Cyazofamid Fungicide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439079 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cyazofamid Fungicide Market Size

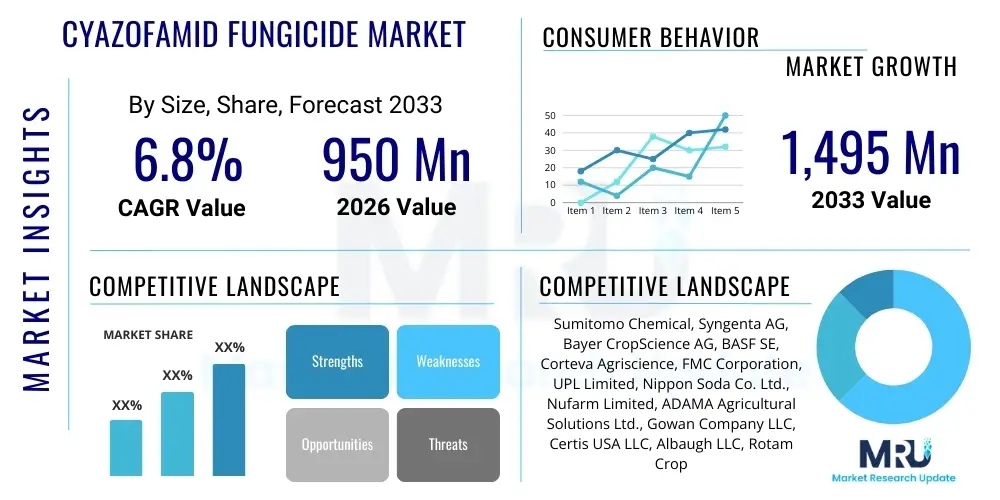

The Cyazofamid Fungicide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 950 million in 2026 and is projected to reach USD 1,495 million by the end of the forecast period in 2033.

Cyazofamid Fungicide Market introduction

Cyazofamid, a powerful fungicide belonging to the cyanoimidazole chemical group, is widely recognized for its exceptional efficacy in controlling diseases caused by water molds (oomycetes), most notably the devastating Late Blight caused by Phytophthora infestans in potato and tomato crops, and various forms of downy mildew across specialty crops. Discovered and developed by Sumitomo Chemical, Cyazofamid stands out due to its unique chemical structure, which includes a cyanoimidazole ring providing high specificity and potent activity against targeted pathogens. Its mechanism of action, involving the inhibition of Complex III (ubiquinol-cytochrome c reductase) in the mitochondrial respiration chain, is critical for disrupting energy production in fungal cells. This distinct fungicidal signature allows Cyazofamid to be classified separately from older QoI fungicides, making it an invaluable tool in strategic fungicide resistance management programs globally, thereby ensuring the sustained productivity of essential agricultural outputs. The compound exhibits excellent residual activity, primarily acting as a protectant, but also displaying limited translaminar movement, which enhances its protective scope within the plant foliage following application.

The primary commercial applications of Cyazofamid are focused on safeguarding high-value horticultural crops that are highly susceptible to oomycete infections. These include extensive use in potato and tomato fields across North America, Europe, and Asia, as well as in viticulture for protecting grapes against Downy Mildew (Plasmopara viticola). Furthermore, it is extensively deployed on leafy vegetables such as lettuce and brassicas, and in cucurbits like squash and melons. The inherent benefits of Cyazofamid extend beyond high efficacy; its relatively favorable toxicological and environmental profile, characterized by low application rates and specific target action, aligns well with increasingly stringent global regulatory frameworks aimed at minimizing pesticide residues in food and the environment. This regulatory compliance factor has significantly bolstered its market acceptance and competitive advantage over older, broader-spectrum chemistries.

The persistent growth of the Cyazofamid market is fundamentally driven by two macro-factors: the necessity for enhanced global food security and the increasing intensity and unpredictability of climate-related disease pressure. Climatic variability, particularly extended periods of high humidity and moderate temperatures, creates optimal breeding grounds for aggressive oomycete pathogens, turning prevention into an absolute necessity for commercial growers. Moreover, as global population and wealth increase, the demand for consistently high-quality, blemish-free fresh produce requires faultless crop protection inputs. The expansion of precision agriculture techniques, which allow for the optimized, targeted application of potent products like Cyazofamid, ensures that growers can achieve maximum biological effectiveness while efficiently managing input costs. This convergence of biological need, environmental compliance, and technological optimization solidifies Cyazofamid's long-term market position as a cornerstone protective fungicide.

Cyazofamid Fungicide Market Executive Summary

The global Cyazofamid Fungicide Market is experiencing robust expansion, characterized by strategic shifts toward enhanced formulation technologies and integrated product offerings. Business trends highlight intense competitive efforts focused on intellectual property defense and the formation of cross-regional distribution partnerships to secure market access in rapidly expanding agricultural economies. A key commercial focus involves developing pre-mixed formulations where Cyazofamid is combined with fungicides from different chemical classes, such as Phenylamides or Carboxylic Acid Amides (CAAs). This approach is designed not only to broaden the spectrum of controlled diseases but, more importantly, to provide farmers with a single, compliant product solution for robust anti-resistance stewardship, thereby enhancing the product's value proposition and market longevity. Furthermore, leading agrochemical companies are investing heavily in digital marketing and technical services, offering AI-backed advice on application timing to ensure optimal product performance and customer loyalty in key commercial farming sectors.

Regionally, the Asia Pacific (APAC) market maintains its undisputed leadership in market consumption volumes, driven by massive acreage under cultivation and high incidence of waterborne diseases in staple crops. However, growth rates are accelerating notably in Latin America, especially across the high-production agricultural regions of the Southern Cone, where rapid technological adoption and foreign direct investment in agriculture are transforming farming practices. Conversely, mature markets in North America and Western Europe are defined by innovation quality rather than volume growth; here, the market prioritizes ultra-low residue products, precision application compatibility, and formulations that support sustainable farming certifications. The regulatory environment in Europe, particularly the ongoing review of active substances, continues to dictate innovation speed and product positioning, favoring actives like Cyazofamid that demonstrate specific, low-toxicity action.

Analysis of market segments reveals that the SC (Suspension Concentrate) formulation type remains dominant, preferred for its stability, ease of mixing, and enhanced efficacy characteristics in spray applications. Within the application segment, specialized horticulture—specifically protection of potatoes, tomatoes, and grapes—accounts for the overwhelming majority of market revenue, reflecting the high monetary value per acre of these crops and the critical risk posed by diseases like Late Blight. A crucial segment trend involves the increasing demand for preventative treatments, underscoring a proactive shift in global farming practices away from expensive curative measures. The strategic segmentation of distribution channels emphasizes the reliance on specialized agricultural cooperatives and certified retailers who provide essential localized technical support, credit access, and stewardship training, particularly in highly fragmented agricultural markets where product education is paramount for effective resistance management compliance.

AI Impact Analysis on Cyazofamid Fungicide Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Cyazofamid Fungicide Market primarily revolve around three critical areas: optimization of application timing, predictive modeling for disease outbreaks, and enhancing supply chain efficiency. Users frequently ask how AI-driven precision agriculture platforms can minimize fungicide usage while maximizing efficacy, thereby reducing input costs and environmental footprint. Specifically, common questions pertain to the integration of satellite imagery analysis and drone-based multispectral sensing with traditional meteorological data to achieve ultra-precise prescription mapping for Cyazofamid application. Concerns also focus on the role of machine learning in forecasting late blight or downy mildew epidemics based on hyper-local climate data, soil moisture profiles, and historical disease patterns, ensuring that Cyazofamid is applied exactly when and where it is most needed, drastically reducing unnecessary prophylactic spraying and improving environmental stewardship. Furthermore, manufacturers are keenly interested in how AI can streamline complex global supply chains, optimize inventory based on real-time field demand signals transmitted via IoT devices, and improve the logistics of distributing these specialized formulations to remote farming communities efficiently.

The implementation of AI algorithms in advanced farm management systems allows for highly precise disease scouting and risk mapping which directly translates into resource optimization. By analyzing vast datasets, including environmental conditions, pathogen load dynamics, and crop health metrics derived from in-field sensors and remote sensing, AI can identify early signs of fungal infection or predict favorable conditions for oomycete growth with unprecedented accuracy. This capability directly influences the demand and deployment strategy for Cyazofamid, shifting applications decisively from routine calendar-based treatments to targeted, need-based interventions. Such optimization does not only result in substantial savings for the farmer by lowering the overall volume of chemicals used but also extends the effective life of the fungicide by significantly reducing the selection pressure on pathogen populations for resistance development, which is a key sustainability and commercial concern for highly valued actives like Cyazofamid.

Moreover, AI contributes significantly to R&D efficiency within the agrochemical industry, impacting the future development and market positioning of Cyazofamid. Machine learning models are being utilized to analyze high-throughput screening data, predicting potential synergistic effects when Cyazofamid is mixed with various adjuvants or other active ingredients, thereby accelerating the development and commercialization timeline of next-generation combination products. On the farmer and advisory side, AI-powered digital advisory services provide tailored, real-time recommendations to agricultural consultants and end-users regarding fungicide selection, optimal dosage, and mandatory rotation strategies. This analytical integration ensures that the market moves towards a smarter, more resource-efficient application paradigm, embedding Cyazofamid within a data-driven ecosystem where efficacy, sustainability, and economic viability are maximized concurrently, reinforcing its market relevance in the age of precision agriculture and data monetization in farming.

- AI-powered predictive modeling optimizes application timing, maximizing Cyazofamid efficacy and minimizing waste through precise prescription maps.

- Machine learning enhances disease risk mapping and forecasts outbreaks, driving targeted, variable-rate fungicide application strategies.

- Automation and predictive analytics in supply chain logistics utilize AI to forecast localized demand accurately, preventing stockouts and improving cold chain distribution efficiency.

- AI aids agrochemical R&D by simulating molecular interactions, accelerating the identification of beneficial and stable combination products involving Cyazofamid.

- Digital advisory services leveraging AI provide farmers with real-time, customized recommendations for dosage and mandatory resistance management protocols, promoting product stewardship.

DRO & Impact Forces Of Cyazofamid Fungicide Market

The Cyazofamid Fungicide market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the competitive landscape and market trajectory over the forecast period. A predominant driver is the escalating global incidence and severity of oomycete diseases, particularly Late Blight (Phytophthora infestans) in staple and cash crops like potatoes and tomatoes. Cyazofamid's classification as a highly effective, modern tool against these destructive, rapidly evolving pathogens ensures sustained, mission-critical demand. This biological driver is amplified by increasing global population figures and the corresponding need to maximize yield output from finite arable land. Coupled with this is the continuous expansion of controlled environment agriculture (CEA) and high-density farming globally, where managing disease pressure in confined, high-humidity spaces necessitates reliable, fast-acting, and low-residue crop protection solutions. The rising awareness among commercial growers and regulatory bodies regarding the critical importance of fungicide resistance management also significantly favors Cyazofamid due to its unique mechanism of action (Complex III inhibitor), making it an indispensable component in fungicidal rotation programs, thereby securing its market share against legacy chemistries.

However, the market faces several complex restraints that temper growth expectations. The primary challenge remains the exceedingly stringent and often protracted regulatory approval and registration process required for new agrochemical active ingredients, particularly across economically significant but highly cautious markets like the European Union and Japan. This regulatory burden significantly increases the time-to-market and R&D investment costs, limiting the potential for rapid innovation cycles. Furthermore, the persistent threat of fungicide resistance development remains a critical long-term concern. If Cyazofamid is not integrated into strict rotation programs and is misused or over-relied upon, pathogens can develop resistance, swiftly diminishing its efficacy and long-term viability. Consequently, regulatory bodies and industry associations are forced to enforce strict usage quotas and rotational guidelines, which can inherently limit the total volume sold per season. Economic volatility, characterized by fluctuating commodity prices, variable currency exchange rates, and persistently rising input costs for farmers, can also temporarily curb discretionary demand, leading growers in price-sensitive regions to occasionally opt for cheaper, often less effective, older generation fungicides despite higher yield risks.

Opportunities for significant market penetration and growth are predominantly centered on the development of novel, highly stable formulations suitable for specific, efficient application methods, such as drip irrigation delivery, seed treatments, or integration into aerial drone spraying systems. Such innovations expand Cyazofamid's utility beyond traditional foliar sprays and improve resource efficiency. The synergistic opportunity presented by combining Cyazofamid with bio-stimulants or biological control agents offers a strategic pathway into the rapidly expanding organic and sustainable agriculture sector, catering to environmentally conscious consumers and growers. Moreover, strategic market penetration into emerging economies across Africa and Southeast Asia, where agricultural modernization is rapidly accelerating and disease pressure is perpetually high, represents a substantial, currently untapped potential for volume growth. The market is also heavily impacted by global regulatory shifts favoring products with demonstrably lower environmental toxicity profiles and superior efficacy, positioning Cyazofamid advantageously compared to many older, broad-spectrum chemical classes facing regulatory phase-out or restriction.

Segmentation Analysis

The Cyazofamid Fungicide Market is structurally segmented based on application type, formulation technology, mode of action, and distribution channel, providing a granular, multi-dimensional view of market dynamics and specialized adoption patterns across the global agricultural landscape. Thorough analysis of these segments is indispensable for strategic planning, enabling manufacturers to precisely tailor product development pipelines, optimize marketing campaigns, and establish highly efficient, localized distribution networks. The segmentation structure reflects both the intrinsic technical specifications of the product and the heterogeneous needs of end-user farming communities, spanning from large-scale, highly mechanized commercial operations focused on export quality to smallholder farms prioritizing subsistence and local market supply. Continuous and real-time assessment of these segmented markets helps to accurately identify fast-growing niches, anticipate areas facing regulatory saturation, and respond effectively to evolving crop protection requirements globally, ensuring long-term product relevance.

Detailed analysis of segment performance reveals several critical market dynamics. The application segment dedicated to high-value horticulture, specifically encompassing vegetables like potatoes and tomatoes, and fruits such as grapes, currently commands the largest revenue share. This dominance stems from the extremely high economic losses associated with oomycete diseases in these crops, compelling heavy investment in premium protection solutions. Formulation-wise, liquid concentrates, predominantly Suspension Concentrates (SC), continue to dominate the market preference. SC formulations offer superior benefits related to ease of handling, enhanced shelf stability, minimized dust exposure for applicators, and most critically, improved spray coverage and adhesion characteristics on plant surfaces, which are vital for achieving maximum biological effectiveness under diverse field conditions. Furthermore, the market's operational strategy is overwhelmingly driven by preventive applications (protectant mode of action), reflecting a mature global trend toward proactive disease management philosophies which aim to maintain crop health from the outset, minimizing reliance on often less successful and more costly curative interventions.

Future expansion within the segmentation landscape is anticipated to be driven by significant technological innovations in delivery systems. This includes the strategic integration of Cyazofamid into highly advanced encapsulated systems designed for controlled, slow release, or its optimized use within drone-based application solutions, especially targeting large, difficult-to-access tracts of land efficiently and sustainably. The distribution channel segment is undergoing rapid transformation, influenced by the increasing penetration of specialized e-commerce platforms and digital advisory services. These digital channels offer farmers direct access to high-quality products, robust technical support, and critical product stewardship information, bypassing traditional multi-tiered distribution bottlenecks. Analyzing the intricate relationships and interdependencies between these various segments is paramount for predicting market evolution, strategically allocating R&D capital, and ensuring that Cyazofamid’s product portfolio remains entirely aligned with evolving international regulatory mandates and the growing global demand for verifiable sustainable farming practices, thereby solidifying its position as a high-performance disease control agent.

- By Application:

- Vegetables (Potatoes, Tomatoes, Cucurbits, Onions) - Largest Segment, focusing on Late Blight and Downy Mildew control.

- Fruits (Grapes, Citrus, Berries) - High-value segment driven by Downy Mildew protection.

- Ornamentals and Turf - Niche market requiring specialized, low-phytotoxicity formulations.

- Cereals and Field Crops (Limited Use) - Targeted applications in specific disease outbreak scenarios.

- Others (e.g., Oilseeds, Specialty Crops, Tobacco) - Emerging application areas benefiting from broad spectrum oomycete control.

- By Formulation:

- Suspension Concentrate (SC) - Dominant formulation due to stability and ease of application.

- Wettable Powder (WP) - Older generation, still relevant in certain emerging markets.

- Water Dispersible Granules (WDG) - Growing in popularity for reduced dust exposure and easier metering.

- Emulsifiable Concentrate (EC) - Less common for Cyazofamid but used in specific combination products.

- By Mode of Action:

- Preventive/Protectant - The vast majority of market use, optimizing yield security.

- Curative (Limited Systemic Action) - Used strategically at early signs of infection, leveraging translaminar properties.

- By Distribution Channel:

- Direct Sales/Key Account Managers - Used for major commercial growers and institutional tenders.

- Agricultural Retailers and Distributors - The primary channel providing localized support and logistics.

- Cooperative Stores - Essential in regions with fragmented land ownership structures.

- Online Channels/E-commerce - Rapidly growing segment enhancing accessibility and transparency.

Value Chain Analysis For Cyazofamid Fungicide Market

The intricate value chain for the Cyazofamid Fungicide Market commences with the Upstream activities, which are inherently complex and centered on the highly specialized procurement and synthesis of intermediate chemicals necessary for producing the technical grade active ingredient (TGAI). This stage is characterized by high barriers to entry, driven by sophisticated proprietary synthesis processes, often involving complex fluorination chemistry unique to Cyazofamid's structure. Consequently, the reliance rests heavily upon a limited number of global chemical manufacturers, principally Sumitomo Chemical and licensed partners, who specialize in producing these high-purity, structurally specific compounds. Efficient management and quality assurance at this initial stage are paramount for cost control, as the technical specifications and purity of the TGAI directly dictate the biological efficacy, stability, and regulatory acceptance of the final formulated product. Key suppliers of raw materials, including specialized dispersing agents, non-ionic surfactants, and inert ingredients used in stabilization and formulation, also form a critical element of the upstream segment, demanding strict adherence to global supply chain integrity and reliable sourcing to maintain production consistency amidst volatile commodity markets.

Midstream activities encompass the sophisticated conversion of the technical grade material into commercially marketable formulations, such as SC, WP, and WDG, followed by advanced packaging and global branding. This manufacturing phase demands cutting-edge formulation technology to overcome challenges like ensuring uniform nano-scale particle size distribution, achieving optimal suspension properties in liquid forms, and guaranteeing long-term shelf stability under diverse climatic storage conditions. Investment in state-of-the-art manufacturing facilities is crucial for maintaining the high standards required by international agricultural markets. Distribution forms the crucial downstream segment, representing the complex logistical challenge of connecting manufacturers to the highly diverse global end-user base. Distribution channels are highly tiered and customized, typically integrating direct sales to multinational food processors and key agricultural accounts, alongside extensive indirect sales networks utilizing national distributors, regional wholesalers, and thousands of local agricultural retailers or cooperatives. This multi-layered approach is designed to ensure maximum geographical market reach, particularly in developing economies where farming structures are often geographically fragmented and highly reliant on local dealer relationships for technical guidance and financing.

Direct sales channels, often deployed for very large commercial operations or institutional procurement through governmental tenders, allow manufacturers to retain maximum control over product stewardship, pricing integrity, and the delivery of highly specialized technical support. Conversely, indirect channels rely substantially on the regional expertise, established farmer relationships, and localized logistical capabilities of third-party distributors. These distributors frequently provide essential services such as critical credit facilities and localized technical advisory support on application methodologies and resistance protocols. The speed and efficiency of this downstream network become a core competitive differentiator, particularly regarding the ability to execute prompt delivery during time-sensitive planting or peak disease outbreak seasons. The final and critical component of the value chain is the end-user interaction and post-sales stewardship. This includes comprehensive training and continuous guidance provided to farmers (the ultimate buyers) on responsible and rotation-compliant use of Cyazofamid to ensure maximum effectiveness, minimize environmental risk, and preserve the product’s long-term commercial viability against resistance development.

Cyazofamid Fungicide Market Potential Customers

The primary potential customers and core end-users of Cyazofamid fungicide are strategically targeted entities across the global agriculture value chain who face persistent and significant yield risks from aggressive oomycete pathogens. This foundational customer segment is predominantly composed of large-scale, highly capitalized commercial vegetable and specialty crop farmers who operate under immense commercial pressure to meet high-volume, high-quality quotas for both domestic and international food supply chains. Specifically, growers specializing in potatoes and tomatoes represent the single largest customer base globally, given Cyazofamid's demonstrated, near-unparalleled efficacy against Late Blight. These advanced commercial enterprises prioritize continuous product reliability, comprehensive technical assistance, and seamless compatibility with large-scale mechanized application systems, demonstrating a high willingness to invest in premium, high-efficacy crop protection solutions to guarantee harvest quality and quantity.

A crucial secondary customer segment includes viticulturalists (grape growers) across major wine and table grape producing regions globally, such as the Mediterranean Basin, Bordeaux, and California, who require robust and aesthetically clean protection against persistent Downy Mildew (Plasmopara viticola). Similarly, commercial producers of cucurbits (including melons, squash, and cucumbers) and onions in regions susceptible to intense humidity and water molds are heavy users of Cyazofamid. Institutional buyers and governmental organizations, such as large agricultural management firms, sovereign wealth funds managing agricultural holdings, or government bodies responsible for staple crop reserves, also constitute significant customers. These institutional entities focus on securing large-volume tenders and critically require products that adhere rigorously to complex international Maximum Residue Limits (MRLs) and specific phytosanitary regulations established by major importing nations, necessitating meticulous regulatory compliance from manufacturers.

An increasingly important and rapidly growing customer segment encompasses the operators of highly controlled, high-tech agricultural environments, specifically modern greenhouses and sophisticated vertical farms. These Controlled Environment Agriculture (CEA) facilities require fungicides with extremely low-residue footprints, high specificity, and proven efficacy to manage localized disease outbreaks without disrupting sensitive indoor recirculation systems or posing risks to worker health. These buyers prioritize product characteristics that minimize volatility and environmental impact within enclosed systems, driving demand for specialized, often liquid-based, Cyazofamid formulations. Ultimately, the entire potential customer base is unified by the absolute necessity of preventing catastrophic economic loss caused by rapidly spreading oomycete pathogens, driving continuous and resilient demand for a high-performance, resistance-management capable active ingredient like Cyazofamid across all scales of cultivation intensity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 950 million |

| Market Forecast in 2033 | USD 1,495 million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sumitomo Chemical, Syngenta AG, Bayer CropScience AG, BASF SE, Corteva Agriscience, FMC Corporation, UPL Limited, Nippon Soda Co. Ltd., Nufarm Limited, ADAMA Agricultural Solutions Ltd., Gowan Company LLC, Certis USA LLC, Albaugh LLC, Rotam CropSciences Ltd., Sharda Cropchem Ltd., Sinon Corporation, Kumiai Chemical Industry Co., Ltd., ISK Biosciences Corporation, Jiangsu Yangnong Chemical Group Co., Ltd., Dalian Lvyuan Biological Technology Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cyazofamid Fungicide Market Key Technology Landscape

The technology landscape supporting the Cyazofamid fungicide market is highly dynamic, focusing intensely on refining product performance, enhancing environmental safety, and enabling ultra-precision application methods to maximize biological efficacy and comply with increasingly stringent residue standards. A cornerstone technological area is advanced formulation science, particularly the development and optimization of highly stable Suspension Concentrates (SC) and specialized Water Dispersible Granules (WDG). These modern formulations leverage cutting-edge polymer, dispersant, and surfactant chemistry to meticulously control the size and distribution of Cyazofamid particles, often reaching nano-scale dimensions to ensure superior stability, excellent tank mix compatibility with complex fertilizers or other pesticides, and significantly improved spray coverage and adhesion on plant foliage. The objective of this formulation innovation is twofold: to improve rain-fastness immediately following application and to ensure controlled, sustained release of the active ingredient, thereby maximizing residual protection against recurrent disease cycles.

Another monumental technological shift involves the integration of Cyazofamid application protocols into sophisticated digital agriculture and smart farming platforms. This includes seamless compatibility with advanced Variable Rate Application (VRA) technologies, which utilize high-resolution GPS, satellite monitoring, and Internet of Things (IoT) sensors to generate real-time prescription maps. These maps dynamically modulate the fungicide dosage and coverage intensity based on specific environmental parameters, localized disease pressure gradients, and crop canopy density within defined field zones. Furthermore, the development and deployment of Decision Support Systems (DSS), powered by machine learning algorithms that fuse meteorological data, historical pathogen spread models, and in-field sensor readings, are crucial. These systems provide growers with highly accurate, data-driven advice regarding the optimal economic and biological window for Cyazofamid application, essential for effective stewardship and for countering the escalating threat of fungicide resistance.

Current research and development efforts are also strategically concentrated on two related areas: synthesizing novel, stable co-formulations and exploring advanced application methodologies. Efforts to synthesize new derivatives or enhanced stereoisomers of the Cyazofamid molecule aim to improve systemic uptake and movement within the plant or slightly broaden the spectrum of activity while rigorously maintaining its favorable toxicological profile. Simultaneously, there is intensive exploration into pre-mix products, which combine Cyazofamid with one or more fungicidal actives possessing completely different modes of action (e.g., CAAs or Phenylamides). This technology requires advanced encapsulation and blending techniques to ensure chemical stability of all components, delivering a comprehensive, single-product solution that rigorously adheres to mandated resistance management rotation guidelines. Finally, the emerging technology of drone-based and robotic application systems is forcing formulation specialists to develop ultra-concentrated, low-volume spray solutions suitable for accurate aerial dispersion, representing the future pathway for efficient, large-scale Cyazofamid deployment.

Regional Highlights

- Asia Pacific (APAC) Market Dominance: The APAC region maintains its commanding position as the largest market for Cyazofamid fungicide, primarily fueled by the immense scale of agricultural production across China, India, and Southeast Asia. The large acreage devoted to highly susceptible food staples such as potatoes, tomatoes, and certain field crops, combined with the region’s predominantly humid and monsoonal climates, creates ideal, continuous conditions for aggressive oomycete disease development, demanding high-frequency, reliable fungicidal protection. Government policies focused on achieving national food security, coupled with growing middle-class demand for blemish-free, high-quality fresh produce, further propel the adoption of premium active ingredients like Cyazofamid. While local production of generic versions exists, the market remains loyal to proprietary formulations due to perceived quality and technical support. Strategic distribution agreements and efficient supply chain management are key competitive factors in this highly fragmented market structure.

- North American Market Focus on High-Value Crops and Precision: North America (specifically the US and Canada) constitutes a highly mature and technologically advanced market. Demand for Cyazofamid here is hyper-focused on protecting very high-value specialty crops, predominantly seed and tablestock potatoes, wine and table grapes, and commercial lettuce. The market is defined by growers prioritizing maximum yield and quality, stringent compliance with low MRLs (Maximum Residue Limits), and absolute adherence to resistance management protocols. Consequently, adoption is tightly linked to precision agriculture platforms. Farmers leverage sophisticated digital tools to justify the use of premium-priced, high-efficacy products, ensuring optimal application rates and timing, thereby maximizing the return on investment (ROI) and securing the long-term effectiveness of the active ingredient against resistant strains.

- European Market Driven by Regulatory Compliance and Sustainability: The European market, encompassing Western and Southern Europe (France, Spain, Italy), is critical but highly regulated. Cyazofamid's use is robust due to its relatively favorable toxicological profile compared to many older chemistries, positioning it as an indispensable resistance rotation partner under the complex framework of the EU's Farm to Fork Strategy and Green Deal objectives. Demand is consistently high in key agricultural powerhouses, particularly for viticulture (grapes) and fresh vegetable production, where the humidity necessitates powerful protectants against Downey Mildew and Late Blight. Future growth hinges significantly on the ability of manufacturers to continuously provide efficacy data, successfully navigate the EU's rigorous active substance renewal process, and adapt formulations to integrate seamlessly with the continent’s accelerating shift toward sustainable and integrated pest management (IPM) systems.

- Latin America (LATAM) Growth Acceleration and Intensification: Latin America, led by the massive agricultural sectors in Brazil, Argentina, and Mexico, represents the most rapidly accelerating regional market. This rapid expansion is fueled by increasing agricultural intensification aimed at boosting global exports and substantial foreign investment in modern farming technologies. While traditionally focused on large commodity crops, the region is rapidly diversifying into high-value fresh produce, driving increased demand for specialized fungicides like Cyazofamid. Severe disease pressure, intensified by tropical and subtropical climates, necessitates highly effective, reliable treatments for ensuring yield security. The key market challenge involves overcoming logistical hurdles and financial instability across various local economies, requiring innovative financing and robust technical training programs to drive adoption amongst commercial growers.

- Middle East and Africa (MEA) Emerging Potential: The MEA region is characterized by substantial but nascent growth potential, particularly in technologically advanced agricultural zones like South Africa, Egypt, and Turkey. Growth is intrinsically tied to governmental commitments to enhancing domestic food sovereignty and the rapid expansion of high-tech commercial farming in Controlled Environment Agriculture (CEA), where high-value crops are protected from harsh external conditions. Despite the relatively smaller current market volume, increasing investments in water-efficient irrigation and protected cultivation techniques create a defined need for highly specific, effective, and environmentally compatible crop protection solutions, positioning Cyazofamid as a high-potential active ingredient for managing oomycete diseases in these rapidly modernizing agricultural segments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cyazofamid Fungicide Market.- Sumitomo Chemical Co., Ltd.

- Syngenta AG

- Bayer CropScience AG

- BASF SE

- Corteva Agriscience

- FMC Corporation

- UPL Limited

- Nippon Soda Co. Ltd.

- Nufarm Limited

- ADAMA Agricultural Solutions Ltd.

- Gowan Company LLC

- Certis USA LLC

- Albaugh LLC

- Rotam CropSciences Ltd.

- Sharda Cropchem Ltd.

- Sinon Corporation

- Kumiai Chemical Industry Co., Ltd.

- ISK Biosciences Corporation

- Jiangsu Yangnong Chemical Group Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Cyazofamid Fungicide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mode of action of Cyazofamid and why is it important for resistance management?

Cyazofamid operates by inhibiting Complex III (ubiquinone oxidizing site, or QoI site) in the mitochondrial respiration chain of oomycete pathogens, effectively halting cellular energy production. This distinct biochemical mechanism is crucial because it differentiates Cyazofamid from older fungicide classes, minimizing cross-resistance risks. Utilizing Cyazofamid in strict rotation programs, as mandated by industry stewardship guidelines, is essential for maintaining its efficacy and securing the long-term viability of this important tool against aggressive, resistance-prone pathogens like Late Blight.

Which crops benefit most from the application of Cyazofamid fungicide?

Crops that benefit most are high-value horticulture commodities highly susceptible to oomycete diseases, particularly potatoes and tomatoes, where Cyazofamid is the cornerstone treatment for controlling economically devastating Late Blight (Phytophthora infestans). Significant application also occurs in viticulture for protection against Downy Mildew, and across the production of various cucurbits, onions, and leafy vegetables destined for fresh markets, where crop appearance and quality are paramount.

How is the increasing adoption of biological controls impacting the market demand for Cyazofamid?

The rise of biological controls is fostering a shift toward Integrated Pest Management (IPM) where Cyazofamid is valued as an essential, high-efficacy component within hybrid solutions. Market demand is increasingly favoring innovative co-formulations (pre-mixes) that combine Cyazofamid with biocontrol agents or bio-stimulants. This strategy allows commercial growers to achieve powerful disease suppression while simultaneously meeting evolving sustainability criteria and lowering overall chemical load, thereby stabilizing and diversifying the demand for Cyazofamid.

What are the primary formulation types of Cyazofamid available in the global market?

The dominant formulation is the Suspension Concentrate (SC), highly preferred by commercial growers due to its enhanced handling safety, excellent storage stability, and superior foliar coverage characteristics compared to older powder forms. Other available types include Wettable Powder (WP) and Water Dispersible Granules (WDG), which offer advantages in certain niche applications, all relying on advanced formulation technology to ensure uniform particle dispersion and optimal biological efficacy.

Which geographic region currently dominates the Cyazofamid Fungicide market and what are the key drivers?

The Asia Pacific (APAC) region currently dominates the market by volume, driven primarily by the region’s expansive agricultural base in China and India, focusing heavily on staple crops like potatoes and tomatoes. Key drivers include extremely high, continuous disease pressure resulting from tropical and monsoonal climates, coupled with critical national mandates to secure food production yields against widespread oomycete infections, demanding reliable, high-performance fungicides like Cyazofamid.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager