutions include significantly reduced response times, lower operational costs due to automation, improved agent productivity, and enhanced data collection for strategic business insights. These systems transform reactive support into proactive customer relationship management (CRM), fostering stronger brand loyalty and retention. Key driving factors propelling market expansion involve the exponential growth of e-commerce, necessitating robust digital support infrastructure; the rising complexity of customer queries demanding specialized technical assistance; and the increasing adoption of cloud-based SaaS models which offer flexibility, scalability, and reduced initial capital expenditure for businesses of all sizes, especially Small and Medium-sized Enterprises (SMEs). Furthermore, the competitive differentiation achievable through superior customer experience mandates continuous investment in state-of-the-art support technologies.

Customer Support Software Market Executive Summary

The Customer Support Software Market is experiencing significant dynamic shifts driven by technological convergence and evolving customer expectations. Key business trends indicate a strong move towards unified, omnichannel platforms that centralize all customer interactions, reducing data silos and ensuring continuity of service. The shift from traditional on-premise solutions to cloud-based Software as a Service (SaaS) models continues to dominate deployment strategies, offering scalability and faster feature updates, thus democratizing access for smaller enterprises. Moreover, the integration of Artificial Intelligence (AI) and Machine Learning (ML) capabilities is a defining characteristic, fundamentally changing how service is delivered through sophisticated chatbots, predictive analytics for query routing, and intelligent agent assistance tools. Investment in proactive support tools, aimed at resolving issues before they impact the customer, is also increasing across enterprise segments, reinforcing customer retention strategies.

Regionally, North America maintains the largest market share, characterized by high technological adoption rates, the presence of major industry vendors, and substantial expenditure on advanced CRM and customer experience (CX) platforms across the BFSI and IT sectors. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, fueled by rapid digitalization, the burgeoning e-commerce ecosystem, and increasing awareness among SMEs in countries like India and China regarding the competitive advantage of superior customer service infrastructure. Europe shows steady growth, driven by stringent data privacy regulations (like GDPR) which necessitate secure, compliant software solutions, promoting investment in specialized security features within support platforms. Latin America and the Middle East & Africa (MEA) are emerging markets, gradually adopting cloud-based solutions to modernize public and private sector customer interaction centers.

Segment trends reveal that the Service and Support Automation segment, leveraging AI and NLP, is anticipated to record the highest growth due to its efficiency benefits. By component, the Solutions segment (which includes ticketing, knowledge management, and analytics) continues to hold the largest value, though the Services segment (professional services, training, and integration) is growing rapidly as organizations seek expert assistance for complex platform deployment and customization. Furthermore, large enterprises, historically the primary adopters, are now being joined by a significant influx of SMEs, especially those in the high-growth technology and digital services sectors, who are capitalizing on subscription-based, affordable, and scalable support software designed for rapid deployment. The demand for industry-specific solutions tailored to regulatory and operational needs in healthcare and finance is also influencing product development.

AI Impact Analysis on Customer Support Software Market

Common user questions regarding AI's impact on customer support software frequently revolve around several critical themes: the extent of job displacement for human agents, the practical benefits of Generative AI (GenAI) beyond simple chatbots, concerns about data privacy and ethical AI usage in handling sensitive customer information, and the return on investment (ROI) derived from deploying sophisticated automation tools. Users are keen to understand how AI can move beyond basic Level 1 support automation to handle complex, multi-step queries, and how it can effectively augment human agents (AI Co-pilots) rather than merely replacing them. There is also significant interest in AI-driven predictive analytics that can preempt customer churn and identify potential issues before they escalate into tickets.

Based on this analysis, the key themes summarize the market's expectation for AI to fundamentally enhance efficiency and personalization while requiring robust governance frameworks. Users expect AI to handle up to 60-70% of routine inquiries, freeing up specialized human agents for high-value tasks that require emotional intelligence and complex problem-solving. The influence of GenAI, particularly Large Language Models (LLMs), is seen as transformative, enabling instantaneous content creation for knowledge bases, summarizing long interaction histories for agents, and providing hyper-personalized customer responses that mimic human communication fidelity. However, concerns about maintaining a positive human touchpoint and ensuring the accuracy (reducing hallucinations) of AI-generated advice remain central to strategic planning for enterprises adopting these advanced capabilities.

The industry consensus is that AI is not merely an optional feature but a foundational layer for modern customer support architecture, enabling true 24/7 global service and unprecedented scaling. This pervasive integration is driving software vendors to prioritize AI/ML development, focusing on natural language understanding (NLU) improvements, sentiment analysis capabilities, and seamless integration of AI outputs directly into agent workflows. This shift elevates customer support software from a reactive cost center to a strategic driver of revenue generation and brand equity, provided the technology is implemented thoughtfully to balance automation efficiency with empathetic human interaction.

- AI enhances operational efficiency by automating routine and repetitive queries via sophisticated chatbots and virtual assistants.

- Generative AI significantly improves agent productivity through automated email drafting, ticket summarization, and knowledge base content generation.

- Predictive analytics driven by AI minimizes customer churn by identifying at-risk customers and suggesting proactive intervention strategies.

- AI-powered sentiment analysis provides real-time insights into customer emotion during interactions, allowing agents to adjust their communication style immediately.

- Intelligent routing systems use machine learning to match complex queries to the most qualified human agent, improving first-contact resolution rates.

- Increased investment in ethical AI and data governance protocols is required to build customer trust regarding the handling of personal data processed by algorithms.

- The development of 'AI Co-pilots' provides human agents with instant access to relevant information and guided workflows, augmenting human capabilities rather than replacing them entirely.

DRO & Impact Forces Of Customer Support Software Market

The dynamics of the Customer Support Software Market are heavily influenced by a confluence of powerful Drivers, strategic Restraints, and latent Opportunities, collectively shaping the competitive landscape through various Impact Forces. Key drivers include the overwhelming consumer demand for seamless, omnichannel experiences, the accelerated digital transformation across all industries post-2020, and the realization by enterprises that exceptional customer experience (CX) is a primary competitive differentiator. These drivers push organizations to invest heavily in integrated, scalable, and intelligent support platforms that can manage large volumes of diverse interactions efficiently. The increasing proliferation of mobile devices and social media platforms further necessitates unified support solutions, forcing vendors to prioritize deep integration capabilities across disparate channels.

Conversely, significant restraints hinder growth potential, primarily centered around the substantial initial investment required for large-scale enterprise deployments, particularly for migrating legacy on-premise systems to complex cloud environments. Data security and privacy concerns, particularly in highly regulated sectors like BFSI and Healthcare, pose a continuous challenge, requiring vendors to maintain expensive, compliant solutions. Additionally, the complexity involved in integrating new customer support software with existing fragmented legacy CRM, ERP, and internal systems often leads to implementation delays and user resistance, necessitating specialized professional services and extensive change management strategies.

The market presents compelling opportunities driven by technological advancements and unmet needs. The massive potential for applying Generative AI across all layers of support (from knowledge creation to agent interaction) represents a significant growth vector. Expansion into untapped SME markets, facilitated by accessible SaaS pricing models, offers broad adoption opportunities. Furthermore, the rising demand for industry-specific, highly customized support solutions that address unique vertical challenges (e.g., regulatory compliance tracking in finance or complex diagnostics in manufacturing) allows vendors to capture premium market segments. These forces combine to create an environment where rapid innovation, especially concerning intelligent automation and integrated data analytics, determines market leadership.

Segmentation Analysis

The Customer Support Software Market is meticulously segmented based on components, deployment modes, organization size, application type, and industry vertical, allowing for granular analysis of market demand and tailored solution development. This comprehensive segmentation helps businesses identify specific pain points and target offerings that align with distinct operational requirements, technological maturity, and budgetary constraints of various enterprise sizes and sectors. The shift toward cloud deployment and the specialized nature of applications targeting advanced automation are the key features driving the differential growth rates across these segments.

By component, the division between Solutions (the core software offerings like ticketing systems, call center software) and Services (consulting, implementation, maintenance) reflects how companies consume support technology. Deployment modes highlight the fundamental architectural preference between flexible, subscription-based Cloud/SaaS models and traditional On-premise installations. Application types distinguish between functionalities such as customer relationship management (CRM), contact center management, and self-service portals, each addressing specific customer interaction needs. Finally, vertical segmentation demonstrates the customized requirements of industries ranging from highly digitalized e-commerce to highly regulated public sector entities.

- By Component:

- Solutions (Ticketing System, CRM, Knowledge Management, Reporting & Analytics, Omnichannel Routing)

- Services (Professional Services, Managed Services, Training & Consulting)

- By Deployment Mode:

- Cloud (SaaS)

- On-Premise

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Application/Functionality:

- Call Center & Contact Center Management

- Social Media & Community Management

- Self-Service & Knowledge Management

- Chatbots & Virtual Assistant Automation

- Reporting & Analytics

- Field Service Management

- By Industry Vertical:

- Banking, Financial Services, and Insurance (BFSI)

- Retail & E-commerce

- Telecommunications & IT

- Healthcare & Life Sciences

- Government & Public Sector

- Manufacturing

- Travel & Hospitality

Value Chain Analysis For Customer Support Software Market

The Value Chain for the Customer Support Software Market commences with Upstream activities, primarily involving technology development and intellectual property creation. This stage is dominated by core software vendors and independent software vendors (ISVs) who invest heavily in R&D focused on proprietary algorithms, AI/ML models (especially GenAI and NLP capabilities), secure cloud infrastructure, and robust API development. Key inputs include advanced computational resources, cloud computing services (e.g., AWS, Azure, Google Cloud), and specialized engineering talent. Strategic partnerships with foundational technology providers are crucial here to ensure access to cutting-edge tools and infrastructure necessary for developing scalable, high-performance support platforms. Success in the upstream segment is defined by innovation velocity and the ability to maintain a competitive technological edge.

Midstream activities focus on the actual distribution and implementation of the software solution. The Distribution Channel is heavily skewed towards Direct sales, especially for large enterprise contracts, where vendors manage complex sales cycles, negotiation, and dedicated professional services for deployment. However, Indirect channels, including value-added resellers (VARs), system integrators (SIs), and managed service providers (MSPs), play a pivotal role, particularly in reaching SMEs and regional markets where local expertise is essential. SaaS deployment models simplify distribution logistics but intensify the need for robust channel partner ecosystems capable of providing implementation, customization, and ongoing support services, effectively bridging the gap between vendor capabilities and end-user needs. The effectiveness of the distribution channel hinges on the quality of partnerships and the speed of solution deployment.

Downstream activities involve post-sales services, customer utilization, and continuous improvement based on feedback. This includes ongoing technical support, continuous feature updates delivered via the cloud, maintenance, and comprehensive training programs designed to maximize user adoption and platform utilization. Feedback loops from the end-user (customer support agents and customers themselves) feed directly back into the Upstream R&D process, ensuring the product evolves to meet dynamic market demands. The value delivered downstream is measured by customer satisfaction (CSAT), operational efficiency gains, and the overall total cost of ownership (TCO) for the buyer. Customer success initiatives are critical in this phase, ensuring high retention rates for subscription-based revenue models, which are central to market profitability.

Customer Support Software Market Potential Customers

The Customer Support Software Market’s potential customers span across nearly every sector that engages directly with consumers or business clients, necessitating structured, trackable, and efficient service delivery. The primary End-Users/Buyers include Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Heads of Customer Experience (CX) or Customer Service within large enterprises, who prioritize robust, scalable, and feature-rich platforms integrated into their existing CRM ecosystems. For Large Enterprises, particularly in finance and telecommunications, the focus is on achieving compliance, high uptime, and advanced predictive analytics capabilities to manage massive transaction volumes and customer bases globally.

A rapidly expanding segment of buyers comprises Small and Medium-sized Enterprises (SMEs), particularly those engaged in e-commerce, software development, and specialized B2B services. These buyers are primarily attracted to flexible, affordable, and rapidly deployable Cloud (SaaS) solutions that offer essential ticketing, chat, and self-service functionalities without the heavy IT overhead associated with on-premise solutions. Their purchasing decision is heavily influenced by ease of use, time-to-value, and the ability to scale subscriptions based on immediate growth. The shift towards digital-first operations means even niche businesses are now potential customers for sophisticated support platforms.

Furthermore, departmental heads within specific verticals, such as hospital administrators (seeking patient support tools) or logistics managers (needing supply chain visibility and tracking support), represent high-value, specialized customer segments. The underlying driver for all potential customers is the strategic imperative to reduce customer friction, improve resolution speed, and use customer interaction data as a competitive intelligence asset, thereby transforming the support function from a cost center into a strategic value generator.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.8 Billion |

| Market Forecast in 2033 | USD 37.1 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zendesk, Salesforce, Oracle, Microsoft, HubSpot, ServiceNow, SAP, Freshworks, Genesys, Zoho Corporation, Intercom, PegaSystems, LiveChat, Kustomer (A Meta Company), Twilio, NICE, Five9, SugarCRM, HappyFox, BMC Software |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Customer Support Software Market Key Technology Landscape

The technology landscape of the Customer Support Software Market is defined by rapid innovation centered on cloud computing, Artificial Intelligence, and highly flexible integration architectures. Cloud-native SaaS infrastructure remains the dominant foundational technology, providing unparalleled scalability, rapid deployment capabilities, and reliable uptime, essential for global operations. This adoption allows vendors to push continuous updates and advanced features, ensuring all clients are always operating on the latest version, which accelerates the integration of emerging capabilities like Generative AI. Furthermore, the reliance on advanced Application Programming Interfaces (APIs) and Microservices architecture is paramount, enabling seamless integration between the support software and disparate enterprise systems (e.g., billing, inventory, marketing automation) without disruptive customization, facilitating the creation of true 360-degree customer views.

Artificial Intelligence (AI) and Machine Learning (ML) are the most disruptive technologies influencing feature development. Core AI applications include Natural Language Processing (NLP) for sophisticated understanding of customer intent across text and voice channels, and ML algorithms for predictive analytics, forecasting agent workload, and routing complex tickets efficiently. The recent surge in Large Language Models (LLMs) and Generative AI is shifting the paradigm from rule-based chatbots to highly conversational and context-aware virtual assistants, capable of handling complex interactions and providing instant, human-quality responses. This also extends to internal use, where GenAI assists agents by instantly summarizing complex case histories and drafting customized replies, dramatically reducing handling time and training periods for new staff.

Other crucial technological advancements include advanced biometric and voice authentication technologies to secure access in contact center environments, particularly in the BFSI sector. The shift towards headless commerce and micro-frontends is influencing how customer service widgets and self-service portals are developed, prioritizing a frictionless user experience embedded directly within the customer's application journey. Furthermore, advanced data visualization and reporting tools are becoming mandatory, leveraging technologies like real-time streaming data processing to provide CX leaders with instant operational dashboards and performance metrics, allowing for agile decision-making based on current service level agreements (SLAs) and agent performance indicators.

Regional Highlights

- North America: North America, comprising the United States and Canada, holds the largest market share globally in the Customer Support Software Market. This dominance is primarily attributed to the early and widespread adoption of advanced technologies, substantial investment capacity in digital infrastructure, and the presence of numerous large enterprises demanding sophisticated, cloud-based, AI-integrated customer relationship management (CRM) and support solutions. The competitive landscape mandates constant innovation in CX, leading to high expenditure on solutions incorporating predictive analytics and omnichannel capabilities. High regulatory standards in sectors like finance and healthcare also drive demand for robust, secure, and compliant software solutions.

- Europe: The European market demonstrates steady growth, driven by stringent customer data protection regulations such as GDPR, which necessitate high levels of security and compliance features within support software. The primary focus for European companies is achieving seamless integration across fragmented markets and maintaining multilingual support capabilities efficiently. Western European countries, including the UK, Germany, and France, lead the adoption curve, with strong traction in the SaaS and cloud deployment segments. The market is increasingly adopting automated solutions to offset higher labor costs and improve service consistency across the Union.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region during the forecast period. This rapid expansion is fueled by massive growth in e-commerce, increasing internet and mobile penetration, and the accelerated digital transformation initiatives across emerging economies like India, China, and Southeast Asian nations. While large enterprises in developed APAC markets adopt advanced AI and sophisticated contact center solutions, the vast SME segment is rapidly adopting affordable, scalable cloud-based ticketing and chat tools. Investment in localized language support and mobile-first CX solutions are key growth drivers in this diverse region.

- Latin America (LATAM): The LATAM market is characterized by increasing foreign investment and a growing awareness of digital customer engagement importance. Adoption is accelerating, driven primarily by the shift from legacy systems to flexible cloud models. Economic instability in certain areas can be a restraint, but the underlying need for cost-effective, multi-channel communication tools ensures continuous moderate growth, particularly in countries like Brazil and Mexico, which possess large, digitally active consumer bases.

- Middle East and Africa (MEA): The MEA region is witnessing slow but determined growth, largely concentrated in the Gulf Cooperation Council (GCC) states due to significant governmental investment in smart city initiatives and digitalization across the public sector, BFSI, and telecommunications industries. The market is primarily adopting basic ticketing and omnichannel integration tools, with high potential for growth as digital maturity increases, especially in high-growth economies in South Africa and the UAE, where customer service differentiation is becoming a competitive necessity.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Customer Support Software Market.- Zendesk

- Salesforce

- Oracle Corporation

- Microsoft Corporation

- HubSpot Inc.

- ServiceNow Inc.

- SAP SE

- Freshworks Inc.

- Genesys

- Zoho Corporation

- Intercom

- PegaSystems

- LiveChat Inc.

- Kustomer (A Meta Company)

- Twilio Inc.

- NICE Ltd.

- Five9 Inc.

- SugarCRM

- HappyFox Inc.

- BMC Software

Frequently Asked Questions

Analyze common user questions about the Customer Support Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of Customer Support Software?

The primary driver is the overwhelming demand from modern consumers for seamless, personalized, and immediate omnichannel experiences. Businesses are compelled to adopt sophisticated software to centralize communication channels (chat, email, social media, voice) and ensure fast, consistent resolution across every touchpoint, which directly impacts customer retention and brand loyalty.

How is Generative AI transforming the role of human agents in customer support?

Generative AI is transforming the agent role by acting as a powerful co-pilot, automating low-complexity tasks like summarizing large case histories, drafting standard replies, and retrieving knowledge base content instantly. This augmentation allows human agents to focus their expertise on high-value, emotionally sensitive, or complex problem-solving interactions, improving overall job satisfaction and service quality.

Which deployment model dominates the Customer Support Software Market?

The Cloud (SaaS) deployment model significantly dominates the market. SaaS offers superior benefits in terms of flexibility, reduced upfront capital expenditure, rapid scalability, and automatic software updates, making it the preferred choice for both Large Enterprises seeking agility and SMEs requiring low operational overhead.

What are the main risks associated with implementing new customer support systems?

Key risks include poor integration with existing fragmented legacy systems (leading to data silos), significant security and data privacy breaches, user resistance to new workflows, and failing to secure sufficient internal training, which often results in underutilization of the platform's advanced features and a poor return on investment (ROI).

Which industry vertical is projected to show the highest growth rate in this market?

The Retail and E-commerce vertical is projected to show one of the highest growth rates. The massive transactional volumes, the critical need for post-sale support (returns, tracking), and the competitive pressure to offer 24/7 service due to global sales necessitate continuous, rapid investment in scalable and automated support technologies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager