Cyclopropylacetylene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436970 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Cyclopropylacetylene Market Size

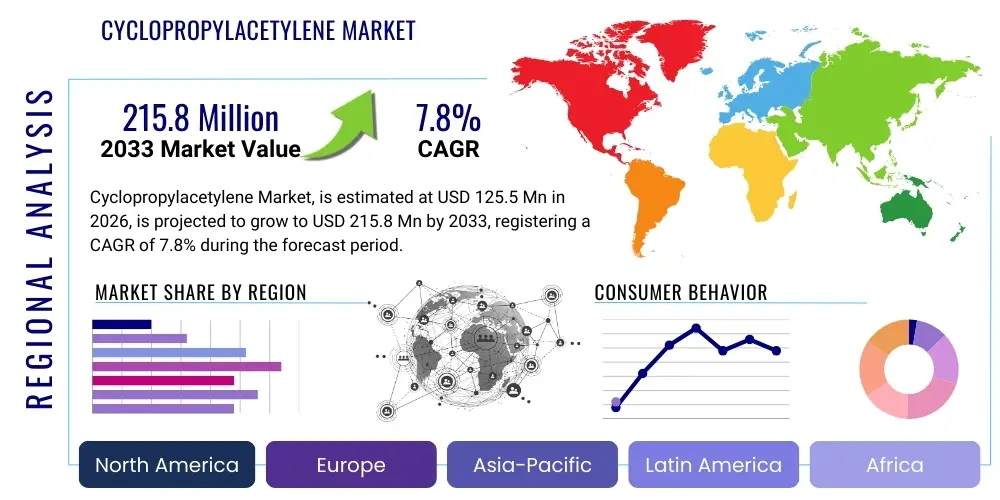

The Cyclopropylacetylene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at $125.5 Million in 2026 and is projected to reach $215.8 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the chemical compound's increasing relevance as a versatile building block, particularly within the highly regulated and rapidly innovating pharmaceutical sector, where its unique structural properties are essential for synthesizing advanced therapeutic agents. Market growth is further bolstered by sustained investment in specialty chemicals and materials science, where cyclopropylacetylene serves as a critical intermediate for novel polymer structures and specialized catalytic ligands.

The valuation reflects a growing demand for high-purity cyclopropylacetylene across major industrialized economies, particularly those with robust biotechnology and chemical manufacturing capabilities. While the initial synthesis and handling present inherent challenges due to the compound’s volatility and specificity, improvements in large-scale synthesis technologies and safety protocols are lowering production barriers, thus allowing more manufacturers to enter the high-purity segment. Geographical market concentration in areas like North America and Europe, which host key pharmaceutical research hubs, contributes significantly to the market size, although Asia Pacific is emerging as a dominant growth engine due to expanding chemical production capacities and increasing R&D spending.

Cyclopropylacetylene Market introduction

Cyclopropylacetylene (CPA), chemically defined as C5H6, is an organic compound featuring a cyclopropyl ring attached directly to an acetylene (ethynyl) group. This unique structure combines the rigidity and ring strain of the cyclopropane moiety with the reactivity of the terminal alkyne group, making it an indispensable intermediate, or synthon, in complex organic synthesis. It serves as a pivotal chemical tool for constructing sophisticated molecules with specific spatial orientations and enhanced biological activity, which is highly sought after in drug discovery and advanced material development. The intrinsic strain and high electron density associated with the cyclopropyl ring influence the reactivity of the alkyne, allowing for unique cycloaddition and coupling reactions that are challenging to achieve with simpler acetylenic compounds.

The primary applications of Cyclopropylacetylene lie predominantly within pharmaceutical synthesis, where it is instrumental in the preparation of nucleoside analogues, crucial components in antiviral drugs (e.g., anti-HIV medications) and certain anticancer agents. Its structural framework allows medicinal chemists to introduce metabolically stable and conformationally restricted groups into drug candidates, often improving pharmacokinetics, bioavailability, and target specificity. Beyond life sciences, CPA is employed in material science for synthesizing highly specialized polymers, liquid crystals, and organometallic complexes used in catalysis, leveraging the compound's capacity to form highly ordered structures or act as a functional ligand.

The market driving factors include the escalating global investment in pharmaceutical R&D, particularly in therapeutic areas requiring novel structural motifs, such as infectious diseases and personalized medicine. Furthermore, the rising adoption of sophisticated chemical synthesis techniques, including green chemistry methodologies and flow chemistry, which facilitate safer and more efficient handling of volatile materials like CPA, significantly contributes to market expansion. The key benefit offered by CPA is its ability to accelerate the synthesis of chirally pure and structurally complex molecules, offering a crucial advantage in competitive drug development pipelines where speed and structural novelty are paramount.

Cyclopropylacetylene Market Executive Summary

The Cyclopropylacetylene market is experiencing robust growth driven by its increasing critical role in specialty chemical synthesis, particularly within the burgeoning pharmaceutical and advanced materials sectors. Business trends indicate a strong move toward high-ppurity, custom-synthesized CPA, reflecting the stringent quality requirements of end-user industries, specifically regulated drug manufacturing. Key market participants are focusing on optimizing synthesis routes—moving away from traditional batch processes towards continuous flow methodologies—to improve scalability, reduce hazardous waste, and enhance safety, directly impacting competitive positioning and supply chain stability. Strategic partnerships between chemical manufacturers and pharmaceutical R&D institutions are becoming essential to secure long-term contracts and inform product specification requirements, stabilizing demand fluctuations.

Regional trends highlight the continued dominance of North America and Europe, attributed to the presence of large multinational pharmaceutical companies and established research infrastructure. However, the Asia Pacific region, led by China and India, is registering the highest growth rate. This accelerated expansion is fueled by significant government investments in chemical manufacturing bases, lower operational costs, and the rapid expansion of generic and specialty chemical production facilities aiming to service both domestic and international markets. Latin America and the Middle East & Africa (MEA) currently represent niche markets, but show burgeoning potential as local biotechnological and agrochemical industries develop, necessitating reliable access to high-quality chemical building blocks like CPA.

Segment trends reveal that the Pharmaceutical Synthesis application segment maintains the largest market share due to the irreversible dependence of critical drug classes on the cyclopropyl moiety. Within the purity segment, High Purity (>99%) Cyclopropylacetylene is dominating revenue generation, commanding premium pricing because its use is non-negotiable in clinical-grade API (Active Pharmaceutical Ingredient) production where impurities can have serious biological consequences. Future growth is anticipated to be strong in the Material Science segment, driven by R&D focused on next-generation organic electronics and high-performance polymers requiring unique cross-linking agents provided by CPA.

AI Impact Analysis on Cyclopropylacetylene Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Cyclopropylacetylene market frequently center on three main themes: optimizing the notoriously complex and hazardous synthesis process, accelerating the discovery of novel molecules that utilize CPA as a building block, and improving supply chain resilience and demand forecasting for this specialty chemical. Users are keen to understand how AI-driven predictive modeling can mitigate risks associated with handling volatile intermediates and whether machine learning algorithms can design more efficient, safer, and greener reaction pathways for CPA manufacturing. Furthermore, there is significant interest in AI's capability to search vast chemical libraries, identifying novel drug targets or polymer structures where the cyclopropylacetylene moiety provides optimal functionality, thereby directly influencing future market demand and application expansion.

AI is poised to transform the R&D workflow where Cyclopropylacetylene is employed. Machine learning models are increasingly deployed to predict the outcome of specific alkyne coupling reactions, such as Sonogashira or Cadiot-Hass reactions involving CPA, minimizing the need for extensive, costly, and resource-intensive lab experimentation. By rapidly filtering non-viable synthesis routes and prioritizing pathways with high yield and low byproduct formation, AI dramatically speeds up the lead optimization phase in drug discovery. This targeted approach ensures that CPA, a relatively expensive and complex synthon, is utilized most effectively, maximizing return on investment for pharmaceutical companies and driving increased, predictable demand for the highest purity grades.

On the manufacturing and operational side, AI algorithms are being integrated into advanced process control (APC) systems within chemical plants producing CPA. These systems use real-time sensor data to maintain optimal temperature, pressure, and catalyst concentrations, crucial for ensuring stability and high yield during hazardous intermediate production. Furthermore, AI-enabled supply chain management tools are crucial for specialty chemicals like CPA, where shelf life and strict storage conditions are paramount. Predictive analytics can forecast sudden shifts in demand from biotechnology clients, allowing manufacturers to adjust production schedules precisely, reducing waste and inventory costs, and ensuring timely delivery of this essential, but difficult-to-handle, reagent.

- AI optimizes synthesis protocols, reducing reaction time and improving CPA yield through predictive modeling.

- Machine learning accelerates drug discovery by identifying novel applications and molecular targets for CPA-containing compounds.

- Predictive analytics enhance supply chain efficiency, ensuring just-in-time delivery and minimizing storage risks associated with volatile CPA.

- Robotics integrated with AI platforms automate hazardous handling processes, improving worker safety in CPA manufacturing.

- AI supports green chemistry initiatives by modeling solvent-free or low-waste synthesis routes for Cyclopropylacetylene production.

DRO & Impact Forces Of Cyclopropylacetylene Market

The Cyclopropylacetylene market dynamics are governed by a unique interplay of powerful drivers, significant restraints, and emerging opportunities, all shaped by overarching impact forces. The primary market driver is the sustained and escalating requirement for sophisticated chemical building blocks in the high-stakes pharmaceutical industry, particularly for the synthesis of complex antiviral, antifungal, and anticancer agents that rely on the constrained structure of the cyclopropyl moiety for enhanced biological efficacy. Furthermore, the growing adoption of cyclopropyl-containing compounds in high-performance materials and specialized agrochemicals ensures a diversified and resilient demand base, lessening reliance solely on the volatile drug discovery cycle. The versatility of CPA as a starting material in diverse coupling reactions—enabled by improved catalytic systems—also acts as a strong driver, encouraging its widespread use across various R&D departments globally.

Despite these drivers, significant restraints temper the market’s potential. Cyclopropylacetylene is inherently volatile and often requires cryogenic storage or extremely careful handling due to its low boiling point and potential instability, posing substantial logistical and safety challenges during transport and storage, which significantly increases operational costs. The synthesis process itself is technically demanding, requiring specialized equipment and highly skilled personnel, leading to high production expenses. Furthermore, the market faces competition from alternative, structurally related synthons, and regulatory scrutiny regarding the industrial use and waste disposal of highly reactive intermediates can restrict market entry and expansion for smaller manufacturers. The complexity of regulatory compliance in pharmaceutical-grade production (GMP standards) acts as a high barrier for producers.

Opportunities for growth are predominantly found in the technological sphere, particularly the adoption of microreactor technology and continuous flow chemistry. These advanced manufacturing techniques allow for the safer, more efficient, and scalable synthesis of CPA, mitigating risks associated with batch processes and opening doors for high-volume, cost-effective production. Secondly, the increasing academic and industrial focus on developing novel cyclopropyl-containing pesticides and veterinary pharmaceuticals presents an untapped segment. The overarching impact forces include strict environmental regulations dictating chemical waste management, the ever-present threat of technological substitution by greener or simpler chemical pathways, and fluctuating costs of key raw materials (e.g., reagents for cyclopropanation or acetylation steps), which directly influence manufacturer profit margins and market pricing stability.

Segmentation Analysis

The Cyclopropylacetylene market is segmented primarily based on Purity Level, Application, and End-Use Industry, providing a nuanced view of demand patterns and strategic market entry points. Segmentation by purity is crucial because the performance and regulatory acceptance of CPA are highly dependent on minimal impurity levels, particularly in pharmaceutical applications. The segmentation by application reflects the chemical versatility of CPA, distinguishing between its use in medicinal chemistry, material science, and other specialty chemical manufacturing. The end-use industry analysis highlights the primary economic sectors driving consumption, revealing strategic sales targets and long-term investment priorities.

The High Purity segment, typically defined as purity levels exceeding 99%, dominates the market in terms of value, largely driven by the stringent quality requirements for Active Pharmaceutical Ingredients (APIs) and clinical research chemicals, where even trace impurities can invalidate biological testing or fail regulatory audits. In contrast, the Standard Purity segment (95%-99%) finds common use in early-stage academic research, certain low-cost material synthesis, and industrial processes where absolute purity is less critical. Geographically, segmentation underscores the importance of the Asia Pacific region, which, despite historically focusing on standard purity manufacturing, is rapidly shifting towards high-purity production to cater to global export demands and domestic high-tech industries.

- By Purity Level

- High Purity (>99.0%)

- Standard Purity (95.0% - 99.0%)

- Technical Grade (Below 95.0%)

- By Application

- Pharmaceutical Synthesis (Antivirals, Anticancer Agents, CNS Drugs)

- Agrochemicals (Herbicides and Fungicides)

- Material Science (Specialty Polymers, Liquid Crystals, Catalysis Ligands)

- Chemical Research and Development

- By End-Use Industry

- Biotechnology and Pharmaceutical Companies

- Academic and Government Research Institutions

- Contract Research and Manufacturing Organizations (CROs/CMOs)

- Specialty Chemical Manufacturers

- By Region

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Argentina)

- Middle East and Africa (MEA)

Value Chain Analysis For Cyclopropylacetylene Market

The value chain for the Cyclopropylacetylene market is characterized by complexity stemming from the specialized nature of its synthesis and the critical quality requirements of its end-user industries. The upstream segment involves the procurement and preparation of specialized raw materials, primarily cyclopropane derivatives and various acetylene precursors, alongside proprietary reagents and catalysts required for the challenging coupling reactions. Due to the need for specific, often patented synthesis pathways, the upstream activities are highly specialized, involving a limited number of niche chemical suppliers who ensure the quality and consistency of these high-cost precursors. Efficiency in this stage significantly influences the final cost of CPA.

The core manufacturing process, or midstream, transforms these precursors into CPA. This stage requires significant capital investment in reaction vessels, cryogenic storage, and purification technology (such as high-vacuum distillation or chromatography) to achieve the required high-purity levels demanded by pharmaceutical applications. Direct distribution typically involves specialized logistics providers equipped to handle and transport highly volatile or pressurized chemicals, ensuring cold chain integrity and regulatory compliance (e.g., DOT/ADR regulations). Indirect channels often involve large global chemical distributors (like Sigma-Aldrich or TCI) who aggregate supply and provide smaller quantities to research institutions and specialized SMEs globally.

Downstream activities are dominated by the specialized end-use sectors—pharmaceutical and agrochemical companies—which integrate CPA into multi-step synthesis pathways to create final products like APIs or novel pesticides. The market is defined by a strong direct relationship between CPA manufacturers and large CMOs/pharmaceutical buyers, particularly for bulk high-purity orders, emphasizing reliability and stringent quality agreements. The success of the downstream industry is directly tied to the innovation cycle in drug discovery, meaning CPA demand is often driven by successful clinical trials of molecules utilizing the cyclopropyl core structure, creating a highly dependent, but high-value, final consumption market.

Cyclopropylacetylene Market Potential Customers

The potential customer base for Cyclopropylacetylene is highly concentrated within research-intensive industries that require complex, chirally selective, and conformationally rigid chemical building blocks. The largest volume consumers are global pharmaceutical and biotechnology companies, which utilize CPA as a vital synthon for synthesizing Active Pharmaceutical Ingredients (APIs), especially those targeting chronic diseases, viruses, and oncology. These customers prioritize guaranteed high purity, regulatory documentation (such as Certificate of Analysis), and reliable supply chain logistics, often engaging in multi-year procurement contracts with manufacturers.

A second major segment comprises Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs). These entities serve as intermediaries, synthesizing chemical libraries or producing drug intermediates on behalf of pharmaceutical clients. Their demand is project-based but often involves large batch orders during scale-up phases, requiring technical-grade and high-purity CPA, depending on the stage of development. Furthermore, academic and government research institutions, although purchasing smaller volumes, represent a foundational customer segment, driving early-stage innovation and discovering novel applications for CPA in emerging fields like materials science and specialized catalysis, influencing future industrial demand curves.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $125.5 Million |

| Market Forecast in 2033 | $215.8 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Sigma-Aldrich (Merck), TCI Chemicals, Alfa Aesar (Thermo Fisher Scientific), Sarnova, SynQuest Labs, Acros Organics, J&K Scientific, BOC Sciences, Hairui Chemical, Alichem, Nanjing Chemlin, Glentham Life Sciences, Angene International, Clearsynth, Matrix Scientific, Santa Cruz Biotechnology, Chem-Impex International, AK Scientific, Toronto Research Chemicals, Ascent Scientific. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Cyclopropylacetylene Market Key Technology Landscape

The manufacturing of Cyclopropylacetylene relies on sophisticated organic synthesis technologies, primarily focusing on highly specific carbon-carbon bond formation reactions. Historically, synthesis involved classic methods relying on the conversion of cyclopropyl methyl ketones or cyclopropyl carboxylic acids, often utilizing harsh reagents and multistep procedures resulting in moderate yields and significant purification challenges. However, the current technological landscape is dominated by optimized, proprietary routes that aim to increase atom economy and stereoselectivity. Key technologies include advanced catalytic systems, often involving palladium or copper catalysts (e.g., Sonogashira coupling variants), which facilitate the highly efficient coupling of cyclopropyl halides or boronic acids with acetylenic compounds under mild conditions. Continuous refinement of these catalytic protocols is central to reducing production costs and environmental impact.

A transformative technology rapidly gaining traction in CPA manufacturing is Flow Chemistry, also known as continuous processing. CPA is a volatile and potentially unstable intermediate, and traditional batch reactors pose risks related to heat accumulation and localized high concentrations. Flow chemistry systems utilize microreactors where small volumes of reactants are mixed and reacted continuously. This approach allows for precise control over reaction conditions (temperature, residence time, pressure) and rapid heat dissipation, dramatically enhancing safety and allowing manufacturers to handle the exothermic CPA synthesis with far greater confidence. This technology not only increases yield and purity but is also essential for complying with modern industrial safety standards and achieving scalable, consistent production necessary for meeting global pharmaceutical demand.

Furthermore, advanced purification and analytical technologies are critical components of the CPA landscape, especially for producing the dominant high-purity segment. Technologies such as preparative high-performance liquid chromatography (HPLC), advanced flash chromatography, and high-vacuum fractional distillation are utilized to separate minute traces of structural isomers or residual catalysts. Accurate and sensitive analytical techniques like Nuclear Magnetic Resonance (NMR) spectroscopy and high-resolution Mass Spectrometry (HRMS) are mandatory to confirm the chemical structure and quantify purity, meeting the stringent quality control standards mandated by regulatory bodies like the FDA and EMA for materials used in drug synthesis. The integration of automated quality control using spectroscopic methods further streamlines the process and ensures batch-to-batch consistency.

Regional Highlights

- North America: North America, particularly the United States, represents a mature and high-value market for Cyclopropylacetylene, driven by the world's largest concentration of pharmaceutical and biotechnology R&D firms. Demand here is characterized by a strong preference for ultra-high purity (>99.5%) CPA, primarily sourced from certified, compliant suppliers. The market benefits from substantial private and public funding poured into drug discovery, especially in areas like oncology, CNS disorders, and novel infectious disease treatments, where the cyclopropyl moiety plays a vital structural role. Regulatory stringency maintains high barriers to entry for new suppliers but ensures premium pricing for quality-assured products.

- Europe: Europe holds a strong position as a key consumer and producer, anchored by chemical powerhouses in Germany, Switzerland, and the UK. The market is fueled by established research centers and robust generic drug manufacturing sectors. European regulations, particularly REACH standards, influence production methods, pushing manufacturers toward greener and more sustainable synthesis processes, often favoring flow chemistry applications. The high demand for CPA in agrochemical synthesis also provides a substantial revenue stream, complementing the pharmaceutical consumption across the continent.

- Asia Pacific (APAC): The APAC region is projected to exhibit the fastest growth over the forecast period. This acceleration is spearheaded by China and India, which are rapidly transitioning from regional commodity chemical manufacturers to global providers of specialized chemical intermediates and APIs. Lower operational costs, increasing government support for domestic chemical industries, and massive expansion of Contract Manufacturing Organizations (CMOs) attract global pharmaceutical outsourcing, dramatically increasing the regional consumption of CPA. Japan and South Korea also contribute significantly, focusing on advanced material science applications, particularly in display technology and specialized polymers.

- Latin America (LATAM): The LATAM market is currently characterized by moderate consumption, concentrated primarily in Brazil and Mexico. Demand is generally driven by domestic generic drug production and limited agrochemical formulation activities. Market expansion depends on further development of local R&D capabilities and greater integration into global pharmaceutical supply chains. Current procurement often relies on imports from North American and European distributors, making logistics and import tariffs key determinants of final product cost.

- Middle East and Africa (MEA): The MEA market for CPA is nascent but shows potential, largely tied to burgeoning investments in localized pharmaceutical manufacturing hubs, particularly in the UAE and Saudi Arabia, aimed at achieving drug self-sufficiency. Current demand is low volume and specialized, driven mainly by university research and small-scale formulation industries. Future growth hinges on successful industrialization initiatives and the establishment of robust, regulated chemical supply networks within the region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Cyclopropylacetylene Market.- Sigma-Aldrich (Merck KGaA)

- TCI Chemicals

- Alfa Aesar (Thermo Fisher Scientific)

- Sarnova

- SynQuest Labs

- Acros Organics

- J&K Scientific

- BOC Sciences

- Hairui Chemical

- Alichem

- Nanjing Chemlin

- Glentham Life Sciences

- Angene International

- Clearsynth

- Matrix Scientific

- Santa Cruz Biotechnology

- Chem-Impex International

- AK Scientific

- Toronto Research Chemicals

- Ascent Scientific

Frequently Asked Questions

Analyze common user questions about the Cyclopropylacetylene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications of Cyclopropylacetylene (CPA)?

Cyclopropylacetylene is predominantly used as a versatile chemical intermediate (synthon) in complex organic synthesis. Its primary applications are in pharmaceutical synthesis, specifically for creating antiviral drugs and anticancer agents, and in material science for developing specialty polymers and catalytic ligands.

Why is High Purity Cyclopropylacetylene essential for the pharmaceutical sector?

High purity CPA (>99%) is essential because it is used in the synthesis of Active Pharmaceutical Ingredients (APIs). Strict regulatory standards require minimal impurities to ensure drug efficacy, safety, and compliance with Good Manufacturing Practice (GMP) guidelines, making the high-purity segment the most valuable.

What key challenges restrict the growth of the Cyclopropylacetylene market?

The main restrictions include the high volatility and potential instability of the compound, leading to complex and costly handling, storage, and logistics requirements. Furthermore, the specialized synthesis routes and strict regulatory burden for pharmaceutical use increase overall production costs significantly.

How is Flow Chemistry technology impacting CPA manufacturing?

Flow Chemistry is transforming CPA manufacturing by enabling continuous processing in microreactors. This technology enhances safety, allows for superior control over exothermic reactions, and increases production scalability and consistency, mitigating the risks associated with handling this volatile chemical in traditional batch processes.

Which region is expected to demonstrate the highest growth rate for CPA demand?

The Asia Pacific (APAC) region, driven by countries like China and India, is expected to exhibit the highest growth rate. This surge is attributed to substantial expansion in the Contract Manufacturing Organization (CMO) sector and increasing regional investment in sophisticated specialty chemical production capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager