Data Center Optical Distribution Frames Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433543 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Data Center Optical Distribution Frames Market Size

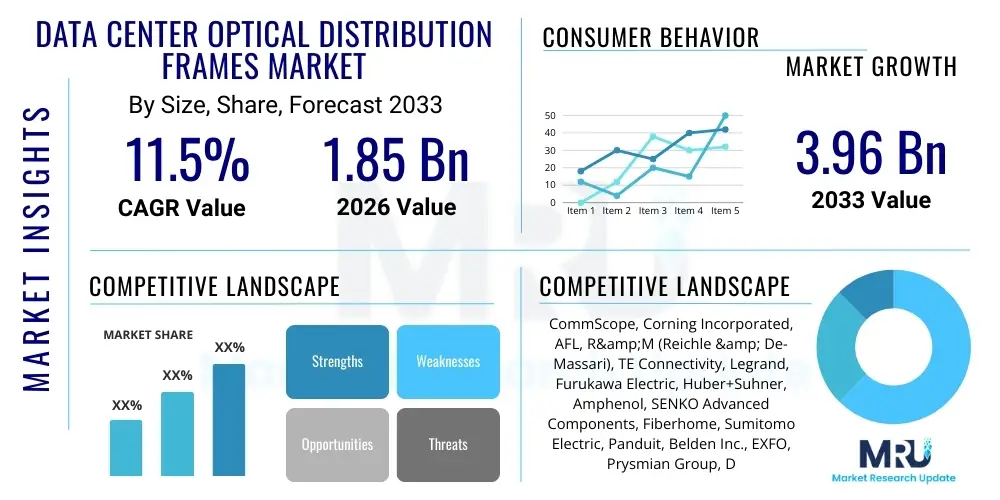

The Data Center Optical Distribution Frames Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 11.5% CAGR between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 3.96 Billion by the end of the forecast period in 2033. This robust growth trajectory is primarily fueled by the unrelenting demand for data storage and processing capabilities driven by emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the global rollout of 5G networks. Optical Distribution Frames (ODFs) are critical components within data center infrastructure, serving as the central point for managing, splicing, and distributing fiber optic cables. As data centers scale up to hyperscale architectures and network speeds transition to 400G and 800G, the requirement for high-density, modular, and reliable fiber management solutions becomes paramount, directly boosting the ODF market size and value globally. The increasing deployment of cloud services and the consequent expansion of co-location and enterprise data centers worldwide necessitate standardized and efficient cable management systems, positioning ODFs as indispensable assets for optimizing network performance and reducing operational complexities. Furthermore, the longevity and reliability associated with advanced ODF designs contribute to their increasing adoption across new and retrofitted data center projects, cementing the market’s positive outlook through 2033.

Data Center Optical Distribution Frames Market introduction

The Data Center Optical Distribution Frames (ODF) Market encompasses the sales and integration of physical interfaces designed to terminate, manage, and protect the optical fiber cables that interconnect various networking devices within a data center environment. An ODF acts as the intermediary point between the outside cable plant and the data center internal cabling, providing secure storage, termination points, splicing locations, and cross-connection functionalities for fiber optic infrastructure. These frames are essential for maintaining the physical integrity of fibers, ensuring organized cable routing, and simplifying future additions, moves, and changes (MACs) within highly complex, high-density environments. The primary product configurations include rack-mounted, wall-mounted, and floor-standing cabinets, often featuring modular designs to facilitate easy scalability and optimization of space utilization.

Major applications of ODFs span across hyperscale cloud providers, enterprise data centers, carrier-neutral facilities (colocation), and telecom central offices where massive amounts of data traffic necessitate reliable, high-speed fiber interconnections. Key benefits of utilizing advanced ODF solutions include enhanced network reliability through protected fiber pathways, efficient utilization of valuable data center real estate due to high-density module packaging, and reduced downtime owing to simplified troubleshooting and repair processes. Modern ODFs are specifically designed to handle the extremely high fiber counts characteristic of modern data center spine-and-leaf architectures, often accommodating thousands of terminations within a single frame, which is crucial for supporting 400G and future 800G Ethernet speeds.

Driving factors propelling this market include the unprecedented global data traffic growth, catalyzed by streaming services, e-commerce, and remote work infrastructure. The widespread implementation of 5G technology demands localized data processing capabilities, leading to the proliferation of edge data centers, all requiring compact and robust ODF solutions. Furthermore, the continual migration of traditional enterprise workloads to hyperscale cloud platforms necessitates the constant expansion and upgrade of optical infrastructure, wherein ODFs play a foundational role in enabling seamless fiber optic connectivity, driving substantial market investment, particularly in regions experiencing rapid digital transformation and infrastructure development.

Data Center Optical Distribution Frames Market Executive Summary

The Data Center Optical Distribution Frames (ODF) market is experiencing a significant paradigm shift characterized by a move toward ultra-high-density and modular architectures, driven by the intense space constraints and connectivity demands of hyperscale cloud operators. Business trends indicate a strong preference for pre-terminated, plug-and-play ODF solutions that drastically reduce installation time and labor costs while minimizing the risk of termination errors in the field. Furthermore, there is a rising trend toward integrating intelligent features, such as remote sensing and automated infrastructure management (AIM) systems, directly into ODF platforms, allowing data center operators to monitor fiber connectivity status in real time and optimize port utilization, thereby improving overall operational efficiency and reducing latency.

Regionally, the Asia Pacific (APAC) market is forecast to exhibit the fastest growth, primarily due to massive investments in new data center construction across countries like China, India, and Southeast Asia, fueled by governmental digitalization initiatives and escalating internet penetration rates. North America maintains its position as the largest market, characterized by the presence of major hyperscale players and early adoption of 400G and beyond networking standards, demanding the most advanced ODF solutions. European trends emphasize sustainability and energy efficiency, leading to the adoption of high-quality, long-lasting ODF materials and standardized modular systems compliant with strict regional data sovereignty and infrastructure guidelines.

Segmentation trends reveal that the modular ODF segment dominates the market, offering unparalleled flexibility and scalability for data center operators who require the ability to expand fiber capacity incrementally without service disruption. By application, the hyperscale segment remains the primary consumer, driving demand for the highest fiber count frames, while the enterprise segment focuses on compact, rack-mounted solutions suitable for smaller footprints and lower port density requirements. The material segmentation shows a gradual shift toward specialized plastics and alloys that offer lightweight yet durable structures, facilitating easier handling and installation while adhering to stringent fire safety and thermal management protocols within enclosed data center environments.

AI Impact Analysis on Data Center Optical Distribution Frames Market

User queries regarding AI's influence on the ODF market consistently revolve around how the computational intensity of AI/ML workloads translates into physical infrastructure requirements, specifically concerning fiber density, speed, and automation. The central themes emerging from this analysis include the expectation that AI applications, such as large language models (LLMs) and advanced deep learning training clusters, necessitate infrastructure capable of supporting immense inter-server communication bandwidth, often demanding 400G and 800G optical links across entire clusters. Users are highly concerned about the resulting fiber cable congestion and the need for ODF solutions that can manage thousands of low-latency connections effectively. Furthermore, inquiries focus on whether AI can be utilized within the ODF itself, through Automated Infrastructure Management (AIM) systems, to predict connectivity failures, automate patching processes, and optimize physical layer routing based on real-time traffic analysis, moving the ODF from a passive component to an intelligent, active asset.

- AI workloads accelerate the migration to 400G/800G Ethernet, necessitating ultra-high-density (UHD) ODFs capable of managing increased fiber counts per rack unit.

- Demand for ultra-low latency connections driven by AI model training requires premium ODFs that minimize signal loss and physical connection degradation.

- AI-driven monitoring systems integrate with intelligent ODFs to provide real-time port utilization analysis and predictive maintenance alerts.

- Increased server power density driven by AI chips raises thermal challenges, requiring ODF designs that facilitate efficient airflow management and cable organization to prevent hot spots.

- AI infrastructure expansion often involves rapid scaling, favoring modular, pre-terminated ODF solutions for faster deployment cycles and reduced configuration time.

- The adoption of advanced silicon photonics architectures requires specialized ODF connections that maintain extremely tight tolerances for alignment and signal integrity.

DRO & Impact Forces Of Data Center Optical Distribution Frames Market

The Data Center Optical Distribution Frames (ODF) market is fundamentally shaped by a complex interaction of driving forces, inherent limitations, and significant growth opportunities. The primary driver is the exponentially increasing volume of data generated globally, which necessitates continuous expansion and densification of data center infrastructure, compelling operators to adopt high-capacity fiber management solutions. However, this growth is often restrained by the high initial capital expenditure required for deploying advanced, ultra-high-density modular ODF systems, particularly for smaller enterprises, alongside persistent challenges related to fiber optic cable standardization and the difficulty of managing extremely high fiber counts without specialized training. These opposing forces dictate the pace of market adoption and technological innovation.

Significant opportunities are emerging from the proliferation of edge computing and the subsequent demand for rugged, compact ODF solutions designed for non-traditional data center environments. Furthermore, the integration of intelligent features, such as automated patching robotics and embedded monitoring sensors (Smart ODFs), presents a massive opportunity for manufacturers to transition from selling hardware components to providing integrated, data-driven fiber management solutions. The impact forces indicate a shift in competitive strategy, emphasizing not just density and footprint, but also ease of installation, scalability, and integration capabilities with broader Data Center Infrastructure Management (DCIM) platforms, making lifecycle support a critical differentiating factor.

Key impact forces include the relentless pursuit of higher network speeds (400G/800G), which makes fiber optic connectivity mandatory over copper, directly benefitting the ODF market. Regulatory pressures for data localization and sovereignty mandate the construction of local data centers, creating consistent demand across emerging regions. Conversely, the market faces impact challenges from potential economic downturns affecting capital spending on new infrastructure, and the continuous shortage of skilled technicians capable of handling complex fiber termination and maintenance tasks, which favors the adoption of factory-terminated, simple-to-install ODF modules.

Segmentation Analysis

The Data Center Optical Distribution Frames (ODF) market is systematically segmented based on product type, fiber count/density, end-user application, and geographical region to provide targeted market insights. Product type segmentation distinguishes between rack-mounted, wall-mounted, and floor-standing units, with rack-mounted options dominating due to their compatibility with standard data center racks. Fiber count segmentation categorizes products by the maximum number of terminations they can support, ranging from low-density (under 144 fibers) to ultra-high density (UHD, exceeding 576 fibers), reflecting the core operational requirement of modern data centers. The analysis of these segments reveals that modularity and scalability are the dominant features driving investment, as operators prioritize solutions that can be scaled incrementally, minimizing upfront costs while maximizing future expansion potential.

End-user application analysis delineates demand from various consumer groups, primarily hyperscale cloud providers, telecom companies, enterprises, and co-location facilities. Hyperscale data centers, characterized by their massive scale and constant need for bandwidth upgrades, are the leading adopters of the highest density ODF solutions. Conversely, small to medium-sized enterprises (SMEs) typically opt for lower-cost, wall-mounted or smaller rack-mounted units. The detailed segmentation assists manufacturers in tailoring their product offerings—for instance, developing robust, outdoor-rated ODFs for telecom edge deployments, or highly compartmentalized, secure ODFs for financial and governmental institutions adhering to strict security protocols. This granular view of the market demonstrates that specialized solutions addressing niche requirements are gaining traction alongside the mass adoption of generalized modular systems.

- By Type:

- Rack-Mounted ODFs (Most widely adopted in large data centers)

- Wall-Mounted ODFs (Common in smaller enterprise and edge computing sites)

- Floor-Standing ODF Cabinets (Used for centralized distribution points and legacy infrastructure)

- By Fiber Count/Density:

- Low Density (Up to 144 fibers)

- Medium Density (145 to 288 fibers)

- High Density (HD) (289 to 576 fibers)

- Ultra-High Density (UHD) (577 fibers and above)

- By Application/End-User:

- Hyperscale Data Centers

- Enterprise Data Centers

- Colocation and Managed Services

- Telecommunication Central Offices and Edge Nodes

- By Components:

- ODF Housings/Chassis

- Splice Trays

- Pigtails and Patch Cords

- Adapters and Connectors

Value Chain Analysis For Data Center Optical Distribution Frames Market

The value chain for the Data Center Optical Distribution Frames market begins with the upstream segment involving the raw material suppliers, predominantly providers of high-grade plastics (such as flame-retardant polymers), specialized metals (like cold-rolled steel and aluminum alloys for housing), and, most critically, optical fiber manufacturers (silica glass fiber and protective jacketing). Quality and consistency in these raw materials directly impact the long-term reliability and physical specifications of the final ODF product, particularly concerning fire safety ratings and structural integrity. Manufacturers of core components, such as optical connectors, adapters, and splice protectors, then feed into the primary ODF assembly stage, where frames and modular cassettes are produced. Expertise in precision engineering and clean-room assembly is critical at this mid-stream stage to ensure optical performance.

The mid-stream focus is on Original Equipment Manufacturers (OEMs) who design and assemble the finished ODF products, focusing on features like modularity, density, and ease of installation. Many of these OEMs specialize in creating pre-terminated fiber solutions (plug-and-play modules), which shifts the complexity of termination from the installation site to the factory, significantly adding value. The distribution channel is bifurcated into direct and indirect methods. Direct distribution involves large-scale sales teams engaging directly with hyperscale and major telecommunication clients, offering customized solutions, extensive engineering support, and integration services. This channel is crucial for high-value projects where specifications are highly unique and demanding, ensuring seamless integration with existing DCIM platforms.

Indirect distribution relies heavily on global and regional specialized distributors, value-added resellers (VARs), and system integrators. These intermediaries handle sales to smaller enterprise data centers, colocation facilities, and regional service providers, often bundling ODFs with other networking hardware, installation services, and maintenance contracts. This channel offers broader market reach and localized support. Downstream, the final customers—data center operators, IT managers, and network engineers—rely on these ODF products for efficient cable management and network scalability. The success of the ODF ultimately depends on its ease of deployment, its reliability under high stress conditions, and its ability to integrate into the overall automated data center environment.

Data Center Optical Distribution Frames Market Potential Customers

The primary consumers and buyers in the Data Center Optical Distribution Frames market are entities that operate and maintain large-scale, high-bandwidth data network infrastructure where efficient fiber management is non-negotiable for uptime and performance. The most influential segment comprises hyperscale cloud service providers (CSPs) such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, who require standardized, mass-deployable ultra-high-density ODFs to manage millions of fiber connections across their vast global facilities. These clients prioritize modularity, speed of deployment, and adherence to strict low-latency standards necessary for global data replication and instant service delivery. Their procurement decisions often involve multi-year agreements and customized product designs to fit proprietary data center blueprints.

Telecommunication carriers and service providers constitute another vital customer segment. As they roll out 5G and fiber-to-the-home (FTTH) infrastructure, these companies rely on robust ODFs both in their central offices and newly established edge data centers to handle the aggregation and distribution of high-capacity optical transport networks. For this segment, the focus is on ruggedized, high-reliability products that can withstand variable environmental conditions, often requiring specialized outdoor-rated enclosures. Furthermore, large enterprise organizations across sectors like finance (banking, stock exchanges), technology, and healthcare represent a stable customer base, demanding compliant and secure ODF solutions to manage mission-critical internal networks and disaster recovery infrastructure.

Finally, colocation and managed service providers (MSPs) represent a continuously expanding customer group. These companies sell data center space and connectivity services to multiple tenants, meaning their ODF infrastructure must be highly flexible, scalable, and multi-tenant secure. They seek ODF solutions that maximize density within a limited footprint while offering clear delineation between tenant connections. The procurement strategy of co-location providers often centers on ODFs that support rapid provisioning of new clients with minimal disruption to existing tenants, thereby favoring highly organized and easily traceable fiber management systems integrated with DCIM tools for efficient resource tracking and billing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 3.96 Billion |

| Growth Rate | 11.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CommScope, Corning Incorporated, AFL, R&M (Reichle & De-Massari), TE Connectivity, Legrand, Furukawa Electric, Huber+Suhner, Amphenol, SENKO Advanced Components, Fiberhome, Sumitomo Electric, Panduit, Belden Inc., EXFO, Prysmian Group, Diamond SA, Fujikura, Rosenberger, and 3M. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Optical Distribution Frames Market Key Technology Landscape

The technological evolution within the Data Center Optical Distribution Frames market is focused primarily on maximizing density, enhancing modularity, and enabling intelligence through automation. The development of Ultra-High Density (UHD) ODFs represents the most critical advancement, leveraging miniaturized components like multi-fiber push-on (MPO/MTP) connectors and highly compact cassettes. These UHD solutions allow data centers to terminate hundreds, sometimes thousands, of fibers within a small footprint, such as a single standard 42U rack, which is vital for managing the exponential growth of fiber links required for 400G and 800G connectivity. The design innovation here centers on improving access and reducing strain on sensitive fibers despite the extreme packing density, often using features like sliding trays, front access patching, and integrated slack management systems that maintain the fiber’s minimum bend radius.

Another pivotal technology is the widespread adoption of pre-terminated optical cable assemblies and plug-and-play ODF modules. Factory termination ensures higher quality and consistent optical performance compared to field termination, which significantly reduces the risk of dirty or incorrectly installed connections—a common cause of signal loss. This technology accelerates deployment, especially in hyperscale environments where rapid infrastructure build-out is essential. Furthermore, the modular nature allows operators to pay-as-they-grow, installing ODF chassis now and populating them with fiber modules incrementally as bandwidth demands increase, offering financial flexibility and better capacity planning. This technological shift addresses the labor shortage challenge by simplifying installation processes, making it less dependent on highly specialized optical technicians.

Looking ahead, the integration of Automated Infrastructure Management (AIM) systems and sensor technology is transforming ODFs into "Smart ODFs." These intelligent systems utilize embedded sensors and RFID/barcode technology to automatically map and track every physical connection and patch cord within the frame in real time. This capability eliminates manual documentation errors, drastically cuts down troubleshooting time, and enables proactive management of network resources. This level of physical layer automation is increasingly crucial for managing complex AI/ML cluster fabrics and supports seamless integration with higher-level network orchestration tools, ensuring the physical infrastructure aligns instantly with software-defined networking (SDN) protocols, thereby maximizing network efficiency and providing a verifiable audit trail for compliance purposes.

Regional Highlights

The Data Center Optical Distribution Frames market exhibits distinct growth patterns and technological adoption rates across key geographical regions, reflecting varying levels of digital maturity, regulatory environments, and data center investment cycles.

- North America: This region maintains market leadership driven by the presence of major hyperscale cloud providers (CSPs) and a relentless commitment to adopting the latest networking technologies (e.g., 400G and 800G deployment). North American data centers are characterized by massive scale and high power density, necessitating the immediate adoption of Ultra-High Density (UHD) and highly modular ODF solutions integrated with advanced AIM systems. The market here is highly competitive, focusing on innovation in installation speed and physical layer automation to handle the enormous fiber counts required for intra-data center connectivity.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing market, propelled by rapid urbanization, significant government investments in digital infrastructure, and explosive growth in internet and mobile penetration, particularly in China, India, Japan, and Southeast Asian nations. The region is seeing a massive influx of foreign investment into new data center construction and the establishment of numerous edge computing sites. Demand is high for scalable, cost-effective, and robust ODFs that support localized deployments and rapidly expanding colocation facilities, although pricing pressures remain significant compared to Western markets.

- Europe: The European market is characterized by a strong emphasis on data sovereignty (GDPR), sustainability, and standardization. Adoption rates for modular ODFs are high, focusing on energy-efficient designs and long product lifecycles. Growth is steady, driven by the expansion of large centralized data centers in connectivity hubs like Frankfurt, London, Amsterdam, and Paris (FLAP markets). The region also shows strong demand for ODFs supporting submarine cable landings and cross-border connectivity, demanding exceptionally reliable fiber management systems.

- Latin America (LATAM): Growth in LATAM is accelerating, fueled by increasing cloud adoption and the expansion of regional data center hubs in countries like Brazil and Mexico. The demand is currently focused on standardized, reliable ODFs to build foundational infrastructure. While less focused on UHD solutions compared to North America, the market is beginning to prioritize modularity as local enterprises migrate services to the cloud and regional connectivity improves.

- Middle East and Africa (MEA): This region is witnessing substantial infrastructure investment, particularly in the UAE, Saudi Arabia, and South Africa, driven by national visions for digital transformation and smart city initiatives. ODF demand is focused on robust, scalable solutions for new hyperscale facilities and telecom central offices. The adoption of advanced ODF technology is often directly tied to government-backed ICT projects and the massive expansion of internet gateways and regional cloud availability zones.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Optical Distribution Frames Market.- CommScope

- Corning Incorporated

- AFL (A Furukawa Company)

- R&M (Reichle & De-Massari)

- TE Connectivity

- Legrand

- Furukawa Electric

- Huber+Suhner

- Amphenol

- SENKO Advanced Components

- Fiberhome

- Sumitomo Electric Industries, Ltd.

- Panduit

- Belden Inc.

- EXFO

- Prysmian Group

- Diamond SA

- Fujikura Ltd.

- Rosenberger

- 3M

Frequently Asked Questions

Analyze common user questions about the Data Center Optical Distribution Frames market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is an Optical Distribution Frame (ODF) and why is it critical in modern data centers?

An ODF is a centralized rack or enclosure used for fiber cable management, termination, splicing, and patching. It is critical because it protects and organizes the massive number of optical fibers required for high-speed network connectivity (400G and above), ensuring high network reliability and simplifying infrastructure scaling and maintenance.

How are Ultra-High Density (UHD) ODFs addressing hyperscale data center challenges?

UHD ODFs maximize fiber terminations within the smallest possible physical footprint, typically supporting over 576 fibers per rack unit. They address hyperscale challenges by conserving valuable data center space, managing the proliferation of fiber links needed for high-bandwidth server clusters, and supporting modular, rapid deployment strategies.

What is the role of modularity in the future growth of the ODF market?

Modularity is essential as it allows data center operators to scale fiber capacity incrementally, installing only the necessary components as demand grows. This "pay-as-you-grow" approach minimizes initial capital investment, reduces stranded capacity, and facilitates easier upgrades or reconfigurations without disrupting live services, driving flexibility.

What impact does the deployment of 5G infrastructure have on ODF market demand?

5G deployment necessitates the construction of localized edge data centers and increased backhaul capacity. This drives demand for compact, ruggedized ODF solutions capable of handling high fiber counts in smaller, sometimes non-traditional, environments near cell towers or core networking facilities, supporting distributed network architectures.

Are intelligent or "Smart ODFs" becoming standard technology?

Yes, Smart ODFs, integrated with Automated Infrastructure Management (AIM) technology, are rapidly gaining adoption, particularly in hyperscale and large enterprise environments. They use sensors and tracking tools (like RFID) to monitor connections in real time, automate physical layer documentation, and integrate with DCIM systems for enhanced operational visibility and efficiency.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager