CZT Radiation Detector Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438121 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

CZT Radiation Detector Market Size

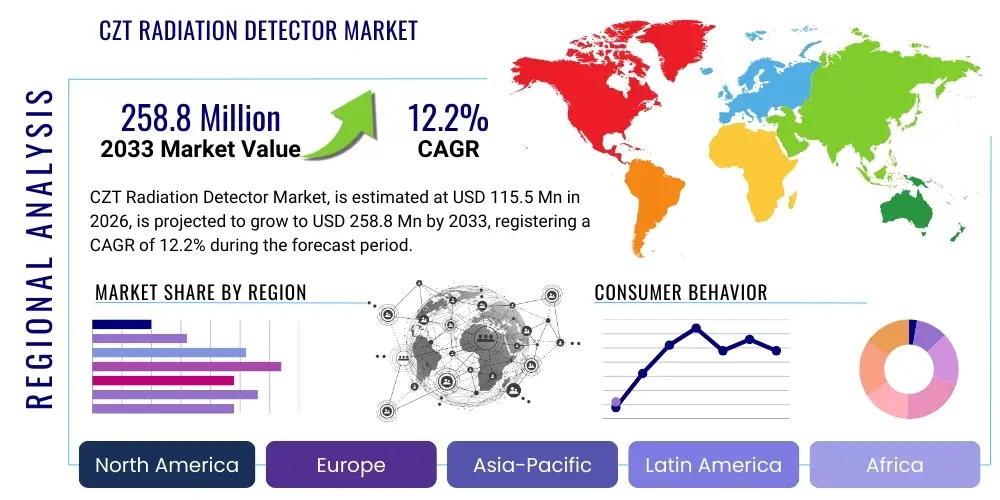

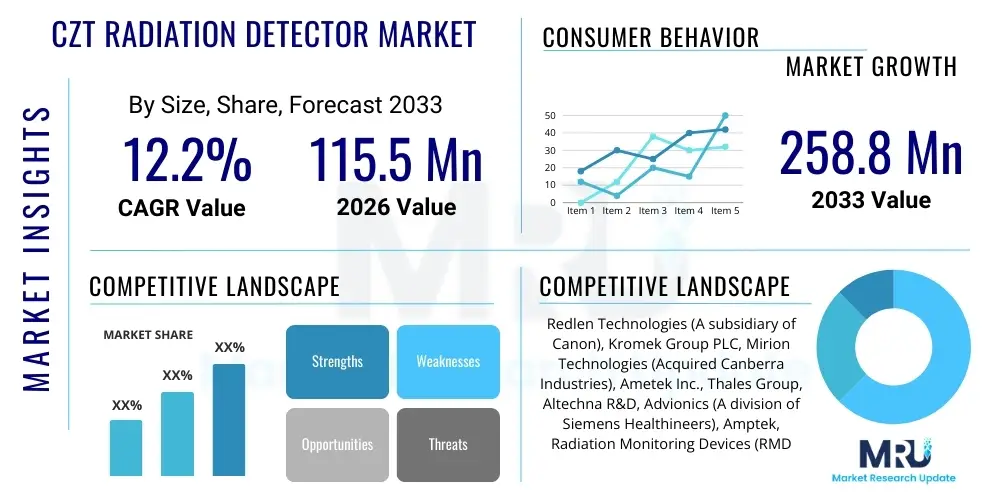

The CZT Radiation Detector Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12.2% CAGR between 2026 and 2033. The market is estimated at $115.5 Million in 2026 and is projected to reach $258.8 Million by the end of the forecast period in 2033.

CZT Radiation Detector Market introduction

Cadmium Zinc Telluride (CZT) radiation detectors represent a significant advancement in solid-state radiation detection technology, primarily due to their ability to operate at room temperature with high energy resolution. Unlike traditional detectors requiring cryogenic cooling, CZT systems offer portability, compactness, and reliability, making them indispensable across sophisticated applications. These detectors function by converting incident gamma rays or X-rays directly into electrical signals without an intermediate light conversion stage, providing superior spectral detail necessary for precise nuclide identification and dose measurement. The intrinsic characteristics of CZT, notably its high density and high atomic number, enable exceptional stopping power, facilitating the detection of high-energy photons effectively in small volumes.

The primary applications driving the CZT market span critical sectors, including nuclear medicine imaging, homeland security, industrial gauging, and astrophysics. In nuclear medicine, CZT is pivotal for Positron Emission Tomography (PET) and Single Photon Emission Computed Tomography (SPECT), where its high resolution significantly improves image quality and diagnostic accuracy, particularly in cardiac and brain imaging. For security purposes, portable CZT detectors are crucial for identifying illicit nuclear materials at borders and key infrastructure points, offering fast, accurate, and non-intrusive screening capabilities. Furthermore, their small form factor allows deployment in harsh or remote environments, enhancing monitoring capabilities in nuclear power plants and geological surveys.

Key benefits driving market adoption include the elimination of cooling systems, resulting in lower operational costs and enhanced system uptime, coupled with superior spectroscopic performance that allows for the differentiation of complex radiation sources. The driving factors encompass the increasing global prevalence of cancer and cardiovascular diseases necessitating advanced diagnostic imaging tools, concurrent with heightened governmental concerns regarding nuclear proliferation and terrorism, leading to substantial investment in detection infrastructure. Moreover, continuous technological improvements in CZT crystal growth techniques are addressing historical constraints related to material purity and cost, thereby broadening the commercial viability and scale of deployment across both medical and non-medical sectors.

CZT Radiation Detector Market Executive Summary

The CZT Radiation Detector market is undergoing a transformative period marked by relentless innovation focused on miniaturization, enhanced spectral performance, and cost reduction through optimized manufacturing processes. Business trends indicate a strong shift towards application-specific detector designs, such as high-pixel-density arrays for medical imaging and ruggedized portable units for field operations in security and industrial monitoring. Strategic partnerships between crystal growers and end-device manufacturers are accelerating the integration of CZT into next- generation diagnostic and inspection systems. Furthermore, the market is characterized by intense research and development aimed at improving the yield and quality of large-volume CZT crystals, which remains a key technological hurdle impacting mass commercialization.

Regional trends demonstrate North America's continued dominance, largely propelled by significant defense spending on homeland security infrastructure and the early adoption of advanced medical imaging technologies in leading research hospitals. Europe maintains a robust market share, driven by a strong nuclear energy sector and strict regulatory frameworks requiring high-resolution environmental monitoring. The Asia Pacific (APAC) region is emerging as the fastest-growing market, primarily fueled by massive investments in healthcare infrastructure expansion, rising demand for advanced cancer diagnostics, and the rapid development of nuclear power capabilities in countries like China, India, and South Korea, necessitating robust radiation detection systems for safety and security.

Segment trends highlight the leading position of the medical imaging segment, specifically in SPECT systems, where CZT detectors are replacing traditional scintillation crystals due to superior resolution, leading to improved clinical outcomes. The security and defense segment is anticipated to exhibit rapid growth, driven by increasing demand for highly mobile and accurate Spectroscopic Personal Radiation Detectors (SPRDs). Technology trends show a distinct movement towards advanced electrode structures, such as coplanar grid and pixelated designs, which mitigate charge carrier trapping issues inherent to CZT material, thereby enhancing detector efficiency and overall performance across all major application segments, ensuring sustained high-resolution capabilities even in complex operational environments.

AI Impact Analysis on CZT Radiation Detector Market

User queries regarding the impact of Artificial Intelligence (AI) on the CZT Radiation Detector market frequently revolve around its potential to overcome material limitations and enhance operational efficiency. Common themes include how AI algorithms can improve energy resolution by compensating for charge trapping effects, whether deep learning can automate and speed up complex nuclide identification in security screening, and the extent to which AI contributes to predictive maintenance and quality control in CZT manufacturing. Users are keenly interested in the integration of AI for advanced spectral analysis, asking if it can reliably differentiate complex overlapping gamma-ray signatures characteristic of dirty bomb scenarios or mixed tracer studies in nuclear medicine, essentially seeking enhanced performance beyond the intrinsic physical limitations of the detector material.

The integration of AI, particularly machine learning (ML) and deep learning (DL) algorithms, is fundamentally transforming the value proposition of CZT detectors by addressing their inherent imperfections and optimizing data output. CZT detectors, while superior in resolution, often suffer from signal degradation due to incomplete charge collection and variations in crystal purity. AI models are now being trained on vast datasets of raw spectral data to recognize and computationally correct these non-idealities, resulting in significantly enhanced peak symmetry and improved signal-to-noise ratios. This computational correction is a game-changer, pushing the practical performance of CZT systems closer to their theoretical limits, especially crucial for high-precision applications like gamma-ray astronomy and advanced SPECT imaging.

Furthermore, AI is instrumental in accelerating the decision-making process in critical applications such as homeland security and industrial monitoring. By employing pattern recognition and anomaly detection algorithms, AI systems integrated with CZT detectors can rapidly analyze complex radiation spectra, automatically classify the detected isotope, and flag potential threats with minimal human intervention. This capability drastically reduces the time required for identifying highly enriched uranium (HEU) or plutonium in cargo containers or identifying material defects in industrial gauging, offering a significant improvement in throughput and accuracy compared to manual or conventional signal processing techniques. This computational enhancement transforms CZT systems from simple detectors into intelligent, autonomous spectroscopy instruments.

- AI-Enhanced Spectral Deconvolution: Utilization of deep neural networks to separate overlapping spectral peaks, improving the accuracy of complex isotope identification in mixed-source environments.

- Charge Trapping Compensation: Implementation of machine learning models to analyze pulse shapes and apply real-time computational corrections, effectively mitigating signal distortion caused by charge carrier trapping within the CZT lattice.

- Automated Quality Control (QC): AI-driven analysis of crystal uniformity and performance characteristics during the manufacturing process, optimizing selection and reducing defect rates in high-purity detector fabrication.

- Predictive Maintenance: Use of ML algorithms to monitor detector performance parameters (e.g., leakage current, baseline noise) and predict potential failures, ensuring maximized operational uptime in critical security and medical environments.

- Optimized Image Reconstruction: Deployment of AI in nuclear medicine (SPECT/PET) to accelerate and improve the fidelity of 3D image reconstruction from CZT detector data, leading to faster diagnosis and reduced patient exposure time.

- Real-time Threat Identification: AI classification models enabling rapid, autonomous categorization of detected radiation sources in security applications (e.g., benign sources vs. potential radiological threats), enhancing response capabilities.

- Reduced False Alarm Rates: Machine learning optimization of background subtraction and noise filtering parameters, significantly decreasing false positives in high-sensitivity detection scenarios, particularly in portal monitors.

DRO & Impact Forces Of CZT Radiation Detector Market

The CZT Radiation Detector market is influenced by a complex interplay of Drivers, Restraints, and Opportunities (DRO) that shape its growth trajectory, compounded by significant external impact forces. A primary driver is the accelerating demand for high-performance, compact medical imaging devices, particularly in oncology and cardiology, where CZT's superior energy resolution translates directly into clearer diagnostic images and more accurate quantification of tracer uptake. Concurrently, the global emphasis on nuclear safety and security, evidenced by increasing international regulations governing border control and the monitoring of nuclear materials, provides a substantial governmental driver for portable, high-fidelity detection solutions. These drivers collectively push the technology towards greater accessibility and broader deployment across diverse sectors.

However, the market faces considerable restraints, predominantly centered on the material science challenges inherent to CZT production. The difficulty and high cost associated with growing large-volume, high-purity single crystals free from defects (such as Te inclusions and grain boundaries) severely limits manufacturing yield and drives up the final detector unit cost. This high entry cost often restricts adoption, particularly in price-sensitive markets or non-critical industrial applications. Furthermore, concerns regarding long-term device stability and polarization effects under high flux conditions remain technological hurdles that require continuous mitigation through advanced electrode design and operational protocols, slowing widespread commercial integration outside of specialized fields.

Opportunities for market expansion are substantial, particularly within emerging applications and technological refinement. The burgeoning field of industrial non-destructive testing (NDT), where high-resolution gamma spectroscopy can reveal fine details of material composition, represents a fertile growth area. Furthermore, the space exploration and astrophysics segments require extremely stable, high-resolution detectors for deep space missions, where CZT is uniquely suited due to its robustness and room-temperature operation. The ongoing development of innovative processing techniques, such as Traveling Heater Method (THM) and Vertical Gradient Freeze (VGF) coupled with advanced purification stages, promises to lower production costs and improve crystal quality, potentially mitigating the primary restraint and opening new avenues for mass adoption.

The primary impact forces affecting this market include stringent regulatory requirements from bodies like the FDA and IAEA, which dictate performance standards for medical devices and security apparatus, respectively, forcing manufacturers to invest heavily in compliance and certification. Economic volatility, particularly concerning the supply chain of high-purity Cadmium (Cd) and Tellurium (Te), acts as an external force impacting raw material costs. Technological breakthroughs in competing materials (e.g., Lanthanum Bromide scintillators) or alternative detector concepts (e.g., semiconductor materials like TlBr) exert competitive pressure, forcing continuous innovation in CZT performance and cost structure to maintain market relevance and dominance in high-resolution spectroscopy applications.

Segmentation Analysis

The CZT Radiation Detector Market is comprehensively segmented based on Detector Type, Application, and End-User, reflecting the diverse functional requirements and operational environments encountered across its primary industries. Analysis of these segments is crucial for understanding specific growth dynamics, investment priorities, and target market penetration strategies. The detector type segmentation differentiates between planar detectors, often used for simple spectroscopy and small field-of-view applications, and highly complex pixelated/3D detectors, which are essential for advanced imaging and precise spatial localization in nuclear medicine and security portal monitors. The choice of detector geometry directly impacts performance metrics such as spatial resolution and detection efficiency, tailoring the product offering to specific end-user needs.

Application-wise, the market is heavily skewed towards high-value sectors where detection fidelity is paramount. Medical imaging remains the cornerstone, characterized by rigorous quality standards and cyclical upgrades of installed systems in hospitals and specialized clinics. Conversely, the homeland security and defense segment, while highly sensitive to geopolitical factors and government spending cycles, demands robust, portable, and reliable instruments capable of continuous operation in field conditions. Industrial applications, including oil and gas monitoring, industrial radiography, and process control, focus more on durability and long-term stability in harsh operational settings.

End-user segmentation clearly distinguishes between institutional buyers, such as hospitals, diagnostic centers, and government defense agencies, and commercial buyers, including industrial plants and research laboratories. This delineation helps manufacturers tailor service agreements, technical support, and distribution networks. Given the high capital expenditure required for CZT systems, especially in medical and security domains, sales cycles are often long and dependent on budget approvals. The trend toward developing cheaper, modular CZT systems is gradually shifting the demand profile, enabling greater adoption by smaller research labs and localized clinical facilities seeking enhanced diagnostic capability without the prohibitive costs associated with legacy technologies.

- By Detector Type:

- Planar Detectors (Used primarily for basic spectroscopy and low-flux measurements).

- Pixelated/3D Position Sensitive Detectors (Essential for SPECT, PET, and advanced spatial resolution in imaging and security).

- Coplanar Grid Detectors (Designed to mitigate hole trapping effects, optimizing performance in higher energy ranges).

- Strip Detectors (Used where 1D position sensitivity is sufficient).

- By Application:

- Medical Imaging (SPECT, PET, Gamma Cameras, Cardiac Imaging, Breast Imaging).

- Homeland Security & Defense (Portable Detection Systems, Isotope Identification Devices, Vehicle Portal Monitors, Customs Screening).

- Industrial Gauging & Process Control (Non-Destructive Testing, Material Analysis, Thickness Gauging).

- Nuclear Power & Environmental Monitoring (Reactor Monitoring, Waste Characterization, Decommissioning).

- Research & Academic (High-Energy Physics, Synchrotron Radiation Experiments, Astrophysics).

- Space Exploration (Gamma-Ray Burst Spectrometers, Planetary Mission Detectors).

- By End-User:

- Hospitals & Diagnostic Centers (Primary consumers in the medical segment).

- Government & Defense Agencies (Homeland security, military, border patrol).

- Nuclear Facilities & Power Plants (Safety monitoring and compliance).

- Industrial Manufacturing & NDT Firms (Process control and quality assurance).

- Research Laboratories & Universities (Fundamental science and detector development).

Value Chain Analysis For CZT Radiation Detector Market

The value chain for the CZT Radiation Detector Market is characterized by high technical complexity and capital intensity, starting with the synthesis of ultra-high purity raw materials. The upstream segment involves procuring and refining Cadmium (Cd), Zinc (Zn), and Tellurium (Te) to 6N or 7N purity levels, a crucial and technologically demanding step, as minute impurities significantly degrade detector performance. This is followed by the intricate process of single crystal growth, typically using methods like THM or VGF. Crystal growers, who possess specialized expertise, then supply large boules to manufacturers, representing a critical bottleneck due to low yield rates of electronic-grade material.

The midstream phase involves the transformation of raw CZT boules into finished detector components. This includes slicing, polishing, electrode deposition (often complex designs like pixelated or coplanar grids using photolithography), encapsulation, and hybridizing the detector with application-specific electronics, such as Application-Specific Integrated Circuits (ASICs) for signal readout and processing. This stage is dominated by specialized detector fabrication firms that require cleanroom environments and precision engineering capabilities. Quality assurance and rigorous performance testing (energy resolution, leakage current) are paramount before assembly into final systems.

Downstream distribution channels vary significantly based on the application. Direct sales are prevalent for high-value, complex systems like SPECT cameras sold to major hospital networks and government security organizations, requiring specialized technical support and long-term service contracts. Indirect channels, involving third-party distributors and integrators, are more common for standardized, lower-cost components sold to research labs or industrial NDT firms. System integrators play a vital role in bundling CZT detectors with sophisticated software and data acquisition systems to deliver comprehensive solutions tailored to specific end-user environments, ensuring both effective market reach and localized technical expertise.

CZT Radiation Detector Market Potential Customers

The primary end-users and buyers of CZT radiation detectors are concentrated in sectors where high spectral resolution and room-temperature operation provide a decisive technological advantage over conventional detection methods. In the healthcare domain, potential customers include large private and public hospital systems, specialized cardiac and neurological clinics, and dedicated diagnostic imaging centers that are seeking to upgrade their SPECT and hybrid SPECT/CT capabilities to achieve higher diagnostic accuracy and lower doses. These buyers prioritize systems offering improved lesion detection sensitivity and better quantification of radionuclide uptake, thereby leading to improved patient management and reduced overall healthcare costs.

Another major customer base resides within the governmental and security sectors, encompassing national defense departments, homeland security agencies, customs and border protection units, and police forces responsible for counter-terrorism and non-proliferation efforts. These customers require portable, rugged, and highly sensitive Spectroscopic Personal Radiation Detectors (SPRDs) and large-scale vehicle portal monitors. Their purchasing decisions are driven by mandates to identify concealed or shielded Special Nuclear Materials (SNM) rapidly and reliably in complex logistical environments, favoring systems that integrate real-time isotope identification capabilities and operate reliably under challenging field conditions.

Beyond these primary markets, significant potential customers exist in high-technology industrial and research environments. This includes nuclear power utilities and waste management firms requiring detectors for precise spent fuel characterization and decommissioning monitoring; major industrial conglomerates performing critical non-destructive material analysis; and academic/governmental research institutions (like NASA, DOE labs, CERN) engaged in fundamental physics research, detector development, and space science missions. These customers value the superior intrinsic energy resolution of CZT for highly precise measurements that are often unattainable with conventional detection technologies, necessitating detectors that meet stringent criteria for low noise and long-term stability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $115.5 Million |

| Market Forecast in 2033 | $258.8 Million |

| Growth Rate | 12.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Redlen Technologies (A subsidiary of Canon), Kromek Group PLC, Mirion Technologies (Acquired Canberra Industries), Ametek Inc., Thales Group, Altechna R&D, Advionics (A division of Siemens Healthineers), Amptek, Radiation Monitoring Devices (RMD), Ajat Oy, Imdetek, Suzhou Kangming Detectors, L3Harris Technologies, Saint-Gobain Crystals, Zecotek Photonics, TCI-Components, Dynasil Corporation, Photonis, Hitachi High-Tech Corporation, Teledyne FLIR. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

CZT Radiation Detector Market Key Technology Landscape

The key technological landscape of the CZT market is defined by continuous efforts to refine material synthesis, optimize detector geometry, and advance signal processing capabilities to maximize performance. The foundation of this technology lies in crystal growth techniques. While the conventional High-Pressure Bridgman (HPB) method was historically used, modern manufacturing relies heavily on the Traveling Heater Method (THM) and the Vertical Gradient Freeze (VGF) technique. THM is often favored for producing crystals with potentially better uniformity and fewer structural defects, crucial for achieving high energy resolution. However, the scalability and cost-efficiency of VGF are also being enhanced to produce larger volumes of usable material, striking a critical balance between quality and commercial viability necessary for widespread adoption across all market segments.

Significant technological advancements are concentrated on electrode design and detector architecture aimed at overcoming the intrinsic limitation of low hole mobility in CZT. The development of specialized electrode geometries, such as coplanar grid (CPG) detectors, allows for effective weighting potential modifications that compensate for the poor charge collection efficiency of holes, thereby maintaining high energy resolution even in larger volume devices. Furthermore, highly pixelated array architectures, combined with sophisticated lithographic processes, enable the production of detectors with exceptional spatial resolution, essential for high-fidelity medical imaging (e.g., dedicated CZT breast gamma cameras) and fine-grained threat localization in security applications. Integrating these pixelated CZT detectors directly with custom-designed low-noise ASIC readout electronics minimizes signal loss and parasitic capacitance, further enhancing performance.

Beyond the physical detector itself, the technology landscape is heavily influenced by ancillary electronics and computational methods. High-speed, low-power pulse processing electronics are essential for handling the fast signal transients produced by CZT. Digital pulse shape analysis (DPSA) has become standard practice, enabling manufacturers to extract maximum information from each detected pulse, compensating for charge collection inefficiencies and mitigating noise. The emerging incorporation of advanced Field-Programmable Gate Arrays (FPGAs) and AI/ML algorithms into the readout chain (as detailed in the AI analysis section) represents the current cutting edge, allowing for real-time spectral correction, automated background suppression, and instantaneous nuclide identification, transforming raw detector output into actionable intelligence with unprecedented speed and accuracy, thereby solidifying CZT’s position as a leading room-temperature spectrometer.

The manufacturing technology also focuses intensely on encapsulation and packaging, particularly for applications in harsh environments like space or industrial settings. Hermetic sealing techniques and robust housing designs are essential to protect the sensitive CZT crystal and associated electronics from moisture, thermal cycling, and mechanical shock, ensuring long operational lifetimes and reliable performance. Continuous research into surface passivation layers and optimized ohmic contacts is critical for maintaining low leakage currents and stable baseline performance over extended periods, particularly for high-sensitivity detectors required for very low-flux environmental monitoring or long-duration space missions where detector degradation cannot be tolerated.

Regional Highlights

- North America: This region maintains the largest market share, driven primarily by extensive governmental investment in homeland security infrastructure, particularly post-9/11 mandates for improved nuclear material detection at ports and borders. The region benefits from a robust ecosystem of research institutions, key defense contractors, and leading medical technology manufacturers (e.g., GE Healthcare, Siemens Healthineers), facilitating rapid research translation and commercialization. High rates of adoption of advanced medical imaging systems (SPECT/PET) in the US and Canada further solidify its market leadership, prioritizing performance and resolution over initial cost constraints.

- Europe: Europe represents a mature market characterized by stringent nuclear safety regulations and a strong presence in the nuclear power and industrial sectors. Countries like Germany, France, and the UK are major consumers, utilizing CZT technology for environmental monitoring, reactor safety, and specialized industrial NDT applications. Furthermore, significant funding for high-energy physics research (e.g., CERN) and astrophysics contributes to technological innovation, particularly concerning large-area, highly segmented CZT arrays. The emphasis on sustainability and safety drives steady demand for replacement and upgrade cycles in existing nuclear infrastructure.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing regional market, largely attributable to escalating public and private investment in healthcare expansion across emerging economies such as China, India, and South Korea. The rapid construction of new hospitals and diagnostic centers, coupled with rising middle-class disposable income, drives the demand for modern, high-resolution diagnostic tools. Additionally, ambitious nuclear power programs in several Asian nations necessitate sophisticated, reliable radiation safety and monitoring equipment, creating a burgeoning segment for CZT detectors in industrial and security applications.

- Latin America: This region exhibits moderate but increasing growth, primarily focusing on leveraging CZT technology for specialized applications in oil and gas exploration (e.g., well logging, density measurements) and gradually upgrading public health diagnostic facilities. Market penetration is often slower due to economic instability and reliance on imported technology, but governmental initiatives to modernize infrastructure are expected to drive growth in the latter half of the forecast period, particularly in Brazil and Mexico.

- Middle East and Africa (MEA): The MEA market is largely centered around oil and gas pipeline inspection and homeland security upgrades, especially in the Gulf Cooperation Council (GCC) countries investing heavily in border protection and critical infrastructure security. Adoption in the medical field is growing, albeit from a low base, focusing on high-end diagnostic equipment in private specialized medical centers. Geopolitical factors heavily influence security-related procurement, making it a highly strategic and procurement-driven segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the CZT Radiation Detector Market.- Redlen Technologies (A subsidiary of Canon)

- Kromek Group PLC

- Mirion Technologies (Acquired Canberra Industries)

- Ametek Inc. (Through Ortec and Hamilton Scientific)

- Thales Group

- Advionics (A division of Siemens Healthineers)

- Amptek Inc.

- Radiation Monitoring Devices (RMD) (A part of Dynasil Corporation)

- Ajat Oy

- Imdetek (Imaging Detector Technology)

- Suzhou Kangming Detectors

- L3Harris Technologies

- Saint-Gobain Crystals (Specializing in material science and components)

- Zecotek Photonics

- TCI-Components (Focusing on material purity)

- Dynasil Corporation

- Hitachi High-Tech Corporation

- Teledyne FLIR (Focusing on security and defense applications)

- Bridgeport Instruments

- eV-Products (An independent CZT producer)

Frequently Asked Questions

Analyze common user questions about the CZT Radiation Detector market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of CZT detectors over traditional scintillators?

The primary advantage of Cadmium Zinc Telluride (CZT) detectors is their capability for room-temperature operation combined with vastly superior energy resolution compared to traditional scintillators like NaI(Tl) or BGO. This direct conversion capability eliminates the need for bulky, costly cryogenic cooling systems, enabling the deployment of compact, portable, and highly accurate spectrometers critical for applications such as high-resolution medical imaging (SPECT) and precise nuclide identification in field security scenarios.

In which application segment is the CZT detector market experiencing the fastest growth?

The CZT detector market is currently experiencing the fastest growth in the medical imaging segment, particularly within Single Photon Emission Computed Tomography (SPECT) and Positron Emission Tomography (PET). CZT technology is replacing older detector materials due to its ability to significantly improve image clarity, reduce scanning time, and lower radiation dose requirements for patients. Rapid expansion of healthcare infrastructure in the Asia Pacific region further fuels this segment's accelerated compound annual growth rate.

What are the main material-related restraints hindering the widespread adoption of CZT detectors?

The main restraints stem from the high cost and complexity of manufacturing electronic-grade CZT crystals. The challenge lies in growing large, single crystals with extremely high purity, minimal lattice defects, and uniform composition (specifically, controlling the concentration of tellurium inclusions and dislocations). These material imperfections lead to low manufacturing yield and issues like charge carrier trapping, which necessitate advanced signal processing and contribute significantly to the high unit cost of CZT detectors, limiting their mass-market potential.

How is Artificial Intelligence (AI) enhancing the performance of CZT detection systems?

AI is critically important for optimizing CZT system performance by employing machine learning algorithms to correct raw spectral data corrupted by charge trapping and non-uniformities. Deep learning models are used for advanced digital pulse shape analysis, computationally improving the energy resolution beyond the detector's intrinsic material limits. Furthermore, AI automates rapid and accurate classification of complex radiation spectra, greatly benefiting homeland security applications by reducing false positives and accelerating threat identification.

Which geographical region holds the largest market share and what factors drive this dominance?

North America holds the largest market share in the CZT Radiation Detector market. This dominance is driven by substantial, sustained governmental funding for homeland security and defense-related nuclear detection programs, coupled with the early and widespread adoption of advanced CZT-based medical imaging equipment in technologically sophisticated hospital systems. The presence of major research and development centers and established semiconductor manufacturing infrastructure also facilitates continuous innovation and product refinement in the region.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager