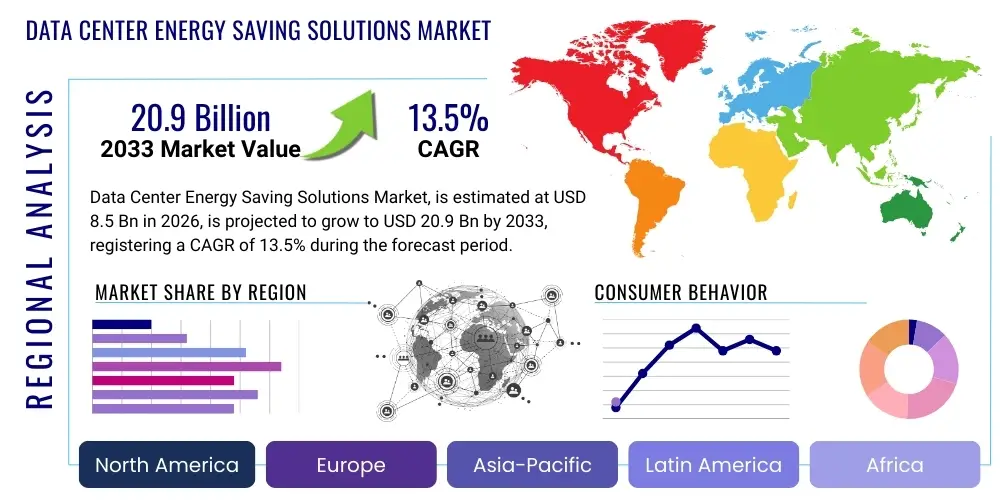

Data Center Energy Saving Solutions Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438511 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Data Center Energy Saving Solutions Market Size

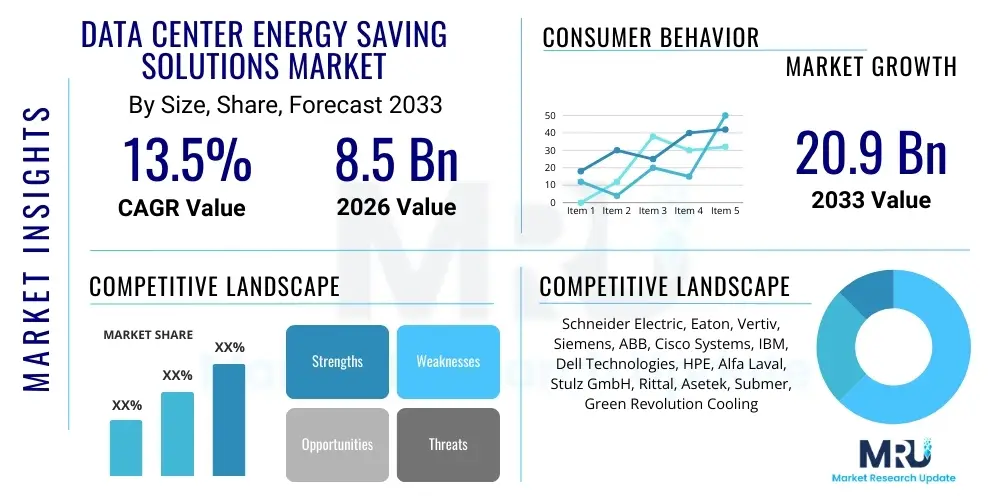

The Data Center Energy Saving Solutions Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 20.9 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the escalating demand for digital services coupled with intense regulatory pressure worldwide to reduce carbon emissions associated with IT infrastructure. Data centers globally are consuming increasingly massive amounts of power, making efficiency measures not merely a cost-saving initiative but a core operational mandate.

The imperative to reduce Power Usage Effectiveness (PUE) ratios below the current global average is a primary catalyst fueling investment in advanced cooling systems, efficient power distribution, and sophisticated Data Center Infrastructure Management (DCIM) software. Organizations are increasingly adopting holistic strategies that span optimized hardware configuration, intelligent workload placement, and the transition to renewable energy sources to achieve near-net-zero operational status. This trend is particularly pronounced among hyperscale operators and large colocation facilities, which possess the capital and scale necessary to implement high-density, energy-efficient solutions such as liquid cooling and modular data center designs.

Furthermore, the evolution of high-performance computing (HPC) and the rapid deployment of Artificial Intelligence (AI) and Machine Learning (ML) workloads necessitate cooling and power solutions capable of handling extreme heat densities. Traditional air cooling methods are proving inadequate for modern rack densities exceeding 30 kW. Consequently, the shift towards next-generation technologies like direct-to-chip liquid cooling and single-phase immersion cooling is becoming a defining characteristic of market growth, offering superior energy performance and contributing significantly to the overall market valuation throughout the forecast period.

Data Center Energy Saving Solutions Market introduction

The Data Center Energy Saving Solutions Market encompasses a diverse portfolio of products, services, and technologies designed to minimize the energy consumption of data center operations while maintaining or improving computational performance and reliability. These solutions address the three major areas of energy use: cooling infrastructure, power delivery and conditioning, and IT equipment utilization. The primary objective is to lower the PUE, which is the ratio of total energy entering the data center to the energy used by the computing equipment. Achieving lower PUE ratios directly translates into reduced operational expenditure (OpEx) and a smaller environmental footprint, aligning business goals with global sustainability mandates.

Major applications of these solutions span across various types of data center facilities, including enterprise, cloud, colocation, and hyperscale environments. Key technologies involved include advanced cooling methodologies (such as adiabatic cooling, free cooling, and liquid cooling), high-efficiency uninterruptible power supplies (UPS), optimized server virtualization tools, and comprehensive DCIM platforms. Benefits derived from implementing these solutions are multifaceted, including significant reductions in energy utility costs, enhanced system uptime through better thermal management, prolonged equipment lifespan, and compliance with stringent energy efficiency regulations such as those imposed by the European Union’s Green Deal or localized government mandates.

Driving factors propelling this market forward include the exponential growth in global data traffic, necessitating continuous data center expansion; the mounting cost of electrical energy, particularly in densely populated urban centers; and increasing stakeholder pressure, including investors and consumers, demanding demonstrable corporate social responsibility (CSR) initiatives focusing on environmental sustainability. The shift towards edge computing, which requires smaller, decentralized, and highly efficient micro-data centers, also acts as a critical driver for modular and optimized energy saving solutions tailored for distributed deployment. Furthermore, technological innovation in power electronics and the widespread adoption of software-defined power management are enabling granular control over energy consumption, thereby accelerating market growth.

Data Center Energy Saving Solutions Market Executive Summary

The global Data Center Energy Saving Solutions Market is characterized by robust growth, propelled primarily by the acceleration of digitalization and the concurrent need for sustainable infrastructure development. Current business trends indicate a definitive shift toward sophisticated, integrated energy management ecosystems rather than relying on disparate components. Hyperscale cloud providers remain the dominant force in driving innovation and adoption, investing heavily in large-scale liquid cooling deployments and leveraging machine learning algorithms to achieve real-time energy optimization, often pushing PUE boundaries below 1.1. Mergers and acquisitions focused on consolidating specialized DCIM and power hardware expertise are frequently observed, reflecting the industry’s movement toward full-stack solution providers.

Regionally, North America continues to lead the market in terms of technological maturity and total installed capacity, benefiting from favorable regulatory environments and the presence of major technology hubs. However, the Asia Pacific (APAC) region is projected to exhibit the highest CAGR, fueled by massive data center construction booms in markets like India, Southeast Asia, and China, often utilizing greenfield sites optimized for natural cooling techniques. Europe, driven by stringent mandates like the EU Taxonomy and the need to comply with the European Green Deal, demonstrates strong demand for retrofitting existing facilities with highly efficient cooling and waste heat reuse technologies, promoting circular economy principles within the sector.

Segment trends highlight the exceptional growth rate of the Cooling Solutions segment, specifically driven by liquid cooling methodologies (Direct-to-Chip and Immersion Cooling) which are essential for supporting AI and HPC loads. The DCIM and Software segment is also witnessing substantial momentum, moving beyond mere monitoring to encompass predictive maintenance, resource orchestration, and automation of cooling loops using advanced analytics. The transition from legacy AC-based power architecture to high-voltage DC (HVDC) distribution systems is another key trend, offering improved power conversion efficiency and reduced footprint within data center white spaces, thereby maximizing computational capacity per unit of energy consumed.

AI Impact Analysis on Data Center Energy Saving Solutions Market

User queries regarding the impact of Artificial Intelligence on data center sustainability often center on a dichotomy: the massive energy demands of training large language models (LLMs) versus the potential of AI to optimize operational efficiency. Common user concerns revolve around whether the heat generated by specialized AI accelerators (GPUs, TPUs) will negate any energy savings achieved through optimization software. There is also significant interest in how AI can be leveraged for predictive cooling management, dynamic power capping, and automated fault detection to ensure peak energy performance. Users expect AI to move data centers beyond static operational set points into highly adaptive, self-optimizing environments capable of responding instantaneously to workload fluctuations.

The introduction of AI workloads fundamentally alters the heat density profile of modern data centers. These specialized computing tasks, particularly deep learning training, require sustained, high-power operation of server racks, leading to unprecedented thermal output that conventional cooling systems cannot handle efficiently. This directly drives the demand for innovative, high-efficiency cooling solutions, primarily liquid cooling, which offers a 30% to 50% energy reduction compared to air cooling for high-density environments. Thus, AI mandates the adoption of energy-saving solutions that are thermally robust.

Conversely, AI is simultaneously becoming the most powerful tool for energy management itself. Sophisticated Machine Learning models are integrated into DCIM platforms to process vast streams of sensor data related to temperature, humidity, airflow, and power utilization. By analyzing these complex relationships, AI can precisely predict thermal loads, adjust chiller operation hours, optimize fan speeds, and control server power states just moments before an issue arises or a change in demand occurs. This predictive optimization significantly reduces energy waste by eliminating unnecessary over-provisioning of power and cooling capacity, leading to dramatic improvements in overall PUE. The strategic deployment of AI for operational control is essential for managing the energy paradox created by AI’s immense computational hunger.

- AI workload acceleration increases rack heat density, mandating the adoption of high-efficiency liquid cooling solutions.

- Predictive cooling management powered by AI algorithms optimizes chiller and HVAC operation, reducing fan power consumption by up to 15%.

- Machine Learning models analyze real-time power metrics for dynamic power capping, ensuring efficient utilization during low-load periods.

- AI assists in workload placement optimization, strategically moving compute tasks to geographically cooler data centers or physically cooler rack locations.

- Automated anomaly detection utilizing AI minimizes energy losses associated with equipment malfunction or sub-optimal system configuration.

DRO & Impact Forces Of Data Center Energy Saving Solutions Market

The market for Data Center Energy Saving Solutions is shaped by a powerful interplay of Drivers, Restraints, and Opportunities (DRO), all contributing to its accelerating growth trajectory. Primary drivers include the global mandate for climate action and decarbonization, translated into concrete regulatory requirements like net-zero targets and strict PUE compliance. Concurrently, the operational economics favor efficiency, as rising global energy prices significantly increase the OpEx for data center operators, making energy-saving investments economically compelling. However, the high initial capital expenditure (CapEx) associated with installing advanced infrastructure, such as liquid cooling loops or sophisticated DCIM software, acts as a significant restraint, particularly for smaller enterprise data centers or those operating older legacy facilities. Additionally, the complexity of integrating new solutions with diverse existing IT infrastructure poses technical and logistical challenges.

Opportunities abound in emerging technological areas, most notably the integration of waste heat recovery systems, allowing data centers to contribute heat to local district heating networks, thereby achieving dual efficiency benefits. The expansion of edge computing necessitates the deployment of highly compact and energy-efficient micro-data centers, presenting a lucrative niche for modular, optimized power and cooling solutions. Furthermore, advancements in power electronics, particularly the proliferation of SiC (Silicon Carbide) and GaN (Gallium Nitride) components in UPS systems, offer breakthrough efficiencies in power conversion and delivery. These interconnected factors define the impact forces guiding market investment and innovation, prioritizing solutions that offer the fastest return on investment and demonstrate measurable environmental compliance.

Segmentation Analysis

The Data Center Energy Saving Solutions Market is comprehensively segmented based on the component type, the nature of the data center facility, the end-user profile, and the specific application area addressed by the solution. This detailed segmentation allows for precise analysis of market demand, reflecting diverse operational priorities across different market verticals. The solutions spectrum ranges from physical hardware components, such as cooling units and power distribution systems, to sophisticated software platforms designed for real-time monitoring and predictive control. The primary components driving market value are the integrated solutions combining hardware and software management capabilities necessary to achieve holistic PUE reductions.

- Component:

- Hardware (Cooling Systems, Power Management Systems, Rack/Server Hardware)

- Software (Data Center Infrastructure Management (DCIM), Energy Monitoring and Control (EMC), Automation Software)

- Services (Consulting, Integration, Maintenance, Managed Services)

- Data Center Type:

- Hyperscale Data Centers

- Colocation Data Centers

- Enterprise Data Centers

- Edge Data Centers/Micro Data Centers

- Application:

- Cooling Optimization (Free Cooling, Immersion Cooling, Direct-to-Chip Liquid Cooling)

- Power Optimization (High-Efficiency UPS, HVDC Systems, Power Distribution Units (PDUs))

- IT Optimization (Server Virtualization, Workload Management, Decommissioning Services)

- End-User Vertical:

- BFSI (Banking, Financial Services, and Insurance)

- IT and Telecommunications

- Government and Public Sector

- Healthcare

- Retail and E-commerce

- Energy and Utilities

Value Chain Analysis For Data Center Energy Saving Solutions Market

The value chain for Data Center Energy Saving Solutions is intricate, starting with the upstream sourcing of core components and extending through deployment and ongoing service provision to the final data center operator. Upstream activities involve the manufacturing of specialized hardware, including high-efficiency cooling components (e.g., chillers, heat exchangers, cooling distribution units) and advanced power electronics (e.g., modular UPS units, high-density batteries). Key providers in this segment focus heavily on R&D to enhance component efficiency, particularly in areas like semiconductor technology for power conversion and fluid dynamics for thermal management. This stage is capital intensive and highly reliant on material science expertise to deliver competitive products.

The midstream segment involves system integration and software development. System integrators play a crucial role, taking disparate components from various manufacturers—servers, cooling units, power gear, and networking hardware—and assembling them into a cohesive, optimized data center environment. Software providers, focusing on DCIM and AI-driven optimization tools, add significant value by enabling intelligent control and monitoring. The integration stage often includes energy auditing and customized solution design, tailored to the specific PUE goals and environmental conditions of the client’s location. Distribution channels are typically a mix of direct sales to large hyperscalers, and indirect channels through channel partners and value-added resellers (VARs) who serve enterprise and regional colocation markets.

Downstream activities involve the operation and ongoing optimization of the installed solutions. The end-user, such as a major cloud provider or enterprise client, utilizes maintenance and managed services to ensure sustained energy efficiency and system reliability. Services provided here include predictive maintenance contracts, energy performance monitoring, and continuous system calibration based on evolving workload demands. The direct distribution channel dominates for mission-critical and large-scale projects, allowing manufacturers to maintain tight quality control and offer comprehensive support, while the indirect channel provides localized reach and specialized integration skills necessary for penetrating diverse geographical markets and smaller facilities.

Data Center Energy Saving Solutions Market Potential Customers

The demand landscape for Data Center Energy Saving Solutions is highly concentrated among entities with substantial IT infrastructure footprints and rigorous operational demands for uptime and sustainability. Hyperscale cloud providers (e.g., AWS, Microsoft, Google) are the largest consumers, constantly seeking revolutionary solutions to manage tens of thousands of servers, driving adoption of technologies like custom immersion cooling and waste heat reuse. Their immense scale makes even marginal gains in PUE translate into hundreds of millions in annual savings, positioning them as early adopters of high-CapEx, high-efficiency technologies.

Colocation providers represent another critical customer segment. Their business model is often built around offering attractive PUE metrics to tenants, making energy efficiency a key competitive differentiator. These providers invest heavily in shared infrastructure efficiency, such as advanced HVAC and power distribution, to lower the operating costs passed onto their numerous clients. Furthermore, large enterprise organizations, particularly those in the BFSI and telecommunications sectors, are significant buyers, focusing on retrofitting existing, aging data centers to comply with new internal and external sustainability mandates without incurring massive rebuild costs.

Finally, government agencies and research institutions, often operating dedicated high-performance computing (HPC) centers, are also prime potential customers. These entities are typically bound by public mandates to demonstrate environmental responsibility and efficiency in their operations. The recent surge in edge computing deployments by telecommunications and content delivery networks (CDNs) also creates a rapidly expanding customer base for compact, highly optimized, and modular energy saving micro-data centers, designed for remote deployment and minimal human intervention.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 20.9 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Schneider Electric, Eaton, Vertiv, Siemens, ABB, Cisco Systems, IBM, Dell Technologies, HPE, Alfa Laval, Stulz GmbH, Rittal, Asetek, Submer, Green Revolution Cooling |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Energy Saving Solutions Market Key Technology Landscape

The technology landscape in the Data Center Energy Saving Solutions Market is rapidly evolving, driven by the necessity to manage increasing thermal densities and improve power efficiency beyond traditional limits. One of the most disruptive technologies is Liquid Cooling, which includes Direct-to-Chip (D2C) solutions using cold plates attached to CPUs/GPUs, and Immersion Cooling, where servers are submerged in dielectric fluids. Liquid cooling significantly outperforms air cooling in terms of heat transfer efficiency, reducing the cooling component of PUE by up to 50% and enabling rack densities of over 100 kW. The adoption of liquid cooling is critical for enabling next-generation high-performance and AI computing without unsustainable energy demands.

Another foundational technology is Data Center Infrastructure Management (DCIM) software, which has matured from basic monitoring tools into sophisticated, AI-enhanced orchestration platforms. Modern DCIM solutions integrate predictive analytics to forecast energy demand and thermal trends, allowing operators to automate adjustments to power distribution, cooling set points, and airflow management in real-time. These intelligent platforms are vital for maximizing resource utilization and achieving the lowest possible operational PUE consistently across fluctuating loads. Furthermore, DCIM platforms facilitate the integration of renewable energy sources and manage peak load shifting to minimize exposure to expensive utility rates.

The evolution of power conditioning and distribution is equally crucial. High-Efficiency Uninterruptible Power Supplies (UPS) leveraging modular architectures and advanced semiconductor materials (like Silicon Carbide - SiC) are achieving conversion efficiencies exceeding 98%. Additionally, the transition to high-voltage Direct Current (HVDC) power distribution within the data center eliminates multiple AC/DC conversion stages required by traditional systems, leading to lower energy loss, reduced equipment footprint, and simplified electrical infrastructure, further driving significant energy savings and operational reliability in mission-critical environments.

Regional Highlights

- North America: North America holds the largest market share, characterized by high technological maturity, the presence of major hyperscale cloud providers, and stringent energy efficiency regulations implemented at state and federal levels. The region is a leader in adopting advanced DCIM software, utilizing AI for operational optimization, and pioneering large-scale liquid cooling deployments to manage the vast energy requirements of its immense installed data center capacity. Innovation here is often focused on achieving ultra-low PUE targets (approaching or below 1.1) and integrating renewable energy procurement strategies.

- Europe: The European market exhibits strong growth driven primarily by regulatory compliance requirements, most notably the European Green Deal and the upcoming implementation of the Energy Efficiency Directive (EED), which mandates specific PUE targets and reporting standards. Europe shows high adoption rates for free cooling technologies (due to favorable climates in Nordic countries) and is a global leader in waste heat reuse systems, utilizing exhaust heat from data centers to warm residential or industrial buildings, promoting circular economy objectives. Retrofitting existing urban facilities is a key activity.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid digitalization, massive growth in internet penetration, and significant foreign investment in developing localized data center hubs (e.g., India, Singapore, Japan). This region sees high demand for greenfield, modular data center construction, allowing operators to implement the latest high-efficiency technologies from the ground up, including advanced air-side economizers and hybrid cooling solutions tailored to diverse and often challenging climate conditions.

- Latin America (LATAM): The LATAM market is experiencing solid growth, particularly in major economies like Brazil and Mexico, driven by increasing cloud adoption and localization requirements. The focus in this region is balanced between utilizing high-efficiency power management systems to combat power quality issues and leveraging localized free cooling opportunities where available, alongside investment in containerized and modular energy solutions for rapid deployment.

- Middle East and Africa (MEA): MEA is an emerging market with significant recent infrastructure investment, largely concentrated in the UAE, Saudi Arabia, and South Africa. The extreme ambient temperatures necessitate reliance on high-efficiency cooling technologies, including evaporative cooling and specialized high-efficiency chillers, alongside robust power redundancy systems. Governments in the region are increasingly prioritizing sustainable development mandates, acting as key demand drivers for advanced energy saving technologies.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Energy Saving Solutions Market.- Schneider Electric SE

- Eaton Corporation plc

- Vertiv Holdings Co

- Siemens AG

- ABB Ltd.

- Johnson Controls International plc

- Rittal GmbH & Co. KG

- Stulz GmbH

- Emerson Electric Co.

- Cisco Systems Inc.

- Dell Technologies Inc.

- Hewlett Packard Enterprise (HPE)

- IBM Corporation

- Alfa Laval AB

- Asetek Inc.

- Submer Technologies

- Green Revolution Cooling (GRC)

- LiquidStack

- Nokia Corporation

- Mitsubishi Electric Corporation

Frequently Asked Questions

Analyze common user questions about the Data Center Energy Saving Solutions market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary metric used to measure data center energy efficiency?

The primary metric is Power Usage Effectiveness (PUE), calculated as the ratio of total facility power to IT equipment power. A PUE closer to 1.0 indicates maximum energy efficiency, with modern, high-performance facilities targeting 1.2 or below.

How is liquid cooling contributing to overall energy savings in data centers?

Liquid cooling, including immersion and direct-to-chip methods, significantly reduces energy consumption by efficiently removing heat from high-density server racks, often resulting in PUE reductions of 20-50% compared to traditional air cooling systems for the same workload.

What role does Data Center Infrastructure Management (DCIM) software play in optimization?

DCIM software acts as the central intelligence platform, providing real-time monitoring, predictive analytics, and automated control over power, cooling, and environmental systems, enabling dynamic adjustments that maintain efficiency and reduce energy waste.

Which geographical region is projected to experience the fastest growth in this market?

The Asia Pacific (APAC) region is projected to exhibit the fastest growth rate, driven by expansive new data center construction and increasing demand for localized cloud and digital services across key emerging markets like India and Southeast Asia.

What are the main financial barriers restricting the adoption of advanced energy saving solutions?

The main financial barrier is the high initial Capital Expenditure (CapEx) required for sophisticated infrastructure upgrades, such as implementing liquid cooling loops, high-voltage DC power systems, and comprehensive AI-integrated DCIM platforms.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager