Dairy Protein Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437375 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Dairy Protein Market Size

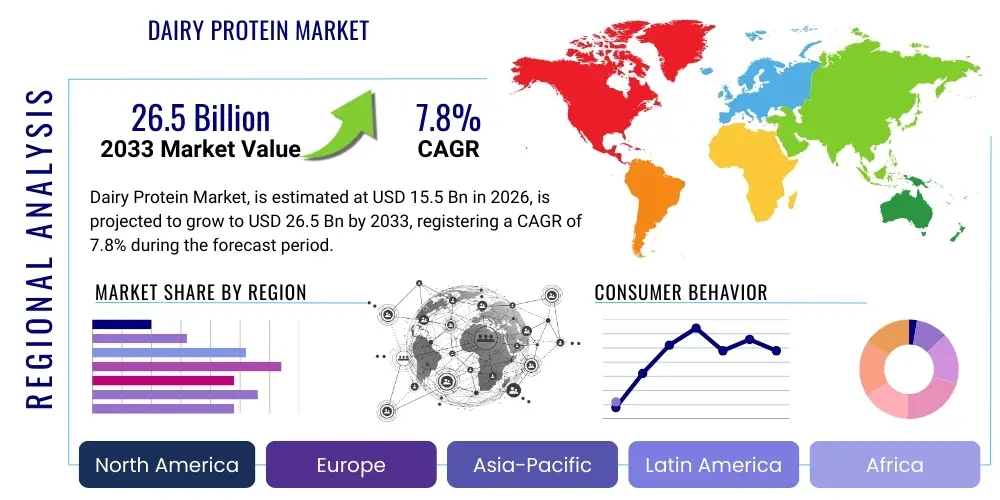

The Dairy Protein Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 15.5 Billion in 2026 and is projected to reach USD 26.5 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating consumer focus on health and wellness, particularly the recognized benefits of high-quality protein sources for muscle synthesis, weight management, and satiety. The penetration of dairy protein ingredients, such as whey protein concentrate (WPC) and isolates (WPI), across various application segments, including sports nutrition, functional foods, and clinical nutrition, serves as a primary catalyst for this robust market trajectory.

The consistent increase in global disposable income, coupled with the rising geriatric population seeking nutritional solutions to combat sarcopenia, further underpins the market's positive outlook. Developing economies, particularly those in the Asia Pacific region, are experiencing a rapid Westernization of dietary patterns, leading to greater acceptance and incorporation of packaged food and functional beverages fortified with dairy proteins. This demographic shift is not only fueling demand for bulk ingredients but is also necessitating innovations in taste, texture, and solubility to cater to diverse consumer preferences, thereby maintaining high valuation throughout the forecast period.

Furthermore, technological advancements in fractionation and purification processes are enabling manufacturers to produce higher purity and more specialized protein ingredients, such as alpha-lactalbumin and lactoferrin, which command premium pricing due to their targeted functional and biological benefits. The strategic expansion of production capacities by major global players, often through mergers, acquisitions, and strategic partnerships, is essential to meet the burgeoning demand from the fast-growing segments like performance enhancement beverages and customized medical nutrition formulas. These combined factors solidify the market's trajectory towards significant financial milestones by 2033.

Dairy Protein Market introduction

The Dairy Protein Market encompasses the commercial production and utilization of protein derived from milk, primarily focusing on whey and casein, which are highly valued for their superior nutritional profile, excellent functionality, and bioavailability. These proteins are complete proteins, containing all nine essential amino acids necessary for human health. Whey protein, a byproduct of cheese manufacturing, is known for its fast digestion kinetics, making it ideal for post-exercise recovery, while casein provides a slow and sustained release of amino acids, often utilized in nighttime recovery supplements and clinical applications. The versatility of dairy proteins allows them to be incorporated into a vast array of products, ranging from sports supplements and functional beverages to infant formulas and specialized medical foods, serving as both a nutritional powerhouse and a functional ingredient for emulsification and stabilization.

Major applications for dairy proteins span the entire nutritional spectrum. In the sports nutrition segment, isolates and concentrates are essential for muscle repair and performance enhancement. The clinical nutrition sector relies heavily on these proteins for feeding tube formulas and managing malnutrition in hospitalized or elderly patients. Moreover, the food and beverage industry leverages dairy proteins to fortify standard food items like yogurts, baked goods, and snack bars, aligning with the clean label and high-protein trends favored by contemporary consumers. The inherent functional benefits, such as water binding, foaming, and gelation properties, also make them indispensable in optimizing texture and mouthfeel in processed foods.

The primary driving factors sustaining the dairy protein market include the surging global interest in proactive health management, the proven efficacy of protein consumption in mitigating lifestyle diseases, and sustained innovation in processing technologies that enhance the usability and purity of the ingredients. The increasing incidence of obesity and chronic diseases worldwide is pushing consumers towards high-protein diets for weight management and metabolic health improvement. Simultaneously, ongoing research is continually uncovering new therapeutic and functional benefits of minor milk components, such as lactoferrin and milk phospholipids, creating premium market niches and ensuring continuous market dynamism.

Dairy Protein Market Executive Summary

The Dairy Protein Market is characterized by robust business trends centered on premiumization, functional customization, and sustainability commitments. Key players are aggressively investing in advanced processing technologies, particularly membrane separation techniques, to produce high-purity whey protein isolates (WPI) and micellar casein, catering to the exacting requirements of the specialized nutrition segment. A significant shift is observed towards ‘clean label’ and transparent sourcing practices, driven by millennial and Gen Z consumer demands for naturally derived, minimally processed ingredients. Furthermore, strategic partnerships between large dairy processors and end-product manufacturers are crucial for co-developing application-specific solutions, accelerating product formulation cycles and ensuring timely market entry for innovative functional foods and beverages.

Regionally, the market exhibits divergent growth patterns. North America and Europe remain mature but high-value markets, dominated by established sports and clinical nutrition segments, where innovation focuses on formulation efficiency and specialized derivatives. Conversely, the Asia Pacific region is rapidly emerging as the growth engine, fueled by burgeoning middle-class populations, increasing acceptance of infant formula, and a noticeable rise in lifestyle diseases necessitating fortified foods. China and India, in particular, present lucrative opportunities, though navigating local regulatory complexities and establishing efficient cold chain logistics remain critical operational challenges for international players seeking market dominance in these high-potential geographies.

Segmentation trends highlight the dominance of the whey protein segment, specifically Whey Protein Isolates (WPI), due to their high protein concentration (90%+) and minimal lactose content, making them suitable for specialized diets and individuals with lactose sensitivities. However, the casein and caseinate segment maintains steady growth, largely driven by its indispensable role in medical nutrition and its slow-release properties valued in specific dietary supplements. The application segment sees the highest incremental revenue generated by functional foods and beverages, outpacing traditional sports supplements, as protein fortification becomes mainstream in daily consumer diets, transforming dairy protein from a niche ingredient to a staple food component globally.

AI Impact Analysis on Dairy Protein Market

Users frequently inquire about how Artificial Intelligence (AI) and machine learning are transforming the traditional dairy processing and protein manufacturing sectors. The core concerns revolve around AI’s capability to optimize yield from raw milk, personalize protein formulation for consumer needs, and ensure stringent quality control and supply chain traceability. Key themes emerging from these queries highlight expectations for AI to reduce operational waste, predict market demand fluctuations more accurately, and accelerate the discovery and validation of novel functional dairy peptides. Consumers and industry professionals alike anticipate that AI will facilitate a new era of ‘precision nutrition,’ where dairy protein products are tailored not just to broad demographic groups, but to individual genetic and metabolic profiles, significantly enhancing product efficacy and consumer engagement.

The implementation of AI algorithms across the dairy protein value chain is proving transformative, particularly in enhancing efficiency and innovation. In the upstream processing phase, machine learning models analyze large datasets related to milk quality, seasonal variations, and processing parameters (like temperature, pH, and membrane flux) to predict optimal fractionation conditions, thereby maximizing protein yield and minimizing energy consumption. Downstream, AI supports rapid formulation development by simulating the interaction between dairy proteins and various matrix components (fats, stabilizers), significantly reducing the time and cost associated with traditional trial-and-error R&D cycles. This predictive capability allows manufacturers to swiftly respond to dynamic market demands for new textures and solubilities in functional products.

Furthermore, AI is pivotal in strengthening quality assurance and transparency, crucial elements in a highly regulated industry. Computer vision systems, powered by AI, are used for real-time contaminant detection during packaging and processing. Predictive analytics models monitor supply chain vulnerabilities, from farm milk collection to final product distribution, enabling proactive risk mitigation related to spoilage or adulteration. The integration of AI into personalized nutrition platforms uses consumer health data to recommend precise protein intake levels and specific dairy protein types (e.g., highly hydrolyzed whey for sensitive digestion), ensuring the dairy protein market remains aligned with the future trajectory of individualized health solutions.

- AI optimizes membrane filtration parameters to maximize Whey Protein Isolate (WPI) yield.

- Machine learning predicts consumer flavor preferences, aiding in rapid new product formulation development.

- AI-driven supply chain management improves traceability and reduces cold chain spoilage risks.

- Predictive analytics forecasts raw material quality fluctuations based on seasonal and environmental data.

- AI facilitates personalized protein recommendations based on individual microbiome and genetic data for targeted nutrition.

- Robotics and AI vision systems enhance quality control for purity and contamination detection in high-volume production lines.

- Advanced AI models accelerate the discovery of novel bioactive peptides derived from milk for enhanced health benefits.

DRO & Impact Forces Of Dairy Protein Market

The Dairy Protein Market dynamics are governed by a robust interplay of Drivers (D), Restraints (R), and Opportunities (O), which collectively shape the competitive landscape and growth trajectory, often amplified by potent Impact Forces. The primary driver is the accelerating consumer recognition of high protein diets for muscle maintenance, weight management, and overall metabolic health, particularly in developed regions experiencing aging populations. This driver is powerfully complemented by rapid innovation in sports nutrition and the mainstream adoption of protein-fortified foods and beverages, transcending their traditional niche status. However, market expansion is constrained by key restraints, most notably the rising prevalence of lactose intolerance and the competitive pressure exerted by surging consumer interest in plant-based and alternative protein sources, which challenge dairy’s dominant position, particularly in sustainability-conscious markets.

Opportunities for growth are abundant and center on diversification and high-value specialization. Significant potential exists in developing highly specialized dairy fractions, such as lactoferrin, alpha-lactalbumin, and milk phospholipids, which offer specific immunity and cognitive benefits beyond basic nutrition, fetching premium prices in clinical and infant nutrition. Furthermore, manufacturers can leverage sustainable sourcing and waste reduction technologies, transforming traditional processing byproducts into valuable ingredients, appealing to environmentally conscious consumers and mitigating regulatory risks. The push towards personalized nutrition presents a lucrative avenue for customizable dairy protein blends tailored to specific demographic needs, such as geriatric populations or individuals with specific metabolic disorders, requiring sustained investment in R&D and advanced manufacturing flexibility.

The impact forces influencing the market are multifaceted, encompassing regulatory shifts, geopolitical instability affecting feed costs, and technological advancements. Regulatory frameworks, particularly concerning infant formula standards and novel food approvals in regions like the European Union, dictate product specifications and market access. Economic impact forces, such as volatile global milk prices and energy costs, directly influence operational profitability and end-product pricing, sometimes constraining immediate capacity expansion. The strongest impact force remains changing consumer behavior, which increasingly values traceability, ethical sourcing, and minimal processing, forcing the industry to adapt rapidly through transparent labeling and verifiable supply chain certifications to maintain consumer trust and market relevance.

Segmentation Analysis

The Dairy Protein Market is comprehensively segmented based on the type of protein, its application, and the form in which it is utilized, providing granular insights into demand patterns and competitive positioning. Segmentation by type—primarily Whey Protein, Casein & Caseinates, and Milk Protein Concentrates/Isolates (MPC/MPI)—reveals distinct functional roles and end-user preferences. Whey protein dominates due to its superior amino acid profile and rapid absorption rate, essential for the sports and performance segment. In contrast, MPC/MPI are critical in formulating functional dairy products like yogurt and cheese alternatives, leveraging their stabilizing and texture-enhancing properties. Analyzing these segments helps stakeholders understand which ingredient forms are attracting the highest investment and technological innovation.

The application segmentation is crucial for understanding revenue distribution, covering Sports Nutrition, Infant Formula, Clinical Nutrition, and Functional Food & Beverages. While Sports Nutrition remains a high-visibility sector, the fastest growth is observed in Functional Food & Beverages, where protein fortification is moving beyond specialized stores into mainstream grocery aisles. This shift reflects the broader trend of preventive healthcare and the demand for everyday nutritional enhancement. The form segmentation, differentiating between powder and liquid formats, is also important; while powder remains dominant for bulk ingredients and dietary supplements, the liquid form is gaining traction, particularly in Ready-to-Drink (RTD) protein beverages, driven by convenience and immediate consumption trends.

Understanding these detailed segmentations allows market participants to tailor their operational strategies, focusing on high-growth, high-margin niches. For instance, companies specializing in high-purity hydrolysates target the Clinical and Infant Nutrition segments, which demand stringent quality and specific digestibility profiles, often requiring specialized production facilities and certifications. Conversely, those focusing on MPC/MPI may target the mainstream food processing industry, prioritizing volume production and cost-efficiency. This strategic alignment of production capabilities with targeted segmentation demand is paramount for achieving sustained market leadership and optimizing resource allocation across the value chain.

- By Type:

- Whey Protein Concentrate (WPC)

- Whey Protein Isolate (WPI)

- Whey Protein Hydrolysate (WPH)

- Casein & Caseinates (Sodium, Calcium, Potassium Caseinate)

- Milk Protein Concentrate (MPC)

- Milk Protein Isolate (MPI)

- Specialty Dairy Proteins (Lactoferrin, Milk Phospholipids)

- By Application:

- Sports Nutrition

- Infant Formula

- Clinical Nutrition

- Functional Food & Beverages

- Personal Care & Cosmetics

- Animal Feed

- By Form:

- Powder

- Liquid

Value Chain Analysis For Dairy Protein Market

The Dairy Protein market value chain begins with intensive upstream analysis centered on raw milk procurement and initial processing. The quality of raw milk, influenced by farm management practices, animal genetics, and feed inputs, directly dictates the efficiency of protein extraction and the functional characteristics of the final ingredient. Key upstream activities include securing reliable milk sources, ensuring milk standardization, and the initial separation of cream and skim milk. This stage is capital-intensive, reliant on large-scale dairy farms and highly automated collection and chilling infrastructure, demanding stringent quality checks and strong contractual relationships to manage price volatility and supply consistency.

Midstream processing involves highly sophisticated techniques, primarily membrane filtration (ultrafiltration and microfiltration), ion exchange, and chromatography, used to fractionate milk components and concentrate specific proteins (WPC, WPI, Casein). This stage represents the core value addition, where technological expertise dictates the purity, solubility, and functional attributes of the resulting protein powder. The choice of distribution channel is critical for efficiency; direct channels involve selling large volumes of bulk ingredients (powder) to major food manufacturers (downstream users) for formulation. Indirect channels utilize specialized distributors and ingredient brokers to reach smaller and regional functional food producers, managing inventory and providing technical support across diverse geographic markets.

The downstream analysis focuses on the final application sectors, including manufacturers of sports supplements, infant formulas, and functional beverages, which transform the bulk dairy protein ingredients into consumer-ready products. Success at this stage relies on formulation expertise, regulatory compliance (especially in infant and clinical nutrition), and effective consumer marketing. Direct engagement allows ingredient suppliers to secure long-term contracts and co-develop specialized ingredients, ensuring their products meet precise formulation requirements. Indirect distribution provides wider market penetration, particularly in the rapidly evolving nutraceutical and specialized health food sectors, where distributors act as technical intermediaries bridging the gap between sophisticated ingredient technology and regional formulation needs.

Dairy Protein Market Potential Customers

The Dairy Protein Market caters to a diverse range of sophisticated end-users and buyers whose purchasing decisions are highly sensitive to ingredient functionality, purity, and cost-in-use. The primary buyers are large-scale food and beverage manufacturers, particularly those dominant in the functional and fortified sectors. These customers require bulk quantities of standard ingredients like WPC 80 or MPC for fortification purposes in items such as yogurts, protein bars, and nutritional snacks. Their purchasing criteria often prioritize supply security, price stability, and standardized technical specifications to ensure consistent quality across massive production volumes, often necessitating long-term supply agreements directly with major dairy cooperatives or processors.

A high-value segment of potential customers includes specialized pharmaceutical and clinical nutrition companies. These end-users demand ultra-high purity ingredients, such as specialized hydrolysates or isolated minor proteins like lactoferrin, for use in infant formula, clinical feeding tubes, and medical food products designed for patients with specific metabolic or digestive constraints. For these buyers, quality certifications, regulatory compliance (e.g., adherence to FDA/EFSA standards), and demonstrated biocompatibility are non-negotiable prerequisites. The relationship with these customers is characterized by extensive qualification processes and stringent audit requirements, reflecting the critical nature of their finished products.

Furthermore, the rapidly expanding sports nutrition and dietary supplement industry forms a vital customer base. Companies producing whey protein powders, pre-mixed drinks, and recovery aids are consistently high-volume buyers of WPI and WPH, prioritizing ingredients that offer excellent solubility, clean flavor profiles, and rapid digestion kinetics. These buyers are often responsive to market trends, such as organic sourcing or specific labeling claims (e.g., grass-fed), and seek ingredient suppliers capable of rapid customization and co-development of novel product applications to maintain a competitive edge in a highly saturated consumer market.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 15.5 Billion |

| Market Forecast in 2033 | USD 26.5 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Fonterra Co-operative Group, Glanbia plc, FrieslandCampina Ingredients, Arla Foods Ingredients, Saputo Inc., Lactalis Ingredients, Bunge Limited, AMCO Proteins, Hoogwegt Group, Agropur Cooperative, Hilmar Ingredients, Milk Specialties Global, Valio, Prolacta Bioscience, Carbery Group, Kerry Group, NZMP, Davisco (Bunge), Leprino Foods Company, Grande Cheese Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dairy Protein Market Key Technology Landscape

The Dairy Protein market is heavily dependent on advanced separation and purification technologies that ensure high yield, superior purity, and enhanced functional properties of the final ingredients. Membrane filtration techniques, particularly ultrafiltration (UF) and microfiltration (MF), form the backbone of modern dairy processing. UF concentrates whey proteins and separates them from lactose and minerals, while MF is crucial for producing native whey protein and specialized ingredients like Milk Protein Isolate (MPI) by removing bacteria and fat with minimal thermal damage. Continuous process optimization through advanced automation and sensors enhances flux rates and reduces energy consumption, making these technologies central to efficient, large-scale ingredient manufacturing globally.

Beyond standard filtration, fractionation and purification rely on sophisticated methods like ion exchange chromatography and Simulated Moving Bed (SMB) chromatography. Ion exchange is vital for achieving high-purity Whey Protein Isolate (WPI 90%+) by selectively binding and eluting proteins based on their charge, resulting in a cleaner flavor profile and minimal fat/lactose content, which is highly sought after by the sports and clinical nutrition sectors. Furthermore, enzymatic hydrolysis is a key technology for producing Whey Protein Hydrolysates (WPH), which are pre-digested proteins offering improved absorption rates and reduced allergenicity, making them essential for infant formulas and specialized medical foods. The degree of hydrolysis must be precisely controlled to balance functional benefits with the resulting bitter taste, requiring innovative enzyme selection and processing management.

Emerging technologies are continually pushing the boundaries of dairy protein functionality. These include novel drying techniques, such as low-temperature spray drying and freeze-drying, which help preserve the native structure and biological activity of delicate minor proteins like lactoferrin and immunoglobulins. Furthermore, encapsulation technology is being explored to protect sensitive protein ingredients, enhance their stability in challenging food matrices (like acidic beverages), and mask potential off-flavors associated with hydrolysates. The integration of advanced analytical tools, including mass spectrometry and nuclear magnetic resonance (NMR), is crucial for quality control and confirming the structural integrity and bioactivity of these complex, value-added dairy derivatives, ensuring compliance with stringent regulatory requirements.

Regional Highlights

- North America: North America, particularly the United States, represents the largest and most mature market for dairy proteins, driven primarily by its established and dynamic sports nutrition industry and a highly health-conscious consumer base. The region exhibits high consumption rates of protein supplements, functional bars, and RTD beverages, facilitated by robust retail and e-commerce distribution networks. Key trends include the demand for clean label certifications, specialized native whey products, and sustainable sourcing. Regulatory standards are stable, supporting continuous product innovation focused on performance enhancement and weight management applications.

- Europe: Europe is a high-value market characterized by stringent food safety regulations and a strong emphasis on sustainability and quality. The market is segmented into mature dairy processing hubs (Ireland, Netherlands, France) and rapidly expanding consumer markets in Central and Eastern Europe. Demand is strong in clinical nutrition, particularly for elderly care, and in the infant formula sector, where quality standards are exceptionally high. European consumers demonstrate a growing preference for specialty proteins like organic and grass-fed dairy sources, driving premiumization across segments.

- Asia Pacific (APAC): APAC is the fastest-growing regional market, driven by demographic shifts, rapid urbanization, and rising disposable incomes, leading to increased acceptance of fortified foods and high-quality infant formula. China and India are the primary growth engines, showing explosive demand for whey-based ingredients due to the burgeoning fitness culture and the need for nutritional supplements. Investment in local processing infrastructure is increasing, although the region remains a significant net importer of high-purity isolates, presenting major export opportunities for Western producers.

- Latin America: This region presents substantial untapped potential, fueled by growing health awareness and increasing penetration of international food and beverage brands. Brazil and Mexico are the dominant markets, where dairy proteins are increasingly used in mainstream dietary supplements and functional snacks. Market growth is sensitive to local economic conditions and import tariffs, but sustained expansion is expected, particularly as local manufacturers seek to localize production and formulation expertise to cater to regional tastes.

- Middle East and Africa (MEA): The MEA region is witnessing steady growth, largely concentrated in the Gulf Cooperation Council (GCC) countries due to high per capita income and Westernized consumer preferences. Demand is robust for packaged functional foods and clinical nutrition products addressing nutritional deficiencies. Market penetration is often dependent on successful navigation of Halal certification requirements, which is a critical factor for market acceptance across the majority of the region’s diverse consumer base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dairy Protein Market.- Fonterra Co-operative Group

- Glanbia plc

- FrieslandCampina Ingredients

- Arla Foods Ingredients

- Saputo Inc.

- Lactalis Ingredients

- Bunge Limited

- AMCO Proteins

- Hoogwegt Group

- Agropur Cooperative

- Hilmar Ingredients

- Milk Specialties Global

- Valio

- Prolacta Bioscience

- Carbery Group

- Kerry Group

- NZMP

- Davisco (Bunge)

- Leprino Foods Company

- Grande Cheese Company

- Mead Johnson Nutrition (Reckitt Benckiser Group)

- Danone S.A.

- Tate & Lyle PLC

- Dairygold Co-Operative Society Ltd.

- Omega Protein Corporation

- A&I Corporation

- California Dairies, Inc.

- Guthrie River Dairy

- Idaho Milk Products

Frequently Asked Questions

Analyze common user questions about the Dairy Protein market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the key differences between Whey Protein Isolate (WPI) and Concentrate (WPC)?

WPI contains a higher protein percentage (typically over 90%) and significantly less fat and lactose compared to WPC (which is usually 34% to 80% protein). WPI undergoes more intensive processing (ion exchange or cross-flow microfiltration), making it suitable for individuals with lactose intolerance or those requiring very high purity protein sources for lean muscle gain.

How is the rise of plant-based proteins impacting the dairy protein market?

The rise of plant-based alternatives, driven by sustainability and ethical concerns, presents a significant competitive restraint. While plant proteins are gaining traction, dairy proteins maintain superiority in essential amino acid profile and functionality (solubility, texture). The dairy industry is responding by focusing on sustainability certifications and leveraging the functional benefits where plant proteins currently fall short.

Which application segment holds the largest market share for dairy proteins?

The Functional Food and Beverages segment currently holds the largest and fastest-growing share due to the widespread integration of protein fortification into everyday products like fortified dairy, bakery items, and health snacks. However, the Sports Nutrition segment remains a high-value and high-innovation driver, particularly for premium ingredients like WPI and hydrolysates.

What major technological advancement is driving ingredient purity in the market?

Membrane filtration technologies, specifically microfiltration and ultrafiltration, are the core advancements driving high ingredient purity. These technologies enable the production of native whey and high-purity isolates (WPI, MPI) by separating proteins based on molecular size with minimal heat exposure, preserving their biological activity and superior functional quality.

Why is the Asia Pacific (APAC) region experiencing such rapid growth in dairy protein demand?

APAC growth is fueled by rapid urbanization, rising middle-class disposable income, increasing awareness of health and fitness, and robust demand for infant nutrition products. The region is increasingly adopting Westernized dietary habits, leading to higher consumption of packaged and fortified functional foods, necessitating large imports of high-quality dairy protein ingredients.

What regulatory factors most influence the clinical nutrition segment of dairy proteins?

The clinical nutrition segment is heavily influenced by strict regulatory bodies (like the FDA and EFSA) governing medical food claims, ingredient safety, and formulation standards, especially concerning digestibility and allergen management. Manufacturers must ensure high purity and provide comprehensive documentation proving efficacy and stability for use in vulnerable patient populations.

How does sustainability impact sourcing decisions for dairy protein manufacturers?

Sustainability is a critical impact force, driving manufacturers to seek dairy sources with lower environmental footprints, better animal welfare practices (e.g., grass-fed certifications), and improved water and energy efficiency in processing. Consumers increasingly favor brands that demonstrate supply chain transparency and verifiable ethical sourcing, influencing premium pricing structures.

What is the primary role of Caseinates in the food processing industry?

Caseinates (such as sodium and calcium caseinate) are primarily valued for their excellent functional properties, including superior emulsification, stability, and water-binding capacity. They are widely used in non-dairy creamers, processed cheeses, and specialized medical nutrition products where gelling and thickening properties are necessary.

What role does Lactoferrin play in the specialty dairy protein segment?

Lactoferrin, a minor but highly valuable milk glycoprotein, plays a crucial role in immunity and iron metabolism. It is a high-value ingredient primarily targeted towards premium infant formulas and clinical nutrition supplements, leveraging its bioactive properties to support gut health and immune defense, thus commanding premium market prices.

Which regions dominate the global production capacity of dairy proteins?

North America (specifically the U.S.) and Europe (led by the Netherlands, Ireland, and France) dominate the global production capacity for high-quality, fractionated dairy proteins due to established dairy infrastructure, advanced processing technology, and high milk yield efficiency. These regions are the largest exporters of WPI and specialized derivatives globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager