Data Buoy Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433771 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Data Buoy Market Size

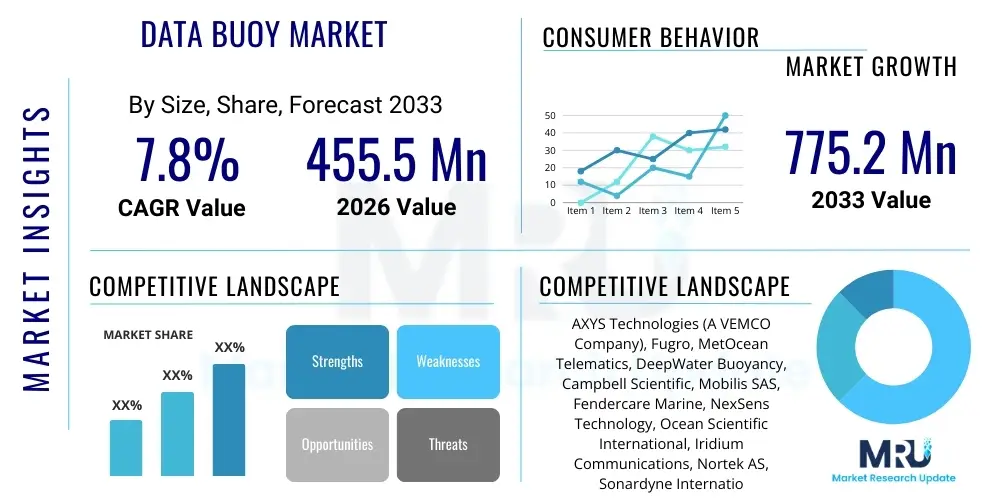

The Data Buoy Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 455.5 Million in 2026 and is projected to reach USD 775.2 Million by the end of the forecast period in 2033.

Data Buoy Market introduction

The Data Buoy Market encompasses the design, manufacturing, deployment, and maintenance of specialized floating platforms equipped with advanced instrumentation for real-time monitoring of meteorological and oceanographic parameters. These systems, ranging from small coastal instruments to large deep-sea structures, are crucial for collecting vital marine data, including wave height, current velocity, temperature, salinity, atmospheric pressure, and air quality. The resultant data is essential for various sectors, including climate modeling, maritime safety, offshore industrial operations, and environmental conservation efforts.

Data buoys serve multiple critical applications, primarily supporting oceanography research, operational weather forecasting, and strategic defense activities. In oceanography, they provide continuous, long-term datasets necessary for understanding complex deep-sea processes and tracking major currents. For commercial applications, particularly in the expanding offshore wind and oil & gas industries, data buoys offer essential site assessment and operational monitoring capabilities, ensuring infrastructure integrity and optimizing energy extraction processes. Their utility lies in providing robust, reliable, and standardized data collection across vast, remote ocean territories where traditional monitoring methods are impractical or prohibitively expensive.

The core benefits derived from utilizing data buoys include enhanced predictive modeling capabilities for extreme weather events, improved operational efficiency for marine industries, and strengthened coastal resilience against climate change impacts such as sea-level rise and ocean acidification. The market is fundamentally driven by the escalating global focus on climate research, increasing investments in renewable offshore energy infrastructure, and the necessity for advanced early warning systems for tsunamis and severe storms. Furthermore, technological advancements, such as enhanced sensor integration, improved communication technologies like satellite telemetry, and long-life power systems, are continually expanding the operational lifespan and data quality of these devices, thereby accelerating market adoption across governmental and commercial entities.

Data Buoy Market Executive Summary

The Data Buoy Market is undergoing significant expansion, propelled by robust global investments in marine research infrastructure and the critical need for precise oceanographic and meteorological data to manage offshore assets and address climate change. Key business trends indicate a strong shift towards highly integrated, smart buoy systems featuring edge computing capabilities and interoperability with diverse satellite communication networks, enhancing real-time data accessibility and reducing latency. Furthermore, major market players are focusing on service-based models, offering Data-as-a-Service (DaaS) solutions that bundle deployment, maintenance, and analytics, thereby lowering the barrier to entry for smaller organizations and specialized research institutes.

Regionally, North America maintains market leadership due to extensive government funding for agencies like NOAA and consistent investment in deep-sea monitoring networks, particularly supporting climate modeling and defense applications. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, driven by massive investments in offshore wind farms in countries like China, Taiwan, and Vietnam, alongside increasing maritime security concerns and the necessity for disaster preparedness in heavily populated coastal zones. Europe remains a mature market, emphasizing technological leadership through the development of advanced sensor arrays and standardized European marine observation systems.

In terms of segmentation, the Moored Buoy segment currently dominates the market due to its stability, capacity for larger sensor payloads, and suitability for long-term, fixed-location monitoring required by meteorological offices and long-term climate projects. Conversely, the Drifting Buoy segment is expected to exhibit rapid growth, supported by global initiatives such as the Argo program, which necessitates vast arrays of standardized, low-cost instruments for profiling the subsurface ocean. The Application segment is dominated by Environmental Monitoring and Oceanography Research, though the Oil & Gas sector continues to be a crucial revenue generator, requiring highly ruggedized buoys for pipeline monitoring and platform safety assurance in harsh environments.

AI Impact Analysis on Data Buoy Market

User inquiries regarding the integration of Artificial Intelligence (AI) and Machine Learning (ML) in the Data Buoy Market overwhelmingly center on three key themes: how AI enhances data quality and processing speed, the role of AI in optimizing buoy maintenance and deployment schedules, and the potential for autonomous decision-making in remote operational environments. Users seek assurance that the massive, complex datasets generated by modern buoys—often terabytes of high-frequency sensor readings—can be efficiently managed and converted into actionable insights, moving beyond simple data aggregation to sophisticated predictive modeling. There is also a keen interest in utilizing ML algorithms for anomaly detection, ensuring early identification of sensor drift or equipment failure, which is crucial given the high costs associated with remote repair missions.

The core expectation is that AI will transform buoys from passive data collectors into intelligent, proactive monitoring stations. ML models are increasingly being deployed at the edge (on the buoy itself) to perform preliminary data validation, filter out noise, and compress data streams before transmission, significantly lowering satellite communication bandwidth costs and enhancing efficiency, especially in power-constrained systems. This shift allows scientists and operators to receive highly refined, pre-analyzed data, accelerating response times for critical events like rogue waves or harmful algal blooms. Furthermore, AI-driven predictive maintenance models analyze telemetry and performance metrics to forecast potential component failures, enabling operators to schedule intervention missions only when necessary, maximizing operational uptime and significantly reducing vessel deployment expenses.

Ultimately, the impact of AI extends to improving the scientific rigor and economic viability of marine monitoring projects. AI algorithms facilitate the fusion of heterogeneous data sources—combining buoy data with satellite imagery and numerical weather prediction models—to create comprehensive, high-resolution models of marine environments. This advanced processing capability provides deeper market differentiation for manufacturers offering 'Smart Buoy' solutions, driving demand primarily from government defense sectors and specialized commercial entities (e.g., offshore renewable energy developers) requiring highly reliable, autonomous, and intelligent ocean monitoring platforms for critical infrastructure protection and resource management.

- AI-enabled anomaly detection enhances data quality and flags faulty sensors in real-time.

- Machine Learning (ML) optimizes predictive maintenance schedules, reducing costly unplanned vessel deployments.

- Edge computing facilitated by AI reduces communication latency and bandwidth requirements by processing data onboard.

- AI algorithms improve forecasting capabilities for weather, ocean currents, and environmental hazards.

- Advanced data fusion allows integration of buoy inputs with satellite data for comprehensive environmental modeling.

DRO & Impact Forces Of Data Buoy Market

The Data Buoy Market is fundamentally shaped by a confluence of powerful drivers, structural restraints, and emerging opportunities, collectively defining the trajectory of market growth. A primary driver is the accelerating global imperative for climate change research and mitigation strategies. Governments and international bodies are significantly increasing funding for long-term ocean observation networks to track phenomena such as sea surface temperature rise, ocean acidification, and changes in thermohaline circulation. This persistent demand ensures a stable base for the procurement of standardized and advanced deep-sea buoys and associated sensors.

Concurrently, the expansion of the offshore energy sector, particularly in offshore wind and deep-water oil and gas exploration, serves as a major commercial driver. These complex infrastructure projects rely heavily on highly accurate metocean data collected by specialized buoys during site assessment, construction, and operational phases to ensure structural integrity and safety. However, the market faces significant restraints, chiefly the extremely high initial capital expenditure for advanced buoy systems, including specialized sensors, robust mooring systems, and sophisticated communication hardware. Furthermore, the operational challenge of maintenance—requiring specialized, costly vessels for deployment, calibration, and retrieval in often remote and hostile marine environments—limits the achievable scale and accessibility of these systems for smaller research groups.

Opportunities for market expansion are centered on technological breakthroughs and diversification of application areas. The development of low-cost, disposable, and modular sensor systems, coupled with advancements in energy harvesting technologies (solar, wave energy conversion), promises to lower overall ownership costs and extend deployment durations. Furthermore, the integration of 5G and enhanced satellite constellations (like Starlink) offers the opportunity for higher bandwidth, real-time data transmission, transforming data delivery models. The convergence of these technological opportunities with the growing demand for maritime security and defense applications, particularly related to monitoring exclusive economic zones and tracking subsurface activities, provides robust avenues for sustained revenue generation and market penetration throughout the forecast period.

Segmentation Analysis

The Data Buoy Market is structurally analyzed based on four primary parameters: Hull Type, Application, Component, and Depth. Hull Type segmentation differentiates the market based on deployment stability and mobility, primarily categorized into Moored, Drifting, and Offshore Platform-Integrated Buoys. Application segmentation reflects the end-user purpose, spanning crucial areas such as Environmental Monitoring, Oceanography Research, Oil & Gas operations, and Defense & Security. Component analysis dissects the internal technology stack, highlighting the importance of Sensors, Data Loggers, Communication Systems, and Power Systems, which dictates the performance and data capacity of the devices. Lastly, Depth segmentation classifies buoys based on their operational environment, separating coastal/shallow water buoys from deep-sea buoys, each requiring distinct design specifications and mooring strategies.

The Moored Buoys segment holds a commanding market share owing to their high payload capacity, superior stability, and suitability for long-term, fixed-point monitoring, essential for infrastructure projects and sustained climate observation programs. Their dominance is linked to the need for continuous, time-series data at specific geographical coordinates, which cannot be reliably achieved by drifting systems. Conversely, the Drifting Buoys segment, though smaller in revenue, is projected to experience the highest growth rate, driven by expansive international scientific programs focused on mapping global ocean currents and profiling temperature and salinity across vast, inaccessible areas, often utilizing disposable, standardized platforms.

Examining the Application segment, Environmental Monitoring and Oceanography Research collectively account for the largest demand, primarily funded by national governmental agencies and multilateral organizations focused on climate science and maritime safety. The growing severity of weather phenomena and increased global focus on marine biodiversity necessitate continuous data collection. While the Oil & Gas sector demands fewer units, their requirement for high-specification, ruggedized systems for dynamic positioning and infrastructure safety monitoring ensures that this segment contributes significantly to the overall market value. The underlying technological advancements in sensor miniaturization and power efficiency are critical factors supporting the commercial viability and expansion across all defined application sectors, ensuring that segmentation dynamics remain focused on balancing cost-effectiveness with data quality and reliability.

- Hull Type

- Moored Buoys

- Drifting Buoys

- Offshore Platform-Integrated Buoys

- Application

- Environmental Monitoring (Weather & Climate)

- Oceanography Research (Physical & Biological)

- Oil & Gas (Metocean Assessment, Safety)

- Defense & Security

- Fisheries & Aquaculture

- Component

- Sensors (Metocean, Water Quality, Acoustic)

- Data Loggers & Processing Units

- Communication Systems (Satellite, Radio, Cellular)

- Power Systems (Solar, Battery, Hybrid)

- Depth

- Shallow Water/Coastal

- Deep Sea/Open Ocean

Value Chain Analysis For Data Buoy Market

The value chain of the Data Buoy Market begins with upstream activities focused on the design and manufacturing of specialized components, primarily high-precision sensors, robust communication modules, and durable hull materials. Upstream suppliers are critical, providing state-of-the-art metocean sensors (e.g., CTDs, hydrophones, ADCPs) and advanced microprocessors necessary for onboard data logging and conditioning. Success in this phase relies heavily on research and development (R&D) to ensure components meet the stringent durability and reliability requirements of harsh marine environments, making technological innovation a core competitive differentiator for component manufacturers.

The central manufacturing stage involves the integration and assembly of these components into complete buoy systems. This phase requires specialized engineering expertise in hydrodynamics, materials science (anti-fouling coatings, corrosion resistance), and system integration (power management and telemetry optimization). Distribution channels are highly specialized. Direct sales are common for large governmental and defense contracts, where customization and complex system integration are required, facilitating direct interaction between the manufacturer and the end-user agency, such as national weather services or navies. Indirect channels involve value-added resellers (VARs) and specialized marine equipment distributors who often provide regional installation, maintenance, and technical support services, particularly targeting smaller commercial users or international clients.

Downstream activities center on deployment, operation, data management, and subsequent analytics. Deployment requires specialized marine logistics, including survey vessels and trained technical personnel capable of handling heavy equipment and complex mooring configurations in open waters. The final and most critical downstream step involves data processing and delivery. With the rise of advanced analytics, many buoy manufacturers now offer software platforms or Data-as-a-Service (DaaS) subscriptions, transforming raw data into actionable insights, such as real-time forecasts or long-term climate trends. This comprehensive service model strengthens customer retention and moves the value proposition beyond hardware sales to continuous data intelligence provision.

Data Buoy Market Potential Customers

The primary end-users and buyers of data buoy systems span a diverse array of governmental, research, and commercial entities, all requiring precise and continuous marine monitoring capabilities. Government agencies constitute the largest customer base, including national meteorological and hydrological services (e.g., NOAA, UK Met Office), defense departments (navies and coast guards), and environmental protection agencies. These entities rely on buoys for mission-critical operations such as generating public weather forecasts, monitoring climate change indicators, ensuring maritime domain awareness, and providing early warnings for natural disasters like tsunamis and hurricanes.

Academic and specialized research institutions form another substantial segment of potential customers. Universities, oceanographic institutes (like WHOI, Scripps), and international research consortiums (such as those managing the Argo network or specific deep-sea observatories) procure buoys for long-term scientific projects focused on understanding ocean dynamics, biodiversity, and biogeochemical cycles. For these customers, the emphasis is often on high-fidelity, research-grade sensors and flexibility in data retrieval protocols, supporting experimental data collection rather than purely operational monitoring.

The commercial sector represents the fastest-growing customer group, driven primarily by the high-value infrastructure of the energy industry. Potential customers include major global oil and gas companies requiring metocean assessments for drilling rigs and pipeline safety, and, increasingly, offshore renewable energy developers (wind and tidal energy). Furthermore, the burgeoning aquaculture and specialized fisheries management sectors are adopting smaller, coastal buoys for monitoring water quality, temperature, and current flow to optimize fish farm operations and ensure regulatory compliance. For commercial buyers, key purchase criteria revolve around system reliability, operational uptime, and the total cost of ownership (TCO) over multi-year deployment cycles.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 455.5 Million |

| Market Forecast in 2033 | USD 775.2 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AXYS Technologies (A VEMCO Company), Fugro, MetOcean Telematics, DeepWater Buoyancy, Campbell Scientific, Mobilis SAS, Fendercare Marine, NexSens Technology, Ocean Scientific International, Iridium Communications, Nortek AS, Sonardyne International, Teledyne Marine, Xylem Inc. (Aanderaa Data Instruments, YSI), Pro-Oceanus Systems, Clear-Water Sensors, Ocean Data Equipment Corporation, Offshore Sensing, Miros AS, CNR-ISMAR (Consiglio Nazionale delle Ricerche - Istituto di Scienze Marine). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Buoy Market Key Technology Landscape

The technological landscape of the Data Buoy Market is defined by continuous evolution across three critical domains: sensor sophistication, communication efficiency, and power longevity. Modern data buoys are transitioning from simple analogue devices to sophisticated digital platforms capable of housing numerous integrated sensors, including multi-parameter water quality probes, high-frequency Acoustic Doppler Current Profilers (ADCPs), and specialized CO2/pH sensors for monitoring ocean acidification. A significant trend is the miniaturization and increased reliability of these sensors, coupled with the integration of micro-electro-mechanical systems (MEMS) technology, allowing for greater payload flexibility without compromising the hydrodynamic stability of the buoy platform.

Communication technology represents a pivotal area of advancement. The traditional reliance on costly and low-bandwidth geostationary satellite systems (like Inmarsat) is being supplemented or replaced by low Earth orbit (LEO) satellite constellations (e.g., Iridium, Starlink) and emerging 5G connectivity for coastal deployments. These technologies offer substantially higher data throughput and reduced latency, enabling the transmission of high-volume datasets (such as raw acoustic data or high-resolution imagery) in near real-time, which is essential for operational forecasting and rapid decision-making in defense and maritime safety applications. Furthermore, the implementation of decentralized, mesh-network protocols between multiple buoys and autonomous underwater vehicles (AUVs) is enhancing data relay capabilities in remote areas, creating more resilient and redundant monitoring networks.

Power management and energy harvesting are foundational technologies crucial for extending buoy deployment cycles and reducing servicing costs. While solar panels remain the standard primary power source, significant R&D efforts are focused on integrating secondary and complementary energy sources. These include kinetic wave energy converters, thermoelectric generators (TEGs) leveraging temperature gradients, and improved battery chemistry, such as high-density lithium variants, to ensure continuous operation through extended periods of low sunlight or harsh weather. Additionally, advancements in edge computing—where data processing units on the buoy utilize specialized, low-power microcontrollers (like ARM-based systems) to perform analytics and compression before transmission—dramatically reduce the energy burden associated with communications, maximizing the operational lifespan of the entire system and minimizing the environmental footprint of frequent battery replacements.

Regional Highlights

The Data Buoy Market demonstrates distinct geographical purchasing patterns influenced by climate dynamics, economic focus, and regulatory requirements.

- North America: This region holds the largest market share, predominantly driven by governmental funding through organizations like the National Oceanic and Atmospheric Administration (NOAA) for extensive climate modeling and coastal warning systems. The demand is robust for both deep-sea monitoring (DART buoys for tsunami warnings) and advanced coastal systems supporting marine research and defense capabilities. Significant technological innovation, particularly in data processing and sensor technology, originates from U.S. and Canadian firms.

- Europe: Characterized by high technological maturity and standardized multinational initiatives such as the European Marine Observation and Data Network (EMODnet). The focus is heavily placed on renewable energy metocean assessment to support the massive expansion of the North Sea and Baltic Sea offshore wind infrastructure. European companies lead in specialized buoy design, particularly concerning anti-fouling solutions and low-maintenance systems.

- Asia Pacific (APAC): Expected to register the highest growth rate due to massive governmental investments in disaster preparedness (typhoons, cyclones) and rapidly expanding maritime trade and offshore energy production, especially in East and Southeast Asia. Countries like China, Japan, and India are rapidly deploying domestic observation networks, creating substantial demand for both localized coastal buoys and high-capacity deep-sea monitoring platforms.

- Latin America (LATAM): Market growth is moderate but steady, focused primarily on supporting local fisheries management, port operations, and monitoring weather patterns originating in the tropical Pacific and Atlantic for regional safety. Brazil and Mexico are key markets, driven by their deep-water oil and gas operations and coastal research initiatives.

- Middle East and Africa (MEA): This region is an emerging market with demand primarily concentrated in the Middle East for supporting oil and gas export infrastructure and coastal security. Africa’s adoption is slowly growing, centered on projects addressing fisheries regulation, climate adaptation in vulnerable coastal zones, and early warning systems, often reliant on international aid and collaborative research funding.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Buoy Market.- AXYS Technologies (A VEMCO Company)

- Fugro

- MetOcean Telematics

- DeepWater Buoyancy

- Campbell Scientific

- Mobilis SAS

- Fendercare Marine

- NexSens Technology

- Ocean Scientific International

- Iridium Communications

- Nortek AS

- Sonardyne International

- Teledyne Marine (multiple subsidiaries)

- Xylem Inc. (Aanderaa Data Instruments, YSI)

- Pro-Oceanus Systems

- Clear-Water Sensors

- Ocean Data Equipment Corporation

- Offshore Sensing

- Miros AS

- CNR-ISMAR (Consiglio Nazionale delle Ricerche - Istituto di Scienze Marine)

Frequently Asked Questions

Analyze common user questions about the Data Buoy market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for Data Buoys?

The primary applications driving demand are Environmental Monitoring (including climate change tracking and pollution analysis), Operational Oceanography Research, and commercial applications related to the Offshore Energy sector (site assessment and infrastructure safety for oil & gas and wind farms).

How does the integration of AI affect the cost-efficiency of data buoy systems?

AI significantly improves cost-efficiency by enabling predictive maintenance, reducing the necessity for expensive unscheduled vessel deployments. Furthermore, AI-driven edge processing reduces communication costs by compressing and validating data onboard before transmission via high-cost satellite links.

Which geographical region exhibits the fastest growth potential for the Data Buoy Market?

The Asia Pacific (APAC) region is projected to show the fastest growth potential, primarily fueled by substantial governmental investments in disaster warning systems, rapid expansion of coastal infrastructure, and ambitious offshore renewable energy projects, particularly in East and Southeast Asian nations.

What are the major technological challenges currently limiting the deployment of buoys?

Major technological challenges include ensuring long-term power autonomy in remote locations, mitigating biofouling (biological growth) which degrades sensor performance, and developing highly robust mooring systems capable of surviving extreme weather events over multi-year deployment cycles.

What is the difference between Moored Buoys and Drifting Buoys in terms of application?

Moored Buoys are utilized for continuous, long-term monitoring at a fixed geographical location, ideal for site-specific projects (e.g., offshore wind assessment or harbors). Drifting Buoys are used for large-scale, mobile surveys, tracking currents and profiling subsurface ocean properties across vast areas, often supporting global climate research programs like Argo.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Powered Data Buoy Market Size Report By Type (Base, Tower), By Application (Oil & Gas, Defense, Research, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Powered Data Buoy Market Statistics 2025 Analysis By Application (Oil & Gas, Defense, Research), By Type (Solar Powered, Battery Powered), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager