Darbepoetin Alfa Injection Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437258 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Darbepoetin Alfa Injection Market Size

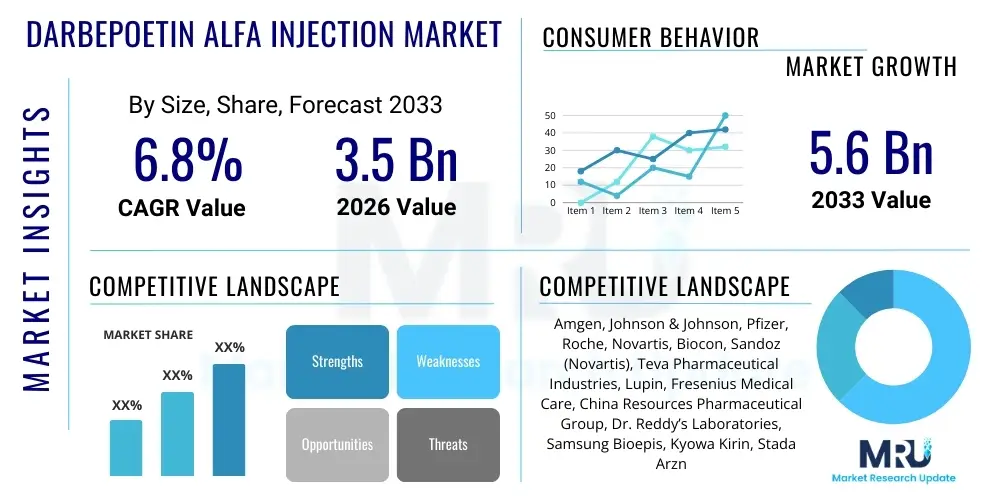

The Darbepoetin Alfa Injection Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.6 Billion by the end of the forecast period in 2033.

Darbepoetin Alfa Injection Market introduction

The Darbepoetin Alfa Injection market encompasses the global sales and distribution of an erythropoiesis-stimulating agent (ESA) primarily utilized for the management of anemia associated with chronic kidney disease (CKD), both in patients on dialysis and those who are not. Darbepoetin Alfa, a highly glycosylated derivative of recombinant human erythropoietin, offers a significantly prolonged half-life compared to conventional epoetin alfa, permitting less frequent dosing—a critical factor enhancing patient compliance and quality of life. The market is defined by the necessity for effective biological treatments that stimulate the production of red blood cells, addressing a significant unmet clinical need globally. Key therapeutic applications also extend to treating chemotherapy-induced anemia in non-myeloid malignancies, although CKD remains the dominant application segment.

The market landscape is intensely competitive, driven by the presence of both innovator products and increasingly potent biosimilar versions. Product efficacy, safety profiles, convenient dosing schedules, and evolving regulatory guidelines significantly influence market dynamics. The increasing global prevalence of chronic diseases such as diabetes and hypertension, which are major underlying causes of CKD, ensures a steady growth trajectory for anemia management therapies. Furthermore, advancements in drug delivery systems, particularly the refinement of pre-filled syringes for patient self-administration, are continually improving treatment accessibility and efficiency, supporting market expansion.

Major driving factors include the rising geriatric population, which is highly susceptible to CKD and associated anemia, coupled with heightened awareness and improved diagnostic capabilities in emerging economies. The inherent benefit of Darbepoetin Alfa—reduced administration frequency (typically weekly or biweekly) compared to traditional ESAs—positions it favorably among healthcare providers seeking to minimize logistical burdens and optimize patient outcomes. However, the market faces headwinds from stringent pricing pressures, increased regulatory scrutiny regarding cardiovascular risks associated with high ESA doses, and robust competition from pipeline drugs offering novel mechanisms of action for anemia treatment.

Darbepoetin Alfa Injection Market Executive Summary

The Darbepoetin Alfa Injection market is characterized by robust growth underpinned by persistent demand for advanced anemia management in chronic kidney disease patients. Business trends are dominated by strategic maneuvers around patent expiration, resulting in an influx of biosimilars which are intensely driving down average selling prices and forcing innovator companies to focus on volume, specialized formulations, and enhanced patient support programs. The shift towards value-based healthcare models necessitates manufacturers demonstrating superior pharmacoeconomic benefits, favoring long-acting agents like Darbepoetin Alfa that reduce total healthcare expenditure related to administration and patient management. Consolidation among pharmaceutical distributors and specialty pharmacies is also shaping the commercial landscape, emphasizing efficient supply chain management for temperature-sensitive biologics.

Regionally, North America remains the largest market due to high healthcare expenditure, established reimbursement policies, and a large patient pool undergoing dialysis treatment. However, the Asia Pacific region is demonstrating the highest growth potential, driven by escalating prevalence of CKD, improving healthcare infrastructure, and rising disposable incomes allowing access to specialized treatments. European markets are defined by national tendering processes and strong biosimilar uptake, particularly in countries like Germany and the UK, which prioritize cost containment. Developing regions, while presenting logistical challenges, represent long-term growth opportunities as access to renal care expands.

Segmentation trends highlight the dominance of the Chronic Kidney Disease (CKD) application segment, overshadowing chemotherapy-induced anemia. In terms of product type, pre-filled syringes are rapidly gaining market share over traditional vials due to enhanced safety, ease of use, and suitability for home healthcare settings, aligning with broader trends towards decentralized patient care. The end-user segment is heavily weighted towards hospitals and specialized renal clinics, which possess the necessary infrastructure and expertise for managing complex anemia protocols and administering injectable biological agents. Growth is particularly strong in dialysis centers, where routine ESA administration is a standard component of care.

AI Impact Analysis on Darbepoetin Alfa Injection Market

User inquiries regarding AI's influence on the Darbepoetin Alfa market primarily focus on optimizing personalized dosing, predicting patient responsiveness to ESAs, enhancing clinical trial efficiency for new formulations or biosimilars, and refining supply chain resilience for this complex biologic. The core concern revolves around whether AI/Machine Learning (ML) can improve the narrow therapeutic window of Darbepoetin Alfa, minimizing risks like hypertension or thrombotic events while ensuring optimal hemoglobin levels. Users are also keen to understand how AI tools can accelerate the R&D process, particularly in analyzing large pharmacovigilance datasets to monitor long-term safety profiles, and how AI-driven predictive modeling can manage inventory and reduce waste across the sophisticated cold chain logistics required for injectable biologics.

The deployment of Artificial Intelligence in the Darbepoetin Alfa domain is primarily centered on enhancing precision medicine and operational efficiency. AI algorithms are increasingly used to analyze complex patient data—including biomarkers, comorbid conditions, and dialysis parameters—to develop personalized dosing schedules for Darbepoetin Alfa. This shift from standardized protocols to dynamic, patient-specific administration not only improves therapeutic outcomes by maintaining target hemoglobin levels more consistently but also reduces the risk of adverse events associated with over- or under-dosing. Furthermore, AI and ML are critical tools in drug discovery and manufacturing optimization, predicting protein stability and refining fermentation processes crucial for producing high-quality biosimilars, thereby potentially lowering production costs and increasing market access.

Beyond clinical applications, AI is revolutionizing the commercial aspects of the market. Predictive analytics are being leveraged by manufacturers and distributors to forecast demand fluctuations based on regional disease outbreaks, regulatory changes, and competitive pressures, ensuring optimal inventory levels and minimizing stock-outs of this essential medicine. AI-powered diagnostic support systems aid nephrologists in early identification of CKD patients requiring ESA therapy, broadening the eligible patient population and ensuring timely intervention. The utilization of these advanced tools ultimately supports the market's evolution towards safer, more efficient, and cost-effective anemia management strategies.

- AI-driven personalized dosing optimization models minimize anemia fluctuations and adverse event risks.

- Machine learning improves clinical trial efficiency for biosimilars by identifying optimal patient cohorts and endpoints.

- Predictive supply chain analytics enhance cold chain logistics, reducing spoilage and improving global distribution reliability.

- AI analyzes pharmacovigilance data to quickly detect and mitigate emerging safety signals specific to long-term ESA use.

- Integration of AI in electronic health records (EHRs) assists in early diagnosis and referral for Darbepoetin Alfa therapy initiation.

DRO & Impact Forces Of Darbepoetin Alfa Injection Market

The Darbepoetin Alfa Injection market is shaped by a balance of significant drivers, critical restraints, and substantial opportunities, collectively summarized as the DRO & Impact Forces. The primary drivers stem from the escalating global incidence of chronic kidney disease and related anemia, fueled by the growing prevalence of diabetes and hypertension worldwide, coupled with the proven clinical benefit and convenience of Darbepoetin Alfa’s prolonged dosing interval. Opportunities are largely concentrated in the expansion of biosimilar penetration into regulated and emerging markets, and the development of specialized delivery systems to support patient self-administration at home. However, the market growth is significantly restrained by patent cliffs leading to intense price erosion from biosimilar competition, persistent safety concerns regarding high ESA doses (specifically cardiovascular risk), and evolving regulatory requirements regarding hemoglobin targets, which often lead to lower administered doses.

The key driver is the demographic shift towards an aging global population, which disproportionately suffers from end-stage renal disease (ESRD). As access to renal care, including dialysis and specialized clinics, improves in developing nations, the diagnosed and treated patient pool expands rapidly. Darbepoetin Alfa’s characteristic long half-life remains a key competitive advantage, reducing the burden on healthcare facilities and improving patient adherence compared to shorter-acting ESAs. Furthermore, ongoing investments in R&D focus on refining formulation stability and improving administration technologies, reinforcing the product's market position against competing therapeutic modalities, such as HIF-PH inhibitors.

Restraints are deeply rooted in the economic pressures within global healthcare systems. Patent expiry has allowed cost-effective biosimilars to capture significant market share, putting considerable downward pressure on the pricing structure of the entire segment. Clinicians must also navigate stringent regulatory warnings (Black Box warnings in some regions) related to the use of ESAs in certain cancer patients and the risks associated with achieving overly high hemoglobin levels. These safety restrictions limit the potential scope of treatment and necessitate careful patient monitoring. Opportunities, conversely, lie in geographical expansion, particularly leveraging government initiatives in the Asia Pacific and Latin American regions to subsidize or promote high-quality, long-acting anemia treatments, offering a significant pathway for sustained revenue generation despite domestic price competition.

Segmentation Analysis

The Darbepoetin Alfa Injection market is comprehensively segmented based on key parameters including Dosage (High Dose, Low Dose), Application (Chronic Kidney Disease Anemia, Chemotherapy-Induced Anemia, Others), and End-User (Hospitals & Clinics, Dialysis Centers, Ambulatory Surgical Centers). This segmentation allows for precise market evaluation, highlighting distinct growth pockets and competitive dynamics across therapeutic areas and healthcare settings. The market exhibits different demand elasticity based on the dosage and application, with high-dose segments often correlating with late-stage CKD, predominantly treated in specialized dialysis centers. The shift towards outpatient care models also necessitates careful analysis of the End-User segment.

The Application segmentation is the most critical determinant of market revenue. Anemia associated with Chronic Kidney Disease (CKD) accounts for the overwhelming majority of Darbepoetin Alfa sales, driven by the lifelong necessity of ESA therapy for patients undergoing dialysis. Although Chemotherapy-Induced Anemia (CIA) represents a vital secondary market, stringent guidelines concerning ESA use in cancer patients to avoid potential tumor progression risk have moderately restrained growth in this specific segment, focusing usage on palliative care settings where treatment benefit outweighs the small risk.

The Dosage segment reflects varying treatment protocols and patient severity. Low Dose administration is typically utilized for patients in earlier stages of CKD or for maintenance therapy, while High Dose regimens are employed during the initiation phase of therapy or for patients requiring significant correction of severe anemia. The End-User analysis reveals that Dialysis Centers are the single largest consumer of Darbepoetin Alfa due to the high volume of recurring treatments they administer, followed closely by large hospital systems that manage both inpatient and outpatient renal care, as well as complex oncology protocols.

- Dosage

- Low Dose

- High Dose

- Application

- Chronic Kidney Disease Anemia

- Chemotherapy-Induced Anemia

- Other Anemia Types

- End-User

- Hospitals & Clinics

- Dialysis Centers

- Ambulatory Surgical Centers

- Home Healthcare

- Geography

- North America (U.S., Canada)

- Europe (Germany, France, UK, Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Value Chain Analysis For Darbepoetin Alfa Injection Market

The value chain for Darbepoetin Alfa Injections is complex, beginning with upstream biopharmaceutical manufacturing, moving through rigorous quality control, specialized distribution, and ultimately reaching the patient via healthcare providers. Upstream activities involve cell culture, fermentation, purification, and sterile formulation of the recombinant protein. Given that Darbepoetin Alfa is a biologic, this phase requires substantial capital investment, specialized facilities, and adherence to Good Manufacturing Practices (GMP). Key raw material suppliers include specialized media providers, chemical reagents suppliers, and pre-filled syringe manufacturers, all demanding high precision and quality assurance due to the injectable nature of the final product. Patent status and technical expertise in glycosylation are vital differentiators in the upstream segment, particularly for biosimilar producers aiming for equivalence.

The downstream analysis focuses on market access and delivery. The distribution channel for Darbepoetin Alfa is inherently specialized due to its high cost and cold chain requirements (typically 2°C to 8°C). Distribution is classified into direct and indirect channels. Direct channels involve manufacturers supplying large integrated delivery networks (IDNs) or national dialysis providers under contract. Indirect channels rely heavily on specialty pharmaceutical distributors, wholesale pharmacies, and group purchasing organizations (GPOs) that manage inventory for smaller hospitals and retail specialty pharmacies. Pricing negotiations and reimbursement policies, especially through government programs like Medicare and Medicaid in the U.S., heavily influence profitability throughout the downstream segment.

Direct distribution offers greater control over inventory and temperature management, crucial for maintaining product integrity, while indirect distribution provides broader market penetration. End-users—primarily dialysis centers and hospitals—act as the final point of purchase and administration. The effectiveness of sales and marketing hinges on educating nephrologists, oncologists, and renal nurses about the clinical benefits, safety profile, and pharmacoeconomic value of the long-acting ESA. Given the high cost, successful market performance relies significantly on favorable inclusion in hospital formularies and specialized payer coverage, making stakeholder engagement a critical function within the value chain.

Darbepoetin Alfa Injection Market Potential Customers

The primary consumers and end-users of Darbepoetin Alfa Injections are patients suffering from anemia related to chronic illnesses, predominantly Chronic Kidney Disease (CKD) and certain types of chemotherapy. Consequently, the key institutional buyers are specialized medical facilities that manage these patient populations. Dialysis Centers represent the most significant segment of potential customers, as anemia management is integral to standard care for hemodialysis and peritoneal dialysis patients. These centers purchase large volumes of ESAs on a consistent basis, often through contractual agreements and GPOs to leverage scale for better pricing.

Hospitals and integrated healthcare systems constitute the second major customer base. They purchase Darbepoetin Alfa for both inpatient use—treating acute anemia and initiating therapy—and for their outpatient clinics, where non-dialysis CKD patients and oncology patients receive treatment. Ambulatory Surgical Centers (ASCs) and specialized infusion centers also serve as important customers, catering to chemotherapy-induced anemia treatment and non-dialysis dependent CKD patients who receive routine injections outside of a major hospital setting. These institutions prioritize reliable supply, favorable pricing, and formulations that support efficient administration, such as pre-filled syringes.

Finally, a growing segment of potential customers includes specialized Home Healthcare providers and patients who self-administer the product under strict clinical guidance. The long half-life of Darbepoetin Alfa makes it particularly suitable for home administration, driven by increasing preference for decentralized care models. These customers require detailed patient education, user-friendly device technology (auto-injectors or pre-filled pens), and robust logistical support to ensure proper storage and disposal, highlighting the need for manufacturers to partner effectively with specialty pharmacies and nurse-managed home care services.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amgen, Johnson & Johnson, Pfizer, Roche, Novartis, Biocon, Sandoz (Novartis), Teva Pharmaceutical Industries, Lupin, Fresenius Medical Care, China Resources Pharmaceutical Group, Dr. Reddy’s Laboratories, Samsung Bioepis, Kyowa Kirin, Stada Arzneimittel AG |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Darbepoetin Alfa Injection Market Key Technology Landscape

The technology landscape surrounding the Darbepoetin Alfa market is primarily focused on biomanufacturing excellence, formulation stability, and advanced drug delivery systems. As a genetically engineered protein, the core technology involves sophisticated recombinant DNA techniques utilized in cell lines (often CHO cells) to produce the highly glycosylated protein structure that confers the long half-life. Continuous process optimization, including bioreactor design and purification chromatography, is paramount for ensuring high yield, purity, and batch-to-batch consistency, which are essential for biologics. Furthermore, the development of biosimilars relies heavily on advanced analytical technologies, such as mass spectrometry and functional assays, to demonstrate structural and functional similarity to the originator product, driving competition and lowering manufacturing costs over time.

In terms of drug delivery, the shift towards patient-centric administration is propelling innovation in device technology. The market is increasingly adopting sophisticated pre-filled syringes and auto-injector pens, replacing traditional vials that require complex reconstitution and multiple steps. These devices incorporate safety features, such as needle shields and dose-locking mechanisms, which minimize accidental needle sticks and reduce the potential for dosing errors, making them ideal for use in non-clinical settings and supporting the growth of home healthcare. Manufacturers invest heavily in usability studies to ensure these injection devices are intuitive for patients, thereby boosting adherence rates, which is a critical measure of treatment success.

Furthermore, technology related to cold chain management and monitoring is indispensable for maintaining the efficacy of Darbepoetin Alfa during distribution. Advanced sensor technology, including temperature-logging devices and blockchain-enabled tracking systems, ensures end-to-end traceability and verifies that the product remains within its strict temperature range from the manufacturing site to the point of administration. This technological focus on supply chain integrity is a non-negotiable requirement for high-value biologic injections, protecting both patient safety and manufacturer liability across global markets with diverse climatic and logistical challenges, setting a high entry barrier for new competitors.

Regional Highlights

- North America: Dominates the Darbepoetin Alfa market, driven by high prevalence of ESRD, advanced healthcare infrastructure, and favorable reimbursement policies, particularly through Medicare for dialysis patients. The U.S. is the single largest country market, characterized by intense competition between branded and biosimilar products and a robust focus on specialized renal care facilities.

- Europe: Characterized by strong government-led efforts to contain healthcare costs, resulting in early and significant uptake of Darbepoetin Alfa biosimilars. Western European nations, such as Germany, France, and the UK, have well-established dialysis networks and procurement through centralized tendering, which favors cost-effective long-acting ESAs.

- Asia Pacific (APAC): Exhibits the highest projected growth rate due to rapidly increasing CKD incidence, improving access to advanced medical treatments, and expansion of healthcare insurance coverage, especially in large markets like China and India. Japan maintains a mature, high-value market focused on product quality and stability.

- Latin America (LATAM): Growth is steady but constrained by variable healthcare spending and economic stability. However, increasing awareness and efforts to formalize renal care protocols in countries like Brazil and Mexico are driving demand for long-acting ESAs, often procured via national public health systems.

- Middle East & Africa (MEA): Represents an emerging market with potential, primarily focused in the GCC countries (Saudi Arabia, UAE) due to high diabetes prevalence and increasing investment in specialized healthcare facilities. Market penetration is slower in most of Africa due to logistical and affordability constraints, though key urban centers are adopting these treatments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Darbepoetin Alfa Injection Market.- Amgen

- Johnson & Johnson

- Pfizer

- Roche

- Novartis

- Biocon

- Sandoz (Novartis)

- Teva Pharmaceutical Industries

- Lupin

- Fresenius Medical Care

- China Resources Pharmaceutical Group

- Dr. Reddy’s Laboratories

- Samsung Bioepis

- Kyowa Kirin

- Stada Arzneimittel AG

- Viatris Inc.

- Mylan N.V. (now Viatris)

- F. Hoffmann-La Roche Ltd.

- AstraZeneca PLC

- Bayer AG

Frequently Asked Questions

Analyze common user questions about the Darbepoetin Alfa market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Darbepoetin Alfa primarily used for?

Darbepoetin Alfa is an erythropoiesis-stimulating agent (ESA) primarily used to treat anemia associated with Chronic Kidney Disease (CKD) in both dialysis and non-dialysis patients, and also for chemotherapy-induced anemia in specific oncology patients.

How does the dosing frequency of Darbepoetin Alfa compare to Epoetin Alfa?

Darbepoetin Alfa has a significantly longer half-life due to increased glycosylation, allowing for less frequent dosing (typically weekly or biweekly) compared to Epoetin Alfa, which usually requires thrice-weekly administration, enhancing patient convenience and adherence.

What impact are biosimilars having on the Darbepoetin Alfa market?

Biosimilars are increasing competition significantly, leading to substantial price erosion and market share loss for the originator product. This dynamic is favorable for healthcare systems seeking cost savings, especially in highly regulated European and North American markets.

Which segment holds the largest share in the Darbepoetin Alfa application market?

The Chronic Kidney Disease (CKD) Anemia application segment accounts for the largest market share globally, driven by the lifelong need for ESA therapy among the growing population of patients with end-stage renal disease (ESRD).

What are the primary challenges restraining the market growth?

Primary challenges include intense price competition from biosimilars, stringent regulatory guidelines and safety warnings regarding cardiovascular risks associated with high ESA doses, and the emergence of competing oral therapies like HIF-PH inhibitors in the anemia treatment pipeline.

Further analysis into the competitive dynamics of the Darbepoetin Alfa market reveals a critical strategic shift among pharmaceutical manufacturers. Innovator companies, facing declining revenues from the primary product due to patent expiration, are focusing intensely on life cycle management strategies. This includes developing enhanced delivery mechanisms, such as customized auto-injector devices optimized for self-administration, and investing in new clinical data to support expanded labeling indications, particularly in complex patient subsets where efficacy differences might be more pronounced. Moreover, key players are leveraging their established distribution networks and brand loyalty within specialized renal care systems to maintain market presence, even as biosimilars capture volume share. The differentiation strategy often involves bundling Darbepoetin Alfa with comprehensive patient support programs, compliance monitoring tools, and educational resources tailored for both patients and healthcare providers, creating a value proposition that extends beyond the drug itself. This approach is vital in markets like the United States, where contracting with major dialysis organizations and specialized GPOs dictates large volume procurement decisions and requires comprehensive service integration. The financial health of these major players is increasingly dependent on the performance of their broader biologics portfolio, viewing Darbepoetin Alfa as an anchor product in their renal and oncology segments, while simultaneously preparing for the launch of next-generation therapies designed to overcome current limitations of ESAs, such as hypoxia-inducible factor prolyl hydroxylase (HIF-PH) inhibitors.

The regulatory environment plays an exceptionally influential role in shaping the market landscape for Darbepoetin Alfa, a highly potent therapeutic agent. Regulatory agencies, including the FDA in the U.S. and the EMA in Europe, maintain strict oversight regarding the safety and efficacy of all ESAs. Key regulatory mandates often involve black box warnings concerning increased risk of serious cardiovascular events (myocardial infarction, stroke, venous thromboembolism) and mortality when ESAs are administered to achieve high hemoglobin targets. These warnings necessitate careful clinical monitoring and adherence to specific target hemoglobin ranges, directly impacting prescribing habits and overall demand volume. Furthermore, the pathway for biosimilar approval demands robust comparative clinical data, ensuring that the follow-on products demonstrate similar efficacy, safety, and immunogenicity profiles to the reference product. This high regulatory bar ensures product quality but also delays the entry of some competitors, thereby managing the pace of price decline. The harmonization of global regulatory standards, or the lack thereof, between major markets affects the speed and cost of global product launches for both originator companies and biosimilar developers. Specific regulations governing local manufacturing requirements and intellectual property protection in fast-growing regions like APAC are pivotal in determining regional market growth potential and investment strategies. The convergence of strict quality requirements and pressure for cost efficiency defines the operational challenge for all participants in the Darbepoetin Alfa market.

Technological innovation extends beyond the product itself into the realm of data management and connectivity, which is increasingly relevant in the administration of Darbepoetin Alfa within complex healthcare settings. The integration of dosing protocols with electronic health records (EHRs) and specialized nephrology IT systems facilitates automatic dosage adjustments based on real-time laboratory results, ensuring tighter control over hemoglobin levels and reducing the chance of clinical inertia. These integrated systems also improve compliance with clinical practice guidelines by alerting providers to potential contraindications or missed monitoring opportunities. Furthermore, advancements in analytical chemistry and quality control are continually improving the precision with which biosimilar manufacturers can characterize their products, further eroding the scientific justification for premium pricing of the reference product. The use of advanced computational fluid dynamics (CFD) and simulation tools is aiding in the design of next-generation injection devices, ensuring that the viscosity and physical properties of the highly concentrated Darbepoetin Alfa formulations are compatible with smooth, pain-minimized subcutaneous injection, which is highly valued in the patient demographic. This technological focus on streamlining clinical workflow and enhancing patient experience is a significant competitive differentiator in the modern pharmaceutical market.

Geographically, the distinct market dynamics necessitate customized commercial strategies. In North America, the complexity of payer-provider relationships and the dominance of major dialysis chains (e.g., Fresenius Medical Care, DaVita) means success hinges on securing large, long-term contracts and navigating the quarterly formulary review processes. Pricing power is consistently being eroded by the presence of multiple approved biosimilars, forcing companies to compete fiercely on net price and bundled services. Conversely, the APAC region, particularly in countries like China and India, presents a substantial opportunity due to the massive, underserved patient population and improvements in healthcare access, albeit accompanied by challenges related to fragmented distribution, lower price ceilings, and varying intellectual property protection. Companies often employ a two-tiered pricing structure in these markets, balancing profitability in major urban centers with accessibility in rural areas. European strategies are dictated by national tendering, where the lowest-cost acceptable biosimilar often wins the majority contract, resulting in rapid market penetration for cost-effective alternatives. The Middle East and Africa represent frontier markets where market entry requires overcoming infrastructural barriers related to cold chain logistics and securing high-level government approvals for drug procurement, often tied to national health initiatives focused on non-communicable diseases like diabetes and hypertension, which are precursors to CKD. These regional variances confirm that a one-size-fits-all approach is ineffective, mandating geographically tailored market access and pricing strategies for Darbepoetin Alfa products.

Looking ahead, the long-term outlook for the Darbepoetin Alfa market will be heavily influenced by the adoption rate of emerging therapeutic classes, most notably the oral HIF-PH inhibitors. These oral agents, offering a potentially more physiological mechanism of action and ease of administration, pose the most significant long-term threat to the injectable ESA market. Manufacturers of Darbepoetin Alfa are strategically responding by emphasizing the decades of established clinical safety data for ESAs, the immediate and reliable effect of injectables, and the convenience of supervised administration within dialysis centers, where adherence is ensured. Should HIF-PH inhibitors gain widespread clinical acceptance and demonstrate long-term cardiovascular safety equivalence or superiority, the demand for all injectable ESAs, including Darbepoetin Alfa, could plateau or slightly decline by the later stages of the forecast period. Therefore, current market strategies must prioritize maximizing revenue capture from the established patient base through cost leadership (via biosimilars) and premium services (via originator products) while closely monitoring competitive threats and maintaining a robust clinical differentiation profile against new oral treatments. The continued expansion of dialysis populations globally, however, ensures that a fundamental demand floor remains strong, supporting stable but moderate growth in the face of competitive threats.

Segmentation by End-User further illuminates market expenditure patterns and procurement centralization. Dialysis centers, both independent and corporate-owned, represent high-volume, consolidated purchasing entities. They operate under tightly managed care models where pharmacoeconomic data and total cost of care are paramount. Manufacturers engage these centers through specialized contracts, often involving volume discounts and specific performance metrics. Hospitals, conversely, represent more fragmented purchasing points but are crucial for initiating therapy, especially in critical care or oncology settings. Their procurement decisions are often influenced by pharmacy and therapeutic (P&T) committees, which evaluate clinical evidence alongside cost-effectiveness, favoring products with robust documentation and favorable safety profiles. The emerging Home Healthcare segment, while currently smaller, is vital for future growth, aligning with trends toward personalized and convenient patient care. Success in this segment requires developing specialized patient support programs and ensuring seamless integration with existing home care infrastructure and reimbursement mechanisms. As governments and payers worldwide push for healthcare decentralization, the procurement influence of home health agencies and specialty pharmacies is expected to increase, requiring a shift in commercial focus toward these distribution channels and end-users, alongside the traditional renal centers.

The role of mergers and acquisitions (M&A) in shaping the Darbepoetin Alfa market is significant, particularly among biosimilar developers and regional specialty pharmaceutical companies. Larger multinational pharmaceutical companies often seek to acquire or license Darbepoetin Alfa biosimilars to instantly gain access to established therapeutic markets and leverage existing sales forces in renal and oncology care. These strategic moves are aimed at quickly diversifying revenue streams and offsetting patent expirations in other drug classes. For example, acquisition of regional manufacturing capabilities or specialized distribution networks can immediately boost market access in complex geographic areas, such as China or India. Conversely, smaller biotech firms focusing on novel ESA formulations or alternative anemia treatments (like HIF-PH inhibitors) become prime targets for acquisition by major players seeking to future-proof their renal portfolio. The consolidation among key players emphasizes a drive toward vertical integration, ensuring control over manufacturing costs and supply chain reliability, which is critical in a price-sensitive market characterized by complex biologics manufacturing and stringent quality requirements. These M&A activities reflect the intense competitive pressure and the strategic importance of maintaining a strong portfolio position in the chronic disease management space.

Detailed insight into the Low Dose versus High Dose segmentation reveals differential market sensitivity. Low Dose administration, typically used for maintenance therapy in patients who have achieved target hemoglobin levels, represents stable, recurring revenue and is less susceptible to abrupt changes than the higher dose segments. High Dose regimens are often used to correct severe anemia, requiring careful clinical monitoring and carrying higher costs per patient, making this segment more vulnerable to substitution by lower-priced alternatives or therapeutic decisions to increase frequency of lower doses instead of maximizing unit dosage. Furthermore, clinical trials and real-world evidence continue to refine optimal dosing strategies. Ongoing research aims to determine the minimum effective dose required to maintain hemoglobin levels while minimizing cardiovascular risks, a persistent safety concern for all ESAs. The adoption of AI-driven personalized dosing protocols, as discussed previously, promises to rationalize both dose segments, potentially leading to more precise, lower average cumulative doses per patient over time. This shift towards personalized minimum effective dosing, driven by safety concerns and technological advancements, will subtly reshape the volume and value contribution of the Low Dose and High Dose segments over the forecast period, favoring precision over broad standardization.

The overall regulatory framework also includes rigorous post-market surveillance requirements. Manufacturers of Darbepoetin Alfa and its biosimilars must continuously collect and analyze data related to adverse events, ensuring proactive management of safety profiles. This pharmacovigilance process is particularly intense for biologics, which carry the inherent risk of immunogenicity (the development of antibodies against the drug). While Darbepoetin Alfa has a favorable immunogenicity profile compared to some predecessors, ongoing monitoring is mandatory. Compliance with these stringent safety reporting requirements adds substantial operational complexity and cost to manufacturers, contributing to the overall high cost structure of the biologic market segment. Furthermore, changes in clinical guidelines issued by major professional bodies, such as the Kidney Disease: Improving Global Outcomes (KDIGO) foundation, significantly influence prescribing patterns. When KDIGO revises its recommendations regarding acceptable hemoglobin targets or initiation criteria for ESAs, the entire market adjusts, leading to shifts in therapeutic volume. Therefore, manufacturers must maintain continuous engagement with clinical guideline developers and regulatory bodies to ensure their product information remains current and relevant within the evolving standard of care for anemia management in CKD and oncology settings.

Finally, the sustainability aspect of the Darbepoetin Alfa market is gaining traction, particularly in terms of environmental impact from complex manufacturing processes and the disposal of medical waste (pre-filled syringes). As environmental, social, and governance (ESG) criteria become more important to institutional investors and public healthcare systems, manufacturers are pressured to adopt more sustainable biomanufacturing techniques, reduce energy consumption in cold chain logistics, and develop more environmentally friendly packaging solutions. Biosimilar manufacturers, often operating with newer facilities and optimized processes, sometimes gain a competitive edge by demonstrating a lower carbon footprint compared to legacy originator products. While currently a secondary consideration, the drive towards sustainable production and responsible waste management is expected to become a more explicit factor in procurement decisions by large public health systems in the next decade, subtly influencing the long-term viability and brand perception of companies within the Darbepoetin Alfa injection market.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager