CVD Diamond Heat Spreaders Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435328 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

CVD Diamond Heat Spreaders Market Size

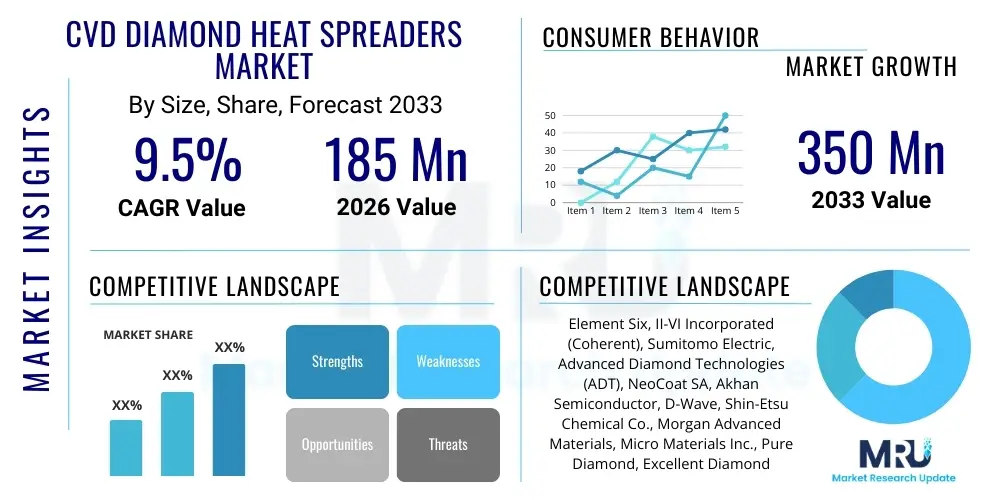

The CVD Diamond Heat Spreaders Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $185 Million in 2026 and is projected to reach $350 Million by the end of the forecast period in 2033.

CVD Diamond Heat Spreaders Market introduction

The CVD Diamond Heat Spreaders market encompasses the production, distribution, and utilization of chemical vapor deposition (CVD) synthetic diamond materials specifically engineered for advanced thermal management applications. These specialized diamonds exhibit the highest known thermal conductivity (typically exceeding 2000 W/mK), making them indispensable for handling the intense heat generated by modern high-power density electronic components. As semiconductor devices continue to shrink while increasing operational frequency and power output, traditional materials like copper and aluminum nitride are becoming inadequate, thereby cementing the role of CVD diamond as the premier thermal dissipation solution.

CVD diamond heat spreaders are primarily used in applications where reliable and rapid heat transfer is critical to maintain device performance, longevity, and operational stability. Major applications include advanced microwave and radio frequency (RF) devices, high-power laser diodes, optoelectronics, high-performance integrated circuits (HPC/IC), and specific segments within electric vehicle (EV) power electronics. The ability of CVD diamond to efficiently spread thermal energy across a wider area before it is absorbed by a primary cooling system provides a significant advantage, often enabling higher performance ceilings for the underlying electronic devices.

The core benefits driving market growth include enhanced device reliability due to lower junction temperatures, increased power handling capacity, and miniaturization of overall electronic systems enabled by superior thermal management. Key driving factors are the global proliferation of 5G infrastructure requiring high-power RF components, the escalating demand for data centers utilizing HPC processors, and the critical need for robust thermal solutions in aerospace and defense radar systems. Furthermore, advancements in CVD production techniques, which are gradually lowering manufacturing costs and increasing scalability, are making diamond heat spreaders more accessible across various high-value segments.

CVD Diamond Heat Spreaders Market Executive Summary

The CVD Diamond Heat Spreaders market is experiencing robust growth fueled by the relentless technological demands for superior thermal management in high-power and high-frequency electronics. Business trends indicate a shift towards strategic collaborations between diamond manufacturers and semiconductor fabricators to ensure materials integration early in the design phase, particularly for Gallium Nitride (GaN) and Silicon Carbide (SiC) devices. Investment in larger area deposition technology and improved polishing and metallization processes is a key focus area for market players aiming to improve cost-effectiveness and address high-volume manufacturing requirements, positioning the material as a vital enabler for next-generation computing and telecommunications infrastructure.

Regionally, Asia Pacific (APAC), led by manufacturing powerhouses such as China, Japan, and South Korea, is projected to maintain dominance due to its massive semiconductor manufacturing base and aggressive deployment of 5G networks. North America and Europe are significant contributors, particularly in the high-reliability sectors such as defense, aerospace, and high-performance computing, where performance trumps cost considerations. Regional trends show a focused effort in North America and Europe on developing novel cooling architectures that fully leverage the isotropic thermal properties of CVD diamond, including integration into microchannel liquid cooling systems and thermal vias for complex 3D stacking architectures.

Segment trends highlight the dominance of the optoelectronics and laser segment, driven by industrial lasers and defense applications, while the high-power density RF and microwave segment exhibits the fastest growth rate, directly correlated with the global rollout of 5G infrastructure and advanced satellite communication systems. By type, free-standing CVD diamond films continue to hold the majority share, offering the highest thermal performance, but polycrystalline diamond layers deposited directly onto device substrates are gaining traction due to streamlined manufacturing processes. Overall, the market remains highly specialized, but the increasing ubiquity of high-heat flux applications ensures sustained expansion across all major product categories.

AI Impact Analysis on CVD Diamond Heat Spreaders Market

Users commonly inquire about how the adoption of Artificial Intelligence (AI) and Machine Learning (ML) influences the demand trajectory and manufacturing complexity of CVD diamond heat spreaders. Key themes center on the thermal challenges posed by AI accelerator chips and the use of AI in optimizing the CVD growth process itself. The high computational density required by modern AI training and inference hardware—such as specialized GPUs and ASICs—results in unprecedented heat flux, directly escalating the critical need for ultra-efficient thermal interfaces like CVD diamond. Furthermore, users are keenly interested in whether AI-driven design optimization tools are being employed to refine the placement and bonding of these spreaders, ensuring maximum thermal efficiency in complex 3D packaging environments.

The proliferation of sophisticated AI hardware, particularly in hyperscale data centers, constitutes a major demand driver. These large-scale deployments require thousands of high-TDP (Thermal Design Power) processors operating continuously, making thermal failure an expensive and significant risk. CVD diamond addresses this challenge by enabling these processors to operate at peak efficiency without thermal throttling. The secondary impact involves the application of AI/ML algorithms in optimizing the complex parameters of the CVD growth reactors, leading to improved yield, enhanced crystal quality, and greater thickness uniformity of the diamond films. This operational optimization can contribute to lower long-term manufacturing costs, indirectly fostering broader adoption of diamond spreaders in high-volume applications.

- AI acceleration hardware necessitates extreme thermal management, driving demand for CVD diamond spreaders.

- AI-driven optimization of CVD reactor parameters improves diamond film quality, uniformity, and manufacturing yield.

- Machine learning aids in predicting and preventing thermal runaway in high-density chip stacks utilizing diamond interfaces.

- AI processing units in autonomous vehicles and 5G base stations require robust diamond thermal solutions for long-term reliability.

- Data centers deploying large AI clusters represent a primary end-user segment for high-volume diamond heat spreader procurement.

DRO & Impact Forces Of CVD Diamond Heat Spreaders Market

The CVD Diamond Heat Spreaders market is shaped by a critical balance of technical necessity and economic viability. The primary driver is the fundamental requirement for enhanced thermal performance in advanced electronics, particularly the transition from standard silicon to wide-bandgap materials like GaN and SiC, which operate at higher power densities and temperatures. This technological push is counterbalanced by the high initial manufacturing cost and the complexity associated with integrating diamond into existing semiconductor packaging schemes, acting as the main restraint. Opportunities lie in scaling up production and developing cost-effective hybrid diamond-metal composite materials. The impact forces are currently tilted toward driving growth, as the performance gains outweigh the cost premiums in critical, high-value applications such as defense, telecommunications, and satellite technology.

Drivers: The explosive growth of high-frequency and high-power applications, notably 5G deployment globally, mandates materials capable of managing extremely high heat fluxes in small form factors. Furthermore, the stringent performance requirements for defense radar systems, satellite communication systems, and high-performance industrial lasers continue to necessitate the unparalleled thermal conductivity offered exclusively by CVD diamond. The increasing adoption of solid-state lighting (LEDs) and the burgeoning market for power conversion modules in electric vehicles also contribute significantly to sustained demand, as efficient thermal management is paramount for battery life and system reliability.

Restraints: The most significant restraint is the high production cost of high-quality, large-area CVD diamond films compared to conventional heat spreading materials like copper, molybdenum, or AlN ceramics. This cost factor limits their use predominantly to niche, high-end applications rather than general consumer electronics. Technical challenges related to wafer-level integration, including reliable metallization, bonding, and managing thermal expansion mismatch with different substrate materials, also pose hurdles. Additionally, the fragmented supply chain and the limited number of suppliers capable of delivering high-specification diamond films create bottlenecks in scaling production volumes.

Opportunities: Significant market opportunities exist in developing cost-optimized manufacturing techniques, such as continuous wave CVD processing, and exploring novel composite structures that maintain high thermal performance while reducing diamond material volume. The burgeoning electric vehicle market, specifically power modules for inverter systems, offers a high-volume, long-term growth opportunity, provided costs can be strategically reduced. Furthermore, the rising interest in 3D integrated circuits (3D ICs) creates a critical need for efficient thermal interfaces between stacked dies, positioning CVD diamond as an ideal solution for vertical thermal dissipation.

Segmentation Analysis

The CVD Diamond Heat Spreaders market is segmented based on the type of product, the application area, and the geography. Segmentation provides a granular understanding of where the highest growth potential resides and which technical specifications are most valued by specific end-user industries. The product types primarily differentiate between free-standing diamond films, which offer maximum performance, and integrated or deposited thin films, which prioritize seamless integration and cost-efficiency. Application segments reflect the areas of greatest thermal stress, ranging from RF devices to optoelectronics and industrial power systems, all of which benefit uniquely from diamond’s thermal properties.

The dominance of the optoelectronics segment is historically due to the critical nature of temperature stability in high-power laser diodes, where even minor temperature fluctuations can drastically impact wavelength stability and output efficiency. However, the RF/Microwave segment is rapidly closing the gap, driven by the massive infrastructure investment into advanced telecommunication systems (5G/6G) and defense applications utilizing GaN components. Understanding these segments is crucial for manufacturers to tailor product specifications, such as surface roughness, metallization layer composition (e.g., Ti/Pt/Au), and film thickness, to meet the specialized requirements of each application.

- By Type:

- Free-Standing Diamond Heat Spreaders

- Deposited/Integrated Diamond Thin Films

- Diamond-Composite Materials (e.g., Diamond/Copper composites)

- By Application:

- RF and Microwave Devices (e.g., 5G Base Stations, Radar Systems)

- Optoelectronics and Laser Diodes (e.g., High-Power Industrial Lasers)

- High-Performance Integrated Circuits (HPC, CPUs, GPUs)

- Power Electronics (e.g., EV Inverters, Industrial Power Modules)

- Defense and Aerospace

- By Geometry:

- Wafers/Sheets

- Custom Shapes/Substrates

Value Chain Analysis For CVD Diamond Heat Spreaders Market

The value chain for CVD diamond heat spreaders is characterized by high technical complexity and capital intensity, beginning with the highly specialized gas precursor manufacturing and ending with final integration into complex electronic systems. Upstream activities involve the production of high-purity gases (like methane and hydrogen) and the synthesis of raw CVD diamond material using advanced reactor technology, typically Microwave Plasma CVD (MPCVD). The quality of the diamond material, determined by factors such as impurity levels, crystal structure, and thermal conductivity, is established at this initial stage, making it a critical bottleneck requiring significant technological expertise and investment.

Midstream processing involves several precise steps: separation of the diamond film from the growth substrate, precision laser cutting or dicing into specific geometries, and crucially, metallization and polishing. Metallization involves depositing specific metal layers (e.g., titanium, platinum, gold) on the diamond surface to enable robust soldering or bonding to the semiconductor device and the ultimate heatsink. This step ensures low thermal contact resistance, which is vital for realizing the full thermal potential of the diamond. Quality control and rigorous testing of thermal properties are integral components of the midstream process, converting the raw diamond film into a market-ready heat spreader component.

Downstream activities involve distribution channels and final integration. Distribution is typically direct from the specialized diamond manufacturer to the Original Equipment Manufacturers (OEMs) or specialized semiconductor packaging houses, due to the customized nature and high value of the product. Direct distribution is favored to ensure technical support and controlled logistics. Indirect distribution, involving specialized high-tech material distributors, plays a minor role. The end-users—primarily semiconductor fabricators, defense contractors, and laser system manufacturers—integrate the heat spreaders directly beneath the high-heat-generating component using advanced bonding techniques like eutectic soldering, concluding the value addition process.

CVD Diamond Heat Spreaders Market Potential Customers

The primary customers for CVD diamond heat spreaders are entities operating at the forefront of high-power and high-frequency electronics, where thermal budget constraints are the most severe limiting factor to performance and reliability. These include semiconductor device manufacturers specializing in wide-bandgap materials like Gallium Nitride (GaN) and Silicon Carbide (SiC), utilized extensively in 5G power amplifiers, radar modules, and electric vehicle inverters. These customers view diamond spreaders not merely as a component, but as an enabling technology that allows them to push the performance envelope of their devices beyond what is achievable with traditional materials.

A second major customer category involves defense and aerospace contractors. These sectors require systems that operate reliably in extreme environmental conditions and possess high power output (e.g., phased array radar, electronic warfare systems). Reliability and operational lifetime are non-negotiable, positioning CVD diamond as the material of choice despite its higher cost. Furthermore, manufacturers of high-power industrial and medical lasers, particularly diode-pumped solid-state lasers (DPSSLs), form a consistent customer base, relying on diamond spreaders to maintain the thermal stability essential for precision beam quality and wavelength accuracy.

The emerging high-performance computing (HPC) and data center market segment also represents significant potential customers. As AI accelerators and high-core-count processors continue to demand higher TDPs (up to hundreds of watts per chip), companies building hyperscale infrastructure are exploring advanced packaging solutions, including the use of diamond thermal interface materials (TIMs) and heat spreaders to manage localized hot spots, thereby increasing processor clock speeds and longevity. The long-term trajectory suggests that any industry adopting increasingly powerful and miniaturized electronics will eventually become a target customer for these advanced thermal solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $185 Million |

| Market Forecast in 2033 | $350 Million |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Element Six, II-VI Incorporated (Coherent), Sumitomo Electric, Advanced Diamond Technologies (ADT), NeoCoat SA, Akhan Semiconductor, D-Wave, Shin-Etsu Chemical Co., Morgan Advanced Materials, Micro Materials Inc., Pure Diamond, Excellent Diamond Products (EDP), SP3 Diamond Technologies, Crystallume, CVD Diamond Co. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CVD Diamond Heat Spreaders Market Key Technology Landscape

The technology landscape of the CVD Diamond Heat Spreaders market is dominated by the Chemical Vapor Deposition (CVD) method, specifically using Microwave Plasma CVD (MPCVD) reactors. MPCVD is the preferred technique as it allows for the synthesis of high-quality, polycrystalline diamond films at relatively low pressures and temperatures compared to traditional high-pressure/high-temperature (HPHT) methods. The key technological differentiators among manufacturers lie in the precise control of gas purity (methane, hydrogen, sometimes nitrogen or oxygen), reactor design, and plasma uniformity, which collectively determine the thermal conductivity, grain size, and mechanical strength of the resulting diamond film. Recent advancements focus on increasing the deposition rate while maintaining ultra-high thermal conductivity (above 2000 W/mK), a crucial requirement for commercial viability and scalability.

A critical secondary technological area involves post-processing techniques, particularly surface finishing and metallization. Since thermal performance is highly sensitive to the interface quality, ultra-low roughness polishing methods are essential to ensure minimal thermal contact resistance when bonded to the semiconductor die. Metallization technology is equally important, involving sputter deposition of multi-layered metal stacks (e.g., Ti/Pt/Au or Cr/Au) that provide a chemically stable and bondable surface, capable of withstanding high-temperature operating environments without degradation. Innovation in this area centers on developing robust metallization schemes that are compatible with various semiconductor bonding techniques, such as Au-Sn eutectic bonding, while minimizing stress introduced by thermal expansion mismatch.

The emerging technological focus includes the development of heteroepitaxial diamond growth, aiming to deposit single-crystal diamond films directly onto foreign substrates (like GaN or SiC) with minimal defects, which could dramatically simplify the integration process and eliminate the need for traditional bonding interfaces. Furthermore, research into diamond-metal composites (e.g., Diamond/Cu or Diamond/Al) seeks to harness the thermal benefits of diamond while improving the coefficient of thermal expansion (CTE) matching and reducing overall material costs. These composites utilize diamond particles dispersed in a metallic matrix, offering a performance compromise suitable for cost-sensitive, high-volume power electronics applications.

Regional Highlights

The regional dynamics of the CVD Diamond Heat Spreaders market reflect global concentrations of advanced semiconductor manufacturing, telecommunication infrastructure deployment, and defense expenditure. Market leaders are intensely focused on securing supply chains and establishing partnerships in key regions to capitalize on localized technological demands.

- Asia Pacific (APAC): APAC holds the dominant market share, primarily due to the concentration of high-volume electronics and semiconductor fabrication facilities (fabs) in countries like China, Taiwan, South Korea, and Japan. The rapid and extensive rollout of 5G infrastructure, coupled with major investments in AI research and development, particularly in data centers, creates massive demand for thermal management solutions in high-power RF devices and HPC processors. Japan, in particular, remains a hub for CVD diamond technology development and advanced packaging solutions.

- North America: North America represents the second-largest market, characterized by significant R&D spending, particularly within the defense, aerospace, and high-performance computing sectors. The region demands ultra-high reliability diamond spreaders for advanced radar and satellite communication systems. The presence of major semiconductor design houses and hyperscale cloud providers drives the adoption of diamond solutions in next-generation GPU and CPU thermal architectures.

- Europe: The European market demonstrates steady growth, driven largely by its strengths in power electronics, automotive research (especially EV power modules), and industrial laser manufacturing. Countries such as Germany, the UK, and France are critical markets due to their focus on high-reliability industrial automation and defense technology requiring stringent thermal control. European manufacturers often focus on specialized, niche applications requiring custom geometries and high-specification materials.

- Latin America, Middle East, and Africa (MEA): These regions are emerging markets with limited current penetration, driven primarily by localized infrastructure projects and defense procurement. The adoption rate is slower but is expected to accelerate with increasing foreign direct investment in telecom infrastructure (especially high-power base stations) and the development of local high-tech manufacturing capabilities.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CVD Diamond Heat Spreaders Market.- Element Six

- II-VI Incorporated (Coherent)

- Sumitomo Electric

- Advanced Diamond Technologies (ADT)

- NeoCoat SA

- Akhan Semiconductor

- D-Wave

- Shin-Etsu Chemical Co.

- Morgan Advanced Materials

- Micro Materials Inc.

- Pure Diamond

- Excellent Diamond Products (EDP)

- SP3 Diamond Technologies

- Crystallume

- CVD Diamond Co.

- Advanced Abrasives Corp.

- New Diamond Technology (NDT)

- Diamond Materials GmbH

- Sandvik Group

- Precision Microdrives

Frequently Asked Questions

Analyze common user questions about the CVD Diamond Heat Spreaders market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of CVD diamond heat spreaders over traditional materials?

The primary advantage is unparalleled thermal conductivity, typically exceeding 2000 W/mK, significantly higher than copper (approx. 400 W/mK) or AlN ceramics. This enables much faster and more efficient dissipation of extreme heat fluxes generated by high-power density electronic devices, leading to improved reliability and performance.

Which industry applications are driving the highest demand for CVD diamond heat spreaders?

The highest current demand is driven by the RF and Microwave segment, specifically for 5G base station power amplifiers utilizing GaN technology, high-power laser diodes in optoelectronics, and advanced radar systems in defense and aerospace sectors.

What are the main restraints hindering the broader adoption of CVD diamond thermal solutions?

The most significant restraint is the high manufacturing cost associated with producing large-area, high-quality CVD diamond films. This cost limits their use primarily to niche, high-value, performance-critical applications where the investment is justified by required reliability gains.

How does the integration of CVD diamond affect the lifespan of semiconductor devices?

By drastically lowering the operational junction temperature of semiconductor devices, CVD diamond heat spreaders mitigate thermally induced stress and degradation mechanisms. This significantly increases the Mean Time Between Failures (MTBF) and extends the overall operational lifespan of high-power electronic components.

Is the CVD Diamond Heat Spreaders market consolidating, or is it characterized by specialized niche players?

The market remains characterized by specialized niche players with high technical barriers to entry. While some consolidation is occurring through acquisitions by larger material science corporations (like II-VI/Coherent), the core production technology is highly proprietary, maintaining fragmentation among specialized diamond synthesis firms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager