Cycling Helmet and Glasses Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437426 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Cycling Helmet and Glasses Market Size

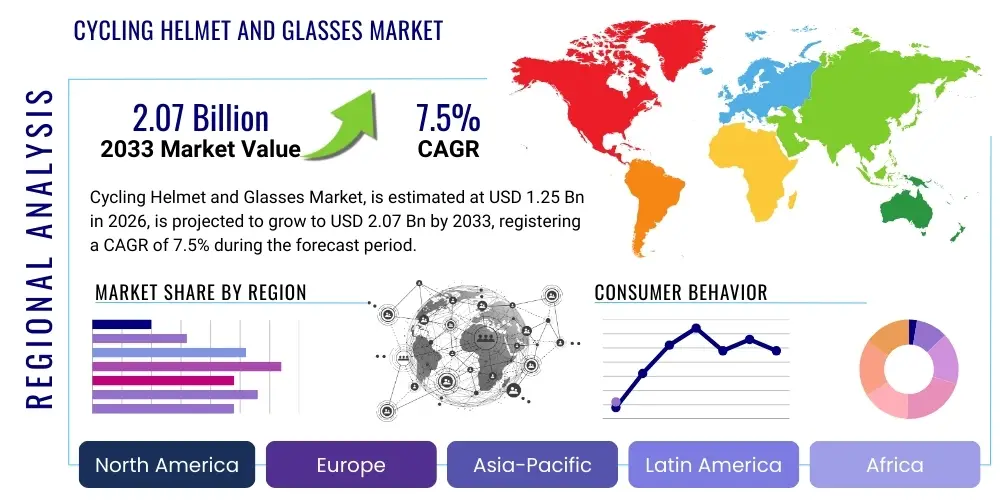

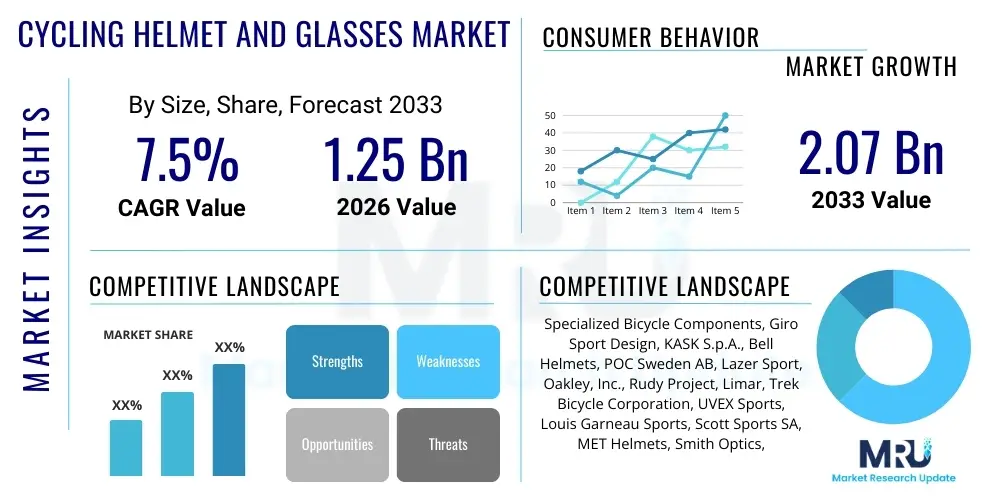

The Cycling Helmet and Glasses Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 2.07 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by increasing global cycling participation, elevated consumer awareness regarding head safety, and continuous advancements in aerodynamic design and materials science, particularly in performance-focused segments like road racing and mountain biking. Regulatory mandates enforcing helmet usage in various jurisdictions also contribute significantly to the baseline demand, pushing manufacturers to innovate beyond basic protection.

The valuation reflects the combined sales revenue generated from various product types, including recreational helmets, road helmets, mountain bike helmets (MTB), smart helmets, and corresponding specialized cycling eyewear, such as photochromic and polarized lenses. The market landscape is characterized by high levels of innovation, especially concerning integration of MIPS (Multi-Directional Impact Protection System) technology and integrated LED lighting systems. Furthermore, the rising popularity of electric bikes (e-bikes) introduces a distinct segment for higher-speed rated safety gear, necessitating new standards and product development cycles for both helmets and protective eyewear.

Geographic market size variations are highly dependent on regional cycling culture, disposable income, and investment in cycling infrastructure. Developed markets in North America and Europe currently dominate the revenue share due to well-established professional and recreational cycling communities and strong safety regulations. However, the Asia Pacific region is expected to demonstrate the fastest growth rate, fueled by improving infrastructure, increasing health consciousness among urban populations, and the adoption of cycling as a sustainable commuting option in rapidly expanding metropolitan areas. This dual focus on high-performance gear in mature markets and mass-market safety gear in emerging economies solidifies the market's strong financial trajectory.

Cycling Helmet and Glasses Market introduction

The Cycling Helmet and Glasses Market encompasses the manufacturing, distribution, and sale of essential protective equipment designed to enhance cyclist safety and performance. Cycling helmets are critical safety devices engineered using advanced materials like expanded polystyrene (EPS) foam, polycarbonate shells, and, increasingly, carbon fiber, providing essential protection against impact forces during falls or collisions. Modern helmets incorporate sophisticated technologies such as rotational energy absorption systems (e.g., MIPS, WaveCel) and improved ventilation systems to optimize comfort without compromising structural integrity. Cycling glasses, or eyewear, complement helmets by protecting the eyes from wind, debris, UV radiation, and glare, often featuring interchangeable lens technology optimized for varying light conditions and disciplines (road, gravel, mountain).

Major applications of these products span the entire spectrum of cycling, including competitive road racing, professional mountain biking, casual urban commuting, and long-distance touring. Helmets are fundamentally designed for impact mitigation, reducing the risk of severe head and brain injuries. Eyewear serves the dual purpose of protection and visual enhancement, ensuring clear, unobstructed vision crucial for navigating complex terrain and high-speed environments. The integration of technology, such as communication systems and crash detection sensors in high-end helmets, is broadening the application scope from pure protection to comprehensive safety and connectivity solutions for modern cyclists and e-bike users.

The market is significantly driven by mandatory safety regulations imposed by governmental and sporting bodies worldwide, coupled with a surging global interest in fitness and outdoor recreational activities. Key benefits include dramatically reduced risk of fatal and severe head trauma, improved aerodynamic efficiency (especially critical for competitive cyclists), and enhanced visual comfort and performance regardless of weather conditions. Driving factors involve continuous material innovation leading to lighter and safer products, effective marketing emphasizing lifestyle and performance benefits, and the expansion of urban cycling infrastructure globally, making the use of appropriate safety gear a routine practice for millions of commuters and enthusiasts alike.

Cycling Helmet and Glasses Market Executive Summary

The Cycling Helmet and Glasses Market is poised for consistent upward growth, driven predominantly by shifting business trends favoring technological integration and sustainability, combined with pronounced regional differences in adoption patterns. Key business trends include the consolidation of safety features, such as the ubiquity of MIPS technology across price points, and the proliferation of 'smart' helmets offering integrated lighting, GPS, and communication features, appealing to tech-savvy consumers and urban commuters seeking all-in-one solutions. Furthermore, leading brands are heavily investing in specialized sub-markets, such as gravel biking and e-MTB, which require unique design specifications for increased speed and rigorous off-road conditions, thereby diversifying revenue streams and raising the average selling price (ASP).

Regionally, North America and Europe maintain dominance, characterized by high disposable income, well-established cycling events, and stringent safety standards, particularly the CPSC (US) and CE EN (Europe) certifications that mandate compliance for market entry. However, the most significant future expansion is projected for the Asia Pacific (APAC) region, specifically in urban centers across China, India, and Southeast Asia. This growth is underpinned by rapid urbanization, increased government spending on bicycle infrastructure, and a nascent but quickly growing professional cycling culture. The Middle East and Africa (MEA) and Latin America represent emerging markets where growth is steadier, influenced by economic development and the gradual implementation of cycling-friendly policies and safety awareness campaigns.

Segmentation trends highlight the increasing importance of the high-performance segment, where aerodynamic advantages and lightweight materials command premium pricing. Simultaneously, the market is segmenting by consumer age, with dedicated product lines for children and youth receiving increased attention due to parental safety concerns and robust regulatory standards. Material science remains a key differentiator; while traditional polycarbonate and EPS remain the backbone, the adoption of advanced materials like Koroyd and specialized composite fibers is fueling the premium eyewear segment. The retail distribution channel is witnessing a strong shift towards e-commerce platforms, enabling manufacturers to reach a global consumer base directly and offer highly specialized, customizable products efficiently.

AI Impact Analysis on Cycling Helmet and Glasses Market

Common user questions regarding AI's impact on cycling safety gear center on three main themes: enhanced safety through real-time detection, personalized fit and design, and the integration of data analytics for performance optimization. Users frequently inquire about how AI can detect imminent crash situations or fatigue, asking if helmets can genuinely 'think' or anticipate danger. They also express interest in AI-driven customization, wanting to know if 3D scanning and machine learning algorithms can create perfectly fitting helmets tailored to individual head shapes, thereby maximizing comfort and protective capability. Finally, there is significant curiosity about using AI to analyze ride data, helmet ventilation efficiency, and aerodynamic flow in conjunction with eyewear design, moving beyond basic GPS tracking toward sophisticated biofeedback and performance insights. The summary suggests users anticipate AI moving the industry from reactive protection to proactive safety and highly individualized gear optimization.

The application of Artificial Intelligence is poised to revolutionize the design, manufacturing, and functionality of cycling safety equipment, moving it toward an ecosystem of intelligent personal protection. In the design phase, Generative Design algorithms utilizing AI can optimize helmet structure for maximum energy dispersion while minimizing weight, exploring thousands of structural variations impossible to test manually, thereby accelerating product development cycles. On the consumer side, AI facilitates advanced monitoring capabilities. Integrated sensors in smart helmets, coupled with machine learning, can analyze continuous physiological data (heart rate, exertion level) and environmental inputs (traffic patterns, road hazards), providing real-time audio warnings or adaptive visual cues via heads-up display integration in cycling glasses.

In manufacturing, AI-powered quality control systems are being deployed to inspect complex material structures, such as the consistency of EPS foam density or the structural integrity of carbon fiber weaving, ensuring every unit meets rigorous safety standards with minimal variation. For the eyewear segment, machine learning algorithms can analyze vast datasets of visual environments and cyclist needs to recommend optimal lens tints, polarization levels, and curvature, catering specifically to the user's typical riding environment (e.g., dense forest trails versus open road high noon sun). This shift towards data-driven product iteration and real-time situational awareness represents the next frontier in cycling safety technology, enhancing both performance and protective efficacy significantly.

- AI-enhanced crash detection and emergency communication systems utilizing accelerometers and machine learning models for accurate incident recognition.

- Generative design for optimal aerodynamic and safety structures, leading to lighter, stronger helmets tailored for specific cycling disciplines.

- Personalized helmet fitting achieved through AI analysis of 3D head scans, improving compliance and protection standards.

- Adaptive smart glasses with AI-driven light sensitivity adjustment and heads-up display (HUD) integration for navigation and physiological data.

- Predictive maintenance analytics for safety gear, assessing material degradation and suggesting replacement times based on usage patterns.

DRO & Impact Forces Of Cycling Helmet and Glasses Market

The Cycling Helmet and Glasses Market is shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), which collectively constitute the primary Impact Forces determining market trajectory. The primary drivers revolve around heightened safety awareness stemming from global marketing campaigns and regulatory mandates, particularly in developed economies where liability concerns and cycling participation are high. Coupled with this is the continuous technological advancement in materials science—specifically the development of multi-impact protective technologies and highly durable, performance-enhancing lens coatings—which drives replacement cycles and premium product adoption. The surge in recreational cycling and the growing popularity of cycling as a sustainable commuting solution in urban areas also provide a foundational increase in the overall addressable market size, translating directly into sustained volume demand.

Conversely, the market faces notable restraints that could impede exponential growth. High manufacturing costs associated with integrating advanced safety technologies (such as MIPS or specialized composite fibers) can translate into prohibitive price points for mass-market consumers, particularly in developing nations where basic safety gear is prioritized over premium features. Furthermore, the issue of counterfeiting, especially concerning highly sought-after brand names in emerging economies, undermines consumer trust and official revenue streams, presenting a persistent challenge to legitimate manufacturers. Seasonal demand fluctuations, particularly in regions with harsh winters, and the required adherence to diverse and complex international safety certifications (e.g., CPSC, ASTM, CE EN 1078) also act as logistical and operational restraints.

Significant opportunities exist, particularly in penetrating the rapidly expanding e-bike safety gear segment, which requires distinct, higher-rated protection due to increased average speeds and usage profiles. Opportunities also lie in adopting sustainable manufacturing practices, utilizing recycled and bio-based materials, which appeals strongly to the environmentally conscious modern consumer and aligns with broader corporate social responsibility goals. The development of integrated 'ecosystems'—where helmets, glasses, communication devices, and mobile apps seamlessly interact—presents a pathway to commanding greater market share and enhancing customer loyalty. These opportunities, leveraged against the persistent drivers, indicate a positive long-term outlook, provided the restraints relating to cost and regulation can be effectively managed through scale and innovation.

Segmentation Analysis

The Cycling Helmet and Glasses Market is segmented based on product type, technology, application, distribution channel, and geography, reflecting the highly specialized nature of the cycling industry. This granular segmentation allows manufacturers to target specific end-user needs, whether they are professional athletes seeking peak aerodynamic performance or casual commuters prioritizing visibility and comfort. The market for helmets is primarily split by cycling discipline (Road, Mountain, Urban/Commute), each demanding different features—aerodynamics and ventilation for road; maximum coverage and durability for MTB; and integrated lighting and ruggedness for urban use. Glasses are segmented by lens technology (e.g., Photochromic, Polarized, Mirrored) and frame material, catering to varying light conditions and performance requirements.

- By Product Type:

- Cycling Helmets (Road, Mountain, Urban/Commuter, Smart Helmets, Full Face)

- Cycling Glasses (Interchangeable Lenses, Photochromic, Polarized, Specific Tints)

- By Technology:

- Rotational Impact Protection Systems (MIPS, WaveCel, SPIN)

- Integrated Electronics (LED Lights, GPS, Communication, Crash Sensors)

- Materials (EPS, EPP, Carbon Fiber, Composite Shells)

- By Application:

- Recreational and Leisure Cycling

- Professional and Competitive Cycling (Road Race, MTB Enduro, BMX)

- Urban Commuting and E-Biking

- Youth and Children

- By Distribution Channel:

- Online Retail (E-commerce Platforms, Brand Websites)

- Offline Retail (Specialty Sports Stores, Department Stores, Direct-to-Consumer Outlets)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Cycling Helmet and Glasses Market

The value chain for the Cycling Helmet and Glasses Market begins with the upstream suppliers responsible for raw material procurement, primarily focusing on advanced polymers (EPS, EPP), specialized plastics (polycarbonate, nylon), advanced fibers (carbon fiber, Kevlar), and optical-grade materials for lenses. This stage is crucial as the quality and cost of these input materials directly determine the safety performance, weight, and final price of the product. Manufacturers rely heavily on long-term relationships with specialized chemical and materials science companies to ensure a stable supply of materials that meet stringent safety certifications. Innovation at this stage, such as bio-based polymers or advanced viscoelastic materials, is a key competitive differentiator.

The middle segment of the value chain involves design, manufacturing, assembly, and quality assurance. This phase is characterized by intensive R&D investment, particularly in structural engineering, ventilation design, and impact testing protocols. Helmets and glasses are produced in specialized facilities, often centralized in Asia Pacific regions to leverage efficient manufacturing capabilities. Quality control is paramount, involving rigorous testing against international safety standards (e.g., CE, CPSC). The manufacturers then distribute the finished goods through a multi-tiered distribution channel, which includes direct sales, national distributors, and regional wholesalers who manage inventory and logistics to retail endpoints.

The downstream segment focuses on market reach and customer engagement, primarily driven by retail channels. Direct distribution involves brand websites and flagship stores, offering greater control over pricing and customer experience. Indirect channels rely on specialty cycling stores, large format sporting goods retailers, and third-party e-commerce platforms (like Amazon or specialized cycling marketplaces). Specialty stores offer high-touch sales, providing expert fitting and advice, which is critical for premium, technically complex products. E-commerce platforms provide scale and geographical reach. The final stage involves customer service and warranty support, closing the loop on the value chain and informing future product iterations based on end-user feedback and usage patterns.

Cycling Helmet and Glasses Market Potential Customers

Potential customers for the Cycling Helmet and Glasses Market are diverse, ranging from highly specialized professional cyclists demanding peak performance gear to casual riders prioritizing safety and comfort, alongside the emerging segment of e-bike users. Professional athletes and high-level amateurs form the premium customer base, seeking helmets with optimal aerodynamic profiling, minimal weight, and cutting-edge rotational protection, often valuing brand sponsorship and technology integration. These buyers are typically less price-sensitive and engage in frequent equipment upgrades, viewing safety gear as a direct determinant of performance and competitive advantage. Their purchasing decisions are heavily influenced by independent third-party safety ratings and endorsements from leading cycling organizations.

A second major customer segment comprises recreational cyclists, fitness enthusiasts, and weekend warriors. This group requires a balance between safety, comfort, style, and affordability. They often look for multi-purpose helmets suitable for both road and light trail riding, prioritizing features like good ventilation, integrated visors (for glasses), and accessible pricing. For cycling glasses, this segment seeks reliable UV protection and durability, often favoring photochromic lenses for versatility across changing light conditions. Purchasing is often mediated through specialty retail stores where they can receive fitting assistance and product comparisons from knowledgeable staff.

The third, rapidly growing customer demographic includes urban commuters and electric bicycle (e-bike) riders. These users prioritize visibility (integrated LEDs), durability, theft-deterrence features (in smart helmets), and compliance with higher speed impact requirements specific to e-bike standards (NTA 8776 in Europe). Their purchases are driven by daily functional needs and mandatory safety requirements imposed by employers or city regulations. Furthermore, parents purchasing safety gear for children and youth represent a distinct, highly safety-conscious segment, driving demand for pediatric-sized, highly visible, and certified products, where the focus is almost exclusively on achieving the highest possible safety rating regardless of performance considerations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.07 Billion |

| Growth Rate | 7.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Specialized Bicycle Components, Giro Sport Design, KASK S.p.A., Bell Helmets, POC Sweden AB, Lazer Sport, Oakley, Inc., Rudy Project, Limar, Trek Bicycle Corporation, UVEX Sports, Louis Garneau Sports, Scott Sports SA, MET Helmets, Smith Optics, 100%, Ekoi, Abus, Sweet Protection, Endura |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cycling Helmet and Glasses Market Key Technology Landscape

The technology landscape of the Cycling Helmet and Glasses Market is dominated by advancements in impact protection and material science, focusing on minimizing both linear and rotational forces during a crash. The widespread adoption of Rotational Impact Protection Systems (RIPS), exemplified by MIPS, is arguably the most significant recent development, moving from a niche feature to an expected standard across mid-to-high-end helmets. These technologies are integrated layers designed to allow the helmet shell to slide relative to the inner liner, redirecting dangerous rotational energy that can lead to severe brain injuries. Complementary technologies like WaveCel, Koroyd, and Kali Protectives' LDL (Low-Density Layer) represent proprietary approaches striving to achieve superior energy absorption and structural integrity while managing weight and ventilation requirements for cyclist comfort and performance.

The emergence of "smart helmets" represents a convergence of protective gear with IoT and connectivity features. These helmets incorporate integrated electronic components such as LED lighting systems for enhanced visibility, GPS tracking capabilities, and advanced crash detection sensors paired with automated emergency notification systems (e.g., ANGi or proprietary systems). Furthermore, bone conduction or integrated speaker systems allow cyclists to receive navigation instructions or communication without blocking ambient sounds, addressing a critical safety concern. This technology adoption is particularly robust in the urban commuting segment where visibility and connectivity are paramount for daily travel efficiency and security.

In the eyewear segment, technological differentiation is driven primarily by lens performance and material durability. Photochromic technology, which allows lenses to automatically adjust their tint based on changing UV light exposure, remains a high-value feature, eliminating the need for manual lens swapping during long rides traversing various environments. Polarization and high-definition optics (e.g., Oakley's Prizm or Smith's ChromaPop) are critical for enhancing contrast and reducing glare, crucial for safety on technical terrain. Manufacturers are also focusing on improving anti-fog and hydrophobic coatings to maintain clear vision in diverse weather conditions, often integrating these high-tech lenses into lightweight, durable, and adjustable Grilamid TR90 or advanced composite frames designed for secure fit under a helmet.

The constant pursuit of marginal gains in performance cycling necessitates relentless technological refinement. Advanced computational fluid dynamics (CFD) modeling is now routinely used to optimize helmet shape for minimal aerodynamic drag, yielding 'aero road' helmets that save crucial watts for competitive racers. The manufacturing process itself is incorporating more automation and precision techniques, such as in-mold construction, which fuses the exterior shell and the EPS foam liner into a single, cohesive, and stronger structure. The utilization of 3D printing is also gaining traction, especially in the prototyping phase and for creating highly customized internal padding systems that ensure a precise, performance-oriented fit, further enhancing the protective potential of the equipment.

Finally, sustainable technology is emerging as a critical competitive edge. Companies are exploring and integrating recycled plastics and biodegradable materials into helmet shells, liners, and packaging. This is driven not only by consumer demand but also by regulatory pressures in regions like the EU. While challenging due to the strict safety requirements, the move towards eco-friendly production methods, including optimizing manufacturing processes to reduce waste and energy consumption, is becoming a foundational technological requirement for large market players looking to maintain relevance and address the modern consumer's environmental concerns, ensuring long-term technological viability alongside safety performance.

Regional Highlights

- North America: North America represents a mature and high-value market, characterized by stringent safety regulations (CPSC standards are mandatory) and a strong consumer preference for premium, technologically advanced products. The region, particularly the US, sees high demand for high-performance road and mountain biking gear, reflecting substantial participation in these sports. The rapid increase in e-bike adoption, especially in urban centers, is driving demand for new helmet classes compliant with higher speed safety ratings, propelling investment in smart helmet features like crash detection and integrated lighting. Manufacturers focus on brand loyalty, specialized distribution networks, and strong marketing campaigns linking products to professional athletic endorsements.

- Europe: Europe is the largest revenue contributor, benefiting from a deeply embedded cycling culture, excellent cycling infrastructure, and strong legislative enforcement of helmet standards (CE EN 1078). Key growth drivers include recreational tourism cycling, widespread bicycle commuting across countries like the Netherlands and Denmark, and the massive popularity of professional road racing. The EU market is also leading in the adoption of e-bike specific standards (NTA 8776), pushing innovation in durable and certified urban protective gear. Sustainability is a major regional trend, with consumers actively seeking products made with recycled or sustainable materials, influencing design and production choices significantly.

- Asia Pacific (APAC): APAC is the fastest-growing region, driven by rapid urbanization, increasing governmental investment in sustainable transport infrastructure, and rising disposable incomes, particularly in China, Japan, and South Korea. While the segment for high-end professional gear is expanding, the primary growth engine is the volume sales of mid-range helmets and glasses for urban commuting and general fitness use. Manufacturing dominance in this region provides cost advantages, but market penetration is challenged by varying safety standards and intense price competition from local brands. Safety awareness campaigns, often government-backed, are critical for stimulating baseline demand.

- Latin America (LATAM): The LATAM market, while smaller, is exhibiting steady growth, fueled by the emerging middle class, particularly in Brazil and Mexico, and a growing enthusiasm for competitive cycling events. Market penetration remains constrained by economic volatility and slower adoption of comprehensive cycling infrastructure compared to Northern markets. However, demand for entry-level and mid-range certified products is expanding. Challenges include dealing with the proliferation of counterfeit goods and the need for greater consumer education on the importance of certified safety equipment over non-regulated alternatives.

- Middle East and Africa (MEA): MEA is an emerging market, highly fragmented and primarily focused on basic recreational and utility cycling needs. Growth is concentrated in metropolitan areas of the GCC countries and South Africa, driven by outdoor sports participation and government initiatives to promote healthier lifestyles. Demand for high-end gear is primarily limited to expatriate populations and niche luxury consumers. The climate necessitates highly ventilated helmets and advanced anti-fog, UV-protective eyewear, making climate-specific design a key focus for successful market entry in this region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cycling Helmet and Glasses Market.- Specialized Bicycle Components

- Giro Sport Design

- KASK S.p.A.

- Bell Helmets

- POC Sweden AB

- Lazer Sport

- Oakley, Inc.

- Rudy Project

- Limar

- Trek Bicycle Corporation

- UVEX Sports

- Louis Garneau Sports

- Scott Sports SA

- MET Helmets

- Smith Optics

- 100%

- Ekoi

- Abus

- Sweet Protection

- Endura

Frequently Asked Questions

Analyze common user questions about the Cycling Helmet and Glasses market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is MIPS technology and how is it impacting helmet safety standards?

MIPS (Multi-Directional Impact Protection System) is a leading technology integrated into cycling helmets designed to reduce rotational forces transmitted to the brain during certain angled impacts. It consists of a low-friction layer that allows a 10-15mm relative motion between the helmet and the head upon impact, significantly mitigating the risk of severe brain injury. Its widespread adoption is establishing a new benchmark for safety, leading consumers to prioritize RIPS-equipped helmets across all price categories, thus influencing mandatory safety ratings globally.

How does the growth of the e-bike segment affect demand for cycling safety gear?

The rapid expansion of the e-bike segment drives demand for specialized safety gear designed for higher speeds and prolonged usage. E-bike riders often require helmets certified to stricter standards, such as the European NTA 8776 rating, which addresses higher impact velocities. This shift is stimulating innovation toward more robust construction, increased head coverage, and integrated smart features like lighting and communication necessary for faster, heavier commutes, thereby boosting the average selling price in the urban segment.

What are the primary differences between photochromic and polarized cycling glasses?

Photochromic lenses automatically adjust their tint based on the intensity of UV light, making them ideal for riding in varied light conditions, such as moving between open sunlight and shaded trails, eliminating the need to swap lenses. Polarized lenses, conversely, feature a filter that blocks horizontal light waves, specifically designed to reduce glare and reflection from surfaces like water or pavement, improving visual comfort and clarity. Selection depends on the primary use environment; photochromic for versatility, and polarized for glare-heavy, consistent light conditions.

Which regional market offers the highest growth potential for safety equipment manufacturers?

The Asia Pacific (APAC) region offers the highest growth potential due to expansive urbanization, rapid infrastructure development supporting cycling, and increasing consumer health awareness. While currently smaller in total value than Europe, the accelerating rate of adoption among urban commuters, combined with rising disposable incomes, positions markets like China and Southeast Asia for exponential volume growth, provided manufacturers can successfully navigate regional price sensitivities and establish robust local distribution channels.

Are smart helmets becoming mandatory, and what integrated features are most valued by consumers?

Smart helmets are not currently mandatory globally, but certain jurisdictions encourage their use through safety initiatives. Consumers highly value integrated crash detection systems with automated emergency notification (sending location data to contacts), high-visibility integrated LED lighting, and Bluetooth communication capabilities. These features transform the helmet from a passive safety device into an active safety and connectivity tool, particularly appealing to urban commuters and solo riders concerned with security and visibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager