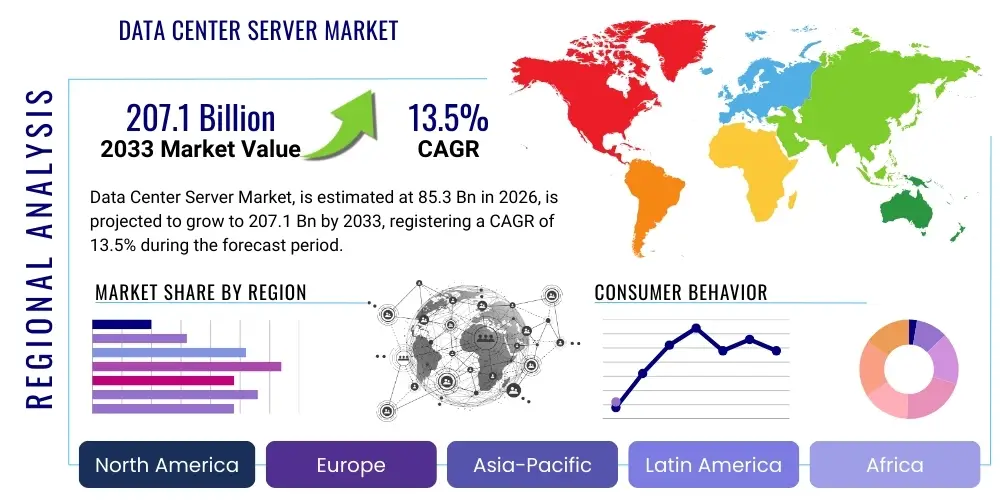

Data Center Server Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440444 | Date : Jan, 2026 | Pages : 246 | Region : Global | Publisher : MRU

Data Center Server Market Size

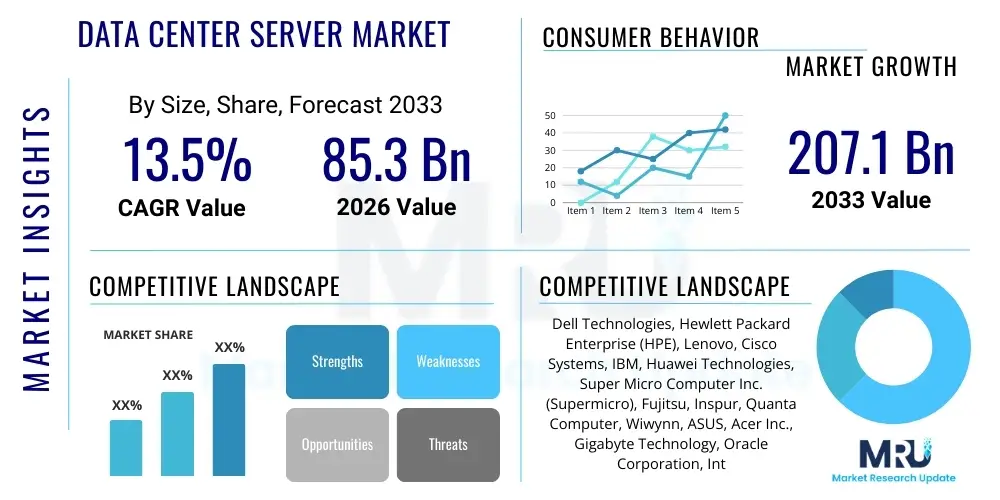

The Data Center Server Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033. The market is estimated at USD 85.3 Billion in 2026 and is projected to reach USD 207.1 Billion by the end of the forecast period in 2033. This substantial growth is primarily driven by the escalating global demand for digital transformation, increased adoption of cloud computing across various industries, and the continuous expansion of data generation from diverse sources such as IoT devices, mobile applications, and enterprise systems. The foundational role of servers in processing, storing, and managing this ever-increasing volume of data underscores their critical importance to modern digital infrastructure. Enterprises and cloud service providers are consistently investing in advanced server technologies to enhance computational power, improve energy efficiency, and ensure robust data security, further propelling market expansion.

The market's trajectory is also significantly influenced by the rapid advancements in processor technologies, memory solutions, and storage innovations that enable higher performance and greater scalability. Next-generation servers are designed to handle complex workloads, including artificial intelligence (AI), machine learning (ML), big data analytics, and high-performance computing (HPC), which are becoming indispensable for competitive advantage. Moreover, the shift towards more flexible and software-defined infrastructures, such as hyper-converged infrastructure (HCI) and composable infrastructure, is reshaping the demand for server architectures, favoring solutions that offer agility and efficient resource utilization. This technological evolution, coupled with the ongoing need for businesses to maintain resilient and high-performing IT environments, solidifies the robust growth outlook for the data center server market.

Data Center Server Market introduction

The Data Center Server Market encompasses the global industry involved in the manufacturing, sales, and deployment of specialized computer hardware designed to process, store, and manage data within a data center environment. These servers are distinct from typical consumer-grade computers, built for continuous operation, high reliability, and scalability to handle massive computational workloads and vast amounts of data. The primary product offering includes various server types such as rack servers, blade servers, tower servers, and hyper-converged infrastructure (HCI) systems, each optimized for different performance, density, and deployment requirements. Major applications span across virtually every industry sector, including information technology and telecommunications, banking, financial services, and insurance (BFSI), government, healthcare, manufacturing, and retail, where they form the backbone of cloud services, enterprise applications, big data analytics, and mission-critical operations. The inherent benefits of these servers include enhanced processing capabilities, robust data storage, improved network connectivity, greater energy efficiency compared to previous generations, and advanced security features, all contributing to the seamless operation of digital services.

Key driving factors for the market's robust growth are multi-faceted and deeply embedded in the contemporary digital landscape. The exponential surge in data generation globally, fueled by the proliferation of smart devices, the Internet of Things (IoT), and digital content consumption, necessitates increasingly powerful and efficient server infrastructure. Furthermore, the pervasive adoption of cloud computing models—public, private, and hybrid—by organizations of all sizes is a significant catalyst, as cloud service providers continuously expand their data center capacities. The imperative for digital transformation initiatives across industries, alongside the escalating demand for high-performance computing (HPC) for scientific research, simulations, and complex analytical tasks, further amplifies the need for advanced data center servers. The rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) workloads, which require specialized hardware for efficient processing, also act as a crucial growth driver, pushing innovation in server design and component integration.

Data Center Server Market Executive Summary

The Data Center Server Market is experiencing dynamic shifts, underpinned by significant business, regional, and segment trends. From a business perspective, the market is characterized by intense competition among established hardware manufacturers and emerging innovators, all striving to deliver more powerful, energy-efficient, and cost-effective server solutions. Consolidation within the industry is observed as companies seek to expand their portfolio, intellectual property, and market reach, particularly in areas like specialized accelerators for AI and sophisticated management software. The emphasis on sustainability and green computing is driving investments in liquid cooling technologies, power-efficient processors, and modular data center designs, reflecting a broader corporate responsibility trend. Furthermore, a growing trend towards customization and open hardware platforms, like the Open Compute Project (OCP), allows enterprises greater flexibility and control over their infrastructure, influencing procurement strategies and supply chain dynamics.

Regionally, North America and Europe continue to dominate the market due to the early adoption of cloud technologies, significant investments in data center infrastructure by hyperscalers, and a strong presence of major technology companies. However, the Asia Pacific (APAC) region is emerging as the fastest-growing market, propelled by rapid digitalization initiatives in countries like China, India, and Southeast Asian nations, coupled with increasing internet penetration and smartphone adoption. Latin America, the Middle East, and Africa (MEA) are also showing promising growth, albeit from a smaller base, driven by nascent digital transformation efforts, government-backed IT infrastructure projects, and the expansion of local cloud service providers. These regional disparities highlight diverse growth opportunities and challenges related to infrastructure development, regulatory environments, and economic conditions.

In terms of segmentation, the market is witnessing robust growth across various server types and components. Rack servers remain the most prevalent, balancing density and flexibility, while blade servers continue to be popular for high-density computing environments. The component segment is seeing a significant shift with the increasing adoption of Graphics Processing Units (GPUs), Data Processing Units (DPUs), and Field-Programmable Gate Arrays (FPGAs) to accelerate AI/ML and specialized workloads, moving beyond traditional CPUs. Storage solutions, particularly Solid-State Drives (SSDs) and Non-Volatile Memory Express (NVMe) drives, are critical for high-performance data access. End-user segments such as IT & Telecom and BFSI are major contributors, alongside strong growth in healthcare and manufacturing sectors driven by big data analytics and industrial automation. The deployment landscape is evolving with a strong push towards hybrid cloud and edge computing models, which necessitate servers optimized for distributed architectures and lower latency applications, further diversifying market demand.

AI Impact Analysis on Data Center Server Market

The profound and accelerating adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies is fundamentally reshaping the data center server market, driving an unprecedented demand for specialized and high-performance computing infrastructure. Common user questions often revolve around how AI will impact server specifications, what new server architectures will emerge, the challenges of power consumption and cooling for AI workloads, and the potential for market disruption. Users are keenly interested in understanding the shift from general-purpose CPUs to specialized accelerators like GPUs, DPUs, and FPGAs, and how this will affect procurement strategies and total cost of ownership. There is also significant concern regarding the scalability of existing data center infrastructure to meet the intense computational and data handling requirements of large AI models, alongside expectations for more energy-efficient and purpose-built AI servers. The overarching theme is a strong desire for clarity on how server technology will evolve to support the ever-increasing complexity and scale of AI applications, from training sophisticated neural networks to deploying inferencing at the edge, all while managing operational efficiency and sustainability.

- Increased demand for specialized AI accelerators: The shift from traditional CPU-centric computing to GPU, DPU, and FPGA-based architectures for parallel processing and AI model training/inference is a primary driver.

- Higher power density and cooling requirements: AI workloads consume immense power, necessitating advanced liquid cooling solutions and redesigned data center power infrastructures.

- Development of purpose-built AI servers: Manufacturers are designing servers optimized specifically for AI, featuring multiple accelerators, high-bandwidth interconnects, and enhanced power delivery.

- Growth of data-centric infrastructure: AI relies heavily on vast datasets, driving demand for high-performance storage solutions (NVMe SSDs) and high-throughput networking within data centers.

- Evolution of hybrid and edge AI deployments: Demand for smaller, powerful servers capable of AI inferencing at the edge is growing, supporting real-time applications and reducing latency.

- Emphasis on software-defined infrastructure for AI: Flexible, programmable infrastructure is crucial for efficiently deploying, managing, and scaling diverse AI workloads across different hardware.

- Supply chain adjustments for advanced components: The increased reliance on specialized chips is influencing supply chain dynamics, leading to strategic partnerships and vertical integration among vendors.

- Innovation in server management and orchestration: Tools capable of optimizing resource allocation for heterogeneous AI workloads (CPUs, GPUs, etc.) are becoming essential for efficient operation.

- Sustainability concerns driving energy efficiency: The high energy consumption of AI is accelerating research and development into more energy-efficient chips and sustainable data center designs.

DRO & Impact Forces Of Data Center Server Market

The Data Center Server Market is shaped by a complex interplay of Drivers, Restraints, Opportunities, and broader Impact Forces that dictate its growth trajectory and competitive landscape. Key drivers include the exponential growth in global data volumes, propelled by digitalization, IoT, and content consumption, which necessitates constant expansion and upgrading of server infrastructure. The pervasive adoption of cloud computing, encompassing public, private, and hybrid models, by organizations of all sizes, serves as a significant catalyst, as cloud service providers continuously invest in scaling their data center capacities. Furthermore, the burgeoning demand for high-performance computing (HPC) for scientific research, complex simulations, and advanced analytics across various sectors, coupled with the rapid advancements in Artificial Intelligence (AI) and Machine Learning (ML) workloads requiring specialized server hardware, are profoundly driving market expansion. Digital transformation initiatives across enterprises worldwide, aimed at enhancing operational efficiency, customer experience, and innovation, form the fundamental underpinning for sustained demand for advanced data center servers.

However, the market also faces considerable restraints. The substantial initial investment required for procuring and deploying high-end data center servers, along with the escalating operational costs associated with power consumption and cooling, poses a significant barrier for many organizations, particularly SMEs. Supply chain disruptions, exacerbated by geopolitical tensions and global events, can lead to component shortages and increased lead times, impacting server production and delivery. Moreover, the increasing complexity of server management, requiring specialized IT skills and sophisticated automation tools, can be a deterrent. Data security and privacy concerns, particularly in an era of increasing cyber threats and stringent regulatory compliance requirements, necessitate continuous investment in secure server architectures and robust protection measures, adding to the operational overhead.

Amidst these challenges, significant opportunities are emerging. The proliferation of edge computing, driven by the need for lower latency and localized data processing for applications like autonomous vehicles and industrial IoT, presents a new frontier for specialized, compact server deployments. The development of sustainable and energy-efficient server solutions, including liquid cooling technologies and more power-efficient processors, offers a compelling opportunity to address environmental concerns and reduce operational costs. The continuous innovation in specialized hardware for AI/ML workloads, such as advanced GPUs, DPUs, and FPGAs, opens new avenues for server manufacturers to cater to niche, high-growth segments. Furthermore, the growing demand for hybrid cloud architectures, which combine on-premise and public cloud resources, creates opportunities for servers that offer seamless integration and unified management capabilities. Advancements in serverless computing and composable infrastructure are also paving the way for more agile and resource-optimized server environments.

The broader impact forces influencing the market are technological advancements, which perpetually drive innovation in processing power, memory density, and storage speed, making previous generations of servers quickly obsolete. The evolving regulatory landscape, particularly concerning data localization, privacy (e.g., GDPR, CCPA), and environmental standards, profoundly impacts server deployment strategies and compliance requirements. Economic conditions, including global GDP growth, inflation, and investment cycles, directly affect enterprise IT spending and data center expansion plans. Geopolitical factors, such as trade policies, international relations, and regional conflicts, can disrupt supply chains, influence market access, and drive strategic sourcing decisions. Lastly, environmental concerns, including the carbon footprint of data centers and the urgent need for energy conservation, are increasingly pushing the industry towards more sustainable server technologies and operational practices, transforming design philosophies and investment priorities.

Segmentation Analysis

The Data Center Server Market is meticulously segmented across various dimensions to provide a granular understanding of its complex structure and diverse demands. These segmentation categories allow for a comprehensive analysis of market dynamics, identifying specific growth drivers, competitive landscapes, and emerging trends within each sub-segment. Understanding these distinct segments is crucial for stakeholders to tailor their product offerings, marketing strategies, and investment decisions effectively. The market can be broadly categorized by server type, components, end-users, and deployment models, each reflecting different technological priorities, operational requirements, and budget considerations of diverse customers ranging from hyperscale cloud providers to small and medium-sized enterprises (SMEs).

- By Server Type

- Rack Servers: Versatile and widely used, optimized for density and scalability in standard server racks.

- Blade Servers: High-density, modular servers designed for space-saving and simplified management in specialized enclosures.

- Tower Servers: Standalone servers resembling desktop PCs, suitable for small businesses or specific tasks not requiring rack mounting.

- Microservers: Energy-efficient, compact servers designed for scale-out workloads with lower performance per core.

- Open Compute Project (OCP) Servers: Hardware designed to open specifications, promoting efficiency and cost reduction, favored by hyperscalers.

- Hyper-converged Infrastructure (HCI): Integrates compute, storage, and networking into a single platform, simplifying data center operations.

- By Component

- Processors: CPUs (Intel Xeon, AMD EPYC), GPUs (NVIDIA, AMD), DPUs (NVIDIA BlueField, Intel IPU), FPGAs (Intel, Xilinx), ASICs.

- Memory: DRAM (DDR4, DDR5), Storage Class Memory (Intel Optane, Samsung Z-NAND).

- Storage: SSDs (SATA, SAS, NVMe), HDDs (SAS, SATA).

- Networking Components: Network Interface Cards (NICs), Switches, Cables, Transceivers.

- By End-User

- BFSI (Banking, Financial Services, and Insurance): For transaction processing, risk management, and data analytics.

- IT & Telecom: Core infrastructure for cloud services, network operations, and data management.

- Government & Public Sector: For administrative services, national security, and public data management.

- Healthcare: For electronic health records (EHR), medical imaging, and research data processing.

- Manufacturing: For industrial automation, supply chain management, and IoT data processing.

- Retail & E-commerce: For online transactions, inventory management, and customer analytics.

- Media & Entertainment: For content creation, streaming, and digital asset management.

- Education: For research, e-learning platforms, and administrative systems.

- By Deployment

- On-Premise: Servers deployed and managed within an organization's own facility.

- Cloud-Based:

- Public Cloud: Services hosted by third-party providers (AWS, Azure, Google Cloud).

- Private Cloud: Dedicated cloud infrastructure for a single organization.

- Hybrid Cloud: A combination of on-premise, private, and public cloud environments.

- Edge Computing: Servers deployed closer to data sources to reduce latency and bandwidth usage.

Value Chain Analysis For Data Center Server Market

The value chain for the Data Center Server Market is a complex ecosystem involving multiple stages, from raw material sourcing and component manufacturing to final deployment and maintenance, all contributing to the creation and delivery of server solutions to end-users. At the upstream end, the chain begins with the procurement of critical raw materials and components, which include semiconductors (silicon, rare earth metals), metals for chassis (steel, aluminum), plastics, and various electronic components. This stage is dominated by specialized suppliers of microprocessors (CPUs, GPUs, DPUs), memory modules (DRAM, flash), storage drives (SSDs, HDDs), power supplies, cooling systems, and networking interface cards. Key players in this segment are often large semiconductor companies and electronic component manufacturers, who invest heavily in R&D to produce advanced, high-performance, and energy-efficient components that meet the rigorous demands of data center environments. Their ability to innovate and maintain a robust supply chain directly impacts the cost, performance, and availability of finished server products.

Moving downstream, the value chain encompasses the actual manufacturing, assembly, distribution, and sales of data center servers. Server manufacturers integrate the various components, design the server chassis, develop firmware, and conduct extensive testing to ensure reliability and performance. These manufacturers often operate globally, leveraging sophisticated supply chain logistics to assemble and deliver products. The distribution channel plays a pivotal role in reaching the diverse customer base. Direct channels involve server manufacturers selling directly to large enterprises, hyperscale cloud providers, and government entities, often through custom-configured solutions and long-term contracts. Indirect channels involve a network of value-added resellers (VARs), system integrators, and distributors who provide additional services like installation, configuration, maintenance, and support to a broader range of businesses, particularly SMEs. These indirect partners often offer localized expertise and tailored solutions, making them critical for market penetration and customer reach. The efficiency and effectiveness of these distribution channels are crucial for competitive advantage, ensuring timely delivery and comprehensive after-sales support.

Data Center Server Market Potential Customers

The Data Center Server Market serves a wide and diverse array of potential customers, all unified by their fundamental need for robust and scalable computing infrastructure to support their digital operations. The primary end-users and buyers of data center servers range from massive hyperscale cloud providers to small and medium-sized enterprises (SMEs), each with unique requirements regarding performance, cost, scalability, and management complexity. Hyperscale cloud operators, such as Amazon Web Services (AWS), Microsoft Azure, Google Cloud, and Alibaba Cloud, represent a significant segment, purchasing servers in vast quantities to build and expand their global data center footprints, offering Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS) to millions of customers worldwide. These entities often demand highly customized, energy-efficient, and cost-optimized server designs, sometimes collaborating directly with original design manufacturers (ODMs) or leveraging open computing initiatives.

Beyond the hyperscalers, large enterprises across various industries constitute another critical customer base. This includes companies in the Banking, Financial Services, and Insurance (BFSI) sector, which require high-performance servers for transactional processing, risk analysis, and vast data warehousing. Telecommunication companies rely on servers for network infrastructure, mobile services, and new 5G deployments. Government agencies and public sector organizations purchase servers for citizen services, national security, and scientific computing. Healthcare providers utilize servers for electronic health records, medical imaging, and research databases. Manufacturing companies depend on servers for supply chain management, industrial IoT data processing, and enterprise resource planning (ERP) systems. The retail and e-commerce sectors use servers to power online stores, manage inventory, and analyze customer behavior. Furthermore, research institutions and universities invest in high-performance computing (HPC) servers for complex simulations and scientific discovery. Even smaller businesses, increasingly adopting digital tools and cloud services, represent a growing segment, often opting for more standardized server solutions or leveraging managed service providers who, in turn, procure data center servers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 85.3 Billion |

| Market Forecast in 2033 | USD 207.1 Billion |

| Growth Rate | 13.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, Cisco Systems, IBM, Huawei Technologies, Super Micro Computer Inc. (Supermicro), Fujitsu, Inspur, Quanta Computer, Wiwynn, ASUS, Acer Inc., Gigabyte Technology, Oracle Corporation, Intel Corporation, Advanced Micro Devices (AMD), NVIDIA Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Data Center Server Market Key Technology Landscape

The Data Center Server Market is characterized by a rapidly evolving technology landscape, driven by the relentless pursuit of higher performance, greater energy efficiency, and enhanced scalability to meet the demands of modern digital workloads. At the core of this landscape are advancements in processor architectures, moving beyond traditional CPUs to incorporate specialized accelerators. Graphics Processing Units (GPUs) from NVIDIA and AMD are paramount for Artificial Intelligence (AI) and Machine Learning (ML) workloads, providing parallel processing capabilities essential for training complex neural networks. Data Processing Units (DPUs) and Field-Programmable Gate Arrays (FPGAs) are also gaining prominence for offloading network, storage, and security tasks from the main CPU, thereby improving overall system efficiency and reducing latency. These heterogeneous computing architectures are enabling data centers to handle increasingly diverse and computationally intensive tasks with greater agility and cost-effectiveness.

Beyond processing, innovations in memory and storage technologies are critical. The transition from DDR4 to DDR5 DRAM offers increased bandwidth and capacity, supporting larger datasets and more concurrent operations. The emergence of Storage Class Memory (SCM), such as Intel Optane and Samsung Z-NAND, bridges the performance gap between DRAM and NAND flash, providing faster data access for critical applications. In storage, Non-Volatile Memory Express (NVMe) over PCIe has become the standard for high-performance Solid-State Drives (SSDs), significantly reducing I/O latency compared to older SATA and SAS interfaces, which is crucial for big data analytics and real-time processing. Furthermore, advancements in networking technologies, including 400 Gigabit Ethernet (GbE) and beyond, InfiniBand, and disaggregated networking, are essential for ensuring high-throughput data transfer within and between servers, preventing bottlenecks and supporting increasingly distributed and interconnected data center environments. The ongoing development of liquid cooling solutions, server management software, and open hardware designs (like OCP) further underscores the dynamic technological evolution shaping the data center server market, all aiming to build more resilient, efficient, and intelligent infrastructure.

Regional Highlights

- North America: This region continues to be a dominant force in the Data Center Server Market, primarily driven by the presence of major hyperscale cloud providers (e.g., AWS, Microsoft Azure, Google Cloud), robust enterprise adoption of advanced IT infrastructure, and significant investments in AI, IoT, and high-performance computing (HPC) research. The United States is at the forefront, boasting numerous large-scale data centers and a mature technological ecosystem that fosters continuous innovation and early adoption of new server technologies. Canada also contributes significantly with its growing cloud market and increasing digital transformation efforts across various sectors.

- Europe: A strong market driven by stringent data privacy regulations (GDPR), increasing digitalization across industries, and the expansion of local and regional cloud service providers. Countries like Germany, the UK, France, and the Nordics are key contributors, investing heavily in modernizing their data center infrastructure, with a particular focus on energy efficiency and sustainable server solutions. The adoption of hybrid cloud strategies and edge computing is also gaining momentum in the region, fueling demand for flexible server architectures.

- Asia Pacific (APAC): Emerging as the fastest-growing region, APAC is witnessing unprecedented expansion fueled by rapid economic growth, increasing internet penetration, smartphone adoption, and government-led digital transformation initiatives in countries such as China, India, Japan, South Korea, and Australia. The proliferation of e-commerce, online gaming, and digital services necessitates massive data center build-outs, making it a critical market for server manufacturers. Local hyperscalers and enterprises are rapidly scaling their infrastructure to meet surging demand.

- Latin America: This region is experiencing steady growth, driven by increasing digitalization, expanding cloud adoption among businesses, and foreign investments in data center infrastructure. Brazil and Mexico are leading the market, with rising demand from financial services, retail, and telecommunications sectors. The need for localized data processing and cloud services is propelling the establishment of new data centers and the modernization of existing ones, though infrastructure development can vary across countries.

- Middle East and Africa (MEA): While a smaller market compared to other regions, MEA shows significant potential, propelled by government visions for digital economies (e.g., Saudi Vision 2030, UAE's digital initiatives), increased broadband connectivity, and the establishment of local data centers by global cloud providers. Countries like UAE, Saudi Arabia, and South Africa are key growth hubs, with rising demand from banking, oil & gas, and public sector entities as they embark on their digital transformation journeys.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Data Center Server Market.- Dell Technologies

- Hewlett Packard Enterprise (HPE)

- Lenovo

- Cisco Systems

- IBM

- Huawei Technologies

- Super Micro Computer Inc. (Supermicro)

- Fujitsu

- Inspur

- Quanta Computer

- Wiwynn

- ASUS

- Acer Inc.

- Gigabyte Technology

- Oracle Corporation

- Intel Corporation

- Advanced Micro Devices (AMD)

- NVIDIA Corporation

Frequently Asked Questions

What is the projected growth rate of the Data Center Server Market?

The Data Center Server Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% between 2026 and 2033, driven by increasing data volumes, cloud adoption, and AI/ML demands.

How is AI impacting the demand for data center servers?

AI is driving significant demand for specialized servers equipped with GPUs, DPUs, and FPGAs for parallel processing, requiring higher power density, advanced cooling, and purpose-built architectures optimized for AI workloads.

What are the primary drivers for the Data Center Server Market?

Key drivers include the exponential growth in global data volumes, widespread adoption of cloud computing, escalating demand for AI/ML and big data analytics, high-performance computing (HPC) requirements, and ongoing digital transformation initiatives across industries.

Which regions are leading the growth in the Data Center Server Market?

North America remains a dominant market, while Asia Pacific (APAC) is emerging as the fastest-growing region due to rapid digitalization, economic growth, and significant infrastructure investments.

What are the key technological trends shaping data center servers?

Key trends include the adoption of heterogeneous computing architectures (CPUs, GPUs, DPUs), advancements in DDR5 memory and NVMe storage, high-speed networking (400GbE), liquid cooling solutions, and the development of open-source server designs and composable infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Data Center Server Market Statistics 2025 Analysis By Application (Industrial Servers, Commercial Servers), By Type (Tower Server, Rack Server, Blade Server), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Data Center Server Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (SAN System, NAS System, DAS System), By Application (Industrial Servers, Commercial Servers), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager