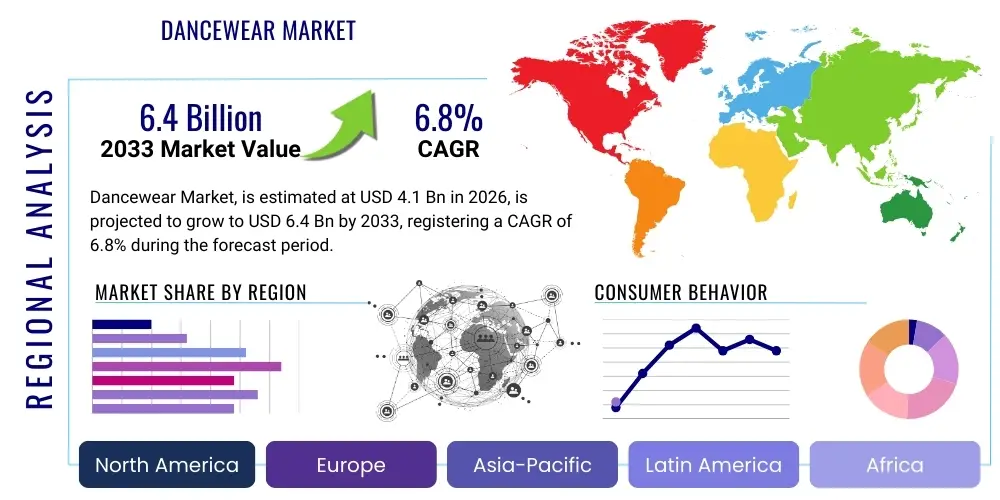

Dancewear Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436169 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Dancewear Market Size

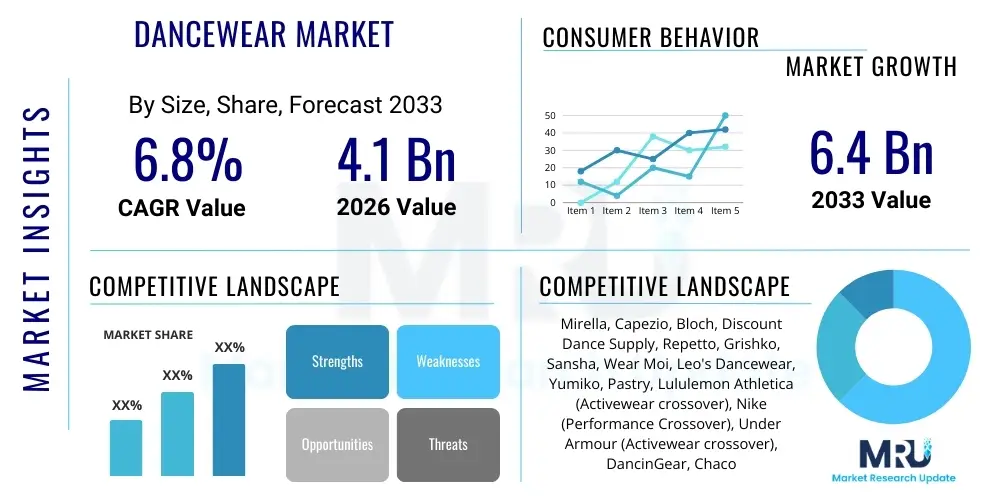

The Dancewear Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.4 Billion by the end of the forecast period in 2033. This growth trajectory is fundamentally supported by the increasing global participation in dance and fitness activities, coupled with significant advancements in technical textiles that enhance performance and comfort. The shift towards incorporating dancewear aesthetics into everyday athleisure fashion further amplifies market expansion, positioning dance apparel as a key component of specialized sports and recreational attire globally.

Dancewear Market introduction

The Dancewear Market encompasses specialized apparel, footwear, and accessories designed explicitly for various forms of dance, including ballet, jazz, contemporary, tap, and ballroom. Core product descriptions typically include high-performance leotards, tights, tutus, specialized skirts, and technical dance shoes constructed to facilitate extreme flexibility, precision, and moisture management. These garments are engineered using advanced synthetic and natural fiber blends, ensuring durability and unrestricted movement essential for complex choreographies. Major applications span professional dance company performances, intensive training and preparatory schools, recreational community classes for both children and adults, and specialized physical fitness routines that utilize dance elements.

The primary benefits of high-quality dancewear include enhanced safety through muscle support and articulation visibility, superior thermal and moisture regulation, and the promotion of standardized aesthetic forms required in traditional dance disciplines. Furthermore, modern dancewear often incorporates seamless technology and ergonomic design to minimize chafing and maximize comfort during prolonged, rigorous practice sessions. The growing demand for specialized attire that bridges the gap between traditional aesthetics and modern athletic requirements is a critical factor driving consumer interest and brand innovation.

Driving factors for market expansion are multifaceted, including rising disposable incomes in emerging economies, increased media representation of dance culture through television shows and social media, and a global trend toward health and wellness that integrates dance as a primary form of exercise. Furthermore, the mandatory requirements for specialized attire in formal dance academies and competitive circuits ensure a persistent, captive consumer base. Manufacturers are responding by focusing heavily on sustainable materials and customization options, broadening the market appeal beyond strictly professional circles into the lucrative athleisure and fitness segments.

Dancewear Market Executive Summary

The Dancewear Market is characterized by robust business trends emphasizing digital engagement, sustainable production, and the vertical integration of specialized technical fabrics. Key market players are increasingly adopting direct-to-consumer (D2C) models, leveraging e-commerce platforms to offer personalized fitting solutions and exclusive product lines, thereby bypassing traditional retail margins and enhancing customer loyalty. Innovation is concentrated on developing biodegradable or recycled materials, responding directly to heightened consumer environmental consciousness. Furthermore, strategic collaborations between dancewear brands and prominent choreographers or dance institutions serve as powerful marketing vectors, solidifying brand visibility within specialized communities.

Regionally, North America and Europe maintain dominance, driven by established dance infrastructure, high consumer purchasing power, and the presence of major international dance companies. However, the Asia Pacific (APAC) region is projected to exhibit the fastest growth over the forecast period, primarily fueled by the burgeoning middle class in countries like China and India, increased investment in performing arts education, and the rapid westernization of recreational activities. Latin America and the Middle East are also displaying steady growth, albeit from a smaller base, driven by cultural events and government initiatives promoting performing arts education. Companies are prioritizing expansion into APAC through localized product offerings that respect regional cultural norms regarding modesty and traditional attire colors.

Segment trends reveal that the children's dancewear segment remains the largest volume contributor, anchored by recurring needs for standardized training uniforms. Simultaneously, the technical dance footwear segment, encompassing specialized pointe shoes, ballet slippers, and character shoes, commands the highest average selling prices (ASPs) due to the necessity of skilled craftsmanship and precise fit, often requiring semi-customization. A notable trend is the strong cross-segment migration of dance-inspired aesthetics into the broader activewear category, blurring the lines between specialized training apparel and general athletic wear. This convergence drives product diversification and offers significant opportunity for market penetration into general fitness retail channels.

AI Impact Analysis on Dancewear Market

User inquiries regarding the integration of Artificial Intelligence (AI) in the Dancewear Market predominantly revolve around achieving perfect fit accuracy for highly specialized garments, optimizing inventory levels for seasonal and trend-driven demand, and personalizing the customer shopping experience. Consumers are keenly interested in solutions that address the common challenge of sizing inconsistencies, especially for critical items like pointe shoes and leotards, where small variances can drastically affect performance and safety. The key themes summarized from user concerns focus on leveraging computer vision for 3D body scanning, predictive analytics for fashion forecasting in dance styles, and utilizing conversational AI for customer service and style recommendations, ensuring that technology enhances, rather than dilutes, the tactile and aesthetic nature of dance apparel shopping.

- AI-Powered Precision Fitting: Utilization of computer vision and machine learning algorithms for 3D body scanning and virtual try-on systems, drastically reducing return rates related to sizing errors for complex items such as leotards and specialized footwear.

- Predictive Trend Forecasting: Employing AI models to analyze social media trends, performance aesthetics, and seasonal demands to optimize material procurement and production planning, thereby enhancing responsiveness to rapidly shifting dance styles and performance needs.

- Optimized Supply Chain Management: Implementing AI for demand sensing and inventory optimization, reducing stockouts of high-demand sizes or popular colors, particularly during peak recital and performance seasons, improving operational efficiency.

- Personalized Shopping Experience: Development of recommendation engines that suggest specific apparel styles, fabrics, and technical specifications based on the user's dance discipline, skill level, and previous purchasing history, both online and in physical stores.

- Quality Control and Manufacturing Efficiency: Using AI for automated textile defect detection during manufacturing and optimizing cutting patterns to reduce material waste, aligning with sustainability goals.

DRO & Impact Forces Of Dancewear Market

The dynamics of the Dancewear Market are powerfully shaped by an increasing global emphasis on structured extracurricular activities and fitness (Driver), counterbalanced by the high cost of premium technical fabrics and the prevalence of counterfeiting (Restraint), presenting significant opportunities through the fusion of performance dancewear with athleisure fashion and personalized manufacturing processes (Opportunity). The market impact forces reflect a moderate competitive rivalry among specialized global brands and local manufacturers, intense buyer power driven by brand loyalty and the necessity of precise fit, and moderate supplier power linked to patented textile innovations and sustainable sourcing commitments. Navigating these forces requires meticulous supply chain control and targeted branding to overcome price sensitivity.

The primary driver stems from the institutionalization and expansion of dance education worldwide, necessitating continuous purchases of regulated uniforms and specialized equipment by schools and parents. Furthermore, professional standards require frequent replacement of performance-critical items like pointe shoes and professional-grade tights, creating continuous demand. Conversely, a major restraint is the significant intellectual property risk associated with textile technology and design; while technical fabrics are costly to source and develop, the specialized nature of the garments makes them vulnerable to low-cost imitation, particularly impacting margins for mid-tier brands. Additionally, the fragmented nature of dance retail, often relying on small specialty boutiques, creates distribution bottlenecks and limits global reach for smaller brands.

Opportunities are abundant in integrating smart technology into dancewear, such as embedding sensors for movement tracking and injury prevention, catering directly to the professional segment's need for performance optimization data. The largest scalable opportunity lies in the intersection with athleisure; as consumers increasingly value comfort and flexibility in daily wear, performance dance garments are transitioning into mainstream casual wear, significantly broadening the addressable market beyond core dancers. Impact forces dictate that successful entry requires either establishing deep brand trust (mitigating buyer power) or securing exclusive rights to next-generation materials (mitigating supplier power). The threat of substitutes is high from general activewear, pressuring dancewear manufacturers to continuously justify their premium pricing through superior technical features and aesthetic differentiation.

Segmentation Analysis

The Dancewear Market is primarily segmented based on product type (apparel, footwear, accessories), end-user (women, men, children), and distribution channel (specialty stores, online retail, mass merchandisers). The apparel segment, comprising leotards, tights, and skirts, holds the largest market share by revenue, driven by volume sales across all end-user categories, particularly in mandatory school uniforms. The segmentation by end-user highlights the dominance of the women and children segments, reflecting the traditionally higher participation rates in structured dance forms within these demographics. Understanding the distinct purchasing motivations across these segments—where children’s purchases are driven by durability and price sensitivity, and professional purchases are driven by technical performance and brand trust—is crucial for effective market penetration strategies.

- By Product Type:

- Apparel (Leotards, Tights, Warm-up wear, Skirts/Tutus)

- Footwear (Ballet shoes, Pointe shoes, Jazz shoes, Tap shoes, Ballroom shoes)

- Accessories (Bags, Hair accessories, Jewelry, Protective padding)

- By End-User:

- Women

- Men

- Children

- By Distribution Channel:

- Specialty Dance Stores

- Online Retail (E-commerce Platforms and Brand Websites)

- Mass Merchandisers and Sporting Goods Stores

- Direct Sales (Dance Schools and Studios)

- By Application:

- Training and Practice

- Performance and Professional

Value Chain Analysis For Dancewear Market

The value chain for the Dancewear Market begins with the Upstream activities, focused heavily on the sourcing and processing of specialized raw materials, primarily high-performance synthetic fibers like spandex, nylon, and specialized moisture-wicking polyesters, along with technical knit and weave processes. The integration of sustainable and recycled fabrics is becoming a critical component of upstream innovation, often requiring specialized partnerships with textile mills that adhere to stringent environmental certifications. Procurement leverage is often moderate, as patented technical textile providers hold significant negotiation power, especially for premium-grade, four-way stretch fabrics essential for performance attire. Successful firms focus on strategic, long-term contracts with key fabric suppliers to ensure quality consistency and cost stability in an increasingly volatile raw material market.

Midstream activities involve design, manufacturing, and quality control. Design is critical due to the intersection of aesthetic requirements (classical forms) and functional demands (ergonomics and flexibility). Manufacturing processes often require specialized sewing techniques, particularly for seamless garments and complex construction like reinforced pointe shoes, which still heavily rely on skilled manual labor in certain critical stages. Quality control is paramount, as defects can compromise safety and performance; therefore, rigorous testing for stretch retention, colorfastness, and durability is integrated throughout the production cycle. Distribution Channel effectiveness is determined by reaching the targeted customer base through highly specialized conduits.

Downstream distribution channels are bifurcated into Direct and Indirect sales. Direct channels, primarily brand-owned e-commerce platforms and flagship stores, offer manufacturers maximum control over branding, pricing, and customer data, facilitating personalized marketing. Indirect channels are dominated by highly essential specialized dance retail stores, which serve as crucial fitting centers—especially for technical footwear—offering expert advice and maintaining strong local relationships with dance schools. Dance studios and schools also act as important indirect distribution points, frequently facilitating bulk orders for class uniforms and recital costumes. The optimal strategy often involves an omnichannel approach, combining the reach and efficiency of online sales with the high-touch, personalized service capabilities of specialty physical retail outlets to ensure consumer trust and fit accuracy.

Dancewear Market Potential Customers

The Dancewear Market targets a diverse spectrum of end-users, ranging from highly demanding professional artists to casual recreational participants, with distinct purchasing habits and quality expectations defining each group. The core demographic includes children and young adolescents enrolled in formal dance academies, representing the largest segment in terms of volume. These customers are driven by mandatory school or class requirements, with purchasing decisions often heavily influenced by parents who prioritize durability, washability, and adherence to specific dress codes mandated by instructors, making price and longevity key decision criteria for this high-volume recurring purchase base.

A second major customer segment comprises professional and semi-professional dancers, competitive athletes, and university-level students in performing arts programs. This group constitutes the high-value segment, characterized by extreme sensitivity to garment technical performance, fabric technology (e.g., specific moisture-wicking capabilities and stretch indices), and brand reputation within the professional community. These buyers require specialized, precision-fitted items, such as hand-crafted pointe shoes or highly tailored performance costumes, and often exhibit strong brand loyalty to manufacturers known for catering to elite standards, resulting in higher average transaction values and frequent replacement cycles due to rigorous training schedules.

The rapidly expanding tertiary customer base encompasses fitness enthusiasts and activewear consumers who utilize dancewear elements for general exercise, yoga, Pilates, or daily casual wear (athleisure). This segment values versatility, comfort, and fashion-forward aesthetics. Their purchasing behaviors are often influenced by broader fashion trends, social media influencers, and the appeal of garments that transition seamlessly from the studio to street settings. Successfully targeting this group requires brands to emphasize style and multifunctional design over strict traditional performance adherence, broadening their distribution beyond specialized dance retailers into mainstream sports and fashion outlets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.4 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mirella, Capezio, Bloch, Discount Dance Supply, Repetto, Grishko, Sansha, Wear Moi, Leo's Dancewear, Yumiko, Pastry, Lululemon Athletica (Activewear crossover), Nike (Performance Crossover), Under Armour (Activewear crossover), DancinGear, Chacott, Danskin, So Danca, Jalie Patterns. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Dancewear Market Key Technology Landscape

The technological evolution within the Dancewear Market is heavily concentrated on advanced material science and digital manufacturing processes aimed at optimizing performance and fit. Material innovation focuses on textiles that offer superior moisture management, rapid drying capabilities, and antimicrobial properties to enhance hygiene and comfort during extended training sessions. Key breakthroughs include the widespread adoption of specialized four-way stretch synthetic blends (nylon, spandex, Lycra) that provide targeted compression and muscle support without restricting the dancer's range of motion. Furthermore, the development of eco-friendly fabrics derived from recycled plastics or natural, sustainable sources (such as bamboo and organic cotton) addresses consumer demand for environmentally responsible products while maintaining necessary technical specifications.

Beyond material composition, significant technological strides are being made in digital integration for personalization and retail enhancement. Three-dimensional (3D) body scanning technology is increasingly utilized by premium brands and specialty retailers to map the exact dimensions of a dancer, enabling manufacturers to offer truly custom-fitted garments and precision footwear, significantly minimizing the historically high rate of return and dissatisfaction caused by generic sizing. Furthermore, Augmented Reality (AR) applications are being deployed online to allow customers to virtually try on garments, improving the digital shopping experience for visually oriented fashion items like dance apparel, thereby converting hesitant online shoppers into purchasers.

Manufacturing technologies are also undergoing transformation, moving towards automated cutting systems, seamless knitting techniques, and advanced heat bonding to replace traditional stitching methods, which reduce bulk and irritation points, crucial for items worn close to the skin like leotards and unitards. Lean manufacturing principles and sophisticated supply chain software (often AI-driven) are employed to manage complex inventory demands—balancing seasonal costume requirements with year-round uniform sales—ensuring agile production responses and minimized waste, reinforcing the market’s technological trajectory toward high performance, personalization, and operational efficiency.

Regional Highlights

- North America (NA): Represents a mature and dominant market segment characterized by high consumer spending power, a large established infrastructure of commercial dance studios, and high participation in competitive dance events. The U.S. and Canada drive innovation in technical wear and athleisure integration. Key market trends include strong D2C brand growth and the demand for inclusive sizing and body positivity in marketing.

- Europe: A culturally rich market focused on traditional, high-end, classic dance forms (Ballet, Ballroom). Countries like the UK, France, and Germany are key revenue generators, with consumers prioritizing heritage brands (e.g., Repetto) known for craftsmanship and quality. The region shows strong demand for professional-grade footwear and sustainable/ethical sourcing practices mandated by regional regulations.

- Asia Pacific (APAC): The fastest-growing market, propelled by rapidly increasing middle-class income and the surging popularity of Western dance forms (e.g., K-pop, Hip-Hop, Contemporary) across metropolitan areas in China, South Korea, and India. This growth is volume-driven, with significant opportunities in educational and recreational sectors. Manufacturers are adapting sizing and aesthetics to cater to diverse regional body types and preferences.

- Latin America (LATAM): Growth is primarily concentrated in urban centers like Brazil and Mexico, supported by vibrant local dance traditions and the expansion of international fitness franchises that integrate dance. The market is moderately price-sensitive, with increasing demand for multi-functional, durable dancewear suitable for both training and performance in diverse climates.

- Middle East & Africa (MEA): A nascent but developing market, primarily focused on high-end luxury dancewear catering to expatriate communities and specialized institutions in the UAE and Saudi Arabia. Market penetration requires sensitivity to cultural norms, often leading to increased demand for modest apparel and specialized, locally tailored garments, presenting unique sourcing and design challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Dancewear Market.- Capezio Ballet Makers Inc.

- Bloch International Pty Ltd

- Mirella

- Repetto SA

- Grishko

- Sansha

- Wear Moi

- Danskin (Hanesbrands Inc.)

- Discount Dance Supply

- Leo's Dancewear

- So Danca

- Yumiko

- Chacott Co., Ltd.

- DancinGear

- Ainsliewear

- Jalie Patterns

- Pastry

- Lululemon Athletica (Activewear Crossover)

- Under Armour, Inc. (Performance Crossover)

- Nike, Inc. (Performance Crossover)

Frequently Asked Questions

Analyze common user questions about the Dancewear market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the segmentation of the Dancewear Market by product type?

Segmentation is driven by functional necessity, primarily differentiating between specialized technical footwear (high ASP, necessity-driven) and apparel (high volume, fashion-driven). Footwear requires precision manufacturing for safety and performance, while apparel is segmented by required flexibility, material composition, and compliance with specific dance discipline dress codes, increasingly incorporating seamless and moisture-wicking technologies.

How significantly does the integration of athleisure influence dancewear market growth?

The integration of dancewear aesthetics into athleisure significantly broadens the market's total addressable audience beyond traditional dancers. This convergence drives sales by positioning flexible, durable, and stylish dance garments as desirable everyday activewear, increasing volume sales through mass merchandiser and general sports channels, thereby mitigating reliance on seasonal performance purchasing.

Which distribution channel is most critical for technical dance footwear?

Specialty Dance Stores remain the most critical distribution channel for technical dance footwear, particularly pointe shoes. This is because these items require highly specialized, in-person fitting by trained professionals to ensure correct support and prevent injury, a service that general online retail cannot adequately replicate, establishing these specialized shops as essential gatekeepers of quality and safety.

What are the primary technological challenges facing dancewear manufacturers?

Primary technological challenges involve mastering 3D sizing accuracy across diverse body shapes for custom fit, innovating sustainable performance fabrics that maintain stretch and durability without compromising ethical sourcing, and integrating smart textile technology (e.g., biometric sensors) while keeping costs manageable for the consumer base.

Why is the Asia Pacific region expected to exhibit the highest CAGR in the Dancewear Market?

The APAC region's high CAGR is attributed to rapid urbanization, significant increases in disposable income, and governmental or private investment in performing arts and fitness education. This fuels a rising consumer base of recreational and professional dancers adopting global dance trends, creating massive demand for entry-level and performance-grade dance apparel and footwear.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Dancewear Market Size Report By Type (Womens Dancewear, Mens Dancewear, Girls Dancewear, Boys Dancewear), By Application (Schools, Theatre, TV and Film, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Dancewear Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Womens Dancewear, Mens Dancewear, Girls Dancewear, Boys Dancewear), By Application (Schools, Theatre, TV & Film, Others), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager