Cyber Security Testing, Inspection And Certification Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431546 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Cyber Security Testing, Inspection And Certification Market Size

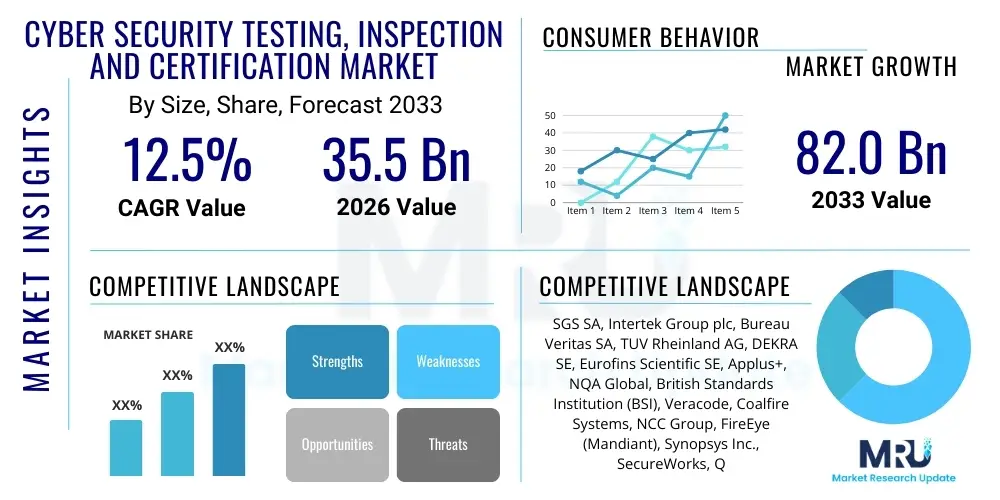

The Cyber Security Testing, Inspection And Certification Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.5% between 2026 and 2033. The market is estimated at USD 35.5 Billion in 2026 and is projected to reach USD 82.0 Billion by the end of the forecast period in 2033.

Cyber Security Testing, Inspection And Certification Market introduction

The Cyber Security Testing, Inspection, and Certification (TIC) Market encompasses a suite of specialized services designed to evaluate, validate, and formally confirm the security posture and compliance of an organization’s digital assets, systems, networks, and processes. This critical market segment is fundamentally driven by the escalating sophistication of cyber threats, the rapid pace of digital transformation across all industries, and stringent global regulatory mandates such as GDPR, HIPAA, and PCI DSS. TIC services ensure that organizations not only identify vulnerabilities but also implement and maintain robust security controls that meet established industry standards, thereby building trust with customers and stakeholders.

The primary applications of these services span across various organizational security lifecycle stages, including initial system design validation (inspection), continuous vulnerability assessment and penetration testing (testing), and final compliance verification against international benchmarks (certification). Key benefits include minimizing financial losses due to breaches, enhancing brand reputation, ensuring adherence to contractual and legal requirements, and maintaining operational resilience. The increasing reliance on cloud computing infrastructure, the expansion of the Internet of Things (IoT) landscape, and the proliferation of remote work models are major driving factors compelling organizations to invest proactively in comprehensive TIC frameworks.

The core components of the market include the delivery of highly technical services such as application security testing, network security assessment, ethical hacking, and risk management consulting, culminating in formal issuance of certificates (e.g., ISO 27001, SOC 2). Market growth is further accelerated by sector-specific needs, particularly within Banking, Financial Services, and Insurance (BFSI) and governmental agencies, where data protection and infrastructural integrity are paramount. Technological advancements in automation and continuous compliance monitoring are transforming the delivery landscape of TIC services, making them more efficient and scalable for large enterprises.

Cyber Security Testing, Inspection And Certification Market Executive Summary

The Cyber Security Testing, Inspection, and Certification market exhibits robust expansion, primarily fueled by global digital initiatives and increasing regulatory scrutiny regarding data governance. Business trends indicate a significant shift towards integrated security platforms that combine automated testing tools with expert human analysis, moving away from fragmented, one-off audits. Enterprises are increasingly demanding continuous security verification services rather than annual assessments, driving demand for Security as a Service (SECaaS) models in the TIC space. Mergers and acquisitions among specialized testing firms and larger certification bodies are reshaping the competitive landscape, aiming to offer end-to-end security assurance capabilities that cover emerging areas like operational technology (OT) and supply chain risk management.

Regionally, North America maintains market dominance due to high concentration of technological innovation, advanced regulatory frameworks (like NIST in the US), and high incidence of sophisticated cyber-attacks necessitating resilient security postures. The Asia Pacific (APAC) region, however, is projected to demonstrate the highest Compound Annual Growth Rate, driven by massive digital infrastructure investments, particularly in India, China, and Southeast Asia, coupled with nascent but rapidly maturing regulatory environments. European growth is consistently strong, propelled mainly by strict compliance adherence required under the General Data Protection Regulation (GDPR) and Network and Information Systems (NIS) Directive.

Segmentation trends highlight the Testing segment, particularly Penetration Testing and Vulnerability Assessment, as the most rapidly evolving due to the need for proactive vulnerability discovery in complex hybrid cloud environments. Within verticals, BFSI and IT & Telecom sectors remain the largest adopters, reflecting their heavy reliance on critical data and interconnected systems. Furthermore, the demand for specialized certification services focused on cloud security (e.g., CSA STAR) and IoT device security is rapidly increasing, reflecting the market’s adaptation to modern technology stacks and distributed infrastructure challenges.

AI Impact Analysis on Cyber Security Testing, Inspection And Certification Market

User queries regarding the impact of Artificial Intelligence (AI) on the Cyber Security TIC market predominantly center on automation capabilities, ethical considerations, and the requirement for new certification standards tailored for AI systems themselves. Users are keenly interested in how AI tools, particularly Machine Learning (ML), can accelerate vulnerability scanning, reduce false positives in threat identification, and automate compliance checks, thereby lowering the cost and increasing the frequency of security assessments. A major concern is the potential for AI-driven offensive tools (Adversarial AI) to bypass current security measures, necessitating the development of equally sophisticated defensive testing techniques and new inspection protocols to assess systems trained on potentially biased or compromised data sets. Expectations revolve around AI transforming certification by enabling continuous, real-time auditing, ensuring systems remain compliant instantaneously rather than through periodic snapshots, and the establishment of "AI trustworthiness" certifications.

The application of AI in testing services significantly improves efficiency. ML algorithms are increasingly deployed in static application security testing (SAST) and dynamic application security testing (DAST) tools to analyze massive codebases and runtime behaviors more effectively than traditional methods. This efficiency gain allows service providers to offer more comprehensive security coverage without proportional increases in human effort, addressing the severe industry shortage of specialized cyber security talent. Furthermore, AI assists in prioritizing discovered vulnerabilities based on real-world exploitability probability and asset criticality, moving security teams away from merely managing long lists of low-priority findings.

In inspection and certification, AI facilitates automated evidence collection and compliance monitoring, dramatically simplifying the complex documentation and reporting processes mandated by standards like ISO 27001 or SOC 2. However, the introduction of AI also necessitates the development of specialized TIC services aimed at AI systems themselves, focusing on assessing algorithmic fairness, robustness against adversarial attacks, and data privacy maintenance within complex AI pipelines. This shift creates a new premium market segment for AI assurance, requiring certification bodies to innovate their standards and methodologies rapidly to address opaque "black box" machine learning models.

- AI automates repetitive security testing tasks, increasing throughput and coverage.

- Machine Learning enhances accuracy in identifying sophisticated zero-day threats during inspection phases.

- Adversarial AI research drives the need for advanced defensive testing and red-teaming exercises.

- AI aids in continuous compliance monitoring and automated evidence gathering for certification audits.

- New specialized certification frameworks are required to validate the ethical and robust nature of deployed AI systems.

- AI algorithms prioritize vulnerability remediation efforts based on calculated risk scores and asset value.

- AI integration helps mitigate the constraints imposed by the global shortage of highly specialized cyber security analysts.

DRO & Impact Forces Of Cyber Security Testing, Inspection And Certification Market

The dynamics of the Cyber Security TIC Market are shaped by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively constitute the Impact Forces influencing investment and technological adoption. The primary driver is the exponentially increasing frequency and severity of cyber-attacks, ranging from advanced persistent threats (APTs) targeting intellectual property to large-scale ransomware attacks crippling critical infrastructure. This palpable threat landscape compels organizations across all sectors, particularly those handling sensitive consumer data or managing vital national services, to seek independent verification of their security controls. Concurrently, the proliferation of strict, globally enforced regulatory mandates—such as GDPR, CCPA, and sector-specific rules (e.g., DORA in finance)—makes comprehensive testing and certification a legal necessity rather than a discretionary investment, ensuring compliance drives sustained market demand.

Despite the strong demand drivers, the market faces significant restraints. A major limitation is the high initial cost and ongoing expenditure associated with rigorous testing and certification processes, which can be particularly prohibitive for Small and Medium-sized Enterprises (SMEs). Furthermore, the acute global shortage of certified and highly skilled cyber security professionals capable of conducting sophisticated penetration testing and detailed auditing acts as a bottleneck, slowing down service delivery and escalating labor costs. Technical limitations also exist, specifically the inherent difficulty in achieving complete security assurance due to the rapid evolution of technology stacks (e.g., serverless computing, microservices architecture), which often outpace the standardization efforts of inspection and certification bodies, creating potential coverage gaps.

Significant opportunities are emerging from the shift towards continuous security verification methodologies, leveraging cloud-native tools and automation to embed security assessment into the DevOps pipeline (DevSecOps). The rapid expansion of the Internet of Things (IoT) and Operational Technology (OT) sectors, covering everything from smart manufacturing to connected healthcare devices, presents a vast untapped market for specialized TIC services focused on hardware and firmware security protocols. Moreover, the integration of cutting-edge technologies like Blockchain for immutable auditing trails and AI for continuous threat exposure management offers pathways for service providers to innovate, deliver enhanced value, and create niche certification offerings focused on digital trust, thereby ensuring continued market expansion and technological advancement.

Segmentation Analysis

The Cyber Security Testing, Inspection, and Certification market is predominantly segmented based on the Type of Service, the Service Offering, the Deployment Mode, and the Industry Vertical. This segmentation allows providers to tailor their offerings to specific enterprise needs, ranging from technical vulnerability analysis to formal governance and compliance assessments. The core segmentation by Service Type—Testing, Inspection, and Certification—reflects the lifecycle of security assurance, where Testing focuses on technical validation (e.g., penetration testing), Inspection involves reviewing policies and processes, and Certification provides formalized, third-party assurance against established standards. The complexity and depth required for these activities are directly proportional to the criticality of the organization's assets and the regulatory environment it operates within.

Service Offerings are further differentiated to address specific security domains. Key sub-segments include application security testing (essential for secure software development), network security testing (critical for perimeter defense), and compliance auditing (necessary for maintaining regulatory mandates). The evolution toward hybrid and multi-cloud architectures has propelled the cloud security testing and inspection sub-segments into high growth areas, demanding expertise in configuration management, identity access management (IAM) security, and container security. Furthermore, segmentation by vertical—such as BFSI, Healthcare, Government, and Retail—reflects the variance in threat models and compliance requirements, necessitating specialized knowledge and standardized methodologies relevant to each sector’s unique data sensitivity and operational context.

The trend towards consumption models is also a crucial segmentation factor. While traditional, on-site annual testing remains relevant, the market is rapidly embracing managed security services and cloud-based testing platforms (SaaS/PaaS). These models offer scalability, continuous coverage, and predictable cost structures, making advanced TIC accessible to a broader range of organizations. The convergence of governance, risk, and compliance (GRC) solutions with specialized security testing services is driving integrated offerings, enabling clients to manage their security posture holistically across technical controls and organizational policies, ensuring maximum operational efficiency in security management.

- By Service Type:

- Testing Services (Penetration Testing, Vulnerability Assessment)

- Inspection Services (Security Audits, GRC Reviews)

- Certification Services (ISO 27001, SOC 2, HIPAA Compliance Certification)

- By Service Offering:

- Application Security Testing (SAST, DAST, IAST)

- Network Security Testing

- Cloud Security Assessment

- Compliance and Policy Auditing

- Incident Response Testing

- By Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecom

- Government and Defense

- Healthcare and Life Sciences

- Retail and E-commerce

- Energy and Utilities (OT Security)

- By Deployment Mode:

- On-Premises

- Cloud-Based

Value Chain Analysis For Cyber Security Testing, Inspection And Certification Market

The value chain for the Cyber Security TIC market begins with the Upstream Analysis, which involves the development of methodologies, standards, and enabling technologies. This stage is dominated by international standards organizations (e.g., ISO, IEC, NIST) that establish the benchmarks, and technology vendors who develop advanced testing tools, threat intelligence platforms, and automated compliance software. The quality and sophistication of these inputs—such as advanced static analysis tools or simulation platforms for red teaming—directly dictate the effectiveness and scalability of the services delivered downstream. Investment in research and development at this stage is crucial for addressing emerging threat vectors like supply chain attacks and AI-driven vulnerabilities.

The core of the value chain is the Service Provision stage, where TIC providers—ranging from large multinational conformity assessment bodies to specialized boutique security consulting firms—execute the testing, inspection, and certification processes. This stage includes initial risk assessment, technical execution of vulnerability scans and penetration tests, policy review, remediation consulting, and ultimately, the issuance of formal certifications. The distribution channel plays a critical role here. Direct channels involve large enterprises engaging TIC firms directly for bespoke, high-value contracts. Indirect channels often involve partnerships with Managed Security Service Providers (MSSPs), system integrators, and value-added resellers (VARs) who bundle TIC services with broader security management solutions, increasing market reach, especially to SMEs.

The Downstream Analysis focuses on the end-users and the long-term impact of TIC services. End-users incorporate the security findings into their development and operational cycles, leading to enhanced security posture and compliance maintenance. Effective service delivery often results in recurring revenue, as compliance mandates require annual re-certification and continuous monitoring. The successful execution of TIC services not only reduces operational risk for the client but also validates the credibility and authority of the certification body, reinforcing the entire value chain through documented assurance and digital trust metrics.

Cyber Security Testing, Inspection And Certification Market Potential Customers

Potential customers for Cyber Security Testing, Inspection, and Certification services span virtually every industry sector that handles sensitive data, operates critical IT infrastructure, or is subject to regulatory oversight. The primary buyers are large organizations in the BFSI sector, which require stringent compliance with financial regulations (e.g., Basel III, PCI DSS) and face the highest monetary risk exposure from data breaches and service downtime. Government and defense entities represent another major customer segment, driven by national security requirements and the need to protect sensitive citizen data and critical national infrastructure (CNI) from state-sponsored threats, often mandating adherence to frameworks like NIST or FedRAMP.

Beyond highly regulated sectors, the fastest-growing customer base includes organizations undergoing aggressive digital transformation, such as retail and e-commerce companies utilizing extensive customer data, and healthcare providers managing electronic health records (EHRs) under strict privacy laws like HIPAA. These customers require continuous application security testing to secure proprietary platforms and robust cloud security inspections to validate their rapidly migrating infrastructure. Furthermore, organizations involved in developing connected devices—from automotive manufacturers to industrial control system (ICS) operators—are emerging as crucial customers demanding specialized TIC services focused on hardware security and firmware integrity assessments.

In essence, any organization seeking to demonstrate due diligence, mitigate liability, obtain insurance coverage, or satisfy partner contractual obligations regarding cyber resilience is a potential customer. Small and Medium-sized Enterprises (SMEs) are increasingly entering the market, often driven indirectly by supply chain requirements from large corporate partners who mandate certain security certifications (e.g., ISO 27001) as a prerequisite for business engagement, thereby broadening the customer base significantly and increasing the demand for scalable, affordable managed TIC solutions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 35.5 Billion |

| Market Forecast in 2033 | USD 82.0 Billion |

| Growth Rate | 12.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGS SA, Intertek Group plc, Bureau Veritas SA, TUV Rheinland AG, DEKRA SE, Eurofins Scientific SE, Applus+, NQA Global, British Standards Institution (BSI), Veracode, Coalfire Systems, NCC Group, FireEye (Mandiant), Synopsys Inc., SecureWorks, Qualys, Deloitte, PwC, Ernst & Young (EY), KPMG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cyber Security Testing, Inspection And Certification Market Key Technology Landscape

The Cyber Security TIC market is rapidly evolving, driven by the adoption of sophisticated technological solutions designed to handle the complexity and scale of modern enterprise architectures. A key technological pillar is the proliferation of automated security testing tools, including Dynamic Application Security Testing (DAST) and Static Application Security Testing (SAST), which are increasingly integrated directly into Continuous Integration/Continuous Deployment (CI/CD) pipelines, enabling DevSecOps. These automated tools rely on advanced parsing and analysis engines to identify vulnerabilities early in the software development lifecycle. Furthermore, the development of specialized attack simulation platforms, often leveraging sophisticated techniques like fuzz testing and breach and attack simulation (BAS), is replacing traditional, time-consuming manual penetration testing methods for baseline assurance, allowing human experts to focus only on highly critical or novel threat vectors.

Another dominant technology trend involves the application of Machine Learning (ML) and Artificial Intelligence (AI) to enhance both the offensive and defensive capabilities within the testing lifecycle. ML algorithms are used to process massive amounts of threat intelligence data to identify subtle patterns indicative of impending attacks, significantly improving the accuracy of risk prioritization and vulnerability scoring during the inspection phase. For certification, technologies such as blockchain are being explored to create immutable, transparent, and auditable records of compliance status and security control implementation. This distributed ledger technology reduces the reliance on centralized trust mechanisms and streamlines the validation process, potentially leading to 'certifications-as-a-code' models.

The foundational shift towards cloud-native architectures necessitates a technological landscape centered on API security testing and container security inspection. Tools leveraging Infrastructure as Code (IaC) principles are crucial for assessing cloud configuration drift and ensuring security policies are applied consistently across ephemeral environments. Furthermore, technologies focusing on Identity and Access Management (IAM) governance and Privileged Access Management (PAM) review are critical components of modern inspection services, reflecting the fact that identity compromise remains the leading cause of major breaches. The convergence of IT security testing with Operational Technology (OT) security demands specialized hardware and protocol analysis tools capable of interfacing securely with industrial control systems and legacy infrastructure.

Regional Highlights

- North America: North America, particularly the United States, holds the largest market share due to its established regulatory environment (NIST, HIPAA, CCPA) and high levels of technological maturity and security awareness. The region boasts a dense concentration of major TIC service providers and early adopters of advanced security technologies, especially in the finance and technology sectors. High incidence of complex cybercrime and significant federal mandates for critical infrastructure protection drive continuous investment. The market is characterized by a strong emphasis on penetration testing, managed detection and response, and highly customized security certification services tailored to cloud and mobile environments.

- Europe: Europe represents a highly regulated and rapidly growing market, primarily shaped by the General Data Protection Regulation (GDPR) and the NIS Directive, which impose strict compliance requirements and significant penalties for non-adherence. This legislative framework mandates comprehensive inspection and certification of data processing activities across all member states. Germany, the UK, and France are key contributors, with high demand for ISO 27001 certification and specialized testing focused on data residency and cross-border data transfer security. The European market is also seeing increased demand for TIC services related to automotive security and digital identity verification.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive digital transformation initiatives, rapid economic expansion, and increasing internet penetration in countries like China, India, Japan, and South Korea. While the regulatory landscape is fragmented, major economies are swiftly implementing data localization and privacy laws (e.g., India's Digital Personal Data Protection Act), driving the need for formal certification. Growth is particularly prominent in the IT & Telecom and BFSI sectors, which are expanding their cloud footprints and require scalable, localized testing solutions to address unique regional threat landscapes and linguistic requirements.

- Latin America (LATAM): The LATAM market is characterized by increasing security awareness spurred by growing financial sector digitalization and compliance mandates similar to Brazil's LGPD. While budget constraints can limit spending, the need to conform to global standards to participate in international supply chains drives demand for essential testing and certification services. The focus is often on basic security hygiene, vulnerability management, and cost-effective cloud security solutions.

- Middle East and Africa (MEA): Growth in the MEA region is accelerating, primarily driven by substantial government investments in smart city projects and critical infrastructure modernization (especially in the Gulf Cooperation Council countries). Regulatory bodies are establishing national cyber security standards, increasing the requirement for inspection and certification services, particularly in the energy and oil & gas sectors (Operational Technology security). The emphasis is on building local expertise and adopting high-end surveillance and advanced threat modeling techniques.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cyber Security Testing, Inspection And Certification Market.- SGS SA

- Intertek Group plc

- Bureau Veritas SA

- TUV Rheinland AG

- DEKRA SE

- Eurofins Scientific SE

- Applus+

- NQA Global

- British Standards Institution (BSI)

- Veracode

- Coalfire Systems

- NCC Group

- FireEye (Mandiant)

- Synopsys Inc.

- SecureWorks

- Qualys

- Deloitte

- PwC

- Ernst & Young (EY)

- KPMG

Frequently Asked Questions

Analyze common user questions about the Cyber Security Testing, Inspection And Certification market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between cyber security testing and inspection services?

Cyber security testing involves technical, hands-on activities like penetration testing and vulnerability scanning to discover flaws in systems. Inspection focuses on non-technical assessments, reviewing documentation, policies, controls, and compliance status against established governance frameworks like ISO 27001.

How is the proliferation of IoT devices impacting the demand for TIC services?

IoT proliferation mandates specialized TIC services focused on hardware security, firmware analysis, and secure connectivity protocols. Demand is rising for certifications ensuring devices meet baseline security standards before deployment, especially in consumer and industrial sectors where device volume is massive.

Which compliance standards drive the highest demand for cyber security certification globally?

The most influential global standards driving certification demand are ISO/IEC 27001 (Information Security Management Systems), SOC 2 (Service Organization Control), and industry-specific mandates such as PCI DSS (Payment Card Industry Data Security Standard) and GDPR compliance frameworks.

What is the role of automation in modern cyber security testing?

Automation, particularly through SAST, DAST, and AI-driven platforms, streamlines repetitive tasks, integrates security into DevOps pipelines (DevSecOps), significantly increases testing frequency, and helps prioritize remediation efforts based on calculated risk, reducing manual effort and time-to-compliance.

How is the cloud migration trend affecting traditional TIC service models?

Cloud migration necessitates a shift from traditional perimeter testing to specialized cloud security inspections focusing on configuration management, identity and access controls (IAM), and multi-cloud governance. TIC providers are adopting continuous verification models to assess dynamic cloud environments effectively, moving away from static, annual assessments.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager