Cyber Security Software Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439876 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Cyber Security Software Market Size

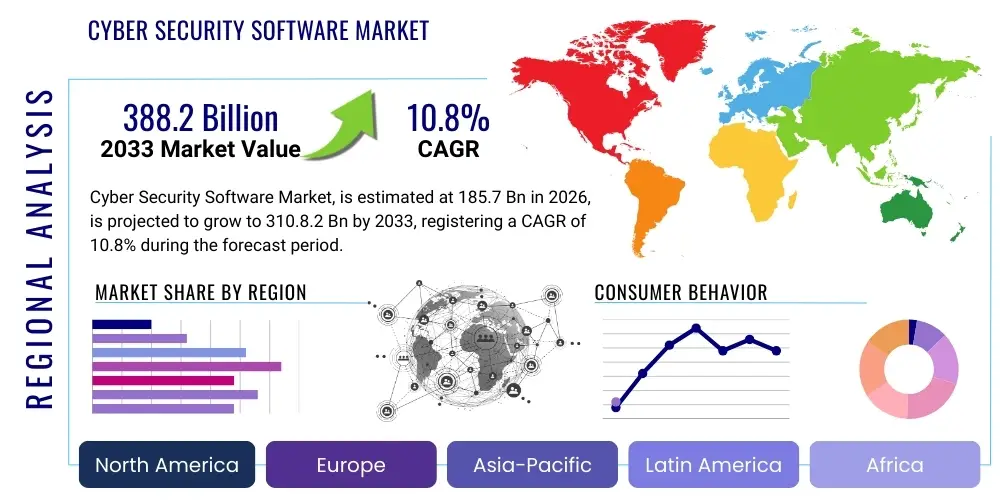

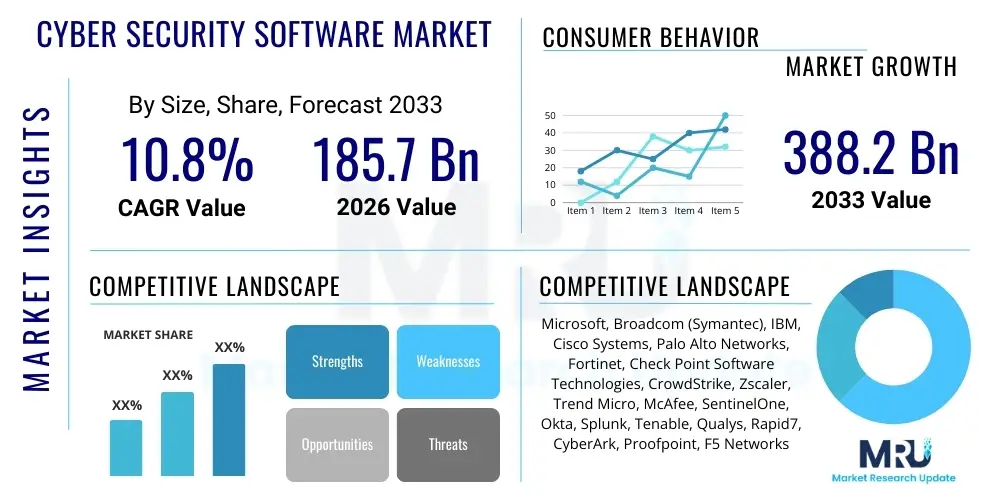

The Cyber Security Software Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10.8% between 2026 and 2033. The market is estimated at USD 185.7 billion in 2026 and is projected to reach USD 388.2 billion by the end of the forecast period in 2033.

Cyber Security Software Market introduction

The Cyber Security Software Market encompasses a vast array of solutions designed to protect computer systems, networks, programs, and data from digital attacks. These sophisticated software applications are crucial for safeguarding sensitive information, preventing unauthorized access, and maintaining the integrity and availability of digital assets across various sectors. The primary applications span from protecting individual devices and home networks to securing complex enterprise infrastructures, critical national infrastructure, and cloud environments. Key benefits include data breach prevention, regulatory compliance, operational continuity, and enhanced trust among customers and stakeholders. The market's growth is predominantly driven by the escalating frequency and sophistication of cyber threats, the increasing adoption of digital transformation initiatives, and the stringent regulatory landscape mandating robust data protection measures.

Cyber security software solutions range from antivirus and anti-malware programs to more advanced tools like Security Information and Event Management (SIEM), Identity and Access Management (IAM), Data Loss Prevention (DLP), intrusion detection and prevention systems (IDPS), and endpoint detection and response (EDR). These products are fundamentally designed to create multiple layers of defense, ensuring that organizations can detect, prevent, and respond to cyber incidents effectively. The comprehensive nature of modern cyber threats, including ransomware, phishing, advanced persistent threats (APTs), and zero-day exploits, necessitates a multi-faceted approach to security, which these software solutions provide by integrating various functionalities into cohesive platforms.

The market also benefits significantly from the pervasive shift towards cloud computing, the proliferation of IoT devices, and the increasing reliance on remote work models, all of which expand the attack surface and intensify the need for robust cyber defenses. Furthermore, heightened awareness among both businesses and consumers about the financial and reputational damage caused by cyber incidents is fueling investment in proactive security measures. Driving factors also include geopolitical tensions leading to state-sponsored cyber warfare, the increasing value of digital assets, and the continuous evolution of compliance standards such as GDPR, CCPA, and HIPAA, which compel organizations to invest in advanced cyber security software to avoid hefty penalties and maintain customer trust.

Cyber Security Software Market Executive Summary

The Cyber Security Software Market is experiencing profound shifts driven by dynamic business trends, evolving regional priorities, and specialized segment growth. Business trends highlight a pronounced move towards integrated security platforms, Managed Security Services (MSS), and Security-as-a-Service (SaaS) models, reflecting organizations' desire for simplified management, scalability, and access to advanced threat intelligence without the burden of extensive in-house infrastructure. There is also a significant trend towards automation and artificial intelligence (AI) integration within cyber security solutions to enhance threat detection capabilities and accelerate response times. The increasing scarcity of skilled cyber security professionals is further propelling demand for solutions that reduce manual intervention and provide intelligent insights.

Regionally, North America continues to dominate the market due to its advanced technological infrastructure, high adoption rates of cloud and IoT technologies, and a strong presence of key market players and research institutions. Europe is witnessing significant growth, largely driven by stringent data privacy regulations like GDPR and a growing awareness among enterprises regarding cyber risks. The Asia Pacific (APAC) region is emerging as a rapidly expanding market, fueled by digital transformation initiatives, increasing internet penetration, and a rising number of small and medium-sized enterprises (SMEs) realizing the importance of cyber protection. Latin America, the Middle East, and Africa are also showing steady growth as their digital economies mature and regulatory frameworks strengthen.

Segment-wise, cloud security, endpoint security, and network security are witnessing substantial growth, reflecting the current architectural shifts in IT infrastructure. Identity and Access Management (IAM) solutions are gaining traction as organizations prioritize robust authentication and authorization mechanisms in hybrid work environments. Data Loss Prevention (DLP) is also a critical segment, responding to the increasing need to protect sensitive information from accidental or malicious exfiltration. Furthermore, the BFSI (Banking, Financial Services, and Insurance), healthcare, and government sectors remain dominant end-users, given the critical nature of their data and the strict compliance requirements they face, consistently driving innovation and adoption of specialized security software.

AI Impact Analysis on Cyber Security Software Market

User questions regarding the impact of AI on the Cyber Security Software Market frequently revolve around its potential to revolutionize threat detection, automate response mechanisms, and personalize security protocols. Common inquiries focus on whether AI can truly outpace human adversaries, the accuracy and reliability of AI-driven threat intelligence, and the ethical implications of autonomous security systems. Users are keen to understand how AI can reduce the burden on security analysts, handle the massive volume of alerts generated by traditional systems, and provide predictive capabilities to anticipate future attacks. Concerns also surface about the potential for AI itself to be exploited by attackers, leading to sophisticated AI-powered cyber tools or data poisoning attacks on AI models used for security.

Artificial intelligence is fundamentally transforming the landscape of cyber security software by introducing unprecedented levels of automation, predictive analysis, and adaptive learning capabilities. AI algorithms can process vast quantities of data from various sources, including network traffic, endpoint logs, and user behavior, to identify anomalies and patterns indicative of malicious activity far more rapidly and accurately than traditional rule-based systems. This capability is crucial for detecting zero-day threats and sophisticated, evasive attacks that often bypass conventional defenses. AI-powered security solutions are particularly adept at reducing false positives, allowing security teams to focus on genuine threats and improve overall operational efficiency.

The integration of AI also enables cyber security software to evolve and adapt in real-time, learning from new attack vectors and improving its defensive posture autonomously. This adaptive learning is vital in a threat landscape where attackers constantly innovate their tactics. For instance, AI can analyze user and entity behavior (UEBA) to detect insider threats or compromised accounts by flagging deviations from baseline activities. Furthermore, AI contributes significantly to automating incident response, allowing systems to quarantine infected devices, block malicious IP addresses, or isolate compromised segments of a network without human intervention, thereby minimizing the impact and spread of attacks. However, the development and deployment of AI in cyber security also require careful consideration of data privacy, algorithmic bias, and the potential for adversarial AI attacks, where attackers specifically target and manipulate AI models.

- Enhanced Anomaly Detection: AI algorithms rapidly identify unusual patterns in network traffic, user behavior, and system logs, indicating potential threats.

- Predictive Threat Intelligence: AI analyzes historical data and global threat landscapes to predict emerging cyber threats and vulnerabilities.

- Automated Incident Response: AI-powered systems can automatically detect, triage, and respond to security incidents, reducing human intervention and response times.

- Reduced False Positives: Machine learning models improve the accuracy of threat detection, minimizing irrelevant alerts and improving analyst efficiency.

- Behavioral Analytics: AI-driven User and Entity Behavior Analytics (UEBA) identify insider threats and compromised accounts by detecting deviations from normal behavior.

- Adaptive Security: AI enables security systems to learn from new threats and adapt defenses in real-time, improving overall resilience.

- Malware Analysis Automation: AI accelerates the analysis and classification of new malware variants, aiding in rapid signature generation and protection.

- Vulnerability Management: AI assists in prioritizing vulnerabilities based on their potential impact and likelihood of exploitation.

DRO & Impact Forces Of Cyber Security Software Market

The Cyber Security Software Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities, collectively forming its Impact Forces. Key drivers include the exponential increase in cybercrime and the evolving sophistication of attack vectors, compelling organizations to continuously enhance their defenses. The rapid digital transformation across industries, coupled with the widespread adoption of cloud computing, IoT, and mobile technologies, significantly expands the attack surface, creating an urgent demand for comprehensive security solutions. Additionally, the tightening regulatory landscape, with directives like GDPR, HIPAA, and CCPA, imposes stringent data protection and privacy requirements, further pushing enterprises to invest in advanced cyber security software to ensure compliance and avoid severe penalties. The growing awareness among businesses about the potential financial, reputational, and operational damage from data breaches also acts as a strong motivator for increased security spending.

However, several restraints temper the market's growth. The most significant challenge is the persistent shortage of skilled cyber security professionals, which makes it difficult for organizations to effectively deploy, manage, and optimize complex security software. This talent gap often leads to underutilized security capabilities and increased reliance on managed security services. Another restraint is the high cost associated with implementing and maintaining advanced cyber security software, especially for Small and Medium-sized Enterprises (SMEs) with limited budgets. The inherent complexity of integrating diverse security solutions, coupled with the constant need for updates and patches to counter emerging threats, also poses operational hurdles. Furthermore, the challenge of securing legacy systems and the fragmentation of the vendor landscape, which can lead to interoperability issues, also act as significant impediments.

Opportunities for growth in the Cyber Security Software Market are abundant and diverse. The burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) within security solutions presents a massive opportunity for more proactive, predictive, and automated threat detection and response capabilities. The increasing demand for cloud-native security solutions, including Cloud Security Posture Management (CSPM) and Cloud Workload Protection Platforms (CWPP), driven by cloud migration strategies, offers substantial growth avenues. The expansion of the IoT ecosystem and the advent of 5G networks create new frontiers for specialized security software tailored to these environments. Moreover, the increasing focus on Zero Trust architecture, supply chain security, and data privacy management provides fertile ground for innovation and market expansion, as organizations seek holistic approaches to security that protect every access point and data flow, regardless of location or user. The rise of hybrid work models further necessitates robust endpoint and identity security solutions, presenting additional opportunities.

Segmentation Analysis

The Cyber Security Software Market is meticulously segmented based on various critical attributes, including solution type, deployment model, organization size, and end-user industry. This segmentation provides a granular view of market dynamics, enabling a deeper understanding of specific demands and growth drivers across different verticals and operational scales. Each segment exhibits unique characteristics and adoption patterns, influenced by factors such as regulatory compliance, budget constraints, technical infrastructure, and the specific threat landscape faced by each entity. Analyzing these segments is essential for identifying niche opportunities, tailoring product offerings, and formulating effective market entry and expansion strategies.

The solution type segment is highly diverse, encompassing a wide range of technologies designed to address distinct aspects of cyber defense. From foundational elements like endpoint security and network security to advanced functionalities such as security information and event management (SIEM), identity and access management (IAM), and data loss prevention (DLP), each solution plays a crucial role in an organization's overall security posture. Cloud security solutions, including Cloud Access Security Brokers (CASB) and Cloud Workload Protection Platforms (CWPP), have gained significant traction with the accelerating shift towards cloud computing. Furthermore, threat intelligence platforms, security orchestration, automation, and response (SOAR) systems, and vulnerability management solutions are increasingly vital for proactive threat management and efficient incident response.

Deployment models primarily differentiate between on-premises, cloud-based, and hybrid solutions. On-premises deployments, historically dominant, offer greater control and customization but require significant upfront investment and maintenance. Cloud-based solutions, often delivered as Security-as-a-Service (SaaS), provide scalability, flexibility, and reduced operational overhead, making them attractive to organizations of all sizes, especially SMEs. Hybrid models combine the benefits of both, allowing organizations to secure critical assets on-premises while leveraging cloud elasticity for other workloads. Organization size segmentation distinguishes between large enterprises and Small and Medium-sized Enterprises (SMEs), each with unique security requirements, budget considerations, and risk appetites. Finally, the end-user industry segmentation, covering sectors like BFSI, Government, Healthcare, IT & Telecom, Retail, and Manufacturing, highlights the tailored security needs and compliance mandates specific to each vertical, driving demand for specialized cyber security software solutions.

- By Solution Type:

- Endpoint Security

- Network Security

- Cloud Security

- Cloud Access Security Broker (CASB)

- Cloud Workload Protection Platform (CWPP)

- Cloud Security Posture Management (CSPM)

- Security Information and Event Management (SIEM)

- Identity and Access Management (IAM)

- Privileged Access Management (PAM)

- Identity Governance and Administration (IGA)

- Customer Identity and Access Management (CIAM)

- Data Loss Prevention (DLP)

- Vulnerability Management

- Encryption

- Web Security

- Email Security

- Security Orchestration, Automation, and Response (SOAR)

- Threat Intelligence Platform

- Managed Detection and Response (MDR)

- By Deployment Model:

- On-Premises

- Cloud-Based

- Hybrid

- By Organization Size:

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By End-User Industry:

- Banking, Financial Services, and Insurance (BFSI)

- Government and Defense

- Healthcare

- Information Technology (IT) and Telecommunications

- Retail and E-commerce

- Manufacturing

- Energy and Utilities

- Others (Education, Media & Entertainment)

Value Chain Analysis For Cyber Security Software Market

The value chain for the Cyber Security Software Market is intricate, involving multiple stages from initial research and development to final deployment and ongoing support, impacting both upstream and downstream activities. Upstream activities primarily involve foundational technological innovation, including the development of algorithms for threat detection, encryption protocols, and vulnerability analysis. This phase is characterized by intense R&D investments, collaboration with academic institutions, and sourcing of specialized talent in areas like AI, machine learning, and cryptography. Component suppliers, such as those providing hardware for secure enclaves or specialized processors, also form a critical part of the upstream segment, ensuring the underlying infrastructure can support advanced security functions.

Midstream activities focus on the actual software development, testing, and integration. This includes coding, rigorous quality assurance, ensuring interoperability with various operating systems and network environments, and embedding compliance features. Software vendors often acquire or partner with smaller security firms to integrate cutting-edge technologies or fill gaps in their product portfolios, reflecting the dynamic nature of the threat landscape. The packaging of solutions into comprehensive platforms or modular services, along with obtaining relevant certifications and industry standards compliance, is also crucial at this stage, preparing products for market entry. This phase requires significant project management capabilities and a robust understanding of current and future cyber threats.

Downstream activities encompass the distribution, sales, implementation, and post-sales support of cyber security software. Distribution channels are varied, including direct sales forces engaging large enterprises, value-added resellers (VARs) providing localized expertise, managed security service providers (MSSPs) offering comprehensive security operations, and online marketplaces for smaller solutions. Implementation involves integrating the software into client IT environments, configuring policies, and training end-users. Post-sales support, including regular updates, patch management, threat intelligence feeds, and technical assistance, is paramount for customer satisfaction and long-term retention. Both direct and indirect distribution play pivotal roles, with indirect channels extending market reach and providing specialized integration services, while direct channels allow for closer client relationships and custom solution development.

Cyber Security Software Market Potential Customers

The potential customers for Cyber Security Software are incredibly diverse, spanning virtually every sector and organization size, driven by the universal need to protect digital assets and maintain operational integrity. Enterprises, ranging from large multinational corporations to Small and Medium-sized Enterprises (SMEs), constitute the largest segment of buyers. These organizations utilize cyber security software to protect their intellectual property, financial data, customer information, internal communications, and critical infrastructure from a wide array of cyber threats, including data breaches, ransomware attacks, and espionage. The specific types of software adopted by businesses vary based on their industry, regulatory requirements, risk appetite, and existing IT infrastructure, creating a complex but expansive market for tailored solutions.

Beyond traditional businesses, critical infrastructure operators, including those in energy, utilities, transportation, and telecommunications, represent a significant customer base. These entities face unique and severe threats due to the potential for widespread disruption and national security implications if their systems are compromised. Government agencies, at all levels (federal, state, local), are also major consumers of cyber security software, tasked with protecting sensitive citizen data, classified information, and national digital assets. Their purchasing decisions are often influenced by stringent compliance mandates and a need for highly robust, certified solutions that can withstand sophisticated state-sponsored attacks.

Furthermore, educational institutions, healthcare providers, and individual consumers also form important segments of potential customers. Educational sectors require solutions to protect student data and research, while healthcare organizations must comply with strict regulations like HIPAA to safeguard patient records. Individual consumers, though often purchasing simpler antivirus and anti-malware solutions, contribute to a vast market for personal device protection. The increasing shift to remote work models has also expanded the customer base to include individuals and small businesses requiring robust endpoint security, secure network access, and cloud security for their home offices and remote operations, emphasizing the ubiquitous demand for digital protection in the modern era.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 185.7 Billion |

| Market Forecast in 2033 | USD 388.2 Billion |

| Growth Rate | 10.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Microsoft, Broadcom (Symantec), IBM, Cisco Systems, Palo Alto Networks, Fortinet, Check Point Software Technologies, CrowdStrike, Zscaler, Trend Micro, McAfee, SentinelOne, Okta, Splunk, Tenable, Qualys, Rapid7, CyberArk, Proofpoint, F5 Networks. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cyber Security Software Market Key Technology Landscape

The Cyber Security Software Market is characterized by a rapidly evolving technological landscape, driven by the continuous arms race between cyber defenders and attackers. At its core, the technology landscape is built upon foundational principles such as encryption, firewall technologies, and intrusion detection/prevention systems (IDPS), which remain critical components of any security architecture. However, modern advancements are heavily reliant on sophisticated data analytics, artificial intelligence (AI), and machine learning (ML) algorithms. These advanced capabilities enable predictive threat intelligence, automated anomaly detection, and highly accurate malware analysis, moving security from a reactive to a proactive stance. The integration of AI/ML into SIEM, EDR, and network traffic analysis tools is fundamentally reshaping how threats are identified and mitigated, allowing systems to learn and adapt to new attack patterns autonomously.

Another crucial technological development is the shift towards cloud-native security paradigms. With the widespread adoption of cloud computing, security software is increasingly designed to protect dynamic cloud workloads, containers, and serverless functions. Technologies like Cloud Security Posture Management (CSPM) and Cloud Workload Protection Platforms (CWPP) offer continuous monitoring and protection for cloud environments, ensuring compliance and identifying misconfigurations. Similarly, the growing complexity of hybrid and multi-cloud environments necessitates robust Identity and Access Management (IAM) solutions, including Privileged Access Management (PAM) and Customer Identity and Access Management (CIAM), which leverage advanced authentication methods like multi-factor authentication (MFA) and biometric verification to secure access across disparate systems. The Zero Trust security model, which assumes no implicit trust inside or outside the network and requires verification for every access attempt, is gaining significant traction and relies on a suite of interconnected technologies for its implementation.

Furthermore, the emergence of Security Orchestration, Automation, and Response (SOAR) platforms is a transformative technology, enabling security teams to streamline workflows, automate repetitive tasks, and accelerate incident response through playbooks and integrations with various security tools. Behavioral analytics, often powered by AI/ML, are becoming indispensable for detecting insider threats and compromised accounts by establishing baseline user behavior and flagging deviations. Quantum-safe cryptography is also an emerging technology, albeit still in early stages, anticipating the threat posed by future quantum computers to current encryption standards. Edge computing and IoT security are also prominent areas of innovation, with specialized software developed to secure devices and data at the network edge, addressing unique challenges related to device heterogeneity, resource constraints, and distributed attack surfaces. These diverse technologies collectively form a robust and dynamic ecosystem, continuously adapting to safeguard digital assets in an ever-changing threat landscape.

Regional Highlights

The global Cyber Security Software Market exhibits distinct regional dynamics, each influenced by varying technological adoption rates, regulatory frameworks, economic development, and unique threat landscapes. Understanding these regional highlights is crucial for market players to tailor strategies, identify growth opportunities, and address specific challenges. The concentration of technological innovation, the maturity of digital infrastructures, and the stringency of data protection laws are key determinants shaping the market across different geographies. These factors lead to significant disparities in adoption rates, preferred solutions, and investment levels in cyber security software, creating a complex mosaic of market conditions worldwide.

North America continues to be the dominant market for cyber security software, primarily driven by the presence of a highly developed IT infrastructure, early adoption of advanced technologies like cloud and AI, and a proactive approach to cybersecurity. The region is home to numerous leading cyber security vendors and a strong research and development ecosystem. Stringent regulations such as HIPAA, PCI DSS, and various state-level data breach notification laws in the United States, along with Canada's privacy laws, compel organizations to invest heavily in robust security solutions. The high incidence of sophisticated cyberattacks targeting critical infrastructure and major corporations further fuels market growth, particularly in areas like endpoint detection and response (EDR), cloud security, and threat intelligence. Large enterprises across diverse sectors like BFSI, government, and technology are significant contributors to this market's sustained growth and innovation.

Europe represents another significant market, characterized by strong regulatory mandates, notably the General Data Protection Regulation (GDPR), which has significantly increased the demand for data protection, privacy management, and compliance-related cyber security software. Countries like the UK, Germany, France, and the Nordics are at the forefront of adopting advanced security technologies. The region's focus on digital sovereignty and critical infrastructure protection also drives investments in sovereign cloud solutions and specialized security software for industrial control systems. The Asia Pacific (APAC) region is projected to be the fastest-growing market, propelled by rapid digital transformation, increasing internet penetration, and the burgeoning number of SMEs adopting cloud services. Economic powerhouses like China, India, Japan, and Australia are witnessing substantial investments in cyber security to combat a rising tide of localized cyber threats and safeguard burgeoning digital economies. Latin America, the Middle East, and Africa (MEA) are also experiencing steady growth as their digital economies mature, regulatory environments strengthen, and awareness of cyber risks increases among both businesses and governments, particularly in sectors such as oil and gas, financial services, and telecommunications.

- North America: Market leader due to advanced tech infrastructure, high cloud/IoT adoption, stringent regulations (HIPAA, PCI DSS), and a high volume of sophisticated cyberattacks. Strong presence of key vendors and R&D.

- Europe: Significant growth driven by GDPR compliance, focus on digital sovereignty, and critical infrastructure protection. Key markets include the UK, Germany, France, and Nordic countries.

- Asia Pacific (APAC): Fastest-growing market fueled by rapid digital transformation, increasing internet penetration, rise of SMEs, and growing awareness of cyber threats. Major contributors include China, India, Japan, and Australia.

- Latin America: Steady growth driven by increasing internet usage, digital payment adoption, and evolving regulatory frameworks. Key countries like Brazil and Mexico are leading regional adoption.

- Middle East and Africa (MEA): Emerging market with increasing investments in cybersecurity due to digital initiatives, smart city projects, and diversification efforts away from oil. Growth in BFSI, government, and telecom sectors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cyber Security Software Market.- Microsoft Corporation

- Broadcom Inc. (Symantec)

- IBM Corporation

- Cisco Systems, Inc.

- Palo Alto Networks, Inc.

- Fortinet, Inc.

- Check Point Software Technologies Ltd.

- CrowdStrike Holdings, Inc.

- Zscaler, Inc.

- Trend Micro Inc.

- McAfee Corp.

- SentinelOne, Inc.

- Okta, Inc.

- Splunk Inc.

- Tenable Holdings, Inc.

- Qualys, Inc.

- Rapid7, Inc.

- CyberArk Software Ltd.

- Proofpoint, Inc.

- F5 Networks, Inc.

Frequently Asked Questions

Analyze common user questions about the Cyber Security Software market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is cyber security software and why is it important?

Cyber security software refers to programs and applications designed to protect computer systems, networks, and data from digital attacks, unauthorized access, and damage. It is crucial for safeguarding sensitive information, ensuring business continuity, maintaining regulatory compliance, and protecting against financial and reputational losses from cyber threats.

How is AI impacting the cyber security software market?

AI significantly enhances cyber security software by enabling advanced threat detection through pattern recognition, automating incident response, reducing false positives, and providing predictive analytics for emerging threats. It helps systems learn and adapt to new attack vectors, improving overall defense capabilities and efficiency.

What are the main types of cyber security software solutions available?

Key types include Endpoint Security (antivirus, EDR), Network Security (firewalls, IDPS), Cloud Security (CASB, CWPP), Identity and Access Management (IAM), Security Information and Event Management (SIEM), Data Loss Prevention (DLP), and Vulnerability Management. These solutions often integrate to form comprehensive security frameworks.

Which industries are the largest adopters of cyber security software?

Industries with high volumes of sensitive data and stringent regulatory requirements are major adopters. These include Banking, Financial Services, and Insurance (BFSI), Government and Defense, Healthcare, and Information Technology (IT) and Telecommunications. Retail, manufacturing, and energy sectors are also significant users.

What are the key challenges faced by the cyber security software market?

Major challenges include a persistent shortage of skilled cybersecurity professionals, the high cost of implementing and maintaining advanced solutions, the complexity of integrating diverse security tools, and the constant evolution of sophisticated cyber threats. Securing legacy systems and ensuring compliance across various regulations also pose significant hurdles.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager