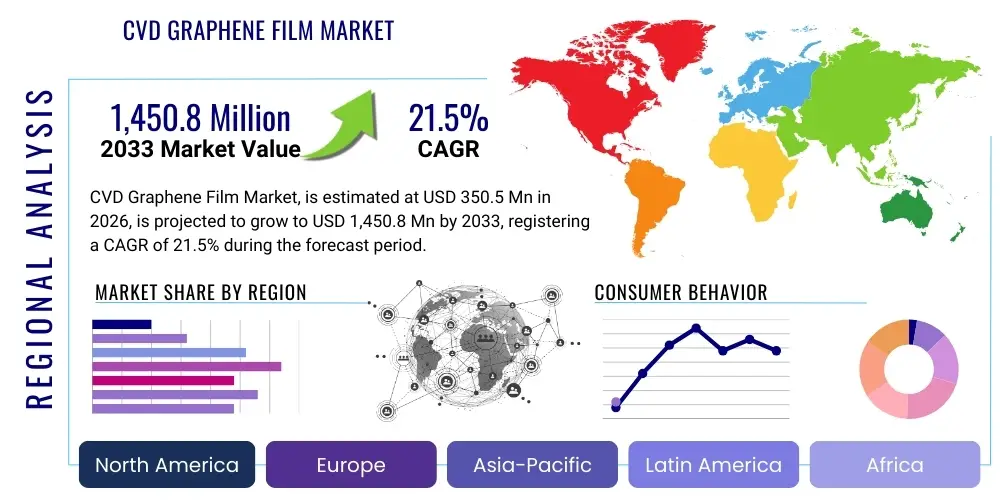

CVD Graphene Film Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435660 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

CVD Graphene Film Market Size

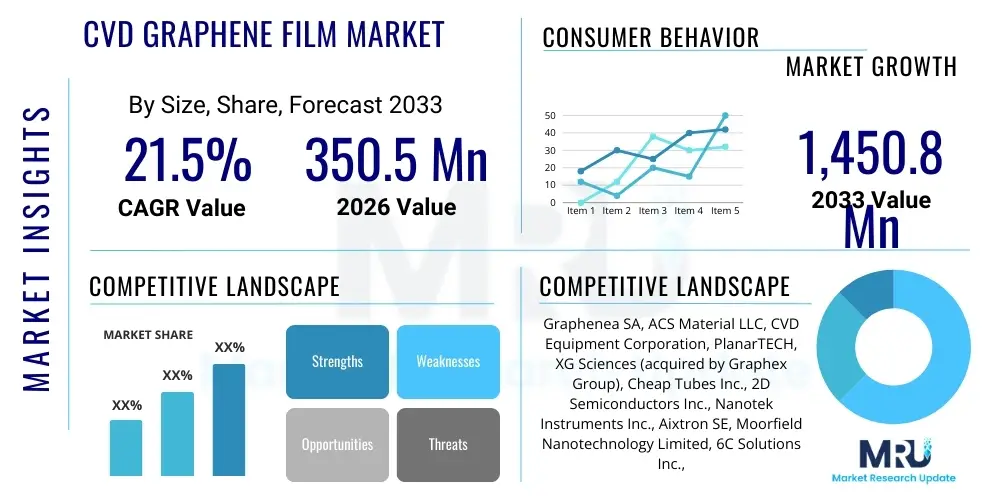

The CVD Graphene Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at USD 350.5 Million in 2026 and is projected to reach USD 1,450.8 Million by the end of the forecast period in 2033.

CVD Graphene Film Market introduction

The CVD Graphene Film Market encompasses the commercial production and utilization of large-area, high-quality graphene synthesized primarily through Chemical Vapor Deposition (CVD). This method is paramount for industrial scalability, offering the capability to grow uniform, thin layers of graphene—a single layer of carbon atoms arranged in a hexagonal lattice—on metal substrates, typically copper or nickel. Graphene films derived from CVD possess extraordinary properties, including superior electron mobility, high mechanical strength, thermal conductivity, and optical transparency, positioning them as critical enablers for next-generation electronic and energy technologies. The process involves introducing carbon precursor gases (like methane or ethylene) into a high-temperature reactor where they decompose, depositing graphene onto the catalytic substrate surface. The subsequent transfer of these films onto diverse target materials, such as polymers, glass, or silicon, is a key technical challenge that continuous research aims to optimize for high yield and minimal defect introduction.

The products within this market are categorized based on layer count and quality, ranging from monolayer films essential for transparent electrodes and high-frequency electronics to few-layer films suitable for thermal management and advanced composite materials. Major applications driving market adoption include transparent conductive electrodes (TCEs) in flexible displays, touchscreens, and organic light-emitting diodes (OLEDs), where graphene offers performance advantages over traditional materials like Indium Tin Oxide (ITO) due to its flexibility and lower sheet resistance. Furthermore, the material is increasingly utilized in advanced energy storage systems, specifically enhancing the performance of supercapacitors and lithium-ion batteries by providing highly conductive pathways and large surface areas for electrochemical reactions. This rapid expansion in application scope underscores graphene's transition from a novel laboratory material to a commercially viable industrial input.

Market dynamics are primarily fueled by global digital transformation, necessitating lighter, faster, and more efficient components in consumer electronics, automotive sensors, and telecommunication infrastructure. Significant benefits of adopting CVD graphene films include enhanced device longevity, reduced power consumption, and the enabling of truly flexible or wearable electronic architectures. Driving factors include escalating R&D spending by governments and private entities aimed at nanomaterial commercialization, coupled with increasing sophistication in CVD equipment design, which addresses historical bottlenecks such as film uniformity and high production costs. As transfer techniques mature and standardization improves, the CVD Graphene Film Market is poised for substantial penetration across highly regulated sectors like medical diagnostics and aerospace structural components, demanding materials with high reliability and performance under extreme conditions.

CVD Graphene Film Market Executive Summary

The CVD Graphene Film Market is undergoing accelerated commercialization, driven by the imperative need for advanced materials capable of supporting the high-performance requirements of flexible electronics and next-generation energy storage solutions. Business trends indicate a strong move toward industrial-scale continuous manufacturing techniques, such as roll-to-roll (R2R) CVD systems, designed to significantly reduce the cost per unit area and improve throughput, which is crucial for achieving parity with established materials like ITO. Strategic collaborations between specialized graphene producers and large semiconductor manufacturers are becoming commonplace, focusing on integrating graphene films into pilot production lines for flexible OLED displays and advanced memory modules. Furthermore, investment capital is shifting towards optimizing post-synthesis processing, particularly dry transfer methods and selective area deposition, to minimize surface contamination and defects introduced during the conventional wet transfer processes, thereby enhancing the functional yield of final devices.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, primarily due to the concentration of the world’s largest consumer electronics and battery manufacturing ecosystems in countries like China, South Korea, and Japan. These economies benefit from robust governmental support for nanotechnology research and substantial commercial capacity for material scaling. North America and Europe, while possessing smaller manufacturing bases for consumer electronics, lead in application development within high-value segments such as specialized biosensors, defense technologies, and advanced composites, driven by significant academic research output and venture capital funding focused on intellectual property development. Latin America and the Middle East & Africa (MEA) are emerging markets, currently focused on adopting graphene technology for localized applications in water filtration, corrosion-resistant coatings, and solar energy generation infrastructure, gradually expanding their engagement through technology transfer and localized R&D efforts.

Segmentation trends reveal monolayer graphene films maintaining the largest market share by value, dictated by their essential role in transparent electrodes requiring high optical clarity and low sheet resistance. However, the multi-layer graphene segment is exhibiting the highest growth rate, fueled by expanding applications in thermal interface materials (TIMs), structural composites, and high-capacity supercapacitors, where slightly thicker films offer robust mechanical and thermal performance benefits. The application segment analysis shows electronics holding a dominant position, although the energy sector, encompassing batteries and fuel cells, is projected to witness explosive growth due to the increasing demand for high-energy density storage solutions for electric vehicles (EVs) and grid stabilization. This market growth is fundamentally underpinned by the continuous refinement of CVD techniques, shifting production toward highly customized films tailored to specific end-user specifications regarding conductivity, uniformity, and mechanical resilience.

AI Impact Analysis on CVD Graphene Film Market

Common user inquiries regarding AI’s influence on the CVD Graphene Film Market are centered on the necessity of automating and optimizing the highly sensitive synthesis process. Users frequently ask about the role of Machine Learning (ML) in predictive quality control, seeking assurance that high-cost precursors and substrates are utilized effectively to yield defect-free, large-area films. The primary concern is reproducibility; how can AI ensure batch-to-batch consistency in properties like grain size, defect density, and sheet resistance, which are crucial for semiconductor integration? Expectations are high regarding AI’s ability to move CVD manufacturing from empirical, human-controlled operation to an autonomous, data-driven system, thereby mitigating the current cost barriers associated with low yields and specialized process expertise. Analysis of these questions indicates a strong market desire for AI-driven solutions that simplify the complexity of nanomaterial synthesis and accelerate the overall commercial viability of graphene films in mainstream industrial applications.

The integration of Artificial Intelligence and advanced data analytics is fundamentally transforming the manufacturing landscape of CVD graphene, moving beyond basic process control to sophisticated optimization and predictive modeling. AI algorithms, particularly reinforcement learning models, are now being deployed to analyze real-time sensor data—including temperature distribution across the reactor, flow rates of precursor gases (e.g., methane/hydrogen ratio), and vacuum pressure dynamics—to adjust parameters dynamically. This continuous, self-learning optimization loop ensures that the growth conditions are maintained at peak efficiency, maximizing the area coverage of monolayer film while simultaneously minimizing the formation of defects such as wrinkles, folds, and unwanted multi-layer nucleation sites. This autonomous process tuning drastically reduces human intervention, leading to higher throughput and significantly improved material homogeneity, which is essential for applications requiring strict uniformity, such as high-mobility transistors and advanced photodetectors.

Furthermore, AI plays a crucial role in post-synthesis analysis and R&D acceleration. Deep learning models, specifically Convolutional Neural Networks (CNNs) coupled with high-throughput imaging techniques (like Raman spectroscopy and optical microscopy), are utilized for automated, non-destructive quality inspection. These models can instantaneously identify, classify, and quantify defects on a synthesized film, providing immediate feedback that links specific defects to the precise moments or conditions of their formation during the CVD process. This capability shortens the design-of-experiment cycle from weeks to hours. In research, Generative Adversarial Networks (GANs) and other generative AI tools are used to predict the optimal catalyst surface modification or alternative carbon sources required to produce customized graphene structures, such as films with tailored doping profiles or specific crystallographic orientations, which are critical for specialized thermal management or high-frequency communication devices.

- AI optimizes CVD parameters (temperature, gas flow, pressure) in real-time, significantly increasing yield and uniformity.

- Machine Learning (ML) algorithms enable predictive maintenance and fault detection in expensive CVD equipment, reducing downtime.

- Deep Learning models automate high-throughput quality control by instantly classifying defects (e.g., pinholes, multi-layers) using spectroscopic and microscopic data.

- Generative AI accelerates materials discovery, predicting optimal precursor-catalyst combinations for tailored graphene film properties.

- AI facilitates the development of automated, closed-loop feedback systems for scaling up roll-to-roll continuous production.

- Enhanced simulation capabilities driven by AI reduce the reliance on costly physical experimentation during process development.

DRO & Impact Forces Of CVD Graphene Film Market

The market for CVD Graphene Films is characterized by a complex interplay of Drivers, Restraints, and Opportunities, which collectively define the impact forces shaping its trajectory. A primary driver is the accelerating demand for flexible, durable, and lightweight electronic components, particularly in the rapidly evolving markets for wearables, foldable devices, and automotive displays. Graphene's inherent flexibility and superior conductivity make it an ideal replacement or enhancement material over traditional conductors. Coupled with this is the critical demand from the energy sector for enhanced battery and supercapacitor performance, where CVD graphene improves power density and cycle life. However, significant restraints include the persistently high cost of production, stemming from expensive precursor materials, high energy consumption in the high-temperature CVD process, and the technical difficulties associated with large-area, defect-free transfer from the growth substrate to the target device substrate. The transfer process often introduces microscopic tears, wrinkles, and residue, compromising the material's ideal properties, leading to lower final device yield and increasing manufacturing complexity, which hampers widespread adoption.

Opportunities in the CVD Graphene Film Market are abundant, especially in emergent high-value sectors. The development of advanced, highly sensitive biosensors and diagnostic devices presents a major avenue for growth, leveraging graphene's high surface area and electronic sensitivity for precise detection of biomarkers. Furthermore, the aerospace and defense industries are exploring graphene films for electromagnetic interference (EMI) shielding, stealth applications, and lightweight structural composites that demand exceptional strength-to-weight ratios. The shift toward developing cleaner and more efficient transfer techniques, particularly fully dry or electrochemical transfer methods that maintain film quality, offers a crucial opportunity to overcome current restraints and unlock mass production capabilities. Moreover, ongoing research into specialized doped graphene films (e.g., nitrogen or boron doped) tailored for specific electrochemical or catalytic applications promises to broaden the market beyond conventional electronics into specialized chemical processing and environmental remediation technologies.

The cumulative impact forces indicate a market in a phase of high capital investment and technical innovation. While the restraints related to production cost and quality control are significant, the overwhelming performance advantages offered by CVD graphene in critical, growing sectors—flexible electronics, advanced energy, and biomedical devices—create a powerful gravitational pull toward commercial success. The market’s future growth heavily depends on successful technology maturation: if research can consistently deliver low-defect, large-area films through high-throughput methods (such as R2R), the economies of scale will quickly lower unit costs, enabling graphene to displace incumbent materials like ITO. The increasing competitive pressure from alternative 2D materials (like MoS2) and advanced polymer films also acts as an impact force, compelling graphene producers to aggressively innovate and establish clear cost-performance superiority to maintain market dominance in their target applications, ensuring continuous optimization of the entire value chain from synthesis to integration.

Segmentation Analysis

The CVD Graphene Film Market is segmented based on the structural characteristics of the film (Type) and the sectors where the film is utilized (Application). Segmentation by Type primarily differentiates films based on the number of atomic layers, directly impacting properties such as sheet resistance, transparency, and mechanical durability. Segmentation by Application highlights the diverse end-use sectors, with Electronics and Energy being the current revenue powerhouses, driven by global electrification and digitalization trends. The ongoing refinement of CVD synthesis techniques allows for the tailored production of films optimized for these distinct segments, ranging from ultra-thin, highly transparent films for displays to slightly thicker, more mechanically robust films required for effective heat spreading and structural composite reinforcement. Understanding these segment dynamics is crucial for manufacturers to align production capabilities with evolving market needs and application-specific quality thresholds, such as extremely low defect density required for high-frequency field-effect transistors (FETs) versus the requirement for mechanical robustness in composite materials.

- By Type:

- Single-layer Graphene Film

- Multi-layer (2-5 layers) Graphene Film

- Doped Graphene Film (e.g., Nitrogen-doped, Boron-doped)

- By Application:

- Electronics (Transparent Conductive Electrodes, Flexible Displays, High-Frequency Transistors, Memory Devices)

- Energy (Supercapacitors, Lithium-ion Batteries, Fuel Cells)

- Biomedical (Biosensors, Drug Delivery Systems, Wearable Health Monitoring)

- Aerospace and Defense (Composites, EMI Shielding)

- Others (Water Purification, Coatings, Thermal Management)

Value Chain Analysis For CVD Graphene Film Market

The value chain for the CVD Graphene Film Market begins with upstream activities focused on securing high-purity raw materials. This involves sourcing high-purity metal substrates, predominantly copper foil, and reliable carbon precursors, such as methane, acetylene, or various alcohols. Upstream also includes the manufacturing and maintenance of sophisticated CVD reactor equipment, which represents a significant capital investment. The core manufacturing step—graphene synthesis via CVD—is highly proprietary and skill-intensive, involving precise control over temperature, pressure, and gas flow dynamics to ensure the growth of large, defect-free single-crystal domains. This is followed by the crucial transfer process, where the graphene film is removed from the metallic growth substrate and laminated onto the target substrate (e.g., glass, plastic, or silicon wafer). The quality and yield of the final product are heavily reliant on the efficiency and cleanliness of this transfer step, often requiring specialized chemical etching and handling techniques.

The downstream activities involve the integration and functionalization of the CVD graphene films into end-user devices. Direct distribution occurs when specialized graphene manufacturers sell large-area films or patterned films directly to OEMs or Tier 1 suppliers in the electronics, energy, or aerospace sectors. These downstream players perform final device fabrication, incorporating the graphene film as a component, such as a transparent electrode in a touch panel or an electrode material in a battery cell. Indirect distribution involves working through specialized material distributors or integrators who perform intermediate processing steps, such as laser patterning, dicing, or applying protective coatings, before supplying the films to smaller end-users who lack in-house capabilities for handling 2D materials. Key challenges downstream include ensuring consistent quality control across different device manufacturing environments and educating end-users on the specialized handling requirements for ultra-thin films.

The current structure favors indirect distribution for specialized applications where end-users require customized small batches, while large-volume electronics manufacturers increasingly seek direct partnerships to ensure supply chain stability and leverage economies of scale provided by continuous roll-to-roll CVD systems. The high degree of customization required for specific applications (e.g., precise doping levels for biosensors or specific film thicknesses for thermal management) means that value is created not just by the material itself, but by the intellectual property surrounding the synthesis and integration techniques. Therefore, close collaboration across the value chain—from precursor suppliers optimizing gas purity to OEMs defining functional specifications—is critical for overcoming current yield and cost challenges and accelerating the commercial maturation of CVD graphene technology globally.

CVD Graphene Film Market Potential Customers

The potential customer base for CVD Graphene Films is highly diversified, spanning multiple high-technology sectors globally, driven by the material's unparalleled electronic, mechanical, and thermal properties. The primary end-users are concentrated within the electronics manufacturing ecosystem, specifically large original equipment manufacturers (OEMs) specializing in consumer devices, including flexible and foldable smartphones, tablets, and high-definition displays. These customers procure graphene films for use as transparent conductive electrodes, seeking to replace less flexible and resource-intensive materials like Indium Tin Oxide (ITO). Additionally, semiconductor companies focused on high-frequency and specialized photonics devices represent a crucial customer segment, utilizing graphene for advanced field-effect transistors and photodetectors demanding high carrier mobility and thermal stability.

Another rapidly expanding segment of buyers includes manufacturers in the energy storage sector—producers of advanced lithium-ion batteries, solid-state batteries, and supercapacitors for electric vehicles (EVs) and stationary grid storage. These companies utilize graphene films, often in multi-layer or composite formats, to enhance electrode conductivity, improve charge/discharge rates, and extend the overall cycle life of their products. Furthermore, the biomedical sector, encompassing diagnostics and pharmaceutical research companies, represents a high-value customer base, purchasing graphene films for developing highly sensitive wearable biosensors and advanced platforms for controlled drug delivery. The unique physical and chemical properties of graphene enable the construction of platforms capable of detecting minute changes in chemical composition or biological markers with high accuracy and speed.

The adoption is also increasing among aerospace, defense, and automotive composite material suppliers. These customers integrate graphene into polymers and resins to create extremely lightweight yet mechanically robust components, and utilize its conductivity for effective electromagnetic shielding (EMI) and anti-corrosion coatings. In essence, any industry seeking performance enhancements in areas requiring superior electrical conductivity, robust mechanical flexibility, or efficient thermal dissipation, coupled with ultra-lightweight properties, constitutes a potential buyer of CVD graphene films. The procurement decision for these buyers is increasingly shifting from cost-per-area to total cost of ownership, factoring in enhanced device performance, longevity, and manufacturing yield improvements achieved by using high-quality CVD material.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 350.5 Million |

| Market Forecast in 2033 | USD 1,450.8 Million |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Graphenea SA, ACS Material LLC, CVD Equipment Corporation, PlanarTECH, XG Sciences (acquired by Graphex Group), Cheap Tubes Inc., 2D Semiconductors Inc., Nanotek Instruments Inc., Aixtron SE, Moorfield Nanotechnology Limited, 6C Solutions Inc., Saint Jean Carbon Inc., GrafTech International, The Sixth Element (Changzhou) Materials Technology Co., Ltd., Global Graphene Group, Angstron Materials, Inc., Cambridge Graphene Centre, Iljin Display, LG Electronics, Samsung SDI. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CVD Graphene Film Market Key Technology Landscape

The CVD Graphene Film Market is defined by technological advancements aimed primarily at improving scalability, consistency, and reducing the post-synthesis damage incurred during handling. The foundational technology remains the thermal CVD process, utilizing atmospheric or low-pressure chambers and various heating mechanisms (resistive or induction). Significant innovation centers on precursor selection; while methane remains dominant for monolayer growth on copper, research is progressing into solid carbon sources or alternative gaseous precursors that offer lower growth temperatures or better quality control, thereby reducing energy consumption and infrastructure costs. The landscape also includes techniques like plasma-enhanced CVD (PECVD), which operates at much lower temperatures, making it compatible with a wider range of substrates, although often yielding graphene with higher defect concentrations, better suited for applications like energy storage rather than high-performance electronics.

The most critical technological developments are currently focused on the integration of continuous manufacturing systems, specifically Roll-to-Roll (R2R) CVD. R2R systems allow for the growth of graphene on long, flexible metallic foils, enabling high-volume production analogous to standard industrial film manufacturing processes. This shift from batch processing to continuous flow is essential for meeting the massive volume demands of the consumer electronics industry. Crucially, the transfer technology is evolving rapidly; traditional wet-etching techniques, which utilize chemical solutions to dissolve the copper catalyst, are being challenged by cleaner, more scalable methods such as dry transfer via thermal release tapes, or electrochemical bubbling transfer. These advanced transfer methods aim to preserve the high quality of the synthesized graphene film by minimizing exposure to harsh chemicals and physical stress, directly boosting the yield of functional electronic devices.

Furthermore, the key technology landscape includes advancements in selective area deposition and patterning. Techniques utilizing masks, focused ion beams, or specialized surface treatments allow for the direct growth or precise tailoring of graphene films onto specific device architectures, eliminating wasteful etching steps and simplifying downstream processing. This area of technological development is particularly relevant for specialized electronic components where precision and integration density are paramount. Manufacturers are also heavily investing in real-time monitoring and quality assurance systems, often powered by AI, utilizing in-situ spectroscopic analysis (e.g., in-line Raman spectroscopy) during the CVD process. This real-time feedback loop allows for immediate process adjustments, ensuring that the entire fabricated area meets stringent quality specifications before the costly transfer and integration steps, solidifying the market's shift toward highly controlled, automated, and high-yield production methodologies.

Regional Highlights

- Asia Pacific (APAC): APAC commands the largest share of the CVD Graphene Film Market and is projected to exhibit the highest CAGR during the forecast period. This dominance is intrinsically linked to the region's position as the global hub for consumer electronics manufacturing, particularly in South Korea (Samsung, LG) and China (major display and battery producers). Extensive governmental funding for nanotechnology research, coupled with established supply chains for high-volume flexible display and lithium-ion battery production, accelerates the adoption of CVD graphene films as a next-generation material. Countries like South Korea and Japan are pioneers in integrating graphene into commercial touchscreens and flexible OLED devices, driving demand for high-quality, continuous roll-to-roll manufactured films. The region benefits from lower operational costs and rapid scale-up capabilities, making it the central production and consumption nexus for commodity-grade and high-performance graphene films.

- North America: North America represents a mature, high-value market characterized by robust academic research and early adoption in specialized, critical applications. The demand is heavily driven by the defense, aerospace, and biomedical sectors, requiring high-specification graphene films for advanced sensors, lightweight composites, and precise diagnostics. The region boasts a strong presence of dedicated graphene startup companies and material science research centers, often supported by significant government defense contracts, focusing on innovative CVD processes, including scalable transfer methods and targeted doping techniques. While the volume manufacturing base is smaller than APAC, North America leads in establishing stringent quality standards and is a critical driver for advancements in high-mobility transistors and advanced thermal management solutions for high-performance computing.

- Europe: The European market demonstrates steady growth, concentrating on industrial applications, particularly in the automotive, environmental, and energy sectors. European initiatives, such as the Graphene Flagship, have fostered substantial investment in developing graphene integration technologies and optimizing specialized CVD growth for industrial partners. Key areas include advanced composite materials for lighter vehicles, filtration systems for water purification, and integration into high-capacity supercapacitors for renewable energy storage and transportation. Germany, the UK, and Scandinavian countries are leaders in leveraging graphene's properties for sustainable technology, focusing on creating circular economy solutions and high-specification materials tailored for rigorous industrial environments and long-term durability.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions represent emerging markets with growth focused on specialized applications such as localized water treatment, infrastructure coatings (anti-corrosion), and nascent solar energy projects. Growth is slower due to limited indigenous high-tech manufacturing capacity and reliance on imported films or technology transfer. However, strategic local investments, particularly in countries like Brazil and the UAE, are targeting the use of graphene-enhanced materials in oil and gas infrastructure, leveraging its corrosion resistance, and exploring localized production capabilities to serve regional industrial needs, indicating a long-term potential for specialized market entry and technology adoption.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CVD Graphene Film Market.- Graphenea SA

- ACS Material LLC

- CVD Equipment Corporation

- PlanarTECH

- XG Sciences (acquired by Graphex Group)

- Cheap Tubes Inc.

- 2D Semiconductors Inc.

- Nanotek Instruments Inc.

- Aixtron SE

- Moorfield Nanotechnology Limited

- 6C Solutions Inc.

- Saint Jean Carbon Inc.

- GrafTech International

- The Sixth Element (Changzhou) Materials Technology Co., Ltd.

- Global Graphene Group

- Angstron Materials, Inc.

- Cambridge Graphene Centre

- Iljin Display

- LG Electronics

- Samsung SDI

Frequently Asked Questions

Analyze common user questions about the CVD Graphene Film market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of CVD Graphene Film over alternative transparent conductive materials?

CVD Graphene Film offers significantly higher flexibility, superior mechanical strength, lower material weight, and better thermal stability compared to traditional materials like Indium Tin Oxide (ITO). These attributes are critical for high-performance flexible displays, wearable electronics, and robust high-frequency devices, enabling thinner and more durable product designs.

What is the most significant technical challenge in scaling up CVD Graphene Film production for commercial use?

The most significant challenge is achieving large-area, defect-free transfer of the synthesized graphene from the metal catalyst substrate (usually copper) onto the final insulating substrate. The transfer process must be optimized for high throughput, minimal damage (wrinkles, tears), and low residue contamination to maintain the high electrical properties necessary for device integration.

How is the CVD process being adapted to reduce the current high cost of graphene film production?

Cost reduction is primarily achieved through the implementation of continuous manufacturing techniques, specifically roll-to-roll (R2R) CVD systems, which dramatically increase throughput and yield. Additionally, optimizing precursor utilization, lowering growth temperatures using techniques like PECVD, and employing automated, AI-driven quality control reduce material waste and operational time.

In which application segment is CVD Graphene Film expected to see the fastest market growth?

The Energy sector, encompassing advanced battery technologies (e.g., anode materials in lithium-ion batteries) and high-power supercapacitors, is projected to experience the fastest growth rate. Graphene films enhance charge rates, energy density, and cycle stability, addressing the critical performance needs of the rapidly expanding electric vehicle (EV) and grid storage markets.

What role does single-layer graphene play compared to multi-layer graphene in the market?

Single-layer graphene dominates high-value applications requiring maximum optical transparency and high electronic mobility, such as transparent conductive electrodes for displays and high-frequency transistors. Multi-layer graphene, offering enhanced mechanical robustness and thermal conductivity, is preferred for structural composites, thermal interface materials, and high-capacity energy storage electrodes.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager