Cutting Pads Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431847 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Cutting Pads Market Size

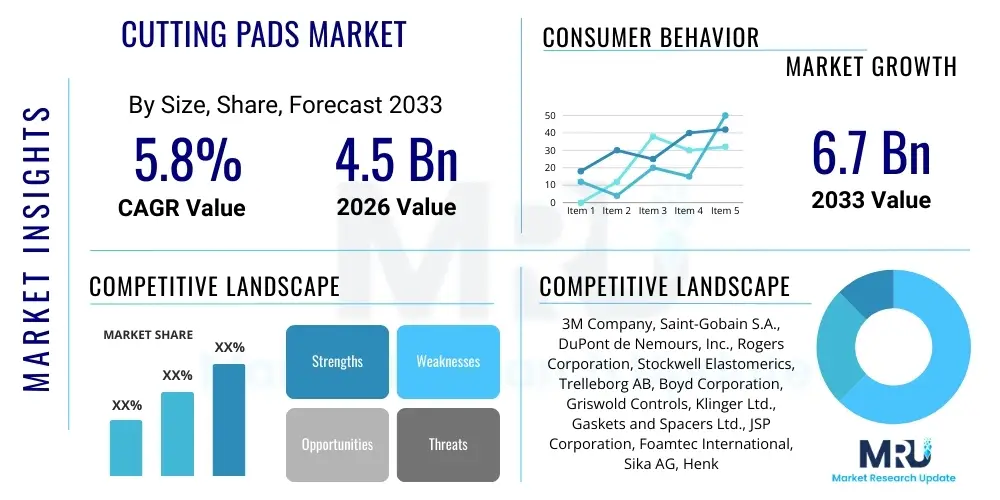

The Cutting Pads Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. This robust expansion is fueled by increasing automation across industrial sectors and the surging demand for high-precision cutting solutions in complex manufacturing processes, particularly in the electronics and automotive industries. The inherent need for durable, reliable, and application-specific protective surfaces drives consistent investment in advanced cutting pad materials and technologies, ensuring sustained market trajectory over the forecast period.

The market is estimated at $4.5 Billion in 2026, serving diverse applications ranging from textile cutting and gasket fabrication to intricate die-cutting in semiconductor manufacturing. The valuation reflects current industrial output levels, established supply chain networks, and the established penetration of polymer-based pads across key manufacturing hubs globally. Significant expenditure on R&D for composite and self-healing pad technologies contributes substantially to this baseline valuation, positioning the market for incremental growth through innovation.

It is projected to reach $6.7 Billion by the end of the forecast period in 2033. This forecast growth is strongly associated with the continued industrialization of developing economies, the sustained shift toward electric vehicle manufacturing requiring specialized component cutting, and the expanding use of automated machinery that necessitates high-quality, resilient cutting surfaces to minimize downtime and maintain operational accuracy. Market players are strategically focusing on geographical expansion and material diversification to capitalize on this projected financial increase.

Cutting Pads Market introduction

The Cutting Pads Market encompasses the global trade of protective, sacrificial, and functional surfaces used beneath cutting tools, dies, or blades to ensure clean cuts, protect underlying machinery, and extend the lifespan of tooling. These pads are crucial components in processes involving die-cutting, automated knife cutting, routing, and pressing across a spectrum of industrial and commercial applications. Products range widely in composition, primarily utilizing polymers like polyurethane, PVC, and specialized composite materials tailored to withstand varying levels of pressure, heat, and friction generated during intense cutting cycles. The selection of a cutting pad is highly dependent on the precision required and the volume of operation, making material science a core competitive factor.

Major applications of cutting pads span highly specialized industries such including the automotive sector, where they are essential for cutting interior fabrics and gaskets, the electronics industry for precision slicing of films and flexible circuits, and the textile and apparel sector for automated pattern cutting. Beyond manufacturing, they are utilized in packaging, printing, and medical device fabrication, where stringent tolerances are mandated. The primary benefit derived from utilizing these products is the preservation of tooling sharpness and the operational surface of the machinery, leading directly to reduced maintenance costs and consistent product quality. Furthermore, the cushioning and impact absorption properties of high-grade cutting pads mitigate vibration, which is critical in high-speed manufacturing environments, thereby improving overall operational efficiency and safety standards.

Key driving factors propelling the growth of this market include the global trend toward sophisticated industrial automation and the increased adoption of computer numerical control (CNC) cutting systems that rely heavily on consistent backing surfaces for optimal performance. Additionally, the proliferation of complex composite materials in end-use industries, such as aerospace and electric vehicles (EVs), necessitates the use of more advanced, durable, and sometimes self-healing cutting pads that can handle challenging material properties. Regulatory standards concerning workplace safety and the increasing focus on waste reduction in manufacturing also drive demand for superior cutting pad solutions that enhance precision and minimize material scrap, contributing significantly to market dynamism.

Cutting Pads Market Executive Summary

The global Cutting Pads Market demonstrates robust growth, primarily driven by accelerated digitalization and automation across the manufacturing landscape, leading to heightened demand for precision tooling accessories. Current business trends indicate a strong move toward developing customized, application-specific pad formulations, particularly those based on high-performance polyurethane and advanced polymer composites, to cater to the stringent requirements of micro-electronics and specialized material processing. Strategic mergers and acquisitions among key industry players are consolidating market expertise and expanding geographical footprints, while environmental concerns are simultaneously pushing manufacturers towards research into sustainable and recyclable cutting pad materials, balancing performance with ecological responsibility. The competitive dynamics are intensifying, placing a premium on product durability, cost-effectiveness, and the integration of smart features into cutting systems.

Regionally, Asia Pacific (APAC) stands out as the dominant growth engine, fueled by massive manufacturing bases in China, India, and Southeast Asian nations that are rapidly adopting automated cutting technologies across textile, automotive component, and consumer electronics production. North America and Europe, characterized by mature industrial sectors, focus heavily on premium, high-durability pads and are pioneering the integration of IoT and digital twin technologies into cutting operations, demanding specialized, high-tolerance pads capable of supporting sophisticated machinery. Emerging markets in Latin America and the Middle East are also exhibiting significant potential, supported by infrastructural development and growing domestic manufacturing capabilities, driving initial adoption rates, although price sensitivity remains a key influencing factor in these regions.

Segmentation trends reveal that the polyurethane material segment maintains the largest market share due to its superior resilience, excellent abrasion resistance, and versatility across varied cutting applications. However, the composite pads segment is projected to exhibit the highest CAGR, propelled by the increasing need to process extremely tough or abrasive materials common in aerospace and wind energy sectors. In terms of end-use, the Automotive segment remains a crucial consumer, particularly with the transition to EV production requiring specialized insulation and battery component cutting. The thickness segmentation is also witnessing a shift, with heavier duty pads gaining traction in industrial heavy machinery and thin pads becoming essential for high-precision, fine-detail work required in consumer electronics manufacturing, illustrating a bifurcation in material demands driven by specific application needs.

AI Impact Analysis on Cutting Pads Market

Common user questions regarding AI's impact on the Cutting Pads Market frequently center on whether AI-driven cutting systems necessitate new material standards, how predictive maintenance affects pad replacement cycles, and if AI can optimize cutting paths to extend pad life. Users are also concerned about the integration costs of smart monitoring systems and the potential for AI algorithms to design hyper-specific, geometry-optimized cutting pad solutions. The core themes revolve around efficiency optimization, material science adaptation, and the transition from reactive maintenance (replacing pads when worn out) to proactive, predictive maintenance guided by machine learning algorithms that analyze usage patterns, temperature fluctuations, and impact forces in real-time. Expectations include significant reductions in waste material and operational downtime due to enhanced operational intelligence.

AI's primary influence is seen in optimizing the entire cutting workflow, extending far beyond the physical pad itself. Machine learning models analyze vast datasets derived from cutting operations—including cutting force, blade temperature, vibration metrics, and material characteristics—to predict the precise moment of optimal pad replacement or resurfacing, maximizing utility and minimizing sudden failures. This predictive capability translates directly into reduced inventory holding costs for spare pads and drastically improved uptime for high-volume automated cutting machinery. Furthermore, AI contributes to design innovation by simulating the wear patterns on various material formulations, allowing manufacturers to rapidly iterate and develop pads with improved resistance to specific types of stress, moving away from generalized material use toward hyper-functionalized surfaces.

Ultimately, the adoption of AI-driven analytics is transforming cutting pads from passive accessories into integral components of a smart manufacturing ecosystem. The data generated provides feedback loops that inform material science R&D, pushing the boundaries for self-healing polymers and composite structures capable of dynamically adapting to varying operational loads. While AI does not physically manufacture the pad, it dictates the material specifications, operational deployment, and replacement schedule, fundamentally altering the procurement strategy and perceived lifecycle value of cutting pad solutions for large-scale industrial consumers who prioritize operational intelligence and continuous performance monitoring.

- AI enables predictive maintenance of cutting machinery, optimizing the timing for pad replacement and minimizing unscheduled downtime.

- Machine learning algorithms analyze usage patterns to optimize cutting paths, leading to reduced localized wear and extended pad lifespan.

- AI simulation and material informatics accelerate the development of new composite and polymer pad materials tailored for specific industrial loads.

- Integration of smart sensors into cutting pads allows for real-time monitoring of pressure, temperature, and wear, feeding data back into AI systems for operational refinement.

- Automated quality control systems use computer vision and AI to detect minute imperfections in the cut resulting from pad degradation, ensuring consistent product quality.

DRO & Impact Forces Of Cutting Pads Market

The dynamics of the Cutting Pads Market are governed by a complex interplay of internal and external forces summarized as Drivers, Restraints, and Opportunities (DRO). A primary driver is the pervasive trend of industrial automation globally, particularly the increased deployment of CNC cutting tables and automated die-cutting machinery across automotive, aerospace, and textile sectors, all requiring highly reliable sacrificial cutting surfaces. Conversely, the market faces significant restraints, chiefly stemming from the volatility of raw material prices, particularly petrochemical-derived polymers like polyurethane and PVC, which directly impact manufacturing costs and product pricing stability. Opportunities are emerging primarily through material innovation, focusing on developing sustainable, recyclable, and bio-based cutting pads to meet evolving environmental regulations and corporate sustainability mandates, alongside geographic expansion into rapidly industrializing emerging economies like Vietnam and Brazil.

The key Impact Forces significantly shaping the market include the high capital investment required for establishing advanced manufacturing facilities capable of producing high-precision, large-format cutting pads, which acts as a barrier to entry for smaller players. Furthermore, supply chain resilience is a critical factor, as disruptions in global logistics or raw material sourcing can immediately halt production of specialized polymer compounds, affecting market stability. Regulatory standards, particularly those concerning material safety and environmental compliance (e.g., restrictions on certain plasticizers or additives), mandate continuous product reformulation, impacting development costs and market accessibility. The technological pace of end-use industries also exerts pressure, as innovations like laser cutting or waterjet technologies offer competitive alternatives, compelling cutting pad manufacturers to continuously enhance product durability and cost-efficiency to maintain market relevance against non-contact cutting methods.

Specific market drivers include the accelerating demand for electric vehicle components, which require precision cutting of specialized battery insulation materials and lightweight composites, necessitating new pad specifications. Restraints also encompass the challenge of recycling worn-out, high-density polymer pads, contributing to landfill waste and generating negative environmental scrutiny. Opportunities exist in pioneering integrated pad solutions, where smart sensors are embedded within the material to provide real-time wear data (linked to AI systems), offering added value and justifying premium pricing. The market's overall equilibrium is defined by the balance between the cost of achieving high precision through traditional cutting methods versus the initial investment and running costs of alternative, non-contact technologies, with superior cutting pads serving as a crucial cost-effective component for maintaining high quality in mechanical cutting processes.

Segmentation Analysis

The Cutting Pads Market is rigorously segmented based on material composition, resulting in classifications such as Polyurethane, PVC, Rubber, and specialized Composites, reflecting the diverse physical properties required across various cutting applications. Polyurethane pads dominate due to their optimal balance of resilience, durability, and cost-effectiveness, making them highly versatile for general manufacturing. However, high-performance composites are rapidly gaining traction, specifically designed to withstand extreme pressures and chemical exposures encountered when cutting advanced materials like carbon fiber reinforced polymers or specialized metallic foils. These material distinctions directly influence the pad’s operational lifespan and the precision level achievable in the end-use process.

Further critical segmentation is defined by the End-Use Industry, encompassing sectors like Automotive, Electronics, Textile, Construction, and Medical Devices. The Automotive segment necessitates pads capable of handling large volumes and diverse materials (fabric, plastic, gaskets), driving demand for large-format, robust solutions. Conversely, the Electronics sector demands pads engineered for extreme precision and cleanliness, often involving thinner, specialized materials for film and circuit board cutting. This industrial segmentation allows manufacturers to tailor product characteristics, such as hardness (durometer), thickness, and chemical resistance, ensuring optimal performance for the specific material being processed in each sector.

Other vital segmentations include product Thickness (Thin, Standard, Heavy Duty) and Sales Channel (Direct Sales, Distributors, Online Retail). Thickness classification directly correlates with the type of cutting equipment and the depth of the material being processed, where heavy-duty pads are used in hydraulic pressing or heavy machinery, and thin pads are preferred for sensitive, high-tolerance applications. The shift towards online retail and distributor networks enhances market penetration, particularly for standardized products, while direct sales remain crucial for highly customized or proprietary composite pads required by large original equipment manufacturers (OEMs), underscoring the necessity for a multi-channel distribution strategy to capture the market comprehensively.

- By Material:

- Polyurethane

- Rubber

- PVC (Polyvinyl Chloride)

- Composite Materials

- Others (e.g., Specialized Foams)

- By Thickness:

- Thin Pads (less than 5mm)

- Standard Pads (5mm to 15mm)

- Heavy Duty Pads (above 15mm)

- By End-Use Industry:

- Automotive

- Electronics and Electrical

- Textile and Apparel

- Construction and Building Materials

- Packaging and Printing

- Medical Devices

- Aerospace and Defense

- By Sales Channel:

- Direct Sales (OEMs)

- Distributors and Wholesalers

- Online Retail and E-commerce

Value Chain Analysis For Cutting Pads Market

The Value Chain for the Cutting Pads Market begins upstream with the sourcing and refinement of raw materials, primarily petrochemical derivatives used to create polymers such as polyurethane, PVC, and various specialized elastomers. This initial stage involves intensive R&D to formulate compounds with specific physical properties, including durometer, elasticity, and abrasion resistance. Key activities at this stage include polymerization, compounding, and mixing additives to achieve the desired material characteristics suitable for different cutting environments. Successful upstream management relies heavily on securing stable, cost-effective supplies of base chemicals and maintaining proprietary knowledge regarding material formulation, which often dictates the final product's performance profile and cost structure.

The midstream process involves the manufacturing and conversion of these refined materials into finished cutting pads. This phase includes complex processes such as molding, casting, extrusion, and advanced CNC machining to cut large sheets into precise dimensions required by end-users. Quality control is paramount during conversion to ensure uniformity in thickness and surface flatness, which are critical for achieving accurate cuts. Distribution channels then facilitate the movement of the finished product downstream. Direct channels are predominantly used for serving large Original Equipment Manufacturers (OEMs) in the automotive or aerospace sectors, where technical specifications and customized solutions are mandatory, requiring close collaboration between the manufacturer and the end-user.

Indirect distribution, involving wholesalers, specialized industrial distributors, and a rapidly growing segment of online retail, caters primarily to smaller manufacturing operations and maintenance, repair, and operations (MRO) markets. Distributors add value by managing inventory, providing immediate local supply, and offering technical support for standard product lines. The final downstream component involves the end-user application across various industries. Efficiency is measured not only by the pad's cost but by its impact on the overall operational expenditure, including tooling lifespan and reduction in scrap material. A critical part of the downstream analysis is the provision of recycling or disposal services, particularly for high-volume users, which is increasingly becoming a competitive differentiator and a vital element of the circular economy strategy within the market structure.

Cutting Pads Market Potential Customers

The primary end-users and buyers of cutting pads are organizations across diverse industrial sectors that rely on automated or semi-automated cutting processes for mass production or precision component manufacturing. The Automotive manufacturing sector is a foundational customer base, using cutting pads extensively for the fabrication of seating materials, interior trim components, gaskets, insulation materials for traditional combustion engines, and critical battery component parts for electric vehicles. These customers prioritize high-durability, large-format pads that can withstand continuous, high-speed operation, often requiring custom formulations resistant to specific oils or chemicals used in assembly.

Another significant group of potential customers resides in the Electronics and Electrical industries, including manufacturers of consumer electronics, flexible circuits, and photovoltaic cells. These buyers demand pads that offer extreme flatness and dimensional stability to support high-precision die-cutting of thin films, laminates, and adhesive layers. For this customer segment, material cleanliness and anti-static properties are non-negotiable requirements, as even minute surface irregularities can compromise the functionality of delicate electronic components, leading to a strong demand for specialized, high-cost polymeric pads.

Furthermore, the Textile and Apparel industries, particularly those utilizing automated CNC fabric cutting machines for high-volume garment production, represent a consistent demand stream. These users require resilient, often soft-surface pads that protect high-speed rotating or oscillating blades while providing sufficient grip for the layered fabric. Beyond traditional manufacturing, the growing Medical Device sector, involved in cutting specialized biocompatible materials and sterile packaging films, is emerging as a high-value customer segment. These buyers focus on certified materials that meet stringent regulatory standards for hygiene and traceability, driving demand for specialized, often clear or chemically inert cutting pad solutions utilized in cleanroom environments.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $4.5 Billion |

| Market Forecast in 2033 | $6.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Saint-Gobain S.A., DuPont de Nemours, Inc., Rogers Corporation, Stockwell Elastomerics, Trelleborg AB, Boyd Corporation, Griswold Controls, Klinger Ltd., Gaskets and Spacers Ltd., JSP Corporation, Foamtec International, Sika AG, Henkel AG & Co. KGaA, Essentra PLC, Avery Dennison Corporation, ITW Permatex, Armacell International S.A., Sekisui Chemical Co. Ltd., Federal-Mogul LLC. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cutting Pads Market Key Technology Landscape

The technological landscape of the Cutting Pads Market is characterized by continuous material science innovation aimed at enhancing durability, resilience, and operational lifespan. A key technological focus is the development of advanced polymer formulations, particularly those based on high-density, cross-linked polyurethane compounds that offer superior resistance to cutting forces, minimizing surface degradation and maintaining dimensional stability over longer operational cycles. Manufacturers are heavily investing in proprietary casting and molding techniques to ensure uniform material density and flatness across large format pads, a critical requirement for precision cutting tables. Furthermore, the integration of specialized additives, such as anti-static agents and friction modifiers, represents a significant technological advancement to address specific industrial requirements, especially within the sensitive electronics manufacturing environment where minimizing particle contamination is paramount.

A second major technological trend involves the exploration and commercialization of self-healing polymer technology within cutting pad materials. While still nascent, this technology aims to incorporate polymers capable of autonomously closing small surface nicks and cuts caused during operation, drastically extending the service life of the pad and reducing replacement frequency and associated downtime. This innovation, if widely adopted, would fundamentally alter the product lifecycle and maintenance paradigms in high-volume manufacturing. Concurrently, there is an increasing adoption of composite materials, blending traditional polymers with reinforcing fibers or particulates, designed for extreme load applications such as cutting thick, abrasive, or rigid composite sheets used in the aerospace or wind turbine industries, offering higher stiffness and enhanced resistance compared to conventional pure polymer pads.

Finally, the technological evolution is also integrating digital and smart features into the cutting environment. This involves incorporating radio-frequency identification (RFID) tags or specialized sensors into the cutting pads, allowing real-time tracking of usage hours, cumulative cutting load, and localized wear patterns. This data integration facilitates predictive maintenance strategies and enables manufacturers to provide usage-based warranties, shifting the product focus from a consumable item to a digitally monitored, performance-based asset. The move toward higher precision demands tighter manufacturing tolerances, utilizing advanced computerized numerical control (CNC) finishing processes to ensure the perfect parallelism and flatness essential for complex die-cutting applications, reinforcing technology's role as the core competitive advantage in this specialized market segment.

Regional Highlights

The global demand for cutting pads exhibits significant regional variation influenced by the density of manufacturing activity, technological adoption rates, and local economic conditions. Analyzing regional highlights provides crucial strategic insights into market penetration opportunities and operational challenges across key geographical areas.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily due to the concentration of global electronics, automotive assembly, and textile manufacturing bases, especially in China, India, Japan, South Korea, and Southeast Asian nations. High levels of foreign direct investment into automated production facilities and lower manufacturing labor costs drive relentless demand for both standard and high-performance cutting pads. The region serves as a massive consumption hub and a major production center, benefiting from scaled manufacturing processes and competitive pricing structures. The increasing shift towards localized supply chains for resilient manufacturing also boosts regional pad demand.

- North America: Characterized by high technological maturity, the North American market demands premium, high-specification cutting pads. Growth is strongly correlated with the expansion of the aerospace, defense, and specialized high-tech manufacturing sectors, as well as the rapid deployment of electric vehicle (EV) production plants. Customers in the US and Canada prioritize extended product lifespan, superior material resistance, and adherence to stringent quality and environmental regulations. The market here is highly receptive to smart pad technologies and integrated digital monitoring solutions.

- Europe: Europe represents a mature market with stable growth, driven by the highly regulated automotive (especially premium and luxury vehicle segments), precision engineering, and medical device manufacturing industries in countries like Germany, France, and Italy. European manufacturers exhibit a strong preference for sustainable and recyclable cutting pad solutions, aligning with strict EU environmental directives. Technological innovation focuses heavily on safety, efficiency, and the reduction of manufacturing waste, necessitating partnerships between material suppliers and machine builders.

- Latin America (LATAM): LATAM is an emerging market with moderate growth potential, tied primarily to industrial expansion in Brazil and Mexico, particularly in the automotive and packaging sectors. The market is often price-sensitive, leading to higher demand for cost-effective, durable general-purpose pads. Investment in modern automated cutting systems is increasing, suggesting a future pivot toward higher-specification requirements, making it a focus area for market expansion strategies seeking early mover advantages.

- Middle East and Africa (MEA): The MEA market is currently the smallest but shows promising potential linked to infrastructural mega-projects, diversification away from oil economies, and growing domestic manufacturing capabilities, particularly in construction materials and basic textile production. Demand remains scattered but is expected to accelerate with further industrial policy implementation, focusing initially on standard polymer pads, with future potential in specialized pads for emerging aerospace and defense manufacturing in key regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cutting Pads Market.- 3M Company

- Saint-Gobain S.A.

- DuPont de Nemours, Inc.

- Rogers Corporation

- Stockwell Elastomerics

- Trelleborg AB

- Boyd Corporation

- Griswold Controls

- Klinger Ltd.

- Gaskets and Spacers Ltd.

- JSP Corporation

- Foamtec International

- Sika AG

- Henkel AG & Co. KGaA

- Essentra PLC

- Avery Dennison Corporation

- ITW Permatex

- Armacell International S.A.

- Sekisui Chemical Co. Ltd.

- Federal-Mogul LLC

Frequently Asked Questions

Analyze common user questions about the Cutting Pads market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the most common material used for industrial cutting pads and why?

The most common material is Polyurethane (PU). PU is favored globally due to its exceptional combination of high abrasion resistance, superior resilience, and optimal durometer consistency, which allows it to absorb the cutting impact effectively while protecting the blade and maintaining operational precision across high-volume industrial cutting applications such as textiles and gaskets.

How does the thickness of a cutting pad impact manufacturing operations?

Pad thickness directly influences operational stability and lifespan. Thicker, heavy-duty pads are necessary for high-pressure die-cutting or heavy materials to absorb greater force and extend the pad's service life, whereas thinner pads are essential for ultra-precision applications, particularly in electronics, where minimal cushioning and maximal flatness are required to achieve fine tolerance cuts.

What are the primary drivers of market growth in the Asia Pacific region?

Market growth in the Asia Pacific is primarily driven by the massive scale of manufacturing expansion across key countries like China and India, the accelerating adoption of automated CNC cutting machinery in textile and automotive sectors, and significant regional investment in consumer electronics production, all of which require consistent replacement of cutting pad consumables.

Are there sustainable or eco-friendly options emerging in the cutting pads market?

Yes, sustainability is a key development focus. Manufacturers are actively researching and piloting bio-based polymers, highly recyclable thermoplastic elastomers, and material compounds designed for easier end-of-life recovery or reprocessing. The objective is to reduce reliance on virgin petrochemicals and address growing environmental regulatory pressure in mature markets like Europe.

How does predictive maintenance technology affect the procurement cycle for cutting pads?

Predictive maintenance, often facilitated by AI and integrated sensors, shifts procurement from a reactive, fixed-interval cycle to a proactive, need-based system. By accurately predicting the exact point of material failure or compromised accuracy, users can order replacements precisely when needed, optimizing inventory levels, reducing emergency purchases, and ensuring maximum pad utilization before disposal.

What is the role of durometer hardness in selecting the right cutting pad?

Durometer hardness is a critical specification that defines the resistance of the pad to indentation and deformation, directly correlating with the required cutting precision and tool wear. Higher hardness (higher Shore D value) is preferred for supporting precision die-cutting of rigid materials, providing a firmer surface that minimizes deflection, while lower hardness (Shore A value) is used for softer materials or applications requiring deeper penetration and vibration dampening.

Which end-use industry represents the highest growth potential for high-performance composite cutting pads?

The Aerospace and Defense industry, coupled with the Electric Vehicle (EV) battery manufacturing sector, holds the highest growth potential for high-performance composite pads. These sectors frequently process abrasive and lightweight materials (like carbon fiber composites, specialized metallic foils, and complex battery insulation layers) that necessitate pads with extreme thermal stability, chemical resistance, and superior structural integrity beyond what standard polymer pads can offer.

What is a key challenge related to the global supply chain for cutting pad manufacturers?

A key challenge is the dependence on petrochemical derivatives as primary raw materials. Global crude oil price volatility and disruptions in the chemical processing supply chain directly influence the cost and availability of critical polymers like specialized polyols for polyurethane production, leading to fluctuating manufacturing costs and inconsistent market pricing for finished cutting pads.

How are advancements in CNC cutting technology influencing cutting pad design?

Advancements in high-speed, multi-axis CNC cutting tables demand pads with unprecedented flatness, consistency, and thermal stability. Modern CNC systems operate with tighter tolerances and higher feed rates, necessitating pad designs that minimize friction, dissipate heat rapidly, and guarantee dimensional accuracy across very large formats to maintain the integrity of automated precision cutting operations.

What distinguishes direct sales channels from distributor channels in this market?

Direct sales are typically utilized for high-volume, highly customized cutting pad orders placed by large Original Equipment Manufacturers (OEMs) who require specific technical support and material engineering collaboration. Distributor channels, conversely, focus on MRO (Maintenance, Repair, and Operations) buyers and smaller manufacturers, offering standardized products, localized inventory, and immediate availability with less emphasis on custom material formulation.

What are the implications of self-healing technology for the future of the cutting pads market?

The commercialization of self-healing polymer technology is expected to dramatically increase the average lifespan of cutting pads, leading to lower replacement frequency and reduced operational expenditure for end-users. This technological leap will transform pads from rapidly consumable goods into long-term durable assets, significantly shifting market revenue models towards higher-initial-cost, value-added products and specialized servicing.

Why is resistance to plasticizers a necessary property for cutting pads in certain industries?

Resistance to plasticizers, particularly in PVC-based products, is crucial in the packaging and specific textile cutting industries. Plasticizers can migrate from the cut material into the cutting pad, causing the pad to swell, soften, or degrade unevenly. A specialized pad that resists this chemical migration ensures stable performance, maintains dimensional integrity, and prevents cross-contamination of materials.

How is the packaging and printing industry driving demand for specialized cutting pads?

The packaging and printing industry, driven by the need for complex, high-speed rotary and flatbed die-cutting of cardboard, labels, and various plastic films, requires pads that offer highly consistent resiliency for rapid production cycles. Demand is growing for custom-formulated elastomeric pads that ensure clean, burr-free edges, critical for high-quality packaging aesthetics and functional integrity, often utilizing clear or transparent materials for optical sensor compatibility.

What is the primary objective of value chain optimization in the cutting pads sector?

The primary objective of value chain optimization in this sector is to stabilize and reduce the total cost of ownership (TCO) for the end-user by ensuring consistent raw material quality, streamlining specialized manufacturing processes (like large-format casting), and improving distribution efficiency. Effective optimization also focuses on minimizing material waste during production and enhancing the recyclability of the finished product to gain a competitive edge.

In what way do governmental regulations affect the Cutting Pads Market in Europe?

Governmental regulations in Europe, such as REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), heavily influence material selection by restricting certain chemical additives and plasticizers used in polymers. This mandates that manufacturers continuously reformulate products, investing in R&D to meet stringent environmental and health standards, making regulatory compliance a significant factor in market access and product viability within the region.

What role do specialized elastomers play compared to polyurethane in high-end applications?

While polyurethane is versatile, specialized elastomers (like high-grade silicone or fluorocarbon rubbers) are utilized when extreme operating conditions are present, such as very high temperatures, exposure to aggressive chemicals, or applications requiring exceptional non-stick properties. These specialized materials offer superior performance in niche markets like advanced medical device manufacturing or extreme industrial environments, justifying their higher cost profile.

How does the transition to electric vehicles (EVs) specifically influence demand for cutting pads?

The transition to EVs increases the demand for specialized cutting pads used to fabricate intricate battery components, high-voltage insulation materials, lightweight structural composites, and complex acoustic dampening components. These materials often require pads with tailored thermal and chemical resistance properties that are distinct from those used in traditional internal combustion engine vehicle manufacturing processes, driving material innovation in the sector.

What defines a 'composite' cutting pad in contrast to a standard polymer pad?

A composite cutting pad is characterized by a multi-phase structure, often involving a polymer matrix reinforced with other materials such as fibers (e.g., glass or carbon) or particulate fillers (e.g., ceramics). This combination is engineered to deliver enhanced mechanical properties—such as increased stiffness, reduced thermal expansion, and superior resistance to cyclic loading—making them suitable for cutting difficult or highly abrasive advanced engineering materials.

Why is surface flatness critical for cutting pads in the electronics industry?

Surface flatness is critical because electronics manufacturing involves micro-tolerance cutting of extremely thin films and flexible circuits. Any deviation or irregularity in the cutting pad surface can lead to inconsistent blade depth, incomplete cuts, material damage, or compromised precision, resulting in high scrap rates. Ultra-flat pads are essential to maintain the integrity of sophisticated optical and automated cutting systems used in this sector.

What is the significance of the MRO segment for the cutting pads distribution strategy?

The MRO (Maintenance, Repair, and Operations) segment is highly significant as it represents the aftermarket demand for replacement cutting pads from existing machinery users, providing a stable, recurring revenue stream. Serving the MRO market efficiently requires robust regional distribution networks and strong partnerships with industrial wholesalers to ensure rapid delivery and minimize costly operational downtime for customers.

How do competitive dynamics affect pricing strategies in the global cutting pads market?

Competitive dynamics necessitate a dual pricing strategy: highly commoditized pricing for standard PVC or basic rubber pads where volume dictates profitability, and premium pricing for proprietary, high-performance polyurethane or composite pads where material innovation, extended lifespan, and technical support justify higher costs. Intense competition, especially from Asian manufacturers, constantly pressures the pricing of standardized products.

What are the main technical challenges in manufacturing large-format cutting pads?

Manufacturing large-format pads presents challenges related to maintaining material consistency, density uniformity, and surface flatness across the entire large surface area during the molding or casting process. Controlling thermal expansion and cooling rates to prevent warping and internal stresses is paramount to ensure the pad meets the precise dimensional stability required by industrial-scale automated cutting tables.

How important is chemical resistance for cutting pads in the medical device sector?

Chemical resistance is extremely important in the medical device sector because pads frequently encounter aggressive sterilization agents, disinfectants, and various bodily fluids. The pad material must remain inert, dimensionally stable, and non-leaching to maintain sterility and regulatory compliance, necessitating the use of specialized, often certified, medical-grade polymers and elastomers.

What strategic advantage does intellectual property offer to market leaders in this industry?

Intellectual property, primarily in the form of patents covering proprietary polymer formulations and unique manufacturing processes (e.g., specialized cross-linking techniques or embedding technologies), provides market leaders with a significant strategic advantage. This IP allows them to offer superior performance characteristics, differentiate products from generic alternatives, and command premium pricing in specialized, high-margin application segments.

How is the textile and apparel sector’s move toward 'fast fashion' affecting pad demand?

'Fast fashion' trends require textile manufacturers to switch designs and materials rapidly, increasing the utilization rate of automated cutting systems. This accelerated pace leads to faster wear and tear on cutting pads, driving up the frequency of replacement cycles and boosting the overall volume demand for reliable, cost-effective cutting surfaces capable of handling diverse fabric types continuously.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager