Cut Flower Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433848 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Cut Flower Packaging Market Size

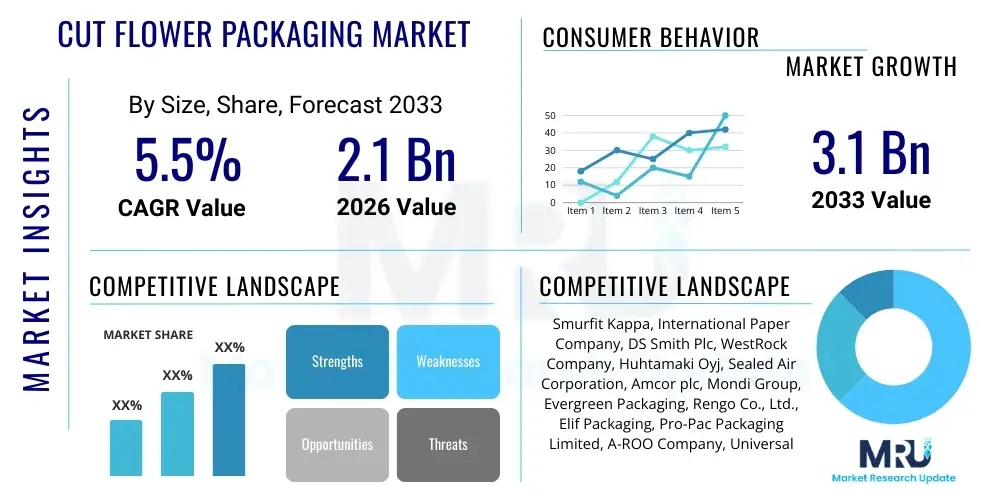

The Cut Flower Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 2.1 Billion in 2026 and is projected to reach USD 3.1 Billion by the end of the forecast period in 2033.

Cut Flower Packaging Market introduction

The Cut Flower Packaging Market encompasses specialized materials and containers designed to protect fresh cut flowers during handling, transportation, and retail display, ensuring their aesthetic integrity and extending their shelf life. Products range from basic wraps and sleeves to sophisticated water-retaining structures, boxes, and pouches made primarily from plastics, paperboard, and various biodegradable polymers. The primary objective of effective cut flower packaging is dual: physical protection against damage and environmental control (temperature, humidity) to minimize dehydration and spoilage. Advanced packaging often incorporates features such as ventilation holes, anti-fog coatings, and built-in water sources to maintain freshness from farm to consumer.

Major applications of cut flower packaging span wholesale distribution, retail floristry, supermarkets, and increasingly, direct-to-consumer e-commerce fulfillment, which demands robust and attractive presentation-ready solutions. Key benefits derived from high-quality packaging include reduced product waste, enhanced brand perception, and facilitation of complex logistical chains, especially for high-value or long-distance shipments. The driving factors for market growth are strongly linked to the rising global demand for flowers, driven by urbanization, expanding gifting culture, and the explosive growth of online flower delivery platforms that necessitate specialized protective packaging that can withstand parcel shipping environments. Furthermore, stringent global regulations promoting sustainability are accelerating the shift towards compostable and recyclable packaging materials, fundamentally reshaping the product landscape.

Cut Flower Packaging Market Executive Summary

The global Cut Flower Packaging Market is currently characterized by a significant transition toward environmentally friendly materials, moving away from conventional single-use plastics in favor of sustainable substrates such as recycled paperboard, corrugated materials, and bio-based polymers. This business trend is largely driven by evolving consumer preferences in Western markets (Europe and North America) where ecological accountability is a core purchasing criterion. Packaging providers are investing heavily in research and development to create robust, water-resistant, yet fully compostable solutions that do not compromise the essential protective and aesthetic functions required for high-value perishable goods. Furthermore, the integration of advanced printing technologies allows for high-definition branding and personalized messaging directly onto the packaging, catering to the rising demand for premium, gift-ready floral presentations.

Regional trends indicate that Europe currently dominates the market due to its mature horticulture industry, strong focus on sustainability standards, and sophisticated cold chain logistics infrastructure; however, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by expanding domestic consumption in populous countries like China and India, coupled with increasing investments in commercial floriculture and modern retail infrastructure. Segmentation trends highlight that the Sleeves and Wraps segment, primarily for individual bouquets and bunches, remains the largest by volume, while the Boxes and Containers segment, crucial for high-volume cross-border trade and e-commerce deliveries, is anticipated to register the fastest revenue growth. Material-wise, the Paper and Paperboard segment is rapidly gaining market share over traditional plastic variants due to its superior recyclability profile and aesthetic versatility, aligning perfectly with current global sustainability mandates and end-user demands for reduced environmental impact.

AI Impact Analysis on Cut Flower Packaging Market

User queries regarding the impact of Artificial Intelligence (AI) on the cut flower packaging domain primarily revolve around three core themes: optimizing supply chain logistics for freshness, predicting demand fluctuations to reduce packaging waste, and automating quality control processes. Consumers and industry stakeholders are concerned about how AI can maintain the delicate balance between rapid delivery and product longevity, specifically asking how AI-driven cold chain monitoring can interface with intelligent packaging indicators. There is strong interest in the application of machine learning for predictive maintenance of packaging machinery and for customizing packaging designs based on algorithmic analysis of e-commerce damage rates per geographical corridor. Key expectations center on AI’s ability to minimize material use through precise pattern cutting and dynamic sizing algorithms, ensuring 'right-sized' packaging for every shipment, thereby addressing both cost efficiency and sustainability goals.

AI is set to revolutionize inventory management for packaging materials by using demand forecasting models that analyze historical sales, seasonal trends, and macro-economic indicators, minimizing obsolescence and ensuring just-in-time material availability for producers. Furthermore, computer vision systems, powered by AI, are increasingly deployed on production lines to detect defects in packaging integrity, print quality, and sealing effectiveness at high speeds, significantly improving overall product reliability before flowers enter the cold chain. This integration of predictive analytics and automated inspection enhances operational efficiency and directly contributes to a reduction in floral waste caused by compromised packaging. The ability of AI to analyze complex multivariate data—such as atmospheric conditions, transit time, and flower type—will allow for the creation of dynamically optimized packaging instructions, tailored uniquely for each specific shipment route and destination environment.

- AI-driven Predictive Analytics for Demand Forecasting of specific packaging types (e.g., holiday spikes).

- Implementation of Computer Vision for automated defect detection in packaging sleeves and wraps.

- Optimization of packaging dimensions using machine learning to minimize void fill and freight costs.

- AI integration with cold chain logistics to monitor temperature and humidity deviations, triggering intelligent packaging responses.

- Enhanced supply chain traceability through AI-analyzed sensor data embedded in smart packaging labels.

DRO & Impact Forces Of Cut Flower Packaging Market

The Cut Flower Packaging Market is shaped by a confluence of influential factors, notably the surge in e-commerce and direct-to-consumer sales (DTC), which necessitates more resilient, protective, and visually appealing packaging that functions as both transport vessel and retail display. This fundamental shift towards DTC models has acted as a potent driver, pushing manufacturers to innovate beyond simple containment to focus on thermal management and impact resistance. Conversely, the market faces significant restraints, primarily the fluctuating costs and often limited availability of high-quality sustainable raw materials, such as certified compostable polymers and recycled fiberboard. The technical challenge of achieving water resistance and structural integrity using biodegradable materials without inflating production costs significantly remains a substantial hurdle for mass adoption. Furthermore, fragmented international regulatory standards concerning composting and recycling processes complicate global supply chain harmonization and investment decisions for multinational packaging providers.

Opportunities within the market are predominantly centered on the development and commercialization of 'active' and 'smart' packaging solutions. Active packaging, which incorporates technologies like ethylene scavengers and controlled release antimicrobial agents directly into the material structure, offers a direct pathway to significantly extend the vase life of sensitive cut flowers, commanding a premium price point. Smart packaging, utilizing near-field communication (NFC) tags or QR codes, allows for enhanced consumer engagement, providing information on flower origin, care instructions, and sustainability credentials, fulfilling the modern consumer's need for transparency. These technological advancements create clear avenues for market differentiation and superior product performance, especially for premium and exotic flower varieties where loss prevention is paramount.

The primary impact forces driving strategic decisions include sustainability mandates from large retailers and floriculture associations, which pressure the entire value chain to adopt circular economy principles, making the material switch from plastic an unavoidable market requirement. Secondly, evolving consumer aesthetics and the 'unboxing' experience, catalyzed by social media, force packaging designers to treat the material not just as a protective shell but as an integral part of the product presentation, influencing purchasing behavior directly. Addressing these forces requires packaging providers to pursue continuous material science innovation and flexible manufacturing capabilities to handle seasonal spikes and custom branding requirements effectively.

Segmentation Analysis

The Cut Flower Packaging Market is comprehensively segmented based on material type, product type, and application, reflecting the diverse requirements of the floriculture industry. The segmentation by material is crucial, detailing the ongoing transition from traditional petroleum-based plastics towards ecologically sound alternatives like paper and paperboard, bioplastics, and corrugated fiberboard. Product type segmentation addresses the functionality required, ranging from lightweight sleeves for basic protection to heavy-duty boxes essential for long-haul shipping and high-end presentation. Analyzing these segments provides a clear map of market maturity and future growth pockets, particularly where sustainable materials intersect with e-commerce logistics demands.

- By Material Type:

- Plastic (Polyethylene, Polypropylene, Polyvinyl Chloride)

- Paper and Paperboard (Recycled Paperboard, Corrugated Boxes, Waxed Paper)

- Bioplastics (PLA, PHA)

- Other Materials (Non-woven fabric, Cellophane)

- By Product Type:

- Sleeves and Wraps

- Boxes and Containers (Standard Boxes, Display Boxes)

- Vase Packs and Water Retention Solutions

- Others (Labels, Inserts, Cushions)

- By Application/End-User:

- Florists and Flower Retailers

- Supermarkets and Mass Retailers

- E-commerce and Online Delivery Platforms

- Wholesale Distributors

- Horticulture Growers

Value Chain Analysis For Cut Flower Packaging Market

The value chain for the Cut Flower Packaging Market commences with the upstream activities involving raw material procurement, encompassing the sourcing of wood pulp for paperboard, petrochemicals for plastic resins, and specialized bio-feedstocks for compostable polymers. Raw material suppliers wield considerable influence, especially given the current volatility in commodity pricing and the increasing premium placed on certified sustainable inputs (e.g., FSC-certified paper or non-GMO bioplastics). Following procurement, conversion and manufacturing processes transform these raw materials into finished packaging products, involving specialized processes such as extrusion, printing, coating, lamination, and structural die-cutting tailored specifically for floral longevity and aesthetics. Efficiency and technological precision at this stage are vital for controlling costs and ensuring the integrity of protective features.

The downstream segment of the value chain is characterized by multiple distribution channels connecting packaging manufacturers to the ultimate users. Direct channels involve large-scale transactions between packaging producers and major floriculture growers or large international wholesalers who require highly customized, bulk orders, often under long-term supply contracts to ensure seasonal readiness. These direct relationships often involve collaborative design and rigorous testing to meet specific cold chain requirements. Indirect distribution involves various intermediaries, including packaging distributors, regional agents, and specialized horticulture suppliers who serve smaller local florists and supermarkets, offering a wider variety of off-the-shelf and lower-volume packaging solutions.

The complexity of the distribution channel is compounded by the perishable nature of the end product. Logistics and supply chain management for cut flower packaging must be highly responsive to seasonal peaks (e.g., Valentine's Day, Mother's Day). E-commerce platforms, representing a rapidly growing end-user segment, place unique demands on the distribution channel, requiring fast turnaround times, customization capabilities for branding, and robust secondary packaging designed to survive individual parcel handling. The optimization of the entire value chain is currently focused on shortening lead times and reducing the carbon footprint associated with material transport and final delivery, driving regionalized production closer to major floriculture hubs.

Cut Flower Packaging Market Potential Customers

Potential customers for cut flower packaging solutions are broadly categorized into entities involved in the commercial growing, distribution, and final sale of fresh flowers, all of whom share the critical need to maintain product quality during transit. Florists and small, independent flower retailers represent a significant customer base, often prioritizing aesthetic quality, easy handling, and moderate customization options for their bouquets and arrangements. They typically source packaging through indirect channels or specialized local suppliers, seeking products that enhance the artistry of their final offering and align with local consumer trends, such as high-end, minimalist paper wraps or branded tissue papers.

The largest volume buyers, however, are Supermarkets and Mass Retailers, whose primary requirement is standardized, cost-effective packaging that ensures maximum shelf life and allows for efficient, high-speed processing through their supply chain. This segment heavily favors durable sleeves and wraps, often demanding anti-fog properties and pre-printed care instructions, focusing on operational throughput and waste minimization across their extensive retail networks. E-commerce and online delivery platforms are the fastest-growing customer segment, demanding specialized transit boxes, internal cushioning systems, and integrated hydration mechanisms to guarantee a perfect arrival condition after single-parcel shipping, viewing the packaging as a critical element of the consumer 'unboxing' experience and brand identity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.1 Billion |

| Market Forecast in 2033 | USD 3.1 Billion |

| Growth Rate | 5.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Smurfit Kappa, International Paper Company, DS Smith Plc, WestRock Company, Huhtamaki Oyj, Sealed Air Corporation, Amcor plc, Mondi Group, Evergreen Packaging, Rengo Co., Ltd., Elif Packaging, Pro-Pac Packaging Limited, A-ROO Company, Universal Protective Packaging, Inc., Atlas Packaging, Robinson Paperboard Packaging, Pactiv Evergreen Inc., Coveris Holdings S.A., Graphic Packaging International, Inc., Flower Guard. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cut Flower Packaging Market Key Technology Landscape

The technological landscape of the Cut Flower Packaging Market is rapidly evolving, driven primarily by the need to balance sustainability with extended shelf life. Key technological developments focus heavily on material science, including the commercial scaling of next-generation bioplastics, such as Polylactic Acid (PLA) and Polyhydroxyalkanoates (PHA), which offer biodegradable alternatives to traditional polyethylene sleeves. Innovations in paperboard technology are equally crucial, specifically the development of moisture-resistant and structural paperboard coatings that are still fully recyclable or compostable, allowing paper-based boxes to replace corrugated plastic containers in cold, humid environments without structural failure. Furthermore, vacuum cooling and modified atmosphere packaging (MAP) technologies, originally common in fresh produce, are being adapted for large-scale floral logistics, requiring specialized films and sealable containers designed to manage internal gas composition (primarily reducing oxygen and increasing carbon dioxide) to slow down respiration and senescence, thereby dramatically extending the freshness window.

Beyond material innovation, packaging integrity and tracking technologies are gaining traction. Advanced printing techniques, including flexographic and digital printing, enable high-resolution, full-color branding and sophisticated anti-counterfeiting measures directly on the packaging material. This enhances consumer appeal and brand protection. The use of functional additives, such as ethylene absorption pads or sachets integrated within the packaging structure, represents a key element of active packaging technology. These additives selectively remove the ripening hormone ethylene, which is a major cause of premature wilting in cut flowers, ensuring the product retains quality throughout the extended supply chain, particularly relevant for international air freight.

Emerging technologies also involve digitization and the Internet of Things (IoT). Smart packaging integrates cheap, disposable sensors (temperature, humidity, shock) and RFID/NFC chips into transport boxes. These technologies facilitate real-time monitoring of environmental conditions throughout the delivery process, providing crucial data back to growers and distributors. This data allows for predictive quality assessment and immediate intervention if cold chain breaches occur. This shift towards data-driven packaging not only improves traceability but also allows packaging designs and materials to be dynamically optimized based on observed performance metrics under real-world transit stress.

Regional Highlights

The global consumption and distribution patterns of cut flowers significantly influence regional market dynamics for packaging. Europe holds a dominant position, not only due to high per capita consumption in countries like Germany, the UK, and the Netherlands but also because of the extensive flower production capabilities centered around the Netherlands (Aalsmeer auction). The European market is highly mature and fiercely regulated regarding environmental standards, driving aggressive adoption of compostable and recyclable fiber-based packaging solutions. Sustainability is not merely an option but a mandatory compliance factor, pushing packaging manufacturers operating in this region to lead the world in developing bio-based films and fully degradable coatings. Furthermore, the region’s sophisticated logistics networks necessitate packaging that integrates seamlessly with automated handling systems, focusing on stackability and standardized pallet sizing.

North America, particularly the United States, represents a massive market characterized by long distribution distances and a rapid shift towards e-commerce sales, which necessitates premium, robust, and highly protective packaging solutions. Demand here is dominated by transit boxes and specialized vase packs that guarantee secure delivery through parcel carrier networks, prioritizing impact resistance and thermal stability over short transit times. Unlike Europe, while sustainability is important, the immediate demand for functional protection due to logistical complexity often takes precedence. The cold chain management for cut flowers originating from South American producers (e.g., Colombia, Ecuador) entering North America drives the demand for highly insulated boxes and advanced temperature monitoring devices integrated into the packaging to prevent damage during extensive cross-border transport.

Asia Pacific (APAC) is projected to be the fastest-growing region, fueled by the rising disposable income, rapid urbanization, and the flourishing adoption of Western gifting traditions, especially in China, India, and Southeast Asian nations. While the market currently relies heavily on traditional plastic sleeves due to cost considerations and less mature recycling infrastructure compared to the West, there is a burgeoning segment focusing on luxury floral packaging driven by the high-end retail sector in metropolitan areas. Investment in local floriculture and the development of regional flower distribution hubs is accelerating, creating vast opportunities for packaging companies specializing in affordable, scalable, and increasingly bio-friendly materials to cater to the enormous, untapped consumer base across the region.

- North America: Strong focus on transit durability for e-commerce, high demand for insulated containers, and rapid adoption of digital tracking technologies in packaging.

- Europe: Market leader in sustainable and biodegradable packaging mandates, driven by regulatory pressure and strong consumer awareness regarding ecological impact.

- Asia Pacific (APAC): Highest projected CAGR, powered by urbanization, growth in middle-class gifting, and increasing investment in modern cold chain infrastructure.

- Latin America (LATAM): Major global exporting hub (Colombia, Ecuador, Kenya), driving demand for cost-efficient, high-volume shipping boxes and basic protective wraps for export logistics.

- Middle East and Africa (MEA): Emerging market with growing luxury segment demand, requiring specialized thermal packaging due to extreme climatic conditions, particularly in the Gulf Cooperation Council (GCC) countries.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cut Flower Packaging Market.- Smurfit Kappa

- International Paper Company

- DS Smith Plc

- WestRock Company

- Huhtamaki Oyj

- Sealed Air Corporation

- Amcor plc

- Mondi Group

- Evergreen Packaging

- Rengo Co., Ltd.

- Elif Packaging

- Pro-Pac Packaging Limited

- A-ROO Company

- Universal Protective Packaging, Inc.

- Atlas Packaging

- Robinson Paperboard Packaging

- Pactiv Evergreen Inc.

- Coveris Holdings S.A.

- Graphic Packaging International, Inc.

- Flower Guard

Frequently Asked Questions

Analyze common user questions about the Cut Flower Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most significant trend currently influencing the Cut Flower Packaging Market?

The most significant trend is the mandatory shift toward sustainability. This involves replacing conventional plastics with recyclable and compostable materials, such as bio-based polymers (PLA) and FSC-certified paperboard. This change is driven by consumer demand, retailer mandates, and stringent governmental regulations, particularly in Europe and North America.

How does e-commerce impact the design requirements for cut flower packaging?

E-commerce necessitates a radical shift in packaging design towards enhanced durability, aesthetic presentation (the unboxing experience), and specialized internal structures (like water sources or cushioning) to ensure the flowers survive single-parcel shipping environments. Packaging must function primarily as a protective transit box while still being visually appealing upon delivery.

Which material segment is expected to exhibit the fastest growth through 2033?

The Paper and Paperboard segment is expected to show the fastest revenue growth. This acceleration is due to its superior sustainability profile, versatility for branding, and continuous technological advancements that improve its moisture resistance, allowing it to increasingly replace plastic solutions across various application types, especially transit boxes.

What role do smart and active technologies play in improving flower shelf life?

Active packaging integrates functional additives like ethylene scavengers to inhibit the ripening process and antimicrobial agents to prevent decay, directly extending vase life. Smart packaging uses IoT sensors (temperature/humidity) and NFC tags to monitor cold chain integrity in real time, providing data essential for quality control and optimizing logistical routes.

Why is the Asia Pacific region considered the key future growth engine for cut flower packaging?

The Asia Pacific region’s growth is fueled by rapidly increasing domestic consumer demand for flowers, driven by urbanization and rising middle-class income. Coupled with growing investments in modern cold chain logistics and the formalization of retail flower distribution networks, this creates vast expansion opportunities for packaging providers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager