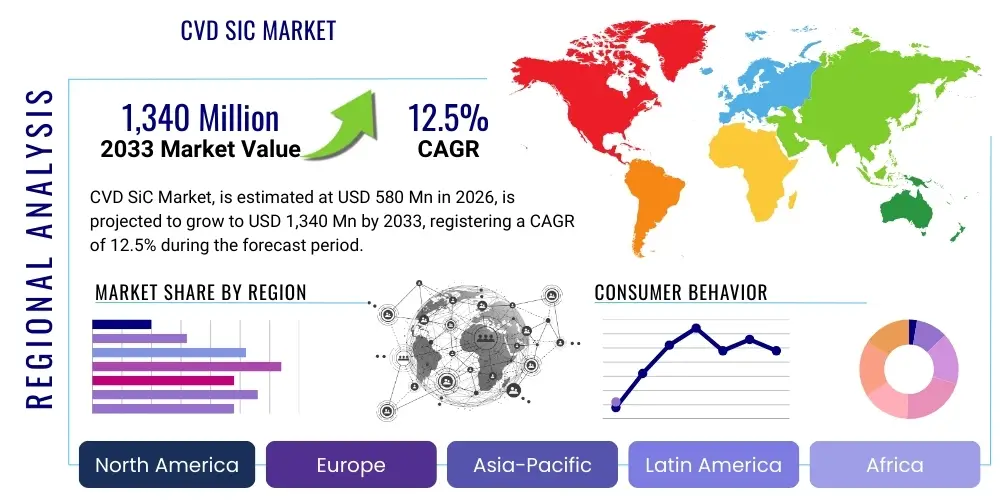

CVD SiC Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437009 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

CVD SiC Market Size

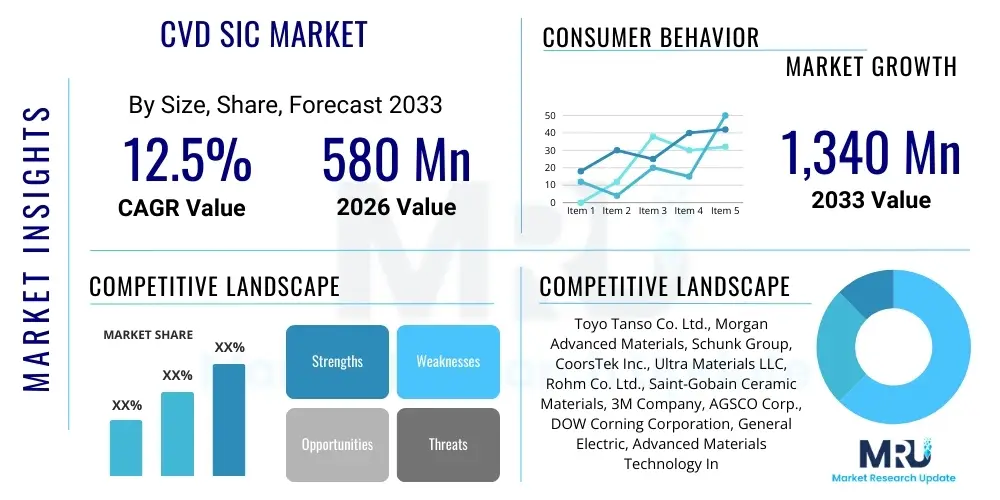

The CVD SiC Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at $580 Million in 2026 and is projected to reach $1,340 Million by the end of the forecast period in 2033.

CVD SiC Market introduction

The Chemical Vapor Deposition (CVD) Silicon Carbide (SiC) market encompasses advanced material manufacturing utilized across high-performance industries. CVD SiC is synthesized by reacting silicon and carbon-containing gases, typically hydrocarbon and silane, at elevated temperatures, resulting in dense, high-purity, isotropic, and non-porous material layers or freestanding components. This deposition process allows for superior control over crystalline structure and film thickness, distinguishing CVD SiC from traditional sintered or reaction-bonded SiC, particularly in applications demanding extreme thermal stability and chemical resistance. The resultant product offers exceptional mechanical strength, superior thermal shock resistance, and chemical inertness, making it indispensable in severe operating environments.

Major applications of CVD SiC span semiconductor processing equipment, where it is used for susceptors and liners due to its plasma resistance; aerospace and defense, utilized in mirror substrates and heat exchangers; and nuclear energy systems, where its radiation tolerance is critical for fuel claddings and structural components. The material’s high thermal conductivity combined with its excellent dielectric properties also positions it favorably in the emerging field of power electronics, particularly for components operating at high voltages and frequencies. The inherent purity achieved through the CVD process minimizes contamination risks, which is vital for sophisticated microelectronic fabrication.

The primary driving factors propelling market expansion include the exponential growth in the SiC power electronics sector, driven by electric vehicles (EVs) and renewable energy infrastructure; increasing demand for materials that can withstand ultra-high temperature and corrosive environments in chemical processing; and sustained investment in space technology requiring lightweight, dimensionally stable mirror optics. Furthermore, the push for miniaturization in electronic devices and the need for enhanced operational efficiencies across industrial furnaces solidify the market trajectory, making CVD SiC a cornerstone material for 21st-century technological advancement. Benefits include enhanced operational lifespan of components, reduced maintenance costs, and improved system performance under extreme conditions.

CVD SiC Market Executive Summary

The CVD SiC market is undergoing significant expansion, primarily driven by surging demand from the semiconductor and power electronics industries, which necessitate high-purity, plasma-resistant materials for wafer processing and efficient energy conversion. Business trends reflect a focus on capacity expansion, particularly in the Asia-Pacific region, to meet the skyrocketing requirements for 300mm SiC wafer processing equipment components. Strategic partnerships between material producers and equipment manufacturers are becoming commonplace to ensure supply chain stability and rapid product innovation tailored to next-generation lithography and deposition techniques. Furthermore, competitive advantage is increasingly being derived from patented CVD techniques that allow for higher deposition rates, reduced material waste, and exceptional uniformity across large substrate areas, addressing critical bottlenecks in high-volume manufacturing.

Regionally, the market momentum is dominated by Asia Pacific (APAC), which serves as the global manufacturing hub for electronics and automotive power systems, fueling demand for susceptors, wafer carriers, and process tubes. North America and Europe, while having lower manufacturing volumes, maintain strong market influence through high-value applications in aerospace, defense, and advanced nuclear reactor designs, focusing on highly customized, complex geometries and ultra-pure grades of CVD SiC. Regulatory frameworks favoring energy efficiency and the global transition towards electrified transportation are reinforcing demand across all major geographies, with governmental incentives accelerating the adoption of SiC-based power modules, directly translating into increased consumption of CVD SiC components necessary for manufacturing these modules.

Segmentation trends indicate that the coating segment holds the largest market share due to its widespread use in protecting graphite and SiC substrates in semiconductor reactors, enhancing durability and reducing particle generation. However, the bulk components segment, comprising structural parts like large-diameter tubes and customized furnace hardware, is projected to exhibit the fastest growth, fueled by capital investments in advanced high-temperature industrial furnaces and next-generation fusion energy research. Application-wise, the semiconductor and power electronics sectors remain paramount, though emerging opportunities in precision optics and medical devices are diversifying the revenue streams, promoting specialized material development focused on low defectivity and stringent surface finish requirements.

AI Impact Analysis on CVD SiC Market

User queries regarding AI's influence on the CVD SiC market frequently center on its potential to revolutionize manufacturing efficiency, optimize material performance, and accelerate the discovery of novel SiC structures. Key themes include the use of machine learning (ML) algorithms for predictive maintenance of costly CVD reactors, optimizing gas flow and temperature profiles to maximize deposition rates and uniformity, and leveraging neural networks to simulate and predict the properties of SiC films based on precursor ratios and process parameters. Users express strong expectations that AI will significantly reduce material defects, lower production costs, and shorten the qualification cycle for new CVD SiC products, thereby addressing the current challenges related to scalability and high capital expenditure in production facilities. The integration of AI-driven digital twins for process modeling is seen as essential for achieving the required level of purity and consistency for advanced semiconductor applications.

The primary influence of Artificial Intelligence in the CVD SiC domain is directed toward enhancing process control and quality assurance, moving away from empirical trial-and-error methods. AI algorithms can analyze massive datasets generated by sensors within the CVD chamber—monitoring temperature gradients, pressure fluctuations, and gas concentrations—to identify complex correlations that human operators might overlook. This capability allows for real-time, micro-adjustments to the deposition process, ensuring optimal crystal growth and minimal structural defects, which is critical for high-reliability components used in space or medical devices. Furthermore, ML is beginning to be deployed in defect classification and root cause analysis, drastically speeding up the time required to diagnose and correct manufacturing anomalies, thereby improving overall equipment effectiveness (OEE).

Beyond manufacturing optimization, AI is a powerful tool in computational materials science being applied to the design phase of CVD SiC materials. Generative AI models can simulate thousands of potential SiC compositions and deposition conditions to predict specific electronic, thermal, or mechanical properties, guiding researchers toward optimal material specifications for bespoke applications like high-power switching or neutron reflection. This capability promises to democratize material innovation, moving the industry toward 'materials-by-design' rather than relying on iterative physical experimentation. The impact is profound: AI accelerates the pace of material development necessary to keep up with the demanding roadmaps of the semiconductor and aerospace industries, providing a competitive edge to companies that successfully integrate these sophisticated analytical tools into their R&D and production workflows.

- AI optimizes CVD reactor operational parameters, predicting ideal temperature and flow regimes for maximum material yield and purity.

- Machine learning enhances quality control by performing real-time defect classification and automated analysis of film uniformity and internal stresses.

- Predictive maintenance using AI reduces unplanned downtime of expensive CVD equipment by forecasting component failure based on operational data signatures.

- AI-driven computational materials science accelerates the design of new SiC polymorphs and composite structures tailored for specific high-performance applications.

- Digital twins powered by AI simulate complex deposition kinetics, allowing manufacturers to rapidly prototype and scale up production processes virtually before physical implementation.

DRO & Impact Forces Of CVD SiC Market

The dynamics of the CVD SiC market are defined by strong demand drivers rooted in technological progression, balanced against significant constraints related to high production barriers. Key drivers include the rapid adoption of SiC-based power semiconductors across automotive and energy infrastructure, mandating high volumes of pure, inert CVD SiC components for their manufacturing processes. Furthermore, the unique combination of properties—extreme hardness, high thermal stability (up to 2700°C), and chemical resistance—makes CVD SiC irreplaceable in harsh environment applications such as advanced nuclear reactors and hypersonic flight systems, ensuring sustained governmental and industrial investment. Conversely, the market faces restraints stemming from the exceptionally high capital expenditure required for setting up and operating CVD reactor facilities, including specialized gas handling systems and high-temperature furnaces, creating formidable barriers to entry for new competitors and limiting rapid scalability.

Opportunities for market growth primarily lie in developing innovative, lower-cost CVD processes and expanding the application scope into niche, high-margin sectors. Research into novel precursor chemistries aims to reduce deposition temperatures and improve material efficiency, potentially lowering operating costs and improving throughput. Significant opportunities also exist in the medical sector, specifically in specialized components requiring biocompatible, ultra-hard, and chemically inert materials, such as surgical instruments and internal implants. Additionally, the proliferation of large-scale solar and wind farms necessitates robust power conversion systems, further solidifying the long-term opportunity for CVD SiC in high-efficiency inverters and converters that demand reliable manufacturing components. The transition toward larger SiC wafer sizes (from 150mm to 200mm and eventually 300mm) also necessitates larger, more complex CVD SiC components, offering new revenue avenues for specialized suppliers.

The primary impact forces shaping the market trajectory involve substitution risk and geopolitical influences on critical material supply chains. While CVD SiC offers superior performance, alternative high-temperature ceramics or advanced metals pose a minor threat in less demanding industrial applications where cost is the overriding factor. However, the fundamental physical and electrical properties of SiC offer substantial insulation against substitution in extreme environments or high-frequency power electronics. Geopolitically, the reliance on a limited number of global suppliers for high-purity precursors, such as Methyltrichlorosilane (MTS) or Silane, introduces supply chain volatility, which necessitates strategic national reserves and diversification of sourcing strategies. The synergistic relationship between the SiC power device market and the CVD SiC component market creates a feedback loop, wherein the successful scaling of power device manufacturing directly and rapidly increases the demand for the specialized CVD equipment components needed to sustain that scale.

Segmentation Analysis

The CVD SiC market is comprehensively segmented based on its structural form (coating or bulk), the application in which it is utilized (semiconductor, aerospace, energy), and the specific end-user industry. This segmentation reflects the material's versatility, differentiating between thin, protective layers applied to graphite or ceramic substrates and solid, standalone components engineered for structural integrity or thermal management. Understanding these segments is crucial because the material purity, microstructure, and surface finish requirements vary drastically; for instance, semiconductor coatings require ultra-low particle generation, while aerospace mirror substrates demand exceptional dimensional stability and stiffness-to-weight ratios. The underlying manufacturing complexity and cost structure are intrinsically tied to these structural and application-specific demands, guiding strategic investment in advanced deposition technology.

- By Type:

- Coatings (Thin Film Deposition for protective layers on susceptors, liners, and graphite heating elements)

- Bulk Components (Freestanding parts such as structural ceramics, mirror substrates, heat exchangers, and furnace components)

- By Application:

- Semiconductor Equipment (Wafer carriers, susceptors, focus rings, gas injectors, liners)

- Aerospace and Defense (Telescope mirrors, structural components, thermal management systems)

- Nuclear Energy (Fuel cladding, structural components, neutron absorbers)

- LED Manufacturing

- High-Temperature Industrial Furnaces (Heating elements, insulation)

- Chemical and Petrochemical Processing (Corrosion-resistant components)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East and Africa (MEA)

Value Chain Analysis For CVD SiC Market

The value chain for CVD SiC is characterized by high integration and technical specialization, beginning with the highly capital-intensive upstream segment focused on precursor synthesis and material preparation. Upstream activities involve the production of high-purity silicon and carbon source gases, such as Methyltrichlorosilane (MTS), Silane (SiH4), and hydrocarbon compounds like propane or acetylene. Achieving the ultra-high purity required for semiconductor-grade CVD SiC demands sophisticated chemical purification processes, often limited to a few specialized chemical manufacturers globally. This reliance on purified precursor gases means that control over the upstream supply chain is a significant determinant of final product quality and cost, making secure, long-term supply agreements crucial for CVD material fabricators.

The midstream constitutes the core manufacturing process: the Chemical Vapor Deposition itself. This stage involves operating complex, high-temperature, vacuum-controlled CVD reactors. Fabricators specialize in process engineering—optimizing temperature gradients, pressure, gas flow rates, and precursor mixtures to deposit SiC onto mandrels or substrates, creating either thin films or dense bulk structures. Downstream activities involve final component machining, polishing, and quality verification. CVD SiC, being an extremely hard material, necessitates highly specialized and costly grinding techniques (e.g., diamond grinding or laser ablation) to achieve the tight tolerances and smooth surface finishes required, particularly for precision optics and semiconductor components. The effectiveness of distribution channels relies heavily on technical support, as components often require customization and application-specific consultation.

Distribution channels for CVD SiC are typically direct or semi-direct due to the highly technical nature of the product and the need for close coordination between the fabricator and the end-user (e.g., semiconductor foundries or aerospace primes). Direct distribution dominates for custom-engineered bulk components, ensuring detailed specifications and quality traceability are maintained throughout the supply process. Indirect distribution, often through specialized high-tech material distributors or sales agents, might be utilized for standardized coating services or commodity components. The channel selection emphasizes technical expertise and application knowledge over simple logistics, underscoring the product's role as a critical enabling technology. Strong intellectual property surrounding the deposition recipes and reactor design reinforces the barriers protecting established players across this specialized value chain.

CVD SiC Market Potential Customers

Potential customers for CVD SiC are primarily large-scale, high-technology industrial organizations operating in environments where material performance cannot be compromised by temperature, chemical attack, or radiation. The most significant customer base resides in the semiconductor industry, specifically integrated device manufacturers (IDMs), foundries, and original equipment manufacturers (OEMs) of wafer fabrication equipment. These entities are buyers of CVD SiC components like susceptors, showerheads, and focus rings, which are essential for processes like plasma etching, chemical vapor deposition, and epitaxy, demanding the highest level of material purity and dimensional stability to prevent yield loss.

Another major segment of buyers comprises defense contractors and space agencies (including their supply chain partners) requiring lightweight, rigid, and thermally stable components. These end-users procure CVD SiC for mission-critical applications such as optical mirror substrates in space telescopes, inertial guidance system components, and heat shields in re-entry vehicles. The decision criteria for these customers are primarily based on reliability, specific stiffness, and resistance to environmental stress, rather than upfront cost, favoring suppliers who can provide extremely low defectivity and precise geometric control, which only advanced CVD processes can deliver.

Furthermore, organizations involved in the energy sector, particularly those focused on nuclear power generation (both fission and next-generation fusion research) and high-efficiency power electronics manufacturing, represent substantial potential customers. In nuclear applications, buyers require specialized SiC grades that exhibit exceptional neutron tolerance and structural integrity at extreme temperatures for fuel cladding and reactor core components. For the power electronics market, while the SiC wafer itself is separate, the CVD components used to manufacture high-power SiC MOSFETs and diodes—such as heating elements and process liners—are critical purchases for ensuring the quality and throughput of the final semiconductor devices.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $580 Million |

| Market Forecast in 2033 | $1,340 Million |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Toyo Tanso Co. Ltd., Morgan Advanced Materials, Schunk Group, CoorsTek Inc., Ultra Materials LLC, Rohm Co. Ltd., Saint-Gobain Ceramic Materials, 3M Company, AGSCO Corp., DOW Corning Corporation, General Electric, Advanced Materials Technology Inc., Ferrotec Corporation, Japan Fine Ceramics Co. Ltd., SGL Carbon, Momentive Technologies, Materion Corporation, Washington Mills Electro Minerals. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CVD SiC Market Key Technology Landscape

The core technology underpinning the CVD SiC market revolves around large-scale, high-vacuum, high-temperature deposition systems capable of maintaining precise control over highly reactive chemical processes. The dominant method employs atmospheric or low-pressure CVD (APCVD/LPCVD) techniques utilizing precursors such as Methyltrichlorosilane (MTS, CH3SiCl3) or mixtures of silane (SiH4) and hydrocarbon gases (e.g., C3H8). Advanced reactor designs, including cold-wall and hot-wall systems, are optimized based on the desired product structure. Hot-wall reactors are often preferred for producing high-purity bulk SiC components due to their ability to maintain uniform temperature profiles across large areas, while cold-wall systems offer advantages in lower deposition temperatures and reduced contamination, often utilized for thin film coating applications. Continuous technological refinement focuses on improving precursor delivery systems to enhance gas phase uniformity and control the stoichiometry of the deposited SiC layer.

A critical technological trend involves the development of specialized processes for depositing isotopically enriched SiC, which is gaining traction in quantum computing and advanced research applications due to its superior electron mobility and nuclear spin properties. Furthermore, innovations in controlling the SiC crystal structure—specifically achieving specific polytypes such as 4H-SiC or 6H-SiC in thin film form—are vital for optimizing performance in power electronics components like epitaxy susceptors. Manufacturers are investing heavily in advanced in-situ monitoring technologies, including optical emission spectroscopy and pyrometry, to gain real-time insights into the deposition environment. This closed-loop control allows for immediate parameter adjustment, crucial for maintaining consistency during long deposition runs required for thick, bulk SiC structures, which can take hundreds of hours to complete.

Furthermore, post-deposition processing technologies constitute a significant part of the landscape. As CVD SiC components require extremely fine tolerances and superior surface finishes (e.g., RMS roughness less than 1 nm for optical mirrors), advanced ultra-precision machining techniques are essential. These include specialized chemical-mechanical polishing (CMP) methods, laser etching, and focused ion beam milling, tailored to the inherent hardness and chemical resistance of the material. The integration of high-resolution metrology tools, such as atomic force microscopy (AFM) and white light interferometry, ensures compliance with stringent quality standards mandated by the semiconductor and aerospace sectors. The ability to seamlessly integrate deposition technology with subsequent high-precision finishing techniques represents a key competitive differentiator in the high-end CVD SiC market.

Regional Highlights

The regional distribution of the CVD SiC market is heavily correlated with the presence of advanced manufacturing ecosystems, particularly those focused on semiconductor fabrication and high-tech defense industries. Asia Pacific (APAC) currently dominates the market, primarily driven by China, South Korea, Taiwan, and Japan. These nations host the majority of global SiC power device manufacturers and leading semiconductor foundries, generating immense demand for CVD SiC susceptors, liners, and process components essential for both epitaxy and wafer processing. The substantial investment in electric vehicle manufacturing and renewable energy infrastructure across China and India is further fueling regional growth, as these applications are rapidly adopting SiC power modules, thereby increasing the ancillary demand for CVD SiC manufacturing tools.

North America holds a significant share, particularly in the high-value, highly customized segments such as aerospace, defense, and advanced nuclear energy research. The United States leads in the use of CVD SiC for precision optics, including large-scale mirror substrates for satellite and ground-based telescopes, owing to the material's unparalleled combination of lightweight properties and thermal stability. Robust government funding for defense programs and space exploration ensures steady demand for specialized, high-purity SiC structures. Moreover, the presence of major SiC wafer and power device innovators in the region drives continuous technological development and initial market adoption of new CVD SiC components optimized for next-generation manufacturing tools.

Europe demonstrates steady growth, particularly due to stringent regulations promoting energy efficiency and the resultant surge in EV and industrial power converter manufacturing across Germany, France, and Italy. European research institutions are also at the forefront of nuclear fusion and high-energy physics research, utilizing specialized CVD SiC components for demanding experimental apparatus. While manufacturing capacity might lag APAC, the region focuses on high-quality, specialized applications and maintains strong R&D expenditure. Latin America and the Middle East and Africa (MEA) represent smaller but emerging markets, with demand primarily concentrated in oil and gas processing (for chemical inertness) and initial investments in renewable energy projects, though these regions rely heavily on imports from the established manufacturing hubs.

- Asia Pacific (APAC): Dominates due to being the global hub for semiconductor and SiC power device manufacturing; rapid adoption of EVs and solar power drives consistent demand for fabrication components.

- North America: Strong market for high-performance applications, especially aerospace mirror substrates, defense systems, and advanced nuclear components; focuses on custom, ultra-pure, and high-tolerance CVD SiC parts.

- Europe: Key growth driven by the transition to SiC-based power electronics in automotive and industrial sectors; strong focus on R&D for fusion energy components and high-efficiency industrial furnaces.

- China: Major consumer and producer, driving volume demand due to massive domestic investments in 5G infrastructure and new energy vehicles.

- Japan and South Korea: Centers for advanced semiconductor equipment OEMs, requiring the highest grade of CVD SiC coatings and bulk components.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CVD SiC Market.- Toyo Tanso Co. Ltd.

- Morgan Advanced Materials

- Schunk Group

- CoorsTek Inc.

- Ultra Materials LLC

- Rohm Co. Ltd.

- Saint-Gobain Ceramic Materials

- 3M Company

- AGSCO Corp.

- DOW Corning Corporation

- General Electric

- Advanced Materials Technology Inc.

- Ferrotec Corporation

- Japan Fine Ceramics Co. Ltd.

- SGL Carbon

- Momentive Technologies

- Materion Corporation

- Washington Mills Electro Minerals

- Hitachi Chemical Company Ltd.

- Nippon Crucible Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the CVD SiC market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of CVD SiC over traditional SiC materials?

CVD SiC offers superior purity, near-theoretical density, and isotropic properties, making it essential for critical applications. Unlike sintered SiC, the CVD process creates non-porous material with exceptional plasma resistance, high thermal conductivity, and chemical inertness, which is crucial for high-yield semiconductor fabrication and extreme environment use.

Which industrial sector drives the largest demand for CVD SiC components globally?

The semiconductor industry is the largest demand driver, utilizing CVD SiC for critical process components like susceptors, showerheads, and liners in etching and epitaxy equipment. This demand is intrinsically linked to the global expansion of SiC power device manufacturing for electric vehicles and renewable energy systems.

How is the CVD SiC market responding to supply chain challenges related to precursor materials?

To mitigate reliance on limited precursor sources (like MTS), companies are strategically diversifying their supply chains and investing in proprietary purification and synthesis technologies. This focus ensures the sustained availability of high-purity silicon and carbon source gases necessary for semiconductor-grade material production and reduces geopolitical risk.

What role does CVD SiC play in the rapidly growing Electric Vehicle (EV) market?

CVD SiC plays an indirect but critical role in the EV market by providing the high-purity components (susceptors, furnace parts) used to manufacture SiC power semiconductors (MOSFETs and diodes). These SiC devices are essential for high-efficiency inverters and onboard chargers, extending battery range and reducing system weight in EVs.

What are the most demanding applications for bulk CVD SiC components?

Bulk CVD SiC is highly sought after in aerospace for lightweight, highly rigid, and thermally stable optical mirror substrates, and in advanced nuclear energy research for structural components requiring extreme radiation and high-temperature tolerance. These applications demand exceptional dimensional stability and complex, custom geometries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- CVD SiC Market Size Report By Type (High Resistivity Grade, Middle Resistivity Grade, Low Resistivity Grade), By Application (Rapid Thermal Process Components, Plasma Etch Components, Susceptors & Dummy Wafer, LED Wafer Carriers & Cover Plates, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- CVD SiC Market Statistics 2025 Analysis By Application (Rapid Thermal Process Components, Plasma Etch Components, Susceptors and Dummy Wafer, LED Wafer Carriers and Cover Plates), By Type (High Resistivity Grade, Middle Resistivity Grade, Low Resistivity Grade), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager