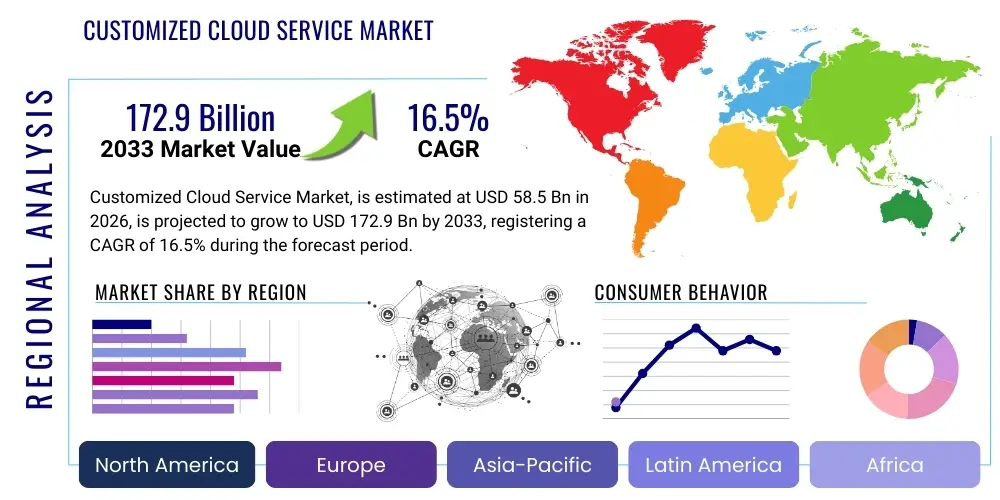

Customized Cloud Service Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436433 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Customized Cloud Service Market Size

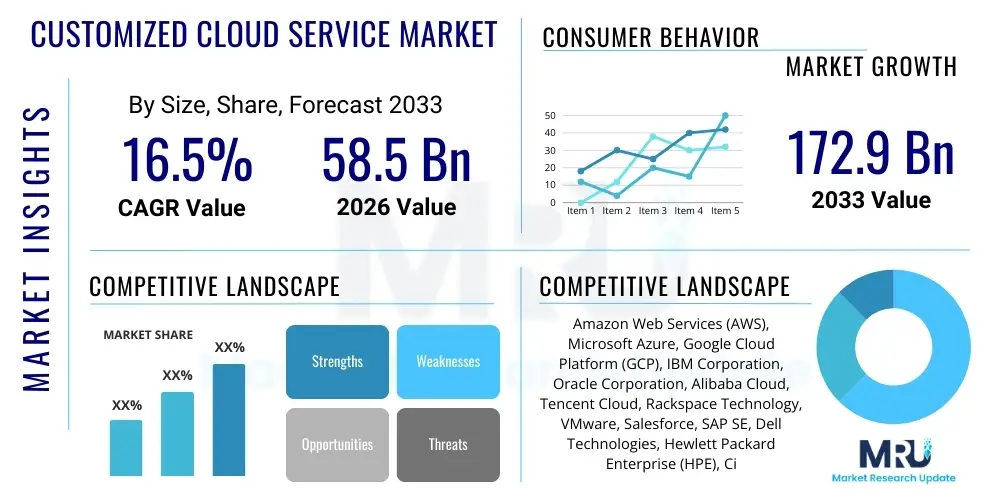

The Customized Cloud Service Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 16.5% between 2026 and 2033. The market is estimated at $58.5 Billion in 2026 and is projected to reach $172.9 Billion by the end of the forecast period in 2033.

Customized Cloud Service Market introduction

The Customized Cloud Service Market involves the provisioning of cloud computing resources—spanning Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS)—that are meticulously tailored to meet the specific, unique operational, security, and compliance requirements of individual organizations. Unlike standard multi-tenant cloud offerings, customized services provide dedicated resources, specialized configurations, and architecture designed from the ground up to integrate seamlessly with the client's existing IT ecosystem, ensuring optimal performance for mission-critical applications and specialized workloads. This bespoke approach offers enhanced control, predictable performance, and stringent data sovereignty capabilities, which are paramount for highly regulated industries.

The core product description encompasses not just dedicated physical infrastructure, but also highly granular configuration controls over network topology, storage solutions, computing power scaling parameters, and unique middleware integration. Major applications for these services include complex enterprise resource planning (ERP) systems, high-performance computing (HPC) for scientific research and financial modeling, large-scale data analytics platforms requiring localized processing, and secure environments for sensitive regulatory data (such as HIPAA in healthcare or PCI DSS in finance). The increasing complexity of digital transformation initiatives, coupled with stricter global regulatory landscapes, necessitates this level of customization, driving market expansion.

Key benefits driving the market include superior workload performance due to dedicated resources, reduced operational latency, improved security posture through isolation and customized access controls, and flexibility in resource management that standard public cloud models often cannot match. Furthermore, the rising need for hybrid and multi-cloud environments—where organizations blend different cloud models to achieve redundancy and compliance—makes customized cloud services essential components for bridging gaps between on-premise systems and external infrastructure. These driving factors solidify the critical role of bespoke cloud solutions in the modern enterprise IT strategy.

Customized Cloud Service Market Executive Summary

The Customized Cloud Service Market is currently experiencing robust growth, primarily fueled by significant business trends emphasizing deep digital transformation, regulatory compliance enforcement, and the strategic shift toward hybrid and multi-cloud architectures. Enterprises are moving beyond commoditized cloud consumption and are demanding highly specialized environments that guarantee resource isolation, low latency, and adherence to specific geographical data residency rules. This trend is accelerating demand in sectors like BFSI and Healthcare, where data governance is non-negotiable. Technology-wise, the focus is on integrating specialized hardware (like FPGAs and specialized GPUs) into cloud offerings to support computationally intensive custom workloads, such as advanced AI model training and sophisticated risk analysis.

Regionally, North America continues to dominate the market share due to the early and rapid adoption of advanced cloud technologies, the presence of major hyperscale providers, and stringent regulatory frameworks that mandate localized data handling and sophisticated security configurations. However, the Asia Pacific (APAC) region is demonstrating the highest growth trajectory, driven by massive investments in digital infrastructure by emerging economies (China, India) and the accelerating adoption of cloud services across diverse industrial bases, particularly manufacturing and e-commerce, which are increasingly seeking tailored solutions for supply chain optimization and localized data processing requirements.

Segment trends indicate a strong preference for customized PaaS and IaaS solutions, as these provide the foundational control necessary for specialized application deployment and data management. While Public Cloud remains the largest deployment segment, the Hybrid Cloud model is experiencing the fastest growth, directly correlating with the demand for customization that effectively links proprietary, on-premise systems with scalable, external cloud resources. Organizationally, Large Enterprises are the primary consumers due to their complex operational requirements, but Small and Medium Enterprises (SMEs) are increasingly adopting entry-level customized cloud packages to gain competitive advantages in security and performance without the substantial upfront investment of traditional IT infrastructure.

AI Impact Analysis on Customized Cloud Service Market

User queries regarding AI's impact on Customized Cloud Services frequently center on three key areas: how AI tools enhance the efficiency of customization and management, whether specialized infrastructure is required for advanced AI/ML workloads, and the security implications of using AI to manage highly sensitive customized environments. Users are primarily concerned with whether AI can automate the complex provisioning and optimization tasks inherent in bespoke cloud setups, thereby reducing management overhead and costs. There is a high expectation that AI/ML models, especially Generative AI, will be used to predict resource needs, automatically configure optimal network paths, and proactively identify and mitigate security vulnerabilities specific to their custom architecture. The analysis reveals a clear demand for AI-driven orchestration layers that transform static customized environments into highly adaptive, self-optimizing cloud solutions.

- AI drives the demand for specialized cloud hardware (GPUs, NPUs, FPGAs) requiring customized IaaS configurations.

- Generative AI tools automate the complex process of designing and provisioning bespoke cloud architectures tailored to specific application blueprints.

- AI-powered operations (AIOps) enhance predictive maintenance, automated scaling, and intelligent resource allocation within customized cloud environments, maximizing efficiency.

- Machine learning algorithms significantly improve the security posture of customized clouds by identifying unique behavioral anomalies and zero-day threats specific to the isolated environment.

- AI facilitates hyper-personalization of cloud billing and usage reporting, providing granular insights into the costs associated with highly specialized resource consumption.

- AI tools assist in complex compliance checks and data governance enforcement, ensuring customized setups strictly adhere to regional data residency and regulatory mandates.

DRO & Impact Forces Of Customized Cloud Service Market

The Customized Cloud Service Market is propelled by powerful drivers centered on the imperative for digital differentiation and stringent regulatory requirements, while simultaneously facing constraints related to cost and operational complexity. Key drivers include the exponential growth in data volumes requiring localized processing, the critical need for application-specific performance guarantees (especially in time-sensitive industries like trading and real-time manufacturing), and the accelerating adoption of advanced technologies like IoT and 5G, which demand localized, high-throughput cloud edge infrastructures. These forces create a potent environment where off-the-shelf cloud solutions are insufficient, forcing enterprises to seek tailored architectures that guarantee quality of service (QoS) and meet strict enterprise-level SLAs.

However, the market faces significant restraints, primarily concerning the initial high costs associated with bespoke infrastructure design, implementation, and the specialized expertise required to manage these environments. The lack of standardized tools and skillsets for administering highly heterogeneous customized clouds presents a critical operational hurdle, often leading to vendor lock-in as clients become heavily reliant on the specific provider that built their architecture. Furthermore, the inherent complexity of integrating custom cloud components with legacy IT systems often leads to extended deployment times and greater initial implementation risk, deterring smaller organizations from immediate adoption.

Opportunities in this market are vast, particularly in developing hyper-converged, industry-specific cloud platforms—such as ‘FinCloud’ for financial services or ‘HealthCloud’ for healthcare—that pre-package compliance and specialized application support into a customizable framework. The growing trend of sovereign cloud initiatives across Europe and Asia Pacific also presents a significant opportunity for providers specializing in tailored data residency solutions. The impact forces are overwhelmingly positive, driven by the escalating cost of non-compliance and the recognized strategic advantage gained from optimized, customized IT infrastructure, making the investment in bespoke cloud solutions increasingly justifiable despite the higher capital expenditure.

Segmentation Analysis

The Customized Cloud Service Market is intricately segmented across various dimensions, reflecting the diverse requirements and maturity levels of different enterprise clients. Segmentation by Service Model (IaaS, PaaS, SaaS) is fundamental, dictating the level of infrastructure control provided to the end-user, with IaaS typically offering the highest degree of customization necessary for specialized workloads. Segmentation by Deployment Model (Public, Private, Hybrid) captures the architectural choices enterprises make based on sensitivity, security needs, and regulatory mandates, with Hybrid Cloud currently serving as the fastest-growing segment due to its ability to blend control and scalability.

Further granularity is achieved through segmentation by Industry Vertical, which highlights the highly specialized needs of sectors like BFSI (requiring high security and compliance customization), Healthcare (demanding HIPAA compliance and data sovereignty), and Manufacturing (focusing on IoT integration and low-latency edge computing). These vertical-specific customized solutions incorporate industry-standard configurations and compliance readiness, significantly reducing the deployment timeline for new clients in these sectors. Finally, segmentation by Organization Size distinguishes the offerings required by Large Enterprises—which demand complex, multi-region architectures—versus the standardized but tailored packages appropriate for Small and Medium Enterprises (SMEs).

- By Service Model: IaaS (Infrastructure as a Service), PaaS (Platform as a Service), SaaS (Software as a Service), Customized Managed Services

- By Deployment Model: Private Cloud, Hybrid Cloud, Public Cloud (Specialized Instances), Community Cloud

- By Industry Vertical: Banking, Financial Services, and Insurance (BFSI), IT and Telecommunications, Healthcare and Life Sciences, Government and Public Sector, Retail and E-commerce, Manufacturing, Media and Entertainment, Energy and Utilities

- By Organization Size: Small and Medium Enterprises (SMEs), Large Enterprises

Value Chain Analysis For Customized Cloud Service Market

The value chain for the Customized Cloud Service Market is highly complex, beginning with upstream hardware and foundational software providers and culminating in highly specialized consulting and integration services delivered to the end-user. Upstream analysis involves suppliers of critical hardware components, including semiconductor manufacturers (for specialized CPUs, GPUs, FPGAs), network equipment providers (for highly configurable SDN/NFV solutions), and storage vendors (providing high-speed, persistent storage optimized for custom workloads). The initial integration and operating system layer is provided by infrastructure software vendors and virtualization technology specialists, who lay the groundwork for resource partitioning and management within the custom environment.

Midstream activities are dominated by the Customized Cloud Service Providers themselves—often hyperscalers or specialized niche vendors—who focus on architecting, provisioning, and maintaining the bespoke environment. This involves deep consulting to understand client requirements, translating those needs into specific infrastructure and software configurations, and managing the dedicated physical or logical isolation. Distribution channels are typically Direct, especially for large enterprise contracts, where the sales process requires intricate technical negotiations and customized service level agreements (SLAs). Indirect distribution occurs through system integrators (SIs) and Managed Service Providers (MSPs) who bundle the customized cloud services with broader IT transformation projects, often targeting specialized industry segments.

Downstream analysis focuses on the end-user deployment and continuous optimization. This phase involves extensive integration services, connecting the newly customized cloud environment back to the client’s legacy systems, security platforms, and specialized applications. Direct channels ensure continuous support, personalized security audits, and dedicated engineering resources focused solely on the client’s unique setup. The complexity of these customized environments makes ongoing monitoring and optimization critical, often requiring specialized third-party software and consulting partners to ensure the environment maintains peak performance and compliance standards throughout its lifecycle.

Customized Cloud Service Market Potential Customers

The primary potential customers in the Customized Cloud Service Market are organizations operating in environments characterized by strict regulatory oversight, demanding performance requirements, or a need for deep integration with proprietary, mission-critical legacy systems. Large Enterprises, particularly those in the BFSI sector, stand out as major buyers. These financial institutions require customized private or hybrid clouds to adhere to stringent data residency laws (like GDPR or CCPA) and specialized security protocols for high-frequency trading platforms or sensitive customer data management, making them heavy consumers of bespoke IaaS and PaaS solutions that ensure dedicated resources and cryptographic control.

Another significant segment comprises the Healthcare and Life Sciences industry, which mandates customized environments compliant with regulations such as HIPAA, requiring guaranteed data isolation and audit trails that standard public cloud environments struggle to provide without extensive modification. Research institutions and pharmaceutical companies also require customized High-Performance Computing (HPC) environments tailored for complex computational biology, drug discovery, and genomic analysis, demanding dedicated server clusters and specialized networking configurations that can only be achieved through customized cloud provisioning.

Furthermore, Government and Public Sector entities globally represent critical potential customers, frequently requiring sovereign cloud solutions or highly segmented community clouds where access is restricted to authorized agencies, often dictated by national security or jurisdictional data laws. These customers prioritize geopolitical control, absolute data sovereignty, and robust security measures, leading them to engage directly with providers capable of building and maintaining fully customized, dedicated infrastructures residing within specific geographical boundaries and managed by locally vetted personnel.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $58.5 Billion |

| Market Forecast in 2033 | $172.9 Billion |

| Growth Rate | CAGR 16.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Corporation, Oracle Corporation, Alibaba Cloud, Tencent Cloud, Rackspace Technology, VMware, Salesforce, SAP SE, Dell Technologies, Hewlett Packard Enterprise (HPE), Cisco Systems, Fujitsu, Capgemini, Accenture, Tata Consultancy Services (TCS), Infosys, Wipro |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Customized Cloud Service Market Key Technology Landscape

The technology landscape for Customized Cloud Services is defined by sophisticated infrastructure management tools and specialized hardware integration designed to deliver isolation and flexibility beyond standard virtualization. Key technologies include advanced Software-Defined Networking (SDN) and Network Functions Virtualization (NFV), which allow providers to create complex, granular network topologies tailored to client security models, enabling micro-segmentation and dedicated low-latency paths critical for high-performance applications. Hyper-converged Infrastructure (HCI) solutions are also paramount, blending compute, storage, and networking into a single, highly flexible customized unit, simplifying resource scaling and management for private and hybrid cloud deployments while ensuring resource dedication.

Another crucial area involves advanced containerization and orchestration technologies, primarily Kubernetes, which are customized to manage containerized workloads within dedicated or isolated clusters. This customization extends to the underlying operating system and security policies applied specifically to the container runtime, guaranteeing compliance and performance integrity for multi-tenant applications running on specialized infrastructure. Furthermore, the integration of specialized hardware accelerators—such as Graphics Processing Units (GPUs) for AI/ML workloads, Field-Programmable Gate Arrays (FPGAs) for ultra-low latency processing, and dedicated Tensor Processing Units (TPUs)—is essential, requiring providers to customize the bare-metal access and software stack integration to maximize the performance benefits for bespoke workloads.

Security technologies are perhaps the most critical component, focusing on zero-trust architectures implemented at a fundamental level within the custom environment. This includes hardware security modules (HSMs) for customized key management, tailored Identity and Access Management (IAM) systems integrated with the client’s existing directory services, and advanced cryptographic techniques for data-at-rest and data-in-transit unique to the client’s architecture. These technologies ensure that the inherent isolation of the customized environment is maintained, providing the highest level of assurance needed by regulated industries and demonstrating technical maturity in handling highly sensitive customized cloud deployments.

Regional Highlights

- North America (Dominant Market Share): North America holds the largest share in the Customized Cloud Service Market, primarily driven by the presence of major hyperscale cloud providers and an advanced technological ecosystem that fosters early adoption. The region benefits from significant enterprise spending on complex digital transformation projects, particularly in the financial services, healthcare, and technology sectors, which mandate high levels of customization for compliance (e.g., SOX, HIPAA) and performance optimization. The robust venture capital funding directed towards AI and HPC startups also fuels demand for specialized, customizable infrastructure, cementing the region's lead in market value.

- Europe (Rapid Growth in Sovereign Cloud): Europe is characterized by stringent data sovereignty and residency regulations, notably GDPR, which serves as a major catalyst for the customized cloud market. The growing political and economic emphasis on establishing 'European' or 'Sovereign' cloud infrastructures encourages enterprises and governments to opt for customized private and community clouds tailored to national jurisdiction laws. Countries like Germany, France, and the UK are heavy investors in customized solutions, seeking to ensure that sensitive public sector and critical infrastructure data remains managed within specific national borders, driving high growth in hybrid cloud deployments.

- Asia Pacific (Highest Growth Trajectory): APAC represents the fastest-growing region, propelled by accelerating industrialization, large-scale urbanization, and government initiatives promoting digital economies (e.g., Digital India, China’s investments in 5G and AI). Rapid expansion of the manufacturing and e-commerce sectors demands customized solutions for complex supply chain logistics, IoT data processing, and localized customer engagement platforms. While initial adoption was focused on public cloud, the burgeoning awareness of data sovereignty and the sheer scale of operational complexity for large Asian conglomerates are rapidly shifting demand toward highly customized hybrid and multi-cloud environments, particularly in emerging economic hubs.

- Latin America (Focus on Local Data Centers): Latin America’s market growth is steady, driven mainly by the financial services and mining sectors that require specialized data security and localized processing due to specific regional regulations. The customization demand often centers on ensuring that data physically resides within the country of origin, leading to investments in highly secured, localized private cloud setups offered by both global and regional providers who understand the distinct regulatory environment of major economies like Brazil and Mexico.

- Middle East and Africa (MEA) (Investment in Critical Infrastructure): The MEA region, particularly the GCC countries, is witnessing significant growth fueled by massive government investments in smart city initiatives, energy diversification, and national digital security programs. These mega-projects necessitate highly customized, secure cloud infrastructures that prioritize sovereign control and performance predictability for critical infrastructure applications, creating high demand for custom cloud services related to security compliance and disaster recovery solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Customized Cloud Service Market.- Amazon Web Services (AWS)

- Microsoft Azure

- Google Cloud Platform (GCP)

- IBM Corporation

- Oracle Corporation

- Alibaba Cloud

- Tencent Cloud

- Rackspace Technology

- VMware Inc.

- Salesforce

- SAP SE

- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Cisco Systems Inc.

- Fujitsu Limited

- Capgemini

- Accenture PLC

- Tata Consultancy Services (TCS)

- Infosys Limited

- Wipro Limited

Frequently Asked Questions

Analyze common user questions about the Customized Cloud Service market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between standard public cloud and customized cloud services?

The primary difference lies in resource allocation and configuration control. Standard public cloud services offer shared, multi-tenant infrastructure with fixed configuration options. Customized cloud services provide dedicated or highly isolated resources (physical or logical), bespoke architecture design, specialized hardware integration, and granular control over network, storage, and security policies tailored to unique enterprise requirements and compliance mandates.

Which industry verticals benefit most from adopting customized cloud solutions?

Industry verticals with stringent regulatory requirements and high-performance computing needs benefit most. These include Banking, Financial Services, and Insurance (BFSI) due to high security and data residency laws, Healthcare and Life Sciences (for HIPAA/GDPR compliance and genomic research), and Government/Public Sector organizations requiring sovereign cloud infrastructure and absolute data segregation for national security purposes.

What are the main financial implications and barriers to entry for customized cloud services?

The main financial barrier is the high initial cost and operational expenditure compared to standard cloud offerings. Customized services require dedicated engineering time for architecture design, specialized hardware acquisition, and complex integration with existing systems. While the Total Cost of Ownership (TCO) can be favorable long-term due to performance gains and compliance mitigation, the high upfront investment often deters Small and Medium Enterprises (SMEs).

How does AI technology enhance the utility and management of customized cloud platforms?

AI significantly enhances customized cloud platforms through AIOps, automating highly complex management tasks such as predictive resource scaling, proactive performance optimization, and autonomous security management. AI tools analyze bespoke configurations to ensure continuous compliance enforcement and rapidly identify configuration drifts or security threats specific to the unique architecture, thereby reducing human intervention and operational latency.

What role do Hybrid and Private cloud models play in the growth of customized services?

Hybrid and Private cloud models are essential growth drivers for customization. Private clouds inherently require customization for isolation and integration, forming the core of many bespoke solutions. Hybrid cloud requires specific architectural tailoring to ensure seamless, compliant, and high-performance interconnectivity between dedicated on-premise infrastructure and scalable external cloud resources, making customization mandatory for effective multi-cloud strategies.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager