Cyber Security Audit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432895 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Cyber Security Audit Market Size

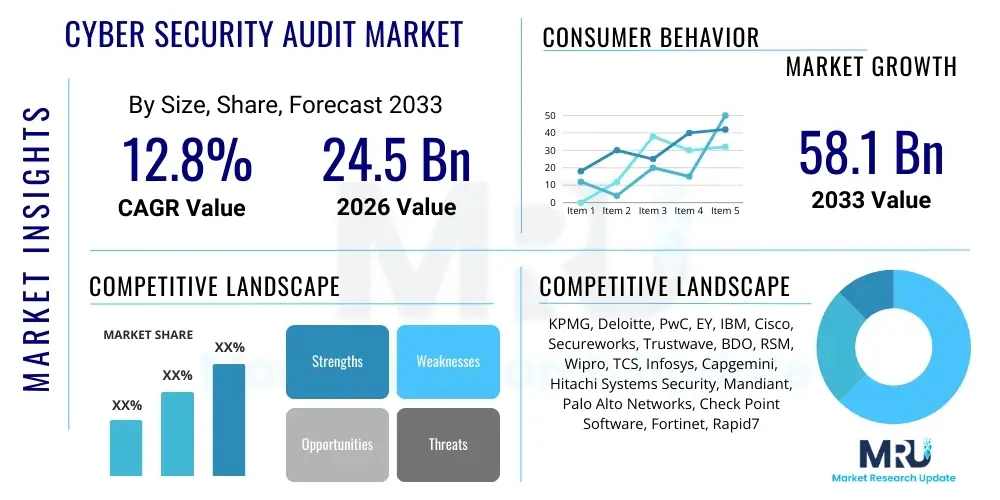

The Cyber Security Audit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.8% between 2026 and 2033. The market is estimated at $24.5 Billion in 2026 and is projected to reach $58.1 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the escalating sophistication of cyber threats, the global shift towards stringent data protection mandates, and the increasing reliance of organizations across all sectors on complex, interconnected digital infrastructure. The transition to cloud computing and remote work models further necessitates continuous auditing and assurance services to maintain a strong security posture against persistent adversarial activity.

Cyber Security Audit Market introduction

The Cyber Security Audit Market encompasses the professional services and specialized software solutions utilized by organizations to systematically evaluate the effectiveness of their information security policies, controls, and infrastructure. A cyber security audit provides an independent assessment, identifying vulnerabilities, compliance gaps, and risks inherent in an organization's digital environment. These audits are crucial for maintaining regulatory adherence, protecting sensitive data assets, and ensuring business continuity in the face of evolving threat landscapes. The scope ranges from technical penetration testing and vulnerability assessments to comprehensive reviews of governance frameworks and employee awareness programs.

Major applications of cyber security audits span highly regulated industries such as Banking, Financial Services, and Insurance (BFSI), Healthcare, Government, and Telecommunications, where data integrity and privacy are paramount. Key benefits derived from these services include enhanced risk mitigation, optimization of security investments, demonstration of due diligence to stakeholders and regulators, and proactive alignment with global compliance standards like GDPR, HIPAA, and ISO 27001. By providing a clear, evidence-based view of the current security state, audits enable organizations to prioritize remediation efforts effectively, shifting security from a reactive cost center to a strategic business enabler.

Driving factors for market expansion include the exponential increase in data breaches and ransomware attacks, forcing boards of directors to allocate larger budgets to preventative and assurance measures. Furthermore, the complexity introduced by hybrid cloud environments and the proliferation of IoT devices create expansive attack surfaces that require continuous, specialized auditing techniques. Legislative pressure, particularly from international bodies implementing unified data protection laws, mandates regular, third-party audits, thereby institutionalizing demand for these specialized market services. This confluence of technological complexity, regulatory burden, and heightened threat exposure establishes a solid foundation for sustained market growth.

Cyber Security Audit Market Executive Summary

The Cyber Security Audit Market is characterized by accelerating demand driven by digital transformation initiatives and the corresponding increase in enterprise vulnerability. Business trends indicate a significant shift towards automated and continuous audit platforms, moving away from traditional periodic assessments, particularly within large enterprises managing vast data sets. The integration of advanced analytics and Artificial Intelligence (AI) tools is transforming service delivery, allowing auditors to process threat intelligence faster and identify zero-day vulnerabilities more efficiently. Furthermore, there is a clear trend towards specialized audits focusing on supply chain risk management and cloud security configurations (e.g., assessing Infrastructure as Code (IaC) compliance), reflecting the modern extended enterprise architecture.

Regionally, North America maintains market dominance due to early adoption of advanced security technologies, the presence of major regulatory bodies (e.g., SEC, NIST), and a high concentration of leading service providers. However, the Asia Pacific (APAC) region is poised for the fastest growth, propelled by rapid industrial digitalization, increased governmental investment in critical infrastructure protection, and the implementation of new regional data localization laws. European markets demonstrate stable, high-value growth, anchored by the enforcement of GDPR, which imposes significant penalties for non-compliance and mandates regular data protection impact assessments (DPIAs) often conducted through formalized auditing processes.

Segment trends highlight the Professional Services component, particularly consulting and managed security services, as the highest revenue generator, as organizations frequently lack the internal expertise required for comprehensive audits covering highly specialized areas like OT (Operational Technology) security or complex regulatory frameworks. Compliance Audits, specifically those related to ISO 27001 and PCI DSS, remain indispensable across verticals. The market is witnessing increased demand for audits tailored to Small and Medium-sized Enterprises (SMEs), spurred by accessible cloud-based audit tools and subscription-based service models offered by providers, thereby democratizing sophisticated security assurance practices previously reserved for large corporations.

AI Impact Analysis on Cyber Security Audit Market

Common user questions regarding AI's impact on cyber security audits revolve around how AI can automate repetitive tasks, improve the accuracy of risk identification, and potentially replace human auditors. Users frequently ask about AI's role in processing vast log data, identifying anomalous behavior indicative of sophisticated threats, and ensuring compliance across dynamic environments like serverless architectures. Concerns often center on the explainability of AI-driven findings (the 'black box' problem), the security risks inherent in the AI tools themselves, and whether AI can adequately handle nuanced interpretations required for high-level governance audits. Overall expectations are high, anticipating that AI will elevate audits from reactive snapshot assessments to continuous, proactive security posture management systems, demanding new skill sets from security professionals.

AI's integration fundamentally changes the execution and scope of cyber security audits. By leveraging machine learning models, auditing tools can now perform continuous monitoring of configuration drifts and identify subtle patterns associated with insider threats or advanced persistent threats (APTs) that manual or rules-based systems often miss. This capability significantly reduces the time required for data collection and initial analysis, allowing human auditors to focus their expertise on strategic remediation planning and complex risk interpretation. AI enhances vulnerability assessment by predicting attack vectors based on environmental context and historical breach data, moving beyond simple static scanning.

The transition to AI-enabled auditing introduces complex governance challenges, requiring auditors to verify the integrity and bias of the AI models themselves. While AI excels at technical analysis, human oversight remains critical for assessing regulatory context, organizational culture, and potential ethical implications—factors that machine learning struggles to interpret holistically. Therefore, AI acts as a powerful force multiplier, increasing the depth, speed, and continuous nature of audits, rather than outright replacing the necessary critical judgment and stakeholder communication skills provided by experienced human auditors. This synergy creates higher standards for audit quality and demands proficiency in data science and AI governance from auditing firms.

- AI-powered threat modeling enhances predictive risk scoring during audits.

- Machine learning automates log analysis and artifact collection, streamlining compliance checks.

- Natural Language Processing (NLP) assists in auditing policy documents for consistency and adherence to mandates.

- AI facilitates Continuous Auditing (CA), shifting assessments from periodic to real-time verification.

- Increased need for auditing AI/ML models themselves (AI trustworthiness and bias assessment).

- Reduction in false positives during vulnerability scanning and anomaly detection.

DRO & Impact Forces Of Cyber Security Audit Market

The Cyber Security Audit Market is primarily driven by rigorous regulatory requirements, the increasing frequency and financial damage of cyberattacks, and the expanding digital attack surface due to cloud migration and IoT proliferation. Restraints include the persistent global shortage of skilled cyber security professionals capable of performing complex audits, the high initial cost of implementing advanced audit solutions, and the organizational resistance to continuous auditing practices due to resource constraints. Opportunities arise from the necessity for supply chain risk auditing, the demand for specialized cloud security compliance services (e.g., multi-cloud environments), and the development of lightweight, AI-driven audit tools accessible to SMEs. The primary impact forces—market leverage, competitive intensity, and technology penetration—are high, creating a fast-moving, competitive landscape where innovation in automation and specialized service delivery is key to gaining market share and establishing premium pricing power.

Key drivers center on legislative mandates such as Europe's NIS 2 Directive and the increasing scrutiny placed by global financial regulators on cyber resilience, making audits a non-negotiable operational expenditure. The economic impact of downtime and data exfiltration further justifies investment in proactive assurance measures, directly influencing budget allocation towards auditing services. Conversely, complexity serves as a significant restraint; as environments become heterogeneous (mixing on-premise, multiple cloud providers, and SaaS applications), achieving comprehensive audit coverage without specialized tools and highly trained personnel becomes exceptionally difficult, often resulting in scope limitations and potential gaps in security assurance.

Opportunities are strongly aligned with addressing emerging risks, particularly in the realm of operational technology (OT) within critical infrastructure sectors like energy and manufacturing. These unique environments require specialized audit frameworks distinct from traditional IT audits, opening a high-growth niche for providers who develop proprietary methodologies and tools. Furthermore, the adoption of continuous monitoring and automated reporting capabilities, enabled by robust integration between audit solutions and existing security stacks (like SIEM and SOAR), provides a differentiating factor. This shift towards real-time compliance validation mitigates the impact of traditional constraints by reducing reliance on extensive human effort and enabling more resource-efficient security management across the enterprise.

Segmentation Analysis

The Cyber Security Audit Market is segmented based on component, type, deployment mode, organization size, and vertical, reflecting the varied needs and operational structures of client organizations globally. The primary segmentation criteria delineate between solutions (the software and tools utilized for automated scanning, monitoring, and reporting) and services (the professional expertise required for assessment, consulting, penetration testing, and management of the audit process). This market structure emphasizes that while technology provides scalability, the complexity of compliance and regulatory interpretation ensures that specialized human services remain the most valuable component of the overall market offering. Understanding these segments is crucial for providers seeking to tailor their offerings to specific industry requirements and technological maturity levels.

Further granularity is achieved by differentiating audit types, ranging from technical assessments like penetration testing and vulnerability management to regulatory-focused compliance audits (e.g., HIPAA, SOC 2). The choice of audit type is directly correlated with the organization's immediate risk profile and legal obligations. Deployment segmentation (Cloud vs. On-Premise) reflects evolving corporate IT architecture, with cloud-based audit tools seeing rapid growth due to their scalability and ease of integration into hybrid environments. The segmentation by vertical (BFSI, IT & Telecom, Healthcare) underscores the highly customized nature of audit requirements; for instance, a healthcare audit emphasizes privacy controls (PHI protection), while a financial audit focuses heavily on transaction integrity and fraud prevention mechanisms.

The organization size segmentation (SMEs vs. Large Enterprises) reveals diverging market needs regarding budget, complexity, and preferred service delivery model. Large enterprises demand bespoke, global audit frameworks and often employ multiple specialized vendors, whereas SMEs increasingly prefer bundled, subscription-based Managed Security Services (MSS) that incorporate automated compliance checks and continuous vulnerability scanning tailored to smaller budgets and limited internal security staff. This detailed segmentation allows market players to develop targeted sales strategies, focusing either on high-value, complex consulting engagements for large corporations or volume-driven, automated service delivery for the growing SME segment globally.

- By Component:

- Solution (Security Information and Event Management (SIEM), Identity and Access Management (IAM), Intrusion Detection/Prevention Systems (IDPS), Vulnerability Management)

- Services (Managed Security Services, Professional Services, Consulting, Training)

- By Type:

- Internal Audit

- External Audit

- Compliance Audit (HIPAA, GDPR, ISO 27001, PCI DSS, SOC 2)

- Penetration Testing

- Vulnerability Assessment

- By Deployment:

- Cloud-Based

- On-Premise

- By Organization Size:

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

- By Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT & Telecom

- Government & Defense

- Healthcare

- Retail & E-commerce

- Manufacturing

- Energy & Utilities

Value Chain Analysis For Cyber Security Audit Market

The value chain for the Cyber Security Audit Market begins with upstream activities focused on the development of specialized audit technology and intellectual property, including vulnerability scanners, automated compliance tools, AI-driven analytics platforms, and proprietary risk frameworks. This initial stage involves intense R&D by independent software vendors (ISVs) and the technology arms of major consulting firms. The quality of this upstream component—the ability to accurately simulate threats, map controls to regulations, and integrate seamlessly with existing security infrastructure—dictates the efficiency and depth of the subsequent audit process. Strategic partnerships between technology providers and compliance certification bodies are crucial at this phase to ensure that tools meet global standards.

Midstream activities primarily encompass the core service delivery phase, where consulting firms and Managed Security Service Providers (MSSPs) utilize these tools, combined with their internal expertise, to execute the audit. This phase involves highly skilled professionals conducting scoping, data collection, execution (e.g., penetration testing), analysis, and risk reporting. Distribution channels play a vital role here; direct channels involve large audit firms engaging directly with major corporate clients for complex, multi-year contracts, often integrating the audit into broader risk advisory services. Indirect channels involve smaller, regional security consultancies or channel partners selling and implementing specific security audit software solutions, particularly targeting the SME segment.

The downstream component involves the implementation of remediation actions and continuous monitoring, which often leads to recurring revenue streams for the auditors or their partners. Successful auditing inherently generates demand for subsequent services such as remediation consulting, security awareness training, and continuous compliance monitoring solutions. The effectiveness of the audit is ultimately judged by the client's improved security posture and continued regulatory adherence. Strong downstream engagement through continuous auditing services ensures long-term customer relationships and stabilizes revenue, transitioning the engagement model from a one-time project to an ongoing, strategic partnership focused on sustained cyber resilience.

Cyber Security Audit Market Potential Customers

Potential customers for cyber security audit services span every vertical that processes, stores, or transmits sensitive data, or relies on complex digital infrastructure for core operations. End-users are typically characterized by their regulatory exposure, the criticality of their systems, and the volume of sensitive data they manage. The BFSI sector represents a significant consumer base, driven by stringent mandates like Basel III, Dodd-Frank, and PCI DSS, requiring continuous assurance regarding financial data integrity and customer privacy. Financial institutions leverage audits not only for compliance but also as a means to assess third-party risk inherent in partnerships with FinTech providers and cloud vendors.

The Healthcare sector (hospitals, pharmaceutical companies, insurers) is another prime customer group, with demand driven specifically by the need to protect Protected Health Information (PHI) under laws such as HIPAA in the US and equivalent privacy regulations globally. Healthcare organizations require specialized audits focusing on electronic medical record (EMR) system security, IoT device security within clinics, and adherence to specific data retention and access control mandates. Furthermore, Government and Defense entities consistently require the highest level of security assurance, mandating audits compliant with standards like NIST, FedRAMP, and various national defense specifications to protect critical national infrastructure and classified information.

Finally, the IT and Telecommunications vertical, characterized by complex network architectures and responsibility for transmitting vast quantities of global data, represents a foundational customer segment. These entities require audits to verify network resilience, assess the security of 5G infrastructure, and ensure compliance with telecommunications-specific regulations regarding data intercept and network reliability. Large enterprises across all manufacturing and retail sectors, especially those engaged in global e-commerce, also rely heavily on audits to secure intellectual property, manage supply chain vulnerabilities, and maintain consumer trust in digital transactions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $24.5 Billion |

| Market Forecast in 2033 | $58.1 Billion |

| Growth Rate | 12.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | KPMG, Deloitte, PwC, EY, IBM, Cisco, Secureworks, Trustwave, BDO, RSM, Wipro, TCS, Infosys, Capgemini, Hitachi Systems Security, Mandiant, Palo Alto Networks, Check Point Software, Fortinet, Rapid7 |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cyber Security Audit Market Key Technology Landscape

The technology landscape supporting the Cyber Security Audit Market is rapidly evolving, driven by the need for automation, real-time visibility, and correlation of security data across disparate environments. Core technologies include sophisticated Vulnerability Management (VM) platforms that integrate threat intelligence feeds to prioritize remediation based on actual risk exposure rather than raw severity scores. Security Information and Event Management (SIEM) systems form the foundational backbone, aggregating logs and security alerts, but they are increasingly augmented by Security Orchestration, Automation, and Response (SOAR) technologies. SOAR plays a critical role in the audit process by automating repetitive evidence collection and initial response actions, thereby speeding up the time required for auditors to assess incident handling capabilities.

A significant technological trend is the proliferation of solutions specifically designed for auditing cloud environments (Cloud Security Posture Management - CSPM). CSPM tools continuously monitor cloud configurations (e.g., AWS, Azure, GCP) to detect misconfigurations, ensure alignment with industry benchmarks (like CIS), and verify compliance with regulatory frameworks automatically. Identity and Access Management (IAM) and Privileged Access Management (PAM) systems are also central to modern audits, as auditors increasingly focus on verifying zero-trust architecture principles and ensuring least-privilege access across the enterprise. The shift toward API-driven auditing allows for deeper integration and faster data retrieval compared to legacy manual methods.

Furthermore, specialized tools for application security testing, including Static Application Security Testing (SAST) and Dynamic Application Security Testing (DAST), are integral to audits assessing software development life cycles (SDLC) and application integrity. The future landscape is defined by the integration of AI and Machine Learning (ML), which enables predictive auditing—using historical data to forecast where future vulnerabilities are most likely to emerge—and Continuous Control Monitoring (CCM) capabilities. This technological sophistication facilitates the transition from compliance snapshots to genuine, resilient security assurance, offering significant competitive advantages to firms that successfully integrate these advanced tools into their service delivery models.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share due to its established regulatory environment, high security spending across critical sectors (BFSI, tech), and the presence of numerous global headquarters demanding enterprise-level governance and comprehensive third-party audits. The region’s advanced technological infrastructure and high adoption rate of cloud and IoT technologies inherently generate complex security challenges, driving continuous demand for assurance services. Strict enforcement of legislation like the California Consumer Privacy Act (CCPA) and mandates from organizations such as the Cybersecurity and Infrastructure Security Agency (CISA) maintain high market momentum. The mature ecosystem allows providers to specialize in high-value services such as advanced threat modeling and customized compliance frameworks.

- Europe: The European market demonstrates robust, stable growth, fueled primarily by the General Data Protection Regulation (GDPR) and ongoing expansion of the Network and Information Security (NIS) Directive. GDPR’s requirement for Data Protection Impact Assessments (DPIAs) and the threat of severe penalties for non-compliance ensure mandatory, regular auditing for almost all organizations handling EU citizen data. The fragmentation of the regulatory landscape across various member states, despite EU directives, creates a need for specialized multi-jurisdictional audit expertise. The UK, Germany, and France are the major revenue contributors, focusing heavily on operational resilience audits in the financial and energy sectors.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, driven by rapid digital transformation, increasing foreign investment, and evolving local data sovereignty laws (e.g., laws in China, India, and Australia). Countries like China and India are experiencing massive growth in cloud adoption and e-commerce, leading to significant exposure and vulnerability that necessitates professional auditing. While regulatory maturity varies, the overall trend is toward stricter data protection laws, compelling multinational corporations operating in the region to adopt global standard audit practices. Market growth is further accelerated by government initiatives focused on modernizing critical infrastructure security and developing local cybersecurity talent pools.

- Latin America (LATAM): The LATAM market is characterized by moderate but accelerating growth, spurred by digital inclusion initiatives and the implementation of regional data protection laws, notably Brazil’s Lei Geral de Proteção de Dados (LGPD). Market expansion is focused on securing the fast-growing financial technology (FinTech) sector and addressing operational technology (OT) security risks in energy and mining. Challenges include economic volatility and a nascent cybersecurity skills market, which drives organizations to rely heavily on international audit providers and remote delivery models for specialized services.

- Middle East and Africa (MEA): Growth in the MEA region is sector-specific, largely driven by large-scale government digitization projects (like Saudi Vision 2030 and UAE strategies) and high investment in the Oil & Gas and financial services sectors. Mandates from central banks and national security agencies necessitate rigorous audits. While the overall market size is smaller than North America, the high investment capacity of sovereign wealth funds and critical dependence on secure infrastructure provide stable, high-value opportunities for specialized international audit firms focusing on physical and digital convergence security assessments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cyber Security Audit Market.- KPMG

- Deloitte

- PwC (PricewaterhouseCoopers)

- EY (Ernst & Young)

- IBM Security

- Cisco Systems (via security services)

- Secureworks

- Trustwave

- BDO

- RSM

- Wipro

- Tata Consultancy Services (TCS)

- Infosys

- Capgemini

- Hitachi Systems Security

- Mandiant (Google Cloud)

- Palo Alto Networks (Consulting services)

- Check Point Software Technologies

- Fortinet (Assessment Services)

- Rapid7

Frequently Asked Questions

Analyze common user questions about the Cyber Security Audit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between a Cyber Security Audit and a Penetration Test?

A cyber security audit is a comprehensive, structured examination of an organization's security controls, policies, procedures, and adherence to specific compliance frameworks (like ISO 27001). It assesses overall security posture. A penetration test (pen test) is a specific, technical assessment that simulates a real-world attack against defined targets to find exploitable vulnerabilities, focusing on specific systems or applications rather than the entire governance framework.

How frequently should an organization conduct a comprehensive Cyber Security Audit?

While compliance mandates often dictate annual external audits (e.g., PCI DSS), best practice recommends a risk-based approach incorporating quarterly internal audits and continuous, automated monitoring. High-risk industries or organizations undergoing major IT changes (cloud migration, M&A) should conduct audits more frequently to ensure continuous control validation and immediate remediation.

Which regulatory compliance frameworks are the most significant drivers for audit demand?

The most significant drivers are the General Data Protection Regulation (GDPR), which mandates audits for data protection; the Health Insurance Portability and Accountability Act (HIPAA) for healthcare data; the Payment Card Industry Data Security Standard (PCI DSS) for card processing entities; and ISO 27001, which provides a globally recognized framework for Information Security Management Systems (ISMS).

What role does Artificial Intelligence (AI) play in enhancing cyber security audits?

AI significantly enhances audits by automating data aggregation and analysis, enabling continuous monitoring of security controls (Continuous Auditing), and using machine learning models to identify complex anomalies and behavioral patterns indicative of advanced threats, thereby moving beyond static compliance checks to proactive risk management.

What are the greatest challenges faced by the Cyber Security Audit Market?

The key challenges include the persistent shortage of highly specialized audit professionals (particularly in cloud and OT security), the high costs associated with deep-dive audits, and the organizational difficulty in maintaining continuous compliance across increasingly complex, hybrid IT environments, often leading to audit fatigue and prioritization challenges.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager