Cycling Refrigerated Air Dryers Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435757 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Cycling Refrigerated Air Dryers Market Size

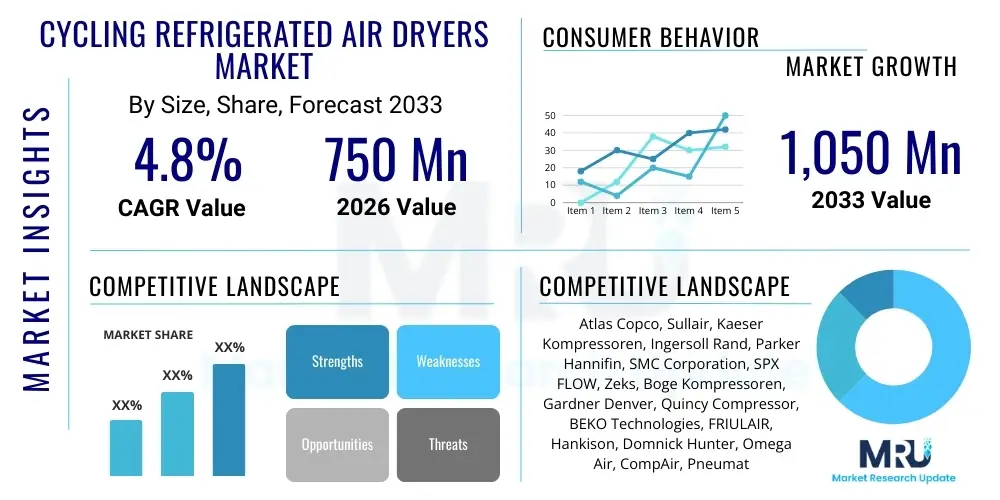

The Cycling Refrigerated Air Dryers Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,050 Million by the end of the forecast period in 2033.

Cycling Refrigerated Air Dryers Market introduction

Cycling refrigerated air dryers represent an advanced technological solution within the compressed air treatment industry, specifically designed to remove moisture vapor and protect pneumatic equipment from corrosion and damage caused by condensation. Unlike non-cycling dryers, these units modulate their cooling capacity based on the actual load and inlet temperature, significantly reducing energy consumption. This cycling mechanism, often employing thermal mass storage or variable speed drives, ensures a consistent pressure dew point, vital for sensitive industrial processes.

The core function of cycling refrigerated air dryers is crucial across various sectors, including automotive manufacturing, food and beverage processing, pharmaceuticals, and electronics assembly, where dry, clean compressed air is non-negotiable for product quality and equipment longevity. Key applications involve powering pneumatic tools, operating control valves, and ensuring the integrity of final products. The primary benefit these dryers offer is substantial energy savings—often ranging from 30% to 60% compared to traditional non-cycling counterparts—due to the ability to shut down the compressor when cooling requirements are met, thus aligning operational costs with fluctuating demand.

Driving factors for market expansion include stringent industrial quality standards requiring ISO 8573 compliance for compressed air purity, increasing global emphasis on energy efficiency and sustainability in manufacturing operations, and the rising adoption of compressed air systems in emerging industrial hubs. Furthermore, technological advancements leading to more compact designs, enhanced thermal storage capabilities, and integrated control systems are making these cycling dryers more attractive substitutes for older, less efficient drying solutions, fueling their adoption globally.

Cycling Refrigerated Air Dryers Market Executive Summary

The global Cycling Refrigerated Air Dryers Market is currently characterized by a strong emphasis on operational efficiency and sustainable technology integration, positioning it for robust growth throughout the forecast period. Business trends indicate a shift towards smart, IoT-enabled dryers capable of predictive maintenance and real-time energy management, thereby offering superior total cost of ownership (TCO) to end-users. Consolidation among major players and a growing competitive landscape focused on specialized thermal storage solutions (e.g., glycol, phase change materials) are defining the market structure. The push for reduced carbon footprints is accelerating the replacement cycle of older, constant-run air dryers with modern cycling units, particularly in industrialized nations adhering to strict energy consumption mandates.

Regionally, the Asia Pacific (APAC) market is exhibiting the fastest growth due to rapid industrialization, large-scale infrastructure investments, and significant expansion in manufacturing sectors like automotive and electronics, particularly in China, India, and Southeast Asian countries. North America and Europe remain mature but vital markets, driven primarily by regulatory compliance regarding energy efficiency (e.g., European Union's Ecodesign Directive) and the need for precision drying in high-value industries such as pharmaceuticals and aerospace. The demand in these established regions is concentrated around high-capacity, thermally efficient models integrated with existing Industrial Internet of Things (IIoT) frameworks.

In terms of segments, the thermal mass segment, which utilizes materials like glycol or water to store cooling energy, holds a dominant market share due to its established reliability and high energy savings potential, especially in applications with fluctuating air demand. Application trends show the Food & Beverage and Pharmaceutical sectors requiring the highest level of air quality (low pressure dew point), thereby driving demand for sophisticated cycling units that minimize moisture content. Furthermore, the increasing popularity of medium-capacity dryers (100–5000 SCFM) reflects the prevalent requirements of mid-sized manufacturing facilities seeking optimized energy consumption without compromising air quality standards.

AI Impact Analysis on Cycling Refrigerated Air Dryers Market

Common user questions regarding AI's impact on cycling refrigerated air dryers revolve primarily around how machine learning can optimize the energy efficiency of these systems beyond basic cycling, specifically focusing on predictive failure detection, adaptive dew point control, and integration with broader plant energy management systems. Users are keen to know if AI can learn individual plant air demand patterns to preemptively adjust the dryer's cooling cycle, thereby eliminating wasted energy during low-demand periods while maintaining the required dew point stability. Concerns often center on the security of data collected by smart sensors and the initial investment required for retrofitting existing dryer fleets with AI-capable controllers. The consensus expectation is that AI will transform these essential utility systems from reactive machines into proactive, self-optimizing components of the smart factory ecosystem.

- AI enhances predictive maintenance by analyzing sensor data (temperature, pressure, flow) to forecast component failure (e.g., refrigerant compressor or thermal storage integrity).

- Machine learning algorithms optimize the cycling schedule in real-time, dynamically adjusting the cooling cycle based on anticipated air demand fluctuations, maximizing energy savings.

- AI facilitates seamless integration with upstream Variable Speed Drive (VSD) compressors, synchronizing both components for system-wide efficiency optimization.

- Advanced diagnostics utilize pattern recognition to isolate root causes of performance degradation, reducing troubleshooting time and minimizing unplanned downtime.

- AI-driven adaptive control ensures exceptionally stable pressure dew points by compensating for environmental variations (ambient temperature, humidity) and load spikes.

DRO & Impact Forces Of Cycling Refrigerated Air Dryers Market

The Cycling Refrigerated Air Dryers Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape the market's trajectory and competitive landscape. The primary driver remains the compelling need for energy efficiency across industrial sectors. Cycling dryers offer significant operational expenditure (OPEX) reductions compared to traditional non-cycling dryers, directly addressing the global pressure on manufacturers to minimize utility consumption and comply with stringent national and international energy efficiency standards. This financial incentive, coupled with mandated energy conservation policies, especially in North America and Europe, provides a sustained impetus for market growth. Furthermore, the growing sophistication of manufacturing processes, particularly in demanding fields like semiconductor fabrication and high-speed packaging, necessitates consistently clean and dry air, cementing the role of high-performance cycling dryers as indispensable utility assets.

However, the market faces notable restraints that temper its expansion velocity. The initial capital investment required for cycling refrigerated air dryers is substantially higher than that for traditional units, creating a significant barrier to entry for small and medium-sized enterprises (SMEs) with constrained budgets. Additionally, the complexity inherent in thermal mass and advanced control systems requires specialized technical expertise for installation, maintenance, and troubleshooting, often leading to reluctance among end-users in regions with limited skilled labor. There is also a continuous competitive pressure from alternative drying technologies, such as desiccant dryers, which, while having higher operating costs, are sometimes preferred in extremely low dew point applications (below 38°F), thereby capping the potential application range of refrigerated technologies.

Opportunities for future market acceleration are intrinsically tied to technological innovation and geographic expansion. The proliferation of the Industrial Internet of Things (IIoT) offers a major avenue for growth, enabling manufacturers to offer smart, remotely monitored cycling dryers that provide real-time performance analytics and automated optimization. Furthermore, the rapid industrial development in emerging economies, particularly across Southeast Asia, Latin America, and Africa, presents untapped markets where the demand for modern, cost-effective air treatment solutions is just beginning to scale. Developing dryers utilizing environmentally friendly refrigerants (low Global Warming Potential or GWP) is also a critical opportunity, aligning product development with evolving environmental regulations and enhancing corporate sustainability profiles. These forces combined suggest a market focused on leveraging efficiency and connectivity to overcome initial cost hurdles.

Segmentation Analysis

The Cycling Refrigerated Air Dryers Market is systematically segmented based on Type, Capacity, and Application, allowing for detailed analysis of demand patterns and strategic planning. The segmentation by Type primarily differentiates units based on their mechanism for achieving cycling efficiency, with Thermal Mass and Non-Thermal Mass (Direct Expansion) being the key categories. Thermal mass systems utilize a stored medium (water, glycol, or phase change material) to maintain a cooling reserve, offering superior stability and efficiency during partial loads, while non-thermal mass systems cycle the refrigerant compressor directly based on demand, prioritizing responsiveness. Capacity segmentation helps classify product suitability across various industrial scales, ranging from small workshops requiring minimal flow rates to large assembly plants demanding high volumes of treated air.

Further analysis within the Application segment reveals that the market drivers vary significantly across different end-user industries. The Food & Beverage sector, for instance, emphasizes hygiene and consistent quality, demanding dryers that meet strict purity standards. Conversely, the Automotive and Machinery industries prioritize robust, high-throughput systems capable of enduring continuous operation and demanding flow rates. The strategic focus for market players is increasingly shifting towards customizing control interfaces and material composition to meet these specific industry requirements, such as incorporating stainless steel components for hygienic applications or implementing corrosion-resistant features for chemical environments.

- By Type

- Thermal Mass Cycling Refrigerated Air Dryers (Water/Glycol-based, Phase Change Material-based)

- Non-Thermal Mass Cycling Refrigerated Air Dryers (Direct Expansion)

- By Capacity (Standard Cubic Feet per Minute - SCFM)

- Small Capacity (Up to 500 SCFM)

- Medium Capacity (500–5000 SCFM)

- Large Capacity (Above 5000 SCFM)

- By Application/End-User

- Automotive and Manufacturing

- Food and Beverage Processing

- Chemical and Petrochemical

- Electronics and Semiconductor

- Pharmaceutical and Healthcare

- Textile and Paper

- General Industrial Applications

Value Chain Analysis For Cycling Refrigerated Air Dryers Market

The value chain for cycling refrigerated air dryers commences with the upstream supply segment, which involves the sourcing of critical components such as refrigerant compressors, heat exchangers (pre-coolers/reheaters), condensers, thermal storage materials (e.g., specialized glycol mixtures), and advanced electronic controllers and sensors. Key raw material suppliers provide necessary metals like aluminum and copper for heat exchange elements, while specialized manufacturers supply highly efficient, low GWP refrigerants. Maintaining strong, stable relationships with compressor manufacturers, particularly those focusing on high efficiency and reliability, is crucial for ensuring the quality and energy performance of the final dryer product. Disruptions in the supply of microcontrollers or specialized refrigerants can significantly impact manufacturing output and cost structures, highlighting the vulnerability of the upstream linkage.

The mid-stream segment encompasses the core manufacturing and assembly processes, where Original Equipment Manufacturers (OEMs) design, fabricate, and test the integrated dryer units. This stage involves complex engineering to optimize the thermal exchange process, integrate sophisticated cycling control logic, and ensure compliance with pressure vessel codes and regional energy efficiency standards (e.g., ISO 7183). Differentiation at this stage is achieved through proprietary thermal mass designs, highly efficient heat exchangers, and the development of user-friendly HMI (Human-Machine Interface) systems. Effective supply chain management and modular manufacturing techniques are leveraged here to minimize production costs and shorten lead times.

The downstream segment, focusing on distribution and end-user engagement, determines market reach and service quality. Distribution channels are typically mixed, involving both direct sales to large industrial clients and indirect channels through certified distributors, industrial equipment dealers, and specialized compressed air system integrators. Indirect channels often provide crucial value-added services, including system installation, sizing consultation, preventative maintenance, and aftermarket support. The effectiveness of this downstream network, particularly the provision of rapid and skilled technical service, is critical for customer satisfaction and brand loyalty, especially given the technical complexity and essential nature of these industrial assets.

Cycling Refrigerated Air Dryers Market Potential Customers

Potential customers for cycling refrigerated air dryers are predominantly industrial entities that utilize compressed air as a primary utility power source and have inherently fluctuating air demand profiles. These customers seek solutions that minimize operational energy consumption while ensuring consistent air purity, making them ideal candidates for the energy-saving capabilities of cycling technology. Major buying sectors include large automotive assembly plants, which require vast volumes of dry air for painting booths and pneumatic tools, and general manufacturing facilities involved in component assembly and fabrication, where efficient utility management is a significant determinant of overall profitability. Furthermore, any company operating under continuous pressure to meet strict energy consumption mandates, often government or industry-driven, is a prime target for adopting this technology.

The Food & Beverage and Pharmaceutical industries represent high-value potential customers due to their stringent regulatory requirements concerning contamination control. In these sectors, even minimal moisture content can compromise product integrity and safety, driving demand for dryers capable of achieving stable, low-pressure dew points with high reliability. Buyers in these fields prioritize hygienic designs, compliance documentation, and integrated filtration solutions alongside the cycling mechanism. Additionally, the electronics and semiconductor manufacturing sectors, which rely on ultra-clean, moisture-free environments for highly sensitive processes, constitute a growing customer base, often demanding medium to large capacity thermal mass units for maximum reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,050 Million |

| Growth Rate | 4.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Atlas Copco, Sullair, Kaeser Kompressoren, Ingersoll Rand, Parker Hannifin, SMC Corporation, SPX FLOW, Zeks, Boge Kompressoren, Gardner Denver, Quincy Compressor, BEKO Technologies, FRIULAIR, Hankison, Domnick Hunter, Omega Air, CompAir, Pneumatech, Zander, Hitachi. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cycling Refrigerated Air Dryers Market Key Technology Landscape

The technological landscape of the Cycling Refrigerated Air Dryers Market is defined by continuous innovation aimed at maximizing energy efficiency and extending component lifespan. A critical technological evolution is the refinement of thermal mass storage systems, moving beyond simple water/glycol mixtures to incorporate advanced Phase Change Materials (PCMs). PCMs offer higher latent heat storage capacity, enabling the system to store cooling energy more efficiently and prolong the compressor off-cycle, thereby drastically reducing the run time and energy consumption of the refrigeration circuit. This focus on thermal management ensures stable dew points even during large swings in air flow or ambient temperature, which is essential for consistent industrial quality.

Another pivotal technological development involves the integration of Variable Speed Drive (VSD) technology within the refrigerant compressor itself. While the core cycling mechanism already saves energy, coupling it with VSD allows the compressor to modulate its speed based on the precise cooling load requirement, further fine-tuning efficiency during the on-cycle phase. This dual efficiency approach—cycling the unit off during low load and modulating speed during the active cycle—offers industry-leading energy performance. Furthermore, sophisticated electronic control units (ECUs) are becoming standard, featuring advanced proportional integral derivative (PID) control loops for highly precise dew point maintenance and integrating connectivity features necessary for IIoT data logging and remote monitoring.

The market is also witnessing rapid adoption of smart sensing technologies, including high-accuracy digital dew point sensors and flow meters. These sensors provide the detailed, real-time data necessary for the cycling control logic to operate optimally. Modern dryers are equipped with interfaces that allow seamless communication with factory wide Energy Management Systems (EMS) and industrial controllers, facilitating predictive diagnostics and centralized utility management. The transition to low Global Warming Potential (GWP) refrigerants, such as HFOs (Hydrofluoroolefins), is also reshaping the technological profile, driven by regulatory mandates and manufacturers’ commitment to sustainability, necessitating redesigned heat exchangers optimized for the thermodynamic properties of these new fluids.

Regional Highlights

Asia Pacific (APAC) stands out as the primary growth engine for the Cycling Refrigerated Air Dryers Market. This rapid expansion is fundamentally fueled by high rates of industrialization, massive investments in infrastructure development, and the relocation of global manufacturing activities to countries such as China, India, Vietnam, and Indonesia. These nations are experiencing increasing adoption of advanced, energy-efficient machinery to meet growing domestic and international demand for manufactured goods. In particular, the electronics, automotive components, and textile industries in APAC are aggressively modernizing their compressed air treatment systems. The region's regulatory environment, while historically less stringent than in the West, is gradually shifting towards mandating higher energy efficiency standards, providing a long-term catalyst for the replacement market and initial adoption of cycling technology.

North America represents a mature market characterized by demand for high-capacity, premium-efficiency cycling dryers integrated with sophisticated facility management systems. The key drivers in this region are the high cost of industrial electricity and robust regulatory pressure emphasizing energy reduction. End-users in the US and Canada, particularly within the aerospace, pharmaceutical, and large-scale manufacturing sectors, prioritize long-term Total Cost of Ownership (TCO) over initial price, thus favoring thermal mass cycling dryers known for deep energy savings and unparalleled reliability. The market is highly competitive, focusing on technological differentiation such as enhanced connectivity, advanced predictive maintenance features, and superior service networks provided by key global players.

Europe exhibits high market penetration of cycling refrigerated air dryers, driven largely by stringent environmental directives, notably the European Union’s Ecodesign requirements, which push manufacturers to adopt the most energy-efficient compressed air technology available. The regional demand is concentrated in Germany, France, and Italy, supporting established automotive, chemical, and precision engineering industries. European end-users often demand systems utilizing low-GWP refrigerants and compliance with ISO 8573 air quality standards. The market here is also heavily influenced by the adoption of Industry 4.0 principles, meaning dryers are expected to communicate seamlessly within integrated production environments, leading to higher demand for smart, network-enabled cycling units.

The Latin America and Middle East & Africa (MEA) regions currently represent developing markets with significant untapped potential. Growth in these areas is spurred by ongoing infrastructure projects, expansion of the oil & gas sector (MEA), and the growth of manufacturing and mining activities (Latin America). While price sensitivity remains a constraint, increasing energy costs are gradually making the energy-saving benefits of cycling dryers more appealing, particularly in industrial centers in Brazil, Mexico, and Saudi Arabia. Market growth relies heavily on international OEMs establishing stronger local distribution and service partnerships to overcome logistical and technical support challenges inherent in these diverse geographical areas.

- Asia Pacific (APAC): Dominates market growth, driven by rapid industrialization, expansion of the electronics and automotive sectors, and increasing focus on manufacturing efficiency in China and India.

- North America: Mature market focused on TCO reduction, high energy efficiency mandates, and adoption of large-capacity, IoT-enabled cycling dryers in pharmaceutical and aerospace industries.

- Europe: Growth primarily driven by strict EU environmental regulations (Ecodesign), high demand for low-GWP refrigerants, and strong integration of dryers into Industry 4.0 frameworks across Central and Western Europe.

- Latin America (LATAM): Emerging market potential driven by investments in manufacturing and infrastructure in countries like Brazil and Mexico, though constrained by initial capital cost sensitivity.

- Middle East and Africa (MEA): Growth tied to the petrochemical industry, industrial diversification initiatives, and increasing need for reliable equipment in challenging climate conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cycling Refrigerated Air Dryers Market.- Atlas Copco

- Sullair (Hitachi)

- Kaeser Kompressoren

- Ingersoll Rand

- Parker Hannifin

- SMC Corporation

- SPX FLOW

- Zeks (Atlas Copco Group)

- Boge Kompressoren

- Gardner Denver (A Pompéi Company)

- Quincy Compressor

- BEKO Technologies

- FRIULAIR S.R.L.

- Hankison

- Domnick Hunter (Parker Hannifin)

- Pneumatech

- Omega Air

- Zander

- CompAir

- Fusheng Industrial

Frequently Asked Questions

Analyze common user questions about the Cycling Refrigerated Air Dryers market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary energy saving benefits of cycling refrigerated air dryers?

Cycling refrigerated air dryers significantly reduce energy consumption—often 30% to 60%—by turning off the refrigerant compressor during periods of low compressed air demand or when sufficient cooling capacity is stored (especially in thermal mass units), minimizing wasted electricity compared to constant-run non-cycling models.

How does a thermal mass cycling dryer differ from a non-thermal mass unit?

Thermal mass dryers use a medium (like water or glycol) to store thermal energy, allowing the compressor to remain off longer while cooling continues. Non-thermal mass units cycle the refrigerant compressor directly based on dew point or cooling demand, offering quicker response but potentially less stability during large load fluctuations.

What is the recommended pressure dew point for cycling refrigerated dryers?

Cycling refrigerated dryers typically maintain a pressure dew point stability range of 35°F to 50°F (approximately 2°C to 10°C). This range is suitable for most general industrial applications, effectively preventing condensation in downstream piping and equipment.

Which industry applications drive the highest demand for these dryers?

The highest demand is driven by industries requiring high air quality and fluctuating demand profiles, notably Automotive Manufacturing (for paint booths and tools), Food and Beverage processing, Pharmaceuticals (for sterile processes), and large-scale General Manufacturing facilities focused on energy expenditure reduction.

Is the integration of IoT technology becoming standard in modern cycling air dryers?

Yes, integration of IoT (Internet of Things) and IIoT capabilities is increasingly standard, enabling remote monitoring, real-time performance diagnostics, predictive maintenance scheduling, and seamless communication with centralized plant Energy Management Systems (EMS).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Cycling Refrigerated Air Dryers Market Statistics 2025 Analysis By Application (Energy, General Industry, Food & Pharmaceutical, Others), By Type (Air-cooled, Water-cooled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Cycling Refrigerated Air Dryers Market Statistics 2025 Analysis By Application (Energy, General Industry, Food & Pharmaceutical), By Type (Air-cooled, Water-cooled), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager